Cogeco Inc. 2008 Activity Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Bell Média Radio La Radio À L’Automne 2014 Numeris – Cahiers D’Écoute

Bell Média Radio La radio à l’Automne 2014 Numeris – cahiers d’écoute Bell Média Recherche bellmediaventes.ca Agenda Résultats par marché • Marché de Québec Radio • Marché de Gatineau-Ottawa Automne 2014 • Marché de Sherbrooke Cahiers d’écoute • Marché de Trois-Rivières • Marché de Saguenay bellmediaventes.ca Méthodologie des cahiers d’écoute Auditeurs âgés de 12 ans + Cahiers distribués à un échantillon différent de la population pendant 8 semaines consécutives Mesure au quart d’heure Bell Média Recherche bellmediaventes.ca Radio Automne 2014 - Contexte L’actualité • Commission Charbonneau • Référendum sur la souveraineté en Écosse • Guy Turcotte remis en liberté provisoire • Mobilisation internationale contre l'État Islamique • Crise de l’Ebola • Entente entre Québec et les deux fédérations de médecins • Procès de Luka Rocco Magnotta • Course au leadership du PQ • Fusillade au parlement d’Ottawa bellmediaventes.ca Marché central de Québec Population de Québec: 706 730 personnes 12 stations membres Numeris : 11 stations de radio de langue française,1 station de langue anglaise. 90% des gens de Québec écoutent la radio. Ils l’écoutent en moyenne 18,8 heures par semaine. Bell Média Recherche Numeris (Sondages BBM), Automne 2014, Québec central bellmediaventes.ca Radio Automne 2014 - Contexte Faits saillants radio Marché de Québec Stephan Dupont se joint à NRJ Québec Le M FM 102,9 devient M102,9 et Gilles Parent en assure la direction Le FM93 accueille Nathalie Normandeau Changement d’imagerie et de logo pour Radio X2 qui devient Rock 100.9 -

98 5 Sondage Mars 2018

COMMUNIQUÉ pour diffusion immédiate Le 98,5 encore la préférée des Montréalais Montréal, le 7 mars 2018 – Pour un 6e sondage consécutif, le 98,5 demeure LA station préférée des Montréalais et sort gagnante de ce sondage. Selon la firme de sondage Numeris qui publie aujourd’hui les résultats d’écoute de la radio pour la région de Montréal, le 98,5 occupe la première place (2+ et Adultes 25-54) 1. Les données PPM, recueillies du 27 novembre 2017 au 25 février 2018, démontrent que le 98,5 est également la station de radio la plus écoutée au Québec.2 Paul Arcand demeure l’animateur du matin le plus écouté au Québec, récoltant 28,5 % des parts de marché à Montréal 3 avec Puisqu’il faut se lever . D’ailleurs, toutes les émissions de jour sont également #1 dans leur créneau respectif : Isabelle Maréchal avec Isabelle et ses 17,5 % parts de marché, Bernard Drainville avec Bernard PM et ses 18,1 parts de marché et également Le Québec Maintenant avec Paul Houde et ses 16,3 % parts de marché. Ils sont définitivement la référence dans le marché .3 Les soirées sportives du 98,5 Sports , partenaire officiel et diffuseur de tous les grands événements sportifs à Montréal, dominent le marché avec ses 18,2 % des parts de marché entre 18h30 et minuit grâce à Ron Fournier , Mario Langlois et la diffusion des grands évènements sportifs. 3 « La station a toujours, au coeur de ses préoccupations, la pertinence, la rigueur et l’accessibilité, des contenus. Les résultats d’aujourd’hui témoignent de l’engagement de nos équipes envers le public de la grande région de Montréal.» » a déclaré le directeur général du 98,5, Philippe Lapointe. -

