2015 Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Mid-Year Market Report Cincinnati, Ohio 2010

Mid-Year Market Report Cincinnati, Ohio 2010 Dear Colleagues, We are Cassidy Turley….we are Cincinnati. As residents and business people, we are dedicated to our region. We don’t just work in our community; we actively belong to the community. Our associates are actively involved in many charitable and civic organizations including The FreeStore Foodbank, United Cerebral Palsy of Cincinnati, United Way and the Cincinnati Museum Center at Union Terminal. We meet regularly with key business and community leaders and are involved in many professional organizations, just a few of them include the Urban Land Institute (ULI),The Society for Industrial and Office Realtors (SIOR), NAIOP Commercial Real Estate Development Association, CCIM Institute, Building and Owners Management Association (BOMA) and the University of Cincinnati Real Estate Roundtable. We look for meaningful ways to promote Cincinnati as a region of opportunity and growth. Our commitment to the community is the foundation for how we conduct business. We believe in face-to-face relationships and hands-on problem solving. Whether you are a Contents firm seeking space or an owner looking to fill space, we have the strategies and skills to assist you. You can also rely on Cassidy Turley to help manage your properties according Letter 2 to your individual goals and priorities. Office Market 3 You don’t simply have to take our word for it. Midwest Real Estate News in its annual “Best of the Best” rankings recently rated Cassidy Turley the #1 Property Management Industrial Market 8 firm and the #3 Brokerage firm in the Midwest. Retail Market 14 These rankings reflect our deep commitment to providing best in class services. -

NGA Retailer Membership List October 2013

NGA Retailer Membership List October 2013 Company Name City State 159-MP Corp. dba Foodtown Brooklyn NY 2945 Meat & Produce, Inc. dba Foodtown Bronx NY 5th Street IGA Minden NE 8772 Meat Corporation dba Key Food #1160 Brooklyn NY A & R Supermarkets, Inc. dba Sav-Mor Calera AL A.J.C.Food Market Corp. dba Foodtown Bronx NY ADAMCO, Inc. Coeur D Alene ID Adams & Lindsey Lakeway IGA dba Lakeway IGA Paris TN Adrian's Market Inc. dba Adrian's Market Hopwood PA Akins Foods, Inc. Spokane Vly WA Akins Harvest Foods- Quincy Quincy WA Akins Harvest Foods-Bonners Ferry Bonner's Ferry ID Alaska Growth Business Corp. dba Howser's IGA Supermarket Haines AK Albert E. Lees, Inc. dba Lees Supermarket Westport Pt MA Alex Lee, Inc. dba Lowe's Food Stores Inc. Hickory NC Allegiance Retail Services, LLC Iselin NJ Alpena Supermarket, Inc. dba Neimans Family Market Alpena MI American Consumers, Inc. dba Shop-Rite Supermarkets Rossville GA Americana Grocery of MD Silver Spring MD Anderson's Market Glen Arbor MI Angeli Foods Company dba Angeli's Iron River MI Angelo & Joe Market Inc. Little Neck NY Antonico Food Corp. dba La Bella Marketplace Staten Island NY Asker's Thrift Inc., dba Asker's Harvest Foods Grangeville ID Autry Greer & Sons, Inc. Mobile AL B & K Enterprises Inc. dba Alexandria County Market Alexandria KY B & R Stores, Inc. dba Russ' Market; Super Saver, Best Apple Market Lincoln NE B & S Inc. - Windham IGA Willimantic CT B. Green & Company, Inc. Baltimore MD B.W. Bishop & Sons, Inc. dba Bishops Orchards Guilford CT Baesler's, Inc. -

