Methodology Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2020 Annual Report

Investors Group Annual Report For the year ended 30 June 2020 200 Adelaide St, Brisbane, QLD 3 Contents Meeting of Securityholders 04 — Highlights 21 October 2020 06 — Message from the Chairman 10:30am (Sydney time) 08 — CEO’s Message Computershare Level 3, 60 Carrington Street, 11 — Financial Report Sydney NSW 2000 12 — Directors’ Report 43 — Auditor’s Independence Declaration 44 — Financial Statements 51 — Notes to the Financial Statements 129 — Directors’ Declaration 130 — Independent Auditor’s Report 136 — Corporate Governance 137 — Securityholder Analysis 139 — Corporate Directory Financial Calendar 21 October 2020 OCT Meeting of Securityholders December 20203 DEC Estimated interim distribution announcement and securities trade ex-distribution February 2021 FEB Interim results announcement March 2021 MAR Interim distribution payment June 2021 JUN Estimated final distribution announcement and securities trade ex-distribution August 2021 AUG Full-year results announcement September 2021 SEP Final distribution payment September 2021 SEP Annual tax statements Responsible Entity Elanor Funds Management Limited (ABN 39 125 903 031). AFSL 398196. Elanor Investors Group comprises Elanor Investors Limited (ABN 33 169 308 187) and Elanor Investment Fund (ARSN 169 450 926). 4 Highlights The Group’s assets are located in metropolitan and prime regional locations across Australia and New Zealand Darwin NT QLD WA Brisbane SA Perth NSW Auckland Sydney Adelaide Canberra Wellington VIC Melbourne Assets: Hotels, Tourism & Leisure TAS Commercial Hobart -

The Rise of the Neo-Bank

The rise of the neo-bank yieldreport.com.au/insights/the-rise-of-the-neo-bank/ 13 January 2020 By guest contributor Jake Jodlowski, Principal, Atchison Consultants Given the continued reputational damage suffered by the big four Australian banks throughout and post the Banking Royal Commission hearings, bank customers and investors may be looking for alternatives. Whilst still in its infancy, Australia’s banking and credit start-up sector has grown leaps and bounds in recent years, with Afterpay Touch Group (ASX: APT) and Zip Co Limited (ASX: ZIP) being high-profile examples. Although the “buy-now, pay-later” (BNPL) sector has received most of the media coverage, the development of so-called “neo-banks” has also started to gain momentum. Neo-banks are best described as traditional banks without a bricks and mortar presence, with their entire offering supplied through digital means, usually through an app and on-line platform. They are fully functioning deposit-taking institutions and therefore fall under the supervision of the Australian Prudential Regulation Authority (APRA). APRA must provide a license before an institution may accept customer deposits. An unrestricted banking license permits a corporation to operate as a “banking business” and therefore an authorized deposit-taking institution (ADI) without restrictions under the Banking Act 1959. Part 5 of the Banking Act defines “banking business” as consisting of both taking deposits (other than as part-payment for identified goods and services) and making advances of money, as well as other financial activities prescribed by regulations made under the Banking Act. The arrival of neo-banking in Australia follows the emergence of start-up banks like Monzo and Starling in the UK. -

Investor Relations Presentation

Investor Relations Presentation 1 DISCLAIMER Disclaimer: Commercial in Confidence. Not to be shared or reproduced without the authority of Cashwerkz Limited (ACN: 010 653 862). Cashwerkz Group I Cashwerkz Limited ABN 42 010 653 862 AFSL 260033 | Cashwerkz Technologies Pty Ltd ABN 70 164 806 357 AFSL 459645 | RIM Securities Ltd ABN 86 111 273 048 AFSL 283119 | Trustees Australia Limited ABN 63 010 579 058 AFSL 260038. This Presentation contains general information only and is, or is based upon, information that has been released to ASX. This document is not an invitation, offer or recommendation (expressed or implied) to apply for or purchase or to take any other action in respect of securities and is not a prospectus, product disclosure statement or disclosure document for the purposes of the Corporations Act 2001 (Cth) and has not been lodged with ASIC. Investment Risk An investment in Cashwerkz Limited (‘CWZ’ or ‘Group’), is subject to known and unknown risks both specific to CWZ and of a general nature, some of which are beyond the control of the Group. Such risks either may individually or in combination adversely affect the future operating and financial performance of CWZ, its investment return and value of its securities. There can be no guarantee, and the directors and management give no assurances, (notwithstanding that they will use their conscientious best endeavours), that CWZ will achieve its stated objectives or that any forward-looking statement or forecast will eventuate. Forward-Looking Statements This Presentation contains certain statements that may constitute forward-looking statements or information (“forward-looking statements”), including statements regarding the use of proceeds of any funds available to the Group. -

