FHA Single Family Housing Policy Handbook TABLE of CONTENTS

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Building an Adu

BUILDING AN ADU GUIDE TO ACCESSORY DWELLING UNITS 1 451 S. State Street, Room 406 Salt Lake City, UT 84114 - 5480 P.O. Box 145480 CONTENT 04 OVERVIEW 08 ELIGIBILITY 11 BUILDING AN ADU Types of ADU Configurations 14 ATTACHED ADUs Existing Space Conversion // Basement Conversion // This handbook provides general Home with Attached Garage // Addition to House Exterior guidelines for property owners 21 DETACHED ADUs Detached Unit // Detached Garage Conversion // who want to add an ADU to a Attached Above Garage // Attached to Existing Garage lot that already has an existing single-family home. However, it 30 PROCESS is recommended to work with a 35 FAQ City Planner to help you answer any questions and coordinate 37 GLOSSARY your application. 39 RESOURCES ADU regulations can change, www.slc.gov/planning visit our website to ensure latest version 1.1 // 05.2020 version of the guide. 2 3 OVERVIEW WHAT IS AN ADU? An accessory dwelling unit (ADU) is a complete secondary residential unit that can be added to a single-family residential lot. ADUs can be attached to or part of the primary residence, or be detached as a WHERE ARE WE? separate building in a backyard or a garage conversion. Utah is facing a housing shortage, with more An ADU provides completely separate living space people looking for a place to live than there are homes. including a kitchen, bathroom, and its own entryway. Low unemployment and an increasing population are driving a demand for housing. Growing SLC is the City’s adopted housing plan and is aimed at reducing the gap between supply and demand. -

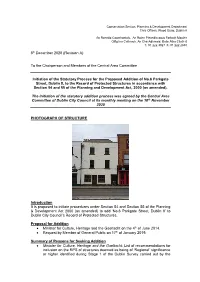

6 Parkgate Street, Dublin 8, to the Record of Protected Structures in Accordance with Section 54 and 55 of the Planning and Development Act, 2000 (As Amended)

Conservation Section, Planning & Development Department Civic Offices, Wood Quay, Dublin 8 An Rannóg Caomhantais, An Roinn Pleanála agus Forbairt Maoine Oifigí na Cathrach, An Ché Adhmaid, Baile Átha Cliath 8 T. 01 222 3927 F. 01 222 2830 8th December 2020 (Revision A) To the Chairperson and Members of the Central Area Committee Initiation of the Statutory Process for the Proposed Addition of No.6 Parkgate Street, Dublin 8, to the Record of Protected Structures in accordance with Section 54 and 55 of the Planning and Development Act, 2000 (as amended). The initiation of the statutory addition process was agreed by the Central Area Committee of Dublin City Council at its monthly meeting on the 10th November 2020 PHOTOGRAPH OF STRUCTURE Introduction It is proposed to initiate procedures under Section 54 and Section 55 of the Planning & Development Act 2000 (as amended) to add ‘No.6 Parkgate Street, Dublin 8’ to Dublin City Council’s Record of Protected Structures. Proposal for Addition Minister for Culture, Heritage and the Gaeltacht on the 4th of June 2014. Request by Member of General Public on 17th of January 2019. Summary of Reasons for Seeking Addition Minister for Culture, Heritage and the Gaeltacht: List of recommendations for inclusion on the RPS of structures deemed as being of ‘Regional’ significance or higher identified during Stage 1 of the Dublin Survey carried out by the National Inventory of Architectural Heritage. No.6 Parkgate Street, Dublin 8, together with the neighbouring properties at Nos.7 and 8 Parkgate Street, Dublin 8 has been assigned a ‘Regional’ rating. -

Effective September 13, 2021

Managing the Office in the Age of COVID-19, effective September 13, 2021 Effective September 13, 2021 Page 1 Managing the Office in the Age of COVID-19, effective September 13, 2021 TABLE OF CONTENTS Summary ......................................................................................................................................... 3 Definitions ....................................................................................................................................... 4 Prepare the Building ....................................................................................................................... 5 Building Systems ........................................................................................................................................ 5 Cleaning ..................................................................................................................................................... 7 Access Control and Circulation .................................................................................................................. 7 Prepare the Workspace ................................................................................................................ 10 Cleaning ................................................................................................................................................... 10 Prepare the Workforce ................................................................................................................. 12 Scheduling ............................................................................................................................................... -

