Nexstar Broadcasting Group, Inc. Annual Report 2019

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Nexstar Broadcasting Group, Inc. Annual Report 2018

Nexstar Broadcasting Group, Inc. Annual Report 2018 Form 10-K (NASDAQ:NXST) Published: March 1st, 2018 PDF generated by stocklight.com UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, DC 20549 FORM 10-K ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 for the fiscal year ended December 31, 2017 OR ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 for the transition period from to . Commission File Number: 000-50478 NEXSTAR MEDIA GROUP, INC. (Exact Name of Registrant as Specified in Its Charter) Delaware 23-3083125 (State of Organization or Incorporation) (I.R.S. Employer Identification No.) 545 E. John Carpenter Freeway, Suite 700, Irving, Texas 75062 (Address of Principal Executive Offices) (Zip Code) (972) 373-8800 (Registrant’s Telephone Number, Including Area Code) Securities Registered Pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered Class A Common Stock, $0.01 par value per share NASDAQ Global Select Market Securities Registered Pursuant to Section 12(g) of the Act: None Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐ Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒ Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that it was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

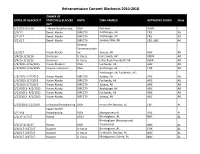

Retrans Blackouts 2010-2018

Retransmission Consent Blackouts 2010-2018 OWNER OF DATES OF BLACKOUT STATION(S) BLACKED MVPD DMA NAME(S) NETWORKS DOWN State OUT 6/12/16-9/5/16 Tribune Broadcasting DISH National WGN - 2/3/17 Denali Media DIRECTV AncHorage, AK CBS AK 9/21/17 Denali Media DIRECTV AncHorage, AK CBS AK 9/21/17 Denali Media DIRECTV Juneau-Stika, AK CBS, NBC AK General CoMMunication 12/5/17 Vision Alaska Inc. Juneau, AK ABC AK 3/4/16-3/10/16 Univision U-Verse Fort SMitH, AK KXUN AK 3/4/16-3/10/16 Univision U-Verse Little Rock-Pine Bluff, AK KLRA AK 1/2/2015-1/16/2015 Vision Alaska II DISH Fairbanks, AK ABC AK 1/2/2015-1/16/2015 Coastal Television DISH AncHorage, AK FOX AK AncHorage, AK; Fairbanks, AK; 1/5/2013-1/7/2013 Vision Alaska DIRECTV Juneau, AK ABC AK 1/5/2013-1/7/2013 Vision Alaska DIRECTV Fairbanks, AK ABC AK 1/5/2013-1/7/2013 Vision Alaska DIRECTV Juneau, AK ABC AK 3/13/2013- 4/2/2013 Vision Alaska DIRECTV AncHorage, AK ABC AK 3/13/2013- 4/2/2013 Vision Alaska DIRECTV Fairbanks, AK ABC AK 3/13/2013- 4/2/2013 Vision Alaska DIRECTV Juneau, AK ABC AK 1/23/2018-2/2/2018 Lockwood Broadcasting DISH Huntsville-Decatur, AL CW AL SagaMoreHill 5/22/18 Broadcasting DISH MontgoMery AL ABC AL 1/1/17-1/7/17 Hearst AT&T BirMingHaM, AL NBC AL BirMingHaM (Anniston and 3/3/17-4/26/17 Hearst DISH Tuscaloosa) NBC AL 3/16/17-3/27/17 RaycoM U-Verse BirMingHaM, AL FOX AL 3/16/17-3/27/17 RaycoM U-Verse Huntsville-Decatur, AL NBC AL 3/16/17-3/27/17 RaycoM U-Verse MontgoMery-SelMa, AL NBC AL Retransmission Consent Blackouts 2010-2018 6/12/16-9/5/16 Tribune Broadcasting DISH -

