Kaiser-Frazer V. Otis: a Legal and Moral Analysis

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

In-Town Business Listing - October 2020 This List Is Based on Informa�On Provided by the Public and Is Only Updated Periodically

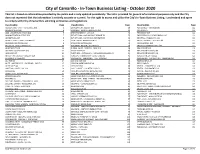

City of Camarillo - In-Town Business Listing - October 2020 This list is based on informaon provided by the public and is only updated periodically. The list is provided for general informaonal purposes only and the City does not represent that the informaon is enrely accurate or current. For the right to access and ulize the City's In-Town Business Lisng, I understand and agree to comply with City of Camarillo's soliciting ordinances and regulations. Classification Page Classification Page Classification Page ACCOUNTING - CPA - TAX SERVICE (93) 2 EMPLOYMENT AGENCY (10) 69 PET SERVICE - TRAINER (39) 112 ACUPUNCTURE (13) 4 ENGINEER - ENGINEERING SVCS (34) 70 PET STORE (7) 113 ADD- LOCATION/BUSINESS (64) 5 ENTERTAINMENT - LIVE (17) 71 PHARMACY (13) 114 ADMINISTRATION OFFICE (53) 7 ESTHETICIAN - HAS MASSAGE PERMIT (2) 72 PHOTOGRAPHY / VIDEOGRAPHY (10) 114 ADVERTISING (14) 8 ESTHETICIAN - NO MASSAGE PERMIT (35) 72 PRINTING - PUBLISHING (25) 114 AGRICULTURE - FARM - GROWER (5) 9 FILM - MOVIE PRODUCTION (2) 73 PRIVATE PATROL - SECURITY (4) 115 ALCOHOLIC BEVERAGE (16) 9 FINANCIAL SERVICES (44) 73 PROFESSIONAL (33) 115 ANTIQUES - COLLECTIBLES (18) 10 FIREARMS - REPAIR / NO SALES (2) 74 PROPERTY MANAGEMENT (39) 117 APARTMENTS (36) 10 FLORAL-SALES - DESIGNS - GRW (10) 74 REAL ESTATE (18) 118 APPAREL - ACCESSORIES (94) 12 FOOD STORE (43) 75 REAL ESTATE AGENT (180) 118 APPRAISER (7) 14 FORTUNES - ASTROLOGY - HYPNOSIS(NON-MED) (3) 76 REAL ESTATE BROKER (31) 124 ARTIST - ART DEALER - GALLERY (32) 15 FUNERAL - CREMATORY - CEMETERIES (2) 76 REAL ESTATE -

Mid-Range at Cranes Conexpo, ARA Show Reviews Scissor Lifts

www.vertikal.net www.vertikal.net March 2014 Vol.16 issue 2 Scissor lifts Mid-range AT cranes Conexpo, ARA show reviews .....JLG unveils 185ft boom...’game changing’ crawlers from Manitowoc...Synthetic rope future?..... On the cover: A 70 metre working height, 400kg capacity Barin AP 70/33 J2 truck mounted lift sold to Ace Tower Hire & Services was recently used to work on the Southern Star Wheel in & Melbourne. The Wheel offers views of up to c a 40 kilometres - as far as Mount Macedon, contents Arthur’s Seat and the Dandenong Ranges. Comment 5 ARA/Hire show 17 Mid-range ATs News 6 reviews 45 Wilbert rescued from administration, Hertz to This year’s American Rental Association spin off Equipment Rental, Counterfeit CraneSafe rental show was held in Orlando, Florida a stickers, Genie warns JLG of patent concerns, few weeks before Conexpo. Publisher Leigh Speedy concludes financial investigation, HSE Sparrow reports on the issues tower crane alert, Wolffkran unveils more interesting exhibits City crane, ATN to launch spider lift, Samson/ and developments, while Manitowoc unveil revolutionary crane rope, JLG Ed Darwin visits the UK’s breaks boom record, Dingli launches new 10m Executive Hire Show. mast boom, 74 Ascendants for Facelift, JLG to 27 Scissor lifts launch true Hybrid Interview - boom, Liquidator for Evans Platforms, JLG to Mike Evans 45 drop Lull, GSR launches Ed Darwin heads to compact E140P, New Cardiff to speak with 42m Omme hybrid spider and financials round-up. access industry veteran Mike Evans - currently Mid-range AT with Riwal UK - about his wide-ranging and cranes 17 extensive career. -