Australia's Best Banking Methodology Report

Mozo Experts Choice Awards Australia’s Best Banking 2021 This report covers Mozo Experts Choice Australia’s Best Banking Awards for 2021. These awards recognise financial product providers who consistently provide great value across a range of different retail banking products. Throughout the past 12 months, we’ve announced awards for the best value products in home loans, personal loans, bank accounts, savings and term deposit accounts, credit cards, kids’ accounts. In each area we identified the most important features of each product, grouped each product into like-for-like comparisons, and then calculated which are better value than most. The Mozo Experts Choice Australia's Best Banking awards take into account all of the analysis we've done in that period. We look at which banking providers were most successful in taking home Mozo Experts Choice Awards in each of the product areas. But we also assess how well their products ranked against everyone else, even where they didn't necessarily win an award, to ensure that we recognise banking providers who are providing consistent value as well as areas of exceptional value. Product providers don’t pay to be in the running and we don’t play favourites. Our judges base their decision on hard-nosed calculations of value to the consumer, using Mozo’s extensive product database and research capacity. When you see a banking provider proudly displaying a Mozo Experts Choice Awards badge, you know that they are a leader in their field and are worthy of being on your banking shortlist. 1 Mozo Experts Choice Awards Australia’s Best Banking 2021 Australia’s Best Bank Australia’s Best Online Bank Australia's Best Large Mutual Bank Australia's Best Small Mutual Bank Australia’s Best Credit Union Australia’s Best Major Bank 2 About the winners ING has continued to offer Australians a leading range of competitively priced home and personal loans, credit cards and deposits, earning its place as Australia's Best Bank for the third year in a row. -

Australian Major Banks FY2019 Results

Challenges, choices and complexities Australian major banks F Y2019 results November 2019 “Bankprofitabilityisunderthreat,ROEhashalved overthepast15years.NIMshavehalvedoverthat period.Wearenowmuchclosertoourcostof equity.Theabilitytoholdthemachinetogetheras itis...isunsustainable.Ithinktheideathatthese universal,mass-marketbanksaregoingtocontinue tothrive,Idon’tagreethat’sthecase.Iamnot sayingthere’sgoingtobenone,butIdon’tbelieve thatthisissustainableinthefuture.’’ Shayne Elliott CEO,ANZi Growthwasa challenge Efficiencyiscritical Cashprofitdeclinedby Total income Total expenses declined by 3.7% increased by 0.8% 7.8% Creditriskincreasing Lendinggrowthhasslowed OntracktomeetAPRA’s ‘unquestionablystrong’ (90DPD+GIA)/GLA Total average increased by interest earning CET1 14 bps assets 3.3% target of 10.5% Source:FY2019resultsandinvestorpresentationsforANZ,CBA,NABandWBC:Deloitteanalysis. Challenges, choices and complexities | Australian major banks FY2019 results Majorbanks:FY2019results AtypicalAustralianbankingreportingseasonafewyearsago Ontopofthis,bankshavehadtoimplementAPRA’sBanking wascharacterisedbyhighretailbankingReturnonEquity ExecutiveAccountabilityRegime(BEAR)effectivefrom1July2018. (ROE),positivejaws,lowerbaddebts,andabovesystem Withintensivecompetitivepressuresfrominternationalbanks mortgage growth. and non-traditionalplayers;‘zerobound’interestanddepositrates; SolidGDPgrowth,highimmigrationintake,andaresilientjob highercapitalrequirementsforNZbusinesses;continuedlarge markethaveprovidedafavourablebackdroptotheAustralian remediationprograms,andthepermanentincreaseinregulatory -

