Guide on Local Housing Allowance

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Introduction Shelter Scotland Welcomes the Opportunity To

SSC/S5/19/SSH/12 SOCIAL SECURITY COMMITTEE SOCIAL SECURITY SUPPORT FOR HOUSING SUBMISSION FROM SHELTER SCOTLAND Introduction Shelter Scotland welcomes the opportunity to respond to the Social Security Committee‟s call for views on how social security support for housing costs is impacting clients, with particular focus on the impact of welfare reform. Every day we support people struggling with housing costs and affordability was the top reason people came to us for help last year. Shelter Scotland is Scotland‟s national housing and homelessness charity. We are here so that no-one has to face bad housing or homelessness alone. In 2017/18 Shelter Scotland helped over 21,000 people through our housing advice and support services across Scotland – more than ever before. Along with our national helpline and local projects, we operate four community hubs across Scotland which offer clients support and advice in Scotland‟s major cities; Glasgow, Edinburgh, Dundee and Aberdeen. Adequate social security, in addition to the supply of affordable homes, is key in helping people to affordably access and sustain their homes, but welfare reform has pared back support for housing costs to the point where many households cannot sustain their tenancies. Mitigation measures and recent developments around Universal Credit (UC) have been helpful, but they are sticking plasters for systemic problems in a system which urgently needs to be reviewed on a number of fronts. Overall, we believe that social security support for housing costs must be more generous to accurately reflect the cost of housing: The freeze on LHA must be lifted in 2020, and at an absolute minimum, be set at the 30th percentile of local rents. -

Voices from the Frontline... Housing Benefit: Shared Accommodation Rate

Voices from the frontline... Housing Benefit: shared accommodation rate Introduction The Scottish CAB Service forms the country’s largest independent advice network. Citizen advice bureaux (CAB) are the key frontline service that hundreds of thousands of people turn to and they deal with over half a million new issues every year. As welfare changes begin to affect clients, CAS is producing briefings in our series Voices from the Frontline. These provide personal experiences of welfare reforms as they take effect in households across Scotland. Through these briefings, citizens advice bureaux will show the impact of welfare changes on the frontline. Summary From January 2012, Local Housing Allowance claimants aged between 26 and 35 have had their payments based on a room in a shared property rather than a self contained one bedroom property. In practice, this means that claimants of this age who want to live on their own have had their housing support significantly reduced. Case evidence from bureaux shows that this change has had a serious impact on thousands of people in Scotland based purely on their age. These claimants are faced with a difficult choice between trying to find very limited alternative accommodation and trying to make up the shortfall in their rent through other benefits. For many, neither option is tenable. Many may therefore face arrears and possible homelessness. The Shared Accommodation Rate Local Housing Allowance (LHA) was introduced in 2008 to provide Housing Benefit entitlement for tenants renting private sector accommodation in England, Scotland and Wales. The amount of LHA awarded depends on the number of bedrooms deemed to be required by the claimant, and where they live. -

Housing Benefit Claim Form

HCTB1 notes 04/13 Housing Benefit Notes for filling in the claim form for Housing Benefit • About this form • About Housing Benefit • Local Housing Allowance • Proof • Filling in the form • If you need help to fill in the form • What to do next • How your local council collects and uses information • Changes you must tell your local council about About this form We have designed this claim form to be easy to fill in. It may look rather long, but there have to be enough questions to make sure that everyone who claims gets the right amount of benefit. You may not have to fill in all parts of the form (for example, a few questions would not apply to most pensioners) but you must fill in any part that is relevant to you. Every part starts with a question to help you decide if you need to fill in that part. About Housing Benefit Housing Benefit can pay all or part of your rent. It may also give you some extra money towards things you have to pay for, like cleaning shared areas. Local Housing Allowance Local Housing Allowance (LHA) arrangements are a way of working out Housing Benefit for people who rent from a private landlord. Local authorities use LHA rates based on the size of household and the area in which a person lives to work out the amount of rent which can be met with Housing Benefit. Housing Benefit paid under the LHA arrangements is normally paid to the tenant, who will then pay the landlord. -

