A Review of UK-Listed Companies' Climate Change

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

We Are an Organisation of Activist Lawyers Committed to Securing A

We are an organisation Trustees’ Report of activist lawyers 2010 committed to securing a healthy planet Contents Achievements in 2010 ................................................................................................................. 4 Message from the Chair ............................................................................................................ 6 Message from the CEO .............................................................................................................. 8 An overview of ClientEarth in 2010 ................................................................................... 10 Our areas of work .......................................................................................................................... 12 Biodiversity .................................................................................................................................... 14 Climate and Energy ................................................................................................................... 16 Climate and Forests ................................................................................................................... 20 Access to Justice .......................................................................................................................... 22 Corporate Transparency .......................................................................................................... 24 Health and the Environment ............................................................................................... -

Rotork Annual Report 2006

2006 Annual Report & Accounts Rotork 2006 Annual Report & Accounts Rotork p.l.c. Rotork House Brassmill Lane Bath BA1 3JQ www.rotork.com Celebrating fifty years of innovation 2006 Annual Report & Accounts Rotork 2006 Annual Report & Accounts Rotork p.l.c. Rotork House Brassmill Lane Bath BA1 3JQ www.rotork.com Celebrating fifty years of innovation FINANCIAL HIGHLIGHTSRotork Annual Report & Accounts 2006 01. Financial Highlights Order Intake The fifties: page 05 • Order intake up 19% at £223m • Revenue up 18% at £206.7m £223m • Operating profit up 23% at £45.1m up 19% The sixties: page 07 • Recommended final dividend of 11.65p, up 18% • £8m additional interim dividend during 2007 Order book Operational Highlights £76m The seventies: page 08 up 19% • Continued strong growth achieved in Rotork Fluid System The eighties: page 11 • Chinese market still buoyant • New Shanghai manufacturing plant commenced production on schedule in the year • Increased focus on Service and Support with new @ management structure The nineties: page 12 The Noughties: page 15 Financial Highlights 01 Revenue (£m) Chairman’s Statement 02 Business Review 04 Geographical Review 16 206.7 Operating Profit - (£m) (£m) Rotork Marketing 18 continuing operations Board of Directors 20 Order Input 223.4 174.8 45.1 Report of the Directors 21 136.0 146.9 Corporate Governance 23 7.7 133.5 18 36.5 Corporate Social Responsibility 26 Remuneration Report 28 30.4 151.8 28.4 Independent Auditors’ Report 35 136.9 26.6 131.3 Consolidated Income Statement 36 Consolidated Balance Sheet 37 Consolidated Statement of Cash Flows 38 Consolidated Statement of Recognised Income and Expense 39 Notes to the Group Financial Statements 40 02 03 04 05 06 Rotork p.l.c. -

Annual Report and Financial Statements 2016 Introduction

ANNUAL REPORT AND FINANCIAL STATEMENTS 2016 INTRODUCTION Antofagasta is a Chilean copper mining group with signifi cant by-product production and interests in transport. The Group creates value for its stakeholders through the discovery, development and operation of copper mining assets. The Group is committed to generating value in a safe and sustainable way throughout the commodity cycle. See page 2 for more information CONTENTS STRATEGIC REPORT GOVERNANCE FINANCIAL STATEMENTS 01-05 66-119 120-187 OVERVIEW 2016 highlights 1 Leadership Independent auditors’ report 122 At a glance 2 Chairman’s Governance Q&A 68 Consolidated income statement 127 Letter from the Chairman 4 Senior Independent Director’s Q&A 70 Consolidated statement Governance overview 71 of comprehensive income 128 Board of Directors 72 Consolidated statement of Executive Committee 76 changes in equity 128 06-27 Effectiveness Consolidated balance sheet 129 STRATEGY Board activities 78 Consolidated cash flow statement 130 Professional development 80 Notes to the financial statements 131 Effectiveness reviews 82 Parent company financial statements 181 Statement from the CEO 8 Accountability Question and answer 9 Nomination and Governance Committee 85 Investment case 10 Audit and Risk Committee 88 Our new operating model 11 Sustainability and Stakeholder Our position in the market 14 188-204 Management Committee 92 Our strategy 16 OTHER INFORMATION Projects Committee 94 Key performance indicators 18 Remuneration Risk management 20 Five year summary 188 Committee Chairman’s Principal -

