BRAND WATCH LUXURY SEGMENT TOPLINE REPORT 2Nd Quarter 2021

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Penndot Fact Sheet

FACT SHEET Van/Mini-Van Titling and Registration Procedures PURPOSE This fact sheet explains the titling and registration procedures for van and mini-van type vehicles being titled and registered in Pennsylvania. DEFINITIONS Motor home: A motor vehicle designed or adapted for use as mobile dwelling or office; except a motor vehicle equipped with a truck-camper. Passenger Car: A motor vehicle, except a motorcycle, designed primarily for the transportation of persons and designed for carrying no more than 15 passengers including the driver and primarily used for the transportation of persons. The term includes motor vehicles which are designed with seats that may be readily removed and reinstalled, but does not include such vehicles if used primarily for the transportation of property. Truck: A motor vehicle designed primarily for the transportation of property. The term includes motor vehicles designed with seats that may be readily removed and reinstalled if those vehicles are primarily used for the transportation of property. GENERAL RULE Van and mini-van type vehicles are designed by vehicle manufacturers to be used in a multitude of different ways. Many vans are designed with seats for the transportation of persons much like a normal passenger car or station wagon; however, some are manufactured for use as a motor home, while others are designed simply for the transportation of property. Therefore, the proper type of registration plate depends on how the vehicle is to be primarily used. The following rules should help clarify the proper procedures required to title and register a van/mini-van: To register as a passenger car - The van/mini-van must be designed with seating for no more than 15 passengers including the driver, and used for non-commercial purposes. -

2012 BMW X5 Xdrive35i Premium Sport Utility 4D | Texas Brand Auto

texasbrandauto.com Texas Brand Auto 972-800-0224 11333 Emerald St Dallas, TX 75229 2012 BMW X5 xDrive35i Premium Sport Utility 4D View this car on our website at texasbrandauto.com/6957117/ebrochure Our Price $16,999 Specifications: Year: 2012 VIN: 5UXZV4C54CL758352 Make: BMW Stock: 758352 Model/Trim: X5 xDrive35i Premium Sport Utility 4D Condition: Pre-Owned Exterior: Black Interior: Black Mileage: 126,349 Drivetrain: All Wheel Drive PRICED TO SELL!!!!! GIVE US A CALL TODAY! 2012 BMW X5 xDrive blacked out!!! Pricing that will fit everyone’s BUDGET!! We work with all credit scores and down payments! Find the vehicle that fits your financial and utility needs. We are a growing car dealership that prides itself on great customer service and reviews, building great experiences for our customers. Our experienced sales staff is ready to help you find the perfect car for you and your family. Located in Plano, our customers have come from all over DFW metroplex including Dallas, Fort Worth, Arlington, Plano, Garland, Irving, Frisco, McKinney, Grand Prairie, Denton, Mesquite, Carrollton, Richardson, Lewisville, Allen, Euless, Coppell, Desoto, Duncanville, Grapevine, Lancaster, Little Elm, Sachse, Red Oak, North Richland Hills, The Colony, and out of state in Louisiana, Oklahoma, Arkansas, and more! Auto check reports are available on all cars on our website! 2012 BMW X5 xDrive35i Premium Sport Utility 4D Texas Brand Auto - 972-800-0224 - View this car on our website at texasbrandauto.com/6957117/ebrochure Our Location : 2012 BMW X5 xDrive35i Premium Sport Utility 4D Texas Brand Auto - 972-800-0224 - View this car on our website at texasbrandauto.com/6957117/ebrochure Installed Options Texas Brand Auto texasbrandauto.com 972-800-0224 11333 Emerald St Dallas, TX 75229 © 2021 AutoRevo - All rights reserved. -

