Weekly Stock Market Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

WEEKLY MARKET REVIEW 14 February 2020

DATABANK RESEARCH WEEKLY MARKET REVIEW 14 February 2020 ANALYST CERTIFICATE & REQUIRED DISCLOSURE BEGINS ON PAGE 4 GSE MARKET STATISTICS SUMMARY Current Previous % Change Weekly Market Review DSI-20 Index 98.39 98.17 0.23% The equity market indices posted a weekly gain. The GSE-CI Level 2,203.63 2,196.72 0.31% Market Cap (GH¢ m) 56,625.40 56,553.66 0.13% benchmark composite index closed 0.31% higher at YTD Return DSI-20 -2.50% -2.73% 2,203.63 points, reflecting an improved YTD return of - YTD Return GSE-CI -2.37% -2.68% 2.37%. The DSI-20 Index also expanded 0.23% w/w to Weekly Volume Traded (Shares) 4,621,673 2,481,186 86.27% 98.39 points, representing a YTD return of -2.50%. Weekly Turnover (GH¢) 3,130,797 2,078,982 50.59% Avg. Daily Volume Traded The indices were lifted by gains in SCB (+0.21% w/w, 2,044,789 2,260,261 -9.53% (Shares) GH¢19.04), MTNGH (+1.52% w/w, GH¢0.67) and SIC Avg. Daily Value Traded (GH¢) 1,633,928 1,827,729 -10.60% (+12.50% w/w, GH¢0.09). However, the gains in the No. of Counters Traded 22 20 indices were limited by declines in EGH (-1.14% w/w, No. of Gainers 3 1 GH¢7.80), GGBL (-4.14% w/w, GH¢1.62), EGL (-2.44% No. of Laggards 4 6 w/w, GH¢1.60) and FML (-0.24% w/w, GH¢4.09). -

THE DATABANK BALANCED FUND LIMITED 2010 Annual Report

AUDITED FULL YEAR REPORT 2010 THE DATABANK BALANCED FUND LIMITED 2010 Annual Report 1 THE DATABANK BALANCED FUND LIMITED 2ii AUDITED FULL YEAR REPORT 2010 THE DATABANK BALANCED FUND LIMITED Audited Full Year Report For The Period Ended December 31, 2010 1 THE DATABANK BALANCED FUND LIMITED 2 AUDITED FULL YEAR REPORT 2010 CONTENTS Notice of Annual General Meeting 04 Chairman’s Statement to Shareholders 05 Performance Summary 09 Portfolio at a Glance 10 Interview with your Fund Manager 11 Report of Directors 14 Report of the Auditors 15 Statement Of Net Assets 16 Statement of Assets and Liabilities 17 Income and Distribution Accounts 18 Statement of Movement In Net Assets and Issued Shares 19 Notes to Financial Statements 21 Custodian’s Report 26 Corporate Information 29 Directors and Officers Information 30 Proxy Form 34 This report shall not constitute an invitation to buy shares of the Fund. Subscriptions are to be made only on the basis of the current scheme particulars, accompanied by a copy of the latest available annual report, and if published thereafter, the most recent half year report. 3 THE DATABANK BALANCED FUND LIMITED NOTICE OF ANNUAL GENERAL MEETING Notice is hereby given that the 3rd Annual General Meeting of the shareholders of Databank Balanced Fund Limited will be held at the National Theatre, Accra, Ghana on Friday the 29th of July 2011 at 11:00a.m for the following purposes: 1. To consider the Directors’ Report and the Report of the Auditors for the year ended December 31, 2010. 2. To receive and adopt the Statement of Assets and Liabilities and Statement of Operations for the year ended December 31, 2010 3. -

