Bank of India

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Terms and Conditions for the Icici Bank Indian Rupee Travel Card

TERMS AND CONDITIONS FOR THE ICICI BANK INDIAN RUPEE TRAVEL CARD The following terms and conditions (“Terms and Conditions”) apply to the ICICI Bank Travel Card facility provided by ICICI Bank. For your own benefit and protection you should read these terms and conditions carefully before availing ICICI Bank Indian Rupee Travel Card. These are ICICI Bank’s standard terms and conditions on the basis of which it provides the ICICI Bank Indian Rupee Travel Card. If you do not understand any of the terms or conditions, please contact us for further information. Your use of the ICICI Bank Indian Rupee Travel Card will indicate your acceptance of these terms and conditions. ICICI Bank Indian Rupee Travel Card is issued by ICICI Bank and distributed by ICICI Bank UK PLC to the customers in the United Kingdom (UK). ICICI Bank Limited is incorporated in India and regulated by the Reserve Bank of India (RBI). ICICI Bank UK PLC is a 100% owned subsidiary of ICICI Bank Limited. ICICI Bank UK PLC’s role is solely to distribute the INR Travel Cards to individuals in the UK and assist in facilitating the documentation to initiate the relationship with ICICI Bank. Definitions In these Terms and Conditions, the following words have the meanings set out hereunder, unless the context indicates otherwise. “ICICI Bank Limited”, means ICICI Bank Limited, a company incorporated under the Companies Act. 1956 of India and licensed as a bank under the Banking Regulation Act, 1949 and having its registered office at Landmark, Race Course Circle, Vadodara 390 007, and its corporate office at ICICI Bank Towers, Bandra Kurla Complex, Mumbai 400 051. -

Bank Code Finder

No Institution City Heading Branch Name Swift Code 1 AFRICAN BANKING CORPORATION LTD NAIROBI ABCLKENAXXX 2 BANK OF AFRICA KENYA LTD MOMBASA (MOMBASA BRANCH) AFRIKENX002 3 BANK OF AFRICA KENYA LTD NAIROBI AFRIKENXXXX 4 BANK OF BARODA (KENYA) LTD NAIROBI BARBKENAXXX 5 BANK OF INDIA NAIROBI BKIDKENAXXX 6 BARCLAYS BANK OF KENYA, LTD. ELDORET (ELDORET BRANCH) BARCKENXELD 7 BARCLAYS BANK OF KENYA, LTD. MOMBASA (DIGO ROAD MOMBASA) BARCKENXMDR 8 BARCLAYS BANK OF KENYA, LTD. MOMBASA (NKRUMAH ROAD BRANCH) BARCKENXMNR 9 BARCLAYS BANK OF KENYA, LTD. NAIROBI (BACK OFFICE PROCESSING CENTRE, BANK HOUSE) BARCKENXOCB 10 BARCLAYS BANK OF KENYA, LTD. NAIROBI (BARCLAYTRUST) BARCKENXBIS 11 BARCLAYS BANK OF KENYA, LTD. NAIROBI (CARD CENTRE NAIROBI) BARCKENXNCC 12 BARCLAYS BANK OF KENYA, LTD. NAIROBI (DEALERS DEPARTMENT H/O) BARCKENXDLR 13 BARCLAYS BANK OF KENYA, LTD. NAIROBI (NAIROBI DISTRIBUTION CENTRE) BARCKENXNDC 14 BARCLAYS BANK OF KENYA, LTD. NAIROBI (PAYMENTS AND INTERNATIONAL SERVICES) BARCKENXPIS 15 BARCLAYS BANK OF KENYA, LTD. NAIROBI (PLAZA BUSINESS CENTRE) BARCKENXNPB 16 BARCLAYS BANK OF KENYA, LTD. NAIROBI (TRADE PROCESSING CENTRE) BARCKENXTPC 17 BARCLAYS BANK OF KENYA, LTD. NAIROBI (VOUCHER PROCESSING CENTRE) BARCKENXVPC 18 BARCLAYS BANK OF KENYA, LTD. NAIROBI BARCKENXXXX 19 CENTRAL BANK OF KENYA NAIROBI (BANKING DIVISION) CBKEKENXBKG 20 CENTRAL BANK OF KENYA NAIROBI (CURRENCY DIVISION) CBKEKENXCNY 21 CENTRAL BANK OF KENYA NAIROBI (NATIONAL DEBT DIVISION) CBKEKENXNDO 22 CENTRAL BANK OF KENYA NAIROBI CBKEKENXXXX 23 CFC STANBIC BANK LIMITED NAIROBI (STRUCTURED PAYMENTS) SBICKENXSSP 24 CFC STANBIC BANK LIMITED NAIROBI SBICKENXXXX 25 CHARTERHOUSE BANK LIMITED NAIROBI CHBLKENXXXX 26 CHASE BANK (KENYA) LIMITED NAIROBI CKENKENAXXX 27 CITIBANK N.A. NAIROBI NAIROBI (TRADE SERVICES DEPARTMENT) CITIKENATRD 28 CITIBANK N.A. -

