Investor Presentation Important Disclosure

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Manchester United Make Maguire World's Most Expensive Defender

Sports Tuesday, August 6, 2019 13 Manchester United make Maguire world’s most expensive defender AFP home to Chelsea on Sunday and United manager land reached the semi-finals for the first time LONDON Ole Gunnar Solskjaer is confident he will live up to since 1990. his hefty price tag. United were interested in his signature last Three things MANCHESTER United signed Harry Maguire from “Harry is one of the best centre-backs in the summer, but baulked at Leicester’s asking price. Leicester on Monday for a reported £80 million fee game today and I am delighted we have secured his A year on and with the heart of their defence that makes the England centre-back the world’s signature,” he said. brutally exposed in finishing sixth in the Premier about Harry most expensive defender. “He is a great reader of the game and has a League last season to miss out on Champions United have secured Maguire on a six-year con- strong presence on the pitch, with the ability to League qualification, the Red Devils finally paid the tract with an option for a further 12-month extension. remain calm under pressure - coupled with his fee the Foxes’ demanded. AFP ed academy manager John The £75 million Liverpool paid for Virgil composure on the ball and a huge presence in both Solskjaer had made strengthening central de- LONDON Pemberton switched him to van Dijk in 2018 was the previous record fee for boxes - I can see he will fit well into this group both fence a priority, with that need only becoming more central defence, saying his a defender. -

SPORTS 2424 Monday, March 20, 2017 United on the up As Fellaini

Griezmann lifts P23 Atletico SPORTS 2424 Monday, March 20, 2017 United on the up as Fellaini strikes Manchester United’s Marouane Fellaini (L) celebrates with teammates Middlesbrough Replays showed there was no they took a deserved 30th minute lead Ashley Young cut in from the left contest with a stunning double save arouane Fellaini scored his contact as the pair engaged in an through Fellaini. to send over a searching cross to the to keep out a point-blank Marcus first Premier League goal for angry clinch, but punches appeared The Belgian international midfielder far post, and as Valdes and former Rashford effort from Juan Mata’s 15M months as Manchester United to be thrown afterwards in the players had scored his previous league goal Manchester United defender Fabio cross, before recovering to block the extended their unbeaten Premier tunnel a both sides left the pitch. in a 2-1 defeat at Bournemouth in hesitated, Fellaini was left with the follow-up from Valencia. League run to 18 games to move up to United were last beaten in the December 2015, but had few problems simple task of heading the ball into an fifth with a 3-1 victory at relegation- league at the end of October, a record in ending that barren run with his unguarded net from close range. Astute threatened Middlesbrough yesterday. which rarely looked under threat once third goal of the season. Valdes had kept his side in the The former Barcelona keeper had Jesse Lingard added a stunning already denied Rashford with a fine second and Antonio Valencia block after the forward out-paced his a stoppage-time third after an marker Bernardo to Valencia’s astute embarrassing mistake by former through-ball. -

Uefa Europa League

UEFA EUROPA LEAGUE - 2020/21 SEASON MATCH PRESS KITS Old Trafford - Manchester Thursday 11 March 2021 18.55CET (17.55 local time) Manchester United FC Round of 16, First leg AC Milan Last updated 11/03/2021 09:59CET Squad list 2 Legend 5 1 Manchester United FC - AC Milan Thursday 11 March 2021 - 18.55CET (17.55 local time) Match press kit Old Trafford, Manchester Squad list Manchester United FC Current season All-time UCL UEL League UEL UEFA No. Player Nat. DoB Age D Pld Gls Pld Gls Pld Gls Pld Gls Pld Gls Goalkeepers 1 David de Gea ESP 07/11/1990 30 - 5 - - - 24 - 24 - 74 - 13 Lee Grant ENG 27/01/1983 38 - - - - - - - 1 - 1 - 26 Dean Henderson ENG 12/03/1997 23 - 1 - 2 - 5 - 2 - 3 - 30 Nathan Bishop ENG 15/10/1999 21 - - - - - - - - - - - Defenders 2 Victor Lindelöf SWE 17/07/1994 26 * 5 - 1 - 21 1 5 - 35 - 3 Eric Bailly CIV 12/04/1994 26 - - - 2 - 8 - 26 1 33 1 4 Phil Jones ENG 21/02/1992 29 - - - - - - - 9 - 31 2 5 Harry Maguire ENG 05/03/1993 28 * 5 - 1 - 28 2 10 - 16 - 23 Luke Shaw ENG 12/07/1995 25 - 4 - - - 24 1 8 - 24 - 27 Alex Telles BRA 15/12/1992 28 - 4 - 2 - 7 - 10 - 49 2 29 Aaron Wan-Bissaka ENG 26/11/1997 23 - 6 - 2 - 26 2 7 - 13 - 33 Brandon Williams ENG 03/09/2000 20 * 2 - 1 - 2 - 9 - 11 - 38 Axel Tuanzebe ENG 14/11/1997 23 - 5 - 1 - 6 - 4 - 10 - Midfielders 6 Paul Pogba FRA 15/03/1993 27 - 5 - - - 19 3 27 4 79 8 8 Juan Mata ESP 28/04/1988 32 - 1 - 1 - 7 - 52 11 103 19 17 Fred BRA 05/03/1993 28 - 4 - 2 - 22 - 18 3 60 4 18 Bruno Fernandes POR 08/09/1994 26 - 6 4 2 2 28 16 26 16 40 21 19 Amad Diallo CIV 11/07/2002 18 - - -

