Final Version Wework Article HBS Header 91Efe3b9-Fc0b-408B-B29e

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Proxy Vote Record

Company Name Ticker Country Meeting DateProposal Text Vote Instruction Abcam Plc ABC United Kingdom 04-Dec-20 Accept Financial Statements and Statutory Reports For Abcam Plc ABC United Kingdom 04-Dec-20 Approve Remuneration Report For Abcam Plc ABC United Kingdom 04-Dec-20 Reappoint PricewaterhouseCoopers LLP as Auditors For Abcam Plc ABC United Kingdom 04-Dec-20 Authorise the Audit and Risk Committee to Fix Remuneration of Auditors For Abcam Plc ABC United Kingdom 04-Dec-20 Re-elect Peter Allen as Director For Abcam Plc ABC United Kingdom 04-Dec-20 Re-elect Alan Hirzel as Director For Abcam Plc ABC United Kingdom 04-Dec-20 Elect Michael Baldock as Director For Abcam Plc ABC United Kingdom 04-Dec-20 Re-elect Louise Patten as Director For Abcam Plc ABC United Kingdom 04-Dec-20 Re-elect Mara Aspinall as Director For Abcam Plc ABC United Kingdom 04-Dec-20 Re-elect Giles Kerr as Director For Abcam Plc ABC United Kingdom 04-Dec-20 Authorise Issue of Equity For Abcam Plc ABC United Kingdom 04-Dec-20 Authorise Issue of Equity without Pre-emptive Rights For Abcam Plc ABC United Kingdom 04-Dec-20 Authorise Issue of Equity without Pre-emptive Rights in Connection with an Acquisition or Other Capital Investment For Abcam Plc ABC United Kingdom 04-Dec-20 Authorise Market Purchase of Ordinary Shares For Abcam Plc ABC United Kingdom 04-Dec-20 Accept Financial Statements and Statutory Reports For Abcam Plc ABC United Kingdom 04-Dec-20 Approve Remuneration Report For Abcam Plc ABC United Kingdom 04-Dec-20 Reappoint PricewaterhouseCoopers LLP as Auditors -

COVID-19 Proxy Governance Update

COVID-19 Proxy Governance Update 2020 AGM mid-season review FROM EQUINITI 01 Looking back and planning ahead It is incredible to note that it has been over 12 weeks since the official announcement on 23 March of the UK Government’s Stay at Home Measures, and nearly seven months since the severity of the pandemic became apparent in China. Over the said period, PLC boards, company secretaries and investor relations officers have kept their corporate calendars going thanks to rapid adoption of modified regulatory guidelines and inventive modes of engagement with investors. With annual general meetings being an obvious highlight in the corporate calendar, we take stock of the progress made so far over the 2020 AGM season, as well as using what we learned to plan ahead. Now that we are over the first ‘hump’ with the busy period of May AGMs out of the way, we are readying for the second ‘peak’ of June and July AGMs, and then an ‘easing’ until the second ‘mini’ season in the early autumn. As such, in this update, we look at: • 2020 AGM season statistics…so far • Proxy adviser engagement and ISS recommendations review • High-level assumptions for Q3 and Q4 • Relevant updates from the regulators, industry bodies and proxy advisers • Communications in the COVID-19 world – special commentary by leading financial PR firm,Camarco • How has COVID-19 impacted activism – special commentary by international law firm,White & Case 02 2020 AGM Season Statistics…so far Scope of data To assess progress and forecast what is to come, we look at the key statistics for the UK AGM season 2020 thus far. -