September 2018

The definitive source of news and analysis of the global fintech sector | September 2018 www.bankingtech.com ELEMENTS OF FINTECH Pure in substance FOOD FOR THOUGHT Ecosystem is not a safe word EXCLUSIVE INTERVIEW: YVES TYRODE, BPCE A whole new digital strategy FINTECH FUTURES BT_AFS Transformation Partner_Final_Layout 1 8/20/2018 9:42 AM Page 1 IN THIS ISSUE Your Core Lending Transformation Partner With hundreds of implementations on time and on budget. Contents AFS System Capabilities •End-to-End Credit Processing NEWS 04 The latest fintech news from around the globe: •Scaleable & Agile the good, the bad and the ugly. •Mobile Enabled 17 Interview: Serena Smith, FIS Being at the heart of the exciting, changing •Real-Time world of payments. •Digital 18 PayTech Awards 2018 Celebrations, winners, photos – all the best bits! •RPA, ML & AI 22 Lendtech vendor spotlight: AFS Innovating and transforming the credit •Data Integrity process globally. •Cyber Security & Risk 23 White paper The state of IT incident response in financial services. •Web Services/APIs for Bank Ecosystem 30 Food for thought •And Much More Fellow bankers: “ecosystem” is not a “safe word”. 33 Spotlight: Sunrise Banks A US bank that is “social enterprise first”. AFS is where technological innovation meets financial services expertise, 34 Case study: Afghanistan International Bank offering the latest in core lending with advanced credit process Facing challenges far more extreme than most banks around the globe. management that is operational in multiple, large banks. We provide 38 Interview: Yves Tyrode, BPCE unique, industry-leading solutions with proven successes to help you On a mission to deploy a whole new digital strategy. -

Unlimited Liquidity the Fiscal and Monetary Response to Covid-19 Provides Critical Support to the Australian and New Zealand Economies

SUSTAINABLE DEBT: COVID-19 RESPONSE: MUTUAL BANKS: CORPORATE GROWTH ECONOMISTS, TRADERS FUNDING AND CAPITAL AND INNOVATION AND INVESTORS SPEAK IN THE SPOTLIGHT VOLUME 15 ISSUE 118 _ APR/MAY 2020 www.kanganews.com UNLIMITED LIQUIDITY THE FISCAL AND MONETARY RESPONSE TO COVID-19 PROVIDES CRITICAL SUPPORT TO THE AUSTRALIAN AND NEW ZEALAND ECONOMIES. MARKET PARTICIPANTS ARE WORKING THEIR WAY THROUGH THE CONSEQUENCES FOR THE FIXED-INCOME SECTOR. STAY ON TOP WITH THE #1 INSTITUTIONAL BANK across Australia, New Zealand & Asia We believe that by working with our Customers as one, we can truly make a difference to the world we live in. Maybe that’s why we were awarded Best Sustainable Finance House 2019 in the FinanceAsia 2019 Australia and NZ Achievement Awards. Not to mention *Australian Dollar Bond, Rates & Credit House of the Year, Australian Sustainability Debt House of the Year, Australian Dollar Secondary Market House of the Year & New Zealand Domestic Bond, Credit & Kauri House of the Year in the KangaNews Awards. anz.com/institutional # In the Peter Lee Associates Large Corporate & Institutional Relationship Banking surveys, New Zealand and Australia, ANZ Bank New Zealand Limited was Rated No.1 for Relationship Strength Index in the 2010 through to 2019 surveys and Australia and New Zealand Banking Group Limited was Rated No.1 for Relationship Strength Index in the 2014 through to 2019 surveys. *KangaNews Awards 2019. Australia and New Zealand Banking Group Limited (ANZ) ABN 11 005 357 522. AU23164 INSTO_KangaNews Awards Ad_Dec 2019_210x280_FA.indd 1 16/12/19 10:18 am KangaNews APR/MAY 2020 EDITION VOLUME 15 ISSUE 118 www.kanganews.com Contents Head of content and editor 18 COVID RESPONSE LAURENCE DAVISON [email protected] COVID-19 timeline Deputy editor MATT ZAUNMAYR COVID-19 and its economic and market impacts evolved [email protected] at a dizzying pace through the first quarter of 2020. -

