ALDI Invades Badger Territory*

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Target Corporation

University of Nebraska - Lincoln DigitalCommons@University of Nebraska - Lincoln Honors Theses, University of Nebraska-Lincoln Honors Program Spring 4-7-2019 Strategic Audit: Target Corporation Andee Capell University of Nebraska - Lincoln Follow this and additional works at: https://digitalcommons.unl.edu/honorstheses Part of the Accounting Commons, and the Strategic Management Policy Commons Capell, Andee, "Strategic Audit: Target Corporation" (2019). Honors Theses, University of Nebraska- Lincoln. 192. https://digitalcommons.unl.edu/honorstheses/192 This Thesis is brought to you for free and open access by the Honors Program at DigitalCommons@University of Nebraska - Lincoln. It has been accepted for inclusion in Honors Theses, University of Nebraska-Lincoln by an authorized administrator of DigitalCommons@University of Nebraska - Lincoln. Strategic Audit: Target Corporation An Undergraduate Honors Thesis Submitted in Partial fulfillment of University Honors Program Requirements University of Nebraska-Lincoln by Andee Capell, BS Accounting College of Business April 7th, 2019 Faculty Mentor: Samuel Nelson, PhD, Management Abstract Target Corporation is a notable publicly traded discount retailer in the United States. In recent years they have gone through significant changes including a new CEO Brian Cornell and the closing of their Canadian stores. With change comes a new strategy, which includes growing stores in the United States. In order to be able to continue to grow Target should consider multiple strategic options. Using internal and external analysis, while examining Target’s profitability ratios recommendations were made to proceed with their growth both in profit and capacity. After recommendations are made implementation and contingency plans can be made. Key words: Strategy, Target, Ratio(s), Plan 1 Table of Contents Section Page(s) Background information …………………..…………………………………………….…..…...3 External Analysis ………………..……………………………………………………..............3-5 a. -

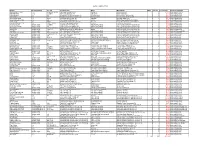

Seafood Violations 2010.Xls Product Declared Quantity Lot Code

Seafood violations 2010.xls Product Declared quantity Lot code Location Found Brand Mfg/packager MAV's Lot size Lot cost error Reason for Rejection Sea Scallops (10-20ct) 12 oz sell by Nov 20/2010 Aldi Foods; Fond du Lac, WI Sea Queen Aldi Inc- Batavia, IL 12 12 ($16.78) short weight/12 MAV's Mahi Mahi fillets 16 oz 8/13/2010 Aldi Foods; Watertown, WI Sea Queen Aldi Inc- Batavia, IL 2 10 ($1.10) short weight/2 MAV's Catfish Nuggets 2 lb N/A Woodmans Food Market; Onalaska, WI Americas Catch Americas Catch- Itta Bena, MS 2 2 ($0.74) short weight/2 MAV's Catfish Fillets 2 lb N/A Woodmans Food Market; Onalaska, WI Americas Catch Americas Catch- Itta Bena, MS 1 2 ($0.73) short weight/1 MAV Sea Scallops 20/30 1 lb 8199 ? Econofood; Sturgeon Bay, WI Aqua Star Aqua Star- Seattle, WA 4 9 ($3.19) short weight/4 MAV's Snow Crab Legs & Claws 2 lb N/A Pick n Save; Fort Atkinson, WI Luxury Atlantic Queen Seafoods- NL Canada 2 2 ($1.76) short weight/2 MAV's Whole Tilapia 3 lb 39989 Wal-Mart Stores East; Janesville, WI Sea Best Beaver Street Fisheries- Jacksonville, FL 2 2 ($0.84) short weight/2 MAV's Uncooked Shrimp 8/12 ct 2 lb 690891, 690881 Fox Bros Piggly Wiggly- Hartland CenSea CenSea, Inc- Northfield IL 2 11 ($4.35) short weight/2 MAV's Frozen Cod Loins Random weight 12102010 Copps Food Center; Anitgo, WI Natures Best Seafood Custom Seafood Packers- Waukesha, WI 4 5 ($2.90) short weight/4 MAV's Jumbo Sea Scallops Random weight N/A Copps Food Center; Appleton, WI Natures Best Seafood Custom Seafood Packers- Waukesha, WI 6 12 ($6.12) short weight/6 MAV's Frozen Cod Random weight sell by Dec22, 10 Copps Food Center; Wis. -

