Japan's Initiative for Fintech Innovation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

News Release SRI International / Nomura Holdings Nomura-SRI Innovation Center Will Begin Operations in July to Accelerate Adopti

Nomura-SRI Innovation Center Will Begin Operations in July to Accelerate Adoption of Emerging Technologies Among Japanese Corporations SRI International and Nomura Will Support Japanese Businesses Through the Process of Evaluating and Bringing New Technology to Market MENLO PARK, Calif., PRNewswire, June 22, 2021: SRI International (SRI) and Nomura announced today that the Nomura-SRI Innovation Center (NSIC), located on SRI’s main campus in Menlo Park, Calif., will begin operations in July 2021. For industry leading businesses, keeping ahead of emerging technologies is vital to continued global success and growth. As NSIC members, Japanese enterprises will be connected with pioneering R&D labs, university research teams, as well as Silicon Valley incubators and startups that are relevant to their industries and specific investments. NSIC will help members acquire and cultivate best practices for identifying and evaluating emerging technologies. It will enhance their adoption of next-generation innovation, allowing members to optimize the value of their technology investments. SRI and Nomura welcome Harmonic Drive Systems Inc., Murata Manufacturing Co., Ltd., Nomura Research Institute, Ltd., Obayashi Corporation and Shizuoka Bank Ltd. as charter members scheduled to participate in July. “Here at NSIC, we’re excited to work with these market-leading companies to support their internal technology, research and innovation teams,” said Chris Cowart, managing director of NSIC. “Our charter members bring a spectrum of industry insights to NSIC’s Silicon Valley immersion program. We will be working closely with each member to share best practices, exclusive partner connections and tailored expertise relevant to their business goals for emerging technologies.” “At Nomura, we know that technology investments are vital to the future growth of our clients and partners in Japan,” commented Neeraj Hora, head of innovation and investment at Nomura Holding America Inc. -

Nber Working Paper Series Did Mergers Help Japanese

NBER WORKING PAPER SERIES DID MERGERS HELP JAPANESE MEGA-BANKS AVOID FAILURE? ANALYSIS OF THE DISTANCE TO DEFAULT OF BANKS Kimie Harada Takatoshi Ito Working Paper 14518 http://www.nber.org/papers/w14518 NATIONAL BUREAU OF ECONOMIC RESEARCH 1050 Massachusetts Avenue Cambridge, MA 02138 December 2008 The paper started as a joint project with Dr. Kelly Wang when she was Assistant Professor at University of Tokyo. The authors are grateful to her for her help in providing us with computer programs and in discussion the ways to apply her methods to the Japanese banking data. Upon Dr. Wang's departure from the University of Tokyo, the project was carried on by the current two authors with full consent from Dr. Wang. The current two authors take responsibility for any remaining errors. Mr. Shuhei Takahashi provided us with superb research assistance. We are grateful for financial support from Nomura foundation for social science and Chuo University for Special Research. We are also grateful for helpful discussions with Masaya Sakuragawa, Naohiko Baba, Satoshi Koibuchi, Woo Joong Kim, Joe Peek, Kazuo Kato and for insigutful comments from participants in Asia pacific Economic Association in Hong Kong in 2007, Japan Economic Association in 2008, NBER Japan Group Meeting in 2008 and Asian FA-NFA 2008 International Conference. The views expressed herein are those of the author(s) and do not necessarily reflect the views of the National Bureau of Economic Research. NBER working papers are circulated for discussion and comment purposes. They have not been peer- reviewed or been subject to the review by the NBER Board of Directors that accompanies official NBER publications. -