Parker Review

Ethnic Diversity Enriching Business Leadership An update report from The Parker Review Sir John Parker The Parker Review Committee 5 February 2020 Principal Sponsor Members of the Steering Committee Chair: Sir John Parker GBE, FREng Co-Chair: David Tyler Contents Members: Dr Doyin Atewologun Sanjay Bhandari Helen Mahy CBE Foreword by Sir John Parker 2 Sir Kenneth Olisa OBE Foreword by the Secretary of State 6 Trevor Phillips OBE Message from EY 8 Tom Shropshire Vision and Mission Statement 10 Yvonne Thompson CBE Professor Susan Vinnicombe CBE Current Profile of FTSE 350 Boards 14 Matthew Percival FRC/Cranfield Research on Ethnic Diversity Reporting 36 Arun Batra OBE Parker Review Recommendations 58 Bilal Raja Kirstie Wright Company Success Stories 62 Closing Word from Sir Jon Thompson 65 Observers Biographies 66 Sanu de Lima, Itiola Durojaiye, Katie Leinweber Appendix — The Directors’ Resource Toolkit 72 Department for Business, Energy & Industrial Strategy Thanks to our contributors during the year and to this report Oliver Cover Alex Diggins Neil Golborne Orla Pettigrew Sonam Patel Zaheer Ahmad MBE Rachel Sadka Simon Feeke Key advisors and contributors to this report: Simon Manterfield Dr Manjari Prashar Dr Fatima Tresh Latika Shah ® At the heart of our success lies the performance 2. Recognising the changes and growing talent of our many great companies, many of them listed pool of ethnically diverse candidates in our in the FTSE 100 and FTSE 250. There is no doubt home and overseas markets which will influence that one reason we have been able to punch recruitment patterns for years to come above our weight as a medium-sized country is the talent and inventiveness of our business leaders Whilst we have made great strides in bringing and our skilled people. -

Softbank Bailout Would Give It Control of Wework: Sources 14 October 2019

SoftBank bailout would give it control of WeWork: sources 14 October 2019 address short-term financing needs, according to the sources. The company has asked JPMorgan Chase to organize a debt financing round to raise up to $5 billion from other investors, said the sources, confirming details reported earlier by the Wall Street Journal. "WeWork has retained a major Wall Street financial institution to arrange a financing," a WeWork spokeswoman said. "Approximately 60 financing sources have signed confidentiality agreements and are meeting with the Under a possible plan, SoftBank would provide needed company's management and its bankers over the funding for WeWork in exchange for control of the course of this past week and this coming week." company, sources told AFP A person familiar with the matter said the two options are not in competition, but that supporters of the company are mulling over the best option. Japan's SoftBank Group has prepared a financing SoftBank could also participate in the round plan that would give it control of WeWork as the organized by JPMorgan. office sharing startup seeks badly- needed financing, sources told AFP Monday. SoftBank, which already holds about 29 percent of the We Company, could also purchase shares not The plan would give SoftBank, which is controled held by Neumann, which would value the We by billionaire Masayoshi Son, more than 50 Company overall at around $10 billion, the sources percent of WeWork and further limit the influence said, well below the $47 billion a few months ago. of former chief executive and co-founder Adam Neumann, said sources who spoke on the WeWork needs to raise at least $3 billion to cover condition of anonymity. -

Worry Over Mistreating Clots Drove Push to Pause J&J Shot

P2JW109000-6-A00100-17FFFF5178F ****** MONDAY,APRIL 19,2021~VOL. CCLXXVII NO.90 WSJ.com HHHH $4.00 Last week: DJIA 34200.67 À 400.07 1.2% NASDAQ 14052.34 À 1.1% STOXX 600 442.49 À 1.2% 10-YR. TREASURY À 27/32 , yield 1.571% OIL $63.13 À $3.81 EURO $1.1982 YEN 108.81 Bull Run What’s News In Stocks Widens, Business&Finance Signaling More stocks have been propelling the U.S. market higher lately,asignal that fur- Strength ther gains could be ahead, but howsmooth the climb might be remains up fordebate. A1 Technical indicators WeWork’s plan to list suggestmoregains, stock by merging with a but some question how blank-check company has echoes of its approach in smooth theywill be 2019,when the shared-office provider’s IPO imploded. A1 BY CAITLIN MCCABE Citigroup plans to scale up its services to wealthy GES Agreater number of stocks entrepreneurs and their IMA have been propelling the U.S. businesses in Asia as the market higher lately,asignal bank refocuses its opera- GETTY that—if historyisany indica- tions in the region. B1 SE/ tor—moregains could be ahead. What remains up forde- A Maryland hotel mag- bate, however, is how smooth natebehind an 11th-hour bid ANCE-PRES FR the climb will be. to acquireTribune Publish- Indicatorsthat point to a ing is working to find new ENCE stronger and moreresilient financing and partnership AG stock market have been hitting options after his partner ON/ LL rare milestones recently as the withdrew from the deal. -

Why Did “We” Not Work?