Reg Test 5-14-GCCE.Xlsx

J.P. WIGGINS 3GTMS SHELTON CT CLAUDIO FIAONI 3GTMS SHELTON CT CHUCK FUERST 3GTMS SHELTON CT DEANNA SEGRAVE-DALY A TEASPOON OF SPICE WASHINGTON DC JOSH GRAY A&B PACKING EQUIPMENT LAWRENCE MI MICHAEL WILLIAMSON A&B PACKING EQUIPMENT LAWRENCE MI MONIQUE BUSHEE A&B PACKING EQUIPMENT LAWRENCE MI TRACY DUDA CHAPMAN A. DUDA & SONS, INC. OVIEDO FL ANITA GRACE ABASTO WINSTON SALEM NC GUS CALABRO ABASTO WINSTON SALEM NC DANIEL THULLEN AC FOODS DINUBA CA JENNIFER HORTON ACADEMY OF NUTRITION & DIETETICS CHICAGO IL JEFF HOWARD ADVANCE STORAGE PRODUCTS HUNTINGTON BEACH CA JEFF BECKER ADVANCE STORAGE PRODUCTS HUNTINGTON BEACH CA KEVIN DARBY ADVANCE STORAGE PRODUCTS HUNTINGTON BEACH CA JOSH ROUSE ADVANCE STORAGE PRODUCTS HUNTINGTON BEACH CA GAIL KELSO ADVANCE STORAGE PRODUCTS HUNTINGTON BEACH CA ANDY SHOEMAKER AG1 SOURCE GREENVILLE SC JOSE CRUZ AGRICOLA LOS GIRASOLES SANTIAGO CHILE JOSE CRUZ JR AGRICOLA LOS GIRASOLES SANTIAGO CHILE ALISON BOSSIO AGRILYST BROOKLYN NY CHRISTINA COLLINS AGRILYST BROOKLYN NY MICHAEL DAFLOS AGRILYST BROOKLYN NY ALLISON KOPF AGRILYST BROOKLYN NY JIM MOYER AGRILYST BROOKLYN NY JON SCHMITZ AGRILYST BROOKLYN NY KEVIN FRYE AGROFRESH PHILADELPHIA PA BILL LUCAS AGROFRESH PHILADELPHIA PA NARCISO VIVOT AGROFRESH PHILADELPHIA PA AMBER FOSTER AGROFRESH COLLEGEVILLE PA JUAN DUQUE AGROPECUARIA DUQUE BOTERO MEDELLIN COLOMBIA GUILLERMO DUQUE AGROPECUARIA DUQUE BOTERO MEDELLIN COLOMBIA DJIMY ANTOINE AGRO-VISION PORT-AU-PRINCE HAITI JEAN A THIERRY BOZILE AGRO-VISION PORT-AU-PRINCE HAITI CLARENS TRIBIE AGRO-VISION PORT-AU-PRINCE HAITI RANDY -

Competing with the Discount Mass Merchandisers

Competing with the Discount Mass Merchandisers A Study by Dr. Kenneth E. Stone Professor of Economics & Extension Economist Iowa State University 1995 2 IMPACT OF WAL-MART STORES AND OTHER MASS MERCHANDISERS IN IOWA, 1983-1993* INTRODUCTION The nature of retailing has changed dramatically in the last decade, compared to previous decades. In the last decade there has been a great proliferation of discount general merchandise stores as Wal-Mart, K Mart, Target and several regional chains. In addition there has been a great expansion of membership warehouse clubs, such as Sam’s, Pace, Cosco, and Price Club. There has also been rapid expansion of “category killer” stores such as Home Depot, Circuit City, Best Buy, Toys “R” Us and others. These stores are called category killer stores because they have a very large selection within a narrow category of merchandise, along with low prices, and they “ kill” smaller local stores within the same “category”. We have also seen the development of many new factory outlet malls and the spread of specialty mail order. The net result of this expansion is the saturation of many retail markets, or what is commonly referred to as the overstoring of America. Many retail markets have more retail stores than can possibly be supported, and it would appear that a major shakeout is coming in the not-too-distant future. Why the Study? This study is an annual update of my original study of the impact of Wal- Mart stores completed in 1988. The 1988 study was conducted at the request of several Iowa merchants and chamber of commerce executives. -

What Is a Warehouse Club?