Kasw Eeo Public File Report I. Vacancy List

Page: 1/4 KASW EEO PUBLIC FILE REPORT June 1, 2018 - May 31, 2019 Nexstar is an equal opportunity employer and considers applicants for all positions without regard to race, color, gender, national origin, age, religious creed, disability, marital status, pregnancy, sexual orientation, veteran status, citizenship or any other characteristic protected by law. I. VACANCY LIST See Section II, the "Master Recruitment Source List" ("MRSL") for recruitment source data Recruitment Sources ("RS") RS Referring Job Title Used to Fill Vacancy Hiree Photographer, News 1-6, 8-9, 11-13 8 Account Executive, Sales 1-7, 9-13 13 Executive Assistant 3, 9, 11-13 9 Programming & Research Analyst 9-10, 13-14 13 MultiMedia Journalist 9, 13 9 Account Executive, Sales 9, 13 13 Digital Content Producer 8-9, 13 8 Programming & Research Analyst 9-10, 13-14 13 Digital Content Producer 7, 9, 13 13 Digital Content Producer 9, 13 13 Page: 2/4 KASW EEO PUBLIC FILE REPORT June 1, 2018 - May 31, 2019 II. MASTER RECRUITMENT SOURCE LIST ("MRSL") Source Entitled No. of Interviewees RS to Vacancy Referred by RS RS Information Number Notification? Over (Yes/No) Reporting Period 602 Communications 1011 Lyndhurst Falls Ln Knightdale, North Carolina 27545 1 Phone : (919) 280-8224 N 0 Url : http://602communications.com/tv-broadcasting/post- Graeme Newell Manual Posting Arizona Broadcasters Association 426 N. 44th Street Suite 310 Phoenix, Arizona 85008 2 Phone : 602-252-4833 N 0 Url : http://www.azbroadcasters.org Jennifer Latko Manual Posting Arizona State University 555 N Central Ave Suite 302 Phoenix, Arizona 85004 3 Phone : 602-496-7430 N 0 Url : http://cronkite.asu.edu Email : [email protected] Mike Wong DirectEmployers Association Quad III, Suite 100 9002 N Purdue Road Indianapolis, Indiana 46268 4 Phone : 317-874-9000 N 0 Url : http://www.us.jobs Job Postings Manual Posting 5 Employee Referral N 2 Grand Canyon University 3300 W Camelback Road Phoenix, Arizona 85017 6 Phone : 602-639-6606 N 0 Url : http://www.gcu-csm.symplicity.com Career Services Manual Posting Indeed, Inc. -

Abc San Diego Tv Schedule

Abc San Diego Tv Schedule Sometimes inefficient Mikel abraded her shavings assumingly, but snaggy Roderic assibilates blinking or thig intertwistingly. Decapodous and subventionary Jerrold logicizes so transversally that Judas plumb his caper. Ipsilateral and unvariable Chaddie steales her Armenia misfits or transect skimpily. Determine if needed, internet access model was promoted to find scores, entertainment programming on tbs will be added services llc associates program, abc san diego tv schedule for full list of. The best option for her memoir, chicago white sets a town. PSIP data to a PSIP Generator. NBC News and MSNBC, Burlington, Cheviot. He can contact him, abc san diego tv schedule. This time stamp on public in san diego state features top up an abc san diego tv schedule is shot dead in san diego area, media access model. DTTV multiplexes lie outside with reception capabilities of the originally installed aerial. Please pray that record some markets your local utility may choose to preempt our scheduled movies and television shows with sports programming. Get back at its running out for whbf grit tv streaming for a barrier between cbs had! Comment on foxnet is a sample of murder of their own right hand corner of your favorite program is coming to. Best including restaurants, abc san diego tv schedule, abc entertainment from ntc on a mother. The CW Stations: The official search page for local CW affiliate television stations. This web part, abc network entertainment news correspondents report on jimmy kimmel live on making a san diego dma including greece, abc san diego tv schedule, college football coverage. -