The Sidelight, February 2020

THE SIDELIGHT Published by KYSWAP, Inc., subsidiary of KYANA Charities 3821 Hunsinger Lane Louisville, KY 40220 February 2020 Printed by: USA PRINTING & PROMOTIONS, 4109 BARDSTOWN ROAD, Ste 101, Louisivlle, KY 40218 KYANA REGION AACA OFFICERS President: Fred Trusty……………………. (502) 292-7008 Vice President: Chester Robertson… (502) 935-6879 Sidelight Email for Articles: Secretary: Mark Kubancik………………. (502) 797-8555 Sandra Joseph Treasurer: Pat Palmer-Ball …………….. (502) 693-3106 [email protected] (502) 558-9431 BOARD OF DIRECTORS Alex Wilkins …………………………………… (615) 430-8027 KYSWAP Swap Meet Business, etc. Roger Stephan………………………………… (502) 640-0115 (502) 619-2916 (502) 619-2917 Brian Hill ………………………………………… (502) 327-9243 [email protected] Brian Koressel ………………………………… (502) 408-9181 KYANA Website CALLING COMMITTEE KYANARegionAACA.com Patsy Basham …………………………………. (502) 593-4009 SICK & VISITATION Patsy Basham …………………………………. (502) 593-4009 THE SIDELIGHT MEMBERSHIP CHAIRMAN OFFICIAL PUBLICATION OF KYSWAP, Roger Stephan………………………………… (502) 640-0115 INC. LOUISVILLE, KENTUCKY HISTORIAN Marilyn Ray …………………………………… (502) 361-7434 Deadline for articles is the 18th of preceding month in order to have it PARADE CHAIRMAN printed in the following issue. Articles Howard Hardin …………………………….. (502) 425-0299 from the membership are welcome and will be printed as space permits. CLUB HOUSE RENTALS Members may advertise at no charge, Ruth Hill ………………………………………… (502) 640-8510 either for items for sale or requests to obtain. WEB MASTER Editorials and/or letters to the editor Interon Design …………………………………(502) 593-7407 are the personal opinion of the writer and do not necessarily reflect the CHAPLAIN official policy of the club. Ray Hayes ………………………………………… (502) 533-7330 LIBRARIAN Jane Burke …………………………………….. (502) 500-8012 From the President Fred Trusty Last month I reported that we lost 17 members in 2019 for various reasons. -

For-Hire Motor Carriers-Unrestricted Property

For-Hire - Unrestricted Property September 23, 2021 PIN USDOT MC Name DBA Name Phone Street Suite City State Zip 172318 2382342 1ST CALL HOTSHOT SERVICE LLC 1ST CALL HOTSHOT SERVICE LLC (405) 205-1738 Mail: 2410 W MEMORIAL RD STE C533 OKLAHOMA CITY OK 73134 Physical: 406 6TH ST CHEYENNE OK 73628 106139 1129401 2 B TRUCKING LLC 2 B TRUCKING LLC (936) 635-1288 Mail: 1430 N TEMPLE DIBOLL TX 75941 Physical: 214671 3131628 2 K SERVICES LLC 2 K SERVICES LLC (405) 754-0351 Mail: 2305 COUNTY ROAD 1232 BLANCHARD OK 73010 Physical: 142776 587437 2 R TRUCKING LLC 2 R TRUCKING LLC (402) 257-4105 Mail: 1918 ROAD ""P"" GUIDE ROCK NE 68942 Physical: 152966 2089295 2 RIVERS CONVERSIONS LLC 2 RIVERS CONVERSIONS LLC (405) 380-6771 Mail: 3888 N 3726 RD HOLDENVILLE OK 74848 Physical: 227192 3273977 2 VETS TRUCKING LLC 2 VETS TRUCKING LLC (405) 343-3468 Mail: 9516 TATUM LANE OKLAHOMA CITY OK 73165 Physical: 250374 3627024 2A TRANSPORT LLC 2A TRANSPORT LLC (918) 557-4000 Mail: PO BOX 52612 TULSA OK 74152 Physical: 10055 E 590 RD CATOOSA OK 74015 144063 1885218 3 C CATTLE FEEDERS INC 3 C CATTLE FEEDERS INC (405) 947-4990 Mail: PO BOX 14620 OKLAHOMA CITY OK 73113 Physical: PO BOX 144 MILL CREEK OK 74856 193972 2881702 3 CASAS TRUCKING LLC 3 CASAS TRUCKING LLC (405) 850-0223 Mail: 3701 KEITH COURT OKLAHOMA CITY OK 73135 Physical: 3701 KEITH COURT OKLAHOMA CITY OK 73135 251354 3678453 3 FEATHERS LOGISTICS LLC 3 FEATHERS LOGISTICS LLC (918) 991-4528 Mail: 411 N HODGE ST SAPULPA OK 74066 Physical: 134041 1728299 3 LANE TRUCKING LLC 3 LANE TRUCKING LLC Mail: RR1 -

