Imperial Brands Finance

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Report and Accounts 2019

IMPERIAL BRANDS PLC BRANDS IMPERIAL ANNUAL REPORT AND ACCOUNTS 2019 ACCOUNTS AND REPORT ANNUAL ANNUAL REPORT AND ACCOUNTS 2019 OUR PURPOSE WE CAN I OWN Our purpose is to create something Everything See it, seize it, is possible, make it happen better for the world’s smokers with together we win our portfolio of high quality next generation and tobacco products. In doing so we are transforming WE SURPRISE I AM our business and strengthening New thinking, My contribution new actions, counts, think free, our sustainability and value creation. exceed what’s speak free, act possible with integrity OUR VALUES Our values express who we are and WE ENJOY I ENGAGE capture the behaviours we expect Thrive on Listen, challenge, share, make from everyone who works for us. make it fun connections The following table constitutes our Non-Financial Information Statement in compliance with Sections 414CA and 414CB of the Companies Act 2006. The information listed is incorporated by cross-reference. Additional Non-Financial Information is also available on our website www.imperialbrands.com. Policies and standards which Information necessary to understand our business Page Reporting requirement govern our approach1 and its impact, policy due diligence and outcomes reference Environmental matters • Occupational health, safety and Environmental targets 21 environmental policy and framework • Sustainable tobacco programme International management systems 21 Climate and energy 21 Reducing waste 19 Sustainable tobacco supply 20 Supporting wood sustainability -

Pdf (Boe-A-2001-14861

BOE núm. 182 Martes 31 julio 2001 27971 Áreas y materias Primer Segundo Tercer Cuarto curso curso curso curso MINISTERIO DE ECONOMÍA Educación Plástica y Visual ........ 2 2 2 3* 14861 RESOLUCIÓN de 26 de julio de 2001, del Ética .................................. — — — 2 Comisionado para el Mercado de Tabacos, por Música ............................... 2 2 2 3* la que se publican los precios de venta al públi- Tecnología .......................... 2 2 2 3* co de determinadas labores de tabaco en Religión/Actividades de estudio . 1 2 1 2 expendedurías de tabaco y timbre del área Optativas ............................ 2 2 2 2 del monopolio. En virtud de lo establecido en el artículo 4 de la Total horas ..................... 29 29 29 29 Ley 13/1998, de Ordenación del Mercado de Tabacos, se publican los precios de venta al público de deter- (*) Áreas y materias optativas entre las que el alumno cursará dos. minadas labores de tabaco en Expendedurías de Tabaco y Timbre del área del Monopolio, que han sido propues- tos por los correspondientes fabricantes e importadores. ANEXO II Primero.—Los precios de venta al público de las labo- res de tabaco que se indican a continuación, incluidos Horario semanal de áreas y materias en el segundo los diferentes tributos, en Expendedurías de Tabaco y curso de la Educación Secundaria Obligatoria durante Timbre de la Península e Illes Balears, serán los siguien- el año académico 2001-2002 en los centros a los que tes: se refiere el apartado tercero de la presente Orden Precio total de venta al público Áreas y materias Segundo curso Pesetas/cajetilla Euros/cajetilla Lengua Castellana y Literatura ..................... -

Imperial Tobacco Group Plc Interim Management Statement for the Nine Months Ended 30 June 2015