California Avocado Retail Availability Expands

California Avocado Retail Availability Expands he California Avocado Commission’s (CAC) retail marketing directors (RMDs) maintain close contact with retailers and handlers throughout the season, helping to facilitate smooth inventory transitions to California avocados. TRetail distribution of California avocados began in January with small, local retailers showcasing Big Game promotions. In March and April, retail distribution expanded to retailers located within and beyond California, with more significant retail distribution from May to early summer as the volume of harvested fruit increased. 36 / From the Grove / Summer 2020 At press time, California avocados were available at: • California retailers including: Bristol Farms Food 4 Less FoodMaxx Gelson’s Lucky Supermarkets Lunardi’s Markets Board Mercado Mi Tierra Mollie Stone’s of Nugget Markets Directors Raley’s Ralphs District 1 Save Mart Supermarkets Member/Jessica Hunter Sprouts Member/ Ryan Rochefort-Vice Chairman Stater Bros. Alternate/Michael Perricone Whole Foods District 2 • The Fresh Market (Alabama, Arkansas, Connecticut, Delaware, Florida, Georgia, Illinois, Indiana, Kentucky, Louisiana, Maryland, Massachusetts, Member/Charley Wolk Member/Ohannes Karaoghlanian Mississippi, New Jersey, New York, North Carolina, Ohio, Oklahoma, Alternate/John Cornell Pennsylvania, South Carolina, Tennessee, Virginia) • Hy-Vee (Illinois, Iowa, Kansas, Minnesota, Missouri, Nebraska, District 3 South Dakota, Wisconsin) Member/John Lamb-Chairman Member/Robert Grether-Treasurer • New Seasons -

New Economic Approaches to Consumer Welfare and Nutrition

New Economic Approaches to Consumer Welfare and Nutrition Conference Proceedings Food and Agricultural Marketing Consortium Alexandria, Virginia January 14-15, 1999 EXPANSION OF NON-TRADITIONAL FOOD RETAIL OUTLETS: EFFECT ON CONSUMER WELFARE ERS Commissioned Paper for the January 1999 Meeting of the Food and Agricultural Marketing Consortium *Michelle A. Morganosky Associate Professor of Consumer and Retail Marketing Department of Agricultural and Consumer Economics University of Illinois 326 Mumford Hall 1301 West Gregory Drive Urbana, IL 61801-3681 Tel: 217-333-0737 -or- 217-333-3217 Fax: 217-333-5538 Email: [email protected] Brenda J. Cude Professor and Head Department of Housing and Consumer Economics The University of Georgia 215 Dawson Hall Athens, GA 30602-3622 Tel: 706-542-4856 -or- 706-542-4857 Fax: 706-542-4397 Email: [email protected] *Send correspondence to Michelle A. Morganosky EXPANSION OF NON-TRADITIONAL FOOD RETAIL Version: March 3, 1999 BC OUTLETS: EFFECT ON CONSUMER WELFARE ABSTRACT In this study three different methods of data collection (telephone interviews/focus groups/on-line consumer surveys) were used to assess the impact of non-traditional retail outlets on consumer welfare. We analyzed consumer cross patronage between supermarkets and non- traditional food retail channels, examined reasons for cross patronage, and made a preliminary assessment of consumer response to one of the newest retail channels: on-line food shopping. Telephone interviews were conducted in a medium-size market with 300 individuals and focus groups were conducted in two major metropolitan markets and one medium-size market. The on-line survey consisted of responses from 243 on-line food shoppers in six different markets. -

United Natural Foods Annual Report 2020

United Natural Foods Annual Report 2020 Form 10-K (NYSE:UNFI) Published: September 29th, 2020 PDF generated by stocklight.com UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended August 1, 2020 or ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission File Number: 001-15723 UNITED NATURAL FOODS, INC. (Exact name of registrant as specified in its charter) Delaware 05-0376157 (State or other jurisdiction of (I.R.S. Employer Identification No.) incorporation or organization) 313 Iron Horse Way, Providence, Rhode Island 02908 (Address of principal executive offices) (Zip Code) Registrant’s telephone number, including area code: (401) 528-8634 Securities registered pursuant to Section 12(b) of the Act: Title of each class Trading Symbol Name of each exchange on which registered Common stock, par value $0.01 UNFI New York Stock Exchange Securities registered pursuant to Section 12(g) of the Act: None. Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

