Revive Realty Limited Cin: U70102mh2006plc162452

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Agenda 160Th SLBC Meeting, M.P. Convenor: Central Bank of India

Agenda 160th SLBC Meeting, M.P. Convenor: Central Bank of India Venue: Conference Hall, Central Bank Date: 01 July 2016 of India, 9 Arera Hills, BHOPAL Agenda for 160th SLBC Meeting of Madhya Pradesh Page 0 Index AGENDA AGENDA PAGE NO.. 1 Adoption of the Minutes of the 159th SLBC meeting held on 10.03.2016 4 2 Action Taken Report on action points of 159th SLBC meeting held on 10.03.2016 5-6 3 Key Banking parameters of the State: At a glance 7-8 4 Review of performance under Annual Credit Plan (ACP) 2015-16 9-11 a. ACP achievement for year ended 31st March 2016 9 b. Agency wise ACP achievement as on 31.03.2016 10 c. Comparative achievement of ACP over corresponding previous year 10-11 5 CD Ratio performance in Madhya Pradesh 12-14 a. Comparative CD Ratio over corresponding previous year 12 b. Districts with low CD Ratio (Below 40%) 13 c. Centre wise movement of CD Ratio 14 6 Pradhan Mantri Fasal Bima Yojana & Unified Package Insurance Scheme 15 a. Kisan Credit Card 16 7 Levy of Stamp Duty on agricultural loans 17 8 Pradhan Mantri Jan Dhan Yojana (PMJDY) & Financial Inclusion 18-19 a. Status of the State under PMJDY as on 01.06.2016 18 b. First State Level Financial Inclusion Committee Meeting of the State 19 c. Solar Powered VSAT in the SSAs having connectivity Problem 19 9 Social Security Schemes 20-21 a. Status of the State as on 01.06.2016 20 b. Amendments in rules for implementation of PMJJBY 20 c. -

A Review of Chiropterological Studies and a Distributional List of the Bat Fauna of India

Rec. zool. Surv. India: Vol. 118(3)/ 242-280, 2018 ISSN (Online) : (Applied for) DOI: 10.26515/rzsi/v118/i3/2018/121056 ISSN (Print) : 0375-1511 A review of Chiropterological studies and a distributional list of the Bat Fauna of India Uttam Saikia* Zoological Survey of India, Risa Colony, Shillong – 793014, Meghalaya, India; [email protected] Abstract A historical review of studies on various aspects of the bat fauna of India is presented. Based on published information and study of museum specimens, an upto date checklist of the bat fauna of India including 127 species in 40 genera is being provided. Additionaly, new distribution localities for Indian bat species recorded after Bates and Harrison, 1997 is also provided. Since the systematic status of many species occurring in the country is unclear, it is proposed that an integrative taxonomic approach may be employed to accurately quantify the bat diversity of India. Keywords: Chiroptera, Checklist, Distribution, India, Review Introduction smallest one being Craseonycteris thonglongyai weighing about 2g and a wingspan of 12-13cm, while the largest Chiroptera, commonly known as bats is among the belong to the genus Pteropus weighing up to 1.5kg and a 29 extant mammalian Orders (Wilson and Reeder, wing span over 2m (Arita and Fenton, 1997). 2005) and is a remarkable group from evolutionary and Bats are nocturnal and usually spend the daylight hours zoogeographic point of view. Chiroptera represent one roosting in caves, rock crevices, foliages or various man- of the most speciose and ubiquitous orders of mammals made structures. Some bats are solitary while others are (Eick et al., 2005). -