Housing Standards Review

Housing Standards Review Illustrative Technical Standards Developed by the Working Groups August 2013 Department for Communities and Local Government © Crown copyright, 2013 Copyright in the typographical arrangement rests with the Crown. You may re-use this information (not including logos) free of charge in any format or medium, under the terms of the Open Government Licence. To view this licence, www.nationalarchives.gov.uk/doc/open- government-licence/ or write to the Information Policy Team, The National Archives, Kew, London TW9 4DU, or email: [email protected]. This document/publication is also available on our website at www.gov.uk/dclg If you have any enquiries regarding this document/publication, email [email protected] or write to us at: Department for Communities and Local Government Eland House Bressenden Place London SW1E 5DU Telephone: 030 3444 0000 For all our latest news and updates follow us on Twitter: https://twitter.com/CommunitiesUK August 2013 ISBN: 978-1-4098-3974-3 Contents Standard 1: Accessibility 4 Standard 2: Space 46 Standard 3: Domestic Security 62 Standard 4: Water Efficiency 87 Standard 5: Energy 91 The proposals in this technical annex document have been assembled by the working groups and are illustrative, to inform debate. They are not Government policy. 3 Standard 1: accessibility Contents Introduction Requirements Part I: Approach Routes, Communal Entrances and Communal Facilities 1.0 Approach routes 2.0 Car-parking 3.0 Communal entrances 4.0 Communal lifts and stairs Part -

WOODEN SURFACES in a SAUNA and HUMID SPACES INDOORS SATU Protects and Finishes Wooden Surfaces in a Sauna

SAUNA PRODUCTS WOODEN SURFACES IN A SAUNA AND HUMID SPACES INDOORS SATU protects and finishes wooden surfaces in a sauna Products in the SATU sauna series can be used for protecting all wooden surfaces in a sauna and bathroom, such as wall and ceiling panels, benches in the sauna, a sauna stool, and wooden railings. Whether you like the tradi- tional colour of wood, or prefer a modern tinted sauna, you can find suitable products in the SATU series. Using SATU SAUNAVAHA Sauna wax and SATU SAUNASUOJA Protection for Sauna, which can be tinted, you can freshen up the overall image of the sauna or change it so that it is compatible with the rest of the decor at your home. Besides changing the atmosphere of a sauna, the products in the SATU Sauna series form a dirt- and water-repellent coat so it is easy to keep sauna clean and hygienic. SATU SAUNAVAHA wax can be used for protecting all wooden Thanks to a breathable coat, the products in the SATU Sauna series can also surfaces such as benches in the sauna and a sauna stool. be used for other wooden surfaces indoors such as worktops and log surfaces. SATU SAUNAVAHA sauna wax A waterborne protective coating that contains natural wax for all wooden surfaces in the sauna and bathroom. It forms a matt, dirt- and water-repellent but breathable waxy coat. Clear SATU Sauna Wax emphasises the natural colour of wood. Coloured wax gives wooden surfaces a beautiful transparent shade. Paint product group: 711 (MaalausRYL 2012). Spreading capac- ity: Applied once onto a smooth surface about 10 m²/l. -