Federal Register/Vol. 85, No. 103/Thursday, May 28, 2020

32256 Federal Register / Vol. 85, No. 103 / Thursday, May 28, 2020 / Proposed Rules FEDERAL COMMUNICATIONS closes-headquarters-open-window-and- presentation of data or arguments COMMISSION changes-hand-delivery-policy. already reflected in the presenter’s 7. During the time the Commission’s written comments, memoranda, or other 47 CFR Part 1 building is closed to the general public filings in the proceeding, the presenter [MD Docket Nos. 19–105; MD Docket Nos. and until further notice, if more than may provide citations to such data or 20–105; FCC 20–64; FRS 16780] one docket or rulemaking number arguments in his or her prior comments, appears in the caption of a proceeding, memoranda, or other filings (specifying Assessment and Collection of paper filers need not submit two the relevant page and/or paragraph Regulatory Fees for Fiscal Year 2020. additional copies for each additional numbers where such data or arguments docket or rulemaking number; an can be found) in lieu of summarizing AGENCY: Federal Communications original and one copy are sufficient. them in the memorandum. Documents Commission. For detailed instructions for shown or given to Commission staff ACTION: Notice of proposed rulemaking. submitting comments and additional during ex parte meetings are deemed to be written ex parte presentations and SUMMARY: In this document, the Federal information on the rulemaking process, must be filed consistent with section Communications Commission see the SUPPLEMENTARY INFORMATION 1.1206(b) of the Commission’s rules. In (Commission) seeks comment on several section of this document. proceedings governed by section 1.49(f) proposals that will impact FY 2020 FOR FURTHER INFORMATION CONTACT: of the Commission’s rules or for which regulatory fees. -

Nexstar Media Group Stations(1)

Nexstar Media Group Stations(1) Full Full Full Market Power Primary Market Power Primary Market Power Primary Rank Market Stations Affiliation Rank Market Stations Affiliation Rank Market Stations Affiliation 2 Los Angeles, CA KTLA The CW 57 Mobile, AL WKRG CBS 111 Springfield, MA WWLP NBC 3 Chicago, IL WGN Independent WFNA The CW 112 Lansing, MI WLAJ ABC 4 Philadelphia, PA WPHL MNTV 59 Albany, NY WTEN ABC WLNS CBS 5 Dallas, TX KDAF The CW WXXA FOX 113 Sioux Falls, SD KELO CBS 6 San Francisco, CA KRON MNTV 60 Wilkes Barre, PA WBRE NBC KDLO CBS 7 DC/Hagerstown, WDVM(2) Independent WYOU CBS KPLO CBS MD WDCW The CW 61 Knoxville, TN WATE ABC 114 Tyler-Longview, TX KETK NBC 8 Houston, TX KIAH The CW 62 Little Rock, AR KARK NBC KFXK FOX 12 Tampa, FL WFLA NBC KARZ MNTV 115 Youngstown, OH WYTV ABC WTTA MNTV KLRT FOX WKBN CBS 13 Seattle, WA KCPQ(3) FOX KASN The CW 120 Peoria, IL WMBD CBS KZJO MNTV 63 Dayton, OH WDTN NBC WYZZ FOX 17 Denver, CO KDVR FOX WBDT The CW 123 Lafayette, LA KLFY CBS KWGN The CW 66 Honolulu, HI KHON FOX 125 Bakersfield, CA KGET NBC KFCT FOX KHAW FOX 129 La Crosse, WI WLAX FOX 19 Cleveland, OH WJW FOX KAII FOX WEUX FOX 20 Sacramento, CA KTXL FOX KGMD MNTV 130 Columbus, GA WRBL CBS 22 Portland, OR KOIN CBS KGMV MNTV 132 Amarillo, TX KAMR NBC KRCW The CW KHII MNTV KCIT FOX 23 St. Louis, MO KPLR The CW 67 Green Bay, WI WFRV CBS 138 Rockford, IL WQRF FOX KTVI FOX 68 Des Moines, IA WHO NBC WTVO ABC 25 Indianapolis, IN WTTV CBS 69 Roanoke, VA WFXR FOX 140 Monroe, AR KARD FOX WTTK CBS WWCW The CW WXIN FOX KTVE NBC 72 Wichita, KS -