Small Mammal Mail

Small Mammal Mail Newsletter celebrating the most useful yet most neglected Mammals for CCINSA & RISCINSA -- Chiroptera, Rodentia, Insectivora, & Scandentia Conservation and Information Networks of South Asia Volume 6 Number 1 ISSN 2230-7087 September 2014 Contents Study of the Indian Flying Fox (Pteropus giganteus) Colonies of Jambughoda Wildlife Sanctuary, Gujarat, India: Record of largest roosting congregation at Targol, Raju Vyas and Kartik Upadhyay, Pp. 2-8 Records of roosting sites of Indian Flying Fox Pteropus giganteus (Brunnich, 1782) from Madhya Pradesh, India, S.S. Talmale, Pp. 9-11 Interaction of Indian Flying Foxes Pteropus giganteus (Brunnich, 1782) with the plant species in the Lower Brahmaputra Valley of Assam, Azad Ali, Pp. 12-14 Population and Conservation status of the Indian Flying Fox roost in Itiadoh dam, Maharashtra, S.V. Bhandarkar and G.T. Paliwal, Pp. 15-18 Successful One year completion of Small Mammals Hiking Programme in Kathmandu, Nepal, Sabina Koirala, P. 19 Insect Pest Management by Horseshoe Bats of KMTR, Tamil Nadu, Pp. 40-47 Unexpected death of Indian Flying Foxes Pteropus giganteus in Jahangirnagar University campus, Savar, Bangladesh, Tahsinur Rahman Shihan, P. 20 Record of Endemic Malabar Spiny Tree mouse, Platacanthomys lasiurus Blyth 1859 from Nilgiri Biosphere Reserve, Kerala, Divin Murukesh and Anoop Das, P. 21 The Record of Elegant Water Shrew Nectogale elegans from Gaurishankar Conservation area, Nepal, Sagar Dahal, Kaustuv Raj Neupane and Giovanni Amori, Pp. 22-23 Small mammal awareness programme for local communities in Tamil Nadu - a report, Brawin Kumar, Pp. 24-28 Chiroptera Research Techniques and Conservation in Bangladesh, Pp. 29-35 Chiroptera Research Techniques and Conservation in Bangladesh - Report Nurul Islam, Pp. -

District Census Handbook, East-Nimar, Part XIII-B, Series-11

--------------~--.~.~-.~.~ -------- ~~ 11 'lTrr X III-. CfiT STT.fqc.fi "T'tiw (I ~. ~. ~, ",,'Ufiq snllQf~ ~ f;,~, ~'I ~~ 1981 CENSUS-PUBLICATION PLAN '( 1981 Census Publications, Series 11 in All lndia Series will be published;" the following partl) GOVERNMENT OF INDIA PUBLICATIONS Part I-A Administration Report-Enumeration Part I-B Administration Report-Tabulation ·Part II-A General Population Tables Part II-B Primary Census Abstract Part III General Economic Tables Part IV Social and Cultural Tables Part V Migration Tables Part VI Fertility Tables Part VII Tables on Houses and Disabled PopUlation .Part VIII Household Tables Part IX Special Tables on Scheduled Castes and Scheduled Tribes .Part X-A Town Directory Part X-B Survey Reports on selected Towns Part X-C Survey Reports on selected Villages Part XI Ethnographic Nates and special studies on Scheduled Castes and Scheduled Tribes Part XII Census Atlas Paper 1 of 1982 Primlry Census Abstract for Scheduled Cl~tes ani Scheduled Tribes Paperl of 1984 H)u'le:!101d P.Jp'llatio:1 by Religion of Head of Household STATE GOVERNMENT PUBLICATIONS Part XIII-A and B District Census Handbook for each of the 45 districts in the state (Village and Town Directory and Primary Census Abstract) CONTENTS ~ Pages Foreword 1 m~ I-IV 2 Sltal~;'1 Preface V-VI District Map 3 ~'fiT;mn ... "" Important Statistics VII 4 ~vr3{~ 5 rc.~~cq!fl f~ Analytical Note IX-XXXIV <llf(6lfTC1ICfi recqor'Ti ar~~f:qa iifTfu Notes and Explanations: List of Scheduled ar"~ arl~ GfifiifTfu CfiT ~T Castes and Scheduled Tribes Order ( ~mCTif) J fiI&lfiifi 1916 : f~T (Amendment) Act, 1976, History and t3("~vro:rT -rfu!CfiT !!fiT ~fu~HT om: Scope of District Census Handbook, Analytical Note Ii!f I f~~livrT(lftf) f!tq1JJ'T I 6 ~~i6~fl Tahsil Maps 7 e(~"T;rmt ~.') ALPHABETICAL l1ST OF VILLAGES 1-39 .. -