Portfolio of Investments

PORTFOLIO OF INVESTMENTS Variable Portfolio – Partners International Value Fund, September 30, 2020 (Unaudited) (Percentages represent value of investments compared to net assets) Investments in securities Common Stocks 97.9% Common Stocks (continued) Issuer Shares Value ($) Issuer Shares Value ($) Australia 4.2% UCB SA 3,232 367,070 AMP Ltd. 247,119 232,705 Total 13,350,657 Aurizon Holdings Ltd. 64,744 199,177 China 0.6% Australia & New Zealand Banking Group Ltd. 340,950 4,253,691 Baidu, Inc., ADR(a) 15,000 1,898,850 Bendigo & Adelaide Bank Ltd. 30,812 134,198 China Mobile Ltd. 658,000 4,223,890 BlueScope Steel Ltd. 132,090 1,217,053 Total 6,122,740 Boral Ltd. 177,752 587,387 Denmark 1.9% Challenger Ltd. 802,400 2,232,907 AP Moller - Maersk A/S, Class A 160 234,206 Cleanaway Waste Management Ltd. 273,032 412,273 AP Moller - Maersk A/S, Class B 3,945 6,236,577 Crown Resorts Ltd. 31,489 200,032 Carlsberg A/S, Class B 12,199 1,643,476 Fortescue Metals Group Ltd. 194,057 2,279,787 Danske Bank A/S(a) 35,892 485,479 Harvey Norman Holdings Ltd. 144,797 471,278 Demant A/S(a) 8,210 257,475 Incitec Pivot Ltd. 377,247 552,746 Drilling Co. of 1972 A/S (The)(a) 40,700 879,052 LendLease Group 485,961 3,882,083 DSV PANALPINA A/S 15,851 2,571,083 Macquarie Group Ltd. 65,800 5,703,825 Genmab A/S(a) 1,071 388,672 National Australia Bank Ltd. -

【Major Bank】都市銀行 【Local Bank】地方銀行 【Second Regional

【Major bank】都市銀行 Mizuho Bank / Sumitomo Mitsui Banking Corporation / Saitama Resona Bank Mitsubishi UFJ Bank / Resona Bank (5 in total) 【Local bank】地方銀行 Hokkaido Bank / Yamanashi Central Bank /Saningodo Bank Aomori Bank / Hachijuni Bank / Chugoku Bank Michinoku Bank / Hokuriku Bank /Hiroshima Bank Akita Bank / Toyama Bank / Yamaguchi Bank Hokuto Bank / Hokkoku Bank/ Awa Bank Shonai Bank / Fukui Bank/ Hyakujuyon Bank Yamagata Bank / Shizuoka Bank / Iyo Bank Iwate Bank / Suruga Bank/ Shikoku Bank Tohoku Bank / Shimizu Bank / Fukuoka Bank ShichijushichiBank / Ogaki Kyoritsu Bank / Chikuho Bank Toho Bank / Juroku Bank / Saga Bank Gunma Bank Mie Bank Juhachi Bank Ashikaga Bank / Hyakugo Bank / Shinwa Bank Joyo Bank / Shiga Bank Higo Bank Tsukuba Bank Kyoto Bank Oita Bank Musashino Bank / Kansai Mirai Bank / Miyazaki Bank Chiba Bank / IkedaSenshu Bank / Kagoshima Bank Chiba Kogyo Bank / Nanto Bank /Ryukyu Bank Yokohama Bank / Kiyo Bank / Okinawa Bank Daiyon Bank / Tajima Bank / Nishinihon City Bank HuKuetsu Bank / Tottori bank / Kitakyushu Bank (63 in total) 【Second Regional Bank Member Bank】第二地銀協加盟銀行 Hokuyo Bank Daiko Bank Shimane Bank Kirayaka Bank Nagano Bank Tomato Bank Kitanihon Bank Toyama Daiichi Bank Momiji Bank Sendai Bank Shizuokachuo Bank Saikyo Bank Fukushima Bank Aichi Bank Tokushima Bank Daito Bank Nagoya Bank Kagawa Bank Towa Bank Chukyo Bank Ehime Bank Tochigi Bank Daisan Bank Kochi Bank Tokyo Star Bank Taisho Bank Kumamoto Bank Kanagawa Bank Minato Bank (29 in total) 【Trust bank-Shintaku Ginko】信託銀行 Mitsubishi UFJ Trust Bank -

2020 年度-12/31/20 現在)

