The Walt Disney Company

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Research on Marketing Strategy: Case Study of Disneyland

Advances in Economics, Business and Management Research, volume 33 Second International Conference on Economic and Business Management (FEBM 2017) Research on marketing strategy: case study of Disneyland Jia Yao Nanjing University Of Science &Technology, China *Corresponding author: Jia Yao, Master, [email protected] Abstract: In April 8, 2011, Shanghai Disneyland starts construction, Shanghai Disneyland will be the second Disneyland in China, at the same time, China will be the only country which has two Disneyland in the world besides the Unite States. This shows the economic strength of China is rapidly growing. Firstly, this article briefly analyzes the marketing environment and market position of Shanghai Disneyland, and then analyzes the global marketing strategy of Disney. Shanghai Disneyland takes these marketing strategies and appropriate innovation marketing according to the national conditions, which can lead to foresee the great success and unlimited development prospects of Shanghai Disneyland. Key words: disneyland; marketing environment; marketing position; marketing strategy 1. The brief instruction of Disneyland Disneyland opened in 1955, since then, the United States and overseas also have opened 5 Disney theme parks, they are located in 4 countries and regions. In September 12, 2005, Hong Kong Disneyland became the first Disney theme park in China, and the Disney Group has ensured the plan that building another theme park in the Chuansha town of Shanghai at that time. By the end of March 2010, there are six places having -

The Theme Park As "De Sprookjessprokkelaar," the Gatherer and Teller of Stories

University of Central Florida STARS Electronic Theses and Dissertations, 2004-2019 2018 Exploring a Three-Dimensional Narrative Medium: The Theme Park as "De Sprookjessprokkelaar," The Gatherer and Teller of Stories Carissa Baker University of Central Florida, [email protected] Part of the Rhetoric Commons, and the Tourism and Travel Commons Find similar works at: https://stars.library.ucf.edu/etd University of Central Florida Libraries http://library.ucf.edu This Doctoral Dissertation (Open Access) is brought to you for free and open access by STARS. It has been accepted for inclusion in Electronic Theses and Dissertations, 2004-2019 by an authorized administrator of STARS. For more information, please contact [email protected]. STARS Citation Baker, Carissa, "Exploring a Three-Dimensional Narrative Medium: The Theme Park as "De Sprookjessprokkelaar," The Gatherer and Teller of Stories" (2018). Electronic Theses and Dissertations, 2004-2019. 5795. https://stars.library.ucf.edu/etd/5795 EXPLORING A THREE-DIMENSIONAL NARRATIVE MEDIUM: THE THEME PARK AS “DE SPROOKJESSPROKKELAAR,” THE GATHERER AND TELLER OF STORIES by CARISSA ANN BAKER B.A. Chapman University, 2006 M.A. University of Central Florida, 2008 A dissertation submitted in partial fulfillment of the requirements for the degree of Doctor of Philosophy in the College of Arts and Humanities at the University of Central Florida Orlando, FL Spring Term 2018 Major Professor: Rudy McDaniel © 2018 Carissa Ann Baker ii ABSTRACT This dissertation examines the pervasiveness of storytelling in theme parks and establishes the theme park as a distinct narrative medium. It traces the characteristics of theme park storytelling, how it has changed over time, and what makes the medium unique. -

Blue Line Express

Blue Line Express A project report from Dallas Area Rapid Transit || March 2010 Leadership Rowlett takes DART Tour Blue Line Facts Recently, the 2010 Leadership Rowlett class annual, nine-month educational program P at a Glance participated in a special Blue Line tour, devoted to the development of emerging which involved riding DART Rail from community leaders through exposure to 4.5 miles the Downtown Garland Station to DART real life civic and business experiences. Headquarters at Akard Station in downtown The program is open to anyone living Total Project Cost: $275 million Dallas. From there, the class took a bus tour and/or working within the City of Rowlett. Austin Bridge & Road (prime to DART’s Service and Inspection Facility For more information or to request a contractor): $188 million and Rail Control Center. Leadership Rowlett application, contact the Chamber office at (972) 475-3200. 42% participation goal for Chris Masters, DART’s assistant vice Minority/Women-owned Business president of Rail Program Support, gave a Enterprises brief Blue Line Extension project update, Opening to the public in December and Patrick Hamilton, DART’s senior 2012 manager of Operations Control, conducted Blue Line service to Downtown the guided tour. Garland opened in 2002 Sponsored by the Rowlett Chamber of Commerce, Leadership Rowlett is an Construction Radio Disney brings safety measures to Safety Tips Rowlett schools Be aware of your surroundings around The Radio Disney – DART Safety Recently, program organizers hosted three the Blue Line Program, now in its ninth year, promotes Radio Disney programs at Coyle Middle extension project, just as you would safe behaviors near rail construction sites School, Stephens Elementary School and near any construction site. -