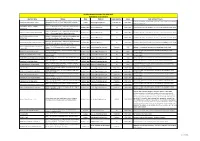

TQ CERT ORGANIC CLIENT LIST-2020-2021 Updated As on 31

TQ CERT ORGANIC CLIENT LIST-2020-2021 Updated as on 31-12-2020 Operator Name Address State EMAIL ID Scope Operation Scope Major certified Products Address: Plot No - 1006 B, Laxmi Sagar, Near Khan Chicken Center, Beetroot, foxtail millet, soyabean white, kodo millet, finger millet, barnyard millet, ORGANIC GROWER GROUP - JAJPUR Bhubaneswar,751006, Pin:751006, State: Odisha And District: Odisha [email protected] Production- ICS NPOP & NOP sunflower, turmeric fresh Khordha SARVMANGAL ORGANIC FARMERS Address: 77- Bhaktambar Colony, Radhika Hills, Ahmadabad Road, Madhya Pradesh [email protected] ICS NPOP & NOP Maize(corn other tha seed), soyabean, sunflower seeds, bengal gran whole, wheat ASSOCIATION Pin:454001,State: Madhya Pradesh, And District: Dhar. Address: 77- Bhaktambar Colony, Radhika Hills, Ahmedabad Road, NIRMAL ORGANIC FARMERS ASSOCIATION Madhya Pradesh [email protected] ICS NPOP & NOP Maize(corn other tha seed), soyabean, sunflower seeds, bengal gran whole, wheat Dhar, Pin:454001, State: Madhya Pradesh, District: Dhar NIRMAL JIVAN ORGANIC FARMERS Address: 77- Bhaktambar Colony, Radhika Hills,Ahmadabad Road, Madhya Pradesh [email protected] ICS NPOP & NOP Maize(corn other tha seed), soyabean, sunflower seeds, bengal gran whole, wheat ASSOCIATION Pin:454001,State: Madhya Pradesh And District: Dhar Address: 77- Bhaktambar Colony, Radhika Hills, Ahmadabad Road, MAHI SAGAR ORGANIC FARMERS ASSOCIATION Madhya Pradesh [email protected] ICS NPOP & NOP Maize(corn other tha seed), soyabean, sunflower seeds, bengal gran -

Common Service Centre (CSC) List (Madhya Pradesh State) List Received on 22 Dec 2018 from Rishi Sharma ([email protected]) for Ayushman Bharat-Madhya Pradesh

Common Service Centre (CSC) List (Madhya Pradesh State) List Received on 22 Dec 2018 from Rishi Sharma ([email protected]) for Ayushman Bharat-Madhya Pradesh SN District Subdistrict Po_Name Kiosk_Name Kiosk_Street Kiosk_Locality Pincode Kiosk_U/R 1 Agar Malwa Susner Agar Malwa S.O Shree Computer's Sunser ward no. 13 dak bangla main road 465441 Urban 2 Agar Malwa Agar Agar Malwa S.O Shankar Online & adhar center Ujjain road Agar Malwa 465441 Urban 3 Agar Malwa Agar Bapcha B.O SHREE COMPUTER DUG ROAD BAROD BAROD AGAR MALWA 465550 Urban 4 Agar Malwa Susner Susner S.O SHREE BALVEER COMPUTERS 96 465447 Urban 5 Agar Malwa Susner Susner S.O KAMAL KISHOR RAMANUJ RAMANUJ ONLINE CENTER BUS STAND SOYAT KALAN 465447 Urban 6 Agar Malwa Susner Susner S.O NEW LIFE COMPUTER TRAINING SCHOOL INDORE KOTA ROAD BUS STAND SOYAT KALAN 465447 Urban 7 Agar Malwa Badod Bapcha B.O Bamniya online Kiosk Barode Barode 465550 Urban 8 Agar Malwa Nalkheda Agar Malwa S.O GAWLI ONLINE CENTER JAWAHAR MARG 465441 Urban 9 Agar Malwa Agar Agar Malwa S.O basra online agar malwa agar malwa 465441 Urban 10 Agar Malwa Agar Agar Malwa S.O mevada online agar malwa agar malwa 465441 Urban 11 Agar Malwa Susner Susner S.O BHAWSAR SUSNER SUSNER 465447 Urban 12 Agar Malwa Susner Susner S.O Suresh Malviya Ward NO. 11 Hari Nagar Colony 465447 Urban 13 Agar Malwa Susner Susner S.O vijay jain itwariya bazar susner 465447 Urban 14 Agar Malwa Susner Susner S.O shailendra rajora shukrwariya bazar susner susner 465447 Urban 15 Agar Malwa Susner Susner S.O ARIHANT COMPUTER'S SHUKRAWARIYA -