寄付ご支援を頂いた企業・団体・個人の方々は下記の通りです。 (2020 年度-12/31/20 現在) $20,000 and up $1,000 and up (under $5,000) continued Mizuho Bank, Ltd. The Norinchukin Bank, Ltd. MUFG Union Bank, N. A. NTT America, Inc. SMBC Global Foundation, Inc. NYK Line (North America), Inc. Panasonic Corp. of North America $10,000 and up (under $20,000) Relo Redac, Inc. SCSK USA Inc. ITOCHU International Showa Denko America Inc. Marubeni America Corp. Sompo Japan Insurance Inc. Mitsubishi Corporation (Americas) Sony Corporation of America Mitsui & Co.(U.S.A.), Inc. Sumitomo Chemical America, Inc. Sumitomo Corporation of Americas Foundation Sumitomo Life Insurance Company, NY Rep.Office Sumitomo Mitsui Finance and Leasing Co., Ltd. $5,000 and up (under $10,000) Sumitomo Mitsui Trust Bank, Ltd. Sumitomo Seika America, Inc. Fujifilm Holdings America Corp. Suntory America Inc. Nippon Express Foundation, Inc. Tokio Marine & Nichido Fire Insurance Co., Ltd. Toray Industries (America), Inc. $1,000 and up (under $5,000) Under $1,000 All Nippon Airways Co., Ltd. Asahi Kasei America, Inc. Marubeni-Itochu Steel America, Inc. Casio America, Inc. The Gunma Bank, Ltd. Daiwa Capital Markets America, Inc. The Shizuoka Bank, Ltd. DNP America, LLC The Shoko Chukin Bank, Ltd. Eneros Americas Inc. EOS Accountants LLP Hanwa American Corp. Hitachi America, Ltd. Ito En (North America) Inc. Janome America, Inc. Japan Airlines Co., Ltd. Japan Bank for International Cooperation JFE Steel America, Inc. Kajima Building & Design Group, Inc. Kaneka America Holding, Inc. Kowa American Corp. Kyowa Hakko USA, Inc. Mitsubishi Gas Chemical America, Inc. Mitsubishi UFJ Trust & Banking Corp. Mitsui Chemicals America, Inc. -

Japan 500 2008 A-Z

FTJapan 500 2008 A-Z Japan rank Company 2008 Abc-Mart 349 Access 451 Acom 199 Advantest 167 Aeon 87 Aeon Credit Service 333 Aeon Mall 172 Aiful 282 Aioi Insurance 202 Air Water 377 Aisin Seiki 76 Ajinomoto 122 Alfresa 246 All Nippon Airways 99 Alps Electric 373 Amada 260 Aoyama Trading 430 Aozora Bank 177 Aruze 296 Asahi Breweries 85 Asahi Glass 57 Asahi Kasei 116 Asatsu-DK 404 Asics 309 Astellas Pharma 36 Awa Bank 459 Bank of Iwate 480 Bank of Kyoto 196 Bank of Nagoya 474 Bank of Yokohama 88 Benesse 175 Bosch 363 Bridgestone 54 Brother Industries 273 Canon 6 Canon Sales 274 Capcom 315 Casio Computer 209 Central Japan Railway 31 Chiba Bank 138 Chiyoda 381 Chubu Electric Power 39 Chugai Pharmaceuticals 132 Chugoku Bank 243 Chugoku Electric Power 104 Circle K Sunkus 432 Citizen Watch 253 Coca-Cola West Japan 285 Comsys 478 Cosmo Oil 287 Credit Saison 170 CSK 364 Dai Nippon Printing 73 Daicel Chemical Industries 358 Daido Steel 319 Daifuku 436 Daihatsu Motor 169 Daiichi Chuo Kisen 357 Daiichi Sankyo 34 Daikin Industries 60 Dainippon Sumitomo Pharma 225 Daiseki 458 Daishi Bank 442 Daito Trust Construction 125 Daiwa House Industry 143 Daiwa Securities Group 65 Davinci Advisors 495 Dena 259 Denki Kagaku Kogyo 415 Denso 24 Dentsu 130 Diamond Lease 276 DIC 297 Disco 433 Don Quijote 469 Dowa Mining 367 East Japan Railway 20 Ebara 473 Eisai 83 Electric Power Development 139 Elpida Memory 197 Exedy 453 Ezaki Glico 371 Familymart 231 Fanuc 32 Fast Retailing 89 Fuji Electric 261 Fuji Fire & Marine Insurance 479 Fuji Heavy Industries 247 Fuji Photo -