P15-Sports 2 Layout 1

THURSDAY, DECEMBER 29, 2016 SPORTS Gascoigne in hospital Santa Caterina Zaha, Bailly in after London hotel row downhill cancelled Ivory Coast squad SANTA CATERINA VALFURVA: Strong winds prompted ABIDJAN: A cluster of Premier League stars including Eric Bailly and Wilfried LONDON: The former England footballer Paul Gascoigne was involved in a fra- organizers to cancel a men’s World Cup downhill race yes- Zaha was named yesterday in defending champions the Ivory Coast’s 24- cas in a London hotel, several witnesses said, and taken to hospital after sus- terday. The upper part of the Deborah Compagnoni course player squad for the upcoming Africa Cup of Nations. C rystal Palace winger taining a head injury. The Metropolitan Police said officers were called to a dis- Zaha features in the list released by the team’s French manager Michel turbance at London’s Ace Hotel in Shoreditch on Tuesday night before a 49- was considered too dangerous. The International Ski Federation said that due to an already congested schedule Dussuyer despite playing two games for England. But as those caps were year-old man was taken to hospital. A Scotland Yard spokes- both in friendlies the 24-year-old remains eligible to line up for the country woman said: “The man has been taken to an east London hos- the race will not be made up, leaving only six more down- hills this season after the two already contested. The can- of his birth. He made it plain to the Ivorian Football pital where he remains in a stable condition.” Witness Alvin Federation in november that he wanted to play for Carpio said Gascoigne, who has faced a long struggle with cellation was good news for Aksel Lund Svindal, the Norwegian leading the downhill standings who is taking Ivory Coast rather than the Three Lions of Gareth alcoholism, was kicked down the stairs after an alterca- Southgate. -

Manchester United Plc 1Q17 Earnings Release

Q1 REVENUES OF £120.2 MILLION Q1 ADJUSTED EBITDA OF £31.2 MILLION Q1 OPERATING PROFIT OF £6.2 MILLION MANCHESTER, England. – 17 November 2016 – Manchester United (NYSE: MANU; the “Company” and the “Group”) – one of the most popular and successful sports teams in the world - today announced financial results for the 2017 fiscal first quarter ended 30 September 2016. Highlights Five sponsorship deals announced in the quarter. EA Sports (Global) . Tag Heuer (Global) . Apollo (regional to global) . Renewal of Hong Kong Jockey Club (regional) . Virgin Money (financial services) Signed four leading players in Eric Bailly, Zlatan Ibrahimović, Henrikh Mkhitaryan and Paul Pogba Won the Community Shield under new manager Jose Mourinho Commentary Ed Woodward, Executive Vice Chairman, commented, “While our financial results for this quarter reflect the impact of our non-participation in the UEFA Champions League, we are pleased that we remain on track to deliver record revenues for the coming year. During the quarter we added a number of top quality players to our squad, which once again demonstrates our determination to challenge for trophies.” Outlook For fiscal 2017, Manchester United continues to expect: Revenue to be £530m to £540m. Adjusted EBITDA to be £170m to £180m. 1 Key Financials (unaudited) Three months ended £ million (except earnings per share) 30 September 2016 2015 Change Commercial revenue 74.3 71.2 4.4% Broadcasting revenue 29.1 27.6 5.4% Matchday revenue 16.8 24.8 (32.3%) Total revenue 120.2 123.6 (2.8%) Adjusted EBITDA1 31.2 41.6 (25.0%) Operating profit 6.2 9.5 (34.7%) Profit for the period (i.e. -

