Beware the Illusion of Value JOHCM UK Opportunities Fund

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Xtrackers Etfs

Xtrackers*/** Société d’investissement à capital variable R.C.S. Luxembourg N° B-119.899 Unaudited Semi-Annual Report For the period from 1 January 2018 to 30 June 2018 No subscription can be accepted on the basis of the financial reports. Subscriptions are only valid if they are made on the basis of the latest published prospectus of Xtrackers accompanied by the latest annual report and the most recent semi-annual report, if published thereafter. * Effective 16 February 2018, db x-trackers changed name to Xtrackers. **This includes synthetic ETFs. Xtrackers** Table of contents Page Organisation 4 Information for Hong Kong Residents 6 Statistics 7 Statement of Net Assets as at 30 June 2018 28 Statement of Investments as at 30 June 2018 50 Xtrackers MSCI WORLD SWAP UCITS ETF* 50 Xtrackers MSCI EUROPE UCITS ETF 56 Xtrackers MSCI JAPAN UCITS ETF 68 Xtrackers MSCI USA SWAP UCITS ETF* 75 Xtrackers EURO STOXX 50 UCITS ETF 80 Xtrackers DAX UCITS ETF 82 Xtrackers FTSE MIB UCITS ETF 83 Xtrackers SWITZERLAND UCITS ETF 85 Xtrackers FTSE 100 INCOME UCITS ETF 86 Xtrackers FTSE 250 UCITS ETF 89 Xtrackers FTSE ALL-SHARE UCITS ETF 96 Xtrackers MSCI EMERGING MARKETS SWAP UCITS ETF* 111 Xtrackers MSCI EM ASIA SWAP UCITS ETF* 115 Xtrackers MSCI EM LATIN AMERICA SWAP UCITS ETF* 117 Xtrackers MSCI EM EUROPE, MIDDLE EAST & AFRICA SWAP UCITS ETF* 118 Xtrackers MSCI TAIWAN UCITS ETF 120 Xtrackers MSCI BRAZIL UCITS ETF 123 Xtrackers NIFTY 50 SWAP UCITS ETF* 125 Xtrackers MSCI KOREA UCITS ETF 127 Xtrackers FTSE CHINA 50 UCITS ETF 130 Xtrackers EURO STOXX QUALITY -

Parker Review

Ethnic Diversity Enriching Business Leadership An update report from The Parker Review Sir John Parker The Parker Review Committee 5 February 2020 Principal Sponsor Members of the Steering Committee Chair: Sir John Parker GBE, FREng Co-Chair: David Tyler Contents Members: Dr Doyin Atewologun Sanjay Bhandari Helen Mahy CBE Foreword by Sir John Parker 2 Sir Kenneth Olisa OBE Foreword by the Secretary of State 6 Trevor Phillips OBE Message from EY 8 Tom Shropshire Vision and Mission Statement 10 Yvonne Thompson CBE Professor Susan Vinnicombe CBE Current Profile of FTSE 350 Boards 14 Matthew Percival FRC/Cranfield Research on Ethnic Diversity Reporting 36 Arun Batra OBE Parker Review Recommendations 58 Bilal Raja Kirstie Wright Company Success Stories 62 Closing Word from Sir Jon Thompson 65 Observers Biographies 66 Sanu de Lima, Itiola Durojaiye, Katie Leinweber Appendix — The Directors’ Resource Toolkit 72 Department for Business, Energy & Industrial Strategy Thanks to our contributors during the year and to this report Oliver Cover Alex Diggins Neil Golborne Orla Pettigrew Sonam Patel Zaheer Ahmad MBE Rachel Sadka Simon Feeke Key advisors and contributors to this report: Simon Manterfield Dr Manjari Prashar Dr Fatima Tresh Latika Shah ® At the heart of our success lies the performance 2. Recognising the changes and growing talent of our many great companies, many of them listed pool of ethnically diverse candidates in our in the FTSE 100 and FTSE 250. There is no doubt home and overseas markets which will influence that one reason we have been able to punch recruitment patterns for years to come above our weight as a medium-sized country is the talent and inventiveness of our business leaders Whilst we have made great strides in bringing and our skilled people. -