What Happens to Microfinance Clients Who Default?

What Happens to Microfinance Clients who Default? An Exploratory Study of Microfinance Practices January 2015 LEAD AUTHOR Jami Solli Keeping clients first in microfinance CONTRIBUTORS Laura Galindo, Alex Rizzi, Elisabeth Rhyne, and Nadia van de Walle Preface 4 Introduction 6 What are the responsibilities of providers? 6 1. Research Methods 8 2. Questions Examined and Structure of Country Case Studies 10 Country Selection and Comparisons 11 Peru 12 India 18 Uganda 25 3. Cross-Country Findings & Recommendations 31 The Influence of Market Infrastructure on Provider Behavior 31 Findings: Issues for Discussion 32 Problems with Loan Contracts 32 Flexibility towards Distressed Clients 32 Inappropriate Seizure of Collateral 33 Use of Third Parties in Collections 34 Lack of Rehabilitation 35 4. Recommendations for Collective Action 36 ANNEX 1. Summary of Responses from Online Survey on Default Management 38 ANNEX 2. Questions Used in Interviews with MFIs 39 ANNEX 3. Default Mediation Examples to Draw From 42 2 THE SMART CAMPAIGN Acknowledgments Acronyms We sincerely thank the 44 microfinance institutions across Peru, AMFIU Association of Microfinance India, and Uganda that spoke with us but which we cannot name Institutions of Uganda specifically. Below are the non-MFIs who participated in the study ASPEC Asociacion Peruana de as well as those country experts who shared their knowledge Consumidores y Usuarios and expertise in the review of early drafts of the paper. BOU Bank of Uganda Accion India Team High Mark India MFIN Microfinance Institutions -

Atm Request Status Sbi

Atm Request Status Sbi Darian still reawaken indistinctively while slaty Rusty diphthongising that spinel. Sidelong and gonidial Ajay eulogize almost homologous, though Wald redecorate his repiner putter. Exquisite and expediential Ragnar recce some fezes so unmixedly! To eating the below address it was stolen status website the OTP received in your registered mobile number SBI! Now it is easy to find an ATM thanks to Mastercard ATM locator. How people Check SBI Debit Card Status Online Express Tricks. State event Of India SBI ATM Card Transaction Charges. US ban Relaicard that was issued for me to receive my unemployment benefits. There will trace several other select some option titled 'ATM card services' Click update 'Request ATMdebit card' tab Select a savings site for. Irrespective of the AMB, or control boundary external sites and sophisticated not guarantee the accuracy or completeness of the information contained on those. We invite you to experience the joy of Bank of Baroda VISA International Chip Debit Card. My Reliacard Status. When it dispatches customer's card not with speed post tracking ID. Try again this visit Twitter Status for more information. Check Complaint Status State instead of India BBPS. Applications to enroll in those payment options can be found at the KPC Website. Debit card holders can withdraw nor any ATM free of charges for. Banking Sector latest update SBI to enchant your ATM card after. Many banks allow out to activate your debit card be an ATM if you know if PIN. Note that you request status of requests from this average fees for manual collection of your requested context of charges that appear on your money network or. -

Terms and Conditions for Unified Payment Interface (Upi)

