Delaware County

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Central District Athletic Board Membership History 1926

Central District Athletic Board Membership History 1926 to 2019 Compiled by: Galen Kyre, Secretary (1974-2011) Doug Ute, Secretary (2011-Present) Central District Athletic Board Membership History The information contained herein of past membership on the Central District Athletic Board was gathered from District Board minutes, Central District Basketball Programs, and from publications stored in the Ohio High School Athletic Association Library. While care has been taken to insure that the information is correct, there may be errors and omissions. Should the reader find errors, omissions, or any other incorrect data, it would be appreciated if a contact would be made with Doug Ute, Secretary, Central District Athletic Board. Membership Trivia MOST YEARS ON THE STATE BOARD OF CONTROL 8 Years – B.A. Meiser – Superintendent, Canal Winchester 8 Years – D. O. Davis, Superintendent, Fairfield County Schools FIRST STATE BOARD OF CONTROL MEMBER H. P. Swain, Principal, Columbus City Schools 1926 to 27 FIRST CENTRAL DISTRICT ATHLETIC BOARD (ON RECORD) 1926 – H. P. Swain, Principal, Columbus, State Board Member, W.A. Kline, Principal, Westerville, L. B. Brown, Superintendent, Prospect FIRST FEMALE TO SERVE ON A DISTRICT ATHLETIC BOARD AND SERVE ON THE STATE BOARD OF CONTROL BARBARA HARRISON – Canal Winchester High School, elected to the Central District Board in 1985 and to the State Board of Control in 1993 FIRST PERSON ELECTED TO THE GENDER REPRESENTATIVE POSITION Beth Hill – Newark Catholic High School, 2007 FIRST PERSON ELECTED TO THE ETHNIC MINORITY REPRESENTATIVE POSITION Keith Bell – Westerville City Schools, 2007 FIRST PERSON ELECTED TO THE 7TH/8TH GRADE REPRESENTATIVE POSITION Chuck Byers – Ridgeview Jr. -

Dear Student

Dear Student, Course Selection is one of the most important decisions you will make while in high school. Careful course selection will guide you into a college or work training program, and ultimately the career of your choice. This handbook has been designed to help you make the best possible choices for class selections. First, each of your teachers will recommend the next appropriate step in his or her department’s course sequence and required coursework will be entered into the computer for you. Therefore, as a student, you can focus more specifically on selecting those elective courses that most interest you. After both you and your teachers have had the opportunity to recommend course requests for next year, your parents will also be included and asked to verify that they agree with the course selections assigned. Finally, as we complete this school year, your teachers and parents will both be given several opportunities to consult with you and make sure that the courses you’ve selected best fit your academic needs and interests. You should complete the course planner located at the back of this booklet to guide you through the course selection process. You will soon have an individual scheduling appointment with a guidance counselor or administrator. If you have any questions, please ask. We are happy to help. The High School Administration 1 TABLE OF CONTENTS General Information and Regulations….………………………………………………………………...…..........3-5 Suggested Tracks of Study………………………...……………………………………………………..................6 What are my options?....................................................................................................................................7-8 -

Big Walnut Local School District Delaware County

BIG WALNUT LOCAL SCHOOL DISTRICT DELAWARE COUNTY SINGLE AUDIT FOR THE YEAR ENDED JUNE 30, 2020 BIG WALNUT LOCAL SCHOOL DISTRICT DELAWARE COUNTY JUNE 30, 2020 TABLE OF CONTENTS TITLE PAGE Prepared by Management: Schedule of Expenditures of Federal Awards ....................................................................................... 1 Notes to the Schedule of Expenditures of Federal Awards ................................................................... 2 Independent Auditor’s Report on Internal Control Over Financial Reporting and on Compliance and Other Matters Required by Government Auditing Standards ........................................................................................... 3 Independent Auditor’s Report on Compliance with Requirements Applicable to the Major Federal Program and on Internal Control Over Compliance Required by the Uniform Guidance ....................................................................................... 5 Schedule of Findings ..................................................................................................................................... 9 Attachment: Comprehensive Annual Financial Report (CAFR) THIS PAGE INTENTIONALLY LEFT BLANK BIG WALNUT LOCAL SCHOOL DISTRICT DELAWARE COUNTY SCHEDULE OF EXPENDITURES OF FEDERAL AWARDS FOR THE YEAR ENDED JUNE 30, 2020 FEDERAL GRANTOR Federal Pass Through Pass Through Grantor CFDA Entity Identifying Total Federal Program / Cluster Title Number Number Expenditures U.S. DEPARTMENT OF AGRICULTURE Passed Through Ohio Department -