2008 Annual Report

2008 ANNUAL REPORT PROFILE COGECO INC. (“COGECO” OR “THE COMPANY”) IS A DIVERSIFIED COMMUNICATIONS COMPANY WITH SHARES LISTED ON THE TORONTO STOCK EXCHANGE (“TSX”), UNDER THE SYMBOL CGO. THE COMPANY STRIVES TO MEET THE COMMUNICATION NEEDS OF CONSUMERS AND ADVERTISERS THROUGH CABLE DISTRIBUTION AND RADIO BROADCASTING. COGECO CABLE INC. (“COGECO CABLE”), THE CABLE SUBSIDIARY, BUILDS ON ITS CABLE DISTRIBUTION BASE BY OFFERING ANALOGUE AND DIGITAL TELEVISION, HIGH SPEED INTERNET AND TELEPHONY SERVICES. COGECO CABLE PROVIDES 2,716,874 REVENUE-GENERATING UNITS TO THE 2,427,534 HOMES PASSED BY ITS CABLE NETWORK IN THE TERRITORIES IT SERVES. IT IS THE SECOND LARGEST CABLE TELECOMMUNICATIONS COMPANY IN ONTARIO, QUÉBEC, AND PORTUGAL IN TERMS OF BASIC CABLE SERVICE CUSTOMERS. COGECO CABLE FOCUSES ITS ATTENTION ON THE SATISFACTION OF RESIDENTIAL AND BUSINESS CUSTOMERS’ VARIED ELECTRONIC COMMUNICATION NEEDS BY INVESTING IN STATE-OF-THE-ART BROADBAND NETWORK FACILITIES, DELIVERING A WIDE RANGE OF SERVICES OVER THESE FACILITIES WITH GREAT SPEED AND RELIABILITY AT ATTRACTIVE PRICES, AND STRIVING TO PROVIDE SUPERIOR CUSTOMER SERVICE AND GROWING PROFITABILITY. THROUGH ITS COGECO RADIO-TELEVISION INC. SUBSIDIARY (“CRTI”), COGECO OPERATES AND WHOLLY-OWNS THE RYTHME FM NETWORK WHICH HAS FOUR RADIO STATIONS THROUGHOUT THE PROVINCE OF QUÉBEC, IN MONTRÉAL, QUÉBEC CITY, AND IN THE MAURICIE AND EASTERN TOWNSHIPS REGIONS, AS WELL AS RADIO STATION 933 IN QUÉBEC CITY. COGECO ENDEAVOURS TO REMAIN AT THE FOREFRONT OF THE COMMUNICATIONS SECTOR THROUGH SOUND INVESTMENTS IN FACILITIES, THE OFFERING OF LEADING EDGE COMMUNICATIONS SERVICES WHILE PURSUING INCREASED PROFITABILITY. ANNUAL REPORT FINANCIAL HIGHLIGHTS 3 CABLE SECTOR CUSTOMER STATISTICS 84 MANAGEMENT'S DISCUSSION AND ANALYSIS 4 BOARD OF DIRECTORS AND CORPORATE MANAGEMENT 86 CONSOLIDATED FINANCIAL STATEMENTS 44 CORPORATE INFORMATION 88 FIVE-YEAR FINANCIAL HIGHLIGHTS 81 SUBSIDIARIES AND OPERATING UNITS 90 INVESTOR INFORMATION 82 COGECO INC. -

French-Language Music Diversity Study (2015)

French-Language Music Diversity Study (2015) Prepared by: Andrew Forsyth Operations Consultant Nielsen BDSradio, Canada Stephanie Friedman Vice President, Radio Nielsen Entertainment June 2015 ISBN: BC92-82/2015E-PDF Cat. No.: 978-0-660-03159-0 Unless otherwise specified, you may not reproduce materials in this publication, in whole or in part, for the purposes of commercial redistribution without prior written permission from the Canadian Radio- television and Telecommunications Commission's (CRTC) copyright administrator. To obtain permission to reproduce Government of Canada materials for commercial purposes, apply for Crown Copyright Clearance by contacting: The Canadian Radio-television and Telecommunications Commission (CRTC) Ottawa, Ontario Canada K1A ON2 Tel: 819-997-0313 Toll-free: 1-877-249-2782 (in Canada only) https://services.crtc.gc.ca/pub/submissionmu/bibliotheque-library.aspx © Her Majesty the Queen in Right of Canada, represented by the Canadian Radio-television and Telecommunications Commission, 2015. All rights reserved. Aussi disponible en français Table of Contents I. Executive Summary page 4 II. Objectives page 5 III. Methodology page 6 IV. Analysis page 8 Overview page 8 V. Stations Profiles Gatineau page 10 Montréal page 14 Quebec City page 20 Trois-Rivières page 25 VI. Duplication page 30 VII. Conclusion page 34 Appendix 1 – Emerging Artists 2009 page 35 Appendix 2 – Emerging Artists 2015 page 37 3 I. Executive Summary In this study the stations provide their audience with a wide repertoire of French-language music. In 2015 songs shared by 94% of the panel stations are performed by 15 artists indicating a concentration of airplay across more stations. The data indicates the French-language library at the panel stations is an evolving entity that is expanding immersed with new artists which add to, but not displace older performers. -