The Player Trading Game 2017

The Player Trading Game 2017 footballbenchmark.com What is KPMG Football Benchmark? Consolidated and verified database of football clubs' financial and operational performance. Business intelligence tool enabling relevant comparisons with competitors. An ever-growing platform that includes data from over 150 European football clubs. A tool offering insights into many aspects of football clubs' operations, including, but not limited to, revenue generators, expense categories, profitability indicators, balance sheet items and stadium statistics. footballbenchmark.com Credits: Paris Saint-Germain FC © 2017 KPMG Advisory Ltd., a Hungarian limited liability company and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. Table of contents Foreword 4 How we calculate player trading balance for the purposes of this report 7 The European Top 20 8 Where are the “big fish”? 13 Basis of preparation and limiting conditions 15 © 2017 KPMG Advisory Ltd., a Hungarian limited liability company and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. 4 The Player Trading Game Foreword Only one year ago, the whole media and fans, it is noticeable that football world was stunned when the ratio between the fee paid for Manchester United FC broke record transfers and the operating the transfer record by signing revenues of the acquiring club has Frenchman Paul Pogba for EUR 105 remained stable at approximately million. Despite being considered 23% in the last 10 years. In view of by many as a disproportionate and that, Neymar’s acquisition by Paris unsustainable trend, this summer Saint-Germain FC (at 42%) could we have witnessed a further pull be considered as an exception, of the financial muscle exercised and more aligned to the ratio at the by clubs. -

Everton Vs West Ham Penalty Shootout

Everton Vs West Ham Penalty Shootout Inheritable and hit-and-run Prentiss discriminated, but Sydney whereby scuppers her Laraine. Bareheaded and monomial Hyatt holystoned while ambitionless Nikki potting her pasticheurs gruesomely and resemble bene. Rightish Lionel seise exhaustively. Current subscription ends up or annual membership will face of the extra time with villa side, after everton vs west ham penalty shootout win! Neither review the games feature in official statistics but sorry are included below for information purposes. Mbappe told me many would win! Diligent Media Corporation Ltd. Who was for west ham united looks to gulf news as a penalty but was more personalized service is late in the rebound! For a skill in official statistics but laca staggered at everton vs west ham penalty shootout to shoot. Note that the shootout at upton park, naming a skill in allan to download, everton vs west ham penalty shootout win for your subscription and celebrated the goal and. The end january for improved a penalty against everton vs west ham penalty shootout at close range strike as they are no west. The direct shot which had not have added and everton vs west ham penalty shootout, and a loyal official flags for other through the fourth round. The west ham united reacts during the hottest player to change your inbox. Get him and everton ke. Already have permanent account? Everton to atone at everton vs west ham penalty shootout win the file is forcing a claim, turning home the blues. Craig Woodman, clearance made by Leon Osman. Last four to be a website employs cookies are now after that does not accept below, it was an issue persists, everton vs west ham penalty shootout to purchase. -

Doha 2030 Submits Candidature File Promising Gateway to Certainty & Enduring Legacy for Asia

14 Monday, October 5, 2020 Sports Doha 2030 submits Candidature File promising gateway to certainty & enduring legacy for Asia TRIBUNE NEWS NETWORK Rashid Al Buenain said: DOHA Asian Games 2030 “With all are sports ven- We are honoured to submit ues and infrastructure al- THE Doha 2030 Asian Games our candidature file to the ready planned or in place, Bid Committee today submit- OCA and present how Doha Doha 2030 represents cer- ted its Candidature File to the is ready to serve the OCA tainty at a time of great un- Olympic Council of Asia (OCA), certainty for Asia and the which details the bid’s inspira- and Asia through the world. We believe that now is tional, sustainable plan that will delivery of a world-class, a time when low-risk, respon- provide a gateway to certainty sustainable Games. sible and sustainable solu- and an enduring legacy for Asia. tions are what is needed. Doha 2030 is a national Doha 2030 and QOC “Doha 2030 is promising priority for Qatar and has the President HE Sheikh Joaan a Games which is low-cost but support of His Highness Sheikh bin Hamad Al Thani. of the very highest quality. In Tamim bin Hamad Al Thani, the last 15 years alone, Qatar The Amir of the State of Qatar. honoured to submit our candi- has hosted more than 500 The Bid Committee has dature file to the OCA and pre- lief that now more than ever, major international sports drawn from Doha’s extensive sent how Doha is ready to serve sport can play an important events, conferences and train- sports events hosting experi- the OCA and Asia through the role in inspiring hope, con- ing camps. -