Fund Fact Sheet

Franklin Templeton Funds GB00B3ZGH246 FTF Franklin UK Mid Cap Fund - A 31 July 2021 (inc) Fund Fact Sheet For Professional Client Use Only. Not for distribution to Retail Clients. Fund Overview Performance Base Currency for Fund GBP Performance over 5 Years in Share Class Currency (%) Total Net Assets (GBP) 1.16 billion FTF Franklin UK Mid Cap Fund A (inc) FTSE 250 ex-Investment Trusts Index Fund Inception Date 17.10.2011 180 Number of Issuers 36 Benchmark FTSE 250 ex-Investment 160 Trusts Index IA Sector UK All Companies 140 ISA Status Yes 120 Summary of Investment Objective The Fund aims to grow in value by more than the FTSE 250 100 (ex-Investment Trusts) Index, from a combination of income and investment growth over a three to five-year period after all fees and costs are deducted. 80 07/16 01/17 07/17 01/18 07/18 01/19 07/19 01/20 07/20 01/21 07/21 Fund Management Discrete Annual Performance in Share Class Currency (%) Richard Bullas: United Kingdom 07/20 07/19 07/18 07/17 07/16 Mark Hall: United Kingdom 07/21 07/20 07/19 07/18 07/17 Dan Green, CFA: United Kingdom A (inc) 36.52 -12.79 -1.25 9.89 23.81 Marcus Tregoning: United Kingdom Benchmark in GBP 42.85 -15.10 -4.98 8.39 17.21 Ratings - A (inc) Performance in Share Class Currency (%) Cumulative Annualised Overall Morningstar Rating™: Since Since Asset Allocation 1 Mth 3 Mths 6 Mths YTD 1 Yr 3 Yrs 5 Yrs Incept 3 Yrs 5 Yrs Incept A (inc) 4.45 5.93 20.14 16.83 36.52 17.58 59.90 821.63 5.55 9.84 10.60 Benchmark in GBP 3.24 3.01 16.86 15.60 42.85 15.25 46.41 622.69 4.84 7.92 9.38 Prior to 7 August 2021, the Fund was named Franklin UK Mid Cap Fund. -

Parker Review

Ethnic Diversity Enriching Business Leadership An update report from The Parker Review Sir John Parker The Parker Review Committee 5 February 2020 Principal Sponsor Members of the Steering Committee Chair: Sir John Parker GBE, FREng Co-Chair: David Tyler Contents Members: Dr Doyin Atewologun Sanjay Bhandari Helen Mahy CBE Foreword by Sir John Parker 2 Sir Kenneth Olisa OBE Foreword by the Secretary of State 6 Trevor Phillips OBE Message from EY 8 Tom Shropshire Vision and Mission Statement 10 Yvonne Thompson CBE Professor Susan Vinnicombe CBE Current Profile of FTSE 350 Boards 14 Matthew Percival FRC/Cranfield Research on Ethnic Diversity Reporting 36 Arun Batra OBE Parker Review Recommendations 58 Bilal Raja Kirstie Wright Company Success Stories 62 Closing Word from Sir Jon Thompson 65 Observers Biographies 66 Sanu de Lima, Itiola Durojaiye, Katie Leinweber Appendix — The Directors’ Resource Toolkit 72 Department for Business, Energy & Industrial Strategy Thanks to our contributors during the year and to this report Oliver Cover Alex Diggins Neil Golborne Orla Pettigrew Sonam Patel Zaheer Ahmad MBE Rachel Sadka Simon Feeke Key advisors and contributors to this report: Simon Manterfield Dr Manjari Prashar Dr Fatima Tresh Latika Shah ® At the heart of our success lies the performance 2. Recognising the changes and growing talent of our many great companies, many of them listed pool of ethnically diverse candidates in our in the FTSE 100 and FTSE 250. There is no doubt home and overseas markets which will influence that one reason we have been able to punch recruitment patterns for years to come above our weight as a medium-sized country is the talent and inventiveness of our business leaders Whilst we have made great strides in bringing and our skilled people. -