Feature Advertising by U.S. Supermarkets Meat and Poultry

United States Department of Agriculture Agricultural Feature Advertising by U.S. Supermarkets Marketing Service Meat and Poultry Livestock, Poultry and Seed Program Independence Day 2017 Agricultural Analytics Division Advertised Prices effective through July 04, 2017 Feature Advertising by U.S. Supermarkets During Key Seasonal Marketing Events This report provides a detailed breakdown of supermarket featuring of popular meat and poultry products for the Independence Day marketing period. The Independence Day weekend marks the high watershed of the summer outdoor cooking season and is a significant demand period for a variety of meat cuts for outdoor grilling and entertaining. Advertised sale prices are shown by region, state, and supermarket banner and include brand names, prices, and any special conditions. Contents: Chicken - Regular and value packs of boneless/skinless (b/s) breasts; b/s thighs; split, bone-in breasts; wings; bone-in thighs and drumsticks; tray and bagged leg quarters; IQF breast and tenders; 8-piece fried chicken. Northeast .................................................................................................................................................................. 03 Southeast ................................................................................................................................................................. 21 Midwest ................................................................................................................................................................... -

Lic. Nursery Dealers

2020 KY Nursery Dealers 10/15/2020 Lic # A/B Business Name Store # Address City Zip Code County 732A 7 in the Forest 603 East 5th St. English 47118‐ Crawford 677B A & D Greenhouse 1245 Clay Cole Rd. Elkton 42220‐ Todd 1059A Abbott Acres Greenhouse 1128 Jess Winn Rd. Belton 42324‐ Muhlenberg 1070B Ace Hardware 388 259 N. Riverhill S.C. Brownsville 42210‐ Edmonson 709B Ace Hardware 386 496 B S. Main St. Leitchfield 42754‐ Grayson 1049B Ace Hardware 393 445 Hwy 44 E. Suite 21 1/2 Sheperdsville 40165‐ Bullitt 1060B Ace Hardware 392 2706 Russellville Rd. Bowling Green 42102‐ Warren 1073B Ace Hardware 387 67 Settlers Center Rd. Taylorsville 40071‐ Spencer 1066B Ace Hardware 389 1105 W US 60 Irvington 40146‐ Breckinridge 1062B Ace Hardware 391 709 US 31W ByPass Bowling Green 42102‐ Warren 724B Ace Hardware 384 3180 Louisville Road Bowling Green 42102‐ Warren 878A Ace Hardware of Independence 2136 Declaration Drive Independence 41051‐ Kenton 559A Advanced Mulching Technologies, Inc. P.O. Box 22273 Lexington 40522‐ Fayette 636B Aldi Foods 63 5156 Hinkleville Road Paducah 42001‐ McCracken 163B Aldi Foods 44 4105 Hwy 27 South Somerset 42501‐ Pulaski 162B Aldi Foods 2 24 South Highway 1223 Corbin 40701‐ Laurel 320B Aldi Foods 19 2554 Ft. Campbell Blvd. Hopkinsville 42240‐ Christian 413B Aldi Foods 43 1455 Campbell Lane Bowling Green 42104‐ Warren 167B Aldi Foods 57 909 Hustonville Road Danville 40422‐ Boyle 853B Aldi Inc. 68 1509 Colesbury Circle Lexington 40511‐ Fayette 734B Aldi Inc. 35 601 N. Dixie Blvd. Radcliff 40160‐ Hardin 976B Aldi Inc. 04 2945 Highway 54 Owensboro 42303‐ Daviess 600B Aldi Inc. -