What is a Warehouse Club? The principle operators in the warehouse club industry are BJ’s Wholesale, Cost-U-Less, Costco Wholesale, PriceSmart and Sam’s Club. These five companies follow the basic warehouse club principles developed by Sol and Robert Price, who founded the warehouse club industry when they opened the first Price Club in San Diego, California in 1976. However, the five warehouse club operators have adapted those basic concepts to today’s retail environment. This chapter provides an explanation of the key characteristics of a warehouse club in 2010. Overall Description A warehouse club offers its paid members low prices on a limited selection of nationally branded and private label merchandise within a wide range of product categories (see picture on the right of Mott’s sliced apples at BJ’s). Rapid inventory turnover, high sales volume and reduced operating costs enable warehouse clubs to operate at lower gross margins (8% to 14%) than discount chains, supermarkets and supercenters, which operate on gross margins of 20% to 40%. BJ’s – Mott’s Sliced Apples Overall Operating Philosophy When it comes to buying and merchandising, the warehouse clubs follow the same simple and straightforward six-point philosophy that was originated by Sol Price: 1. Purchase quality merchandise. 2. Purchase the right merchandise at the right time. 3. Sell products at the lowest possible retail price. 4. Merchandise items in a clean, undamaged condition. 5. Merchandise products in the right location. 6. Stock items with the correct amount of inventory, making sure that supply is not excessive. In 1983, Joseph Ellis, an analyst at Goldman Sachs, summarized the warehouse club operating philosophy in a meaningful and relevant way. -

The Reason Given for the UK's Decision to Float Sterling Was the Weight of International Short-Term Capital

- Issue No. 181 No. 190, July 6, 1972 The Pound Afloat: The reason given for the U.K.'s decision to float sterling was the weight of international short-term capital movements which, despite concerted intervention from the Bank of England and European central banks, had necessitated massive sup port operations. The U.K. is anxious that the rate should quickly o.s move to a "realistic" level, at or around the old parity of %2. 40 - r,/, .• representing an effective 8% devaluation against the dollar. A w formal devaluation coupled with a wage freeze was urged by the :,I' Bank of England, but this would be politically embarrassing in the }t!IJ light of the U.K. Chancellor's repeated statements that the pound was "not at an unrealistic rate." The decision to float has been taken in spite of a danger that this may provoke an international or European monetary crisis. European markets tend to consider sterling as the dollar's first line of defense and, although the U.S. Treasury reaffirmed the Smithsonian Agreement, there are fears throughout Europe that pressure on the U.S. currency could disrupt the exchange rate re lationship established last December. On the Continent, the Dutch and Belgians have put forward a scheme for a joint float of Common Market currencies against the dollar. It will not easily be implemented, since speculation in the ex change markets has pushed the various EEC countries in different directions. The Germans have been under pressure to revalue, the Italians to devalue. Total opposition to a Community float is ex pected from France (this would sever the ties between the franc and gold), and the French also are adamant that Britain should re affirm its allegiance to the European monetary agreement and return to a fixed parity. -

The Future of Abandoned Big Box Stores: Legal Solutions to the Legacies of Poor Planning Decisions

THE FUTURE OF ABANDONED BIG BOX STORES: LEGAL SOLUTIONS TO THE LEGACIES OF POOR PLANNING DECISIONS SARAH SCHINDLER Big box stores, the defining retail shopping location for the majority of American suburbs, are being abandoned at alarming rates, due in part to the economic downturn. These empty stores impose numerous negative externalities on the communities in which they are located, including blight, reduced property values, loss of tax revenue, environmental problems, and a decrease in social capital. While scholars have generated and critiqued prospective solutions to prevent abandonment of big box stores, this Article asserts that local zoning ordinances can alleviate the harms imposed by the thousands of existing, vacant big boxes. Because local governments control land use decisions and thus made deliberate determinations allowing big box development, this Article argues that those same local governments now have both an economic incentive and a civic responsibility to find alternative uses for these “ghostboxes.” With an eye toward sustainable development, the Article proposes and evaluates four possible alternative uses: retail reuse, adaptive reuse, demolition and redevelopment, and demolition and regreening. It then devises a framework and a series of metrics that local governments can use in deciding which of the possible solutions would be best suited for their communities. The Article concludes by considering issues of property acquisition and management. INTRODUCTION ........................................................................ -