IMPERIAL TOBACCO GROUP PLC INTERIM MANAGEMENT STATEMENT FOR THE NINE MONTHS ENDED 30 JUNE 2015 STRATEGIC PROGRESS CONTINUES – ON TRACK FOR FULL YEAR Strengthening our Portfolio • Excellent results from Growth Brands; underlying net revenue, underlying volume and market share up 14 per cent, 10 per cent and 100 bps respectively • Continued success of brand migrations; 13 complete (8 in FY15), 21 ongoing; high level of consumer retention • Growth and Specialist Brands proportion of reported tobacco net revenue up 580 bps to 59 per cent Developing our Footprint • Continued progress in Growth Markets: underlying net revenue down 1 per cent; up 3 per cent ex Iraq • Improving underlying net revenue growth of 1 per cent in Returns Markets • Total underlying net revenue flat and volumes down 6 per cent (net revenue up 1 per cent and volumes down 4 per cent ex Iraq) • Acquisition of US assets completed; ITG Brands fully operational and integration progressing to plan Cost Optimisation • Focus on complexity reduction, improved ways of working and cost efficiencies ongoing • Cost optimisation programme remains on track to deliver £85 million savings in FY15 Capital Discipline • Expect cash conversion of c.90 per cent for the full year with consistent focus on managing working capital • Continuing commitment to ongoing debt reduction • On track to deliver dividend growth of 10 per cent for the full year Overview 9 months to 30 June Change Constant 2015 2014 Actual Currency1 Underlying2 Growth Brands volume bn SE 105.4 91.7 +15% - +10% Tobacco net revenue3 £m 4,435 4,632 R -4% +2% 0% Total Tobacco volume3 bn SE 207.4 213.3 -3% - -6% 1 Change at constant currency removes the effect of exchange rate movements on the translation of the results of our overseas operations. -

American Reynolds – Historic All-Time High in Brand Acquisitions 14

MARKABLES American Reynolds – Historic All-Time High in Brand Acquisitions 14 American Reynolds – Historic All-Time High in Brand Acquisitions White Paper Dr. Christof Binder Schwyz, April 3rd, 2018 Historic All-Time High in Brand Acquisitions Recently, on March 15th, British American Tobacco (BAT) filed their annual report for 2017, including the valuation of the assets purchased with their acquisition of Reyn- olds American on July 25th, 2017. With this report, accounting for brands experienced a historic moment with the reporting of a brand value of US$ 93.6 billion acquired with Reynolds American by BAT. The portfolio of acquired brands includes Newport, Pall Mall, Camel, Natural American Spirits, Grizzly and Kodiak. This is a new all-time high which more than doubles the previous record high of Kraft Foods (2015, US$ 41.3 billion). The brand value embedded the acquisition of Reynolds American is remarkable in three aspects: 1. It is the most valuable brand portfolio ever acquired. What is more, 2. the ratio brand value / brand revenues is amongst the highest ever reported. And 3. the ratio brand value / enterprise value of 89% shows that there were hardly any other assets than brand within this acquisition. The valuation and accounting of brands dates back to the mid-eighties when British and Australian companies like NewsCorp, Reckitt & Coleman, GrandMet and Ranks Hovis McDougall pioneered the valuation, auditing and reporting of some of their brands in their financial statements. According to accounting standards, all acquired brands have to be valued and reported separately since 2000 in the US and since 2004 in most other countries. -

Norsk Varemerketidende Nr 48/16

. nr 48/16 - 2016.11.28 NO årgang 106 ISSN 1503-4925 Norsk varemerketidende er en publikasjon som inneholder kunngjøringer innenfor varemerkeområdet BESØKSADRESSE f Sandakerveien 64 POSTADRESSE f Postboks 8160 Dep. 0033 Oslo E-POST f [email protected] TELEFON f +47 22 38 73 00 INFOSENTERETS TELEFONTID f kl. 09.00 - 15.00 Telefon: +47 22 38 73 33 innholdsfortegnelse og inid-koder 2016.11.28 - 48/16 Innholdsfortegnelse: Etterlysning ............................................................................................................................................................ 3 Registrerte varemerker ......................................................................................................................................... 4 Internasjonale varemerkeregistreringer ............................................................................................................ 82 Ansvarsmerker .................................................................................................................................................. 145 Innsigelser .......................................................................................................................................................... 146 Begrensing i varefortegnelsen for internasjonale varemerkeregistreringer ............................................... 149 Begrensing av varer eller tjenester for nasjonale registreringer ................................................................. 156 Trekninger/slettelser begjært av søker/innehaver ........................................................................................ -