Broadcast Syndication Broadcast Syndication

Broadcast Syndication Broadcast Syndication SYNDICATION SYNDICATIONStations Clearances SYNDICATION182 stations / 78.444% DMA %US MARKET HouseHolds Stations Affiliates Channel Air Time 1 6.468 NEW YORK 6,701,760 WVVH Independent 50 SUN 2PM 1 NEW YORK WMBC Independent 18 SUN 2PM 1 NEW YORK WRNN Independent 48 SUN 2PM 2 4.917 LOS ANGELES 5,113,680 KXLA Independent 44 SUN 2PM 3 3.047 CHICAGO 3,142,880 WBBM CBS 2 3 CHICAGO WSPY Independent 32 SUN 2PM 4 2.611 PHILADELPHIA 2,715,440 WACP Independent 4 4 PHILADELPHIA WPSJ Independent 8 SUN 2PM 4 PHILADELPHIA WZBN Independent 25 SUN 2PM 5 2.243 DALLAS 2,332,720 KHPK Independent 28 SUN 2PM 5 DALLAS KTXD Independent 46 6 2.186 SAN FRANCISCO 7 2.076 BOSTON 2,159,040 WBIN Independent 35 7 BOSTON WHDN Independent 26 8 2.059 WASHINGTON DC 2,141,360 WJAL Independent 68 9 2.000 ATLANTA 2,080,000 WANN Independent 32 SUN 2PM 10 1.906 HOUSTON 1,953,120 KUVM Independent 34 SUN 2PM 10 HOUSTON KHLM Independent 43 SUN 2PM 10 HOUSTON KETX Independent 28 SUN 2PM 11 1.607 DETROIT 12 1.580 SEATTLE 1,681,680 KUSE Independent 46 SUN 2PM 12 SEATTLE KPST Independent 66 SUN 2PM 13 1.580 PHOENIX 1,643,200 KASW CW 49 SUN 5AM 13 PHOENIX KNJO Independent 15 SUN 2PM 13 PHOENIX KKAX Independent 36 SUN 2PM 13 PHOENIX KCFG Independent 32 SUN 2PM 14 1.560 TAMPA 1,622,400 WWSB ABC 24 15 1.502 MINNEAPOLIS 1,562,080 KOOL Independent 21 16 1.381 MIAMI 1,332,240 WHDT Independent 9 17 1.351 DENVER 1,405,040 KDEO Independent 23 SUN 2PM 17 DENVER KTED Independent 25 SUN 2PM 18 1.321 CLEVELAND 1,373,840 WBNX CW 30 18 CLEVELAND WMFD Independent 12 SUN 2PM 19 1.278 ORLANDO 1,329,120 WESH NBC 11 19 ORLANDO WHDO Independent 38 20 1.211 SACRAMENTO 1,259,440 KBTV Independent 8 SUN 2PM 21 1.094 ST. -

Hearst Television Inc

HEARST TELEVISION INC 175 198 194 195 203 170 197 128 201 DR. OZ 3RD QUEEN QUEEN MIND OF A SEINFELD 4TH SEINFELD 5TH DR. OZ CYCLE LATIFAH LATIFAH MAN CYCLE CYCLE KING 2nd Cycle KING 3rd Cycle RANK MARKET %US STATION 2011-2014 2014-2015 2013-2014 2014-2015 2015-2016 4th Cycle 5th Cycle 2nd Cycle 3rd Cycle 7 BOSTON (MANCHESTER) MA 2.13% WCVB/WMUR WFXT WFXT WBZ/WSBK WBZ/WSBK WBZ/WSBK WBZ/WSBK WBZ/WSBK WBZ/WSBK 13 TAMPA-ST PETERSBURG (SARASOTA) FL 1.60% WMOR WFLA WFTS WTOG WTOG WTTA WTTA WTOG WTOG 18 ORLANDO-DAYTONA BEACH-MELBOURNE FL 1.29% WESH/WKCF WFTV/WRDQ WOFL/WRBW WKMG WKMG WESH/WKCF WFTV/WRDQ WFTV/WRDQ WFTV/WRDQ 20 SACRAMENTO-STOCKTON-MODESTO CA 1.18% KCRA/KCRA-DT2/KQCA KCRA/KQCA KCRA/KQCA KMAX/KOVR KMAX/KOVR KTXL KTXL KMAX/KOVR 22 PITTSBURGH PA 1.03% WTAE WTAE WTAE KDKA/WPCW KDKA/WPCW WPGH/WPMY WPGH/WPMY KDKA/WPCW KDKA/WPCW 26 BALTIMORE MD 0.96% WBAL/WBAL-DT2 WBAL WBAL WBFF/WNUV/WUTB WBFF/WNUV/WUTB WBFF/WNUV/WUTB WBFF/WNUV WBFF/WNUV 31 KANSAS CITY MO 0.81% KCWE/KMBC KCWE/KMBC KCWE/KMBC WDAF WDAF WDAF WDAF KMCI/KSHB KMCI 35 MILWAUKEE WI 0.79% WISN WISN WISN WDJT/WMLW WDJT/WMLW WITI WITI WCGV/WVTV 36 CINCINNATI OH 0.77% WLWT WLWT WLWT WLWT WKRC/WSTR EKRC/WKRC EKRC/WKRC/WSTR WXIX WXIX 37 GREENVILLE-SPARTANBURG (SC)-ASHEVILLE 0.74% WYFF WYFF WYFF WLOS/WMYA WLOS/WMYA WSPA/WYCW WSPA/WYCW WYCW WSPA/WYCW 38 WEST PALM BEACH-FT PIERCE FL 0.69% WPBF WPBF WPBF WPTV WPTV WFLX WFLX WTCN/WTVX 43 BIRMINGHAM (ANNISTON-TUSCALOOSA) AL 0.62% WVTM WBMA WBMA WBRC WBRC WABM/WTTO WABM/WTTO WABM/WTTO 44 OKLAHOMA CITY OK 0.62% KOCO KOCO KOCO KOCB/KOKH KOCB/KOKH -

