Market Announcement

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

SIMS GROUP LIMITED Annual REPORT 2008 SIM S G R O U P L IM IT E D a N N U a L RE P O R T 2 0

SIMS GROUP LIMITED GROUP SIMS ANN U a L REPORT2008 L ThE average motor vEhIcle SIMS GROUP LIMITED Lasts 13.5 yEars anD comprises annUaL report 2008 approximately 15,000 IndividuaL Parts, Of whIch 80% are potentially recOverable. Approximately 68% Of a vEhIcle’S Parts by weighT aRE steel, followed by plastic (9%) anD nOn ferrous metals (8%), with ThE remaInder rubber, glass anD other materials. www.simsMM.cOM finanCiaL Summary Corporate DireCtory For the year ended 30 June 2008 SeCuritieS exChange LiSting Shareholder enquirieS The Company’s ordinary shares are quoted Enquiries from investors regarding their $7.67 b 38% $433m 81% 306¢ 60% 130¢ 8% on the Australian Securities Exchange under share holdings should be directed to: the ASX Code ‘SGM’. Computershare Investor Services Pty Limited TotaL REvEnue Profit after Tax EaRnIngs per ShaRE DIvidends per Share The Company’s American Depositary Shares Level 3 (ADSs) are quoted on the New York Stock 60 Carrington Street Exchange under the symbol ‘SMS’. The Company Sydney NSW 2000 has a Level II ADS program, and the Depositary Postal Address: is the Bank of New York Mellon Corporation. GPO Box 7045 ADSs trade under cusip number 829160100 Sydney NSW 2001 with each ADS representing one (1) ordinary Telephone: 1300 855 080 share. Further information and investor Facsimile: (02) 8235 8150 enquiries on ADSs may be directed to: Company SeCretarieS $181m 42% 14.6% 22% 10.9% 43% $8.02 72% The Bank of New York Mellon Corporation Frank Moratti Depositary Receipts Division Scott Miller Net caSh flowS Return -

Before the FEDERAL COMMUNICATIONS COMMISSION Washington, D.C

Before the FEDERAL COMMUNICATIONS COMMISSION Washington, D.C. 20554 In the Matter of ) ) Revitalization of the AM Radio Service ) MB Docket No. 13-249 REPLY COMMENTS OF THE AM RADIO PRESERVATION ALLIANCE ON FURTHER NOTICE OF PROPOSED RULE MAKING The AM Radio Preservation Alliance Members: Alpha Media LLC Bonneville International Corporation CBS Radio Inc. Cox Media Group, LLC Cumulus Media Inc. Entercom Communications Corp. Family Stations, Inc. Grand Ole Opry, LLC Greater Media, Inc. Hearst Stations Inc. Hubbard Radio, LLC iHeartMedia + Entertainment, Inc. NRG License Sub, LLC Scripps Media, Inc. Townsquare Media, Inc. Tyler Media, L.L.C. Tribune Broadcasting Company, LLC April 18, 2016 SUMMARY These Reply Comments are submitted by the AM Radio Preservation Alliance (the “Alliance”) addressing those proposals in the Commission’s Further Notice of Proposed Rule Making, FCC 15-142, MB Docket No. 13-249 (the “FNPRM”) to alter interference protections for Class A AM stations and to reduce the protected daytime contours for Class B, C and D AM stations. These FNPRM proposals, and the variations thereof suggested by certain commenters, would do more harm than good, and if adopted, would undermine the efforts to revitalize the AM radio service undertaken in the Commission’s First Report and Order in this proceeding. The Alliance Comments filed in this docket submitted evidence, grounded in audience data, listener responses and engineering studies, establishing that the FNPRM proposals to protect Class A AM stations only to their 0.1 mV/m groundwave -