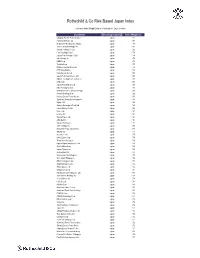

R&Co Risk-Based Japan Index

Rothschild & Co Risk-Based Japan Index Indicative Index Weight Data as of June 30, 2021 on close Constituent Exchange Country Index Weight(%) McDonald's Holdings Co Japan L Japan 1.29 Idemitsu Kosan Co Ltd Japan 1.12 SoftBank Corp Japan 1.05 Nintendo Co Ltd Japan 0.86 Hitachi Metals Ltd Japan 0.83 Yakult Honsha Co Ltd Japan 0.82 Iwatani Corp Japan 0.81 ENEOS Holdings Inc Japan 0.79 FUJIFILM Holdings Corp Japan 0.78 KDDI Corp Japan 0.75 Toshiba Corp Japan 0.73 Calbee Inc Japan 0.73 Ajinomoto Co Inc Japan 0.72 Eisai Co Ltd Japan 0.72 Nissin Foods Holdings Co Ltd Japan 0.71 Morinaga Milk Industry Co Ltd Japan 0.70 Japan Tobacco Inc Japan 0.66 H.U. Group Holdings Inc Japan 0.66 JCR Pharmaceuticals Co Ltd Japan 0.64 MEIJI Holdings Co Ltd Japan 0.64 Yamazaki Baking Co Ltd Japan 0.63 Chugoku Electric Power Co Inc/ Japan 0.63 Nippon Gas Co Ltd Japan 0.63 PeptiDream Inc Japan 0.62 Chubu Electric Power Co Inc Japan 0.62 Seven & i Holdings Co Ltd Japan 0.62 FP Corp Japan 0.61 Pola Orbis Holdings Inc Japan 0.61 Lion Corp Japan 0.61 Shiseido Co Ltd Japan 0.60 Nippon Telegraph & Telephone C Japan 0.60 Nichirei Corp Japan 0.59 Japan Post Bank Co Ltd Japan 0.59 Kobayashi Pharmaceutical Co Lt Japan 0.59 Anritsu Corp Japan 0.58 Skylark Holdings Co Ltd Japan 0.58 Kyowa Kirin Co Ltd Japan 0.58 Lawson Inc Japan 0.58 Suntory Beverage & Food Ltd Japan 0.57 Kinden Corp Japan 0.57 MS&AD Insurance Group Holdings Japan 0.56 Shimano Inc Japan 0.56 Mitsubishi Corp Japan 0.56 Zensho Holdings Co Ltd Japan 0.56 Tokai Carbon Co Ltd Japan 0.56 Japan Post Holdings Co Ltd -

Custody Newsflash

The Bank of Tokyo-Mitsubishi UFJ, Ltd. Transaction Services Division Custody Newsflash June 21, 2016 Fitch Revised Outlook for Japanese Financial Institutions to Negative =============================================================================== Category Japanese Government Bond Issues Summary On June 16, 2016, Fitch Ratings revised the rating Outlooks for Japanese financial institutions to Negative from Stable. The IDRs have been affirmed. The Outlook revision for the financial institutions' IDRs follows the affirmation of Japan's sovereign rating at 'A' and revision of the Outlook to Negative from Stable on 13 June 2016. Impact This Newsflash is sent as general information. Action No immediate action is required. =============================================================================== The following article is compiled from Fitch Ratings and BTMU’s own sources. On June 16, 2016, Fitch Ratings revised the rating Outlooks for Mitsubishi UFJ Financial Group, Inc. (MUFG) and its subsidiaries, Sumitomo Mitsui Financial Group, Inc. (SMFG) and its subsidiaries, Mizuho Financial Group, Inc. (MHFG) and its subsidiaries, The Shizuoka Bank, Ltd. (Shizuoka), Nomura Holdings, Inc. (Nomura) and its subsidiaries and Daiwa Securities Group Inc. (Daiwa) and its subsidiaries to Negative from Stable. The IDRs have been affirmed. The Outlook revision for the financial institutions' IDRs follows the affirmation of Japan's sovereign rating at 'A' and revision of the Outlook to Negative from Stable on 13 June 2016. The revision of the Outlooks on Japanese financial institutions to Negative from Stable reflects the following factors:- MUFG and its listed subsidiary banks/SMFG and its subsidiary banks/Shizuoka Fitch views these entities' Viability Ratings (VRs) are now effectively constrained by the sovereign rating. Their still high exposure to Japanese government bonds (JGBs), despite reductions in the past few years, makes them unlikely to avoid failure in the event of a sovereign default even though their intrinsic profiles otherwise remain broadly stable. -