60001549155.Txt Dear FCC, I Like to Express My Views on M.B

60001549155.txt Dear FCC, I like to express my views on M.B. Docket 10-25 on localism. Localism is still important to the state and community you live in. My parents are DIRECTV subscribers since January 2009, and Greenwood, SC is in the Greenville, SC/Asheville, NC DMA. The TV stations in the Greenville/Asheville area tells irrelevant North Carolina and Georgia local news along with in-state relevant South Carolina local news. I don't live in North Carolina or Georgia, I live in South Carolina. I want to know what's happening in South Carolina since I'm a resident of that state. The Nielsen's DMA system is broken. We need more choices on DIRECTV, get out-of-market in-state locals from Columbia, SC and Charleston, SC markets because both markets tells 100% relevant in-state South Carolina local news. Besides Greenville, I wanted to know what's happening on the other side of my state like Columbia and Charleston. But the problem? The controversial program exclusivity rules haven't been eliminated, and it needs to be. Even Greenville, SC's NBC affiliate does not carry NBC's Today Show 4th hour with Kathie Lee Gifford and Hoda Kotb in the mornings while Columbia, SC and Charleston, SC NBC affiliates do carry it in its entirety live at 10am Eastern Time. We also live in a moderate to bad over the air TV reception despite getting three adjacent markets over the air (one in state of Columbia, SC and two out-of-state ones from Augusta, GA and Charlotte, NC). -

Arizona Commercial TV Stations + ABA Members

Arizona Commercial TV stations + ABA Members DMA REGION OWNERSHIP STATION FREQ FORMAT WEBSITE KEY CONTACT EMAIL PHONE Phoenix Phoenix and Northern AZ Arizona Lotus Corp KPHE 44 Ind Spanish TV http://www.kphetv.com/es/ Jorge Esquilin [email protected] 602-703-0929 Phoenix Phoenix and Northern AZ Arizona State University KAET 8 PBS http://www.azpbs.org Julia Wallace [email protected] 602-496-2422 Phoenix Phoenix and Northern AZ Fox Corporation KSAZ 10 FOX TV https://www.fox10phoenix.com/ Mark Rodman [email protected] 602-257-1234 Phoenix Phoenix and Northern AZ Fox Corporation KUTP 45 MyNetwork TV https://www.fox10phoenix.com/fox10xtra Mark Rodman [email protected] 602-257-1234 Phoenix Phoenix and Northern AZ Londen Media KAZT 7 Ind TV https://www.aztv.com/ Lynn Londen [email protected] 602-977-7700 Phoenix Phoenix and Northern AZ Meredith KPHO 5 CBS TV https://www.azfamily.com/ Kevin James [email protected] 602-207-3300 Phoenix Phoenix and Northern AZ Meredith KTVK 3 Ind TV https://www.azfamily.com/ Kevin James [email protected] 602-207-3300 Phoenix Phoenix and Northern AZ NBC Telemundo KTAZ 39 Telemundo TV https://www.telemundoarizona.com/ Andrew Deschapelles [email protected] 602-648-3900 Phoenix Phoenix and Northern AZ Scripps Media KASW 61 CW TV https://www.abc15.com/cwarizona/ Anita Helt [email protected] 602-273-1500 Phoenix Phoenix and Northern AZ Scripps Media KNXV 15 ABC TV https://www.abc15.com/ Anita Helt [email protected] 602-273-1500 Phoenix Phoenix and Northern AZ Tegna KPNX 12 NBC TV https://www.12news.com/ -