Welcome to the PZ Cussons Strategic Report 2015

Welcome to the PZ Cussons Strategic Report 2015 This interactive pdf allows you to easily access the information that you want. Use the document controls located at the top of each page to navigate through the report and use the contents to jump straight to the section you require. Search the entire Return to the contents document by keyword. at the beginning of the document. Print a single page Next Page/ or whole sections. Previous Page Contents 02 Financial highlights 18 Improving efficiency throughout our supply chain 34 Financial review – Europe 03 Chairman’s statement 22 Our CAN DO values 36 Key focus & risks 04 Chief Executive Officer’s review 24 Creating value by being Good 4 Business 40 Good 4 Business – Business Governance & Ethics 06 Our management structure 26 Chief Executive Officer’s Q&A 42 Good 4 Business – Sourcing 08 Explaining our business model and strategy 28 Financial overview – Brandon Leigh, CFO 44 Good 4 Business – Environment 10 Growth in our geographies 30 Financial review – Africa 46 Good 4 Business – Community & Charity 14 No1 & No2 in our categories 32 Financial review – Asia 48 Shareholder information & contacts Links Throughout this report there are links to pages, other sections and web addresses for additional information. They are recognisable by the red underline simply click to go to the relevant page or web URL www.pzcussons.com Strategic Report 2015 PZ Cussons Plc Strategic Report 2015 Report Strategic Creating sustainable value for all About us Mission Values Enhancing the lives of consumers through sustainable, Our CAN DO values are inspired by the spirit of our founders. -

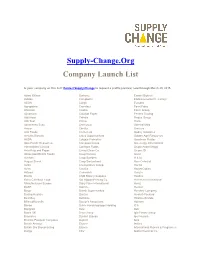

Supply-Change.Org Company Launch List

Supply-Change.Org Company Launch List Is your company on this list? Contact Supply Change to request a profile preview, now through March 25, 2015. Adani Wilmar Burberry Emami Biotech Adidas Campbell's Etablissements Fr. Colruyt AEON Cargill Eurostar Agropalma Carrefour Farm Frites Ahlstrom Casino Fazer Group Ajinomoto Catalyst Paper Ferrero Trading Aldi Nord Cefetra Findus Group Aldi Sud Cémoi Florin Almacenes Exito Cencosud General Mills Amcor Cérélia Ginsters Arla Foods Coca-Cola Godrej Industries Arnott's Biscuits Coles Supermarkets Golden Agri-Resources ASDA Colgate-Palmolive Goodman Fielder Asia Pacific Resources Compass Group Greenergy International International Limited ConAgra Foods Grupo André Maggi Asia Pulp and Paper Co-op Clean Co. Grupo JD Associated British Foods Coop Norway Gucci Auchan Coop Sweden H & M August Storck Coop Switzerland Hain Celestial Aviko Co-operative Group Haribo Avon CostCo HarperCollins Axfood Cranswick Harry's Barilla CSM Bakery Supplies Hasbro Barry Callebaut Food Dai Nippon Printing Co. Heineken International Manufacturers Europe Dairy Farm International Heinz BASF Danone Henkel Bayer Dansk Supermarked Hershey Company Beijing Hualian Danzer Hewlett-Packard Best Buy Delhaize Hillshire Brands BillerudKorsnäs Doctor's Associates Holmen Bimbo Dohle Handelsgruppe Holding ICA Bongrain Dow IGA Boots UK Drax Group Iglo Foods Group Brambles Dunkin' Brands Igor Novara Brioche Pasquier Cerqueux Dupont Ikea British Airways Ecover Inditex British Sky Broadcasting Elanco International Flavors & Fragrances Bunge -

Annex 1: Parker Review Survey Results As at 2 November 2020

Annex 1: Parker Review survey results as at 2 November 2020 The data included in this table is a representation of the survey results as at 2 November 2020, which were self-declared by the FTSE 100 companies. As at March 2021, a further seven FTSE 100 companies have appointed directors from a minority ethnic group, effective in the early months of this year. These companies have been identified through an * in the table below. 3 3 4 4 2 2 Company Company 1 1 (source: BoardEx) Met Not Met Did Not Submit Data Respond Not Did Met Not Met Did Not Submit Data Respond Not Did 1 Admiral Group PLC a 27 Hargreaves Lansdown PLC a 2 Anglo American PLC a 28 Hikma Pharmaceuticals PLC a 3 Antofagasta PLC a 29 HSBC Holdings PLC a InterContinental Hotels 30 a 4 AstraZeneca PLC a Group PLC 5 Avast PLC a 31 Intermediate Capital Group PLC a 6 Aveva PLC a 32 Intertek Group PLC a 7 B&M European Value Retail S.A. a 33 J Sainsbury PLC a 8 Barclays PLC a 34 Johnson Matthey PLC a 9 Barratt Developments PLC a 35 Kingfisher PLC a 10 Berkeley Group Holdings PLC a 36 Legal & General Group PLC a 11 BHP Group PLC a 37 Lloyds Banking Group PLC a 12 BP PLC a 38 Melrose Industries PLC a 13 British American Tobacco PLC a 39 Mondi PLC a 14 British Land Company PLC a 40 National Grid PLC a 15 BT Group PLC a 41 NatWest Group PLC a 16 Bunzl PLC a 42 Ocado Group PLC a 17 Burberry Group PLC a 43 Pearson PLC a 18 Coca-Cola HBC AG a 44 Pennon Group PLC a 19 Compass Group PLC a 45 Phoenix Group Holdings PLC a 20 Diageo PLC a 46 Polymetal International PLC a 21 Experian PLC a 47 -