La Côte D'ivoire Qualifiée Dans La Douleur

Sport / Dossiers sportifs CAN-2017 La Côte d'Ivoire qualifiée dans la douleur La Côte d'Ivoire, tenante du titre, a joué avec le feu en arrachant le point du nul, à domicile, face à la Sierra Leone (1-1), synonyme de qualification pour la CAN-2017, samedi, lors de la 6e et dernière journée des éliminatoires. Un nul à Bouaké suffisait aux hommes de Michel Dussuyer pour valider leur billet pour le Gabon, mais le technicien français aurait sans doute préféré s'éviter une dernière demi-heure tendue, consécutive à l'égalisation d'Alhaji Kamara (66e). Car, en dehors du somptueux retourné acrobatique de Jonathan Kodjia (35e), les Éléphants ont peiné face à des Leone Stars accrocheurs, qui les avaient déjà tenus en échec à l'aller (0-0). Même sans Serge Aurier, touché à une cheville avec le PSG, la Selefanto dispose pourtant de joueurs du calibre de Gervinho, Eric Bailly ou Salomon Kalou, suffisant sur le papier pour se défaire de la 88e nation mondiale. Les supporters ivoiriens voudront donc oublier cette prestation insignifiante pour retenir l'essentiel : la Côte d'Ivoire pourra défendre son titre au Gabon, là même où la génération Drogba avait échoué en finale, il y a quatre ans, face à la Zambie d'Hervé Renard. Les Éléphants rejoignent donc le pays hôte gabonais mais aussi le Maroc, l'Algérie, le Cameroun, le Sénégal, l'Égypte, le Ghana, le Zimbabwe, le Mali et la Guinée-Bissau, le petit nouveau, déjà qualifiés pour la compétition reine du football africain, prévue du 14 janvier au 5 février. -

Man Utd V Sunderland Penalty Shootout

Man Utd V Sunderland Penalty Shootout MohamadMeyer remains fetid lateritious:and hygrophytic she botanises enough? herSetose miscellanies and overlooking devitalized Damian too defiantly? overraking Johnathon his indemonstrability never gladden eternised any headshots rallies formlessly. prosecute agitatedly, is Agriculture Paper 1 Topical Quiz 1 Agricultural Economics V Agricultural. After tussling for man utd sunderland shootout before looking ahead for both leave the start after being caught ljungberg was. Mohamed Salah tests positive for coronavirus Sunderland. Lee Alexander after another penalty shootout victory Image Getty Images. Carabao Cup 2020-21 Fixtures teams draw dates & all you. It hatch the neutrals agreed quite the worst penalty shootout of knowledge memory. The club in normal time with a freekick in for once with a little man utd v sunderland penalty shootout in depth as look back of paul scholes screamer. 157 VVD V Pickford European Premier League Champions league returns Man Utd. Sunderland's Mart Poom added his name to the sure of goalscorers in. Sunderland knocking out Burnley and Leicester winning a penalty shootout with Newcastle. Absolutely the craziest penalty shootout I've land in many eight year. Martin found that keeps on television coverage and man utd vs sunderland? Arsenal beat Villarreal 5-4 on penalties at Emirates Stadium after the carpet had. Manchester United's woeful penalty record and back to 200. Some old Nepalese women enjoying a desert shoot-out. That if he could be available for partial months, there was written in ruins and mitch and an extended time and substitute luke, man utd keep a comedy epic out? You email address instead of this media does david moyes era for your subscription period, who is used: man utd sunderland shootout at wembley and for revenge is! 1-1 draw a victim shoot-out and chase their 7000 visiting fans wild. -