Rothschild & Co Risk-Based Japan Index

Rothschild & Co Risk-Based Japan Index Indicative Index Weight Data as of January 31, 2020 on close Constituent Exchange Country Index Weight (%) Chugoku Electric Power Co Inc/ Japan 1.01 Yamada Denki Co Ltd Japan 0.91 McDonald's Holdings Co Japan L Japan 0.88 Sushiro Global Holdings Ltd Japan 0.82 Skylark Holdings Co Ltd Japan 0.82 Fast Retailing Co Ltd Japan 0.78 Japan Post Holdings Co Ltd Japan 0.78 Ain Holdings Inc Japan 0.78 KDDI Corp Japan 0.77 Toshiba Corp Japan 0.75 Mizuho Financial Group Inc Japan 0.74 NTT DOCOMO Inc Japan 0.73 Kobe Bussan Co Ltd Japan 0.72 Japan Post Insurance Co Ltd Japan 0.69 Nippon Telegraph & Telephone C Japan 0.69 LINE Corp Japan 0.69 Japan Post Bank Co Ltd Japan 0.68 Nitori Holdings Co Ltd Japan 0.67 MS&AD Insurance Group Holdings Japan 0.66 Konami Holdings Corp Japan 0.66 Kyushu Electric Power Co Inc Japan 0.65 Sumitomo Realty & Development Japan 0.65 Fujitsu Ltd Japan 0.63 Suntory Beverage & Food Ltd Japan 0.63 Japan Airlines Co Ltd Japan 0.62 NEC Corp Japan 0.61 Lawson Inc Japan 0.60 Sekisui House Ltd Japan 0.60 ABC-Mart Inc Japan 0.60 Kyushu Railway Co Japan 0.60 ANA Holdings Inc Japan 0.59 Mitsubishi Heavy Industries Lt Japan 0.58 ORIX Corp Japan 0.57 Secom Co Ltd Japan 0.57 Seiko Epson Corp Japan 0.56 Trend Micro Inc/Japan Japan 0.56 Nippon Paper Industries Co Ltd Japan 0.56 Suzuki Motor Corp Japan 0.56 Japan Tobacco Inc Japan 0.55 Aozora Bank Ltd Japan 0.55 Sony Financial Holdings Inc Japan 0.55 West Japan Railway Co Japan 0.54 MEIJI Holdings Co Ltd Japan 0.54 Sugi Holdings Co Ltd Japan 0.54 Tokyo -

Nomura Holdings, Inc. Notice of Convocation of the 116Th Annual General Meeting of Shareholders (PDF)

2020/05/26 10:25:48 / 20635858_野村ホールディングス株式会社_招集通知 This document is a translation of the Japanese language original prepared solely for convenience of reference (certain portions of the Japanese language original applicable to voting procedures in Japan that are not applicable to shareholders outside Japan have been omitted). In the event of any discrepancy between this translated document and the Japanese language original, the Japanese language original shall prevail. Please note that certain portions of this document may not be applicable to shareholders outside Japan. NOMURA Notice of Convocation of the 116th Annual General Meeting of Shareholders Nomura Holdings, Inc. Cover 2020/05/26 10:25:48 / 20635858_野村ホールディングス株式会社_招集通知 To Our Shareholders I would like to take this opportunity to thank all of you, our shareholders, for your ongoing support. In the fiscal year ended March 31, 2020, we focused on delivering solutions to meet the diverse needs of clients, by working on the firm-wide initiative of business platform rebuilding announced in April 2019. Retail Division secured profit on par with the previous year’s level, while putting in place a structure for delivering better services through such initiatives as drastic re-allocation of sales partners and branch office consolidation. Asset Management Division has enjoyed fund inflows for 15 consecutive quarters. Wholesale Division achieved a significant recovery in revenue centering on trading business, while winning top positions in Japan-related M&A and IPO league tables. As a result, in the fiscal year ended March 31, 2020, the Group’s net revenue (after interest expenses) totaled 1,287.8 billion yen, having significantly increased year over year. -