Application for Direct Payments of Local Housing

Application for direct payments of Local Housing Allowance Who should fill in this form? We normally pay local Housing Allowance direct to tenants and not landlords. However, in certain circumstances, we can make payments to a landlord, if we decide the tenant is ‘vulnerable’– see below. If you are a tenant, fill in this form if you want us to consider making payments of Local Housing Allowance (LHA) direct to your landlord. If you are a landlord, a welfare organisation or someone else representing the customer, you can fill in this form. However, you must give your details and ask your tenant or client to sign it. If they cannot sign the form, you must tell us why. What do we mean by vulnerable? We will classify someone as vulnerable if we think they cannot manage their money. We have listed some examples below. However, remember there may be other reasons too. A tenant may be vulnerable if they: . have severe debt problems; . have a recent county-court judgement against them; . are an undischarged bankrupt; . cannot open a bank or building society account; . have some of their Income Support or Jobseeker’s Allowance paid direct to the gas, electricity or water company; . are getting help from Supporting People; . are getting help from a homelessness charity; . have learning difficulties; . have an illness that prevents them from managing on a day-to-day basis; . cannot read English; . cannot speak English; . are addicted to drugs, alcohol or gambling; or . are homeless. There may be other reasons why someone might be vulnerable. Ask us for more information. -

Claim Form for Housing Benefit And/Or Council Tax Support

Claim form for Housing Benefit and/or Council Tax Support Benefit Department, North Norfolk District Council, Holt Road, Cromer, Norfolk, NR27 9EN Telephone (01263) 516349 Email: [email protected] Name & Address: Reference Number: You will need to quote this number when you contact us. Date Sent Officer’s Initials Return by Date received in office New Claim □ □ Change of Circs About Housing Benefit and/or Council Tax Support Housing Benefit (Social Security Contributions & Benefits Act 1992 & The Child Support, Pensions & Social Security Act 2000) can pay all or part of your rent. It may also give you some extra money towards communal services you have to st pay for. It cannot help with personal or support charges. From 1 April 2013 Council Tax Support (Section 13A & Schedule 1A of the Local Government Finance Act 1992) can pay up to 91.5% of your Council Tax if you are working age and up to 100% if you are of pensionable age. If you are in receipt of Universal Credit and you live in supported housing, a hostel or temporary accommodation arranged via our Housing Department then you should use this form to claim Housing Benefit. You should also use this form to claim Housing Benefit if you have a severe disability premium included in your Jobseeker’s Allowance, Employment and Support Allowance or Income Support Award. Local Housing Allowance Local Housing Allowance (LHA) can pay all or part of your contractual rent. Local Housing Allowance cannot be paid on Housing Association properties. If you wish to check the current Local Housing Allowance rates visit our website www.northnorfolk.gov.uk or The Valuation Office Agency website www.voa.gov.uk Universal Credit If you are working age you should claim Universal Credit to help with your rent. -

The Impact of Recent Reforms to Local Housing Allowances: Summary of Key Findings

The impact of recent reforms to Local Housing Allowances: Summary of key findings July 2014 Research Report No 874 A report of research carried out by the Centre for Regional Economic and Social Research, Sheffield Hallam University, the Blavatnik School of Government, University of Oxford, the Institute for Fiscal Studies and Ipsos-Mori on behalf of the Department for Work and Pensions © Crown copyright 2014. You may re-use this information (not including logos) free of charge in any format or medium, under the terms of the Open Government Licence. To view this licence, visit http://www.nationalarchives.gov.uk/doc/open-government-licence/ or write to the Information Policy Team, The National Archives, Kew, London TW9 4DU, or email: [email protected]. This document/publication is also available on our website at: https://www.gov.uk/government/organisations/department-for-work-pensions/about/ research#research-publications If you would like to know more about DWP research, please email: [email protected] First published 2014. ISBN 978 1 910219 31 7 Views expressed in this report are not necessarily those of the Department for Work and Pensions or any other Government Department. The impact of recent reforms to Local Housing Allowances: Summary of key findings Contents Acknowledgements ................................................................................................................. 5 The Authors ............................................................................................................................ -

Local Housing Allowance Safeguard Procedure

CANNOCK CHASE DISTRICT COUNCIL Local Housing Allowance Safeguard Procedure 1 Introduction Local Housing Allowance (LHA) is a scheme of Housing Benefit for people living in private rented sector accommodation. Exceptions to the scheme include: • Supported accommodation provided by local authorities, social landlords, charities or voluntary organisations • Tenancies that started before 15/01/1989 • Tenancies in caravans, houseboats, mobile homes and hostels • Tenancies with substantial board and attendance LHA is usually paid to the tenant. Payment cannot be made to a landlord simply because a tenant requests this. DWP Guidance The Department for Work and Pensions have provided guidance on when direct payments to the landlord may be appropriate where a tenant cannot pay or is unlikely to pay their rent. In most cases the Council will decide whether it is appropriate to pay LHA to the landlord. However, the LHA must be paid to the landlord where: • The tenant is 8 full weeks or more in arrears with their rent • The tenant is having deductions made from their Income Support or Jobseekers Allowance to pay for rent arrears Cannock’s Benefit Service Procedure This procedure will ensure that the safeguards in place are applied correctly in order to prevent the risk of tenants falling into arrears with their rent and subsequently facing eviction, and also to allay any fears that landlords may have regarding potentially vulnerable tenants and those who are unlikely to pay. The circumstances where we will consider paying LHA directly to a landlord -