Residential Bathroom Renovation

CITY OF REDLANDS DEVELOPMENT SERVICES DEPARTMENT BUILDING AND SAFETY DIVISION 35 CAJON AVE SUITE 20 REDLANDS, CALIFORNIA 92373 RESIDENTIAL BATHROOM RENOVATION INTRODUCTION Bathroom renovations generally require a Building permit. The following information can be used as a guideline for the bathroom requirements. Bathroom renovations require compliance with the: 2019 California Residential Code (CRC); 2019 California Plumbing Code (CPC); 2019 California Mechanical Code (CMC); 2019 California Electric Code (CEC); 2019 California Energy Code; 2019 California Green Building Standards Code(CGBS); and The City of Redlands Local Ordinances. A bathroom renovation includes the removal and/or relocation of vanity cabinets, sinks, tub & showers, replacement/changes to the lighting or removal & replacement of the wall board. When the replacement of the toilet, towel bars, mirrors, paint and floor coverings and no other work is included it is considered a maintenance item and no permit is required for these items. The following details the minimum requirements of the bathroom electrical, mechanical and plumbing systems: ELECTRICAL • Provide a 20 AMP GFCI protected electrical outlet within 36” of the outside edge of each basin. The outlet shall be located on a wall or partition that is adjacent to the basin or installed on the side or face of the basin cabinet not more than 12” below the top of the basin. CEC 210.52(D) • Receptacles shall be listed as tamper-resistant. CEC 406.12(A) • A minimum of (1) 20 amp circuit is required for bathroom receptacle outlets. Such circuits shall have no other outlets. This circuit may serve more than one bathroom. CEC 210.11(C)(3) • No parts of cord-connected luminaires, chain-, cable-, or cord-suspended luminaires, lighting track, pendants, or ceiling-suspended fans shall be allowed within a zone measured 3' horizontally and 8' vertically from the top of the bathtub rim or shower stall threshold. -

Harvia Bathroom Saunas

Harvia bathroom saunas Harvia offers a complete new range of high quality saunas. Bathroom sauna is an ingenious invention that enables you to get more out of your bathroom. It can be installed almost any- where, in apartments, hotels, ships etc. As well as being installed in new constructions, it is also a good renovation product. The floor and wall elements consist of watertight laminated fibreglass sandwich panels. Despite their modest weight, the elements are rigid and solid. All Natural well-being. the wood elements are made of premium quality timber. Harvia Sirius The frame design of the walls and ceiling of Sirius bathroom saunas aspen can also be specified. Futura can also be selected as the interior utilises a water, humidity and thermal insulated panel. The interior type. The interior material options will then include aspen, alder, heat- walls and ceiling use 15 mm thick panelling. The panelling in standard treated aspen or otie. models is made of alder, but aspen or heat-treated aspen can also be Adjustable legs under the sauna make it easier to assemble the sauna specified. The front is of clear glass and the frame of the glass is of horizontally if the floor is not even. There is an exhaust air vent in the anodised aluminium. ceiling. The saunas feature the Formula interior. The standard models feature alder for the benches, bench surrounds and backrests. However, Harvia Sirius Standard delivery: Options: Placing Sirius SC1111K into the bathroom • Harvia Formula interior, aspen • Water-, humidity- and heat isolating 1900 • Harvia Futura interior, material options: frame 1140 • Frame of glass (anodised aluminium, aspen, alder, heat-treated aspen, otie colour matt silver) • Panelling options: aspen or heat- • Harvia Formula interior, alder treated aspen • Panelling of alder • Fibre optic lights, 6 light points. -

SOHO Design in the Near Future

Rochester Institute of Technology RIT Scholar Works Theses 12-2005 SOHO design in the near future SooJung Lee Follow this and additional works at: https://scholarworks.rit.edu/theses Recommended Citation Lee, SooJung, "SOHO design in the near future" (2005). Thesis. Rochester Institute of Technology. Accessed from This Thesis is brought to you for free and open access by RIT Scholar Works. It has been accepted for inclusion in Theses by an authorized administrator of RIT Scholar Works. For more information, please contact [email protected]. Rochester Institute of Technology A thesis Submitted to the Faculty of The College of Imaging Arts and Sciences In Candidacy for the Degree of Master of Fine Arts SOHO Design in the near future By SooJung Lee Dec. 2005 Approvals Chief Advisor: David Morgan David Morgan Date Associate Advisor: Nancy Chwiecko Nancy Chwiecko Date S z/ -tJ.b Associate Advisor: Stan Rickel Stan Rickel School Chairperson: Patti Lachance Patti Lachance Date 3 -..,2,2' Ob I, SooJung Lee, hereby grant permission to the Wallace Memorial Library of RIT to reproduce my thesis in whole or in part. Any reproduction will not be for commercial use or profit. Signature SooJung Lee Date __3....:....V_6-'-/_o_6 ____ _ Special thanks to Prof. David Morgan, Prof. Stan Rickel and Prof. Nancy Chwiecko - my amazing professors who always trust and encourage me sincerity but sometimes make me confused or surprised for leading me into better way for three years. Prof. Chan hong Min and Prof. Kwanbae Kim - who introduced me about the attractive -