Download the Toolkit

T OBACCO F R EE T OBACCOPortfolios F R EE Portfolios The toolkit. 12TH EDITION Publication Date: February 2020 2 tobaccofreeportfolios.org Encouraging tobacco-free finance. 3 We“ are entering a new era of collaboration between the health and finance sectors –coming together to stand side by side to address one of the greatest public health challenges of our time. — Dr. Bronwyn King, MBBS, FRANZCR ” Founder and Chief Executive Officer, Tobacco Free Portfolios and Radiation Oncologist 4 tobaccofreeportfolios.org Contents 1. Tobacco Free Portfolios Overview .............................................................. 7 2. Pledge Stamp Membership ..................................................................... 15 3. The Tobacco-Free Finance Pledge ............................................................ 19 4. Tobacco-Free Finance Framework ........................................................... 25 5. Tobacco and The Sustainable Development Goals.......... ........................... 31 6. UN Tobacco Control Treaty ..................................................................... 35 7. Human Rights and Tobacco ..................................................................... 39 8. Engagement with Tobacco Companies ..................................................... 43 9. Prospective Investment Risks .................................................................... 47 10. Case Studies .......................................................................................... 55 11. Common Questions Answered ............................................................... -

Banking in Australia and New Zealand: at a Digital Crossroads

Banking in Australia and New Zealand: At a Digital Crossroads A GlobalData report for NCR Published: July 2018 Banking in Australia and New Zealand: At a Digital Crossroads Published: July 2018 Financial Executive Summary A market in transition to a new banking model The emergence of a raft of neobanks and fintech start-ups has highlighted the shift towards a fully digital experience in the banking market. The shift to digital channels has been a long time coming, but Australia and New Zealand are now seeing an entire generation – millennials – who are not just digital-first but digital-only. This is reflected in all aspects of their lives, with the drive towards better digital banking closely linked to their heavy use of online shopping as well. As banking has shifted channels, new products and services are emerging that leverage the vast volumes of data generated as well as the potential of new technology and standards such as the New Payments Platform (NPP) and the move to open APIs. Key findings • Consumer behavior has shifted towards viewing digital channels as the main means of engaging with their bank, across all age cohorts. • Millennials, though only moderately more digitally inclined than other age cohorts are much more comfortable banking or even paying via their mobile handset. • Millennials are both more open to purely digital banks such as neobanks as well as more likely to switch provider. • Security while shopping online is even more important with having card details stolen over the internet the top type of fraud committed against Australian and New Zealanders. -

ANNUAL REVIEW 2 4 6 8 10 About Us Chair and Highlights Consumer CEO Message Payment Trends

Meeting the challenge ANNUAL REVIEW 2 4 6 8 10 About Us Chair and Highlights Consumer CEO Message Payment Trends Australian Payments Network Limited ABN 12 055 136 519 CONTENTS 12 14 20 26 30 Level 23, Tower 3 International Towers Sydney 300 Barangaroo Avenue Sydney NSW 2000 Our Year Managing Governance Policy and Board of Telephone +61 2 9216 4888 in Review the Payment Advocacy Directors Email [email protected] www.auspaynet.com.au Streams This Annual Review is designed to provide our members and stakeholders with an overview of developments and achievements in financial year 2019-2020. References in this report to a year are to financial year ended 30 June 2020 unless otherwise stated. We hope you enjoy discovering more 32 33 34 35 about your association. Governance Our Team Membership Glossary Framework Australian Payments Network is the industry association and self-regulatory body for payments. Through our network, we bring together a diverse range of organisations including financial institutions, major retailers, payment system operators and technology providers. Our members provide the products and services that enable individuals and public and private organisations to make and receive payments every day. Delivering on our purpose to promote confidence in payments, we work with a wide range of stakeholders to ensure the payments system continues to meet the evolving needs of organisations and individuals. As the self-regulatory body for payments our remit covers the following payment types. $ $$$ $$ $$$ $ $ $$$ $ Cards Direct entry High value Cash Cheques Issuers and Bulk Electronic High Value Australian Cash Australian Acquirers Clearing System Clearing System Distribution and Paper Clearing Community Exchange System System Additionally, AusPayNet’s COIN infrastructure network provides connectivity for low value payments. -