LANGEVOORT.PRINTER.UPDATED (DO NOT DELETE) 7/18/2021 5:50 PM Corporate Adolescence: Why Did “We” Not Work? * Donald C. Langevoort and Hillary A. Sale In academic and public commentary, entrepreneurial finance is usually portrayed as a quintessential American success story, an institutional structure whereby expert venture capitalists with strong reputational incentives channel much-needed equity to deserving entrepreneurs, then subject them to intense monitoring to assure they stay on the path to hoped- for success in the form of an initial public offering or public company acquisition.1 Thus, it is jarring that in recent years there have been so many troubles, from gross embarrassments to allegations of outright criminality, at companies like Uber, Theranos, and our subject here, WeWork. These dramas are often portrayed in terms of the predictable sins of youthfulness: reckless, disruptive, risk-taking behaviors that come from the volatile interaction of a charismatic young leader and a cult(ure) of STEM-smart followers who buy into the dream.2 * The authors thank Craig Lewis, Sharon Nellis, and Elizabeth Pollman for their helpful comments and Olivia Brown, Samantha Glazer, Hollie Chenault, Claire Creighton, Jing Xu, and Michael Marcus for their research, insights, and good humor. 1. E.g., Bernard S. Black & Ronald J. Gilson, Venture Capital and the Structure of Capital Markets, 47 J. FIN. ECON. 243 (1998). 2. See generally JOHN CARREYROU, BAD BLOOD: SECRETS AND LIES IN A SILICON VALLEY STARTUP (2018) (discussing the Theranos scandal -

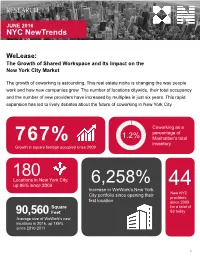

NYC Newtrends: Coworking

Research JUNE 2016 NYC NewTrends WeLease: The Growth of Shared Workspace and Its Impact on the New York City Market The growth of coworking is astounding. This real estate niche is changing the way people work and how new companies grow. The number of locations citywide, their total occupancy and the number of new providers have increased by multiples in just six years. This rapid expansion has led to lively debates about the future of coworking in New York City. Coworking as a 1.2% percentage of 767% Manhattan’s total inventory Growth in square footage occupied since 2009 180 Locations in New York City, 6,258% up 86% since 2009 44 Increase in WeWork’s New York City portfolio since opening their New NYC providers first location since 2009 Square for a total of 90,560 Feet 53 today Average size of WeWork’s new locations in 2016, up 186% since 2010-2011 1 Research JUNE 2016 NYC NewTrends The Boom Years of Coworking and Shared Workspace Market Share of Providers Demand for coworking space has been fueled by citywide growth of freelance workers and small businesses—firms with fewer than 20 employees. According to data from the U.S. Census Bureau, employment in this segment of the labor market has grown by Other (44 Virgo providers) 70,999 jobs since 2010, far outpacing the prior market cycle (2002 Business 18% Centers to 2008), when this segment grew by just 12,255 jobs. 2% The Yard In 2009, there were an estimated 25 coworking locations totaling 2% WeWork 698,501 square feet. -