Agenda 159Th SLBC Meeting, M.P. Convenor: Central Bank of India

Agenda 159th SLBC Meeting, M.P. Convenor: Central Bank of India Venue: Conference Hall, Central Bank of India, 9 Arera Hills, Date: 10th March 2016 BHOPAL 0 Index SR. AGENDA PAGE 1 Adoption of the Minutes of the 158th SLBC meeting held on 16.11.2015 4 2 Action Taken Report 5-7 3 Review of performance under Annual Credit Plan (ACP) 2015-16 8-9 a. ACP achievement for Quarter ended 31st December 2015 8 b. Agency wise ACP achievement FY 2015-16 9 b. Comparative achievement of ACP over corresponding previous year 9 4 CD Ratio performance in Madhya Pradesh 10-11 a. Comparative CD Ratio over corresponding previous year 10 b. Credit to Deposit Ratio Agency wise 10 c. Districts with CD Ratio below 40% 11 5 Pradhan Mantri Fasal Bima Yojana 12-15 6 Prime Minister’s Start-up India Programme 16 7 Pradhan Mantri Awas Yojana 17 8 Progress under Pradhan Mantri MUDRA Yojana 18-19 9 Roadmap for opening brick & mortar branches in villages with population 20-22 more than 5000 without a bank branch of a scheduled commercial bank 10 Rolling out DBT in Kerosene 23 11 Providing Solar Powered VSAT under FIF for Connectivity 24 12 Social Security Schemes 25-27 a. Progress under the schemes b. Claim Status under these schemes 13 Performance under Housing Loan Schemes 27-29 a. Chief Minister Rural Housing Mission (CMRHM) b. Urban Poor Housing Finance 14 Progress under Govt. Sponsored Schemes/Programmes in Madhya 29-34 Pradesh a. Mukhya Mantri Yuva Udyami/Swarojgar Yojana/Arthik Kalyan 29-31 Yojana 32 b. -

Selection List of Gramin Dak Sevak for Madhya Pradesh Circle Cycle II Vide Notification No.ESTT/14-02/GDS VACANCY/2ND CYCLE/20

Selection list of Gramin Dak Sevak for Madhya Pradesh circle Cycle II vide Notification No.ESTT/14-02/GDS VACANCY/2ND CYCLE/20 S.No Division HO Name SO Name BO Name Post Name Cate No Registration Selected Candidate gory of Number with Percentage Post s 1 Bhopal Bhel H.O Bhel H.O Bhel H.O GDS ABPM/ UR 1 CR6B868A3DFBA RISHITA PATIL- Dak Sevak E (95.5)-OBC 2 Bhopal Bhel H.O Bhel H.O Jamuniya GDS BPM PWD 1 CR0C74AD5E531B ANURAG TIWARI- Kalan B.O. -B (87.2)-PWD-B 3 Bhopal Bhopal G.P.O. Bairagarh S.O Bairagarh S.O GDS ABPM/ OBC 1 CR45ECD2543D25 AYUSHI Dak Sevak KUSHWAHA- (96)- OBC 4 Bhopal Bhopal G.P.O. Bairagarh S.O Bairagarh S.O GDS ABPM/ UR 1 CR0A244D5FE26A MANOJ PARMAR- Dak Sevak (96.4)-OBC 5 Bhopal Bhopal G.P.O. Bairagarh S.O Khajuri Sadak GDS BPM UR 1 CR571E444FBB1F POOJA KUSHWAH- B.O (96)-OBC 6 Bhopal Bhopal G.P.O. Bairagarh S.O Phanda B.O GDS ABPM/ UR 1 CR31AB57CF422B RANOO- (96.1667)- Dak Sevak UR 7 Bhopal Bhopal G.P.O. Berasia Balachoan GDS ABPM/ ST 1 CR1F226B778482 VANKUDOTH Bhopal S.O B.O Dak Sevak SURESH- (90.25)-ST 8 Bhopal Bhopal G.P.O. Berasia Balachoan GDS BPM UR 1 CR694DA9E468F8 BHUMIKA Bhopal S.O B.O PATANKER- (96.8333)-OBC 9 Bhopal Bhopal G.P.O. Berasia Berasia GDS ABPM/ EWS 1 CR18B11F4F4F43 PRATIKSHA Bhopal S.O Bhopal S.O Dak Sevak GUPTA- (95)-UR- EWS 10 Bhopal Bhopal G.P.O. -