Weekly Market Watch Sic-Fsl Investment+ Research| Market Reviews|Ghana

WEEKLY MARKET WATCH SIC-FSL INVESTMENT+ RESEARCH| MARKET REVIEWS|GHANA 28th May, 2015 ACCRA BOURSE SOARS, DESPITE…! STOCK MARKET The excitement on the Ghana Stock Exchange (GSE) increased INDICATORS WEEK WEEK END CHANGE last week, as appetite for capital market investment improved. OPEN Indeed, recent corporate actions like the increases in petroleum Market Capitalization products and the worsening of the local currency were looked (GH¢'million) 64,440.64 64,575.13 0.21% upon to thwart market performance, however, the contrary was Market Capitalization (US$'million) 16,499.13 16,305.20 -1.18% true as players appeared unperturbed of current happenings, intensifying their bets on shares. Volume traded (shares) 2,590,114.00 1,395,992.00 -46.10% Shares of Ecobank Ghana Limited (EBG), Total Petroleum Value Traded (GH¢) 2,089,785.25 2,293,571.34 9.75% Ghana Limited (TOTAL), Enterprise Group Limited (EGL), Fan Value Traded (US$) 535,060.36 579,126.18 8.24% Milk Limited (FML) and Aluworks Limited (ALW) were the most Table 1: Market Summary sought after in the week. INDEX ANALYSIS In the end, all the major market indicators went up; with the INDICATORS Closing Week YTD GSE-CI closing last Thursday’s trading at 2,362.28 points, Level Change CHANGE representing a year-to-date change of 4.48% whilst the GSE- FSI also settled at an annual yield of 7.96% to close the week GSE Composite Index 2,362.28 1.06% 4.48% at 2,422.33 points. Also, the SIC-FSL Top 15 index (SIC-FSL T- SIC-FSL Top 15 Index 4,476.58 0.70% 13.53% 15) which measures the performance of liquid equities, posted the biggest returns on the market last week, closing at GSE Financial Stocks Index 2,422.33 1.25% 7.96% 4,476.58 points, which represented a return of 13.53%. -

Ssnit Investments Series

SSNIT INVESTMENTS SERIES SECOND EDITION INTRODUCTION This edition of the SSNIT Investments Series focuses on the Listed Equities Portfolio, one of the three sub-asset classes of the Equities Portfolio. Listed equity refers to ownership interests in companies whose shares are traded publicly on a Stock Market. The Trust currently has share interests in 23 out of the 37 companies listed on the Ghana Stock Exchange (GSE), with a total value of GH¢1.8 billion as at June 2017. A portion of the Trust’s shares in Tullow Oil Plc is also listed on the London Stock Exchange (LSE). The composition of the Trust’s Listed Equities Portfolio, also referred to as the SSNIT Stock Market Portfolio (SSMP), is shown in Table 1. Table 1: SSNIT Listed Equity Holdings # Company Ticker Shareholding (%) 1 Anglogold Ashanti Ltd. AGA 0.02% 2 Aluworks Limited ALW 62.62% 3 Ayrton Drug Man. Ltd. AYRTN 18.00% 4 Benso Oil Palm Plantation BOPP 4.31% 5 CAL Bank Limited CAL 33.18% 6 Cocoa Processing Co. Ltd. CPC 10.14% 7 Ecobank Ghana Ltd. EGH 16.21% 8 Enterprise Group Ltd EGL 6.22% 9 Ecobank Transnational Inc. ETI 3.86% 10 Fan Milk Limited FML 1.59% 11 GCB Bank GCB 29.89% 12 Guinness Gh. Breweries Ltd. GGBL 7.57% 13 Ghana Oil Co. Ltd. GOIL 25.00% 14 Golden Web Ltd. GWEB 20.78% 15 HFC Bank Ltd. HFC 26.09% 16 Produce Buying Co. Ltd. PBC 38.10% 17 Standard Chartered Bank SCB 14.55% 18 SIC Insurance Ltd. -

Social and Environmental Accounting Reporting and Financial Performances in Ghana

International Journal of Economics and Finance; Vol. 11, No. 4; 2019 ISSN 1916-971X E-ISSN 1916-9728 Published by Canadian Center of Science and Education Social and Environmental Accounting Reporting and Financial Performances in Ghana Li KaoDui1, Zou Muyun1 & Osei-Assibey Bonsu Mandella1 1 School of Finance and Economics, Jiangsu University, Zhenjiang, China Correspondence: Osei-Assibey Mandella Bonsu, School of Finance and Economics, Jiangsu University, 301, Xuefu Road, Zhenjiang, 212013, Jiangsu Province, P.R. China. E-mail: [email protected] Received: January 6, 2019 Accepted: March 15, 2019 Online Published: March 20, 2019 doi:10.5539/ijef.v11n4p82 URL: https://doi.org/10.5539/ijef.v11n4p82 This article is the research result of the project “Postgraduate Research & Practice Innovation Program of Jiangsu Province” (Project Number is SJCX17_0565). Abstract The paper seeks to ascertain the effects of social and environmental accounting disclosure on the financial performance of companies registered on the Ghana Stock Exchange over the period of three years from 2015 to 2017. The study similarly seeks to determine the extents of social and environmental accounting issues reported and finally document the extent to which companies included SEAR issues in their corporate strategy plan in Ghana. The study used secondary data from a published corporate annual statements of all the registered companies on the Ghana Stock Exchange. A regression model and t-test were used to ascertain the effects of social and environmental accounting reporting on firm‟s financial performance. However, questionnaires and content analysis were also used in company reports as a system to measure the degree and nature of corporate social accounting reporting as maintained by the number of words disclosed over the three periods. -