Fact Book 2004 Fact Book 2004

Fact Book 2004 Fact Book 2004 Table of Contents Welcome Letter 2 Management Executive Team 4 Board of Directors 4 Operations Media Networks Profile 6 Business 7 Key Dates 8 Fast Facts 10 Data 13 Studio Entertainment Profile 22 Business 22 Key Dates 23 Fast Facts 25 Data 27 Parks and Resorts Profile 34 Business 34 Key Dates 35 Fast Facts 40 Data 42 Consumer Products Profile 48 Business 48 Key Dates 49 Fast Facts 51 History 55 Financials Income Statements 73 Balance Sheets 76 Cash Flows 78 Quarterly Statements 2004 80 Quarterly Statements 2003 82 Financial Ratios 85 Stock Statistics 86 Reconciliations 87 1 Fact Book 2004 Welcome to The Walt Disney Company Fact Book 2004 The Walt Disney Company’s Fact Book 2004 profiles the company’s key business segments and performance, and highlights key events from throughout the company’s 81 year history. The Walt Disney Company strives to be one of the world’s leading producers and providers of quality entertainment and information. Our investment in new content and characters as well as building, nurturing and expanding our existing franchises, gives us an advantage to strengthen and reinforce the affinity that consumers have with our brands and characters across all of our business segments. By growing operating income, improving returns on capital and delivering strong cash flow, the company strives to provide long-term value to Disney’s shareholders. Disney enjoys competitive advantages that underpin all of our successes, both financial and creative. In the long run, we prosper from the inventiveness of our film, television, and other programming; our ability to connect with our audiences; the use of technological advances to enhance our products; the opportunity to delight people around the world with our toys, clothing and other consumer products; and the ability to surprise our Guests with magical experiences at the parks, cruise lines and resorts. -

Cedar Point Debuts Biggest Investment Ever

SPOTLIGHT: Hoffman's reborn as Huck Finn's Playland Pages 26 TM & ©2015 Amusement Today, Inc. August 2015 | Vol. 19 • Issue 5 www.amusementtoday.com Cedar Point debuts biggest investment ever AT: Tim Baldwin [email protected] SANDUSKY, Ohio — Ce- dar Point no longer releases investment figures, but the re- sort has revealed that the Ho- tel Breakers makeover is the biggest investment the park has ever undertaken. With Top Thrill Dragster costing $25 million in 2003, that certainly speaks to what is on display for this season — and beyond. In addition to the new hotel grandeur, Cedar Point has also made new upgrades and ad- ditions in several areas of the park. Hotel Breakers dates back to 1905, a time when most guests coming to Cedar Point Cedar Fair recently completed its largest investment ever at the Cedar Point Resort. The 2015 improvements included a were actually arriving by boat. massive makeover to the historic Hotel Breakers (above) that now gives guests the choice of staying in remodeled rooms The hotel’s historic rotunda or newly-created suites and more activities beachside during the evening hours. At Cedar Point, guests now find the new has always been configured Sweet Spot (below left) awaiting their sweet tooth along the main midway, while coaster fans are enjoying the new B&M more toward the beach side of floorless trains on Rougarou, formerly the Mantis stand-up coaster. AT/TIM BALDWIN the property. As the decades progressed, automobiles took over and eventually the hotel welcomed visitors from what was originally the back of the building. -

Radio Disney "Code Word of the Day" and Other Daily Prize Contest/Sweepstakes Rules

RADIO DISNEY "CODE WORD OF THE DAY" AND OTHER DAILY PRIZE CONTEST/SWEEPSTAKES RULES The following rules apply generally to all Radio Disney "Code Word of the Day" and other Daily Prize Contests/Sweepstakes. However, since Radio Disney runs a wide variety of contests/sweepstakes, at times certain rules will not pertain or additional or different rules may apply. If those circumstances are not noted in these rules, then they will be announced on air or in a separate set of written rules. I. NAME OF SPONSOR(S) Radio Disney, a division of ABC Radio Networks Assets, LLC (hereinafter referred to as "Sponsor"). II. ELIGIBILITY Contests/Sweepstakes are open to all legal United States residents 16 years of age and younger as of entry date. Any individuals (including but not limited to employees, consultants, independent contractors, and interns) who have, within the past six months, performed services for Sponsor, any organizations responsible for sponsoring, fulfilling, administering, advertising or promoting the contest/sweepstakes or supplying the prize, and their respective parent, subsidiary, affiliated and successor companies, and immediate family and household members of such individuals, are not eligible to enter or play. "Immediate family members" shall mean parents, step-parents, children, step-children, siblings, step-siblings, or spouses. "Household members" shall mean people who share the same residence at least three months a year. In the event that a child is young and needs assistance in calling Radio Disney, writing Radio Disney, or visiting RadioDisney.com, parental or guardian assistance is permitted in making the call, mailing the entry, or entering online, but nothing more. -