Major Work Stoppages in 2003 by Ann C

COMPENSATION AND WORKING CONDITIONS U.S. BUREAU OF LABOR STATISTICS Major Work Stoppages in 2003 by Ann C. Foster Bureau of Labor Statistics Originally Posted: November 23, 2004 There were 14 major work stoppages that began in 2003, idling 129,200 workers and resulting in 4.1 million days of idleness. Although these figures are up from the previous year, they are low by historical standards. The number of workers idled, the number of days of idleness, and the percent of estimated working time lost because of strikes and lockouts rose in 2003, but each of these measures remained low by historical standards. There were 14 major work stoppages that began during the year,1 idling 129,200 workers and resulting in 4.1 million workdays of idleness (about 1 out of every 10,000 available workdays).2 In comparison, 19 major work stoppages began in 2002, which idled 46,000 workers and resulted in 660,000 days of idleness. (See table 1 and charts 1, 2, and 3.) Major work stoppages are those involving 1,000 or more workers and lasting a full shift or longer; they include worker- initiated strikes, as well as lockouts by employers. A strike is defined as a temporary stoppage of work by a group of workers (not necessarily union members) to express a grievance or enforce a bargaining demand. A lockout is a temporary withholding or denial of employment by employers during a labor dispute to enforce employment terms on an employee group. Because of the complexity of labor disputes, BLS does not attempt to distinguish between strikes and lockouts in its statistics.3 In this article, however, either of these terms may be used when referring to information from other sources. -

2013 Annual Report

2013 Annual Report To our fellow shareholders: Regency Centers celebrated two remarkable milestones in 2013: our 50th year in business and 20th anniversary as a public company. In 1963, my parents, Joan Newton and Martin Stein, founded a family business called Regency Properties. Four years later they completed Regency Square Shopping Center in Jacksonville, the first enclosed mall in North Florida. Over the next 30 years, the company expanded into other major markets in Florida. I vividly remember the business conditions when we went public. Like today, the U.S. economy was enduring a shaky recovery from the recession of 1990-1991, one that was particularly hard on real estate. Equity from all sources was scarce and lending from the banks essentially frozen. Industry icon Sam Zell’s words at the time said it all, “Stay alive until 95.” It was obvious to many of the top executives of prominent real estate entities that the modern REIT vehicle was the best path not only to survive, but also to thrive as prosperous operating companies. The blueprint for success in the modern REIT era required an emphasis on embracing focused strategies, generating reliable income, using substantially less leverage, and committing to transparency and good governance. Fully appreciating the benefits and responsibilities of operating a successful public REIT, and having the ingredients and track record to make the grade, Regency went public and began trading on the NYSE on October 29, 1993. At the end of our first year as a public company we owned 30 properties. We reported less than $20 million of Net Operating Income (NOI), approximately $12 million in Funds From Operations (FFO), and had a market capitalization of less than $200 million. -

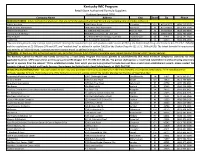

Kentucky WIC Program

Kentucky WIC Program Retail Store Authorized Formula Suppliers Updated January 4, 2016 Company Name Address City State Zip Phone MANUFACTURERS - Infant formula manufacturers that are currently registered with the FDA and are marketing infant formulas in the U.S. Abbott Nutrition 3300 Stelzer Road Columbus OH 43219-7677 (800) 227-5767 Mead Johnson Nutritionals 2400 West Lloyd Expressway Evansville IN 47721-0001 (812) 429-5000 Nestle Infant Nutrition 12 Vreeland Road, Box 697 Florham Park NJ 07932-0697 (818) 549-6000 Nutricia North America* 9900 Belward Campus Dr., Ste. 100 Rockville MD 20850-3969 (301) 795-2300 PBM Products 652 Peter Jefferson Parkway, Suite 300 Charlottesville VA 22911 (434) 297-1148 Vitaflo USA 211 N. Union St., Suite 100 Alexandria VA 22314 (800) 848-1356 *Nutricia manufactures only "exempt infant formula" meeting the requirements for such products under section 412(h) of the Federal Food, Drug, and Cosmetic Act (21 U.S.C. 350a(h)) and the regulations at 21 CFR parts 106 and 107, and "medical food" as defined in section 5(b)(3) of the Orphan Drug Act (21 U.S.C. 360ee(b)(3)). The infant formula list requirement only pertains to "infant formula," contract and non-contract brand, as defined in section 246.2. RETAILERS - All Kentucky WIC authorized vendors may sell infant formula. A list of stores is available upon request (contact 502-564-3827, Vendor Section). The Kentucky Cabinet for Health and Family Services has a Food Safety Program that issues permits to establishments that meet minimum compliance standards for their applicable business. CHFS issues these permits pursuant to KRS Chapter 217. -

