Memory, Attention and Choice∗

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Compare and Contrast Two Models Or Theories of One Cognitive Process with Reference to Research Studies

! The following sample is for the learning objective: Compare and contrast two models or theories of one cognitive process with reference to research studies. What is the question asking for? * A clear outline of two models of one cognitive process. The cognitive process may be memory, perception, decision-making, language or thinking. * Research is used to support the models as described. The research does not need to be outlined in a lot of detail, but underatanding of the role of research in supporting the models should be apparent.. * Both similarities and differences of the two models should be clearly outlined. Sample response The theory of memory is studied scientifically and several models have been developed to help The cognitive process describe and potentially explain how memory works. Two models that attempt to describe how (memory) and two models are memory works are the Multi-Store Model of Memory, developed by Atkinson & Shiffrin (1968), clearly identified. and the Working Memory Model of Memory, developed by Baddeley & Hitch (1974). The Multi-store model model explains that all memory is taken in through our senses; this is called sensory input. This information is enters our sensory memory, where if it is attended to, it will pass to short-term memory. If not attention is paid to it, it is displaced. Short-term memory Research. is limited in duration and capacity. According to Miller, STM can hold only 7 plus or minus 2 pieces of information. Short-term memory memory lasts for six to twelve seconds. When information in the short-term memory is rehearsed, it enters the long-term memory store in a process called “encoding.” When we recall information, it is retrieved from LTM and moved A satisfactory description of back into STM. -

Dopamine Neurons Mediate a Fast Excitatory Signal Via Their Glutamatergic Synapses

972 • The Journal of Neuroscience, January 28, 2004 • 24(4):972–981 Cellular/Molecular Dopamine Neurons Mediate a Fast Excitatory Signal via Their Glutamatergic Synapses Nao Chuhma,1,6 Hui Zhang,2 Justine Masson,1,6 Xiaoxi Zhuang,7 David Sulzer,1,2,6 Rene´ Hen,3,5 and Stephen Rayport1,4,5,6 Departments of 1Psychiatry, 2Neurology, 3Pharmacology, and 4Anatomy and Cell Biology, and 5Center for Neurobiology and Behavior, Columbia University, New York, New York 10032, 6Department of Neuroscience, New York State Psychiatric Institute, New York, New York 10032, and 7Department of Neurobiology, Pharmacology and Physiology, University of Chicago, Chicago, Illinois 60637 Dopamine neurons are thought to convey a fast, incentive salience signal, faster than can be mediated by dopamine. A resolution of this paradox may be that midbrain dopamine neurons exert fast excitatory actions. Using transgenic mice with fluorescent dopamine neurons, in which the axonal projections of the neurons are visible, we made horizontal brain slices encompassing the mesoaccumbens dopamine projection. Focal extracellular stimulation of dopamine neurons in the ventral tegmental area evoked dopamine release and early monosynaptic and late polysynaptic excitatory responses in postsynaptic nucleus accumbens neurons. Local superfusion of the ventral tegmental area with glutamate, which should activate dopamine neurons selectively, produced an increase in excitatory synaptic events. Local superfusion of the ventral tegmental area with the D2 agonist quinpirole, which should increase the threshold for dopamine neuron activation, inhibited the early response. So dopamine neurons make glutamatergic synaptic connections to accumbens neurons. We propose that dopamine neuron glutamatergic transmission may be the initial component of the incentive salience signal. -