35Th Anniversary Finale and Other Events at Tokyo Disney Resort for January Through March

October , 2018 FOR IMMEDIATE RELEASE Publicity Department Oriental Land Co., Ltd. 35th Anniversary Finale and Other Events at Tokyo Disney Resort for January through March URAYASU, CHIBA— From January 11 through March 25, 2019, Tokyo Disney Resort® will host the finale of the yearlong anniversary event, “Tokyo Disney Resort 35th ‘Happiest Celebration!’” at Tokyo Disneyland® Park. At the same time, Tokyo DisneySea® Park will offer the special event, “Pixar Playtime” and the special program “Duffy’s Heartwarming Days.” The Disney hotels and the Disney Resort Line will also offer special programs and activities during this period. The “Tokyo Disney Resort 35th ‘Happiest Celebration!’ Grand Finale” will mark the close of the happiest anniversary celebration ever at Tokyo Disneyland. From the premiere of the anniversary event on April 15, 2018, Guests have enjoyed the colorful, celebratory atmosphere of the Park. And the “Grand Finale” event will give Guests even more to enjoy starting with “Dreaming Up!” This daytime parade will be presented in a special version through March 25. In “Tokyo Disney Resort 35th addition, “Celebration Street” in World Bazaar ‘Happiest Celebration!’ Grand Finale” at Tokyo Disneyland will be presented in a new version after dark just for the “Grand Finale.” The Tokyo DisneySea special event, “Pixar Playtime,” will give Guests a variety of experiences themed to the world of DisneyPixar films. Guests of all ages will be able to enjoy all their favorite DisneyPixar Characters in the participatory stage show “Pixar Playtime Pals,” as well as in other entertainment programs around the Park. In various locations, Guests can also try the interactive game booths that are themed to a board “Pixar Playtime” game. -

Oklahoma City Channel Lineup

Name Call Letters Number Name Call Letters Number Name Call Letters Number Fox College Sports - Central ** FCSC 648 Nicktoons NKTN 316 ActionMAX ACTMAX 835 Oklahoma City Fox College Sports - Pacific ** FCSP 649 Noggin NOG 320 Cinemax MAX 832 Fox Movie Channel FMC 792 Oxygen OXGN 368 Cinemax - West MAX-W 833 Fox News Channel FNC 210 PBS KIDS Sprout SPROUT 337 Encore ENC 932 Fox Reality Channel REAL 130 qubo qubo 328 Encore - West ENC-W 933 Channel Directory Fox Soccer Channel ** FSC 654 QVC QVC 197 Encore Action ENCACT 936 BY CHANNEL NAME Fox Sports en Español ** FSE 655 QVC QVC 420 Encore Drama ENCDRA 938 FSN Arizona ** FSAZ 762 Recorded TV Channel DVR 9999 Encore Love ENCLOV 934 FSN Detroit ** FSD 737 Sci Fi Channel SCIFI 151 Encore Mystery ENCMYS 935 Name Call Letters Number FSN Florida ** FSFL 720 Science Channel SCI 258 Encore Wam WAM 939 FSN Midwest ** FSMW 748 ShopNBC SHPNBC 424 Encore Westerns ENCWES 937 FSN North ** FSN 744 SiTV SiTV 194 FLIX FLIX 890 LOCAL LISTINGS FSN Northwest ** FSNW 764 Sleuth SLEUTH 161 HBO HBO 802 FSN Ohio-Cincinnati ** FSOHCI 732 Smile of a Child SMILE 340 HBO - West HBO-W 803 HSN HSN 8 FSN Ohio-Cleveland ** FSOHCL 734 SOAPnet SOAP 365 HBO Comedy HBOCOM 808 KAUT-43 (MY NETWORK TV) KAUT 43 FSN Pittsburgh ** FSP 730 SOAPnet - West SOAP-W 366 HBO Family HBOFAM 806 KETA-13 (PBS) KETA 13 FSN Prime Ticket ** FSPT 774 Speed Channel ** SPEED 652 HBO Latino HBOLAT 810 KFOR-4 (NBC) KFOR 4 FSN Rocky Mountain ** FSRM 760 Spike TV SPKE 145 HBO Signature HBOSIG 807 KOCB-34 (THE CW) KOCB 34 FSN South ** FSS 724 Spike -