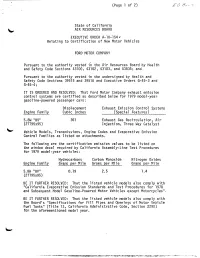

Page 1 Of.Tif

(Page 1 of 2) EO BEST State of California AIR RESOURCES BOARD EXECUTIVE ORDER A-10-154 . Relating to Certification of New Motor Vehicles FORD MOTOR COMPANY Pursuant to the authority vested in the Air Resources Board by Health and Safety Code Sections 43100, 43102, 43103, and 43835; and Pursuant to the authority vested in the undersigned by Health and Safety Code Sections 39515 and 39516 and Executive Orders G-45-3 and G-45-4; IT IS ORDERED AND RESOLVED: That Ford Motor Company exhaust emission control systems are certified as described below for 1979 model-year gasoline-powered passenger cars : Displacement Exhaust Emission Control Systems Engine Family Cubic Inches (Special Features 5. 8W "BV" 351 Exhaust Gas Recirculation, Air (2TT95x95) Injection, Three Way Catalyst Vehicle Models, Transmissions, Engine Codes and Evaporative Emission Control Families as listed on attachments. The following are the certification emission values to be listed on the window decal required by California Assembly-Line Test Procedures for 1979 model-year vehicles : Hydrocarbons Carbon Monoxide Nitrogen Oxides Engine Family Grams per Mile Grams per Mile Grams per Mile 5. 8W "BV" 0. 19 2.5 1.4 (2TT95x95) BE IT FURTHER RESOLVED: That the listed vehicle models also comply with "California Evaporative Emission Standards and Test Procedures for 1978 and Subsequent Model Gasoline-Powered Motor Vehicles except Motorcycles". BE IT FURTHER RESOLVED: That the listed vehicle models also comply with the Board's "Specifications for Fill Pipes and Openings of Motor Vehicle Fuel Tanks" (Title 13, California Administrative Code, Section 2290) for the aforementioned model year. -

The All-New BMW 3 Series Brochure

Sheer Driving Pleasure THE 3 08 2019 BMW India Pvt. Ltd. Printed in India 2019. Printed India Pvt. Ltd. 08 2019 BMW For more information, call 1800 102 2269. The models, equipment and possible vehicle configurations illustrated in this brochure may differ from vehicles supplied in the Indian market. For precise Sheer information, please contact your local Authorised BMW Dealer. Subject to change in design and equipment. © BMW India Pvt. Ltd., Gurugram, India. BMW 3 Series. BMW EFFICIENTDYNAMICS. Driving Pleasure Not to be reproduced wholly or in part without written permission of BMW India Pvt. Ltd., Gurugram, India. LESS EMISSIONS. MORE DRIVING PLEASURE. Job No. 2607 / BMW 3 Series (G20) Brochure (EN) / Size: 20W X 30H cm / Date 06-08-19 BMW Type Global Pro Light | Regular | Bold | Wingdings 3 (TT) Regular THE ALL-NEW BMW 3 SERIES. INNOVATION AND TECHNOLOGY. 17 Dynamics and Efficiency 19 Driver Assistance and Connectivity 20 Comfort and Functionality 18 Powertrain and Suspension EQUIPMENT. 21 Models and Lines 27 Equipment Highlights 34 Original BMW Accessories DISCOVER MORE. Scan the code to get more information, more driving pleasure on the all-new BMW 3 Series. 39 Exterior colours 40 Interior colours 41 Technical data Job No. 2607 / BMW 3 Series (G20) Brochure (EN) / Size: 20W X 30H cm / Date 06-08-19 BMW Type Global Pro Light | Regular | Bold | Wingdings 3 (TT) Regular THRILL SEEKER, TECH B U F F. P A C K E D INTO ONE. Job No. 2607 / BMW 3 Series (G20) Brochure (EN) / Size: 20W X 30H cm / Date 06-08-19 BMW Type Global Pro Light | Regular | Bold | Wingdings 3 (TT) Regular THE ONLY THING THAT KEEPS PACE IS YOUR EXCITEMENT. -

University of Southampton Research Repository

University of Southampton Research Repository Copyright © and Moral Rights for this thesis and, where applicable, any accompanying data are retained by the author and/or other copyright owners. A copy can be downloaded for personal non-commercial research or study, without prior permission or charge. This thesis and the accompanying data cannot be reproduced or quoted extensively from without first obtaining permission in writing from the copyright holder/s. The content of the thesis and accompanying research data (where applicable) must not be changed in any way or sold commercially in any format or medium without the formal permission of the copyright holder/s. When referring to this thesis and any accompanying data, full bibliographic details must be given, e.g. Thesis: Author (Year of Submission) "Full thesis title", University of Southampton, name of the University Faculty or School or Department, PhD Thesis, pagination. Data: Author (Year) Title. URI [dataset] University of Southampton Faculty of Engineering and Physical Sciences Eng Ed – Central; Transportation Research Group The role of digital media in the electromobility transition by Andrea Farah Alkhalisi Thesis for the degree of PhD Engineering and the Environment August 2020 University of Southampton Abstract Faculty of Engineering and Physical Sciences Eng Ed – Central; Transportation Research Group Thesis for the degree of PhD Engineering and the Environment The role of digital media in the electromobility transition by Andrea Farah Alkhalisi Road transport is a major contributor to air pollution in the UK (DEFRA, 2019) with serious effects on public health (DEFRA and DfT, 2017), and a significant source of greenhouse gas emissions (DECC, 2016). -

