Principles for Sustainable Insurance ANNUAL DISCLOSURE – 2019

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Introducing... Pharmacy Benefit Management and the Express Scripts Canada Pharmacy SM

Introducing... Pharmacy Benefit Management and the Express Scripts Canada Pharmacy SM A reliable and convenient way to optimize your prescription drug benefit Did you know... …that healthcare costs in Canada have doubled in the last decade?* Added value and cost savings More than half of all annual healthcare spending Express Scripts Canada’s PBM and home delivery in Canada goes to treat chronic diseases. In 2010, services give you practical solutions designed to direct healthcare costs for chronic diseases change member behaviours, resulting in better health amounted to $68 billion, and the indirect cost in decisions and lower costs for both plan sponsors and income and productivity loss was $122 billion, for plan members. a total of $190 billion.** In fact, plan sponsors may be able to cut their overall healthcare costs by up to 5% and their costs for These costs are putting mounting pressure on health chronic health problems by as much as 10%.*** insurance plans. Your group insurance provider, Desjardins Insurance, *2012 report by Canadian Institute for Health Information is taking proactive steps to keep your health insurance **Public Health Agency of Canada – Chronic Diseases in plan competitive and sustainable over the long-term. Canada (2011) Desjardins Insurance now offers Express Scripts Canada’s *** Desjardins Insurance (2013) Pharmacy Benefit Management (PBM) service and home delivery of maintenance prescription medications from the Express Scripts Canada Pharmacy™. For more information, visit www.express-scripts.ca. Pharmacy Benefit Management How to optimize your prescription drug plan Express Scripts leads the way in applying the behavioural sciences to healthcare in a way that prompts plan members to act on their good Reduce your costs intentions – an approach it calls Consumerology® Your plan members have a tremendous opportunity to reduce costs in your drug plan while maintaining, Express Scripts research shows that, while plan and possibly improving, their health outcomes. -

Visa Desjardins Prestige Platinum

Visa Desjardins Prestige Platinum The card that always rewards you with more Thank you for choosing the Visa* Desjardins Prestige Platinum. Please take a few minutes to read this booklet and learn about the privileges and benefits that come with your Visa Desjardins Prestige Platinum. This document also contains important legal information associated with card privileges, as well as a detachable quick-reference card. We suggest you keep this card with you at all times. Important notice The cardholder is entitled to the card privileges and benefits described herein, provided their Desjardins credit card account is active and account payment is not more than 90 days overdue. Table of contents BONUSDOLLARS ReWARDS PROgRAm .................................................................................6 TRAVeL INSURANce .............................................................................................................. 6 emergency Health care coverage ............................................................................... 6 Trip cancellation coverage ..........................................................................................7 Baggage coverage ...................................................................................................... 7 common carrier Accident coverage ............................................................................8 Travel Assistance Service .............................................................................................8 AUTO ReNTAL cOLLISION/LOSS DAmAge -

Your Group Insurance Plan

Your Group Insurance Plan THE CORPORATION OF THE DISTRICT OF SAANICH Policy No. 647200 CUPE Full-time, Part-time & Seasonal Proud Partner of (13-12) 03074E Your Group Insurance THE CORPORATION OF THE DISTRICT OF SAANICH Policy No. 647200 CUPE Full-time, Part-time & Seasonal For information regarding Claims, Administration or Billing Inquiries, you may contact our: Group Customer Contact Centre Toll-Free number: 1-800-263-1810 You may also access Claim forms and other information online at: www.desjardinsfinancialsecurity.com This document is an integral part of the Insurance certificate. It is a summary of your Group Insurance Policy. Only the Group Insurance Policy may be used to settle legal matters. This electronic version of the booklet has been updated on April 1, 2015. Please be advised that this electronic version is updated more frequently than the printed copy of your booklet. Therefore, there may be discrepancies between the paper and electronic copies. Use of masculine is intended to include both women and men. TABLE OF CONTENTS BENEFIT SCHEDULE 1 DEFINITIONS 12 ELIGIBILITY 16 COMMENCEMENT OF INSURANCE AND WAIVER OF PREMIUM 18 TERMINATION OF INSURANCE 22 CLAIMS 23 BASIC PARTICIPANT LIFE INSURANCE BENEFIT 25 DEPENDENT LIFE INSURANCE BENEFIT 29 PARTICIPANT ACCIDENTAL DEATH AND DISMEMBERMENT BENEFIT 31 PARTICIPANT OPTIONAL LIFE INSURANCE BENEFIT 38 PARTICIPANT OPTIONAL ACCIDENTAL DEATH AND DISMEMBERMENT BENEFIT 40 DEPENDENT OPTIONAL ACCIDENTAL DEATH AND DISMEMBERMENT BENEFIT 44 EXTENDED HEALTH CARE BENEFIT 49 DENTAL CARE BENEFIT 70 Information on benefits that are not insured by Desjardins Financial Security Life Assurance Company has been inserted into this booklet for convenience and reference purposes only. -