2013 Agms: Key Trends and Issues from a Review of 215 FTSE 350 Companies June 2013

2013 AGMs: Key trends and issues from a review of 215 FTSE 350 companies June 2013 Statistics Commentary RESOLUTIONS Annual re-election of all directors 99% (213 companies) proposed annual re- 3% (7 companies) amended their articles to election of all directors reflect annual re-election Authority to allot shares: extra one 67% (144 companies) proposed a resolution This is similar to the results for 2012 third authority for the extra one third authority; 27% (57 companies) included a statement that where Under the UK Corporate Governance Code this extra one-third authority was used, the (Code) FTSE 350 directors should be subject directors would stand for re-election to annual election, so no longer necessary Any resolution to convene general 84% (181 companies) passed a resolution to NAPF recommends that companies should only meeting on 14 days’ notice convene a general meeting on 14 clear days’ call a general meeting on 14 clear days’ notice notice; 73% (158 companies) stated the in limited circumstances and these should be circumstances where meetings will be held on explained when tabling the resolution 14 clear days’ notice Details of any unusual resolution Resolutions proposed to approve an increase A few companies have increased this to in maximum aggregate fees payable to around £700,000 to allow them to appoint directors non-executive directors to the board Details of substantial vote (10-49%) 15% (33 companies) detailed substantial votes So far this year no FTSE 350 company has had against the directors’ remuneration against -

Itraxx Europe & Crossover Series 35 Final Membership List

iTraxx Europe & Crossover Series 35 Final Membership List March 2021 Copyright © 2021 IHS Markit Ltd T180614 iTraxx Europe & Crossover Series 35 Final Membership List 1 iTraxx Europe Series 35 Final Membership List......................................... 3 2 iTraxx Europe Series 35 Final vs. Series 34.............................................. 7 3 iTraxx Crossover Series 35 Final Membership List ................................... 8 4 iTraxx Crossover Series 35 Final vs. Series 34........................................11 5 Further information ...................................................................................12 Copyright © 2021 IHS Markit Ltd | 2 T180614 iTraxx Europe & Crossover Series 35 Final Membership List 1 iTraxx Europe Series 35 Final Membership List iTraxx Sector IHS Markit Ticker IHS Markit Long Name Autos & Industrials AIRBSE AIRBUS SE Autos & Industrials VLVY AKTIEBOLAGET VOLVO Autos & Industrials AKZO AKZO NOBEL N.V. Autos & Industrials ALSTOM ALSTOM Autos & Industrials AAUK ANGLO AMERICAN PLC Autos & Industrials AZN ASTRAZENECA PLC Autos & Industrials BAPLC BAE SYSTEMS PLC Autos & Industrials BASFSE BASF SE Autos & Industrials BYIF BAYER AKTIENGESELLSCHAFT Autos & Industrials BMW BAYERISCHE MOTOREN WERKE AKTIENGESELLSCHAFT Autos & Industrials BOUY BOUYGUES Autos & Industrials CNHIND CNH INDUSTRIAL N.V. Autos & Industrials STGOBN COMPAGNIE DE SAINT-GOBAIN Autos & Industrials COMPFIAG COMPAGNIE FINANCIERE MICHELIN SA Autos & Industrials CONTI CONTINENTAL AKTIENGESELLSCHAFT Autos & Industrials DAMLR DAIMLER -

Airtel Africa Plc Results for the Nine-Month Period Ended 31 December 2020 29 January 2021