DWS CROCI International

Investment Portfolio as of March 31, 2021 (Unaudited) DWS CROCI® International VIP Shares Value ($) Common Stocks 96.0% Australia 9.1% Australia & New Zealand Banking Group Ltd. 84,659 1,814,028 BHP Group Ltd. 110,251 3,815,874 Commonwealth Bank of Australia 4,288 280,930 National Australia Bank Ltd. 62,344 1,234,218 Newcrest Mining Ltd. 15,865 297,603 (Cost $5,536,400) 7,442,653 Belgium 1.6% UCB SA (Cost $1,072,787) 13,795 1,312,687 Denmark 3.0% AP Moller - Maersk AS “B” 870 2,024,140 Novo Nordisk AS “B” 7,052 474,954 (Cost $1,948,110) 2,499,094 Finland 1.0% Fortum Oyj 12,738 340,652 Nokia Oyj* 121,910 486,937 (Cost $695,418) 827,589 France 14.1% Atos SE* 22,260 1,739,792 BNP Paribas SA* 53,894 3,290,488 Credit Agricole SA* 118,678 1,721,985 Engie SA* 79,187 1,127,334 Sanofi 30,370 3,003,484 Television Francaise 1* 80,739 737,194 (Cost $9,733,297) 11,620,277 Germany 8.4% Beiersdorf AG 12,876 1,355,372 Brenntag SE 13,966 1,193,987 Deutsche Boerse AG 4,043 672,742 Deutsche Post AG (Registered) 23,524 1,291,802 Fresenius Medical Care AG & Co. KGaA 7,353 542,699 Fresenius SE & Co. KGaA 10,857 484,249 HeidelbergCement AG 5,007 455,278 Merck KGaA 3,152 539,013 SAP SE 2,641 324,172 (Cost $6,246,907) 6,859,314 Hong Kong 0.7% CLP Holdings Ltd. -

Constituents & Weights

2 FTSE Russell Publications 19 August 2021 FTSE 100 Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 3i Group 0.59 UNITED GlaxoSmithKline 3.7 UNITED RELX 1.88 UNITED KINGDOM KINGDOM KINGDOM Admiral Group 0.35 UNITED Glencore 1.97 UNITED Rentokil Initial 0.49 UNITED KINGDOM KINGDOM KINGDOM Anglo American 1.86 UNITED Halma 0.54 UNITED Rightmove 0.29 UNITED KINGDOM KINGDOM KINGDOM Antofagasta 0.26 UNITED Hargreaves Lansdown 0.32 UNITED Rio Tinto 3.41 UNITED KINGDOM KINGDOM KINGDOM Ashtead Group 1.26 UNITED Hikma Pharmaceuticals 0.22 UNITED Rolls-Royce Holdings 0.39 UNITED KINGDOM KINGDOM KINGDOM Associated British Foods 0.41 UNITED HSBC Hldgs 4.5 UNITED Royal Dutch Shell A 3.13 UNITED KINGDOM KINGDOM KINGDOM AstraZeneca 6.02 UNITED Imperial Brands 0.77 UNITED Royal Dutch Shell B 2.74 UNITED KINGDOM KINGDOM KINGDOM Auto Trader Group 0.32 UNITED Informa 0.4 UNITED Royal Mail 0.28 UNITED KINGDOM KINGDOM KINGDOM Avast 0.14 UNITED InterContinental Hotels Group 0.46 UNITED Sage Group 0.39 UNITED KINGDOM KINGDOM KINGDOM Aveva Group 0.23 UNITED Intermediate Capital Group 0.31 UNITED Sainsbury (J) 0.24 UNITED KINGDOM KINGDOM KINGDOM Aviva 0.84 UNITED International Consolidated Airlines 0.34 UNITED Schroders 0.21 UNITED KINGDOM Group KINGDOM KINGDOM B&M European Value Retail 0.27 UNITED Intertek Group 0.47 UNITED Scottish Mortgage Inv Tst 1 UNITED KINGDOM KINGDOM KINGDOM BAE Systems 0.89 UNITED ITV 0.25 UNITED Segro 0.69 UNITED KINGDOM -