Changes Welfare Reform Autumn 2016

information about benefit the government’s changes welfare reform Autumn 2016 For professionals who work with people affected by changes to welfare benefits There are significant changes to welfare payments that will affect people in Brighton & Hove. APRIL 2016 NOV 2016 APRIL 2017 Benefit cap will drop Local Housing Benefit cap will drop to Benefits will be Allowance was £385 per week for restricted to frozen (This is the amount paid in Housing Benefit to families two children people who rent in the private £258 per week for sector depending on the size of single people the household.) This newsletter explains the impact of these changes and how households are likely to be affected by them. Local Housing 1 Allowance Freeze In April 2016, the Local Housing Allowance* was frozen, for four years. * This is the amount paid in Housing Benefit to people who rent in the private sector depending on the size of the household This will mean that for many people What happens if people who rent privately, the money they fall into arrears with receive in Housing Benefit may not be enough to cover their rent. their rent? • This could eventually lead to eviction Who will be affected by these changes? • People could become homeless and need emergency housing (this is The best estimate is that this could often outside of Brighton & Hove) affect around 10,000 households in Brighton & Hove. Current average advertised rents and Local Housing Allowance levels 1 bedroom 2 bedroom 3 bedroom 4 bedroom Brighton & Hove Per Per Per Per Per Per Per Per Month Week -

Housing Benefit Guide for Private Tenants

A guide to Housing Benefit for Private Tenants and Landlords Contents PAGE 3 What is Housing Benefit? 3 Who can claim? 4 How do I claim? 5 What will you use to work out my benefit? 6 What savings are taken into account? 6 What expenses are taken into account? 6 What is an ‘Applicable Amount? 6 What is a non dependant? 7 When will Housing Benefit start? 7 Can you backdate my claim? 7 What is an “Extended Payment”? 8 How much will I get? 8 Is there a minimum amount of Housing Benefit? 8 How will I be paid? 9 How is Local Housing Allowance worked out? 11 Who does not fall under Local Housing Allowance? 11 Rents higher than Local Housing Allowance 11 Rents lower than Local Housing Allowance 11 What if Local Housing Allowance doesn’t fully cover my rent? 12 Paying your rent 13 Paying a Landlord to secure a tenancy 13 Single claimants under 35 and those living in shared accommodation. 14 Under occupancy – will this affect me? 14 Claimants or partners who are provided with overnight care 14 If my circumstances change do I have to tell you? 15 What happens if benefit is overpaid? 16 Can I make an appeal about my benefit? 16 Discretionary Housing Payments 17 Landlord checklist - What you as a landlord can do to help 18 Useful contact numbers Additional guidance for landlords 2 What is Housing Benefit? Housing Benefit is a national benefit paid by the Local Authority to help people pay their rent. You may be entitled to Housing Benefit if you have a low income, or are receiving welfare benefits. -

Local Housing Allowance, Housing Benefit And/Or My Appliication for Council Tax Reduction

170384_Layout 1 08/12/2014 08:34 Page 1 Use thisUse form this formto claim to claim Local Local Housing Housing Allowance Allowance, Housing HousingBenefit and Benefit to apply and for Council Tax Tax Reduction Benefit Inverclyde Council, Wallace Place, Greenock PA15 1LZ www.inverclyde.gov.uk/advice-and-benefits 170384_Layout 1 08/12/2014 08:34 Page 2 Please read these important notes before you fill in this form How to fill in this form Please answer all of the questions that apply to you. If you do not answer the questions it will take us longer to work out and pay your Housing Benefit and/or Council Tax Reduction. Please contact us if you need any help or advice or if you would like us to send someone to see you in your own home. We will be happy to help you. Benefit usually starts from the Monday after we receive your claim. Sometimes it can be paid from an earlier date. Please send this form back to us as soon as you can. If you do not, you may lose some Housing Benefit and/or Council Tax Reduction. You should send this form back to us even if you are waiting for proof of your income, rent or any other details. You can send us the proof or details later but please make sure that you send original documents and put your name and address on anything you sent to us. If you would like someone to visit you at home to see the proof, please contact us so that we can arrange this for you. -

