Online Payment Fraud Report 2021

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

HSBC Became Aware of Online Accounts Being Accessed by Unauthorized Users Between October 4, 2018 and October 14, 2018

<<Field_36>> <<Field_37>> <<Field_38>> <<Field_39>>, <<Field_40>> <<Field_41>><<Field_42>> <<First Name>> << Middle Name>> <<Last Name>> Date: November 2, 2018 <<Address 1>> <<Address 2>> <<Address 3>> <<City>>, <<State>> <<Zip>><<4 Digit Zip>> Notice of Data Breach What Happened? HSBC became aware of online accounts being accessed by unauthorized users between October 4, 2018 and October 14, 2018. When HSBC discovered your online account was impacted, we suspended online access to prevent further unauthorized entry of your account. You may have received a call or email from us so we could help you change your online banking credentials and access your account. If you need help accessing your account, please call <<Field_47>>. We apologize for this inconvenience. HSBC takes this very seriously and the security of your information is very important to us. What Information The information that may have been accessed includes your full name, mailing Was Involved? address, phone number, email address, date of birth, account numbers, account types, account balances, transaction history, payee account information, and statement history where available. What We Are We have enhanced our authentication process for HSBC Personal Internet Doing. Banking, adding an extra layer of security. Out of an abundance of caution and at our expense, HSBC is offering you a complimentary <<Field_43>>-year subscription to Identity Guard®, a credit monitoring and identity theft protection service. Identity Guard not only provides essential monitoring and protection of credit data, but also alerts you to certain activities that could indicate potential identity theft. This program is provided by Intersections Inc. (NASDAQ: INTX), a leading provider of consumer and corporate identity risk management services. -

Top Trends Shaping Identity Verification (IDV) in 2018

NOT LICENSED FOR DISTRIBUTION Top Trends Shaping Identity Verification (IDV) In 2018 Post-Equifax Breach, IDV Aggregators Will Cater To Multifaceted IDV Requirements by Andras Cser and Merritt Maxim March 29, 2018 Why Read This Report Key Takeaways In the face of increasing identity theft, stricter IDV Based On Credit Header Data Will Become compliance regulations, and the push for online Weaker — Get Ready To Fight Back customer acquisition, reliable, accurate, cost- After the 2017 Equifax breach, we entered a new effective, and easy-to-use identity verification era in which credit header data for IDV solutions (IDV) is becoming a core building block of any and knowledge-based authentication (KBA) customer or employee identity and access are inadequate for reliable identity verification. management (IAM) system. This document Firms will have to adopt new lower cost and less highlights the key trends shaping the IDV market intrusive IDV technologies, such as those based in 2018 and beyond and helps security and risk on device reputation or phone number. pros adapt their strategies, vendor selection, and Social And Behavioral IDV Will Lower Costs implementation. And Improve Accuracy Social IDV, based on comparing identity attributes to profiles on social media, and behavioral biometrics, verifying identities based on how a user moves the mouse or touches the screen, will lower the cost and improve the accuracy of day- to-day IDV across all verticals. FORRESTER.COM FOR SECURITY & RISK PROFESSIONALS Top Trends Shaping Identity Verification -

Parker Review

Ethnic Diversity Enriching Business Leadership An update report from The Parker Review Sir John Parker The Parker Review Committee 5 February 2020 Principal Sponsor Members of the Steering Committee Chair: Sir John Parker GBE, FREng Co-Chair: David Tyler Contents Members: Dr Doyin Atewologun Sanjay Bhandari Helen Mahy CBE Foreword by Sir John Parker 2 Sir Kenneth Olisa OBE Foreword by the Secretary of State 6 Trevor Phillips OBE Message from EY 8 Tom Shropshire Vision and Mission Statement 10 Yvonne Thompson CBE Professor Susan Vinnicombe CBE Current Profile of FTSE 350 Boards 14 Matthew Percival FRC/Cranfield Research on Ethnic Diversity Reporting 36 Arun Batra OBE Parker Review Recommendations 58 Bilal Raja Kirstie Wright Company Success Stories 62 Closing Word from Sir Jon Thompson 65 Observers Biographies 66 Sanu de Lima, Itiola Durojaiye, Katie Leinweber Appendix — The Directors’ Resource Toolkit 72 Department for Business, Energy & Industrial Strategy Thanks to our contributors during the year and to this report Oliver Cover Alex Diggins Neil Golborne Orla Pettigrew Sonam Patel Zaheer Ahmad MBE Rachel Sadka Simon Feeke Key advisors and contributors to this report: Simon Manterfield Dr Manjari Prashar Dr Fatima Tresh Latika Shah ® At the heart of our success lies the performance 2. Recognising the changes and growing talent of our many great companies, many of them listed pool of ethnically diverse candidates in our in the FTSE 100 and FTSE 250. There is no doubt home and overseas markets which will influence that one reason we have been able to punch recruitment patterns for years to come above our weight as a medium-sized country is the talent and inventiveness of our business leaders Whilst we have made great strides in bringing and our skilled people. -