United Fresh Names 25 Retail Produce Manager Award Honorees

- Advertisement - United Fresh names 25 Retail Produce Manager Award honorees March 21, 2019 Marking 15 years of recognizing exceptional retail produce managers, United Fresh Produce Association announced the honorees of its 2019 Retail Produce Manager Awards program. The group of 25 produce managers represents supermarket banners, commissaries and independent retail stores from 16 different states and two Canadian provinces. The winners will be honored guests at the United Fresh 2019 convention, June 10-12 in Chicago. Sponsored by Dole Food Co., the program pays special recognition to produce managers working every day on the front line to increase sales and consumption of fresh fruits and vegetables. Since 1 / 3 the program’s inception in 2005, over 325 retail produce managers, representing more than 110 different retail banners, have been honored for their contributions to the industry. “Produce managers are the face of our industry to the consumer. Their creative merchandising and positive approach to customer service directly correlates to the growth of sales and ultimately consumption of fresh fruits and vegetables,” said Tom Stenzel, United Fresh president and chief executive officer. “We are grateful to Dole for once again sponsoring this program and for their partnership in recognizing these 25 deserving honorees. I look forward to celebrating our winners this June in Chicago” The 2019 Retail Produce Manager Award Winners are: Vincente Aguirre, Fort Bliss Commissary, El Paso, TX Gregory Barnufsky Jr., Yokes Fresh Markets, Spokane, WA Mike Burdi, Metro Ontario Inc., Toronto Jerry Clark II, The Fresh Market, Roanoke, VA Cassandra Crone, North State Grocery Inc., Auburn, CA Bobby David, Audubon Market, St. -

Hypermarket Lessons for New Zealand a Report to the Commerce Commission of New Zealand

Hypermarket lessons for New Zealand A report to the Commerce Commission of New Zealand September 2007 Coriolis Research Ltd. is a strategic market research firm founded in 1997 and based in Auckland, New Zealand. Coriolis primarily works with clients in the food and fast moving consumer goods supply chain, from primary producers to retailers. In addition to working with clients, Coriolis regularly produces reports on current industry topics. The coriolis force, named for French physicist Gaspard Coriolis (1792-1843), may be seen on a large scale in the movement of winds and ocean currents on the rotating earth. It dominates weather patterns, producing the counterclockwise flow observed around low-pressure zones in the Northern Hemisphere and the clockwise flow around such zones in the Southern Hemisphere. It is the result of a centripetal force on a mass moving with a velocity radially outward in a rotating plane. In market research it means understanding the big picture before you get into the details. PO BOX 10 202, Mt. Eden, Auckland 1030, New Zealand Tel: +64 9 623 1848; Fax: +64 9 353 1515; email: [email protected] www.coriolisresearch.com PROJECT BACKGROUND This project has the following background − In June of 2006, Coriolis research published a company newsletter (Chart Watch Q2 2006): − see http://www.coriolisresearch.com/newsletter/coriolis_chartwatch_2006Q2.html − This discussed the planned opening of the first The Warehouse Extra hypermarket in New Zealand; a follow up Part 2 was published following the opening of the store. This newsletter was targeted at our client base (FMCG manufacturers and retailers in New Zealand). -