Airtel Africa plc Results for the nine-month period ended 31 December 2020 29 January 2021 Another quarter of double-digit growth, with continued improvement in revenue growth and EBITDA profitability Highlights • Reported revenue increased by 13.8% to $2,870m with Q3’21 reported revenue growth of 19.5%. • Constant currency underlying revenue growth was 18.6%, with Q3’21 growth of 22.8%. Growth for the nine months was recorded across all regions: Nigeria up 21.6%, East Africa up 23.4% and Francophone Africa up 8.0%; and across all services, with voice revenue up 10.4%, data up 31.1% and mobile money up 34.2%. • Underlying EBITDA for the nine months was $1,297m, up 16% in reported currency while constant currency underlying EBITDA growth was 22.5%. • Underlying EBITDA margin for the nine months was 45.5%, up by 118 bps (up 144 bps in constant currency). Q3’21 underlying EBITDA margin was 46.9%. • Operating profit increased by 21.8% to $800m in reported currency, and by 29.9% in constant currency. • Free cash flow was $466m, up 20% compared to the same period last year. • Basic EPS was 5.5 cents, down 36.5%, largely due to prior year exceptional items and a one-off derivative gain. Excluding these, basic EPS rose by 19.8%. EPS before exceptional items was 5.0 cents. • Customer base up 11.0% to 118.9 million, with increased penetration across mobile data (customer base up 23.5%) and mobile money services (customer base up 29.0%). -

Morningstar Report

Report as of 23 Sep 2021 FTF Franklin UK Mid Cap Fund W (acc) Morningstar® Category Morningstar® Benchmark Fund Benchmark Morningstar Rating™ UK Mid-Cap Equity FTSE 250 Ex Investment Trust TR GBP FTSE 250 Ex Investment Trust TR GBP QQQ Used throughout report Investment Objective Performance The Fund aims to grow in value by more than the FTSE 250 192 (ex-Investment Trusts) Index, from a combination of 169 income and investment growth over a three to five-year 146 period after all fees and costs are deducted. The Fund will 123 invests at least two thirds (but typically significantly more) 100 in the shares of medium-sized companies that are 77 constituents of the FTSE 250 (ex-Investment Trusts) Index and that are incorporated/domiciled in the UK or which 2016 2017 2018 2019 2020 2021-08 have significant business operations in the UK. This will -0.23 26.43 -13.46 42.30 -14.19 23.11 Fund typically be around 30–50 companies. 5.08 18.24 -15.15 30.79 -8.48 22.42 Benchmark 5.27 19.55 -14.94 30.83 -2.93 19.16 Category Risk Measures Trailing Returns % Fund Bmark Cat Quarterly Returns % Q1 Q2 Q3 Q4 3Y Alpha 1.27 3Y Sharpe Ratio 0.45 3 Months 7.81 6.09 6.44 2021 5.67 6.24 - - 3Y Beta 1.03 3Y Std Dev 23.59 6 Months 16.57 13.73 13.19 2020 -34.73 13.41 -3.15 19.70 3Y R-Squared 95.57 3Y Risk Avg 1 Year 48.84 50.23 43.80 2019 10.97 6.77 5.53 13.81 3Y Info Ratio 0.27 5Y Risk Avg 3 Years Annualised 8.30 6.82 8.43 2018 -2.73 6.70 -3.28 -13.79 3Y Tracking Error 5.02 10Y Risk abv avg 5 Years Annualised 10.37 7.88 10.12 2017 6.51 6.02 4.41 7.23 Calculations -