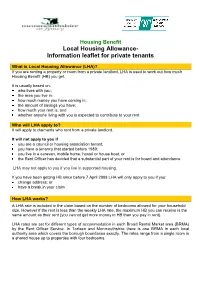

Local Housing Allowance-Summary

Housing Benefit Local Housing Allowance- Information leaflet for private tenants What is Local Housing Allowance (LHA)? If you are renting a property or room from a private landlord, LHA is used to work out how much Housing Benefit (HB) you get. It is usually based on: who lives with you; the area you live in; how much money you have coming in; the amount of savings you have; how much your rent is; and whether anyone living with you is expected to contribute to your rent Who will LHA apply to? It will apply to claimants who rent from a private landlord. It will not apply to you if you are a council or housing association tenant; you have a tenancy that started before 1989; you live in a caravan, mobile home, hostel or house boat; or the Rent Officer has decided that a substantial part of your rent is for board and attendance LHA may not apply to you if you live in supported housing. If you have been getting HB since before 7 April 2008 LHA will only apply to you if you: change address; or have a break in your claim How LHA works? A LHA rate is included in the claim based on the number of bedrooms allowed for your household size. However if the rent is less than the weekly LHA rate, the maximum HB you can receive is the same amount as their rent (you cannot get more money in HB than you pay in rent). LHA rates are set for different types of accommodation in each Broad Rental Market area (BRMA) by the Rent Officer Service. -

Claim Form for Housing Benefit, Local Housing Allowance, Council Tax

Housing Benefit Claim 24pp English Final:Layout 1 01/11/2016 13:03 Page 1 PPhone:hone: 0 165601656 64339 6436436 Bridgend County Borough Council TTeextxt R relay:elay: 1 818001001 (0 1(01656)656) 64 3643643643 PO Box 107 EEmail:mail: b enefiEtsH@QHb¿riWdVg#enEdU.LgGoJvH.uQkGJRYXN Bridgend WWebsite:ebsite: w wwZ.ZbrZidgEeULnGdJ.gHoQvG.uJk RYXN CF31 1WB Name: Reference number: Address: Date issued: / / Postcode: 'DWHRI¿UVWFRQWDFW Claim &foODrLmP IfRoUrP HIoRUu+sRinXgVL QBJe%nHeQfiHt¿, WL/oRcFaDlO H+oRXuVsLQinJg$ AOORllZoDwQaFHnc&eR, XCQoFLuOn7Dc[il5 THaGxX FRWLeRdQu ction, IUHHVFKRROPHDOVDQG'LVWLQFWLYH6FKRRO8QLIRUP*UDQW free school meals and Distinctive School Uniform Grant 3OHDVHWDNHWKHWLPHWRUHDGWKHVHQRWHVRQWKHIURQW DQGEDFNRIHDFKSDJHEHIRUH\RX¿OOLQWKLVIRUP :KDWDUH+RXVLQJ%HQH¿W/RFDO+RXVLQJ$OORZDQFHDQG&RXQFLO7D[5HGXFWLRQ" +RXVLQJ%HQH¿W is help towards paying towards your rent if you rent your home from a housing association or do not qualify for Local Housing Allowance (we will check this for you). /RFDO+RXVLQJ$OORZDQFHLVDUDWHWKDWZHXVHWRZRUNRXW+RXVLQJ%HQH¿WIRU\RXZKHQ\RXUHQW\RXUKRPH from a private landlord. &RXQFLO7D[5HGXFWLRQ is help towards paying your council tax bill. +RZWR¿OOLQWKLVIRUP 6RZHFDQZRUNRXW\RXUEHQH¿WSURSHUO\ZHQHHGWRNQRZDERXW\RXUFLUFXPVWDQFHV:HQHHGWRNQRZ ZKDW\RXULQFRPHLVDQGDQ\VDYLQJV\RXPD\KDYH,I\RXKDYHDSDUWQHUZHQHHGGHWDLOVRIWKHLULQFRPH DQGVDYLQJVWRR:HDOVRQHHGWRNQRZDERXWRWKHUSHRSOHZKROLYHZLWK\RXDQGLI\RXUHQW\RXUKRPH how much rent you pay. Please answer all the questions by ticking either ‘Yes’ or ‘No’ and giving more details when