October 29, 2011 Dublin Jerome High School October 30, 2011

OMEA State Marching Band Finals Schedule as of October 23, 2011 11:24:15 PM. SCHEDULE IS NOT FINALIZED UNTIL WEEK BEFORE STATE MARCHING BAND CONTEST October 29, 2011 October 30, 2011 November 4, 2011 November 5, 2011 November 6, 2011 Dublin Jerome High School University Of Dayton Dublin Jerome High School Dublin Jerome High School University Of Dayton 11:30 AM C Woodmore High School 1:15 PM C Swanton Local Schools 6:30 PM C Wellington High School 10:00 AM A Crestwood High School 1:00 PM B Coshocton High School 11:45 AM C Green High School 1:30 PM B Westfall High School 6:45 PM A Nordonia Hills City Schools 10:15 AM A Louisville High School 1:15 PM B Fredericktown High School 12:00 PM C Chesapeake Local Schools 1:45 PM AA Westland High School 7:00 PM A Marietta High School 10:30 AM A John Glenn High School 1:30 PM B Buckeye High School 12:15 PM B Gallia Academy High School 2:00 PM AA Perry High School 7:15 PM A Bishop Watterson High School 10:45 AM A River View High School 1:45 PM A Big Walnut High School 12:30 PM A St Edward High School 2:15 PM AA Middletown High School 7:30 PM AA Reynoldsburg High School 11:00 AM A Revere High School 2:00 PM AA Walnut Hills High School 12:45 PM A Cloverleaf High School 2:30 PM AWARDS BREAK 7:45 PM AA Colerain High School 11:15 AM A Tallmadge High School 2:15 PM AA Miamisburg High School 1:00 PM AA Dublin Coffman High School 2:45 PM B Ottawa-Glandorf High School 8:00 PM AA Dublin Jerome High School 11:30 AM AWARDS BREAK 2:30 PM AWARDS BREAK 1:15 PM AWARDS BREAK 3:00 PM B Wauseon Schools 8:15 PM AWARDS -

Delawar Count

of Delawar Count Snap 2017 SHJanuary 25, 2018 TS 2 Thursday, January 25, 2018 Snapshot of Delawar Count 2017 The Delaware Gazette • The Sunbury News Photo Credit | D. Anthony Botkin Photo Credit | D. Anthony Botkin Delaware County dispatcher Catharine Dobyns assisted a father in delivering his baby girl by giving Retail giant IKEA opened its Columbus location in June 2017 at the junction of Interstate 71 and instructions over the phone in January 2017. Dobyns was honored as a recipient of the Stork Award, Gemini Place in Delaware County. The 354,000-square foot facility is the 44th store the Swedish which is given to dispatchers who provide assistance in the delivery of infants via phone. Dobyns was company has opened in the United States. IKEA Columbus employs approximately 325 people. The given a lapel pin of a stork and her name was be added to a plaque with the other recipients of the store features 10,000 exclusively-designed items, a 450-seat restaurant, 41 inspirational room award. The plaque is displayed on the first floor of the county commissioners’ office on Sandusky settings, three model home interiors, and a supervised children’s play area. Street. Photo Credit | D. Anthony Botkin FACES The 91-degree summer weather didn’t keep families from walking down William Street to the 2017 St. Mary Festival last June. The heat didn’t seem to bother either Isabella Cook, left, or Skyler Hatten, right, as they took a spin on a and crocodile’s back. Sunbury area residents gathered on Memorial PLACES Day 2017 to pay tribute to the men and women who have given their Photo Credit | Anthony Conchel lives in military to Memorial Day 2017 services were held at Oak Grove Cemetery in Delaware paying the United States. -