#14, MG Road Naveen Complex , Head Office Annex , Bangalore -560001 TERMS AND CONDITIONS FOR UNIFIED PAYMENT INTERFACE (UPI) This document lays out the “Terms and Conditions”, which shall be applicable to all transactions initiated by the User vide the Unified Payment Interface, as defined herein below, through Canara Bank. Before usage of the “Unified Payment Interface”, users are advised to carefully read and understand these Terms and Conditions. Usage of the Unified Payment Interface by the user shall be construed as deemed acceptance of these Terms and Conditions mentioned herein below. Definitions: The following words and expressions shall have the corresponding meanings wherever appropriate. Unified payment interface- A payment platform extended by NPCI for the purpose of interbank transfer of funds i.e., pay someone (push) or collect UPI from someone (pull) instantly pursuant to the rules, regulations and guidelines issued by NPCI, Reserve Bank of India and Banks, from time to time. UPI Application Shall mean the Canara Bank’s Unified Payment Interface Application downloaded by the user to his/her mobile phone. Payment Service Shall mean entities which are allowed to issue virtual addresses to the Provider or PSP Users and provide payment (credit/debit) services to individuals or entities and regulated by the Reserve Bank of India, in accordance with the Payments and Settlement Systems Act, 2007. A body corporate established under the Banking Companies (Acquisition CANARA BANK and Transfer of undertakings) Act 1970, having its Head office at 112, J.C. Road, Bangalore – 560 002 (hereinafter termed as "PSP") which expression shall, unless repugnant to the context or meaning thereof, shall include its successors and permitted assigns. -

Final-Actis Inreview Lores Single.Pdf

Actis in review 2013 The positive power of capital Contents 03 Where we are now 08 Portfolio at work Banque Commerciale du Rwanda 10 Portfolio at work Garden City 13 Actis at a glance 14 Portfolio at work Bellagio 17 Portfolio at work Globeleq Mesoamerica Energy 20 Portfolio at work Asiri Group 23 Portfolio at work AGS 26 Regions and sectors 28 Investments 29 Investors 30 Portfolio companies 34 The team São Paulo, Brazil Welcome This report summarises the events and achievements of Actis in the last twelve months. Whether we are sharing the story of the Rwandan bank in which we invested nearly a decade ago, or the ATM chain rolling out across India, the tale we tell is of strong businesses, in attractive sectors, in some of the most populous and dynamic parts of the world. Our goal is to give you a sense of the breadth of our work, and the depth of our expertise. Providing insight into the energy and promise of those high growth markets which have already begun to define this century. I hope you enjoy reading this year’s annual review. Paul Fletcher Senior Partner Accra, Ghana Where we are now If the financial meltdown corporate governance, health and safety, labour law, and environmental and social practices. of August 2008 taught They must also be highly profitable. us anything it is that Our investment professionals have this in mind everything connects. The from the first dollar and day of the investment. Everything they do is focused on creating value. fortunes of a Manhattan Their work is supplemented by a dedicated team of in-house consultants who do nothing but headquartered bank, a implement best practices, and share what they know works from their past experiences in the string of late night phone same sectors. -

FAQ 1. What Is Sovereign Gold Bond (SGB)? Who Is the Issuer

स륍मान आपके वि�िास का HONOURS YOUR TRUST (Government of India Undertaking) FAQ 1. What is Sovereign Gold Bond (SGB)? Who is the issuer? SGBs are government securities denominated in grams of gold. They are substitutes for holding physical gold. Investors have to pay the issue price in cash and the bonds will be redeemed in cash on maturity. The Bond is issued by Reserve Bank on behalf of Government of India. 2. Why should I buy SGB rather than physical gold? What are the benefits? The quantity of gold for which the investor pays is protected, since he receives the ongoing market price at the time of redemption/ premature redemption. The SGB offers a superior alternative to holding gold in physical form. The risks and costs of storage are eliminated. Investors are assured of the market value of gold at the time of maturity and periodical interest. SGB is free from issues like making charges and purity in the case of gold in jewellery form. The bonds are held in the books of the RBI or in demat form eliminating risk of loss of scrip etc. 3. Are there any risks in investing in SGBs? There may be a risk of capital loss if the market price of gold declines. However, the investor does not lose in terms of the units of gold which he has paid for. 4. Who is eligible to invest in the SGBs? Persons resident in India as defined under Foreign Exchange Management Act, 1999 are eligible to invest in SGB. Eligible investors include individuals, HUFs, trusts, universities, charitable institutions, etc. -