Mnemonics in a Mnutshell: 32 Aids to Psychiatric Diagnosis

Mnemonics in a mnutshell: 32 aids to psychiatric diagnosis Clever, irreverent, or amusing, a mnemonic you remember is a lifelong learning tool ® Dowden Health Media rom SIG: E CAPS to CAGE and WWHHHHIMPS, mnemonics help practitioners and trainees recall Fimportant lists (suchCopyright as criteriaFor for depression,personal use only screening questions for alcoholism, or life-threatening causes of delirium, respectively). Mnemonics’ effi cacy rests on the principle that grouped information is easi- er to remember than individual points of data. Not everyone loves mnemonics, but recollecting diagnostic criteria is useful in clinical practice and research, on board examinations, and for insurance reimbursement. Thus, tools that assist in recalling di- agnostic criteria have a role in psychiatric practice and IMAGES teaching. JUPITER In this article, we present 32 mnemonics to help cli- © nicians diagnose: • affective disorders (Box 1, page 28)1,2 Jason P. Caplan, MD Assistant clinical professor of psychiatry • anxiety disorders (Box 2, page 29)3-6 Creighton University School of Medicine 7,8 • medication adverse effects (Box 3, page 29) Omaha, NE • personality disorders (Box 4, page 30)9-11 Chief of psychiatry • addiction disorders (Box 5, page 32)12,13 St. Joseph’s Hospital and Medical Center Phoenix, AZ • causes of delirium (Box 6, page 32).14 We also discuss how mnemonics improve one’s Theodore A. Stern, MD Professor of psychiatry memory, based on the principles of learning theory. Harvard Medical School Chief, psychiatric consultation service Massachusetts General Hospital How mnemonics work Boston, MA A mnemonic—from the Greek word “mnemonikos” (“of memory”)—links new data with previously learned information. -

Post-Encoding Stress Does Not Enhance Memory Consolidation: the Role of Cortisol and Testosterone Reactivity

brain sciences Article Post-Encoding Stress Does Not Enhance Memory Consolidation: The Role of Cortisol and Testosterone Reactivity Vanesa Hidalgo 1,* , Carolina Villada 2 and Alicia Salvador 3 1 Department of Psychology and Sociology, Area of Psychobiology, University of Zaragoza, 44003 Teruel, Spain 2 Department of Psychology, Division of Health Sciences, University of Guanajuato, Leon 37670, Mexico; [email protected] 3 Department of Psychobiology and IDOCAL, University of Valencia, 46010 Valencia, Spain; [email protected] * Correspondence: [email protected]; Tel.: +34-978-645-346 Received: 11 October 2020; Accepted: 15 December 2020; Published: 16 December 2020 Abstract: In contrast to the large body of research on the effects of stress-induced cortisol on memory consolidation in young people, far less attention has been devoted to understanding the effects of stress-induced testosterone on this memory phase. This study examined the psychobiological (i.e., anxiety, cortisol, and testosterone) response to the Maastricht Acute Stress Test and its impact on free recall and recognition for emotional and neutral material. Thirty-seven healthy young men and women were exposed to a stress (MAST) or control task post-encoding, and 24 h later, they had to recall the material previously learned. Results indicated that the MAST increased anxiety and cortisol levels, but it did not significantly change the testosterone levels. Post-encoding MAST did not affect memory consolidation for emotional and neutral pictures. Interestingly, however, cortisol reactivity was negatively related to free recall for negative low-arousal pictures, whereas testosterone reactivity was positively related to free recall for negative-high arousal and total pictures. -

Teaching Through Mnemonics in Elementary School Classrooms

Teaching Through Mnemonics/Elementary 1 Title Page Teaching Through Mnemonics in Elementary School Classrooms Arianne Waite-McGough Submitted in Partial Fulfillment of the Requirements for the Degree Master of Science in Education School of Education and Counseling Psychology Dominican University of California San Rafael, CA May 2012 Teaching Through Mnemonics/Elementary 2 Acknowledgements Completing my master’s degree, and this thesis, has really been a labor of love. I have worked hard to become a teacher, but I know that none of this could have been possible without my unwavering support team. Which was lead by some of my amazing professors at Dominican University of California, Dr. Mary Crosby, Dr. Mary Ann Sinkkonen, Dr. Madalienne Peters and Dr. Sarah Zykanov. These women have inspired and pushed me to work harder than I have ever worked before. They are truly models of what a great teacher is, and what I strive to become. I would also like to thank Ann Belove, Pat Lightner and Elizabeth Dalzel who were the best mentors that I could have asked for. They guided me through the frightening and daunting world of elementary school. I came out alive, and a much better teacher thanks to their wisdom and direction. I would especially like to thank my family and friends, who have sat through numerous practice lessons and heard about endless educational theories without complaint, as I embarked on this journey. A very special thanks goes out to two great friends that I made in the credential program, Laura Lightfoot and Catherine Janes. These two helped me keep my sanity throughout. -