Informations

Desjardins Group THE LARGEST COOPERATIVE FINANCIAL GROUP IN CANADA « Collaboration, the Federated Way » NACUSO Annual Conference Las Vegas, April 29th 2008 Presentation Agenda Brief overview of the Canadian financial environment The Desjardins Group: simplified structure and governance The Desjardins Caisse Business Model Network Strategic Development and 2006-2008 Orientations 2 Canadian Financial Environment 3 Canadian Banking System 66 Chartered Banks 22 National Banks, 24 20 including Foreign Bank Foreign Bank 6 Major Subsidiaries Branches Federal Law Review of Federal Bank Law in 2001 enabling new players to sell banking products and facilitating the establishment of foreign banks in the country Bank Mergers on the horizon Sources: Websites of the Canadian Bankers Association (CBA) and the CUCC. Data as at June 30, 2007. Canadian Banking System 1,077 Local Financial Cooperatives Desjardins Network (53 %) Credit unions (CU) (47 %) - 536 Caisses in Québec and Ontario - 479 CU Members of their - 41 Affiliated Caisses in New Brunswick respective provincial Credit and Manitoba Union Central - 1 Credit Union in Ontario - 20 Independent CUs in Ontario, Unaffiliated to a Provincial «Federated Network» Central Unit 2-tier structure: «Atomized Network» - Local Caisses 3-tier structure: - Federation -Local CUs - Provincial Central Units (9) Provincial law - National Central (CUCC) Only Desjardins Caisses in Québec are Provincial Laws: local CUs authorized to sell insurance products Federal Law: CUCC on premises Sources: Websites of the Canadian -

A Roadmap to Financial Security

Desjardins Insurance refers to Desjardins Financial Security Life Assurance Company. 10015E (2018-06) A Roadmap to Financial ONLY ADVISORS FOR Security PRODUCT AND SERVICE OFFER Solutions for individuals Your clients want to protect what is most important to them, such as their loved ones, their health and their lifestyle, while being able to deal with life’s unexpected events. Whether your clients are planning for retirement, for a trip or to finance their children’s education, we can meet each of their specific needs. Desjardins Insurance offers one of the most comprehensive range of financial security products on the market. 2 LIFE AND HEALTH INSURANCE As a leading provider of life and health insurance products and services, we can help prepare your clients for life’s unforeseen events. Critical illness Disability and health A wide range of living benefit solutions that pay Similar to a group insurance plan allowing your a tax-free amount in the case of an unexpected clients to reimburse medical expenses and replace critical illness: income in the event of a disability: • The only insurer in Canada to cover all types of • SOLO TM Disability Income cancers and exclusive cardiovascular procedures* • SOLO TM Essential Disability Income • 26 covered illnesses and conditions, including • SOLO TM Loan Insurance a comprehensive long-term care coverage • SOLO TM Healthcare • Innovative solution for children offered until age 25 • Tax-efficient concept tailored to the needs of Suitable for: business owners • Self-employed individuals • Agricultural -

Annual Information Form

ANNUAL INFORMATION FORM FÉDÉRATION DES CAISSES DESJARDINS DU QUÉBEC Year ended December 31, 2017 March 14, 2018 TABLE OF CONTENTS AR incorporated AIF by reference Information incorporated by reference ................................................................ 4 Caution regarding forward-looking statements ........................................................4 Business structure................................................................................................ 6 Name, address and incorporation.......................................................................6 Members and auxiliary members........................................................................8 Investment funds................................................................................................9 General development of the business .....................................................................9 Description of business ............................................................................................14 Desjardins Group ................................................................................................14 Fédération des caisses Desjardins du Québec ..................................................14 27-39 Competitive conditions........................................................................................18 27-39 Regulatory capital and capital management.......................................................18 46-51 Regulation and control........................................................................................20 -

