Annual Report2017 Sompo Holdings, Inc

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Published on July 21, 2021 1. Changes in Constituents 2

Results of the Periodic Review and Component Stocks of Tokyo Stock Exchange Dividend Focus 100 Index (Effective July 30, 2021) Published on July 21, 2021 1. Changes in Constituents Addition(18) Deletion(18) CodeName Code Name 1414SHO-BOND Holdings Co.,Ltd. 1801 TAISEI CORPORATION 2154BeNext-Yumeshin Group Co. 1802 OBAYASHI CORPORATION 3191JOYFUL HONDA CO.,LTD. 1812 KAJIMA CORPORATION 4452Kao Corporation 2502 Asahi Group Holdings,Ltd. 5401NIPPON STEEL CORPORATION 4004 Showa Denko K.K. 5713Sumitomo Metal Mining Co.,Ltd. 4183 Mitsui Chemicals,Inc. 5802Sumitomo Electric Industries,Ltd. 4204 Sekisui Chemical Co.,Ltd. 5851RYOBI LIMITED 4324 DENTSU GROUP INC. 6028TechnoPro Holdings,Inc. 4768 OTSUKA CORPORATION 6502TOSHIBA CORPORATION 4927 POLA ORBIS HOLDINGS INC. 6503Mitsubishi Electric Corporation 5105 Toyo Tire Corporation 6988NITTO DENKO CORPORATION 5301 TOKAI CARBON CO.,LTD. 7011Mitsubishi Heavy Industries,Ltd. 6269 MODEC,INC. 7202ISUZU MOTORS LIMITED 6448 BROTHER INDUSTRIES,LTD. 7267HONDA MOTOR CO.,LTD. 6501 Hitachi,Ltd. 7956PIGEON CORPORATION 7270 SUBARU CORPORATION 9062NIPPON EXPRESS CO.,LTD. 8015 TOYOTA TSUSHO CORPORATION 9101Nippon Yusen Kabushiki Kaisha 8473 SBI Holdings,Inc. 2.Dividend yield (estimated) 3.50% 3. Constituent Issues (sort by local code) No. local code name 1 1414 SHO-BOND Holdings Co.,Ltd. 2 1605 INPEX CORPORATION 3 1878 DAITO TRUST CONSTRUCTION CO.,LTD. 4 1911 Sumitomo Forestry Co.,Ltd. 5 1925 DAIWA HOUSE INDUSTRY CO.,LTD. 6 1954 Nippon Koei Co.,Ltd. 7 2154 BeNext-Yumeshin Group Co. 8 2503 Kirin Holdings Company,Limited 9 2579 Coca-Cola Bottlers Japan Holdings Inc. 10 2914 JAPAN TOBACCO INC. 11 3003 Hulic Co.,Ltd. 12 3105 Nisshinbo Holdings Inc. 13 3191 JOYFUL HONDA CO.,LTD. -

Representative Legal Matters Kiyoshi Endo

Representative Legal Matters Kiyoshi Endo Acted for Panasonic on its acquisition of Zetes, a Belgian publicly-listed company, for EUR 149.6 million. Acted for Japan Pulp and Paper on its acquisition of BJ Ball and Doggett groups operated in Australia and New Zealand. Acted for Yanmar Holdings on its acquisition of an 18% stake in International Tractors in India from US investment fund Blackstone for approximately JPY 25 billion. Acted for Sompo Holdings on its regional non-life bancassurance deal with CIMB Group Holdings. Acted for JFE Steel on its formation of a joint venture with a local partner in Vietnam. Acted for Sompo Holdings on its acquisition of a minority stake in Asia Financial Holdings, a Hong Kong listed investment holding company. Acted for a founder of Iiyonet, a distributor of Garmin products in Japan, on the acquisition of a 100% stake in Iiyonet by Garmin. Acted for Yanmar Holdings on its acquisition of a compact construction business in Europe from Terex Corporation. Acted for Meiji Yasuda Life Insurance Company on its acquisition of StanCorp Financial Group, a publicly-listed US life insurance group, for USD 5 billion. Acted for Yanmar Holdings on its acquisition of a Spanish energy systems manufacturer, Himoinsa SL. Acted for Seino Holdings on its formation of a joint venture with a Thai consumer goods conglomerate, Saha Group. Acted for Sumitomo Corporation on its acquisition of a 17.5% stake in an Indonesian commercial bank, PT. Bank Tabungan Pensiunan Nasional Tbk. Acted for Yanmar Holdings on its acquisition of the shares in Laser Cladding Singapore Pte. -