Efficient Dynamics

A subsidiary of BMW AG BMW U.S. Press Information For Release: October 24, 2013 – 6:00pm EDT/3:00pm PDT Contact: Matthew Russell Product and Technology Communications Manager 201-307-3783 / [email protected] David J. Buchko Product and Technology Communications 201-307-3709 / [email protected] Julian Arguelles Product and Technology Communications 201-307-3755 / [email protected] The All-New BMW 2 Series Coupe A new dimension for The Ultimate Driving MachineTM Woodcliff Lake, N.J. – October 24, 2013 – 6:00pm EDT/3:00pm PDT. BMW today announced the introduction of an entirely new model series with the introduction of the all-new BMW 2 Series Coupe. This new take on The Ultimate Driving MachineTM will arrive in the US in the first quarter of 2014 as the 228i and the M235i. The BMW M235i, the first M Performance Automobile offered in the US, includes an impressive list of performance enhancing features. This successor to the successful 1 Series Coupe will continue the decades-long tradition of premium sub-compact coupes with impeccable driving dynamics when it makes its world debut at the North American International Auto Show in January 2014. The 2014 BMW 2 Series Coupe will be offered at a Manufacturer’s Suggested Retail Price of $33,025 for the 228i and $44,025 for the M235i, including $925 destination and handling. The BMW 2 Series Coupe • BMW celebrates the premiere of another new model series – The BMW 2 Series Coupe which raises the bar in the premium sub-compact segment in terms of dynamic ability, aesthetic appeal and emotional allure; a distinctive vehicle concept unique in its segment, with a two-door body in classic three-box design typical of BMW Coupes, four seats, rear-wheel drive and a pair of engines and chassis set-up focused squarely on sporting ability; market launch from March 2014, line-up to include a BMW M Performance Automobile – the BMW M235i Coupe. -

BMW Price List

Recommended Retail Price List – January 2021 Fuel Consumption Electrical Energy VES (band) Retail Price (l/100km) (kWh/100km) BMW 1 Series 116i Sport B 5.5 $146,888 116i Luxury B 5.5 $151,888 BMW 2 Series 216i Active Tourer Sport B 6.3 $157,888 216i Gran Tourer Sport B 6.5 $163,888 216i Gran Tourer Luxury B 6.5 $170,888 218i Gran Coupe Luxury B 5.5 $171,888 218i Gran Coupe M Sport B 5.5 $174,888 BMW 3 Series 318i Sedan Sport B 5.8 $208,888 320i Sedan Luxury - - P.O.A. 320i Sedan M Sport - - P.O.A. 330e Sedan Luxury A2 2.2 15.4 $261,888 BMW 4 Series 420i Coupe M Sport B 5.8 $228,888 430i Coupe M Sport Pro B 6.2 $276,888 BMW 5 Series 520i Sedan C1 5.5 $259,888 520i Sedan Luxury C1 5.5 $277,888 520i Sedan M Sport C1 5.5 $287,888 530i Sedan M Sport B 5.6 $299,888 530i Sedan M Sport Edition B 5.6 $308,888 530e Sedan B 1.9 15.3 $278,888 Booking Fees (Non-refundable and inclusive of $10,000 COE deposit): A1. BMW 1 Series / BMW 2 Series / BMW 3 Series / BMW X1/ BMW X2 / BMW i3 $20,000 A2. BMW 4 Series / BMW 5 Series / BMW 6 Series / BMW 7 Series / BMW 8 Series / BMW X3 / BMW X4 / BMW X5 / BMW X6 / BMW $28,000 X7 / BMW Z4 B1. Special Indent cars – BMW 1 Series / BMW 2 Series / BMW 3 Series / BMW 4 Series / BMW 5 Series $30,000 BMW X1 / BMW X2 / BMW X3 / BMW X4 / BMW i3 / BMW Z4 B2. -