25 March 2021 – Presentation

A journey to sustainable value creation 25 March 2021 DISCLAIMER This presentation contains certain forward-looking statements relating to expected or anticipated results, performance or events. Such statements are subject to normal risks associated with the uncertainties in our business, supply chain and consumer demand along with risks associated with macro-economic, political and social factors in the markets in which we operate. Whilst we believe that the expectations reflected herein are reasonable based on the information we have as at the date of this presentation, actual outcomes may vary significantly owing to factors outside the control of the Company, such as cost of materials or demand for our products, or within our control such as our investment decisions, allocation of resources or changes to our plans or strategy. The Company expressly disclaims any obligation to revise forward-looking statements made in this or other presentations to reflect changes in our expectations or circumstances. No reliance may be placed on the forward looking statements contained within this presentation. 2 Welcome to our new strategy 3 Our journey to sustainable value creation We are a branded consumer goods company A clear strategy to return to sustainable, profitable revenue growth Investing in the resources we need to succeed Putting sustainability at the heart of everything we do We have already made a start 4 Agenda Growing Our Our Strategy Must Win Brands Enabling Transformation ▪ Welcome and introduction ▪ Carex ▪ Sustainability Kieran -

Industrial & Logistics Viewpoint

INDUSTRIAL & LOGISTICS VIEWPOINT 2020 UK CONTENTS FOREWORD 4 NATIONAL MARKET 6 LONDON & THE SOUTH EAST 8 WEST LONDON 10 SOUTH WEST 12 MIDLANDS 14 NORTH WEST 16 YORKSHIRE & THE NORTH EAST 18 SCOTLAND 20 NORTHERN IRELAND 22 CAPITAL MARKETS 24 2 3 We are pleased to launch our new Industrial and Logistics Viewpoint 2020, which is designed to give you an overview of national and regional activity. Despite the political and economic uncertainty that many businesses in the UK faced in 2019, the Industrial and Logistics sector has remained resilient. Some of the key findings of this Viewpoint include: • Demand for industrial and logistics space in 2019 remained strong with take-up reaching in excess of 30m sq ft for the year, exceeding the 10-year annual average by 17%, but 14% below the record breaking 2018 • The industrial sector out-performed all other property asset classes in 2019, partly driven by very strong rental growth in London and key South East locations • Rental growth is expected to moderate in 2020, although logistics units located in heavily populated areas will reach above average returns • At the beginning of the year we were expecting 2020 to be a record year in terms of demand. However, material downside risks associated with the Covid-19 virus may limit the occupational upside. Should the virus run its course in the first half of 2020, we may expect to see a busy second half as occupiers regroup and press ahead with urgent projects For an informal chat, please do not hesitate to get in touch with either myself or one of the team. -

Creating Sustainable Value for All PZ Cussons Is a Dynamic Consumer Products Group and Innovator of Some of the World’S Best Known and Loved Brands

PZ Cussons Plc Strategic Report 2017 Report Strategic Strategic Report 2017 Creating sustainable value for all PZ Cussons is a dynamic consumer products group and innovator of some of the world’s best known and loved brands. Calling on over 130 years of expertise, we operate internationally in carefully selected developed and emerging markets which present the greatest strategic potential for future growth. Our world-class supply chain and distribution networks enable us to meet global consumer needs and deliver quality brands which add value and enhance everyday lives. Our 2017 Report Our Annual Report is split into two distinct reporting sections: a Strategic Report, and Governance and Financial Statements. These documents are to be read in conjunction with each other. PZ Cussons Plc Strategic Report 2017 Strategic Strategic Report 2017 Creating sustainable value for all Strategic Report Governance and The Strategic Report provides Financial Statements an overview of how the Group The Governance and Financial operates and provides insight Statements provides an into our strategy, business model, in depth analysis of the people and vision. Group’s annual results and governance processes. Imperial Leather, our iconic family favourite Online keeps on innovating. Digital, downloadable copies of the two reports are available online at: Read more at www.pzcussons.com www.imperialleather.com PZ Cussons Plc Strategic Report 2017 01 Contents 02 Financial highlights 03 Chair’s statement 04 Chief Executive Officer’s review 06 Our Business Model -