Grocery Loyalty

Grocery Loyalty Grocery chains are hungry to increase shopper loyalty, as it can be a key factor in the health of their businesses. inMarket’s first-party, SDK derived location insights platform has the ability to reveal these metrics as well as a wide variety of other important consumer trends. In this inMarket inSights Report Card, we rank the 25 grocery chains with the highest customer loyalty indexes using 50 million Comscore-verified monthly active users. The inMarket location platform delivers powerful visibility into every step in the path to purchase using direct integrations into more than 750 of the most popular shopping and lifestyle apps. Our analysts leverage this data and scale to understand visitation trends at brick-and-mortar retailers, predicting future performance while enabling better decisions and better engagement. For more information on methodology, info about our advertising programs, or to request data for a particular retail chain, please contact inMarket today. Key Takeaways: • Some grocery chains with heavy penetrations in urban areas tend to have higher loyalty metrics than their rural competitors. This could be because denser geographic areas incentivize more frequent trips. • Loyalty has often been a barometer of success for businesses. By using metrics like customer loyalty index, grocery stores can determine the health of their repeat shopper business. • Grocery stores have higher customer loyalty than their retail counterparts due to necessity. Consumers simply need to purchase food more often than other retail products. That said, by looking at the grocery category average, we can understand which chains are thriving or struggling in terms of customer loyalty. -

Digital Coupon Publisher COUNTRY: ALL

Page: 1 of 5 Coverage Map – Digital Coupon Publisher COUNTRY: ALL Last Updated 10/15/2020 • A Carlie C's AG BR Central Grocers AHA City Markets Alpine MP Copps Associated Retail Operations Cub Food Associated Wholesale Grocers CV's Family Foods B D Baker's Super Market D'Agostino Berkots DeCA Big Y Supermarket Dicks Fresh Market Brookshire Grocery Dierbergs Buehlers Diiga Butera Markets Dillons C Discount Drug Mart C&K E Caneny Bros Elk Caputos Elmer's County Market Caraluzzis Page: 2 of 5 Coverage Map – Digital Coupon Publisher COUNTRY: ALL Last Updated 10/15/2020 • F GL Havre Family Dollar Goodsons Food 4 Less Great Valu Markets Food City H FoodMaxx Hardings Foods Co. Harmons Fred Meyer Harps Fred's Dollar Store Harris Teeter Fresh Air Harvey's Fresh Cuts Seagrove HomeLand Fresh Direct Honey Fresh Thyme Houchens Frisbees Hugos G J G&L Conrad Jack's Siga Galaxy Jay C Food Stores Gelson's Just $ave Gerbes Page: 3 of 5 Coverage Map – Digital Coupon Publisher COUNTRY: ALL Last Updated 10/15/2020 • K McKim's King Soopers Megafoods Kinney Drugs Meijer Supermarket Kirby Foods Metro Market Kmart Mitchell Knowlans N Krasdale Natural Kroger Natural Grocers KTA Superstores North L Northwest Laurel O Lowes Foods Owen's Market Lucky Supermarket P Lunds & Byerlys Payless Foods M Picchioni Marc's Pick 'n Save Mariano's Piggly Wiggly Martins Polly's Country Market Page: 4 of 5 Coverage Map – Digital Coupon Publisher COUNTRY: ALL Last Updated 10/15/2020 • Price Chopper SN 4A Publix SN Hitech PWCSC SN Network Q Spartan Nash QFC Sprouts R Super A Raley's Supermarket SuperValu Ralphs SuperValu Digital Reasors SuperValu East Remke Markets T S Tadychs Save More Tenutas SaveMart The Market at 25th Saver Group Toms Schnucks Market Tops Market Shoppers U ShopRite Unified Smith's Food & Drug Page: 5 of 5 Coverage Map – Digital Coupon Publisher COUNTRY: ALL Last Updated 10/15/2020 • V Vans Evergreen Vashons W Walts Weis Markets Woodmans.