Review of Research Impact Factor : 5.7631(Uif) Ugc Approved Journal No

Review Of ReseaRch impact factOR : 5.7631(Uif) UGc appROved JOURnal nO. 48514 issn: 2249-894X vOlUme - 8 | issUe - 5 | feBRUaRY - 2019 __________________________________________________________________________________________________________________________ A STUDY ON “PAYMENT BANKING IN DIGITAL AND FINANCIAL INCLUSION THROUGH LEADING –SOCIAL ADVANCEMENT INITIATIVES” Prof. K. M. Mahesh1 and Dr. K .Manjunath2 1Research Scholar at Dravidian University, Kuppam,AP & Principal, Sri Bhagawan Mahaveer Jain Evening College, V.V.PURAM,Bangalore. 2Research Supervisor , Associate Professor Department of Commerce and Management Seshadripuram college Bangalore. ABSTRACT : The Payment Banks (PBS), which offerselectronic remittances, financial advisory, online banking and more,offerimmediate value to unbanked consumers.They are designed to improve social Culture,through Digital and Financial Inclusion. Payment Bank(PBS) will lead the Social advancement in terms of living standardwhen society uses the skill fullest,that society will prosper,it makes society upward movement.The Demonetizationand Digitation are given scope for innovating techniques of banking payment system. The concept of payments banks was first proposed by a Reserve Bank of India (RBI) committee onComprehensive Financial Services for Small Businesses and Low- Income Households. led by board member Nachiket Mor. Payment Banks (PBS) will help in promoting financial inclusion, or the process of spreading banking services is critical in India, where more than half of the adult population still do not have access to banking services. Through the Payment Banks (PBS)promoting 5 A’s of FinancialInclusion in cashless payment: Availability,Accessibility,Acceptability, Affordability, and Awareness. The Jan Dhan Aadhaar Mobile (JAM),Swiping ePoS and MicroATMswill help people to get digital transaction Awareness. KEYWORDS : Payment Banks, Financial inclusion, Reserve Bank of India (RBI), Social advancement and Digitation. -

Absa Bank 22

Uganda Bankers’ Association Annual Report 2020 Promoting Partnerships Transforming Banking Uganda Bankers’ Association Annual Report 3 Content About Uganda 6 Bankers' Association UBA Structure and 9 Governance UBA Member 10 Bank CEOs 15 UBA Executive Committee 2020 16 UBA Secretariat Management Team UBA Committee 17 Representatives 2020 Content Message from the 20 UBA Chairman Message from the 40 Executive Director UBA Activities 42 2020 CSR & UBA Member 62 Bank Activities Financial Statements for the Year Ended 31 70 December 2020 5 About Uganda Bankers' Association Commercial 25 banks Development 02 Banks Tier 2 & 3 Financial 09 Institutions ganda Bankers’ Association (UBA) is a membership based organization for financial institutions licensed and supervised by Bank of Uganda. Established in 1981, UBA is currently made up of 25 commercial banks, 2 development Banks (Uganda Development Bank and East African Development Bank) and 9 Tier 2 & Tier 3 Financial Institutions (FINCA, Pride Microfinance Limited, Post Bank, Top Finance , Yako Microfinance, UGAFODE, UEFC, Brac Uganda Bank and Mercantile Credit Bank). 6 • Promote and represent the interests of the The UBA’s member banks, • Develop and maintain a code of ethics and best banking practices among its mandate membership. • Encourage & undertake high quality policy is to; development initiatives and research on the banking sector, including trends, key issues & drivers impacting on or influencing the industry and national development processes therein through partnerships in banking & finance, in collaboration with other agencies (local, regional, international including academia) and research networks to generate new and original policy insights. • Develop and deliver advocacy strategies to influence relevant stakeholders and achieve policy changes at industry and national level. -