The Underground Economy.Pdf

THE THE The seeds of cybercrime grow in the anonymized depths of the dark web – underground websites where the criminally minded meet to traffic in illegal products and services, develop contacts for jobs and commerce, and even socialize with friends. To better understand how cybercriminals operate today and what they might do in the future, Trustwave SpiderLabs researchers maintain a presence in some of the more prominent recesses of the online criminal underground. There, the team takes advantage of the very anonymity that makes the dark web unique, which allows them to discretely observe the habits of cyber swindlers. Some of the information the team has gathered revolves around the dark web’s intricate code of honor, reputation systems, job market, and techniques used by cybercriminals to hide their tracks from law enforcement. We’ve previously highlighted these findings in an extensive three-part series featured on the Trustwave SpiderLabs blog. But we’ve decided to consolidate and package this information in an informative e-book that gleans the most important information from that series, illustrating how the online criminal underground works. Knowledge is power in cybersecurity, and this serves as a weapon in the fight against cybercrime. THE Where Criminals Congregate Much like your everyday social individual, cyber swindlers convene on online forums and discussion platforms tailored to their interests. Most of the criminal activity conducted occurs on the dark web, a network of anonymized websites that uses services such as Tor to disguise the locations of servers and mask the identities of site operators and visitors. The most popular destination is the now-defunct Silk Road, which operated from 2011 until the arrest of its founder, Ross Ulbricht, in 2013. -

Beware of These Common Scams

Beware of these common scams Nigerian Scams People claiming to be officials, businessmen or surviving relatives of former government officials in countries around the world send countless offers via e-mail, attempting to convince consumers that they will transfer thousands of dollars into your bank account if you will just pay a fee or "taxes" to help them access their money. If you respond to the initial offer, you may receive documents that look "official." Unfortunately, you will get more e-mails asking you to send more money to cover transaction and transfer costs, attorney's fees, blank letterhead and your bank account numbers and other sensitive, personal information. Tech Support Scams A tech support person may call or email you and claim that they are from Windows, Microsoft or another software company. The person says your computer is running slow or has a virus and it’s sending out error messages. Scammers will ask you to visit a website that gives them remote access to your computer. If the caller obtains access they can steal personal information, usernames and passwords to commit identity theft or send spam messages. In some cases, the caller may even be asked for a wired payment or credit card information. Lottery Scams In foreign lottery scams, you receive an email claiming that you are the winner of a foreign lottery. All you need to do to claim your prize is send money to pay the taxes, insurance, or processing or customs fees. Sometimes, you will be asked to provide a bank account number so the funds can be deposited. -

Licensed By: TABLE of CONTENTS

Licensed by: TABLE OF CONTENTS Overview ........................................................................................................................................................................................ 4 Executive Summary ........................................................................................................................................................................ 5 Recommendations .......................................................................................................................................................................... 7 Toward a New Model of Identity Proofing ..................................................................................................................................... 8 Designing a Robust ID Proofing Workflow ................................................................................................................................... 12 Introducing Javelin’s FIT Model .................................................................................................................................................... 13 Overall ........................................................................................................................................................................................... 13 Functional ..................................................................................................................................................................................... 14 Innovative .................................................................................................................................................................................... -

Shadowcrew Organization Called 'One-Stop Online Marketplace for Identity Theft'

October 28, 2004 Department Of Justice CRM (202) 514-2007 TDD (202) 514-1888 WWW.USDOJ.GOV Nineteen Individuals Indicted in Internet 'Carding' Conspiracy Shadowcrew Organization Called 'One-Stop Online Marketplace for Identity Theft' WASHINGTON, D.C. - Attorney General John Ashcroft, Assistant Attorney General Christopher A. Wray of the Criminal Division, U.S. Attorney Christopher Christie of the District of New Jersey and United States Secret Service Director W. Ralph Basham today announced the indictment of 19 individuals who are alleged to have founded, moderated and operated "www.shadowcrew.com" -- one of the largest illegal online centers for trafficking in stolen identity information and documents, as well as stolen credit and debit card numbers. The 62-count indictment, returned by a federal grand jury in Newark, New Jersey today, alleges that the 19 individuals from across the United States and in several foreign countries conspired with others to operate "Shadowcrew," a website with approximately 4,000 members that was dedicated to facilitating malicious computer hacking and the dissemination of stolen credit card, debit card and bank account numbers and counterfeit identification documents, such as drivers' licenses, passports and Social Security cards. The indictment alleges a conspiracy to commit activity often referred to as "carding" -- the use of account numbers and counterfeit identity documents to complete identity theft and defraud banks and retailers. The indictment is a result of a year-long investigation undertaken by the United States Secret Service, working in cooperation with the U.S. Attorney's Office for the District of New Jersey, the Computer Crime and Intellectual Property Section of the Criminal Division of the Department of Justice, and other U.S. -