IR Presentation Material

IR Presentation Material August, 2021 Oriental Land Co., Ltd. This material has been specifically prepared for institutional investors who are not familiar with our company, and is not presentation material for the earnings presentation. Contents I. Business Outline II. Growth Investments beyond FY3/22 I-I. Theme Park Business III. For Long-term Sustainable Growth I-II. Hotel Business IV. Appendix I-III. Overview Cautionary Statement The purpose of this document is to provide information on the operating results and future management strategies of the OLC Group, and not to solicit investment in securities issued by the Company. 2 The data disclosed in this document are based on the judgments and available information as of the date of publication. The OLC Group's business is sensitive to factors such as customer preferences, and social and economic conditions, and therefore the forecasts and outlook presented in this document contain uncertainties. Theme Park attendance figures have been rounded, and financial figures have been truncated. Please refrain from reprinting this document. 2 I. Business Outline Corporate Profile I. Business Outline Corporate Data Stock Information Established July 11, 1960 Tokyo Stock Stock Listing Code Exchange, First No. Total Assets Section 4661 ¥1,040.4 billion [consolidated] Shareholders’ Investment Unit 100 shares Equity ¥759.9 billion [consolidated] Stock Price ¥15,400 JCR : AA [Stable] Aggregate Market Bond Ratings 4 ¥5,600.8 billion R&I : AA- [Stable] Price [As of March 31, 2021] [As of July 28, 2021] Corporate Mission Business Domain Our mission is to create happiness and “We pursue businesses that fill your contentment by offering wonderful heart with energy and happiness” We strive to create new value in a high-value dreams and moving experiences created business for enriching and nourishing people’s hearts with original, imaginative ideas and appealing to abundant humanity and happiness 4 History and Business Description I. -

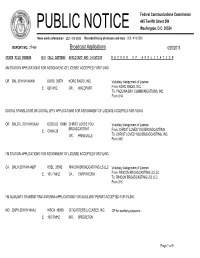

Broadcast Applications 4/20/2011

Federal Communications Commission 445 Twelfth Street SW PUBLIC NOTICE Washington, D.C. 20554 News media information 202 / 418-0500 Recorded listing of releases and texts 202 / 418-2222 REPORT NO. 27469 Broadcast Applications 4/20/2011 STATE FILE NUMBER E/P CALL LETTERS APPLICANT AND LOCATION N A T U R E O F A P P L I C A T I O N AM STATION APPLICATIONS FOR ASSIGNMENT OF LICENSE ACCEPTED FOR FILING OR BAL-20110414AAW KORC 30574 KORC RADIO, INC. Voluntary Assignment of License E 820 KHZ OR , WALDPORT From: KORC RADIO, INC. To: YAQUINA BAY COMMUNICATIONS, INC. Form 314 DIGITAL TRANSLATOR OR DIGITAL LPTV APPLICATIONS FOR ASSIGNMENT OF LICENSE ACCEPTED FOR FILING OR BALDTL-20110415AAU K23CU-D 10890 CHRIST LOVES YOU Voluntary Assignment of License BROADCASTING E CHAN-23 From: CHRIST LOVES YOU BROADCASTING OR , PRINEVILLE To: CHRIST LOVES YOU BROADCASTING, INC. Form 345 FM STATION APPLICATIONS FOR ASSIGNMENT OF LICENSE ACCEPTED FOR FILING CA BALH-20110414ABP KSBL 35592 RINCON BROADCASTING LS LLC Voluntary Assignment of License E 101.7 MHZ CA , CARPINTERIA From: RINCON BROADCASTING LS LLC To: RINCON BROADCASTING LS2 LLC Form 316 FM AUXILIARY TRANSMITTING ANTENNA APPLICATIONS FOR AUXILIARY PERMIT ACCEPTED FOR FILING MO BXPH-20110414AAJ WSGX 48958 CITICASTERS LICENSES, INC. CP for auxiliary purposes. E 100.3 MHZ MO , BRIDGETON Page 1 of 9 Federal Communications Commission 445 Twelfth Street SW PUBLIC NOTICE Washington, D.C. 20554 News media information 202 / 418-0500 Recorded listing of releases and texts 202 / 418-2222 REPORT NO. 27469 Broadcast Applications 4/20/2011 STATE FILE NUMBER E/P CALL LETTERS APPLICANT AND LOCATION N A T U R E O F A P P L I C A T I O N DIGITAL TRANSLATOR OR DIGITAL LPTV APPLICATIONS FOR DIGITAL FLASH CUT ACCEPTED FOR FILING MN BDFCDTT-20110415ABC K51AL 55746 RENVILLE CNTY TV Minor change of callsign K51AL. -