Morningstar Report

Report as of 29 Sep 2021 Artemis Alpha Trust PLC , (GB0004355946) Morningstar Rating™ Peer Group Classification Last Close Last Actual NAV (27 Sep 2021) Discount Estimated Nav Not Rated Morningstar IT UK All 434.00 458.46 -5.34 458.46 Companies Investment Objective Performance To provide long-term capital and income growth by 232 investing predominantly in listed companies and to 199 achieve a NAV total return greater than the total 166 return of the FTSE All-Share Index. 133 100 67 2016 2017 2018 2019 2020 2021-08 1.68 24.30 -11.80 35.31 16.41 12.56 Fund Management Fee Summary A management fee is calculated by 0.75% p.a. of market capitalisation is less than or equal to GBP 250m; plus 0.70% p.a. that is more than GBP 250m but less than or equal to GBP 500m; plus 0.65% p.a. that is more than GBP 500m. No performance fee will be charged. Portfolio 30/04/2021 Asset Allocation % Long Short Net Equity Style Box™ Mkt Cap % Fund America Europe Asia Large Size Stocks 102.84 0.00 102.84 Giant 19.86 Bonds 0.00 0.00 0.00 Mid Large 25.53 Cash 2.88 13.24 -10.37 Medium 32.07 Other 7.53 0.00 7.53 Small Small 8.17 Value Blend Growth Micro 14.37 Style Average Mkt Fund Cap (Mil) Ave Mkt Cap GBP 6,753.1 <25 25-50 50-75 >75 2 Top Holdings Stock Sector Weightings % Fund World Regions % Fund Name Sector % hCyclical 64.09 Americas 1.27 Dignity PLC t 8.59 rBasic Materials - United States 1.27 easyJet PLC p 7.99 tConsumer Cyclical 48.98 Canada 0.00 Frasers Group PLC t 7.19 yFinancial Services 15.11 Latin America 0.00 Delivery Hero SE 6.56 Real Estate - t u Greater -

In the Court of Chancery of the State of Delaware

EFiled: Apr 07 2020 08:04AM EDT Transaction ID 65559679 Case No. 2020-0258- IN THE COURT OF CHANCERY OF THE STATE OF DELAWARE THE WE COMPANY, ) ) Plaintiff, ) ) v. ) C.A. No. ___________ ) SOFTBANK GROUP CORP. and ) SOFTBANK VISION FUND (AIV M1) ) L.P., a Delaware limited partnership, ) ) Defendants. ) VERIFIED COMPLAINT Plaintiff The We Company (the “Company”), acting by and under the direction of the Special Committee (the “Committee”) of the Company’s Board of Directors (the “Board”), by and through its undersigned counsel, for its complaint against Defendant SoftBank Group Corp. (“SBG”) and SoftBank Vision Fund (AIV M1) L.P. (“Vision Fund” and, with SBG, “SoftBank”), upon knowledge as to itself and information and belief as to all other matters, alleges as follows: NATURE OF THE ACTION 1. On October 22, 2019, SBG, its affiliate Vision Fund, the Company, We Holdings LLC, and the Company’s co-founder and former CEO Adam Neumann entered into a Master Transaction Agreement, as amended on December 27, 2019 (the “MTA”).1 The MTA provided for a series of transactions, including a debt financing arrangement and the accelerated funding of an existing $1.5 billion warrant agreement among SoftBank and the Company. 2. The centerpiece bargained-for benefit to be received by the Company’s minority stockholders in the MTA was a tender offer, through which SoftBank would purchase up to $3 billion worth of the Company’s stock held by the Company’s stockholders (the “Tender Offer”). The Committee viewed the Tender Offer as a critical component of the MTA because it provided much-needed liquidity to the Company’s minority stockholders—many of whom are longtime Company employees who depended upon receiving value for their shares. -