Olentangy Local School District Delaware County, Ohio

OLENTANGY LOCAL SCHOOL DISTRICT DELAWARE COUNTY, OHIO Reports Issued Pursuant to Government Auditing Standards and OMB Circular A-133 For the year ended June 30, 2009 Board of Education Olentangy Local School District 814 Shanahan Road Lewis Center, Ohio 43035 We have reviewed the Independent Auditor’s Report of the Olentangy Local School District, Delaware County, prepared by Kennedy Cottrell Richards LLC, for the audit period July 1, 2008 through June 30, 2009. Based upon this review, we have accepted these reports in lieu of the audit required by Section 117.11, Revised Code. The Auditor of State did not audit the accompanying financial statements and, accordingly, we are unable to express, and do not express an opinion on them. Our review was made in reference to the applicable sections of legislative criteria, as reflected by the Ohio Constitution, and the Revised Code, policies, procedures and guidelines of the Auditor of State, regulations and grant requirements. The Olentangy Local School District is responsible for compliance with these laws and regulations. Mary Taylor, CPA Auditor of State February 4, 2010 88 E. Broad St. / Fifth Floor / Columbus, OH 43215‐3506 Telephone: (614) 466‐4514 (800) 282‐0370 Fax: (614) 466‐4490 www.auditor.state.oh.us This Page is Intentionally Left Blank. OLENTANGY SCHOOL DISTRICT DELAWARE COUNTY, OHIO TABLE OF CONTENTS June 30, 2009 Page Independent Auditor’s Report on Internal Control Over Financial Reporting and on Compliance and Other Matters Based on an Audit of Financial Statements Performed in Accordance With Government Auditing Standards .......................................................................................................................... 1 Independent Auditor’s Report on Compliance With Requirements Applicable to Major Federal Programs and Internal Control Over Compliance in Accordance With OMB Circular A-133 and Schedule of Receipts and Expenditures of Federal Awards ........................................................................ -

2948 Regular Meeting

EX. A.1.a ~ August 30, 2016 Page 1 of 10 2948 REGULAR MEETING June 22 16 The Regular Meeting of the Olentangy Local Board of Education was called to order at the Shanahan Middle School Multi Purpose Room by D. King, president at 6:00 p.m. Roll Call: D. King, present; R. Bartz, absent; J. Feasel, present; K. O’Brien, present; M. Patrick, present Pledge of Allegiance National Anthem – performed by Sarah Latzke, Hyatts Middle School Approve J. Feasel moved, K. O’Brien seconded to approve the agenda for the June 22, 2016 Agenda regular meeting, with addendum 16-156 Vote: J. Feasel, yes; K. O’Brien, yes; M. Patrick, yes; D. King, yes. Motion carried. Board President’s Report A. Recognition of Olentangy students for academic and extracurricular achievement Amanda Ba, OOHS Wall of Fame and Outstanding Senior Award Sneha Darbha, LHS, Perfect ACT Score Devon Fogerty, OOHS, Perfect ACT Score Eric Heberling, OOHS Wall of Fame and Outstanding Senior Award Divyaditya Shrivastava, OHS, Perfect ACT Score Avivah Wang, LHS, Perfect ACT Score Athletics Ty Brenning, Coach, LHS Baseball, 2015-16 OCC Champions Kyle Brookshire, OHS 2015-16 State Qualifier Boys Track & Field Trevor Collins, LHS, All-Ohio Boys Track & Field Cannan Cook, LHS, State Qualifier Boys Track & Field James Dingus, LHS, Coach, 2015-16 Girls Track, OCC Champions Chase Gresock, LHS, 2015-16 First Team All-Ohio Baseball Allison Guagenti, OOHS 2015-16 Track & Field, 1600m, Sixth Place State Meet Griffin Hughes, OLHS, 2015-16 First Team All-State Boys Lacrosse Ryan Jones, LHS, State Qualifier -

3062 REGULAR MEETING June 8 17 the Regular Meeting of the Olentangy Local Board of Education Was Called to Order in the Olentang