Tokyo Disney Resort Toy Story® Hotel

April 6, 2021 FOR IMMEDIATE RELEASE Publicity Department Oriental Land Co., Ltd. Name Announced for the Fifth Disney Hotel to Open in Japan Tokyo Disney Resort Toy Story® Hotel URAYASU, CHIBA—Oriental Land Co., Ltd. announced today that the name of the fifth Disney hotel to open in Japan will be Tokyo Disney Resort Toy Story Hotel. The hotel’s exterior, entrance, lobby and other areas will bring to life the world of toys based on the popular Disney and Pixar Toy Story film series. The new hotel is situated directly in front of Bayside Station on the Disney Resort Line, providing convenient access to both Tokyo Disneyland® and Tokyo DisneySea® Parks. Guests staying here will find that their dream-filled Disney experience continues from the Parks to the hotel. Tokyo Disney Resort Toy Story Hotel will be the first “moderate type” Disney hotel in Japan, offering guests a new option between the existing “deluxe type” and “value type” Disney hotels. Offering 595 guest rooms with a unified design and specifications, as well as facilities and services to ensure a comfortable stay, this hotel will offer guests accommodations that are in easier reach compared to a deluxe type hotel. With this new hotel and the opening of the new themed port, Fantasy Springs, in Tokyo DisneySea, Tokyo Disney Resort® will be able to meet the needs of even more guests and make their stay a richer experience as the Resort continues to grow and evolve. Please see attachment for an overview of the hotel. © Disney/Pixar For inquiries from the general public Tokyo Disney Resort Information Center 0570-00-8632 (10:00 a.m. -

Stations Monitored

Stations Monitored 10/01/2019 Format Call Letters Market Station Name Adult Contemporary WHBC-FM AKRON, OH MIX 94.1 Adult Contemporary WKDD-FM AKRON, OH 98.1 WKDD Adult Contemporary WRVE-FM ALBANY-SCHENECTADY-TROY, NY 99.5 THE RIVER Adult Contemporary WYJB-FM ALBANY-SCHENECTADY-TROY, NY B95.5 Adult Contemporary KDRF-FM ALBUQUERQUE, NM 103.3 eD FM Adult Contemporary KMGA-FM ALBUQUERQUE, NM 99.5 MAGIC FM Adult Contemporary KPEK-FM ALBUQUERQUE, NM 100.3 THE PEAK Adult Contemporary WLEV-FM ALLENTOWN-BETHLEHEM, PA 100.7 WLEV Adult Contemporary KMVN-FM ANCHORAGE, AK MOViN 105.7 Adult Contemporary KMXS-FM ANCHORAGE, AK MIX 103.1 Adult Contemporary WOXL-FS ASHEVILLE, NC MIX 96.5 Adult Contemporary WSB-FM ATLANTA, GA B98.5 Adult Contemporary WSTR-FM ATLANTA, GA STAR 94.1 Adult Contemporary WFPG-FM ATLANTIC CITY-CAPE MAY, NJ LITE ROCK 96.9 Adult Contemporary WSJO-FM ATLANTIC CITY-CAPE MAY, NJ SOJO 104.9 Adult Contemporary KAMX-FM AUSTIN, TX MIX 94.7 Adult Contemporary KBPA-FM AUSTIN, TX 103.5 BOB FM Adult Contemporary KKMJ-FM AUSTIN, TX MAJIC 95.5 Adult Contemporary WLIF-FM BALTIMORE, MD TODAY'S 101.9 Adult Contemporary WQSR-FM BALTIMORE, MD 102.7 JACK FM Adult Contemporary WWMX-FM BALTIMORE, MD MIX 106.5 Adult Contemporary KRVE-FM BATON ROUGE, LA 96.1 THE RIVER Adult Contemporary WMJY-FS BILOXI-GULFPORT-PASCAGOULA, MS MAGIC 93.7 Adult Contemporary WMJJ-FM BIRMINGHAM, AL MAGIC 96 Adult Contemporary KCIX-FM BOISE, ID MIX 106 Adult Contemporary KXLT-FM BOISE, ID LITE 107.9 Adult Contemporary WMJX-FM BOSTON, MA MAGIC 106.7 Adult Contemporary WWBX-FM