Establishment of and Participation in the ESG Disclosure Study Group Comprised of 19 Companies in the Private Sector

Press Release 11 June 2020 Sumitomo Mitsui Trust Asset Management Co., Ltd. Establishment of and Participation in the ESG Disclosure Study Group Comprised of 19 Companies in the Private Sector Tokyo, June 11, 2020 –Sumitomo Mitsui Trust Asset Management Co., Ltd. (Representative Director and President: Yoshio Hishida) today announced that it will take part in the ESG Disclosure Study Group ( a general incorporation association; “the Study Group”) which is planned to be established in late June 2020. At the time of its creation, the Study Group will consist of 19 private sector companies and will carry out research related to ESG information disclosure with the goal of creating a mechanism to establish harmony between the sustained development of society and the individual efforts of companies to enhance corporate value and growth. Mr. Tetsuo Kitagawa, Professor Emeritus at Aoyama Gakuin University and a specially appointed professor at Tokyo Metropolitan University, will assume the post of Representative Director of the Study Group and concurrently serve as Chairperson to supervise the Study Group’s research. Companies participating upon the creation of the Study Group (in the order of the Japanese syllabary) Ajinomoto Co., Inc. Asset Management One Co., Ltd. EY Japan Kao Corporation KDDI Corporation KPMG Japan Goldman Sachs Asset Management Co., Ltd. Goldman Sachs Japan Co., Ltd. Seven & i Holdings Co., Ltd. Sompo Holdings, Inc. Takeda Pharmaceutical Company Co., Ltd. Deloitte Touche Tohmatsu LLC Tokyo Electric Power Company Holdings, Incorporated Nippon Life Insurance Company PwC Japan Group Hitachi, Ltd. Mizuho Financial Group, Inc. Sumitomo Mitsui Trust Asset Management Co., Ltd. Mitsubishi UFJ Financial Group, Inc. -

Topics & Basics (Version of August 2020) SOMPO Holgins, Inc

Version of August 2020 Topics & Basics August 2020 1. About SOMPO Holdings P1 2. Mid-term management plan P6P1 (1) Group management P6 (2) Business strategies for each business segment P20 (3) ERM, capital policy & asset management P38 Appendix P46 1 1. About SOMPO Holdings Overview of SOMPO Holdings Positioning the Sompo Japan as the core, SOMPO Holdings develops domestic and overseas insurance businesses, etc. Ordinary income amounted to over ¥3.7 trillion and total assets amounted to around ¥12 trillion. Group at a glance Selected financial data (Consolidated) FY2020 FY2018 FY2019 (¥ bn.) (Forecasts) Consolidated 3,643.0 3,760.3 - Ordinary Income Consolidated Ordinary 198.9 192.4 223.0 Domestic P&C Overseas insurance Profit (Loss) Consolidated 146.6 122.5 150.0 - Sompo Japan - Sompo International (SI) Net Income (Loss) - Saison Automobile & Fire - Sompo Seguros (Brazil) Total Assets 12,018.2 11,977.8 - - Sompo Japan Partners - Sompo Sigorta (Turkey) - DC Securities - Berjaya Sompo (Malaysia) Total Net Assets 1,779.9 1,612.5 - - Risk Management, etc. - Sompo Singapore, etc. Market 1,528.4 1,217.2 - Capitalization Credit Ratings (As of August 2020) Sompo Japan SI* Himawari Life A+ A+ A+ S&P Domestic life Nursing care & (Stable) (Stable) (Stable) healthcare business, etc. A1 - SOMPO Himawari Life Moody’s - - (Stable) - SOMPO Care A+ A+ A.M. Best - - Asset management business, etc. (Stable) (Stable) AA AA R&I - (Stable) (Stable) AA+ JCR - - (Stable) * Sompo International Holdings Ltd. main subsidiaries 2 1. About SOMPO Holdings Overview of Sompo Japan We have a history of over 130 years, and net premiums written amount to around ¥2.1 trillion. -