Media Presence

Media Presence Guylaine Vallée is a Vedic palmist-astrologer at the Birla Center in Montreal and Chénéville. She gives private consultations and training in palmistry. For 30 years, Guylaine Vallée has been a much-loved fixture on radio and television. She has counseled over thousands of clients and expanded her reach doing hundreds of interviews, hosting TV and radio shows, guest appearances and lectures across North America. TELEVISION SHOWS Être bien dans sa peau (1992) – Guylaine hosts her first series. 14 x 30 min. À la portée de votre main (1994) – Guylaine’s live-audience show, with phone-in lines. 13 x 30 min. TELEVISION GUEST APPEARANCES Claire Lamarche (1993) – Guylaine appears on “the Oprah of Quebec” Self-Discovery Magazine (1995) – Guylaine presented a segment on gemmology on this syndicated Canadian show. Claire Lamarche (1996) – encore appearance to read the With Claire Lamarche palms of celebrities La Vie à Montréal (1996) – host Chantal Lacroix interviewed Guylaine at the Birla Center Rock Velours, (1996) - with Juliette Powell Reddy Reddy Go (1996) – with Francis Reddy Évasion Beauté (1998) - with Lise Watier Caféine (2003 & 2008) On Évasion Beauté with Lise Watier Salut Bonjour (2004 & 2009) Deux filles le matin (2001, 2006, 2008, 2009 & 2014) Le Mec à dames (2005, 2006 & 2007) Daytime (monthly appearances between June 2006 & March 2007) Pour le plaisir - Radio-Canada (2010) MCBG (2013) RADIO Guylaine’s voice is well-known on the Quebec airwaves. On Salut Bonjour with Gino Chouinard In 2008, she has been a regular guest -

Channel Guide 521 - 733 407 - 763 406 - 764 205 - 705 208 - 708 - MRC Matawinie - TV-EXTRA SPORT the SMALL BASIC

EXTRAS You can easily personalize your basic programming by choosing one of our pre-assembled packages. TV-EXTRA FAMILY 401 402 - 760 403 - 761 404 - 762 405 TÉLÉ-EXTRA FAMILLE + Channel Guide 521 - 733 407 - 763 406 - 764 205 - 705 208 - 708 - MRC Matawinie - TV-EXTRA SPORT THE SMALL BASIC 152 156 - 637 153 154 - 639 155 Detroit 387 179 - 663 392 106 171 172 143 - 623 144 - 624 145 - 625 157 - 640 The TVA Sports 3 channel is only available during the NHL playoffs. Montréal 103 102 382 112 - 603 174 - 661 175 TV-EXTRA YOUTH Detroit Montréal 180 - 664 386 178 170 104 177 - 660 528 - 771 529 530 531 408 - 770 Rochester 383 181 - 665 108 176 - 662 123 - 614 385 532 533 TV-EXTRA DISCOVERY Montréal Ottawa Montréal 384 124 - 615 616 126 - 617 107 105 - 601 516 517 - 730 518 - 731 519 520 - 732 Detroit HD* Detroit 1* 2* 182 - 666 611 114 - 610 183 - 667 591 592 522 3* 4* 593 594 390 380 140 - 620 141 - 621 TV-EXTRA HOBBIES 47 canaux 1* 524 523 527 525 526 381 391 389 111 298 à 364 595 FRENCH-LANGUAGE CINEMA 2* 596 113 - 602 388 173 150 - 635 151 - 636 491 - 741 492 - 742 493 - 743 494 - 744 Gatineau Montréal 109 - 605 121 - 613 120 - 612 101 - 600 110 115 - 604 ENGLISH-LANGUAGE CINEMA *You need a HD decoder 501 502 503 504 505 506 507 THE ESSENTIAL Anglais Français 200 - 700 201 - 701 204 - 704 202 - 702 203 - 703 205 - 705 206 - 706 207 - 707 211 210 - 710 208 - 708 209 - 709 EXTENDED BASE Vancouver Vancouver 200 - 700 234 - 724 235 230 - 720 490 - 740 236 237 - 725 125 231 - 721 232 - 722 233 - 723 142 - 622 122 CHOOSE 10/15/20 Seattle Vancouver -