Negativliste. Tobaksselskaber. Oktober 2016

Negativliste. Tobaksselskaber. Oktober 2016 Læsevejledning: Indrykket til venstre med fed tekst fremgår koncernen. Nedenunder, med almindelig tekst, fremgår de underliggende selskaber, som der ikke må investeres i. Alimentation Couche Tard Inc Alimentation Couche-Tard Inc Couche-Tard Inc Alliance One International Inc Alliance One International Inc Altria Group Inc Altria Client Services Inc Altria Consumer Engagement Services Inc Altria Corporate Services Inc Altria Corporate Services International Inc Altria Enterprises II LLC Altria Enterprises LLC Altria Finance Cayman Islands Ltd Altria Finance Europe AG Altria Group Distribution Co Altria Group Inc Altria Import Export Services LLC Altria Insurance Ireland Ltd Altria International Sales Inc Altria Reinsurance Ireland Ltd Altria Sales & Distribution Inc Altria Ventures Inc Altria Ventures International Holdings BV Batavia Trading Corp CA Tabacalera Nacional Fabrica de Cigarrillos El Progreso SA Industria de Tabaco Leon Jimenes SA Industrias Del Tabaco Alimentos Y Bebidas SA International Smokeless Tobacco Co Inc National Smokeless Tobacco Co Ltd Philip Morris AB Philip Morris Albania Sh pk Philip Morris ApS Philip Morris Asia Ltd Philip Morris Baltic UAB Philip Morris Belgium BVBA Philip Morris Belgium Holdings BVBA Philip Morris Belgrade doo Philip Morris BH doo Philip Morris Brasil SA Philip Morris Bulgaria EEOD Philip Morris Capital Corp Philip Morris Capital Corp /Rye Brook Philip Morris Chile Comercializadora Ltda Philip Morris China Holdings SARL Philip Morris China Management -

Delivering Against Our Strategy with Adjusted Eps up 12%

IMPERIAL BRANDS PLC PRELIMINARY RESULTS FOR THE 12 MONTHS ENDED 30 SEPTEMBER 2016 DELIVERING AGAINST OUR STRATEGY WITH ADJUSTED EPS UP 12% Performance Headlines Delivering against strategy • Tobacco net revenue up 9.7% • Total adjusted operating profit up 10.4% • Adjusted EPS up 12.0% • Cash conversion 95% • Dividend growth of 10% Next Phase of Strategy to Support Sustainable Quality Growth • Strategy is delivering a stronger business providing a solid foundation for the next decade of growth • Maintaining focus on our same four strategic priorities to drive growth in both revenue and profit • New investment of £300m in FY17 behind selected quality growth opportunities • Supported by a further phase of cost optimisation with an additional £300m of annual savings by 2020 Alison Cooper, Chief Executive, commented “We delivered another strong performance this year with great results from our expanded US business, and we further improved the quality of our growth. We grew the dividend by 10 per cent for the eighth consecutive year and remain committed to this level of increase over the medium term. Our strategy is delivering and we see scope for significant further shareholder value creation by remaining relentlessly focused on the same four strategic priorities. We are today also announcing further investment behind our strategy to support revenue growth over the medium term. This investment will be supported by a new phase of cost optimisation, targeting a further £300 million of annual savings by 2020, at a cost of £750 million. We have -