Overview of Financial Results of Major Non-Life Insurance Groups As of March 31, 2019

(Provisional translation) June 21, 2019 Financial Services Agency Overview of financial results of major non-life insurance groups as of March 31, 2019 I. Profit - Net premiums written (consolidated) slightly decreased from the previous year, primarily because of the sale of overseas subsidiaries in some groups. - Net income attributable to shareholders slightly increased from the previous year, although net claims paid increased primarily because of impact from the losses due to domestic catastrophes, such as Typhoon No.21 (Typhoon Jebi). This was primarily due to the reversal of catastrophe reserves and the previous year’s one-off effect represented by the losses caused by hurricanes in North America. (Unit: 100 million yen) Compared Fiscal year Fiscal year Fiscal year with ended Mar. ended Mar. ended Mar. previous 31, 2017 31, 2018 31, 2019 year Net premiums written 94,382 98,604 98,031 (573) (consolidated ) Ordinary profits 9,819 6,983 9,061 2,077 (consolidated) Net extr aordinary profits/(losses) (804) (21) (385) (363) (consolidated ) Net income attributable to 6,507 5,780 6,139 358 shareholders II. Soundness - The solvency margin ratio (non-consolidated) decreased by 8.0 points from the previous year, attributable mainly to a decrease of unrealized gains on available-for-sale securities. (Unit: %, 100 million yen) Compared Fiscal year Fiscal year Fiscal year with ended Mar. ended Mar. ended Mar. previous 31, 2017 31, 2018 31, 2019 year Solvency margin ratio 756.0 764.6 756.6 (8.0Pt ) (non-consolidated) Total net assets 81,731 87,201 81,616 (5,584) (consolidated ) * Consolidated: Tokio Marine HD, MS&AD HD, and SOMPO HD. -

TOPIX100 Constituents (As of October 31, 2019) No. Code Issue No. Code Issue 1 1605 INPEX CORPORATION 51 7201 NISSAN MOTOR CO.,LTD

TOPIX100 Constituents (as of October 31, 2019) No. Code Issue No. Code Issue 1 1605 INPEX CORPORATION 51 7201 NISSAN MOTOR CO.,LTD. 2 1878 DAITO TRUST CONSTRUCTION CO.,LTD. 52 7202 ISUZU MOTORS LIMITED 3 1925 DAIWA HOUSE INDUSTRY CO.,LTD. 53 7203 TOYOTA MOTOR CORPORATION 4 1928 Sekisui House,Ltd. 54 7267 HONDA MOTOR CO.,LTD. 5 2502 Asahi Group Holdings,Ltd. 55 7269 SUZUKI MOTOR CORPORATION 6 2503 Kirin Holdings Company,Limited 56 7270 SUBARU CORPORATION 7 2802 Ajinomoto Co.,Inc. 57 7733 OLYMPUS CORPORATION 8 2914 JAPAN TOBACCO INC. 58 7741 HOYA CORPORATION 9 3382 Seven & I Holdings Co.,Ltd. 59 7751 CANON INC. 10 3402 TORAY INDUSTRIES,INC. 60 7832 BANDAI NAMCO Holdings Inc. 11 3407 ASAHI KASEI CORPORATION 61 7974 Nintendo Co.,Ltd. 12 4063 Shin-Etsu Chemical Co.,Ltd. 62 8001 ITOCHU Corporation 13 4188 Mitsubishi Chemical Holdings Corporation 63 8002 Marubeni Corporation 14 4452 Kao Corporation 64 8031 MITSUI & CO.,LTD. 15 4502 Takeda Pharmaceutical Company Limited 65 8035 Tokyo Electron Limited 16 4503 Astellas Pharma Inc. 66 8053 SUMITOMO CORPORATION 17 4507 Shionogi & Co.,Ltd. 67 8058 Mitsubishi Corporation 18 4519 CHUGAI PHARMACEUTICAL CO.,LTD. 68 8113 UNICHARM CORPORATION 19 4523 Eisai Co.,Ltd. 69 8267 AEON CO.,LTD. 20 4528 ONO PHARMACEUTICAL CO.,LTD. 70 8306 Mitsubishi UFJ Financial Group,Inc. 21 4543 TERUMO CORPORATION 71 8308 Resona Holdings, Inc. 22 4568 DAIICHI SANKYO COMPANY,LIMITED 72 8309 Sumitomo Mitsui Trust Holdings,Inc. 23 4578 Otsuka Holdings Co.,Ltd. 73 8316 Sumitomo Mitsui Financial Group,Inc. 24 4661 ORIENTAL LAND CO.,LTD. -