ESG Reporting by the ASX200

Australian Council of Superannuation Investors ESG Reporting by the ASX200 August 2019 ABOUT ACSI Established in 2001, the Australian Council of Superannuation Investors (ACSI) provides a strong, collective voice on environmental, social and governance (ESG) issues on behalf of our members. Our members include 38 Australian and international We undertake a year-round program of research, asset owners and institutional investors. Collectively, they engagement, advocacy and voting advice. These activities manage over $2.2 trillion in assets and own on average 10 provide a solid basis for our members to exercise their per cent of every ASX200 company. ownership rights. Our members believe that ESG risks and opportunities have We also offer additional consulting services a material impact on investment outcomes. As fiduciary including: ESG and related policy development; analysis investors, they have a responsibility to act to enhance the of service providers, fund managers and ESG data; and long-term value of the savings entrusted to them. disclosure advice. Through ACSI, our members collaborate to achieve genuine, measurable and permanent improvements in the ESG practices and performance of the companies they invest in. 6 INTERNATIONAL MEMBERS 32 AUSTRALIAN MEMBERS MANAGING $2.2 TRILLION IN ASSETS 2 ESG REPORTING BY THE ASX200: AUGUST 2019 FOREWORD We are currently operating in a low-trust environment Yet, safety data is material to our members. In 2018, 22 – for organisations generally but especially businesses. people from 13 ASX200 companies died in their workplaces. Transparency and accountability are crucial to rebuilding A majority of these involved contractors, suggesting that this trust deficit. workplace health and safety standards are not uniformly applied. -

Shareholder Review 2017

2017 Shareholder Review HT&E LIMITED ABN 95 008 637 643 In May 2017, APN News & Media Limited changed its name to HT&E Limited (HT&E), marking the Company’s final shift away from traditional publishing and reflecting HT&E’s repositioned portfolio of leading, high-quality metropolitan media assets across radio, outdoor and digital. Uniquely placed, HT&E continues to operate in growth segments of the media landscape and brings together a combination of ‘away from home’ assets – Australian Radio Network (ARN), Adshel, Conversant Media, Gfinity Esports Australia (Gfinity Australia) and Emotive. These powerful channels can work together to more effectively target, engage with, and drive behaviours of our consumer audiences while they’re on the move. HT&E’s media and entertainment offering provides unprecedented scale, content creation, and insight-led innovation, to deliver a better proposition for audiences and advertisers. In this report About HT&E 1 Chairman’s Report 2 Chief Executive Officer’s Report 4 Operating and Financial Review 6 Corporate Social Responsibility 14 Senior Management Team 18 Board of Directors 20 Five Year Financial History 22 Corporate Directory 23 HT&E owns Australia’s #1 national metropolitan radio network and the #1 street furniture business in Australia and New Zealand. Results snapshot In 2017, HT&E continued to focus on its core assets, supported by its expanding digital portfolio and data capabilities, and a fresh trade proposition to deliver #1 integrated solutions for advertisers. National Radio Network ARN improved its performance in the second half of the year, regaining the number one network position, growing market share and improving its digital broadcast 0.97x and commercialisation capabilities. -

Boral Announces Board Renewal

ASX RELEASE 28 September 2020 Boral announces Board renewal Boral Limited (“Boral” ASX: BLD) today announced that two new independent non-executive Directors have been appointed to the Board. In addition, Boral has agreed to appoint two nominees of Seven Group Holdings Limited (“SGH”) as non-executive Directors. The appointment of the four new non-executive Directors is effective 28 September 2020, and each of the new Directors will stand for election at Boral’s Annual General Meeting on 27 October 2020. Rob Sindel and Deborah O’Toole appointed as new independent non-executive Directors Boral’s new independent non-executive Directors are Rob Sindel and Deborah O’Toole. Rob Sindel brings to the Board deep operational experience in the building and construction materials sector. He was the former Managing Director & CEO of CSR Limited for eight years to 2019. This was the culmination of his 30-year career in construction materials and building products both in Australia and the United Kingdom. Rob is currently Chairman of Orora Limited and a Director of Mirvac Group. Deborah O’Toole has extensive executive experience and finance capability including as a former CFO in three ASX listed companies – MIM Holdings, Queensland Cotton and Aurizon. She also has substantial Board level experience including as chair of various audit and / or risk committees of Asciano Rail Group, Credit Union Australia, Sims Metal Management and Alumina Limited. Deborah intends to reduce her current commitments to ensure she can devote sufficient time to her new role at Boral. Ryan Stokes and Richard Richards appointed as nominees of Seven Group Holdings SGH and its associated entities now hold a relevant interest in up to ~19.9% of the shares of Boral and the Board considers a level of proportionate representation on the Board appropriate, subject always to any nominees being of a suitable calibre. -