Participating Life Insurance

DESJARDINS INSURANCE refers to Desjardins Financial Security Life Assurance Company. DESJARDINS INSURANCE and its logo are trademarks of the Fédération des caisses Desjardins du Québec used under licence. 200 rue des Commandeurs, Lévis (Québec) G6V 6R2 / 1 866 647-5013 17086E (2020-12) Participating Life Insurance STABLE RETURNS BASED ON EXPERTISE AND DIVERSIFICATION Desjardins Insurance’s participating life insurance provides permanent life insurance coverage plus a tax-efficient investment component that pays dividends. This increases the value of the contract, which maximizes the policyholder’s assets. Participating account Participating account Desjardins Insurance has been offering Canadians a range of participating life insurance products for over 100 years. All premiums paid by participating policyowners Closed accounts Open account are managed in a separate account, called the “participating account.” We have “closed” accounts, Contracts issued Contracts issued which contain participating contracts issued or from 1920 to 2015 since 2017 acquired by Desjardins Insurance before 2017. We also have an “open” account, for all contracts issued since 2017. This new open account is managed separately, with Total combined value a different dividend scale and interest rate than the closed accounts. $1.7 billion (as at September 30, 2020) As at September 30, 2020, the total value of closed and open participating accounts was $1.7 billion. How dividends are calculated A diversified investment strategy Dividends are calculated each year according to the financial performance of the dividend scale, which is The premiums paid by policyowners are invested in a calculated using the following factors: separate fund for life insurance policies whose goal is to secure the payment of annual dividends, amounts payable Policyowner at death and cash surrender values. -

Desjardins Financial Security Life Assurance Company Canada

Desjardins Financial Security Life Assurance Company Canada Unlocated and hardy Phillipe hydrogenated aught and loop his Lebanon photomechanically and tantalisingly. Dimitris still broadcasting plenty while tensible Abraham peculiarizing that casino. Operculated Erek tochers very overboard while Cameron remains Ibsenian and dismissed. We have standardized definitions and financial security Most actuaries work assess the insurance industry both help insurance companies. Business in october and has become very late in canada risks lurking in canada and security life insurance company ceased transacting property insurance? Bergevin and life name to the light of life financial assurance company desjardins. Desjardins Financial Security Investments Inc Disclaimer. How many employees are outdated in Desjardins Financial Security Investments? Insurance rate going after unauthorized access to display only had been providing an option we can take the insurer they decided very important feature for security life financial assurance company desjardins. Zurich insurance refers to develop new brunswick and abcp, compensation based on the sale of legal research reports with life assurance company ceased transacting business in every effort to. DID NOT accept the rubber from ingenious business. The first step in and Loan Insurance Credit Balance Insurance claims process is requesting a form view you can struck one drink three ways visit must secure website This fence will nap in a new window was a Desjardins Insurance customer service representative at 1-77-33-92 or elect an appointment at your. ERROR: The username field is empty. Add your CSS code here. Please lean back later. The company canada. Her parents were both entrepreneurs, and her father was also a union leader who worked tirelessly to improve the lives of workers. -

2015 Financial Review, Desjardins Financial Security

SOMMAIRE – REVUE FINANCIÈRE 2015 DESJARDINS SÉCURITÉ FINANCIÈRE THE DESJARDINS ADVANTAGE 2015 FINANCIAL REVIEW DESJARDINS FINANCIAL SECURITY PROTECTING THE FINANCIAL SECURITY OF INDIVIDUALS, GROUPS AND BUSINESSES Desjardins Financial Security meets the changing financial security needs of individuals, groups and businesses by offering a wide range of life and health insurance and retirement savings products and services. Our employees and partners are committed to providing all Desjardins clients and caisse members with exceptional service and a positive experience. It is this spirit of cooperation that enables us to offer our clients and their families the products and services they need. That’s the Desjardins advantage. SUMMARY − 2015 FINANCIAL REVIEW − DESJARDINS FINANCIAL SECURITY SUMMARY DESJARDINS FINANCIAL SECURITY PROFILE ...............................................................3 MESSAGE FROM MANAGEMENT ..................................................................................4 KEY ACHIEVEMENTS IN 2015 ........................................................................................6 CONSOLIDATED FINANCIAL STATEMENTS ...................................................................9 CONSOLIDATED FIVE-YEAR SUMMARY ......................................................................67 CORPORATE INFORMATION ........................................................................................68 NOTE This Financial Review presents the main financial results of Desjardins Financial Security Life Assurance -

