State of the Uk Leisure Industry

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

House of Lords Official Report

Vol. 708 Tuesday No. 35 24 February 2009 PARLIAMENTARY DEBATES (HANSARD) HOUSE OF LORDS OFFICIAL REPORT ORDER OF BUSINESS Questions Benefits: Winter Fuel Allowance Statute Law Database Economy: Arts and Culture Energy: Renewable Gas Health: Disease Control (Intergovernmental Organisations Committee Report) Motion to Take Note Freedom of Information Act 2000 Statement Energy: Renewables (Economic Affairs Committee Report) Motion to Take Note Human Rights: Religious Belief Question for Short Debate Grand Committee Local Democracy, Economic Development and Construction Bill [HL] Committee (Seventh Day) Written Statements Written Answers For column numbers see back page £3·50 Lords wishing to be supplied with these Daily Reports should give notice to this effect to the Printed Paper Office. The bound volumes also will be sent to those Peers who similarly notify their wish to receive them. No proofs of Daily Reports are provided. Corrections for the bound volume which Lords wish to suggest to the report of their speeches should be clearly indicated in a copy of the Daily Report, which, with the column numbers concerned shown on the front cover, should be sent to the Editor of Debates, House of Lords, within 14 days of the date of the Daily Report. This issue of the Official Report is also available on the Internet at www.publications.parliament.uk/pa/ld200809/ldhansrd/index/090224.html PRICES AND SUBSCRIPTION RATES DAILY PARTS Single copies: Commons, £5; Lords £3·50 Annual subscriptions: Commons, £865; Lords £525 WEEKLY HANSARD Single copies: Commons, £12; Lords £6 Annual subscriptions: Commons, £440; Lords £255 Index—Single copies: Commons, £6·80—published every three weeks Annual subscriptions: Commons, £125; Lords, £65. -

The Eco-Trend As a New Tendency in the Fashion Industry and Its Influence on Modern Design

THE ECO-TREND AS A NEW TENDENCY IN THE FASHION INDUSTRY AND ITS INFLUENCE ON MODERN DESIGN AUTHORSHIP INTRODUCTION Svitlana Oborska Global environmental problems have become Docent, Associate Professor of the Department of Event one of the reasons for the formation of a new Management and Leisure Industry Kyiv National University of the Culture and Arts, Associate Professor of the Department of Event concept in design. In the fashion industry, the Management and Leisure Industry, Kyiv National University of the Culture and Arts. term "environmental sustainability" or "conscious fashion" - the safe use of the ORCID: https://orcid.org/0000-0003-3148-6325 E-mail: [email protected] planet's natural resources and ensuring Liudmyla Bilozub environmental and social safety - is becoming increasingly common. Professor assistant, PhD in History of Arts, Zaporizhzhia National University. It is known that clothes should not only ORCID: https://orcid.org/0000-0002-2384-827X aesthetic, but also have a direct physiological E-mail: [email protected] impact on people, so clothing design has Oksana Minenko rapidly responded to the need for a conscious Associate Professor at the Department of Design of the Faculty of approach to environmental issues. The search Art and Design, Candidate of Art and Criticism, Department of Design of the Faculty of Art and Design, Municipal Institution of for new materials, new methods of natural Higher Education "Khortytsia National Educational Rehabilitation dyeing of fabrics, the use of recycled fibers in Academy" of Zaporizhzhia Regional Council. weaving, the restoration of traditional crafts ORCID: https://orcid.org/0000-0003-4210-5778 that are used in clothing production - all this E-mail: [email protected] has grown from an unpopular theory to a Oleksandra Penchuk stable and generally applied practical activity Candidate of Technical Sciences, Associate Professor, under the general definition of eco-design. -

Introduction

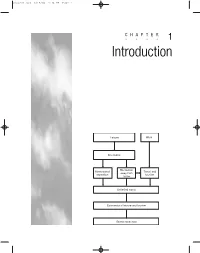

Chap-01.qxd 8/17/04 3:34 PM Page 1 CHAPTER •••• 1 Introduction Leisure Work Recreation Recreation Home-based Travel and away from recreation tourism home Unlimited wants Economics of leisure and tourism Scarce resources Chap-01.qxd 8/17/04 3:34 PM Page 2 The Economics of Recreation, Leisure and Tourism Objectives and learning outcomes • How important are recreation, leisure and tourism to national economies? • Why do these industries provide so many new jobs? • What is the globalization of recreation and leisure? • Are recreation, leisure and tourism shares good investments? • Is the growth of recreation, leisure and tourism sustainable? This book will help you investigate these issues. The objectives of this chapter are to define and integrate the areas of study of this book. First the scope of recreation, leisure and tourism will be discussed, and second the scope and techniques of economics will be outlined. The final part of the chapter explains how the study area of recreation, leisure and tourism can be analysed using economic techniques. By studying this chapter students will be able to: • understand the scope of recreation, leisure and tourism and their interrelationship; • explain the basic economic concerns of scarcity, choice and opportunity costs; • outline the allocation of resources in different economic systems; • explain the methodology of economics; • understand the use of models in economics; • understand the use of economics to analyse issues in recreation, leisure and tourism; • access sources of information. Definition and scope of recreation, leisure and tourism Like all definitions, those pertaining to recreation, leisure and tourism encounter some problems. -