Stations Monitored

Stations Monitored 10/01/2019 Format Call Letters Market Station Name Adult Contemporary WHBC-FM AKRON, OH MIX 94.1 Adult Contemporary WKDD-FM AKRON, OH 98.1 WKDD Adult Contemporary WRVE-FM ALBANY-SCHENECTADY-TROY, NY 99.5 THE RIVER Adult Contemporary WYJB-FM ALBANY-SCHENECTADY-TROY, NY B95.5 Adult Contemporary KDRF-FM ALBUQUERQUE, NM 103.3 eD FM Adult Contemporary KMGA-FM ALBUQUERQUE, NM 99.5 MAGIC FM Adult Contemporary KPEK-FM ALBUQUERQUE, NM 100.3 THE PEAK Adult Contemporary WLEV-FM ALLENTOWN-BETHLEHEM, PA 100.7 WLEV Adult Contemporary KMVN-FM ANCHORAGE, AK MOViN 105.7 Adult Contemporary KMXS-FM ANCHORAGE, AK MIX 103.1 Adult Contemporary WOXL-FS ASHEVILLE, NC MIX 96.5 Adult Contemporary WSB-FM ATLANTA, GA B98.5 Adult Contemporary WSTR-FM ATLANTA, GA STAR 94.1 Adult Contemporary WFPG-FM ATLANTIC CITY-CAPE MAY, NJ LITE ROCK 96.9 Adult Contemporary WSJO-FM ATLANTIC CITY-CAPE MAY, NJ SOJO 104.9 Adult Contemporary KAMX-FM AUSTIN, TX MIX 94.7 Adult Contemporary KBPA-FM AUSTIN, TX 103.5 BOB FM Adult Contemporary KKMJ-FM AUSTIN, TX MAJIC 95.5 Adult Contemporary WLIF-FM BALTIMORE, MD TODAY'S 101.9 Adult Contemporary WQSR-FM BALTIMORE, MD 102.7 JACK FM Adult Contemporary WWMX-FM BALTIMORE, MD MIX 106.5 Adult Contemporary KRVE-FM BATON ROUGE, LA 96.1 THE RIVER Adult Contemporary WMJY-FS BILOXI-GULFPORT-PASCAGOULA, MS MAGIC 93.7 Adult Contemporary WMJJ-FM BIRMINGHAM, AL MAGIC 96 Adult Contemporary KCIX-FM BOISE, ID MIX 106 Adult Contemporary KXLT-FM BOISE, ID LITE 107.9 Adult Contemporary WMJX-FM BOSTON, MA MAGIC 106.7 Adult Contemporary WWBX-FM -

Bluescope Steel Asx Release

Date: 13 December 2019 BLUESCOPE STEEL APPOINTS NEW NON-EXECUTIVE DIRECTOR BlueScope Steel Chairman, Mr John Bevan, today announced the appointment of Kathleen Conlon, as a Non- executive Director with effect from 1 February 2020. Ms Conlon brings over 20 years of professional management consulting experience specialising in strategy and business improvement and has advised leading companies across a wide range of industries and countries. An American/Australian dual national, Ms Conlon joined the Chicago office of The Boston Consulting Group (BCG) in 1985, before transferring to the Sydney office in 1994. In her seven years as partner and director, Ms Conlon led BCG’s Asia Pacific operations practice and the Sydney Office. Ms Conlon is a non-executive director of REA Group Limited, Aristocrat Leisure Limited, Lynas Corporation Limited and a former non-executive director of CSR Limited. Ms Conlon is also a non-executive director of the Benevolent Society and a member of the Corporate Governance Committee of the Australian Institute of Company Directors (AICD). She is also a former President of the NSW Council and a former National Board member of the AICD. Welcoming Ms Conlon, Chairman Mr Bevan said, “We are very pleased to welcome Kathleen onto the Board. She is an experienced listed company director and brings with her deep knowledge and insights in the areas of strategy and business improvement as well as direct experience in the US and Asia, which will be a valuable addition to the Board and benefit BlueScope in the execution of its ongoing future strategy.” Ms Conlon said, “I’m looking forward to joining the Board and adding my expertise and experience to the BlueScope Board for the benefit and future success of the Company”. -

Longwave Capital Partners Invests with a Philosophy Informed by the Belief That for Small Caps, Quality Is a Key Driver of Long-Term Investment Outperformance