Special Edition on Advanced Analytics in Banking

McKinsey on Payments Special Edition on Advanced Analytics in Banking Highlights 4 13 36 The analytics-enabled How machine learning can Hidden figures: The quiet collections model improve pricing performance discipline of managing people using data 52 60 68 Designing a data Building an effective “All in the mind”: Harnessing transformation that delivers analytics organization psychology and analytics to value right from the start counter bias and reduce risk Volume 11 Number 28 August 2018 McKinsey on Payments is written by experts and practitioners in the McKinsey & Company Global Payments Practice. To send comments or request copies, email us at: [email protected] To download selected articles from previous issues, visit: https://www.mckinsey.com/industries/financial-services/our-insights/payments Editorial board for special analytics issue: Kevin Buehler, Vijay D’Silva, Matt Fitzpatrick, Arvind Govindarajan, Megha Kansal, Gloria Macias-Lizaso Miranda McKinsey on Payments editorial board: Alessio Botta, Philip Bruno, Robert Byrne, Olivier Denecker, Vijay D’Silva, Tobias Lundberg, Marc Niederkorn Editors: John Crofoot, Peter Jacobs, Glen Sarvady, Anne Battle Schultz, Jill Willder Global Payments Practice manager: Natasha Karr Global Advanced Analytics in Banking Practice manager: Josephine Axtman Managing editor: Pa ul Feldman Design and layout: Derick Hudspith Copyright © 201 8 McKinsey & Company. All rights reserved. This publication is not intended to be used as the basis for any transaction. Nothing herein shall be construed as legal, financial, accounting, investment, or other type of professional advice. If any such advice is required, the services of appropriate advisers should be sought. No part of this publication may be copied or redistributed in any form without the prior written permission of McKinsey & Company. -

Wolters Kluwer Governance Roadshow

Wolters Kluwer Governance Roadshow Selection & Remuneration Committee of the Supervisory Board of Wolters Kluwer September, 2020 Governance Roadshow, September 2020 1 Forward-looking statements This presentation contains forward-looking statements. These statements may be identified by words such as "expect", "should", "could", "shall", and similar expressions. Wolters Kluwer cautions that such forward-looking statements are qualified by certain risks and uncertainties that could cause actual results and events to differ materially from what is contemplated by the forward-looking statements. Factors which could cause actual results to differ from these forward-looking statements may include, without limitation, general economic conditions, conditions in the markets in which Wolters Kluwer is engaged, behavior of customers, suppliers and competitors, technological developments, the implementation and execution of new ICT systems or outsourcing, legal, tax, and regulatory rules affecting Wolters Kluwer's businesses, as well as risks related to mergers, acquisitions and divestments. In addition, financial risks, such as currency movements, interest rate fluctuations, liquidity and credit risks could influence future results. The foregoing list of factors should not be construed as exhaustive. Wolters Kluwer disclaims any intention or obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Growth rates are cited in constant currencies unless otherwise noted. -

Workers' Compensation Payer List (PDF)