A Study on the Fashion Styles of the Wellness Kin in the Contemporary Fashion

Journal of Fashion Business Vol. 6, No. 6, pp.19~33(2002) A Study on the Fashion Styles of the Wellness Kin in the Contemporary Fashion Kan, Ho-Sup* and Park, Na-Na Assoc. Prof., Dept. of Fashion Design, Dongduk Women’s University* M.A., Dept. of Fashion Design, Dongduk Women’s University Abstract In the middle of economic and mental riches in the 21st century, the importance of well being and the pursuit of happiness are emerging as the new trend. Thus the lifestyle that values comfortable and practical naturalness and intrinsic merits has come to influence the human life rather than the old showing-off and formal desire. In addition to this, the spread of the five day week has given more leisure time, which has led to the increasing interest in health and leisure. The interest in sports has skyrocketed since the successful holding of the 2002 Korea and Japan World Cup event. All these changes to the lifestyle have contributed to the fusion of luxury wear and sports wear. As the result of the consumers in the 21st century having more classified and upgraded way of living thanks to the settlement of the above-mentioned lifestyle and the enlargement of the leisure sports culture, there has appeared the wellness kin, who value the importance of life and the nature and believe in the idea that they can reconstruct the environment in the way they can enjoy their lifestyle and pursue happiness. They favor healthy fashion items and think much of exercise, nutrition, and rest. They pursue the natural and comfortable style, whose ideas came from simple exercises such as health training and yoga and the easy and comfortable look observed at resorts. -

GCSE Leisure and Tourism 2009 Unit1.Pdf

GCSE Leisure & Tourism – Investigating Leisure & Tourism in a chosen area 2.1.2 A Introduction to Leisure and Tourism Leisure Every person has things that they have to do. Many adults have to go to work; someone has to do the shopping, prepare meals, and clean the house and so on. Students and children have to go to school or college and may have homework projects to do after school has finished. Also, every person has to sleep, wash and shower usually for somewhere between 6 to 8 hours each night. When all these things have been completed there is time left over, and this time is a person’s leisure time. During this time, people choose to do what they enjoy doing rather than what they have to do. Put another way: Leisure time is the opportunity available to a person after completing the immediate necessities of life. During this time the person has the freedom to choose what activities to take part in. Another term used is a person’s free time. Some people choose to do very little in their leisure time and may watch television, listen to music or read a newspaper. All of these are very popular leisure activities. They are all things which many people choose to do because they can be done at home and cost very little money. Also, they are activities which people can enjoy on their own. Each person can decide what to do in their leisure time and there are many factors which influence this choice, including the age of the person, their family and friends, their religion and culture, the money they have to spend on leisure and where they live. -

Constructive Suggestions on the Development of Leisure Sports

6th International Conference on Electronic, Mechanical, Information and Management (EMIM 2016) Constructive Suggestions on the Development of Leisure Sports Industry in Ganzhou Renzhuo Zhang School of Science, Jiangxi University of Science and Technology, Ganzhou, China [email protected] Keywords: Ganzhou; Leisure sports; Industry; Suggestion Abstract. This article studies the current situation of leisure sports industry in Ganzhou by using literature consultation, interview method and field research method. And through relevant researches on the current situation, problems existing in the development of leisure sports industry had been found, and thus corresponding suggestions were proposed: create good leisure sports environment to attract tourists from various places and promote further development of this industry; then enhance propaganda, and establish scientific leisure sports values, the development of leisure sports should be connected with the nationwide fitness campaign tightly; the school should establish new educational philosophy; pay more attention on cultivating social sports instructors, popularize red sports to boost the development of leisure sports industry. Introduction Leisure time is an inevitable rules for social development, “the coming of the leisure time” would provide opportunity for the development of leisure sports development, and as a cultural, scientific and healthy ways of life, it could help people gain spiritual motivations for life at the same time of promoting healthy development of both the body and the mind, it plays an important role in increasing the overall quality of people; also, has significant effect on promoting the development of industrial economy and the society and interpersonal communication, the vitality of the sports cause and the perfection of the life-long education system. -