New BMW 2 Series Convertible.Pdf

A subsidiary of BMW AG BMW U.S. Press Information For Release: September 9, 2014 6:00pm EDT/3:00pm PDT Contact: Matthew Russell Product & Technology Communications Manager 201-307-3783 / [email protected] David J. Buchko Product & Technology Communications Spokesperson 201-307-3709 / [email protected] Julian Arguelles Product & Technology Communications Spokesperson 201-307-3755 / [email protected] The New BMW 2 Series Convertible Style and dynamics of the acclaimed BMW 2 Series Coupe combined with open-air driving Available in the US as 228i and M235i All-wheel drive 228i xDrive available from launch Woodcliff Lake, NJ – September 9, 2014 6:00pm EDT/3:00pm PDT. Few new cars have been more anticipated than the BMW 2 Series Coupe when it arrived in early 2014. Hot on the heels of the widely acclaimed BMW 228i and M235i Coupe, BMW announces the new BMW 2 Series Convertible. Available in the US as the 228i and M235i, the 2 Series Convertible blends the style and dynamic driving character for which the 2 Series Coupe is already renowned with the open-air pleasure of a folding soft-top. The BMW 2 Series Convertible will make its world debut at the Paris Motor Show. The 2015 M235i and 228i as well as the 228i xDrive, featuring BMW’s intelligent all-wheel drive system, will arrive in US showrooms in early 2015. The 2015 BMW 2 Series Convertible will be offered at a Manufacturer’s Suggested Retail Price of $38,850 for the 228i, $40,650 for the 228i xDrive, $48,650 for the M235i, including $950 destination and handling. -

The Bmw 5 Series Touring

The BMW 5 Series Touring www.bmw.co.uk The Ultimate www.bmw.ie Driving Machine THE BMW 5 SERIES TOURING. BMW EFFICIENTDYNAMICS. LESS EMISSIONS. MORE DRIVING PLEASURE. THE ONLY LIMITS ARE SET BY YOU. Editorial PRECISION IN EVERY DETAIL. PRESENCE IN EVERY LINE. A love of detail was essential when creating the progressive and stylish form of the BMW 5 Series Touring. Every design element, every line and every surface – from the front to the rear – is an expression of passion. The result is a distinctive, charismatic presence that radiates commanding character from every angle. But the BMW 5 Series Touring showcases many other unique qualities to complement the dynamic design. There is the elegant and functional interior with its innovative and endlessly practical solutions plus a wide variety of intelligent services from BMW ConnectedDrive, ensuring the perfect connection between driver, vehicle and the outside world. Another kind of perfection can be found in the combination of dynamics with efficiency. The four-cylinder in-line diesel engine with BMW The BMW 5 Series Touring Technology Equipment Overview TwinPower Turbo technology in the BMW 520d, for instance, demonstrates this extremely well. Power is impressive and harmonious while, at the same time, fuel consumption and emissions values remain PROGRESS AT INNOVATION AS INDIVIDUAL THE ENTIRE RANGE convincingly low. ITS HIGHEST LEVEL. IN MOTION. AS YOUR IMAGINATION. AT A GLANCE. These characteristics, along with a wealth of other typical BMW qualities, mean that the BMW 5 Series Touring is now better than 06 Exterior 18 BMW ConnectedDrive 30 The BMW 5 Series SE Touring 56 BMW Service and it ever has been. -

BMW Group Plant Munich

BMW PLANT MUNICH. FLEXIBILITY. INNOVATION. PASSION. The BMW Group’s parent plant. Production in the heart of a metropolitan city. Plant Munich PREFACE. Dear Reader, the heart of BMW beats in Munich. different technologies, ranging from years. Key projects include the expan- Here, right by the Olympic Park, are the press shop to the body shop and sion of the body shop and assembly as our parent plant as well as BMW Welt, the paint shop and on to assembly and well as a new, resource-friendly paint the BMW Museum and our landmark engine production. shop. BMW Headquarters. The beginnings of our plant date back to the year 1913. The complexity we are facing will But our greatest asset are the approx. So it is truly the starting point for what only grow further with the increasing 8,000 people who work at the plant. has since become the BMW Group’s electrification of our vehicle offering. It is their expertise and experience, global production network with 30 Already today, we produce cars with creativity and passion that allow us to sites in 14 countries. conventional petrol or diesel engines create the perfect car and inspire our on a single line together with plug- customers – a thousand times a day. The plant’s unique location in the in hybrids. In the near future, the center of a big city poses challenges all-electric BMW i4 will complement I hope you enjoy discovering for us on a daily basis. The confined our model range. In other words, our BMW Group Plant Munich. -