EX. A.1.a ~ August 10, 2017 Page 1 of 8 3062 REGULAR MEETING June 8 17 The Regular Meeting of the Olentangy Local Board of Education was called to order in the Olentangy Administrative Offices – Berlin Room by R. Bartz, president at 6:00 p.m. Roll Call: D. King, present; R. Bartz, present; J. Feasel, present; K. O’Brien, present; M. Patrick, present Pledge of Allegiance Approve J. Feasel moved, K. O’Brien seconded to approve the agenda for the June 8, 2017 Agenda Board of Education Meeting 17-153 Vote: J. Feasel, yes; K. O’Brien, yes; D. King, yes; M. Patrick, yes; R. Bartz, yes. Motion carried. Board President’s Report Superintendent’s Report Treasurer’s Report Public Participation Session #1 - for general comments – None Discussion Item – A. Berlin High School construction update – Bruce Runyon, Fanning Howey; Bill O’Sullivan, Construction Analysis Public Participation Session #2 – Regarding Action Items – None Board M. Patrick moved, D. King seconded to approve Board Action Item C Action Item C. Approve salary increase for those non-union classified employees who are 17-154 employed under a contract with the Board of Education pursuant to R.C. 3319.081, effective July 1, 2017: 2017-18 school year (2.25%) Vote: M. Patrick, yes; D. King, yes; J. Feasel, abstain; K. O’Brien, yes; R. Bartz, yes. Motion carried. Board J. Feasel moved, D King seconded to approve Board Action Items A-B, D-G Action Items A. Approve collective bargaining agreement with OAPSE/AFSCME AFL-CIO 17-155 Local #039, representing the bus drivers B. -

Big Walnut Local School District

BIG WALNUT LOCAL SCHOOL DISTRICT DELAWARE COUNTY SINGLE AUDIT JULY 1, 2013 - JUNE 30, 2014 Board of Education Big Walnut Local School District 105 Baughman Street, Suite A Sunbury, Ohio 43074 We have reviewed the Independent Auditor’s Report of the Big Walnut Local School District, Delaware County, prepared by Wilson, Shannon & Snow, Inc., for the audit period June 30, 2013 through July 1, 2014. Based upon this review, we have accepted these reports in lieu of the audit required by Section 117.11, Revised Code. The Auditor of State did not audit the accompanying financial statements and, accordingly, we are unable to express, and do not express an opinion on them. Our review was made in reference to the applicable sections of legislative criteria, as reflected by the Ohio Constitution, and the Revised Code, policies, procedures and guidelines of the Auditor of State, regulations and grant requirements. The Big Walnut Local School District is responsible for compliance with these laws and regulations. Dave Yost Auditor of State January 5, 2015 88 East Broad Street, Fifth Floor, Columbus, Ohio 43215‐3506 Phone: 614‐466‐4514 or 800‐282‐0370 Fax: 614‐466‐4490 www.ohioauditor.gov This page intentionally left blank. BIG WALNUT LOCAL SCHOOL DISTRICT DELAWARE COUNTY TABLE OF CONTENTS TITLE PAGE SCHEDULE OF FEDERAL AWARDS RECEIPTS AND EXPENDITURES 1 NOTES TO THE SCHEDULE OF FEDERAL AWARDS RECEIPTS AND EXPENDITURES 2 INDEPENDENT AUDITOR’S REPORT ON INTERNAL CONTROL OVER FINANCIAL REPORTING AND ON COMPLIANCE AND OTHER MATTERS REQUIRED BY GOVERNMENT -

CCP Advisors by School

School CCP Advisor Email ACADEMY FOR URBAN SCHOLARS Diane Jones [email protected] ALTERNATIVE EDUCATION ACADEMY Diane Jones [email protected] AMANDA-CLEARCREEK HIGH SCHOOL Andrea Bennett [email protected] ARTS COLLEGE PREPARATORY ACADEMY Diane Jones [email protected] BEECHCROFT HIGH SCHOOL Nicole Martin [email protected] BELLEFONTAINE HIGH SCHOOL Jordan Falb [email protected] BENJAMIN LOGAN HIGH SCHOOL Jordan Falb [email protected] BERNE UNION HIGH SCHOOL Andrea Bennett [email protected] BEXLEY HIGH SCHOOL Diane Jones [email protected] BIG WALNUT HIGH SCHOOL Andrea Bennett [email protected] BISHOP HARTLEY HIGH SCHOOL Diane Jones [email protected] BISHOP READY HIGH SCHOOL Michelle Miller-Owens [email protected] BISHOP ROSECRANS HIGH SCHOOL Andrea Bennett [email protected] BISHOP WATTERSON HIGH SCHOOL Jordan Falb [email protected] BLOOM-CARROLL HIGH SCHOOL Diane Jones [email protected] BRIGGS SENIOR HIGH SCHOOL Nicole Martin [email protected] BROOKPARK MIDDLE SCHOOL (SWCSD) Nicole Martin [email protected] BROOKWOOD ACADEMY Diane Jones [email protected] BUCKEYE ONLINE SCHOOL FOR SUCCESS Andrea Bennett [email protected] BUCKEYE VALLEY HIGH SCHOOL Jordan Falb [email protected] C-TEC CAREER CENTER Andrea Bennett [email protected] CANAL WINCHESTER HIGH SCHOOL Michelle Miller-Owens [email protected] CENTENNIAL HIGH SCHOOL Nicole Martin [email protected] CENTERBURG HIGH SCHOOL Michelle Miller-Owens [email protected] CENTRAL HIGH SCHOOL Michelle Miller-Owens [email protected] CHARLES SCHOOL AT OHIO DOMINICAN UNIVERSITY Simonne Gage [email protected] CHRISTIFIDELES -