The Cabinet Manual

The Cabinet Manual A guide to laws, conventions and rules on the operation of government 1st edition October 2011 The Cabinet Manual A guide to laws, conventions and rules on the operation of government 1st edition October 2011 Foreword by the Prime Minister On entering government I set out, Cabinet has endorsed the Cabinet Manual as an authoritative guide for ministers and officials, with the Deputy Prime Minister, our and I expect everyone working in government to shared desire for a political system be mindful of the guidance it contains. that is looked at with admiration This country has a rich constitution developed around the world and is more through history and practice, and the Cabinet transparent and accountable. Manual is invaluable in recording this and in ensuring that the workings of government are The Cabinet Manual sets out the internal rules far more open and accountable. and procedures under which the Government operates. For the first time the conventions determining how the Government operates are transparently set out in one place. Codifying and publishing these sheds welcome light on how the Government interacts with the other parts of our democratic system. We are currently in the first coalition Government David Cameron for over 60 years. The manual sets out the laws, Prime Minister conventions and rules that do not change from one administration to the next but also how the current coalition Government operates and recent changes to legislation such as the establishment of fixed-term Parliaments. The content of the Cabinet Manual is not party political – it is a record of fact, and I welcome the role that the previous government, select committees and constitutional experts have played in developing it in draft to final publication. -

Local Communities' Incentives for Forest Conservation

LOCAL COMMUNITIES’ INCENTIVES FOR FOREST CONSERVATION: CASE OF KAKAMEGA FOREST IN KENYA By Paul Guthiga1* and John Mburu1 A Paper Presented at the 11th Biannual Conference of International Association for the Study of Common Property (IASCP) Bali, Indonesia June 19th to June 23rd 2006 Survival of the Commons: Mounting Challenges and New Realities 1Center for Development Research (ZEF), University of Bonn, Walter-Flex-Str. 3, D53113 Bonn, Germany * Corresponding author: Tel +49-228-731731, Fax +49-228-731869, E-mail: [email protected] The authors would like to express their grateful appreciation to the German Federal Ministry of Education and Research (BMBF) for providing funding for this study through the Biodiversity Analysis Transect for Africa (BIOTA)-East project. ABSTRACT The study is based on a biodiversity-rich remnant of a tropical rainforest located in western Kenya under immense threat of survival. The forest is located in a densely populated area inhabited by poor farming communities. Currently the forest is managed by three management regimes each carrying out its function in a different manner. The study identifies, describes and where possible quantifies the various conservation incentives (both economic and non-economic) offered by the three management regimes. Further, the study analyses local people’s perception of management regimes by generating management satisfaction rankings; both overall and for specific management aspects. The findings of the study indicate that extraction of direct forest products is the main incentive offered by two of the regimes. The local people obtain substantial financial benefits in the form of products they extract from the forest. Satisfaction ranking showed that the strictest regime among the three was ranked highest overall for it performance. -

Spending Round 2013

SPENDING ROUND 2013 Cm 8639 June 2013 SPENDING ROUND 2013 Presented to Parliament by the Chancellor of the Exchequer by Command of Her Majesty June 2013 Cm 8639 £45.00 © Crown copyright 2013 You may re-use this information (excluding logos) free of charge in any format or medium, under the terms of the Open Government Licence. To view this licence, visit www.nationalarchives.gov.uk/doc/open-government-licence/ or email [email protected]. Where we have identified any third party copyright information you will need to obtain permission from the copyright holders concerned. Any enquiries regarding this publication should be sent to us at [email protected]. You can download this publication from www.gov.uk ISBN 9780101863926 PU1501 Printed in the UK by the Stationery Office Limited on behalf of the Controller of Her Majesty’s Stationery Office Printed on paper containing 75% recycled fibre content minimum ID 2567822 30559 06/13 Contents Page Executive Summary 5 Chapter 1 Overview 13 Chapter 2 Departmental Settlements 33 Annex A Statistical Annex 57 List of Abbreviations 63 List of Tables 65 List of Charts 66 Executive Summary The Spending Round is the next stage in the Government’s plan to move Britian from rescue to recovery. In 2010, the Government inherited the largest deficit since the Second World War and one pound in every four that the Government spent was borrowed. Thanks to the tough choices taken since then, progress is already being made: the economy is growing, more than a million new jobs have been created by British businesses, and the amount the Government has to borrow each year – the deficit – is down by one third. -

Study on the New Pathway of Ecological Poverty Alleviation an Forest Health Industry Integrated Development