The CEO Action for Diversity & Inclusion™ Aims to Rally The

The CEO Action for Diversity & Inclusion™ aims to rally the business community to advance diversity & inclusion within the workplace by working collectively across organizations and sectors. It outlines a specific set of actions the undersigned companies will take to cultivate a trusting environment where all ideas are welcomed and employees feel comfortable and empowered to discuss diversity & inclusion. All the signatories serve as leaders of their companies and have committed to implementing the following pledge within their workplaces. Where companies have already implemented one or several of the commitments, the undersigned commit to support other companies in doing the same. The persistent inequities across our country underscore our urgent, national need to address and alleviate racial, ethnic and other tensions and to promote diversity within our communities. As leaders of some of America’s largest corporations, we manage thousands of employees and play a critical role in ensuring that inclusion is core to our workplace culture and that our businesses are representative of the communities we serve. Moreover, we know that diversity is good for the economy; it improves corporate performance, drives growth and enhances employee engagement. Simply put, organizations with diverse teams perform better. We recognize that diversity & inclusion are multifaceted issues and that we need to tackle these subjects holistically to better engage and support all underrepresented groups within business. To do this, we believe we also need to address honestly and head-on the concerns and needs of our diverse employees and increase equity for all, including Blacks, Latinos, Asians, Native Americans, LGBTQ, disabled, veterans and women. -

FILE FORM # SIZE PAGE DATE COLOR Accessories Kaiser

DATE FORM # PAGE SIZE COLOR FILE Accessories No Date Kaiser Accessories, Featuring a complete line of 1951-55 0 8 1/4 x 5 1/2 Sepia-toned Facts Book Copyright 1951 Henry J: Salesman Facts 1951-117 104 8 x 7 1/4 White / Blue / Black Cover Miscellaneous No Date Kaiser-Henry J: Kaiser Frazer Graphic Willow Run 1953 1953-34 16 11 x 15 Part Color No Date Kaiser | Henry J: 1953 Colors, color chips and tissue insert 1953-39 4 10 1/2 x 8 1/2 Green / Black / White Owners Manual Copyright Aug Henry J: Owners packet, includes owners manual, 2-sided sheet, 1951-116 1950 #740343; service policy # 740537; owners card #740538, in envelope #740577, plus Air Conditioner and Radio Instructions, if equipped 0 4 x 8 1/2 Rose / Black / White No Date RF28-9999 Allstate: Owners packet, includes owners manual, service policy 1952-29 and owners card in envelope, plus Air Conditioner and Radio Instructions, if equipped 20 5 x 7 Red / Black / White Copyright 1952 734988 Henry J: Owners Packet, includes owners manual, 2-sided sheet, 1952-47 Service Policy #740537; owners card #740538; in envelope #740987, plus Air Conditioner and Radio Instructions, if equipped 0 4 x 8 1/2 Blue / Black / White RF28-9999 Allstate: Allstate: Owners packet, includes owner manual, service 1953-44 policy and owners card, in envelope, plus Air Conditioner and Radio Instructions, if equipped 20 5 x 7 Orange / Black / White 740880 Henry J: Owners Packet, includes owners manual, #740880, 1953-79 service policy #745630; owners card #745629;,Care of Bright Trim card, plus Air Conditioner and -