Various Radio Programming Undertakings – Acquisition of Assets

Broadcasting Decision CRTC 2018-396 PDF version Reference: 2018-216 Ottawa, 11 October 2018 Cogeco Media Inc. Hawkesbury, Ontario, and Alma, Chibougamau, Dolbeau, Lachute, La Sarre, Robervalle, Rouyn-Noranda, Saguenay and Val-d’Or, Quebec Public record for this application: 2018-0383-3 Public hearing in the National Capital Region 6 September 2018 Various radio programming undertakings – Acquisition of assets The Commission approves an application by Cogeco inc. on behalf of its subsidiary Cogeco Media Inc. for authority to acquire from RNC Media Inc. the assets of the French-language commercial radio stations CHPR-FM Hawkesbury, Ontario, CFGT-FM Alma, CKXO-FM Chibougamau, CHVD-FM Dolbeau, CJLA-FM Lachute, CJGO-FM La Sarre and its transmitter CJGO-FM-1 Rouyn-Noranda, CHRL-FM Roberval, CHOA-FM Rouyn-Noranda and its transmitters CHOA-FM-1 Val-D’or and CHOA-FM-2 La Sarre, CKYK-FM Saguenay and its transmitter CKYK-FM-1 Alma and CHGO-FM Val-D’or, Quebec. As a result of the tangible benefits arising from this transaction, $1,184,217 will be directed in equal payments over the next seven broadcast years to various initiatives to support and promote Canadian music and increase the diversity of radio programming available to listeners. Application 1. Cogeco inc., on behalf of its subsidiary Cogeco Media Inc. (Cogeco), filed an application for authority to acquire from RNC Media Inc. (RNC) the assets of the French-language commercial radio stations CHPR-FM Hawkesbury, Ontario, CFGT-FM Alma, CKXO-FM Chibougamau, CHVD-FM Dolbeau, CJLA-FM Lachute, CJGO-FM La Sarre and its transmitter CJGO-FM-1 Rouyn-Noranda, CHRL-FM Roberval, CHOA-FM Rouyn-Noranda and its transmitters CHOA-FM-1 Val-D’or and CHOA-FM-2 La Sarre, CKYK-FM Saguenay and its transmitter CKYK-FM-1 Alma and CHGO-FM Val-D’or, Quebec. -