Cigar List Cuban Selections

Cigar List Cuban selections Cohiba Siglo No.VI- Tubos 3,040 This Cohiba Corona Gorda, like all Cohiba cigars, is a well balanced beautifully hand constructed cigar. Full of flavor with a sweet musky aroma. Enjoy this cigar with your favorite cognac or brandy. Length: 14.3 cm / 5.6” Ring Gauge: 46 Size: Corona Gorda Strength: Medium Robusto 3,500 The Cohiba Robusto is perfect balance between power and flavor. This Robusto has a hint of clover among the base flavor of wood and spice. Length: 12.4 cm / 4.7” Ring Gauge: 50 Size: Robusto Strength: Medium - Full Siglo No.II- Tubos 2,270 The Sigalo No. II for that quick 15 to 20 minute smoke. It is loaded with flavors of wood and spice with a finish of sweet caramel. Length: 12.9 cm / 5” Ring Gauge: 42 Size: Petit Corona Strength: Medium Panetelas 1,720 The Panatelas is short smoke. The draw and amount of smoke this cigar delivers is perfect and will definitely leave a lasting impression. Length: 11.50cm / 4.5” Ring Gauge: 26 Size: Panetelas Strength: Medium Cohiba Mini 190 This is a sweet to start but spicy to finish. Cohiba mini is the little cigar that causes most of the people to start fully enjoying Cuban tobacco. Length: 8.2cm / 3.2” Ring Gauge: 20 Size: Panetela Strength: Medium – Full All price are in Thai Baht and inclusive of all applicable taxes and service charge Montecristo Montecristo - No 4 1,300 This Monte 4 perform a well balanced with flavorful, earthy tones and easy to smoke. -

Cohiba: Not Just Another Name, Not Just Another Stogie: Does General Cigar Own a Valid Trademark for the Name Cohiba in the United States

Loyola of Los Angeles International and Comparative Law Review Volume 21 Number 4 Article 4 8-1-1999 Cohiba: Not Just Another Name, Not Just Another Stogie: Does General Cigar Own a Valid Trademark for the Name Cohiba in the United States Mark D. Nielsen Follow this and additional works at: https://digitalcommons.lmu.edu/ilr Part of the Law Commons Recommended Citation Mark D. Nielsen, Cohiba: Not Just Another Name, Not Just Another Stogie: Does General Cigar Own a Valid Trademark for the Name Cohiba in the United States, 21 Loy. L.A. Int'l & Comp. L. Rev. 633 (1999). Available at: https://digitalcommons.lmu.edu/ilr/vol21/iss4/4 This Notes and Comments is brought to you for free and open access by the Law Reviews at Digital Commons @ Loyola Marymount University and Loyola Law School. It has been accepted for inclusion in Loyola of Los Angeles International and Comparative Law Review by an authorized administrator of Digital Commons@Loyola Marymount University and Loyola Law School. For more information, please contact [email protected]. COHIBA: NOT JUST ANOTHER NAME, NOT JUST ANOTHER STOGIE: DOES GENERAL CIGAR OWN A VALID TRADEMARK FOR THE NAME "COHIBA" IN THE UNITED STATES? I. INTRODUCTION Cuban Cohiba cigars are widely regarded as the world's finest cigars. Crafted from the "selection of the selection" of Cuba's tobacco,1 cigar aficionados2 clamor for the opportunity to enjoy Cohibas. Cohiba cigars are not, and have never been, legally available in the United States because the economic embargo against Cuba 3 took effect prior to the creation of Cohiba by Avelino Lara in 1968. -