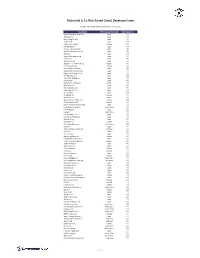

Rothschild & Co Risk-Based Global Developed Index

Rothschild & Co Risk-Based Global Developed Index Indicative Index Weight Data as of January 31, 2020 on close Constituent Exchange Country Index Weight (%) Nippon Telegraph & Telephone C Japan 1.11 Softbank Corp Japan 1.10 Nitori Holdings Co Ltd Japan 0.75 Toshiba Corp Japan 0.67 Kirkland Lake Gold Ltd Canada 0.61 NTT DOCOMO Inc Japan 0.58 Mizuho Financial Group Inc Japan 0.54 Takeda Pharmaceutical Co Ltd Japan 0.50 KDDI Corp Japan 0.49 Japan Post Holdings Co Ltd Japan 0.48 Subaru Corp Japan 0.48 Sekisui House Ltd Japan 0.45 Singapore Telecommunications L Singapore 0.45 Franco-Nevada Corp Canada 0.43 Oriental Land Co Ltd/Japan Japan 0.43 Chugai Pharmaceutical Co Ltd Japan 0.40 Nippon Paint Holdings Co Ltd Japan 0.39 Fast Retailing Co Ltd Japan 0.38 Tokio Marine Holdings Inc Japan 0.38 ITOCHU Corp Japan 0.38 Bandai Namco Holdings Inc Japan 0.37 Bridgestone Corp Japan 0.36 MEIJI Holdings Co Ltd Japan 0.35 Japan Airlines Co Ltd Japan 0.34 Unicharm Corp Japan 0.33 Aroundtown SA Germany 0.33 Ajinomoto Co Inc Japan 0.33 Algonquin Power & Utilities Co Canada 0.32 Deutsche Wohnen SE Germany 0.32 MS&AD Insurance Group Holdings Japan 0.32 Lamb Weston Holdings Inc United States 0.32 ANA Holdings Inc Japan 0.32 Evergy Inc United States 0.32 Kirin Holdings Co Ltd Japan 0.32 Asahi Group Holdings Ltd Japan 0.32 Shiseido Co Ltd Japan 0.32 Wesfarmers Ltd Australia 0.32 Cboe Global Markets Inc United States 0.32 Canon Inc Japan 0.31 Jardine Matheson Holdings Ltd Singapore 0.31 Kao Corp Japan 0.31 Secom Co Ltd Japan 0.31 Agnico Eagle Mines Ltd Canada 0.31 -