Stations Monitored

Stations Monitored 10/01/2019 Format Call Letters Market Station Name Adult Contemporary WHBC-FM AKRON, OH MIX 94.1 Adult Contemporary WKDD-FM AKRON, OH 98.1 WKDD Adult Contemporary WRVE-FM ALBANY-SCHENECTADY-TROY, NY 99.5 THE RIVER Adult Contemporary WYJB-FM ALBANY-SCHENECTADY-TROY, NY B95.5 Adult Contemporary KDRF-FM ALBUQUERQUE, NM 103.3 eD FM Adult Contemporary KMGA-FM ALBUQUERQUE, NM 99.5 MAGIC FM Adult Contemporary KPEK-FM ALBUQUERQUE, NM 100.3 THE PEAK Adult Contemporary WLEV-FM ALLENTOWN-BETHLEHEM, PA 100.7 WLEV Adult Contemporary KMVN-FM ANCHORAGE, AK MOViN 105.7 Adult Contemporary KMXS-FM ANCHORAGE, AK MIX 103.1 Adult Contemporary WOXL-FS ASHEVILLE, NC MIX 96.5 Adult Contemporary WSB-FM ATLANTA, GA B98.5 Adult Contemporary WSTR-FM ATLANTA, GA STAR 94.1 Adult Contemporary WFPG-FM ATLANTIC CITY-CAPE MAY, NJ LITE ROCK 96.9 Adult Contemporary WSJO-FM ATLANTIC CITY-CAPE MAY, NJ SOJO 104.9 Adult Contemporary KAMX-FM AUSTIN, TX MIX 94.7 Adult Contemporary KBPA-FM AUSTIN, TX 103.5 BOB FM Adult Contemporary KKMJ-FM AUSTIN, TX MAJIC 95.5 Adult Contemporary WLIF-FM BALTIMORE, MD TODAY'S 101.9 Adult Contemporary WQSR-FM BALTIMORE, MD 102.7 JACK FM Adult Contemporary WWMX-FM BALTIMORE, MD MIX 106.5 Adult Contemporary KRVE-FM BATON ROUGE, LA 96.1 THE RIVER Adult Contemporary WMJY-FS BILOXI-GULFPORT-PASCAGOULA, MS MAGIC 93.7 Adult Contemporary WMJJ-FM BIRMINGHAM, AL MAGIC 96 Adult Contemporary KCIX-FM BOISE, ID MIX 106 Adult Contemporary KXLT-FM BOISE, ID LITE 107.9 Adult Contemporary WMJX-FM BOSTON, MA MAGIC 106.7 Adult Contemporary WWBX-FM -

Broadcasting Decision CRTC 2010-942

Broadcasting Decision CRTC 2010-942 PDF version Route reference: 2010-543 Additional reference: 2010-543-1 Ottawa, 17 December 2010 Corus Entertainment Inc., on behalf of its wholly owned subsidiaries 591991 B.C. Ltd. and Metromedia CMR Broadcasting Inc. Montréal, Longueuil, Saint-Jérôme, Trois-Rivières, Sherbrooke, Lévis, Québec and Gatineau, Quebec Application 2010-1092-5, received 30 June 2010 Public Hearing in Montréal, Quebec 28 September 2010 Transfer of effective control of various commercial radio programming undertakings from Corus Entertainment Inc. to Cogeco inc. The Commission approves in part an application by Corus Entertainment Inc. (Corus), on behalf of its wholly owned subsidiaries 591991 B.C. Ltd. and Metromedia CMR Broadcasting Inc., to transfer their ownership and control of Corus to Cogeco inc. (Cogeco). The Commission approves, by majority decision, Cogeco’s request to be granted an exception to the Common Ownership Policy (the Policy) in relation to the number of radio stations that it is authorized to operate in the Montréal radio market. The Commission relies on guidelines in the form of regulatory policies, information bulletins or other non-mandatory measures to guide it in exercising its discretionary authority. Such documents serve, among other things, to publicly inform applicants, as well as the general public, concerning the position it proposes to take on a matter. The Commission may not, however, use such instruments to limit the discretion granted to it by Parliament. Therefore, where there is a clearly established rule, the Commission must strike a balance between consistency in its decisions and the need to consider each application on its merits, based on the circumstances specific to that application. -

Salut Bonjoue

Résultats PPM Marchés Montréal franco et anglo | Hiver 2013 13 semaines : 26 novembre 2012 au 24 février 2013 publié le 7 mars 2013 Contenu du document Résultats PPM à Montréal • Période, couverture géographique et actualité 3 • Résultats Montréal franco 5 Portées, parts de marché, courbes d’écoute, profils des stations • Palmarès des émissions, Montréal franco 25 • Analyse des faits saillants CFR, Montréal franco 26 • Résultats Montréal anglo 29 Portées, parts de marché, courbes d’écoute, profils des stations • Palmarès des émissions, Montréal anglo 47 • Analyse des faits saillants CFR, Montréal anglo 51 • Liste des stations représentées par CFR 53 • Annexe Comparagraphe et calendrier 2012-2013 de publication de données PPM 55 Page 2 Période d’analyse | Actualité Période d’analyse Actualité Les résultats présentés couvrent l’hiver 2013, soit la Durant la période d’analyse, certains éléments de période allant du 26 novembre 2012 au 24 février 2013 l’actualité auront influencé l’écoute de la radio, (13 semaines). notamment : Sur la scène nationale : Échantillon - Période des fêtes ●400 foyers Montréal Franco. - Fortes tombées de neige ●400 foyers Montréal Anglo. - Rentrée parlementaire ●Près de 850 panelistes par marché. - Sommet de l’éducation au Québec - Réforme sur l’assurance chômage au Canada Couverture géographique - Commission Charbonneau ●Les résultats sont obtenus pour le marché de - Décès de Richard Garneau Montréal central. - Retour du hockey ●La population francophone 2 ans + équivaut à - Saint-Valentin 3 003 000 personnes -