Glencore's Shares Drop After Justice Department Subpoena

WL SEIS Exhibit 9 https://www.nytimes.com/2018/07/03/business/glencore-subpoena-mining-commodities.html Glencore’s Shares Drop After Justice Department Subpoena By Stanley Reed and Michael J. de la Merced July 3, 2018 LONDON — Glencore, a Switzerland‑based mining and commodities trading giant, said on Tuesday that it had received a subpoena from the United States Department of Justice requesting documents in a money‑laundering and corruption investigation. The subpoena is tied to Glencore’s dealings in the Democratic Republic of Congo, Nigeria and Venezuela since 2007, and it seeks material related to “compliance with the Foreign Corrupt Practices Act” and with United States money‑laundering rules, the company said in a statement. News that American investigators were looking into Glencore’s businesses spooked investors, sending the company’s share price down as much as 13 percent at one point on Tuesday. By late afternoon in London, its stock price had recovered somewhat, but was still 5 percent lower. Charles Watenphul, a Glencore spokesman, said, “We got this letter last night; we are going through it.” While Glencore has not been charged with any crime, the development is a blow to one of the most powerful commodities mining and trading empires around, one that employs 146,000 workers around the world. With headquarters in Baar, near Zurich, the company is among the biggest producers of copper and of cobalt, a crucial component of batteries for electric vehicles and electronic devices like smartphones. (Cobalt is so important that the Trump administration has deemed it critical for American national security.) Glencore is also a major player in coal, with 26 mines in countries such as Australia, Colombia and South Africa. -

FTSE Factsheet

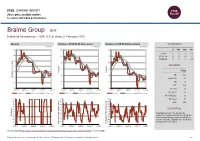

FTSE COMPANY REPORT Share price analysis relative to sector and index performance Data as at: 21 February 2020 Braime Group BMT Industrial Engineering — GBP 17.5 at close 21 February 2020 Absolute Relative to FTSE UK All-Share Sector Relative to FTSE UK All-Share Index PERFORMANCE 21-Feb-2020 21-Feb-2020 21-Feb-2020 26 110 120 1D WTD MTD YTD Absolute 0.0 0.0 6.1 -5.4 24 100 110 Rel.Sector 0.8 0.4 4.7 -1.1 Rel.Market 0.4 0.1 4.1 -3.9 22 90 100 VALUATION 20 80 90 Trailing 18 RelativePrice RelativePrice 70 80 PE 10.9 Absolute(localPrice currency) 16 EV/EBITDA 6.0 60 70 14 PB 1.7 PCF 10.7 12 50 60 Div Yield 0.7 Feb-2019 May-2019 Aug-2019 Nov-2019 Feb-2020 Feb-2019 May-2019 Aug-2019 Nov-2019 Feb-2020 Feb-2019 May-2019 Aug-2019 Nov-2019 Feb-2020 Price/Sales 0.7 Absolute Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Net Debt/Equity 0.2 100 90 100 Div Payout 7.0 90 80 90 ROE 17.4 80 70 80 70 Index) Share 70 Share Sector) Share - - 60 60 60 DESCRIPTION 50 50 50 40 The principal activities of the group are the 40 40 RSI RSI (Absolute) 30 manufacture of metal presswork and the distribution 30 30 of bulk material handling components, trading from 20 20 20 locations in Australia, England, France, South Africa, 10 10 10 Thailand and the United States. -

Revision of the State Aid Guidelines for Environmental Protection and Energy and Exemption Rules Making the EEAG and GBER Fit for Europe’S Carbon Neutrality

January 2021 Revision of the State Aid Guidelines for Environmental Protection and Energy and exemption rules Making the EEAG and GBER fit for Europe’s carbon neutrality CLIENTEARTH.ORG Revision of the State Aid Guidelines for Environmental Protection and Energy and exemption rules January 2021 1 General recommendations ............................................................................................... 4 1.1 Transform the EEAG into true instruments of environmental protection ..................... 4 1.2 Place aid in the energy sector under the overarching EE1st principle ........................ 6 1.3 Making the EEAG future-proof .................................................................................... 7 2 Response to the Questionnaire ........................................................................................ 8 2.1 Comments on the introduction .................................................................................... 8 2.2 Question 23: should aid be allowed for the following areas? ...................................... 9 2.2.1 Renewable electricity ........................................................................................ 9 2.2.2 Renewable and low carbon hydrogen production ........................................... 13 2.2.3 Alternative transport fuel (other than hydrogen) ............................................. 15 2.2.4 Combined Heat and Power (CHP) .................................................................. 15 2.2.5 Renewable heating ........................................................................................