Meeting Changing

Meeting changing needs Annual Report & Financial Statements 2016 Vision Values In all our markets, - Friendliness our pedigree will be - Trust recognized, our - Reliability strength respected, Mission - Excellence our expertise We provide all who - Professionalism valued and our come into contact solutions sought by with us their all who desire an desired advantage advantage in life. because... we are the best at what we do! Contents Review 2 Notice and Agenda of Annual General Meeting 3 Five Year Financial Summary Financial Statements 4 Corporate Information 38 - 40 5 - 7 Report of the independent auditor Chairman’s Statement 41 8 Statements of financial position Board of Directors 42 9 Income statements Non-Executive Directors of Subsidiary Companies 43 10 - 13 Statements of Comprehensive Income Chief Executive Officer’s Review 44 - 46 15 - 17 Statements of Changes in Equity Executive Director’s Review (Insurance) 47 19 - 22 Statements of Cash Flows Executive Director’s Review (Life) 48 - 100 24 - 25 Notes to the Financial Statements General Manager’s Review (Trustees) 101 27 - 28 Shareholders’ Information General Manager’s Review (Properties) 102 - 103 Certificate of Solvency in Respect of the Life Business Governance 105 30 - 31 Proxy Form Corporate Governance Statement 32 - 33 107 Enterprise in The Community Voting Card 34 - 37 Report of the Directors Enterprise Group Limited Annual Report 2015 1 Notice of an Annual General Meeting IS HEREBY GIVEN THAT the Seventh Annual General Meeting of Enterprise Group Limited NOTICE (the “Company”) will be held on Tuesday, August 8, 2017 at the College of Physicians and Surgeons, 54 Independence Avenue, Ridge, Accra, Ghana at 10 am for the following purposes: ORDINARY BUSINESS 1. -

Quarterly Financial Markets Report

Quarterly Financial Markets Report Second Quarter 2016 Global Economic Highlights Highlighted by UK’s vote to leave the EU, weak demand, high unemployment levels, financial frailties and geopolitical risks, the global economic environment continued to be plagued by weakened growth prospects in the last three months. The late June U.K. referendum to leave the European Union sent shock waves across the globe, leaving global financial markets in turmoil. The equity markets fell sharply and the British Pound plunged 8.4% and 12.5% against the U.S. Dollar and Japanese Yen, respectively. The value of the British Pound against the US Dollar was at its lowest in the past 31 years. Reassurance on support from the central bank saw the economy enjoying some reprieve as the financial markets rebounded partially in fragments. With manufacturing growth stalling over the past year and construction figures weakening markedly in June, U.K. growth continued to be driven primarily by the services sector. The rate of Consumer Price Inflation (CPI) remained low at around 0.3% partly due to relatively subdued global demand growth. Both Standard & Poor’s, and Fitch on the back of the foregoing downgraded U.K’s credit ratings. With a lift from the European Central Bank’s stimulus cut, low energy prices and a rebound in consumer spending, figures from the 19-nation bloc were impressive before the Brexit, with GDP rising by 0.6% in Q1 2016 despite a backdrop of the global market turmoil at the start of the year. However, questions about the EU’s stability and the potential for an economic downturn after Britain’s surprise exit from the EU dominated the centre stage in the Eurozone at the end of the second quarter. -