District Census Handbook, Khandwa, Parts X (A) & X

CENSUS OF INDIA 1971 SERIES 10 MADHYA PR ADESH DISTRICT CENSUS HANDBOOK PARTS X(A) & iX(B) VILLAGE AND TOWN DIRECTORY VILLAGE AND TOWN-WISE PRIMARY CENSUS ABSTRACT KHANDWA DISTRICT A.K.PANDYA OP THB INDIAN ADMINISTRATIVl! SIlRVICil DIRECTOR OF CENSUS OPERATIONS, MADHYA PRADESH PUBLISHED BY THE GOVERNMENT OF MADHYA PRADESH 1975 1971 CENSUS PUBLICATIONS, MADHYA PRADESH ( An the Census Publications of this State will bear series No. 10 ) PART I Census General Report including Subsidiary (in Sub-Parts) Tables PART II-A Census Tables on population PART II-B Economic Tables (in Sub-Parts) PART I1-C Social and Cultural Tables (in Sub-Parts) PART III-A E~tablishment Report and Subsidiary Tables PART I1I.B Establishment Tables PART IV Housing Report and Tables PART V Special Tables and Ethnographic Notes on (in Sub-Parts) Scheduled Castes and Scheduled Tribes PART VI-A Town Directory PART VI·B Special Survey Reports on selected Towns PART VI-C Survey Reports on selected Villages PART VII Special Report on Graduates and Technical Personnel PART VIII-A Administration Report-Enumeration PART VIIl-B Administration Repofl-'rabulatioJI PART lX Census Atlas PAR T IX-A Administrative Atlas STAT.E GOVERNMENT PUBLICATIONS PART X-A Village and Town Directory PART X-B Village and Town Primary Census AbstraclS PART X.c Analytical Report and Admini~trative Statements and District Census fabll!ll (District Census Handbooks are published under Part X in 3 Parts-A, B &, C for each of the 43 districts in the State. Parts A and B are published in one volume). -

Office Name Pincode Delivery

Delivery/ Office Office Name Pincode Circle Region Division Non Delivery Type Seoni H.O 480661 Delivery HO Madhya Pradesh Circle Bhopal HQ Region Balaghat Division Chakki Khamariya B.O 480661 Delivery BO Madhya pradesh circle Bhopal HQ Region Balaghat Division Jaitpur Kala B.O 480661 Delivery BO Madhya pradesh circle Bhopal HQ Region Balaghat Division Jam B.O 480661 Delivery BO Madhya pradesh circle Bhopal HQ Region Balaghat Division Amgaon B.O 480661 Delivery BO Madhya pradesh circle Bhopal HQ Region Balaghat Division Chawadi B.O 480661 Delivery BO Madhya pradesh circle Bhopal HQ Region Balaghat Division Mugwani Kala B.O 480661 Delivery BO Madhya pradesh circle Bhopal HQ Region Balaghat Division Pipardahi B.O 480661 Delivery BO Madhya pradesh circle Bhopal HQ Region Balaghat Division Suktara B.O 480661 Delivery BO Madhya pradesh circle Bhopal HQ Region Balaghat Division Tighra B.O 480661 Delivery BO Madhya pradesh circle Bhopal HQ Region Balaghat Division Vijaypani B.O 480661 Delivery BO Madhya pradesh circle Bhopal HQ Region Balaghat Division Badalpar B.O 480661 Delivery BO Madhya pradesh circle Bhopal HQ Region Balaghat Division Palari chhidiya B.O 480661 Delivery BO Madhya pradesh circle Bhopal HQ Region Balaghat Division Rajola B.O 480661 Delivery BO Madhya pradesh circle Bhopal HQ Region Balaghat Division Binjhawada B.O 480661 Delivery BO Madhya pradesh circle Bhopal HQ Region Balaghat Division Marbodi B.O 480661 Delivery BO Madhya pradesh circle Bhopal HQ Region Balaghat Division Sillore B.O 480661 Delivery BO Madhya pradesh circle