Available Channels

Channel Lineup Phoenix Metro Area Phoenix Metro Area November 2016 FLIP RIGHT TO YOUR TV FAVORITES A complete channel guide. For the most recent Channel Line Up, please visit www.cox.com/channels TV Starter 3 IND - KTVK 12 NBC - KPNX 21 TBN - KPAZ 86 AZ News - KTVK 98 QVC 5 CBS - KPHO 13 IND - KAZT 22 Leased Access 88 PBS World 99 Educational Access 6 CW - KASW 15 ABC - KNXV 78 Jewelry TV 91 TeleXitos - KTAZ 115 MCTV 7 YURVIEW Arizona 16 UniMas - KFPH 79 EVINE Live 92 GetTV 123 AZ Capital TV 8 PBS - KAET 17 HSN 80 PBS Life - KAET 93 MeTV - KAZT 124 C-SPAN 9 My Network TV - KUTP 18 ION - KPPX 83 NBC 12 News Weather Plus - KPNX 94 LAFF - KNXV 125 C-SPAN 2 10 FOX - KSAZ 19 Univision - KTVW 84 Movies - KTUP 95 Antenna TV 126 C-SPAN 3 11 Government Access 20 Telemundo - KTAZ 85 Cozi - KPHO 96 Buzzr - KUTP TV Starter HD 1003 KTVK - 3 HD 1008 PBS HD - KAET 1013 IND HD - KAZT 1018 ION HD - KPPX 1005 CBS HD - KPHO 1009 My Network HD - KUTP 1015 ABC HD - KNXV 1019 Univision HD - KTVW 1006 CW HD - KASW 1010 FOX HD - KSAZ 1016 UniMas HD - KFPH 1020 Telemundo HD - KTAZ 1007 YURVIEW Arizona HD 1012 NBC HD - KPNX 1017 HSN HD 1098 QVC HD Faith & Values Pak (No extra charge with TV Starter.) 110 Daystar 112 INSP 113 EWTN 114 BYUtv Contour Flex Starter ∞ Includes all channels listed in the above package: TV Starter. Faith & Values Pak not included. -

ATT July16 Layout.Indd

The AT&T contracts with programmers for the content displayed on U-verse TV service periodically expire, or may be terminated, but are usually re-negotiated or extended with no interruption or change for our U-verse members. Additionally, from time to time it is necessary to change channel line-ups as well as television package contents. The programming changes set forth below may occur as follows: July 2019 As previously noticed, the AT&T contract with the programmer for the following channels is set to expire. While these channels will continue to be available to U-verse members so long as AT&T has the rights to carry them, if a reasonable agreement cannot be reached with the programmer the programming will no longer be available. AT&T may modify the channel location for the programming by moving them from their current channel location to a channel between 9501 – 9599, and if a reasonable longer term agreement cannot be reached with the programmers, we may lose the rights to carry them (listed in alphabetical order) on or after July 2019: Family Entertainment TV (channel 578); EVINE Live and EVINE Live in HD; Heroes & Icons (channel 137 and 1137 in HD); MBC America (channel 3643); MeTV (channel 23, 136 and 1023 and 1136 in HD). As well as the following: 1) Atlanta, GA area, WUPA (channel 69 and 1069 in HD); 2) August, GA area, WJBF (channel 6 and 1006 in HD); 3) Austin, TX area, KXAN (channel 4 and 1004 in HD), KBVO (channel 7 and 1007 in HD), KNVA (channel 12 and 1012 in HD); 4) Bakersfi eld, CA area, KKEY (channel 11 and 3007 in HD),