// Longwave Capital Partners invests with a philosophy informed by the belief that for small caps, quality is a key driver of long-term investment outperformance. When we assess companies considering Environmental, Social and Governance (ESG) characteristics, we see them as markers of quality. // Historically, we have considered ESG as a component in the The first stage uses systematic fundamental assessments to fundamental assessment that determines the quality of a identify companies that exhibit characteristics which have business – factored into the quality score that we use to drive historically been high probability markers of failure or our valuation. This is calculated by applying a discount rate to underperformance. These are low-quality companies we look to our sustainable, mid-cycle earnings estimate in forecast year ensure are not present in our portfolio. Based upon our current five. We believe the equity risk premium required of higher- criteria across the different models we employ, around 85% of quality companies is lower than average companies, and lower- the small caps we assess have a reasonable probability of failure quality companies require a higher equity risk premium than or long-term underperformance. We construct a systematic average. portfolio of the remaining 15%, built from the ensemble of our While cognisant of the impact ESG factors have on the quality of different quality models. a business (and thereby its value), our previous approach did not It would appear at first glance that using available ESG data and have the same objective level of data capture or comparability testing for performance would be an appropriate measure to as the investment process that we now employ, driven by enhance our existing systematic process. -

Morningstar Equity Research Coverage

December 2019 Equity Research Coverage Morningstar covers more than 200 companies in We use the following guidelines to Contact Details Australia and New Zealand as part of our global determine our Australian equity coverage: Australia stock coverage of about 1,500 companies. We are × Nearly all companies in the S&P/ASX 100 Index. Helpdesk: +61 2 9276 4446 Email: [email protected] one of the largest research teams globally with × Companies in the S&P/ASX 200 Index which more than 100 analysts, associates, and have an economic moat and/or have cash flow New Zealand strategists, including 17 in Australia. Local analysts which is at least mildly predictable. Helpdesk: +64 9 915 6770 regularly glean insights from our global sector teams × In total, Morningstar will cover about 80% of Email: [email protected] in China, Europe, and the United States, enriching S&P/ASX 200 companies (which typically the process and enhancing outcomes for investors. equates to about 95% of S&P/ASX 200 by Our research philosophy focuses on bottom-up market capitalisation). Companies we choose analysis, developing differentiated and deep not to cover in this index are usually unattractive opinions on competitive forces, growth prospects, for most portfolios, in our opinion. and valuations for every company we cover. We × About 30 ex-S&P/ASX 200 stocks are selected publish on each company under coverage at least on Morningstar’s judgement of each security's quarterly, and as events demand, to ensure investment merit − which includes a very investment ideas are always relevant. strong lean towards high-quality companies We are an independent research house, and with sustainable competitive advantages, or therefore determine our coverage universe based economic moats. -

AUSTRALIAN MANUFACTURING GAS EFFICIENCY GUIDE Acknowledgments

AUSTRALIAN MANUFACTURING GAS EFFICIENCY GUIDE Acknowledgments The Clean Energy Finance Corporation (CEFC) gratefully acknowledges the contributions of the following organisations • Alan Pears • Mars Australia • BlueScope Australia and New Zealand • Spirax Sarco • CSR Limited Disclaimer This report has been prepared and issued for CEFC for public dissemination and is provided solely for information purposes. This report (or the information, opinions or conclusions set out or referred to in this report (‘Information’) must not be used for any other purpose. This report and the Information is not intended to constitute financial, tax, legal, regulatory or other professional advice or recommendations of any kind and should not be used as a substitute for consultation with financial, tax, legal, regulatory or other professional advisors. You should seek independent advice from those advisors before making any investment or entering into any specific transaction in relation to, or in connection with, any Information, matter or thing referred to in this report. The CEFC has not been engaged to act, and has not acted, as adviser to any person or party in connection with this report or the Information it contains. To the fullest extent permitted by law, this report and the Information is provided as-is and as-available and none of the CEFC, its related bodies corporate and other affiliates, and their respective directors, employees, consultants, agents and advisors makes any representation or warranty (whether express, implied, statutory, or other) as to the authenticity, origin, validity, appropriateness or sufficiency of the Information for any purpose, or its accuracy or completeness, nor takes any responsibility under any circumstances for any loss or damage suffered as a result of any error, omission, inadequacy or inaccuracy contained in this report. -