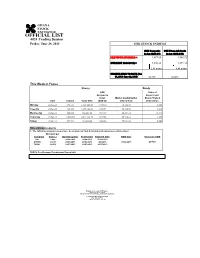

OFFICIAL LIST 4024 Trading Session Friday, June 28, 2013 GSE STOCK INDICES

OFFICIAL LIST 4024 Trading Session Friday, June 28, 2013 GSE STOCK INDICES GSE Composite GSE Financial Stocks Index (GSE-CI) Index (GSE-FSI) PREVIOUS 27/06/2013) = 1,877.65 1,585.72 CURRENT 28/06/2013) = 1,880.26 1,591.18 2.61 points 5.46 points CHANGE-YEAR TO DATE (Jan 01, 2013- June 28, 2013) 56.72% 53.02% This Week in Focus Shares Bonds GSE Value of Composite Government Index Market Capitalization Bonds Traded Date Volume Value GH¢ (GSE-CI) GH¢ million GH¢ million Monday 24-Jun-13 493,511 1,581,041.68 1,900.10 56,154.80 0.000 Tuesday 25-Jun-13 426,550 1,196,438.69 1,891.94 56,110.32 1.240 Wednesday 26-Jun-13 880,088 966,256.30 1,874.67 55,894.32 15.743 Thursday 27-Jun-13 1,553,869 2,844,118.70 1,877.65 55,910.61 4.295 Friday 28-Jun-13 251,546 482,820.80 1,880.26 55,924.82 0.000 Notes/Announcements 1. The following announcements have been made on final dividends and annual general meetings: Dividend per Company Share ¢ Qualifying Date Ex-Div Date Payment Date AGM Date Venue for AGM CAL 0.006 26/06/2013 24/06/2013 30/08/2013 AYRTN 0.0013 25/06/2013 21/06/2013 8/8/2013 27/06/2013 OEPCH TOTAL 0.6900 18/07/2013 16/07/2013 26/07/2013 GCPS:GhanaAICC: Accra International College of Physicians Conference and Centre Surgeons OEPCH:Osu Ebenezer Presbyterian Church HalL Enquiries to: General Manager Ghana Stock Exchange 5th & 6th Floors Cedi House, Liberia Road, Accra Tel: 021 669908, 669914, 669935 Fax: 021 669913 e-mail: [email protected] OFFICIAL LIST 4024 Trading Session ODD LOT Friday, June 28, 2013 ISIN Share Code Total Shares No. -

WEEKLY MARKET REVIEW 3 November 2017

DATABANK RESEARCH WEEKLY MARKET REVIEW 3 November 2017 ANALYST CERTIFICATE & REQUIRED DISCLOSURE BEGINS ON PAGE 4 GSE MARKET STATISTICS SUMMARY Current Previous % Change Market Indices Maintain Bullish Performance (w/w): Databank Stock Index 30,388.18 30,209.24 0.59% By the end of this week’s trading session, the Ghana Stock Exchange’s Composite Index GSE-CI Level 2,367.28 2,352.11 0.64% increased by 15.15 points w/w to ~2,367 points while the Databank Stock Index (DSI) surged by 178.94 points w/w to 30,388 points. The year-to-date returns of the GSE-CI Market Cap (GH¢ m) 58,057.10 58,497.34 -0.75% and the DSI are recorded at 40.15% and 36.07% respectively. YTD Return DSI 36.07% 35.27% Market activity improved by ~32% w/w to 5.37 million shares on the back of block trades YTD Return GSE-CI 40.15% 39.25% in Cal Bank and Total Petroleum. The total volume of shares traded were valued at Weekly Volume Traded (Shares) 5,365,067 941,100 470.08% GH¢8.97 million. Cal Bank and Total Petroleum accounted for ~94% of the aggregate volume of shares traded. Weekly Turnover (GH¢) 8,973,736 3,004,202 198.71% Avg. Weekly Volume Traded The market breadth of the bourse was negative (w/w) with 6 gainers and 7 laggards. 1,443,315 1,417,645 1.81% Unilever Ghana was the best performer (w/w), surging by 39Gp to GH¢10.99. -

Past Award Winners

PAST AWARD WINNERS. MARKETING MAN YEAR NAME 1989 DR.KWESI BOTCHWAY 1990 MR. HANS WOELFER 1991 MR.R.K.SELBY 1992 MR K. ABEASI 1993 MR.ATO POBEE AMPIAH 1994 MR. ESSON BENJAMIN 1995 MR. IBRAHIM ADAM 1997 MR. KEN OFORI-ATTA 1997 MR.P.K AWUAH 1998 DR.KWABENA DUFFOUR 1999 DR.NII NARKU QUAYNOR 2000 MR. KWABENA ADJEI 2001 PROF. KWABENA F.BOATENG 2002 MR. KWABENA ADJEI 2003 MR. KOFI NSIAH POKU 2004 MR. ANTHONY OTENG-GYASI 2005 MR. ALBERT K. ESSIEN 2006 MR. PRINCE KOFI AMOABENG 2007 MR. CHARLES COFIE 2008 MR. KWAME ACHAMPONG-KYEI 2009 MR. IBRAHIM AWAL 2010 MR. SAMUEL AMO TOBBIN MARKETING WOMAN OF THE YEAR YEAR NAME 1989 MRS. CAULLEY HANSON 1990 MS SHERRY AYITTEY 1991 MRS.AMA GYAMFUAH AKPAN 1992 MRS. VIDA NYARKO 1993 MRS. BAETA ANSAH 1994 PROF. M.A. GREENSTREET 1995 PROF. AWURAMA ADDY 1996 VIVIAN SERWAA ADU 1997 MRS DINAH A. AYENSU 1998 MRS. ELIZABETH VILLARS 1999 MRS THERESA OPPONG BEEKO 2000 MRS. L.B.OSAFO-ADDO 2001 MRS.CECILIA ADWOA KWOFIE 2002 MRS. GRACE AMEY AMEYOBENG 2003 MS ADELAIDE AHWIRENG 2004 MRS. BELLA AHU 2005 NANA ADWOA AWINDOR 2006 MRS. FELICITY ACQUAH 2007 MS. JOYCE ARYEE 2008 MRS. NORKOR DUA 2009 MRS. DZIGBORDI DOSOO 2010 MRS. DOREEN OWUSU-FIANKO PAST AWARD WINNERS. MARKETING STUDENT OF THE YEAR YEAR NAME 1989 SAMUEL DUODU 1990 THERESA OPPONG 1992 BENJAMIN ATTAH 1993 OSAM VERA ARABA 1994 WINIFRED YAO AGBAZ 1995 MARY AKWELEY AYI 1996 ABIGAIL ARMAH 1997 MRS. GIFTY OFORI 1998 ABENA OSEI 1999 JERRY ABAYAA 2000 GLORIA ATITSOGBI 2001 ANDREW KPAKPO- MILLS 2002 KOFI COBBOLD 2003 BARIKISU UMAR 2004 DESMOND LAMPTEY 2005 MR. -