Adam Neumann Co-Founder and CEO Wework ______

The Economic Club of New York ____________________________ Adam Neumann Co-Founder and CEO WeWork ____________________________ June 14, 2017 New York City Interviewer: Thomas W. Farley President and Chief Executive Officer New York Stock Exchange The Economic Club of New York – Adam Neuman – June 14, 2017 Page 1 Introduction Chairman Terry J. Lundgren It’s a pleasure to introduce our next speaker. The last time we were here in this beautiful room at the New York Stock Exchange, we had Brian Chesky, who is the co-founder and CEO of Airbnb, and we had a great dynamic conversation. I think today is going to be very similar, having now spent a few moments with Adam Neumann. Adam is the co-founder and CEO of WeWork which provides work space, community, and services to more than its 100,000 members in more than 40 cities around the world. Along with co-founder, Miguel McKelvey, Adam started WeWork in 2010 just up the street in the Soho neighborhood, creating a work space environment that was intended to create a community believing that people could accomplish more together than perhaps they would on their own, and I think that’s proven to be a highly successful formula for him. Adam has a vision now to expand across the globe with his network of spaces and connect its members through technology and empower them to achieve their dreams and their goals. Previously, Adam was co-founder of Big Tent which developed children’s apparel. But he did something, we were just talking about this at the table, that I don’t know that anybody in this room has ever accomplished. -

Shared Space: Coworking's Rapid Growth Set to Be Tested

Shared Space: Coworking’s Rapid Growth Set to Be Tested Special Report October 2019 Contacts Jeff Adler Peter Kolaczynski Vice President & General Manager, Matrix Manager of Yardi Matrix [email protected] [email protected] (800) 866-1124 x2410 (800) 866-1124 x2403 Chris Nebenzahl Jack Kern Institutional Research Manager Director of Research [email protected] and Publications (800) 866-1124 x2200 [email protected] (800) 866-1124 x2444 Paul Fiorilla Director of Research [email protected] (800) 866-1124 x5764 02 Shared Space: Coworking’s Rapid Growth Set to Be Tested ■ Although headlines about the coworking industry this year have been dominated by the ongoing travails of The We Company (WeWork), the industry is growing rapidly. The top 50 office markets contained a total of 93.2 million square feet of coworking space as of September, or 1.7% of total office space, according to a study of Yardi Matrix’s office database. ■ Two prior Matrix studies (of 20 markets) show the footprint has grown 40% from 2018 and 100% from 2017. Those markets had 57.5 million square feet of coworking leases as of October 2019, up from 40.4 million square feet in the fourth quarter of 2018 and 26.9 million square feet in the fourth quarter of 2017. ■ Coworking has accounted for one-third of office leases in the U.S. over the last 18 months, according to the 2019 Colliers report “U.S. Flexible Workspace and Coworking.” ■ Coworking remains a large-market phenomenon. The top six traditional primary commercial real estate markets—New York; Los Angeles; Washington, D.C.; Chicago; Boston; and San Francisco—account for 44.1 million square feet of coworking leases, or 47% of total space. -

164 New York Business Leaders Urge the Trump Administration to Move Forward with Transition

164 New York Business Leaders Urge the Trump Administration to Move Forward with Transition Open Letter on Presidential Transition America is being ravaged by a deadly pandemic with enormous social and economic consequences. The attention and energy of public and private sector leaders should be entirely focused on uniting our country to fight the coronavirus, provide aid to those in need, prevent further business disruption and loss of jobs, and invest in our economic recovery and revitalization. Every day that an orderly presidential transition process is delayed, our democracy grows weaker in the eyes of our own citizens and the nation’s stature on the global stage is diminished. Our national interest and respect for the integrity of our democratic process requires that the administrator of the federal General Services Administration immediately ascertain that Joseph R. Biden and Kamala D. Harris are the president-elect and vice president- elect so that a proper transition can begin. Withholding resources and vital information from an incoming administration puts the public and economic health and security of America at risk. As business and civic leaders who reflect the political diversity of the country, we urge respect for the democratic process and unified support for our duly elected leadership. There is not a moment to waste in the battle against the pandemic and for the recovery and healing of our nation to begin. Sincerely, Lee S. Ainslie, III, Managing Partner, Maverick Capital Ellen Alemany, Chairman & CEO, CIT Group Inc. Simon Allen, Chief Executive Officer, McGraw-Hill Education, Inc. Jeffrey H. Aronson, Managing Principal, Centerbridge Partners Robert Bakish, President & CEO, ViacomCBS Inc.