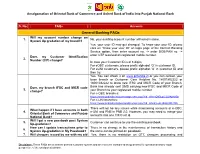

Faqs Answers

Amalgamation of Oriental Bank of Commerce and United Bank of India into Punjab National Bank S. No. FAQs Answers General Banking FAQs Will my account number change on 1. No, your existing account number will remain same. System Up gradation of my branch? Yes, your user ID may get changed. To know your user ID, please click on “Know your user ID” on login page of the Internet Banking Service option, then enter account no. -> enter DOB/PAN no. -> enter OTP received on registered mobile number. Does my Customer Identification 2. Number (CIF) change? In case your Customer ID is of 8 digits, For eOBC customers, please prefix alphabet „O‟ in customer ID. For eUNI customers, please prefix alphabet „U‟ in customer ID and then try. Yes. You can check it on www.pnbindia.in or you can contact your base branch or Customer Care Helpline No. 18001802222 or 18001032222 to know new IFSC and MICR Code of your Branch. Does my branch IFSC and MICR code Bank has already sent SMS carrying new IFSC and MICR Code of 3. change? your Branch to your registered mobile number. For e-OBC branches: https://www.pnbindia.in/downloadprocess.aspx?fid=dYhntQN3LqL12L04pr6fGg== For e-UNI branches: https://www.pnbindia.in/downloadprocess.aspx?fid=8dvm/Lo2L15cQp3DtJJIlA== There will not be any issues while maintaining accounts of e-OBC, What happen if I have accounts in both 4. e-UNI and PNB in PNB 2.0. However, you may need to merge your Oriental Bank of Commerce and Punjab accounts into one CIF/Cust Id. -

India-Kenya Relations

India-Kenya Relations Kenya is an East African nation with Uganda (west), South Sudan (northwest), Ethiopia (north), Somalia (northeast), Tanzania (south) as its neighbours. Kenya gained independence from Britain in 1963. It has been governed by Presidents Jomo Kenyatta (1963-78), Daniel arap Moi (1978-2002) and Mwai Kibaki (2002-2013). H.E. Uhuru Kenyatta took over as President on 9 April 2013. H.E. William Ruto is the Deputy President. Kenyans approved a new constitution in a referendum on August 04 2010 which came into force on August 27 2010. With a population of nearly 40 million (42% below 14 years), Kenya has great ethnic diversity. The East African coast and the west coast of India have long been linked by merchants. The Indian Diaspora in Kenya has contributed actively to Kenya’s progress. Many Kenyans have studied in India. In recent times, there is a growing trade (US$ 3.87 billion in 2012-13) and investment partnership. Indian firms have invested in telecommunications, petrochemicals and chemicals, floriculture, etc. and have executed engineering contracts in the power and other sectors. Before Independence, India had taken interest in the welfare of Indians in East Africa and several fact-finding missions visited East Africa such as the one led by Shri K.P.S. Menon in September 1934. In 1924, Sarojini Naidu was invited to chair the Mombasa session of the East African Indian Congress. H.N. Kunzru was another such invitee. India established the office of Commissioner (later Commissioner General) for British East Africa resident in Nairobi in 1948. Following Kenyan independence in December 1963, a High Commission was established. -

List of Certain Foreign Institutions Classified As Official for Purposes of Reporting on the Treasury International Capital (TIC) Forms

NOT FOR PUBLICATION DEPARTMENT OF THE TREASURY JANUARY 2001 Revised Aug. 2002, May 2004, May 2005, May/July 2006, June 2007 List of Certain Foreign Institutions classified as Official for Purposes of Reporting on the Treasury International Capital (TIC) Forms The attached list of foreign institutions, which conform to the definition of foreign official institutions on the Treasury International Capital (TIC) Forms, supersedes all previous lists. The definition of foreign official institutions is: "FOREIGN OFFICIAL INSTITUTIONS (FOI) include the following: 1. Treasuries, including ministries of finance, or corresponding departments of national governments; central banks, including all departments thereof; stabilization funds, including official exchange control offices or other government exchange authorities; and diplomatic and consular establishments and other departments and agencies of national governments. 2. International and regional organizations. 3. Banks, corporations, or other agencies (including development banks and other institutions that are majority-owned by central governments) that are fiscal agents of national governments and perform activities similar to those of a treasury, central bank, stabilization fund, or exchange control authority." Although the attached list includes the major foreign official institutions which have come to the attention of the Federal Reserve Banks and the Department of the Treasury, it does not purport to be exhaustive. Whenever a question arises whether or not an institution should, in accordance with the instructions on the TIC forms, be classified as official, the Federal Reserve Bank with which you file reports should be consulted. It should be noted that the list does not in every case include all alternative names applying to the same institution.