Financial Services Brochure Small

CONTENTS 01 Profile of Ghana 03 FINANCIAL SERVICES SECTOR PROFILE: 04 Introduction 06 Financial Services Market Opportunities in Ghana 08 Ghana’s Competitive Advantage for FDI in the Financial Services Sector 10 Key Investment Drivers for the Financial Services Sector Brief summary of the current 17 Financial Services sector in Ghana 24 Doing Business in Ghana 27 Next Steps/Contact 28 Appendix Financial Services Sector Profile GHANOur wealth of Gaining the world’s confidenceA with a resources, democratic peaceful political transition and a political system and grounded and firm commitment to democracy has helped in expediting dynamic economy, Ghana’s growth in foreign direct makes us investment (FDI) in recent years. undoubtedly one of Africa’s leading lights. Ghana has attracted the attention of well-known international businesses, investing in all sectors of our economy. All these investors have come to Ghana because they know we have a wonderful conducive social, political and economic environment in which they can invest, grow and be successful. 01 Financial Services Sector Profile Building on significant natural The Ghana Investment Promotion resources, our dear nation is commit- Centre wish to welcome you all to our ted to improving its physical beautiful country. We trust you will infrastructure. Moreover, Ghana has find our reputation for unparalleled recently embarked on an ambitious hospitality well-deserved, and our but achievable reform programme to ability to triumph in challenging improve the investment climate for circumstances as steadfast as ever. both local and international investors. We re-affirm our commitment to These efforts have paid off tremen- moving our continent forward and dously with Ghana being recognised look forward to very useful engage- by the World Bank Doing Business ments with you. -

2020-Annual-Report.Pdf

Vision Mission Values In all our markets, We provide all who - Friendliness our pedigree will be come into contact with us - Trust recognized, our their desired advantage - Reliability strength respected, our because... - Excellence expertise valued and our we are the best at what - Professionalism solutions sought by all who we do! desire an advantage in life. Enterprise Group Plc Financial statements for the year ended 31 December 2020 Contents Review An overview of our businesses, our performance, key achievements and insights into each of our business units 3 Notice and Agenda of Annual General Meeting 4 Five Year Financial Summary 5 Corporate Information 6 - 8 Chairman’s Review 9 - 10 Board of Directors 11 Non-Executive Directors of Subsidiary Companies 12 - 16 Group Chief Executive Officer’s Review 17 - 20 Managing Director’s Report (Insurance) 22 - 25 Managing Director’s Report (Life) 27 - 29 Managing Director’s Report (Trustees) 31 - 33 General Manager’s Report (Properties) 35 - 37 General Manager’s Report (Transitions) Governance Our corporate governance and sustainability efforts 39 - 40 Corporate Governance Statement 41 - 42 Enterprise in The Community 43 - 47 Report of the Directors Financial Statements Audited financial statements and our financial performance 49 - 53 Report of the independent auditor 54 Statements of financial position 55 Statements of Comprehensive Income 56 - 58 Statements of Changes in Equity 59 Consolidated and Separate Statements of Cash Flows 60 - 133 Notes to the Financial Statements 134 Shareholders’