Types of Memory and Models of Memory

Inf1: Intro to Cognive Science Types of memory and models of memory Alyssa Alcorn, Helen Pain and Henry Thompson March 21, 2012 Intro to Cognitive Science 1 1. In the lecture today A review of short-term memory, and how much stuff fits in there anyway 1. Whether or not the number 7 is magic 2. Working memory 3. The Baddeley-Hitch model of memory hEp://www.cartoonstock.com/directory/s/ short_term_memory.asp March 21, 2012 Intro to Cognitive Science 2 2. Review of Short-Term Memory (STM) Short-term memory (STM) is responsible for storing small amounts of material over short periods of Nme A short Nme really means a SHORT Nme-- up to several seconds. Anything remembered for longer than this Nme is classified as long-term memory and involves different systems and processes. !!! Note that this is different that what we mean mean by short- term memory in everyday speech. If someone cannot remember what you told them five minutes ago, this is actually a problem with long-term memory. While much STM research discusses verbal or visuo-spaal informaon, the disNncNon of short vs. long-term applies to other types of sNmuli as well. 3/21/12 Intro to Cognitive Science 3 3. Memory span and magic numbers Amount of informaon varies with individual’s memory span = longest number of items (e.g. digits) that can be immediately repeated back in correct order. Classic research by George Miller (1956) described the apparent limits of short-term memory span in one of the most-cited papers in all of psychology. -

The Absent Minded Consumer

The Absentminded Consumer John Ameriks, Andrew Caplin and John Leahy∗ March 2003 (Preliminary) Abstract We present a model of an absentminded consumer who does not keep constant track of his spending. The model generates a form of precautionary consumption, in which absentminded agents tend to consume more than attentive agents. We show that wealthy agents are more likely to be absentminded, whereas young and retired agents are more likely to pay attenition. The model presents new explanations for a relationship between spending and credit card use and for the decline in consumption at retirement. Key Words: JEL Classification: 1 Introduction Doyouknowhowmuchyouspentlastmonth,andwhatyouspentiton?Itis only if you answer this question in the affirmative that the classical life-cycle model of consumption applies to you. Otherwise, you are to some extent an absent-minded consumer. In this paper we develop a theory that applies to thoseofuswhofallintothiscategory. The concept of absentmindedness that we employ in our analysis was introduced by Rubinstein and Piccione [1997]. They define absentmindedness as the inability to distinguish between decision nodes that lie along the same branch of a decision tree. By identifying these distinct nodes with different ∗We would like to thank Mark Gertler, Per Krusell, and Ricardo Lagos for helpful comments. 1 levels of spending, we are able to model consumers who are uncertain as to how much they spend in any given period. The effect of this change in model structure is to make it difficult for consumers to equate the marginal utility of consumption with the marginal utility of wealth. We show that this innocent twist in a standard consumption model may not only provide insight into some existing puzzles in the consumption literature, but also shed light on otherwise puzzling results concerning linkages between financial planning and wealth accumulation (Ameriks, Caplin, and Leahy [2003]). -