BMW U.S. Media Information Technical Data 2018 BMW X5

BMW U.S. Media Information Technical Data 2018 BMW X5 Sports Activity Vehicle X5 sDrive35i X5 xDrive35i X5 xDrive50i X5 xDrive35d X5 xDrive40e Transmission type automatic automatic automatic automatic automatic Body Seats -- 5 5 5 5 5 Number of Doors -- 5 5 5 5 5 drive type -- RWD AWD AWD AWD AWD Veh. length inch 193.2 193.2 193.2 193.2 193.2 Veh. width inch 76.3 76.3 76.3 76.3 76.3 Width incl mirrors inch 86 86 86 86 86 Veh. height inch 69.4 69.4 69.4 69.4 69.4 Wheelbase inch 115.5 115.5 115.5 115.5 115.5 Overhang front inch 35.9 35.9 35.9 35.9 35.9 Rear overhang inch 41.9 41.9 41.9 41.9 41.9 Ground clearance inch 8.2 8.2 8.2 8.2 8.2 Turning circle ft 41.7 41.7 41.7 41.7 41.7 Legroom front inch 40.4 40.4 40.4 40.4 40.4 Legroom 2nd row inch 36.6 36.6 36.6 36.6 36.6 Shoulder room front inch 60.5 60.5 60.5 60.5 60.5 Shoulder room rear inch 58.3 58.3 58.3 58.3 58.3 Headroom front inch 40.5 40.5 40.5 40.5 40.5 Maximum headroom 2nd row inch 38.8 38.8 38.8 38.8 38.8 Headroom front with moonroof inch 39.8 39.8 39.8 39.8 39.8 Maximum headroom 2nd row with moonroof inch 38.3 38.3 38.3 38.3 38.3 Front Seat Volume ft³ 57.3 57.3 57.3 57.3 57.3 Rear Seat Volume ft³ 47.9 47.9 47.9 47.9 47.9 Approach angle front ° 22.2 22.2 22.2 22.2 22.2 Departure angle rear ° 20.4 20.4 20.4 20.4 20.4 Ramp angle ° 17.3 17.3 17.3 17.3 17.3 Axle clearance front inch 7.2 7.2 7.2 7.2 7.2 Axle clearance rear inch 7.6 7.6 7.6 7.6 7.6 fording depth (without auxiliary heating) inch 19.7 19.7 19.7 19.7 19.7 climbing ability % 50 50 50 50 50 climbing ability starting % 32 32 32 32 32 Press Trunk volume (SAE) ft³ 35.8-76.7 35.8-76.7 35.8-76.7 35.8-76.7 34.2-72.5 US Tank capacity - series gal 22.4 22.4 22.4 22.4 22.4 Weight distribution front / rear (empty car) % 47.9 / 52.1 49.1 / 50.9 50 / 50 50.4 / 49.6 45.8 / 54.2 US Curb weight lbs 4625 4735 5095 4875 5220 Engine Engine type -- N55B30M0 N55B30M0 N63B44O1 N57D30O1 N20B20O0 Cylinders -- 6 6 8 6 4 Valves p.cyl. -

The X5 Price List January 2021 the All-New Bmw X5

THE X5 PRICE LIST JANUARY 2021 THE ALL-NEW BMW X5. The moment you lay eyes on the all-new BMW X5, you’ll be struck by its commanding presence – high and handsome, powerful and elegant. The one-piece double kidney grille hints at what will happen when it takes a deep breath, and the honed X design of the headlights leaves no doubt as to who will take the lead. Equipped with the latest technologies for more safety and maximum driving dynamics on every surface, the all-new BMW X5 says you’ve arrived, even before you get there. The BMW X5. Know you can. BMW EFFICIENT DYNAMICS EfficientDynamics is BMW’s award-winning programme of technologies designed to reduce CO2 emissions and improve fuel economy, without comprising on performance or driving dynamics. These technologies are standard on every new BMW and could lower your fuel and tax costs, as well as well as offering additional benefits for those on company car plans. You can find out more about the benefits of BMW EfficientDynamics, as well as compare your own vehicle against the BMW X5 by clicking here. Auto Start/Stop Brake Energy ECO PRO function Regeneration Mode Optimum BMW Shift EfficientLightWeight Indicator Personalise and buy your perfect BMW online. Find out more at buy.bmw.co.za HIGHLIGHTS. EXTERIOR INTERIOR New design language exudes robust assurance and authority. Optimised power distribution thanks to BMW xDrive and an Clear design and exclusive ambience. New BMW Live Cockpit Professional display and control system electronically controlled differential lock at the rear axle.