Previous Investor Attendees Include

Previous investor attendees include: Advantest Corporate Pension Fund Hulic Aflac Asset Management Japan Idemitsu Pension Fund Aozora Bank Itochu Corp Asahi Mutual Life Insurance Japan Bank for International Cooperation Asset Management One Japan Co-Op Insurance Consumers' Co- Operative Federation AXA Life Insurance Japan IT Software Pension Fund Bank of Yokohama Japan Post Bank BOT Lease JF Kyosuiren Canon JJK China Ping An Insurance Overseas (Holdings) KDDI Daido Life Insurance KDDI Corporate Pension Fund Daiwa House Industry Pension Fund Khazanah Nasional Berhad Daiwa SB Investments Manulife Asset Management DBJ Asset Management Manulife Capital DLI North America Inc. (Dai-ichi Life Meiji Yasuda Life Insurance Group) Mitsubishi Corporation Asset Management Farmers’ Pension Fund Mitsubishi Electric Pension Fund Fuji Xerox Mitsubishi UFJ GIC Mitsubishi UFJ Lease and Finance Government Pension Investment Fund Mitsui Sumitomo Insurance (GPIF) Mitsui Sumitomo Primary Life Insurance Hanwha Asset Management (MSPL) Hitachi Nara Chuo Shinkin Bank Sekisui Pension Fund National Federation of Mutual Aid Shimizu Corporation Associations For Municipal Personnel Shinkin Central Bank National Kyosai Federation of Japan Shinsei Bank Agricultural Cooperatives (ZENKYOREN) Sompo Japan Nipponkoa Insurance National Pension Fund Association Sony Bank Nihon Unisys Ltd Sumitomo Life Insurance Nissay Asset Management Corporation Sumitomo Mitsui Banking Corporation Nomura Asset Management Pension Fund Nomura Funds Research & Technologies Sumitomo Mitsui Trust -

Shizuoka Bank Group Annual Report 2018

Shizuoka Bank Group Annual Report 2018 005_0254585843008.indd 3 2018/08/10 15:40:39 Economic Overview of Shizuoka Prefecture Osaka Industrial Characteristics Tokyo Shizuoka Prefecture is situated midway between the two major con- regional economy. We expect Shizuoka sumer markets and industrial centers of Japan — the Nagoya region that Shizuoka prefecture will be plus the Osaka-Kyoto region to the west, and the Yokohama-Tokyo more internationalized, stimulat- region to the east. Because of this location at a busy “crossroads” of ing the interchange of people the nation, it has historically developed into a significant center of and ideas with the major urban manufacturing industry. The convenient location of Shizuoka centers of Eastern Asia, and act Prefecture in transportation terms has caused the growth of a strong as an important driving force for the regional economy. industrial base. The prefecture is one of the country’s leading manu- In recent years the prefectural authorities have been operating a facturing areas. The wide variety of industries represented within number of schemes to encourage companies in the medical treat- Shizuoka has led to it being dubbed “the industrial department store.” ment, pharmaceuticals, chemicals, and optical technology industries, Corporations active in Shizuoka include world-leading enterprises among others, to set up operations in the so-called “Shizuoka Triangle such as Toyota, Honda, Suzuki, and Yamaha, and the prefecture is Research Cluster” (spread across the prefecture’s eastern, central, renowned for its concentration of export-oriented manufacturing com- and western districts) as a means of developing a next-generation panies. Many of these firms have set up production subsidiaries industrial base.