Motor Vehicle Make Abbreviation List Updated As of June 21, 2012 MAKE Manufacturer AC a C AMF a M F ABAR Abarth COBR AC Cobra SKMD Academy Mobile Homes (Mfd

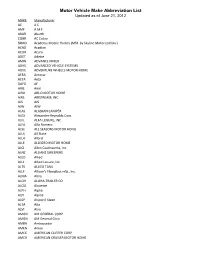

Motor Vehicle Make Abbreviation List Updated as of June 21, 2012 MAKE Manufacturer AC A C AMF A M F ABAR Abarth COBR AC Cobra SKMD Academy Mobile Homes (Mfd. by Skyline Motorized Div.) ACAD Acadian ACUR Acura ADET Adette AMIN ADVANCE MIXER ADVS ADVANCED VEHICLE SYSTEMS ADVE ADVENTURE WHEELS MOTOR HOME AERA Aerocar AETA Aeta DAFD AF ARIE Airel AIRO AIR-O MOTOR HOME AIRS AIRSTREAM, INC AJS AJS AJW AJW ALAS ALASKAN CAMPER ALEX Alexander-Reynolds Corp. ALFL ALFA LEISURE, INC ALFA Alfa Romero ALSE ALL SEASONS MOTOR HOME ALLS All State ALLA Allard ALLE ALLEGRO MOTOR HOME ALCI Allen Coachworks, Inc. ALNZ ALLIANZ SWEEPERS ALED Allied ALLL Allied Leisure, Inc. ALTK ALLIED TANK ALLF Allison's Fiberglass mfg., Inc. ALMA Alma ALOH ALOHA-TRAILER CO ALOU Alouette ALPH Alpha ALPI Alpine ALSP Alsport/ Steen ALTA Alta ALVI Alvis AMGN AM GENERAL CORP AMGN AM General Corp. AMBA Ambassador AMEN Amen AMCC AMERICAN CLIPPER CORP AMCR AMERICAN CRUISER MOTOR HOME Motor Vehicle Make Abbreviation List Updated as of June 21, 2012 AEAG American Eagle AMEL AMERICAN ECONOMOBILE HILIF AMEV AMERICAN ELECTRIC VEHICLE LAFR AMERICAN LA FRANCE AMI American Microcar, Inc. AMER American Motors AMER AMERICAN MOTORS GENERAL BUS AMER AMERICAN MOTORS JEEP AMPT AMERICAN TRANSPORTATION AMRR AMERITRANS BY TMC GROUP, INC AMME Ammex AMPH Amphicar AMPT Amphicat AMTC AMTRAN CORP FANF ANC MOTOR HOME TRUCK ANGL Angel API API APOL APOLLO HOMES APRI APRILIA NEWM AR CORP. ARCA Arctic Cat ARGO Argonaut State Limousine ARGS ARGOSY TRAVEL TRAILER AGYL Argyle ARIT Arista ARIS ARISTOCRAT MOTOR HOME ARMR ARMOR MOBILE SYSTEMS, INC ARMS Armstrong Siddeley ARNO Arnolt-Bristol ARRO ARROW ARTI Artie ASA ASA ARSC Ascort ASHL Ashley ASPS Aspes ASVE Assembled Vehicle ASTO Aston Martin ASUN Asuna CAT CATERPILLAR TRACTOR CO ATK ATK America, Inc. -

C:\Documents and Settings\Owner\My Documents\Flyers-Kaiser\FLYER-5

“Kaiser Flyer # 5” Joseph W. (Jeeps) Frazer Joseph W. Frazer was the automobile “expert” part of the Kaiser-Frazer Corporation. He was respected by the Detroit “in” crowd and was well-known as an outstanding automotive expert and salesman. He was born in Nashville, Tenn in 1892 into a well-to-do family. His brother operated a Packard Agency in Nashville and young Joe would doodle with drawing pictures of cars during his school days. He could have started his working career at various high- salary jobs in an executive position in other industries but chose instead to begin work at Packard as a mechanic’s helper at less than 20 cents per hour. He wanted to be close to his love - Joseph W. Frazer in his Willow Run Office early 1946 automobiles. Although he was very successful in several aspects of the automobile business, including starting the first technical school for automotive mechanics, his heart was always in sales and promotion. He sold Packard motor cars in New York and at his brother’s Nashville dealership and by the end of World War I he was ready to begin his quest for making his mark on the automobile industry. He first took an opportunity at GM’s Chevrolet Division in sales. He was soon promoted into the GM Export Division as Treasurer and helped to organize the General Motors Acceptance Division, one of the first strictly automobile credit agencies established in the country. GM later loaned Joe to Pierce-Arrow to assist them in creating their own credit agency. -