Handbook of Metamemory and Memory Evolution of Metacognition

This article was downloaded by: 10.3.98.104 On: 29 Sep 2021 Access details: subscription number Publisher: Routledge Informa Ltd Registered in England and Wales Registered Number: 1072954 Registered office: 5 Howick Place, London SW1P 1WG, UK Handbook of Metamemory and Memory John Dunlosky, Robert A. Bjork Evolution of Metacognition Publication details https://www.routledgehandbooks.com/doi/10.4324/9780203805503.ch3 Janet Metcalfe Published online on: 28 May 2008 How to cite :- Janet Metcalfe. 28 May 2008, Evolution of Metacognition from: Handbook of Metamemory and Memory Routledge Accessed on: 29 Sep 2021 https://www.routledgehandbooks.com/doi/10.4324/9780203805503.ch3 PLEASE SCROLL DOWN FOR DOCUMENT Full terms and conditions of use: https://www.routledgehandbooks.com/legal-notices/terms This Document PDF may be used for research, teaching and private study purposes. Any substantial or systematic reproductions, re-distribution, re-selling, loan or sub-licensing, systematic supply or distribution in any form to anyone is expressly forbidden. The publisher does not give any warranty express or implied or make any representation that the contents will be complete or accurate or up to date. The publisher shall not be liable for an loss, actions, claims, proceedings, demand or costs or damages whatsoever or howsoever caused arising directly or indirectly in connection with or arising out of the use of this material. Evolution of Metacognition Janet Metcalfe Introduction The importance of metacognition, in the evolution of human consciousness, has been emphasized by thinkers going back hundreds of years. While it is clear that people have metacognition, even when it is strictly defined as it is here, whether any other animals share this capability is the topic of this chapter. -

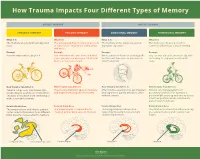

How Trauma Impacts Four Different Types of Memory

How Trauma Impacts Four Different Types of Memory EXPLICIT MEMORY IMPLICIT MEMORY SEMANTIC MEMORY EPISODIC MEMORY EMOTIONAL MEMORY PROCEDURAL MEMORY What It Is What It Is What It Is What It Is The memory of general knowledge and The autobiographical memory of an event The memory of the emotions you felt The memory of how to perform a facts. or experience – including the who, what, during an experience. common task without actively thinking and where. Example Example Example Example You remember what a bicycle is. You remember who was there and what When a wave of shame or anxiety grabs You can ride a bicycle automatically, with- street you were on when you fell off your you the next time you see your bicycle out having to stop and recall how it’s bicycle in front of a crowd. after the big fall. done. How Trauma Can Affect It How Trauma Can Affect It How Trauma Can Affect It How Trauma Can Affect It Trauma can prevent information (like Trauma can shutdown episodic memory After trauma, a person may get triggered Trauma can change patterns of words, images, sounds, etc.) from differ- and fragment the sequence of events. and experience painful emotions, often procedural memory. For example, a ent parts of the brain from combining to without context. person might tense up and unconsciously make a semantic memory. alter their posture, which could lead to pain or even numbness. Related Brain Area Related Brain Area Related Brain Area Related Brain Area The temporal lobe and inferior parietal The hippocampus is responsible for The amygdala plays a key role in The striatum is associated with producing cortex collect information from different creating and recalling episodic memory. -