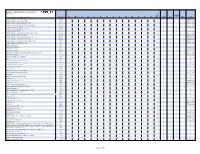

WORKERS' COMPENSATION / AUTO PAYER LIST 09/10/2021 All WORK * Provider must be contracted with Carisk Payer ID TX MN CA IL LA NJ NY OR WI NC NM OK TN VA States 837P 837I COMP AUTO 835 *Carisk Imaging to Allstate Insurance - Auto Only E1069 x x x x Rejects Only *Carisk Imaging to Geico (Auto Only) GEICO x x x x Rejects Only *Carisk Imaging to Nationwide (Auto Only) A0002 x x x x Rejects Only *Carisk Imaging to New York City Law Department NYCL001 x x x x Rejects Only *Carisk Imaging to NJ-PLIGA E3926 x x x x Rejects Only *Carisk Imaging to North Dakota WSI NDWSI x x x x *Carisk Imaging to NYSIF NYSIF1510 x x x x Rejects Only *Carisk Imaging to Progressive Insurance (Auto Only) E1139 x x x x Rejects Only *Carisk Imaging to Pure (Auto Only) PURE01 x x x x Rejects Only *Carisk Imaging to Safeco Insurance (Auto Only) E0602 x x x x Rejects Only *Carisk Imaging to SafeTPA, LLC (NY Only) SAFE01 x x x x Rejects Only *Carisk Imaging to Selective Insurance (Auto Only) E1077 x x x x Rejects Only *Carisk Imaging to USAA (Auto Only) A0001 x x x x Rejects Only 1st Auto & Casualty J1585 x x x x x 21st Century Insurance 41556 x x x x Rejects Only 22125 Roscoe Corp. 41556 x x x x Rejects Only AAA Minnesota/Iowa 11983 x x x x x AAA Northern California, Nevada & Utah Insurance Exchange 41556 x x x x Rejects Only ABC Const. -

Dispute Best Practices

DISPUTE BEST PRACTICES PREPARING YOUR COMPANY TO MINIMIZE FRAUD COSTS TABLE OF CONTENTS Introduction 4 Preventing True Fraud 5 AVS Match on All US Transactions 6 Gather CVV, CVV2, CVC for the Credit Card 6 Look Out for Fraud Red Flags 6 Preventing Legitimate Disputes 8 Source the Best Products 8 Create Robust and Accurate Product Descriptions 9 Cultivate Product Reviews 9 Ship Promptly 10 Communicate Regularly 10 Hold Shipping Carriers Accountable 10 Require Agreement of Clearly Stated Terms & Conditions 11 Prevent Duplicate Transactions 11 Preventing Friendly Fraud 12 Optimize Your Merchant Descriptor 12 Ensure Contact Information is Easy to Find 12 Preventing Recurring Billing Disputes 13 Proactive & Reactive Customer Communication 13 Clearly Displayed, Flexible Subscription Terms 14 Have Customers Manually Opt-In after Free Trials 14 © Xomi, Inc. Dispute Best Practices | 2 TABLE OF CONTENTS Optimize Customer Lifetime Value 14 Preventing & Revealing Chargeback Fraud 15 2HUD&XVWRPHU&HQWULF5HWXUQ3ROLF\ 15 Document Customer Service Communications 16 Proof of Shipment 16 'HSOR\5LVNRUΖGHQWLW\9HULȴFDWLRQ6ROXWLRQV 16 Record User History for Services Rendered 16 Send a Satisfaction Survey 16 Conclusion 17 Here’s To Your Ongoing Success 17 © Xomi, Inc. Dispute Best Practices | 3 INTRODUCTION For almost 10 years, the team at Chargeback has helped merchants of all types prevent and manage credit card disputes. Nearly a decade in the space has provided us with comprehensive knowledge and understanding of disputes and all that accompanies them. In this Dispute Best Practices guide, we’ll outline the foundational elements that we’ve determined to be critical through seeing hundreds of thousands of disputes processed through our app. -

Four Ways Fraudsters Are Taking Their Tactics to New Levels

FOUR WAYS FRAUDSTERS ARE TAKING THEIR TACTICS TO NEW LEVELS Four Ways Fraudsters Are Taking Their Tactics to New Levels pipl.com 1 FOUR WAYS FRAUDSTERS ARE TAKING THEIR TACTICS TO NEW LEVELS A Pandemic Followed by an Epidemic 2020 unleashed more than a disease pandemic—it also precipitated an epidemic of eCommerce fraud. As merchants experienced 25-30% increases in card-not-present (CNP) transactions during the pandemic, fraudsters capitalized. Although “friendly” chargeback CNP fraud and refund fraud was prevalent pre-Covid, fraudsters have elevated these types of fraud to almost an art form. In addition to losses created from cardholders’ attempts to refund losses are transactions, organized networks of professional fraudsters are working full time—with projected legitimate cardholders or cardholder data—to bilk merchants, payment card companies, banks, and consumers of billions of dollars. to total How much are we talking about? $7.9 billion The vast majority of CNP fraud occurs after a transaction. Although risk and fraud analysts work to detect and prevent fraudulent transactions from being fulfilled, that’s pretty difficult in 2021. to accomplish when the fraudster IS the cardholder or when he is using the legitimate cardholder’s information. As a result, CNP fraud losses are rising quickly. According to Aite Group, CNP fraud losses are projected to total $7.9 billion in 2021. For an average business, costs add up quickly: • Value of the stolen goods • Order fulfillment costs Businesses still pay the cost of producing, storing,