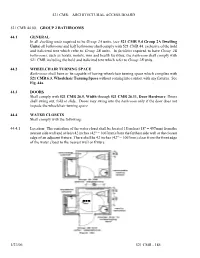

Architectural Access Board 1/27/06 521

521 CMR: ARCHITECTURAL ACCESS BOARD 521 CMR 44.00: GROUP 2 BATHROOMS 44.1 GENERAL In all dwelling units required to be Group 2A units, (see 521 CMR 9.4 Group 2A Dwelling Units) all bathrooms and half bathrooms shall comply with 521 CMR 44, exclusive of the bold and italicized text which refer to Group 2B units. In facilities required to have Group 2B bathrooms, such as hotels, motels, inns and health facilities, the bathroom shall comply with 521 CMR including the bold and italicized text which refer to Group 2B units. 44.2 WHEELCHAIR TURNING SPACE Bathrooms shall have or be capable of having wheelchair turning space which complies with 521 CMR 6.3, Wheelchair Turning Space without coming into contact with any fixtures. See Fig. 44a. 44.3 DOORS Shall comply with 521 CMR 26.5, Width through 521 CMR 26.11, Door Hardware. Doors shall swing out, fold or slide. Doors may swing into the bathroom only if the door does not impede the wheelchair turning space. 44.4 WATER CLOSETS Shall comply with the following: 44.4.1 Location: The centerline of the water closet shall be located 18 inches (18" = 457mm) from the nearest side wall and at least 42 inches (42" = 1067mm) from the farthest side wall or the closest edge of an adjacent fixture. There shall be 42 inches (42" = 1067mm) clear from the front edge of the water closet to the nearest wall or fixture. 1/27/06 521 CMR - 185 521 CMR: ARCHITECTURAL ACCESS BOARD 44.00: GROUP 2 BATHROOMS 44.4.2 Height: The top of the water closet seat shall be 15 inches to 19 inches (15" to 19" = 381mm to 483mm) above the floor. -

Appraisal Report

910 W Main Street, Hamilton MT 59840 Appraisal Report Scott Spear, MAI, SRA Certified General Appraiser Bitterroot Appraisal, LLC [email protected] Bitterroot Appraisal, LLC © 2016 1 910 W Main Street, Hamilton MT 59840 APPRAISAL REPORT Of an Armory Property and Excess Land located at: 910 W Main St, Hamilton MT 59840. EFFECTIVE DATE OF VALUE 07/21/2016 EFFECTIVE DATE OF REPORT 08/10/2016 PREPARED FOR State of Montana Dept. of Military Affairs 1956 Mt Majo Street PO Box 4789 Fort Harrison, MT 59636‐4789 PREPARED BY Scott Spear, MAI, SRA Certified General Appraiser #REA‐RAG‐LIC‐521 Bitterroot Appraisal, LLC PO Box 423 Hamilton, MT 59840 (406) 369‐1969 [email protected] www.bitterrootappraisal.com File #: 060616 Purchase Order #: FL‐16‐60‐09 Bitterroot Appraisal, LLC © 2016 2 910 W Main Street, Hamilton MT 59840 Bitterroot Appraisal, LLC PO Box 423 www.bitterrootappraisal.com Tel (406) 369‐1969 Hamilton MT 59840 [email protected] 8/10/2016 State of Montana Dept. of Military Affairs 1956 Mt Majo Street PO Box 4789 Fort Harrison, MT 59636‐4789 Re: Hamilton Reserve Center. Dear Debra L. Lafountaine: Accompanying this letter of transmittal is an appraisal report containing 92 pages plus 49 page addenda which has been prepared for an Armory property dan related excess land located at 910 W Main St, Hamilton MT 59840. The subject is a 5.93‐acre parcel1 with RS zoning within the city limits of the City of Hamilton. The client signed order/letter of engagement was received 06/13/2016, with an estimated 60 day turn time from date received; the actual delivery schedule is compliant with that estimated. -