Annual Financial Report for the Year Ended 30 June 2020

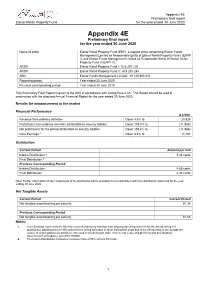

Appendix 4E Preliminary final report Elanor Retail Property Fund for the year ended 30 June 2020 Appendix 4E Preliminary final report for the year ended 30 June 2020 Name of entity Elanor Retail Property Fund (ERF), a stapled entity comprising Elanor Funds Management Limited as Responsible Entity of Elanor Retail Property Fund I (ERPF I), and Elanor Funds Management Limited as Responsible Entity of Elanor Retail Property Fund II (ERPF II). ARSN Elanor Retail Property Fund I: 615 291 220 ARSN Elanor Retail Property Fund II: 615 291 284 ABN Elanor Funds Management Limited: 39 125 903 031 Reporting period Year ended 30 June 2020 Previous corresponding period Year ended 30 June 2019 This Preliminary Final Report is given to the ASX in accordance with Listing Rule 4.3A. The Report should be read in conjunction with the attached Annual Financial Report for the year ended 30 June 2020. Results for announcement to the market Financial Performance A $’000 Revenue from ordinary activities Down 4.5% to 29,924 Profit/(loss) from ordinary activities attributable to security holders Down 159.8% to (11,964) Net profit/(loss) for the period attributable to security holders Down 159.8% to (11,964) Core Earnings 1 Down 8.8% to 11,107 Distribution Current Period Amount per unit Interim Distribution 2 5.24 cents Final Distribution 2 - Previous Corresponding Period: Interim Distribution 4.65 cents Final Distribution 4.33 cents Note: Further information on tax components of the distribution will be provided to securityholders with their distribution statement for the year ending 30 June 2020. -

The Future of Commerce in Asia

26-27 JUNE 2019 SUNTEC CONVENTION CENTRE, SINGAPORE 2019 POST EVENT REPORT THE FUTURE OF COMMERCE IN ASIA Follow us on Facebook: Tweet us at: Created By: Seamless Asia Expo @Seamless Asia KEY STATISTICS 5,081 ATTENDEES 1,836 UNIQUE COMPANIES 179 SPEAKERS 175 SPONSORS AND EXHIBITORS 35 MEDIA PARTNERS 12 ASSOCIATION PARTNERS OVER 5,000 ATTENDEES IN 2019 – THANK YOU! Thank you for helping make Seamless Asia 2019 a great event! On June 26-27 at Suntec Convention and Exhibition Centre in Singapore, over 5,000 attendees joined us for two days of networking, learning and inspiration as we explored the future of commerce in Asia. We wanted to make the insights at Seamless Asia available to everyone, so for this year’s event, we made 90% of the content and the exhibition completely free to attend, offering more choice to our attendees than ever before. So what did Seamless Asia 2020 look like? • 9 FREE in-depth conference theatres of case studies and technology across payments, smart retail, e-commerce marketing & strategy, cards and banking, digital identity & more • A senior level strategic summit on the future of payments and commerce • Keynote insights from industry leaders, including Jakub Zalrzewski, General Manager, APAC, Revolut, Shaifali Nathan, Head of Large Customer Marketing, Lorenzo Peracchione, Regional E-Commerce Director, Sephora, Arun Verma, Country Manager – Singapore, Shopify and more • 175+ exhibitors showcasing their products and services on the buzzing exhibition floor Over 200 expert speakers shared their insights with us, from leading companies from both within Asia and beyond, including DBS, Union Bank, OCBC, Go-Jek, Mastercard, Standard Chartered, Bank Central Asia, ICICI Bank, Tokopedia, Line, HSBC, Shopee, Swarovski, eBay, Zalora, Flipkart, Carousell, Royal Sporting House and many more.