Markit Itraxx Australia Series 28 Final Membership List

Markit iTraxx Australia Series 28 Final Membership List 13th Sep 2017 Markit iTraxx Australia Series 28 Contents Markit iTraxx Australia Series 28 Final Membership List ......................................................................................... 3 Markit iTraxx Australia Series 28 Final vs. Markit iTraxx Series 27........................................................................ 4 Markit iTraxx Australia Series 28 Coupon and Recovery Rate ................................................................................ 4 Copyright © 2017, Markit Group Limited. All rights reserved. www.ihsmarkit.com 2 Markit iTraxx Australia Series 28 Markit iTraxx Australia Series 28 Final Membership List Markit Ticker Markit Long Name AMCOR AMCOR LTD AMPAU-GpHldg AMP GROUP HOLDINGS LIMITED ANZ AUSTRALIA AND NEW ZEALAND BANKING GROUP LIMITED BHP BHP BILLITON LIMITED CHORLIM CHORUS LIMITED CBA COMMONWEALTH BANK OF AUSTRALIA CROWNRE CROWN RESORTS LIMITED CSRLTD CSR LIMITED GPTAU GPT RE LIMITED as responsible entity of the General Property Trust JEMLTD JEMENA LIMITED LENDLCO LENDLEASE CORPORATION LIMITED MQB MACQUARIE BANK LIMITED NAB NATIONAL AUSTRALIA BANK LIMITED QANTAS QANTAS AIRWAYS LIMITED QBEAU QBE INSURANCE GROUP LIMITED RIOLN-Ltd RIO TINTO LIMITED SCENTRE MANAGEMENT LIMITED as responsible entity of Scentre Group SCENTMA Trust 1 STSP-OptusPty SINGTEL OPTUS PTY LIMITED SPARNEW Spark New Zealand Limited TAHAU TABCORP HOLDINGS LIMITED TELECO TELSTRA CORPORATION LIMITED WESAU WESFARMERS LIMITED WSTP WESTPAC BANKING CORPORATION WPLAU WOODSIDE PETROLEUM LTD. WOWAU WOOLWORTHS LTD Copyright © 2017, Markit Group Limited. All rights reserved. www.ihsmarkit.com 3 Markit iTraxx Australia Series 28 Markit iTraxx Australia Series 28 Final vs. Markit iTraxx Series 27 Markit Ticker Markit Long Name IN/OUT No Changes Markit iTraxx Australia Series 28 Coupon and Recovery Rate Index Years Maturity Coupon (bps) Recovery Rate % Markit iTraxx Australia 5 20-Dec-2022 100 40 Copyright © 2017, Markit Group Limited. -

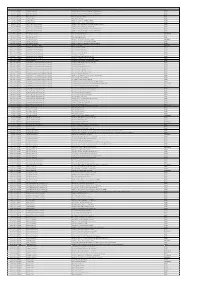

Meeting Date ASX Code Company Name Summary Caresuper Vote 6

Meeting Date ASX Code Company Name Summary CareSuper Vote 6/07/2011 CDU Cudeco Limited Ratify the prior issue of shares to Oceanwide FOR 6/07/2011 CDU Cudeco Limited Ratify the prior issue of shares to Oceanwide FOR 6/07/2011 CDU Cudeco Limited Approve the issue of shares to Oceanwide FOR 7/07/2011 CSR CSR Limited Elect Kathleen Conlon FOR 7/07/2011 CSR CSR Limited Elect Rob Sindel FOR 7/07/2011 CSR CSR Limited Approve grant of ZEPOs to CEO FOR 7/07/2011 CSR CSR Limited Approve the remuneration report FOR 8/07/2011 GCL Gloucester Coal Limited Approve the acquisition of the Donaldson Group FOR 8/07/2011 GCL Gloucester Coal Limited Approve the marketing agreement FOR 8/07/2011 GCL Gloucester Coal Limited Approve the acquisition of the Monash Group FOR 8/07/2011 GCL Gloucester Coal Limited Approve the amendment to the constitution FOR 8/07/2011 GCL Gloucester Coal Limited Approve provision of financial assistance FOR 13/07/2011 SPN SP Ausnet Group Re-elect Jeremy Davis AGAINST 13/07/2011 SPN SP Ausnet Group Re-elect Ian Renard FOR 13/07/2011 SPN SP Ausnet Group Elect Tina McMeckan FOR 13/07/2011 SPN SP Ausnet Group Approve the remuneration report AGAINST 13/07/2011 SPN SP Ausnet Group Approve issue to underwriter of DRP FOR 13/07/2011 SPN SP Ausnet Group Approve issue for Singapore law purposes FOR 27/07/2011 CQO Charter Hall Office REIT Remove the RE AGAINST 28/07/2011 MQG Macquarie Group Limited Re-elect Peter Kirby FOR 28/07/2011 MQG Macquarie Group Limited Re-elect John Niland FOR 28/07/2011 MQG Macquarie Group Limited Re-elect Helen