Highest and Best Use Analysis

BASS FLETCHER & ASSOCIATES, INC. CONSULTING APPRAISERS ! PLANNERS ! ECONOMISTS Stephen A. Garcia Richard W. Bass, MAI State-Certified Commercial Real Estate Appraiser RZ5620 State-Certified General Real Estate Appraiser RZ348 [email protected] [email protected] Susan M. Fletcher State-Certified General Real Estate Appraiser RZ3223 Robert J. Fletcher, MAI/AICP/CCIM [email protected] State-Certified General Real Estate Appraiser RZ2463 [email protected] Tracy T. Shinkarow State-Certified Residential Real Estate Appraiser RD7632 [email protected] HIGHEST AND BEST USE ANALYSIS COCOA REDEVELOPMENT SITE 915 FLORIDA AVENUE COCOA, FL 32922 FOR MR. JOHN TITKANICH, CITY MANAGER CITY OF COCOA 65 STONE STREET COCOA, FL 32922 DATE OF REPORT NOVEMBER 1, 2017 FILE # 17-271 1953 Eighth Street - Sarasota, Florida 34236-4226 - (941) 954-7553 - Fax (941) 952-9440 www.BassFletcherAssociatesInc.com BASS FLETCHER & ASSOCIATES, INC. CONSULTING APPRAISERS ! PLANNERS ! ECONOMISTS Stephen A. Garcia Richard W. Bass, MAI State-Certified Commercial Real Estate Appraiser RZ5620 State-Certified General Real Estate Appraiser RZ348 [email protected] [email protected] Susan M. Fletcher State-Certified General Real Estate Appraiser RZ3223 Robert J. Fletcher, MAI/AICP/CCIM [email protected] State-Certified General Real Estate Appraiser RZ2463 [email protected] Tracy T. Shinkarow State-Certified Residential Real Estate Appraiser RD7632 [email protected] November 1, 2017 Mr. John Titkanich, City Manager City of Cocoa 65 Stone Street Cocoa, FL 32922 RE: An Analysis Report Cocoa Redevelopment Property 915 Florida Avenue Cocoa, FL 32922 Dear Mr. Titkanich: As requested, we have conducted an investigation of the subject property. Through this process we have gathered necessary data, and made certain analyses in order to develop an opinion of the highest and best use for this property. -

C Y CL£ K E AFTER EXECUTION of ALL DOCUMENTS, PLEASE

C y CL£ K E 2019 A G 13 "11:o? CITY OF EL PASO, TEXAS AGENDA ITEM DEPARTMENT HEAD'S SUMMARY FORM DEPARTMENT: El Paso Water Utilities Public - Service Board (EPWater) AGENDA DATE: Introduction - £\()<es ~Q , 2019 Public Hearing - Se\':\; 3 , 2019 CONTACT PERSON/PHONE: James Wolff, 594-5511 DISTRICT(S) AFFECTED: 8 SUBJECT: APPROVE the following Ordinance Authorizing the City Manager to sign a Contract of Sale with the Housing Authority of the City of El Paso for the sale of 6.325 acres of land more or less, being described as Lot 3, Block I , Coronado Del Sol, an Addition to the City of El Paso, El Paso County, Texas. (District: 8) EPWater, James Wolff, (915) 594-551 1. BACKGROUND / DISCUSSION: This parcel of land, is owned by the City of El Paso and managed by the El Paso Water Utilities - Public Service Board (EPWU/PSB). On August 9, 2017, the Public Service Board declared the property inexpedient to the system and authorized the President/CEO of El Paso Water to forward the recommendation to the El Paso City Council for approval at the price per square foot reflected in the April 2017 appraisal obtained by the El Paso Independent School District. The property appraised by Genevieve Pendergras for $130,680 per acre. PRIOR COUNCIL ACTION: Has the Council previously considered this item or a closely related one? No. City Council has not previously considered a related sale between the Housing Authority of the City of El Paso and EPWater. AMOUNT AND SOURCE OF FUNDING: N\A BOARD / COMMISSION ACTION: On August 9, 2017, the El Paso Water Utilities - Public Service Board declared the property inexpedient to the system and authorized the President/CEO to sell the property.