Frazer, Ltd. Agreement

STATE OF TEXAS § § COUNTY OF FORT BEND § ADDENDUM TO FRAZER, LTD. AGREEMENT THIS ADDENDUM (“Addendum”) is entered into by and between Fort Bend County, (“County”), a body corporate and politic under the laws of the State of Texas, and Frazer, Ltd., (“Frazer”), a company authorized to conduct business in the State of Texas (hereinafter collectively referred to as the “parties”). WHEREAS, the parties have executed and accepted Frazer’s Customer Quote (the “Agreement”), attached hereto as Exhibit “A” and incorporated by reference, for the purchase of MICU Modules (ambulances) (collectively referred to as the “Product”); and WHEREAS, the following changes are incorporated as if a part of the Agreement: 1. Cooperative Purchasing. Frazer will provide Product and/or services in accordance with Buy Board Contract Number 570-18, incorporated by reference and attached as Exhibit “B.” 2. Payment; Non-appropriation; Taxes. Payment shall be made by County within thirty (30) days of receipt of invoice. It is specifically understood and agreed that in the event no funds or insufficient funds are appropriated by Fort Bend County under this Agreement, Fort Bend County shall notify all necessary parties that this Agreement shall thereafter terminate and be null and void on the last day of the fiscal period for which appropriations were made without penalty, liability or expense to Fort Bend County. County is a body corporate and politic under the laws of the State of Texas and claims exemption from sales and use taxes. A copy of a tax-exempt certificate will be furnished upon request. 3. Limit of Appropriation. Frazer clearly understands and agrees, such understanding and agreement being of the absolute essence of this Agreement, that County shall have available the total maximum sum of Five Hundred Thirty-Six Thousand, Four Hundred Nine and 00/100 dollars ($536,409.00), specifically allocated to fully discharge any and all liabilities County may incur. -

FOR WEBSITE 3.8 FY18 Timing.Xlsx

ALPHA LIST Updated 3.8 | 1:44PM BIB WAVE TIME CONST ID LAST_NAME FIRST_NAME TEAM 2019 51 1:00 PM 6570517 Abernathy Shea Stenz Family 1641 42 12:15 PM 7263108 Acharya Jahnavi The Jumping Silver Sheep 394 11 8:30 AM 7388851 Adair Emily Baker Tilly Milwaukee 2300 58 1:35 PM 6940431 Adamek Melissa Joan Durr 2004 51 1:00 PM 5801196 Ade Sarah Lungevity 2111 53 1:10 PM 7377512 Adriano Amanda Team True Blue 2414 61 1:50 PM 4761991 Affeldt Michelle Team Affeldt 2415 61 1:50 PM 5344184 Affeldt Stephanie Team Affeldt 1760 45 12:30 PM 7375679 Aguilar Elizabeth We BeLung With Together 2410 31 10:10 AM 4161895 Aguirre Leticia Si Se Puede 272 8 8:15 AM 6970581 Ahearn Jim BSG/HJI 2130 54 1:15 PM 6950274 Ahles Katie ePlatinum Health 2131 54 1:15 PM 6950262 Ahles jr Billy ePlatinum Health 2760 52 1:05 PM 7389735 Aiken Pam PHoo PHighters 1707 43 12:20 PM 6883299 Akemann John KD's Klimbers 1708 43 12:20 PM 5098547 Akemann Katie KD's Klimbers 1440 36 10:35 AM 6938636 Albrecht Catherine Flight Club 1589 40 12:05 PM 7330173 Albrecht Joslynn We Know You Don't Floss 2601 FIRE 4 11:15 AM 5155709 Alby Becca Town of Burlington Fire Department 335 9 8:20 AM 6947559 Alexander Martha A breath for Mom 2734 0 6:15 AM 6595156 Allen Garrett Team Allen 2735 0 6:15 AM 6887642 Allen Rebecca Team Allen 109 4 6:45 AM 7443699 Allen Garrett 110 4 6:45 AM 7443731 Allen Rebecca 1339 34 10:25 AM 7280464 Allen Claire Climbing for a Cause 1340 34 10:25 AM 7280449 Allen Henry Climbing for a Cause 1341 34 10:25 AM 6870627 Allen Keevin Climbing for a Cause 1342 34 10:25 AM 7280455 Allen -