How Retailers Promote Pet Food & Pet Care

The Changing Landscape of Retail & Consumer Promotions Tom Pirovano March 15, 2011 1 Welcome! 2 Topics Covered • What’s What – The State of Retail Promotions Today • What’s New and What’s Next – Game-Changing Trends & Technology – Future Retailing & Promotion Opportunities 3 The State of Retail Promotions Today 4 Major Supermarkets Running More Ad Circulars in 2010 2009 2010 Count Retailer Circulars Circulars Change Safeway (Multiple Banners) 59 87 +28 Carr’s, Dominick’s, Genuardi’s, Randall’s, Tom Thumb, Vons, Pavilions Jewel-Osco 87 102 +15 King Soopers / City Market 52 64 +12 Publix 51 58 +7 Quality Food Centers 48 54 +6 Fresh & Easy 45 51 +6 Save-A-Lot 20 26 +6 Source: ECRM-MarketGate Ad Comparisons, Calendar 2010 5 Other Major Retailers Running Outside the Traditional More Ad Circulars in 2010 Grocery Channel 2009 2010 Count Retailer Circulars Circulars Change JC Penney 54 82 +28 Sears 47 70 +23 Family Dollar 25 44 +19 Home Depot 42 59 +17 Dollar General 18 30 +12 OfficeMax 34 39 +5 Walgreens 57 60 +3 Walmart-US 38 41 +3 Toys - R - Us 39 42 +3 Target Stores 52 54 +2 Source: ECRM-MarketGate Ad Comparisons, Calendar 2010 6 Very Few CPG Retailers Are Running Fewer Ad Circulars 2009 2010 Chg In Retailer Circulars Circulars Circulars Sentry Foods 52 49 -3 Kmart 66 64 -2 Copps 52 50 -2 Farm Fresh 52 50 -2 Big Lots 33 31 -2 Source: ECRM-MarketGate Ad Comparisons, Calendar 2010 7 Squeezing More Ads into Fewer Circulars 2010 Chg In Chg In Retailer Circulars Circulars Ad Blocks Sentry Foods 49 -3 +4,845 Kmart 64 -2 -567 Copps 50 -2 +3,217 Farm Fresh 50 -2 +2,896 Big Lots 31 -2 +253 Source: ECRM-MarketGate Ad Comparisons, Calendar 2010 8 Most leading retailers ran more ad blocks in 2010 than in 2009 Increased 2010 Ad Blocks Vs. -

Feature Advertising by U.S. Supermarkets Meat and Poultry

United States Department of Agriculture Agricultural Feature Advertising by U.S. Supermarkets Marketing Service Meat and Poultry Livestock, Poultry and Seed Program Independence Day 2017 Agricultural Analytics Division Advertised Prices effective through July 04, 2017 Feature Advertising by U.S. Supermarkets During Key Seasonal Marketing Events This report provides a detailed breakdown of supermarket featuring of popular meat and poultry products for the Independence Day marketing period. The Independence Day weekend marks the high watershed of the summer outdoor cooking season and is a significant demand period for a variety of meat cuts for outdoor grilling and entertaining. Advertised sale prices are shown by region, state, and supermarket banner and include brand names, prices, and any special conditions. Contents: Chicken - Regular and value packs of boneless/skinless (b/s) breasts; b/s thighs; split, bone-in breasts; wings; bone-in thighs and drumsticks; tray and bagged leg quarters; IQF breast and tenders; 8-piece fried chicken. Northeast .................................................................................................................................................................. 03 Southeast ................................................................................................................................................................. 21 Midwest ................................................................................................................................................................... -

Retail Format Competition: the Case of Grocery Discount Stores and Why They Haven’T Conquered the Chinese Market (Yet)

MORAVIAN GEOGRAPHICAL REPORTS 2018, 26(3):2018, 220–227 26(3) Vol. 23/2015 No. 4 MORAVIAN MORAVIAN GEOGRAPHICAL REPORTS GEOGRAPHICAL REPORTS Institute of Geonics, The Czech Academy of Sciences journal homepage: http://www.geonika.cz/mgr.html Figures 8, 9: New small terrace houses in Wieliczka town, the Kraków metropolitan area (Photo: S. Kurek) doi: 10.2478/mgr-2018-0018 Illustrations to the paper by S. Kurek et al. Retail format competition: The case of grocery discount stores and why they haven’t conquered the Chinese market (yet) Sina HARDAKER a * Abstract The international expansion of the German discounters Aldi and Lidl in recent years has been a large success in grocery retailing. In China, the world’s largest grocery retail market, however, grocery discounters have not (yet) established a physical store presence. In 2017 Aldi Süd and Lidl for the first time entered a new market without the help of a physical store, implementing an online shop in China. As to the format’s future, significant disagreement amongst retail experts exists. This paper, which is based on qualitative interviews with high-ranking senior executives of international retailers, argues for three major reasons as to why the discount format has not hitherto gained a foothold in the Chinese market. Firstly, due to the characteristics and challenges of China’s market, such as high fragmentation as well as the need for strong localisation, a high standardisation of the format is not possible. Secondly, the extremely low-margin operation of discounters faces a price level in China that is already very low, limiting one of the discounter’s major competitive advantages.