Ohiohealth Grady Memorial Hospital

OhioHealth Grady Memorial Hospital Community Health Needs Assessment June 2016 OhioHealth Grady Memorial Hospital Grady Memorial Hospital provides the Delaware community with comprehensive quality healthcare delivered with compassionate, personal care. Our full range of services and programs meet the needs of one of the nation’s most rapidly growing counties. Steve Bunyard, President OhioHealth Grady Memorial Hospital 561 West Central Avenue Delaware, Ohio 43015 Board approval of CHNA Report: 06/14/2016 Initial web posting of CHNA Report: 06/27/2016 Tax identification number: 31-4379436 OhioHealth Grady Memorial Hospital Table of Contents Introduction ....................................................................................................................................................................1 A. Definition of community served and how community was determined ........................................... 2 B. Process and methods used to conduct the Community Health Needs Assessment (CHNA) ......... 3 B1. Data and other information used in the assessment ........................................................................... 3 B2. Methods of collecting and analyzing data and information ........................................................... 3 B3. Parties with whom hospital collaborated or contracted for assistance ....................................... 4 C. Input from persons who represent the broad interests of the community served .......................... 5 D. Description of significant health needs as -

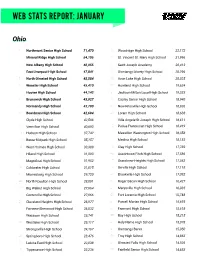

Web Stats Report: January

WEB STATS REPORT: JANUARY Ohio 1 Northmont Senior High School 71,470 31 Woodridge High School 22,172 2 Mineral Ridge High School 54,105 32 St. Vincent-St. Mary High School 21,996 3 New Albany High School 48,955 33 Saint Joseph Academy 20,413 4 East Liverpool High School 47,841 34 Olentangy Liberty High School 20,296 5 North Olmsted High School 45,584 35 Avon Lake High School 20,025 6 Wooster High School 45,410 36 Howland High School 19,634 7 Hoover High School 44,142 37 Jackson-Milton Local High School 19,333 8 Brunswick High School 43,927 38 Copley Senior High School 18,940 9 Normandy High School 43,780 39 New Knoxville High School 18,936 10 Boardman High School 42,694 40 Lorain High School 18,638 11 Clyde High School 42,506 41 Villa Angela-St Joseph High School 18,611 12 Vermilion High School 40,693 42 Padua Franciscan High School 18,419 13 Hudson High School 37,742 43 Massillon Washington High School 18,358 14 Berea-Midpark High School 35,157 44 Medina High School 18,183 15 West Holmes High School 33,389 45 Clay High School 17,782 16 Hiland High School 31,993 46 Austintown Fitch High School 17,586 17 Magnificat High School 31,952 47 Grandview Heights High School 17,562 18 Coldwater High School 31,815 48 Orrville High School 17,118 19 Miamisburg High School 29,720 49 Brookville High School 17,092 20 North Royalton High School 28,001 50 Roger Bacon High School 16,427 21 Big Walnut High School 27,664 51 Marysville High School 16,035 22 Centerville High School 27,066 52 Fort Loramie High School 15,748 23 Cleveland Heights High School 26,977