FTF - FTF Franklin UK Rising Dividends Fund August 31, 2021

FTF - FTF Franklin UK Rising Dividends Fund August 31, 2021 FTF - FTF Franklin UK Rising August 31, 2021 Dividends Fund Portfolio Holdings The following portfolio data for the Franklin Templeton funds is made available to the public under our Portfolio Holdings Release Policy and is "as of" the date indicated. This portfolio data should not be relied upon as a complete listing of a fund's holdings (or of a fund's top holdings) as information on particular holdings may be withheld if it is in the fund's interest to do so. Additionally, foreign currency forwards are not included in the portfolio data. Instead, the net market value of all currency forward contracts is included in cash and other net assets of the fund. Further, portfolio holdings data of over-the-counter derivative investments such as Credit Default Swaps, Interest Rate Swaps or other Swap contracts list only the name of counterparty to the derivative contract, not the details of the derivative. Complete portfolio data can be found in the semi- and annual financial statements of the fund. Security Security Shares/ Market % of Coupon Maturity Identifier Name Positions Held Value TNA Rate Date 0673123 ASSOCIATED BRITISH FOODS PLC 155,000 £3,069,000 2.01% N/A N/A 0989529 ASTRAZENECA PLC 84,000 £7,151,760 4.68% N/A N/A 0263494 BAE SYSTEMS PLC 575,000 £3,268,300 2.14% N/A N/A BYQ0JC6 BEAZLEY PLC 680,000 £2,662,200 1.74% N/A N/A 3314775 BLOOMSBURY PUBLISHING PLC 660,000 £2,329,800 1.52% N/A N/A B3FLWH9 BODYCOTE PLC 275,000 £2,652,375 1.74% N/A N/A 0176581 BREWIN DOLPHIN HOLDINGS -

Act Annual Conference

EVENT OVERVIEW ACT ANNUAL CONFERENCE 21-22 May 2019 Manchester Central, UK ATTENDEE PROFILE TOTAL 9/10 DELEGATES ATTENDEES WOULD RECOMMEND 1075 THE EVENT TO A FRIEND/COLLEAGUE FROM OR ATTEND AGAIN 388COMPANIES 88 DELEGATES SPONSORS AND REPRESENTING 323 EXHIBITORS COMPANIES 97SPEAKERS 548 INCLUDING: • Anglo American • London Stock Exchange • Arup • Mitsubishi • ASOS • National Express • AstraZeneca • National Oilwell Varco SENIORITY OF • BAE Systems • Pearson • Balfour Beatty • Petrofac Services CORPORATE AUDIENCE • BASF • Primark • BT • PZ Cussons • Burberry • RELX • Centrica • Renewi • Compass Group • Rentokil • Deliveroo • Royal Dutch Shell • Drax • Sainsbury’s • Dyson • Schneider Electric • easyJet • Scottish Power • Electrocomponents • Serco • Equiniti • Sky • Etihad Airways • Stagecoach • Farfetch • Statoil • Google UK • Tate & Lyle • GSK • Tesco • Halfords • Thames Water • Hammerson • Thomas Cook • Heathrow Airport • Travelport • Hitachi Capital • UK Power Networks • InterContinental Hotels • Urenco • ITV • Virgin Media • JD Sports Fashion • Vodafone • John Lewis • WorldPay BOARD LEVEL/STRATEGIC LEADER 52% • Just Eat • Yildirim Holdings MANAGERIAL 30% OF COMPANIES CORPORATE SENIOR OPERATIONAL 17% THAT ATTENDED DELEGATES WITH JOB AS DELEGATES TITLES INCLUDING: TACTICAL 1% WERE GROUP TREASURER, HEAD 50% CORPORATE. 107 OF TREASURY, HEAD OF CORPORATE FINANCE EVENT OVERVIEW CONTENT AND FEEDBACK TOTAL NETWORKING TOTAL CONTENT AVAILABLE 10.3 29.4 HOURS HOURS LIBOR DIGITAL TREASURY TOP TOPICS SUSTAINABLE FINANCE PAYMENT INNOVATION AND RISKS OPEN BANKING GLOBAL AND DOMESTIC FINANCING MACROECONOMIC ENVIRONMENT EVENT APP SOCIAL MEDIA UNIQUE USERS: 435 726 TWEETS TOTAL APP GENERATED USING PAGE VIEWS: 74,666 #ACTAC19 DELEGATE FEEDBACK “THE ACT ANNUAL CONFERENCE PROVIDES AN EXCELLENT “IF YOU ONLY ATTEND ONE EVENT IN A YEAR, MAKE IT THE OPPORTUNITY TO NETWORK WITH OTHER TREASURY ACT ANNUAL CONFERENCE.