R&Co Risk-Based Japan Index

Rothschild & Co Risk-Based Japan Index Indicative Index Weight Data as of June 30, 2021 on close Constituent Exchange Country Index Weight(%) McDonald's Holdings Co Japan L Japan 1.29 Idemitsu Kosan Co Ltd Japan 1.12 SoftBank Corp Japan 1.05 Nintendo Co Ltd Japan 0.86 Hitachi Metals Ltd Japan 0.83 Yakult Honsha Co Ltd Japan 0.82 Iwatani Corp Japan 0.81 ENEOS Holdings Inc Japan 0.79 FUJIFILM Holdings Corp Japan 0.78 KDDI Corp Japan 0.75 Toshiba Corp Japan 0.73 Calbee Inc Japan 0.73 Ajinomoto Co Inc Japan 0.72 Eisai Co Ltd Japan 0.72 Nissin Foods Holdings Co Ltd Japan 0.71 Morinaga Milk Industry Co Ltd Japan 0.70 Japan Tobacco Inc Japan 0.66 H.U. Group Holdings Inc Japan 0.66 JCR Pharmaceuticals Co Ltd Japan 0.64 MEIJI Holdings Co Ltd Japan 0.64 Yamazaki Baking Co Ltd Japan 0.63 Chugoku Electric Power Co Inc/ Japan 0.63 Nippon Gas Co Ltd Japan 0.63 PeptiDream Inc Japan 0.62 Chubu Electric Power Co Inc Japan 0.62 Seven & i Holdings Co Ltd Japan 0.62 FP Corp Japan 0.61 Pola Orbis Holdings Inc Japan 0.61 Lion Corp Japan 0.61 Shiseido Co Ltd Japan 0.60 Nippon Telegraph & Telephone C Japan 0.60 Nichirei Corp Japan 0.59 Japan Post Bank Co Ltd Japan 0.59 Kobayashi Pharmaceutical Co Lt Japan 0.59 Anritsu Corp Japan 0.58 Skylark Holdings Co Ltd Japan 0.58 Kyowa Kirin Co Ltd Japan 0.58 Lawson Inc Japan 0.58 Suntory Beverage & Food Ltd Japan 0.57 Kinden Corp Japan 0.57 MS&AD Insurance Group Holdings Japan 0.56 Shimano Inc Japan 0.56 Mitsubishi Corp Japan 0.56 Zensho Holdings Co Ltd Japan 0.56 Tokai Carbon Co Ltd Japan 0.56 Japan Post Holdings Co Ltd -

Internet Disclosure Accompanying the Notice of Convocation the 117Th Ordinary General Meeting of Shareholders (Voluntary Disclosure)

March 6, 2017 Internet Disclosure Accompanying the Notice of Convocation The 117th Ordinary General Meeting of Shareholders (Voluntary Disclosure) Voluntary Disclosure Relating to “3. Matters Concerning Shares Held by the Company” on the Business Report of the Company The 30 Largest Stock-Holdings of Publicly Listed Companies in the Amount on the Balance Sheet, Which the Company Holds for Purposes Other Than Realizing Direct Investment Gains ································································································· 1 Voluntary Disclosure Relating to “5. Matters Concerning Status of Corporate Governance and Directors, Audit & Supervisory Board Members and Corporate Officers of the Company” of the Business Report of the Company Criteria for Independence of “External Directors and Audit & Supervisory Board Members” ······························································································· 2 Criteria for “Important Concurrent Position” Assumed by Company’s Directors and Audit & Supervisory Board Members···························································· 6 Criteria for Stating the Relationship between the Company and the Organizations in Which the Company’s Directors and Audit & Supervisory Board Members Hold “Important Concurrent Positions” ················································································· 7 The 30 Largest Stock-Holdings of Publicly Listed Companies in the Amount on the Balance Sheet, Which the Company Holds for Purposes Other Than Realizing Direct Investment -

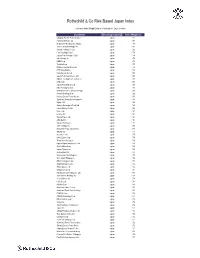

Rothschild & Co Risk-Based Japan Index

Rothschild & Co Risk-Based Japan Index Indicative Index Weight Data as of January 31, 2020 on close Constituent Exchange Country Index Weight (%) Chugoku Electric Power Co Inc/ Japan 1.01 Yamada Denki Co Ltd Japan 0.91 McDonald's Holdings Co Japan L Japan 0.88 Sushiro Global Holdings Ltd Japan 0.82 Skylark Holdings Co Ltd Japan 0.82 Fast Retailing Co Ltd Japan 0.78 Japan Post Holdings Co Ltd Japan 0.78 Ain Holdings Inc Japan 0.78 KDDI Corp Japan 0.77 Toshiba Corp Japan 0.75 Mizuho Financial Group Inc Japan 0.74 NTT DOCOMO Inc Japan 0.73 Kobe Bussan Co Ltd Japan 0.72 Japan Post Insurance Co Ltd Japan 0.69 Nippon Telegraph & Telephone C Japan 0.69 LINE Corp Japan 0.69 Japan Post Bank Co Ltd Japan 0.68 Nitori Holdings Co Ltd Japan 0.67 MS&AD Insurance Group Holdings Japan 0.66 Konami Holdings Corp Japan 0.66 Kyushu Electric Power Co Inc Japan 0.65 Sumitomo Realty & Development Japan 0.65 Fujitsu Ltd Japan 0.63 Suntory Beverage & Food Ltd Japan 0.63 Japan Airlines Co Ltd Japan 0.62 NEC Corp Japan 0.61 Lawson Inc Japan 0.60 Sekisui House Ltd Japan 0.60 ABC-Mart Inc Japan 0.60 Kyushu Railway Co Japan 0.60 ANA Holdings Inc Japan 0.59 Mitsubishi Heavy Industries Lt Japan 0.58 ORIX Corp Japan 0.57 Secom Co Ltd Japan 0.57 Seiko Epson Corp Japan 0.56 Trend Micro Inc/Japan Japan 0.56 Nippon Paper Industries Co Ltd Japan 0.56 Suzuki Motor Corp Japan 0.56 Japan Tobacco Inc Japan 0.55 Aozora Bank Ltd Japan 0.55 Sony Financial Holdings Inc Japan 0.55 West Japan Railway Co Japan 0.54 MEIJI Holdings Co Ltd Japan 0.54 Sugi Holdings Co Ltd Japan 0.54 Tokyo -