Catalog Cigar 2

Cohiba, Fidel Castros preferred brand, was created in 1966 as Havanas premier brand for diplomatic purposes. Since 1982, it was offered to the public in three sizes: Lanceros, Coronas Especiales and Panetelas. In 1989, three more sizes were added to complete the classic line namely: Esplendidos, Robustos and Exquisitos. In 1992, the following five sizes were further made in order to commemorate the 500th anniversary of the discovery of Cuba in 1492: Siglo I, II, III, IV and V. Name Lenght Ring Box Price BEHIKE 54 10 144 mm 54 10 28.958.000 VNĐ ESPLENDIDOS 25 178 mm 47 25 41.699.000 VNĐ EXQUISITOS 25 125 mm 33 25 14.157.000 VNĐ MEDIO SIGLO 25 102 mm 52 25 21.030.000 VNĐ PIRAMIDES EXTRA 10 160 mm 54 10 15.316.000 VNĐ PIRAMIDES EXTRA AT 15 160 mm 54 AT 15 28.314.000 VNĐ ROBUSTOS 25 124 mm 50 25 24.145.000 VNĐ ROBUSTOS 15 124 mm 50 AT 15 14.492.000 VNĐ MADURO SECRETOS 10 110 mm 40 10 5.869.000 VNĐ MADURO SECRETOS 25 110 mm 40 25 14.672.000 VNĐ SIGLO I 25 102 mm 40 25 10.940.000 VNĐ SIGLO I AT 15 102 mm 40 AT 15 9.266.000 VNĐ Name Lenght Ring Box Price SIGLO II 25 129 mm 42 CP 25 16.731.000 VNĐ SIGLO II 25 129 mm 42 25 16.731.000 VNĐ SIGLO III 25 155 mm 42 CP 25 20.798.000 VNĐ SIGLO IV 25 143 mm 46 25 25.225.000 VNĐ SIGLO IV 15 143 mm 46 AT 15 18.147.000 VNĐ SIGLO IV 25 143 mm 46 25 25.225.000 VNĐ SIGLO VI TUBOS 15 150 mm 52 AT 15 26.435.000 VNĐ SIGLO VI 25 150 mm 52 25 37.323.000 VNĐ TALISMAN 10 2017 LIMITED 154 mm 54 10 30.888.000 VNĐ Lenght 156 mm Lenght 124 mm Ring 52 mm Ring 50 mm Box Box COMBINACIONES SELECCION PIRAMIDES, 6'S COMBINACIONES SELECCION ROBUSTOS 6'S Romeo y Julieta, Cohiba, Hoyo de Monterrey, Cohiba Robusto, Montecristo Open Master, The Montecristo No. -

Specials 2019 General Assembly

2019 GENERAL ASSEMBLY SPECIALS NEW YORK www.shopddf.com D.C. 212.838.9151 202.872.5200 WWW.SHOPDDF.COM Btls Catalogue Product Special price Special price Product description in a / Size price per code SKU# per case per bottle case case MALT SCOTCH WHISKEY 45-1102 ABERFELDY 12 YEAR OLD 6 / LITER $ 345.00 $ 168.00 $ 28.00 45-1167 ARDBEG 1 LTR 6 / LITER $ 330.00 $ 222.00 $ 37.00 45-1171 ARDMORE 6 / LITER $ 200.00 $ 150.00 $ 25.00 45-1691 BALCONES TEXAS SINGLE MALT *new 6 / 750ML $ 384.00 $ 255.00 $ 42.50 45-1376 BALVENIE 12YO TRIPLE CASK 12 / LITER $ 550.00 $ 360.00 $ 30.00 45-1072 BALVENIE PEATED 14YO 6 / 700ML $ 345.00 $ 252.00 $ 42.00 45-1388 BALVENIE 16 YO TRIPLE CASK 6 / 700ML $ 425.00 $ 300.00 $ 50.00 45-1403 BALVENIE 25 YO TRIPLE CASK 1 / 700ML $ 360.00 $ 227.00 $ 227.00 45-1154 BALVENIE 30 YO TRIPLE CASK 1 / 700ML $ 830.00 $ 550.00 $ 550.00 45-109 CAOL ILA 12 YO 6 / LITER $ 445.00 $ 300.00 $ 50.00 45-1174 DALMORE 12 YO 12 / LITER $ 605.00 $ 450.00 $ 37.50 45-1199 DALMORE 15 YO 12 / LITER $ 870.00 $ 624.00 $ 52.00 45-1200 DALMORE 18 YO 6 / 700ML $ 640.00 $ 468.00 $ 78.00 45-464 DALWHINNIE 15 YO 6 / LITER $ 400.00 $ 300.00 $ 50.00 45-1470 GLEN DEVERON 16 YO 6 / LITER $ 295.00 $ 198.00 $ 33.00 45-1707 GLENFIDDICH 15 YO DISTILLER EDITION 12 / 700ML $ 1,080.00 $ 660.00 $ 55.00 45-517 GLENFIDDICH 18 YO ANCIENT RESERVE 12 / 700ML $ 984.00 $ 468.00 $ 39.00 45-1477 GLENFIDDICH SELECT CASK 12 / 500ML $ 215.00 $ 159.00 $ 13.25 45-1421 GLENFIDDICH RESERVE CASK 12 / LITER $ 550.00 $ 456.00 $ 38.00 45-1422 GLENFIDDICH SELECT CASK 12 / LITER $ -