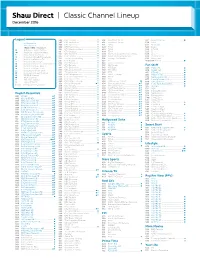

Classic Channel Lineup December 2016

Shaw Direct | Classic Channel Lineup December 2016 Legend 306 CBC Calgary .................................................T 418 Sportsnet West 137 MovieTime HD ........................................... T HD Channels 307 CBC Edmonton .......................................... 419 Sportsnet Pacific 520 A & E T PPV Channels 308 CBC Vancouver .......................................... 421 TSN 5 521 Showcase T SHAW DIRECT Channels 309 CFJC Kamloops .......................................... 422 TSN 4 523 Bravo T Available only in Ontario 310 NTV Newfoundland ................................ 423 TSN 3 524 DTOUR T Available only in the West 311 CTV Ottawa ................................................. 424 TSN 1 527 E! T Included in Cool Stuff 312 CTV Montreal .............................................. 489 Northern Legislative Assembly 528 Space T Included in English Essentials 313 CTV Toronto ................................................ 508 Business News Network 529 Peachtree TV T Included in Intense TV 314 Global Thunder Bay ................................ 519 Vintage TV Canada 533 MovieTime T © Included in Lifestyle 315 CTV Regina .................................................. 527 E! 611E/631W Action ................................................... T Included in Movies East and West 316 CTV Winnipeg ............................................ 536 Cartoon Network T Included in More Movies 317 CTV Calgary ................................................. 537 ABC Spark Fun Stuff T Included in Prime Time 318 CTV Edmonton -

Rapport Final

Analyse sur l’état de l’information locale au Québec présentée au Conseil provincial du secteur des communications (CPSC) du Syndicat canadien de la fonction publique (SCFP) Influence Communication 23 novembre 2016 Rapport Final Influence Communication 505, boul. de Maisonneuve Ouest, Bureau 200 Montréal ( Québec ) H3A 3C2 www.influencecommunication.com 2 1— Description du projet À la demande du Conseil provincial du secteur des communications (CPSC) du Syndicat canadien de la fonction publique (SCFP), Influence Communication a réalisé un mandat d’analyse afin de dresser le portrait de l’information locale au Québec en répertoriant les champs d’intérêt des médias de chaque région du Québec en matière d’information locale. 2— Méthodologie L’ensemble des données repose sur la collecte quotidienne d’information par Influence Communication sur la période du 30 mai au 23 juin 2016 dans les médias traditionnels du Québec, tant en anglais qu’en français : quotidiens, hebdos, magazines, radio, télévision et sites Web d’information. L’ensemble de l’information d’intérêt régional dans chacune des régions du Québec a été considéré. Une valeur nominale a été donnée à chaque mention de nouvelle d’intérêt local. L’ensemble des mentions ont été compilés puis, les résultats ont été ventilé par thème et par type de média, pour l’ensemble de la province et des 17 régions administratives. Afin d’éviter les répétitions, nous avons omis de reprendre des observations générales ou particulières consignées dans notre analyse du 1er février 2016. Les secteurs qui ne sont pas considérés sont : • les jeux télévisés • la publicité • les petites annonces • la chronique nécrologique • le cinéma Note : La somme des données contenues dans les tableaux peut donner entre 101 % et 99 % car les résultats sont arrondis chaque fois.