University of Texas at Arlington Dissertation Template

COLLEGE STUDENT RISK BEHAVIOR: IMPLICATIONS OF RELIGIOSITY AND IMPULSIVITY by MARY CAZZELL Presented to the Faculty of the Graduate School of The University of Texas at Arlington in Partial Fulfillment of the Requirements for the Degree of DOCTOR OF PHILOSOPHY THE UNIVERSITY OF TEXAS AT ARLINGTON December 2009 UMI Number: 3391108 All rights reserved INFORMATION TO ALL USERS The quality of this reproduction is dependent upon the quality of the copy submitted. In the unlikely event that the author did not send a complete manuscript and there are missing pages, these will be noted. Also, if material had to be removed, a note will indicate the deletion. UMI 3391108 Copyright 2010 by ProQuest LLC. All rights reserved. This edition of the work is protected against unauthorized copying under Title 17, United States Code. ProQuest LLC 789 East Eisenhower Parkway P.O. Box 1346 Ann Arbor, MI 48106-1346 Copyright © by Mary Cazzell 2009 All Rights Reserved ACKNOWLEDGEMENTS I would like to thank my family for their unconditional love, support, and understanding during these last four years. My husband, Brian Cazzell, was my special source for encouragement, a shoulder to cry on, and an ear to listen to my troubles. At times, it seemed that he has sacrificed more so I could successfully achieve my doctorate. For all of this, I am truly grateful. I am also thankful to my daughters, Lauren and Emily, for their constant support of me and their pride in me. I believe that our marriage and family relationships have strengthened during this sometimes arduous process. I would also like to thank my parents, Walter and Marilyn Skipper, for their love, support, and encouragement over the years. -

Memory-Modulation: Self-Improvement Or Self-Depletion?

HYPOTHESIS AND THEORY published: 05 April 2018 doi: 10.3389/fpsyg.2018.00469 Memory-Modulation: Self-Improvement or Self-Depletion? Andrea Lavazza* Neuroethics, Centro Universitario Internazionale, Arezzo, Italy Autobiographical memory is fundamental to the process of self-construction. Therefore, the possibility of modifying autobiographical memories, in particular with memory-modulation and memory-erasing, is a very important topic both from the theoretical and from the practical point of view. The aim of this paper is to illustrate the state of the art of some of the most promising areas of memory-modulation and memory-erasing, considering how they can affect the self and the overall balance of the “self and autobiographical memory” system. Indeed, different conceptualizations of the self and of personal identity in relation to autobiographical memory are what makes memory-modulation and memory-erasing more or less desirable. Because of the current limitations (both practical and ethical) to interventions on memory, I can Edited by: only sketch some hypotheses. However, it can be argued that the choice to mitigate Rossella Guerini, painful memories (or edit memories for other reasons) is somehow problematic, from an Università degli Studi Roma Tre, Italy ethical point of view, according to some of the theories of the self and personal identity Reviewed by: in relation to autobiographical memory, in particular for the so-called narrative theories Tillmann Vierkant, University of Edinburgh, of personal identity, chosen here as the main case of study. Other conceptualizations of United Kingdom the “self and autobiographical memory” system, namely the constructivist theories, do Antonella Marchetti, Università Cattolica del Sacro Cuore, not have this sort of critical concerns. -

Memory Performance and Adaptive Strategies in Younger and Older Adults During Single and Dual Task Conditions

MEMORY PERFORMANCE AND ADAPTIVE STRATEGIES IN YOUNGER AND OLDER ADULTS DURING SINGLE AND DUAL TASK CONDITIONS VICTORIA GRACE COLLIN A thesis submitted in partial fulfilment of the requirements of the University of Greenwich for the Degree of Doctor of Philosophy June 2015 DECLARATION “I certify that this work has not been accepted in substance for any degree, and is not currently being submitted for any degree other than that of Doctor of Philosophy being studied at the University of Greenwich. I also declare that this work is the result of my own investigations except where otherwise identified by references and that I have not plagiarised the work of others.” Student Victoria G Collin Date First Supervisor Dr Sandhiran Patchay Date ii ACKNOWLEDGEMENTS . Firstly I would like to thank my supervisors, Dr Sandhi Patchay, Dr Trevor Thompson and Professor Pam Maras for all of your support and guidance over the years. It’s been a long and sometimes difficult journey, and I really appreciate all of your patience and understanding. I would also like to thank Dr Mitchell Longstaff who encouraged me to embark on this journey, and for all of his help early on as my supervisor. Thanks also to all my colleagues in the department for their advice and encouragement over the years. In particular I would like to thank Dr Claire Monks who was very helpful in her role as Programme Leader- sorry for all of the annoying questions! I would like to thank all of the participants, who offered their precious time to take part in my research.