American Journal of Environmental Science and Engineering 2020; 4(4): 70-74 http://www.sciencepublishinggroup.com/j/ajese doi: 10.11648/j.ajese.20200404.14 ISSN: 2578-7985 (Print); ISSN: 2578-7993 (Online) Study on the New Pathway of Ecological Poverty Alleviation an Forest Health Industry Integrated Development Weitao Xu 1, Heding Shen 1, Liqiang Zhang 1, Laicheng Yang 2, *, An Mao 2, *, Yifu Yuan 2, * 1Planning and Design Institute of Forest Products Industry of National Forestry and Grassland Administration, Beijing, China 2College of Forestry, Shandong Agricultural University, Taian, China Email address: *Corresponding author To cite this article: Weitao Xu, Heding Shen, Liqiang Zhang, Laicheng Yang, An Mao, Yifu Yuan. Study on the New Pathway of Ecological Poverty Alleviation an Forest Health Industry Integrated Development. American Journal of Environmental Science and Engineering . Vol. 4, No. 4, 2020, pp. 70-74. doi: 10.11648/j.ajese.20200404.14 Received : December 4, 2020; Accepted : December 14, 2020; Published : December 22, 2020 Abstract: Forest has the function of nourishing body and mind, promoting health, enhancing human immunity, which is of great significance to improve health index. Forest health care can give full play to the advantages of forest landscape, environment, space and culture, and extend forest functions. It is a new industry integrating forestry, health services, tourism and leisure industry, and is a new trend of sustainable development of forestry. Ecological poverty alleviation is a kind of poverty alleviation -

The Leisure Consumer 2021 Emerging from the Pandemic June 2021 the Leisure Consumer 2021 | Emerging from the Pandemic

The Leisure Consumer 2021 Emerging from the pandemic June 2021 The Leisure Consumer 2021 | Emerging from the pandemic Content Foreword ��������������������������������������������������������������������������������������������������������������������������������������� 04 Infographic ������������������������������������������������������������������������������������������������������������������������������������� 05 A recovery in consumer confidence 06 Will COVID-19 have a lasting impact on the behaviours of leisure consumers? 09 Beyond COVID-19: Four leisure consumer profiles ����������������������������������������������������������� 13 Conclusion �������������������������������������������������������������������������������������������������������������������������������������� 18 Authors and Contacts ���������������������������������������������������������������������������������������������������������������� 20 2 The Leisure Consumer 2021 | Emerging from the pandemic The consumer data featured in this About this report: report is based on a survey carried out by independent market research agency, YouGov, on Deloitte’s behalf. This survey was conducted online with a nationally representative sample of more than 3,000 UK adults aged 18+ between 19 and 23 March. Some of the figures in this report show the results in the form of a net balance. This is calculated by subtracting the proportion of respondents that reported doing less of something from the proportion that reported doing -

Government of India Ministry of Tourism and Culture Department of Tourism Market Research Division

GOVERNMENT OF INDIA MINISTRY OF TOURISM AND CULTURE DEPARTMENT OF TOURISM MARKET RESEARCH DIVISION Final Report On 20 YEAR PERSPECTIVE PLAN FOR SUSTAINABLE TOURISM DEVLOPMENT IN UNION TERRITORY OF CHANDIGARH March 2003 Submitted by India Tourism Development Corporation TLC Marketing Pvt. Ltd. Deloitte Touche Tohmatsu India Private Limited 20 year Perspective Tourism Master Plan for Chandigarh Contents for the 20 Year perspective Tourism Master Plan 1. Executive Summary 1 2. The approach a. Guidelines for developing 20 year perspective Master Plans as issued by the Department of Tourism, Government of India 6 b. Background of Consortium partners 11 i. ITDC ii. Deloitte Touche Tohmatsu iii. TLC Marketing Pvt Ltd c. Approach 15 d. Approach to Environmental Impact Assessment 19 3. Background on the State 21 a. History b. Physical features, Flora and Fauna c. Current infrastructure i. Access – Road, Rail, Air ii. Water & Sewage iii. Power – Electricity iv. Industrial Estates – list of major corporates d. Demographics versus other Northern States District Profiles e. Chandigarh Headquartered Corporate Houses 4. Current Tourism scenario in the State 38 a. Current Chandigarh Tourism Policy b. Inventory of Accommodation c. Current Tourism Statistics 1 20 year Perspective Tourism Master Plan for Chandigarh i. By city ii. Comparative with other Indian States – employment, project spends d. Taxes on Tourism activities e. Fairs & Festivals f. Roles of relevant bodies i. State Tourism Development ii. Urban Development & Town Planning iii. Industrial Development g. Tourism activities of contiguous States 5. Assessment of Tourism Attractions of the State 65 a. How other “City States” have developed tourism b. Inventory of attractions i.