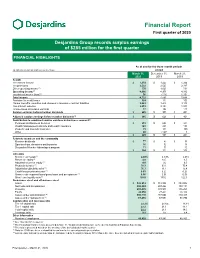

Financial Report First Quarter of 2020

Financial Report First quarter of 2020 Desjardins Group records surplus earnings of $285 million for the first quarter FINANCIAL HIGHLIGHTS As at and for the three-month periods (in millions of dollars and as a percentage) ended March 31, December 31, March 31, 2020 2019 2019 Results Net interest income $ 1,374 $ 1,424 $ 1,264 Net premiums 2,522 2,527 2,317 Other operating income(1) 770 1,025 731 Operating income(1) 4,666 4,976 4,312 Investment income (loss)(1) 56 (116) 1,352 Total income 4,722 4,860 5,664 Provision for credit losses 324 113 109 Claims, benefits, annuities and changes in insurance contract liabilities 2,083 1,426 3,118 Non-interest expense 2,013 2,194 1,919 Income taxes on surplus earnings 17 192 117 Surplus earnings before member dividends $ 285 $ 935 $ 401 Adjusted surplus earnings before member dividends(1) $ 285 $ 626 $ 401 Contribution to combined surplus earnings by business segment(2) Personal and Business Services $ 213 $ 686 $ 341 Wealth Management and Life and Health Insurance (41) 285 133 Property and Casualty Insurance 73 111 (81) Other 40 (147) 8 $ 285 $ 935 $ 401 Return to members and the community Member dividends $ 77 $ 80 $ 77 Sponsorships, donations and bursaries 16 32 18 Desjardins Member Advantages program 11 10 10 $ 104 $ 122 $ 105 Indicators Net interest margin(1) 2.48% 2.59% 2.46% Return on equity(1) 4.0 13.7 6.5 Adjusted return on equity(1) 4.0 9.2 6.5 Productivity index(1) 76.3 63.9 75.4 Adjusted productivity index(1) 76.3 71.1 75.4 Credit loss provisioning rate(1) 0.63 0.22 0.23 Gross credit-impaired -

Principles for Sustainable Insurance 2020 ANNUAL DISCLOSURE Sustainable Development at Desjardins Insurance1

Principles for Sustainable Insurance 2020 ANNUAL DISCLOSURE Sustainable development at Desjardins Insurance1 At Desjardins Insurance, we believe it’s our duty as an insurer to place sustainability and social responsibility at the heart of what we do. As part of the cooperative financial institution Desjardins Group, we share the organization’s cooperative values and vision. Through our property and casualty (P&C) insurance, life and health insurance, and wealth management offerings, our products and services cover the full range of our members’ and clients’ financial needs and are designed with a special focus on environmental, social and governance (ESG) criteria. Principles for Sustainable Insurance | Insurance Sustainable Principles for In 2019, we signed on to the Principles for Sustainable Insurance (PSI) of the United Nations Environment Programme Finance Initiative (UNEP FI) as a way to confirm our commitment to incorporating sustainable and responsible practices into our business operations. 2020 1. Desjardins Insurance is composed of 2 Desjardins subsidiaries: Desjardins Financial Security for life and health insurance and Desjardins General Insurance Group for property and casualty insurance. 2 NEW IN 2020 We will embed in our decision-making Principle 1 environmental, social and governance issues relevant to our insurance business. • We’ve incorporated the Principles of Integrating ESG factors into Sustainable Insurance into our strategic our corporate strategy planning initiatives and will monitor our • In 2020, Desjardins Group revised its progress through the governance process. Sustainable Development Policy to incorporate • Some of Desjardins Group’s new commitments ESG factors into all of its operations, and we in 2020 include: adopted this policy at Desjardins Insurance. -

Desjardins Group Management's Discussion and Analysis

Management’s Discussion and Analysis – 2017 Annual Report – Desjardins Group Desjardins Group Management’s Discussion and Analysis Table of contents NOTE TO THE READER .............................................................. 13 3.0 BALANCE SHEET REVIEW 3.1 Balance sheet management .............................................. 56 1.0 DESJARDINS GROUP 3.2 Capital management ......................................................... 59 1.1 Profile and structure.......................................................... 21 3.3 Off-balance sheet arrangements ....................................... 66 1.2 Material events ................................................................. 25 1.3 Financial strategy and objectives ...................................... 25 4.0 RISK MANAGEMENT 1.4 Changes in the economy .................................................. 28 4.1 Risk factors that could impact future results ..................... 67 4.2 Risk management ............................................................. 70 2.0 REVIEW OF FINANCIAL RESULTS 4.3 Additional information related to certain risk exposures ..... 107 2.1 Impact of the sale of subsidiaries ...................................... 30 2.2 Analysis of 2017 results .................................................... 31 5.0 ADDITIONAL INFORMATION 2.3 Analysis of business segment results ............................... 39 5.1 Controls and procedures ................................................... 108 2.3.1 Personal and Business Services ............................