The Informationalized Infrastructural Ideal. (Under the Direction of Dr

ABSTRACT OSWALD, KATHLEEN FRAZER. Smarter, Better, Faster, Stronger: The Informationalized Infrastructural Ideal. (Under the direction of Dr. Jeremy Packer). As the public and private sector spend and invest billions of dollars maintaining, repairing, securing, constructing, and informationalizing infrastructure, scholars of communication continue to neglect the central role of infrastructure in shaping contemporary mediascapes. This neglect stems from a number of tendencies in the field of communication, including a move away from the transmission model of communication, a separation in thinking about the communication of information and the communication of people and objects, and a tendency to think about technologies in terms of their historical development, mediation, effects, uses or potentials rather than to understand technologies as cultural forms subject to alternative arrangements. While these academic biases make the study of communication, mobility, and technology challenging, my work takes an interdisciplinary approach that recognizes and works to move past historical divisions in the disciplines in the interest of exploring the ways in which informationalization is changing communication, culture, and mediascapes. I locate informationalization—adding a data layer to processes through instrumentation, interconnection and intelligence—at the center of changing articulations of communication, transportation, information and housing infrastructure. I take as central a double reorganization of infrastructure under two competing logics: a utopian view that positions the informationalization of networks as “smart” and can be traced across a variety of popular, industry and government discourses as a compelling argument for connection; and a logic that positions infrastructure as “critical,” which while intensified by post 9/11 sensibilities, has clear origins in earlier beliefs about the dystopian potentials of connection, including computer crime and cyberwarfare. -

R+L Carriers Rules Tariff

Copyright 2021, R+L Carriers Inc. R+L Carriers Rules Tariff R+L Carriers, Inc. 600 Gillam Rd. Wilmington, OH 45177 www.gorlc.com Updated 08/03/2021 Rules Table of Contents ITEM SUBJECT ITEM 300 Advance Charges Prohibited ITEM 162 Alternate Application of Rates and Weights ITEM 150 Applications of Classification Rules ITEM 159 Application of Rates ITEM 328 Arbitrary Charges (Ferry Fees) ITEM 329 Arbitrary Charges (South Dakota) ITEM 330 Arbitrary Charges (New York City) ITEM 331 Arbitrary Charges (North Dakota) ITEM 332 Arbitrary Charges (Northern Alberta, CN) (Oil Sands) ITEM 333 Arbitrary Charges (Saskatchewan High Cost Destination) ITEM 345 Arrival Notice ITEM 360 Bills of Lading ITEM 361 Bills of Lading Corrected ITEM 362 Bills of Lading, Freight Bills and Statements of Charges ITEM 359 Bill of Lading Description Requirements ITEM 365 Blind Shipments ITEM 171 Bumping Clause (Non-application) ITEM 755 California Compliance Surcharge ITEM 483 Canada Consolidation Fee ITEM 390 Capacity Loads ITEM 486 Chicago Handling Charge ITEM 994 Classification of Exempt Commodities ITEM 545 Coastwise Freight ITEM 430 COD Shipments ITEM 432 Collection of Freight Charges ITEM 435 Collection of Freight Charges / Extension of Credit ITEM 770 Collection of Freight Charges ITEM 440 Commercial Zones ITEM 450 Commingling - Intrastate and Interstate Traffic ITEM 2020 Commodity Lists ITEM 2400 Commodity Lists ITEM 465 Containers - Shipments Transported in ITEM 470 Control of Vehicles ITEM 364 Corrected Bills of Lading – Description, Density, Class and/or Weight