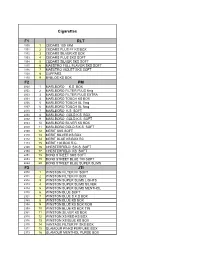

F1 RLT F2 PM F3 JTI Cigarettes

Cigarettes F1 RLT 1000 1 CEDARS 100 MM 1001 2 CEDARS PLUS FF KS BOX 1002 3 CEDARS SILVER KS BOX 1003 4 CEDARS PLUS SKS SOFT 1004 5 CEDARS SILVER SKS SOFT 1015 6 MAESTRO FULL FLAVOR SKS SOFT 1016 7 MAESTRO VIOLET SKS SOFT 1020 8 SUPPARS 1110 9 BYBLOS KS BOX F2 PM 2000 1 MARLBORO K.S BOX 2002 2 MARLBORO FILTER PLUS 6mg 2003 3 MARLBORO FILTER PLUS EXTRA 2004 4 MARLBORO TOUCH KS BOX 2006 5 MARLBORO TOUCH XL 7mg 2007 6 MARLBORO TOUCH XL 5mg 2010 7 MARLBORO K.S SOFT 2030 8 MARLBORO GOLD K.S BOX 2032 9 MARLBORO GOLD K.S SOFT 2033 10 MARLBORO SILVER KS BOX 2040 11 MARLBORO GOLD S.K.S SOFT 2100 12 MERIT SKS SOFT 2110 13 MERIT SILVER KS BOX 2112 14 MERIT BLUE KS BOX RC 2113 15 MERIT 100 BOX R.C. 2160 16 CHESTERFIELD S K.S SOFT 2150 17 CHESTERFIELD KS SOFT 2251 18 BOND STREET SKS SOFT 2253 19 BOND STREET BLUE 100 SOFT 2254 20 BOND STREET BLUE SUPER SLIMS F3 JTI 2310 1 WINSTON FILTER FF SOFT 2311 2 WINSTON FILTER FF BOX 2312 3 WINSTON SUPER SLIMS LIGHTS 2313 4 WINSTON SUPER SLIMS SILVER 2314 5 WINSTON SUPER SLIMS MENTHOL 2318 6 WINSTON BLUE SOFT 2321 7 WINSTON BLUE S.K.S BOX 2360 8 WINSTON BLUE KS BOX 2358 9 WINSTON BLUE KS BOX ROM 2359 10 WINSTON BLUE KS BOX TIN 2361 11 WINSTON SILVER KS BOX 2315 12 WINSTON XS RED KS BOX 2316 13 WINSTON XS BLUE KS BOX 2370 14 VANTAGE FILTER FF SKS BOX 2372 15 GLAMOUR PINKS PERFUME BOX 2373 16 GLAMOUR MENTHOL PURSE BOX 2510 17 WINCHESTER EXPORT FF KS RC 2511 18 WINCHESTER EXPORT L KS RC 2509 19 WINCHESTER SILVER RC KS BOX 2512 20 CAMEL FF BOX (YELLOW) 2513 21 CAMEL BLUE BOX 2514 22 WINCHESTER FILTER EXP FF 100 SOFT 2515 23 WINCHESTER EXP BLUE 100 SOFT 2516 24 WINCHESTER SUPER SL LIGHTS F4 BAT 2610 1 VICEROY K.S SOF 2613 2 VICEROY LIGHTS BLUE 2614 3 VICEROY ULTRA LIGHTS SILVER 2616 4 VICEROY BLUE SUPER SLIMS 2650 5 LUCKY K.S SOF 2751 6 KENT PREMIUM L .