Physical Risks of Climate Change at Tokio Marine, MS&AD and SOMPO

JACSES Briefing Paper Series No.24 Physical Risks of Climate Change at Tokio Marine, MS&AD and SOMPO - Catastrophic Natural Disasters and Emergency Contingency Reserve Depletion Scenarios - February 19, 2020 Yuki Tanabe Program Director Japan Center for a Sustainable Environment and Society (JACSES) JACSES Briefing Paper Series No.24 1 Introduction According to the German think tank, Germanwatch, Japan was the country most affected by natural disasters in 2018.1 In actuality, the increase in typhoons and flooding resulted in Japanese property and casualty (P&C) insurers receiving primary insurance claims amounting to 1.5 trillion yen (USD 13.6 billion, USD1=JPY110) during FY2018. Claims are expected to amount to 1 trillion in FY2019.2 According to the Japan Meteorological Agency (JMA), the intensity of extremely heavy rainfall in Japan in 2018 was approximately 10% higher than in the past 30 years. The JMA explains that this may be attributable to a long-term increasing trend in the amount of water vapor in the atmosphere associated with a background of long-term atmospheric warming.3 As climate change is expected to result in more frequent large-scale natural disasters, it is becoming clear that Japan’s P&C insurers are extremely vulnerable to the physical risks of climate change. Yet despite this, adequate information on climate change risks to P&C insurers has not been disclosed. For this paper, we conducted a rudimentary investigation into the physical risks of climate change at three Japanese leading P&C insurance groups (Tokio Marine Holdings, MS&AD Insurance Group Holdings, and Sompo Holdings). -

NKSJ Holdings Annual Report 2011(PDF/3825KB)

Annual Report 2011 26-1, Nishi-Shinjuku 1-chome, Shinjuku-ku, Tokyo, 160-8338, Japan http://www.nksj-hd.com/ (99MH5172) 202466 Ver2.00 NK:E7-19-0159 Printed in Japan Preface On March 11, 2011, the largest earthquake in Japan’s recorded history struck. Registering 9.0 on the Richter scale, the Great East Japan Earthquake caused significant damage to Japan’s Tohoku and Kanto regions. The quake shocked the nation as a sense of helplessness swept the land. As the impact of the disaster continued to spread, resulting electrici- ty shortages forced manufacturers to suspend production, fueling downward pressure on the Japanese economy. To support the nation in a time of need, the Japanese property and casualty (P&C) insurance industry is working to enable the quickest possible payment of insurance claims through such measures as aerial and satellite photography to approve “total loss areas.” As of August 3, 2011, the total amount of claims paid for “Earthquake Insurance on Dwelling Risks” by all domestic P&C insurers exceeded ¥1 tril- lion, according to the data published by the General Insurance Association of Japan (GIAJ). The mission of an insurance group—to provide customers with absolute peace of mind—is now being called upon. Every employee and executive stands ready to meet this obligation. The NKSJ Group has renewed its commitment to fulfilling its responsibility to society at large. * For details of the NKSJ Group’s activities in connection with the disaster, please see page 20 of this report. Contents Consolidated Financial Highlights