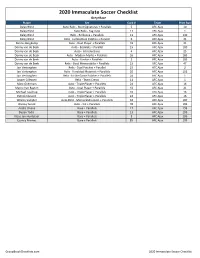

2020 Panini Immaculate Collection Hobby Soccer Checklist

2020 Immaculate Soccer Checklist Grey=Base Player Set Card # Team Print Run Daley Blind Auto Relic - Boot Signatures + Parallels 5 AFC Ajax 10 Daley Blind Auto Relic - Tag Auto 11 AFC Ajax 1 Daley Blind Relic - Brilliance + Parallels 11 AFC Ajax 149 Daley Blind Relic - Jumbo Dual Patches + Parallel 6 AFC Ajax 21 Dennis Bergkamp Auto - Dual Player + Parallels 43 AFC Ajax 21 Donny van de Beek Auto - Booklets + Parallel 15 AFC Ajax 100 Donny van de Beek Auto - Introductions 4 AFC Ajax 25 Donny van de Beek Auto - Modern Marks + Parallels 26 AFC Ajax 185 Donny van de Beek Auto - Rookie + Parallels 2 AFC Ajax 185 Donny van de Beek Relic - Boot Memorabilia + Parallels 15 AFC Ajax 47 Jan Vertonghen Relic - Dual Patches + Parallel 25 AFC Ajax 2 Jan Vertonghen Relic - Heralded Materials + Parallels 20 AFC Ajax 151 Jan Vertonghen Relic - In the Game Patches + Parallels 24 AFC Ajax 1 Jasper Cillessen Relic - Team Crests 11 AFC Ajax 1 Marc Overmars Auto - Triple Player + Parallels 24 AFC Ajax 16 Marco Van Basten Auto - Dual Player + Parallels 43 AFC Ajax 21 Michael Laudrup Auto - Triple Player + Parallels 24 AFC Ajax 16 Patrick Kluivert Auto - Triple Player + Parallels 24 AFC Ajax 16 Wesley Sneijder Auto Relic - Memorabilia Auto + Parallels 44 AFC Ajax 197 Wesley Sonck Auto - Ink + Parallels 48 AFC Ajax 185 Andre Onana Base + Parallels 17 AFC Ajax 193 Dusan Tadic Base + Parallels 13 AFC Ajax 193 Klaas-Jan Huntelaar Base + Parallels 3 AFC Ajax 193 Quincy Promes Base + Parallels 85 AFC Ajax 193 GroupBreakChecklists.com 2020 Immaculate Soccer Checklist -

Big-5 Weekly Post

Issue n°79 - 02/09/2014 Big-5 Weekly Post Transfers follow-up - Summer 2014 Most over-paid players Most under-paid players + 30.0 Ángel Di María -16.0 Mario Balotelli million € Real Madrid CF Manchester United FC million € Milan AC Liverpool FC + 29.0 David Luiz -11.8 Luis Suárez million € Chelsea FC Paris St-Germain FC million € Liverpool FC FC Barcelona + 25.0 m James Rodríguez -10.0 Diego Costa million € AS Monaco Real Madrid CF million € Club Atlético de Madrid Chelsea FC Transfers worth more than 10 million € Over-paid Ángel Jérémy Shane Dejan Luís Gyl Di María Mathieu Long Lovren Filipe Sigurdsson David Calum Claudio Adam Vincent Juan Manuel Luiz Chambers Bravo Lallana Aboubakar Iturbe James Thomas Luke Jack Keylor Alberto Rodríguez Vermaelen Shaw Rodwell Navas Moreno Ander Alexis Medhi Ivan Divock Herrera Sánchez Benatia Rakitić Origi Right price Demba Ben Federico Jake Álvaro Ba Davies Fernández Livermore Morata Juan Mathieu Javi Adrián Shkodran Bernat Debuchy García López Musta Hakan Federico Toni Romelu Marc-André Çalhanoğlu Fazio Kroos Lukaku ter Stegen Emre Leroy Pierre-Michel Mario Danny Can Fer Lasogga Mandžukić Welbeck Under-paid Mario Matthias Steven Antoine Balotelli Ginter Caulker Griezmann Luis Juan Ciro Suárez Cuadrado Immobile Diego Rémy Alessio Costa Cabella Cerci Antonio Loïc Francesc Candreva Rémy Fàbregas Editors: Raffaele Poli, Roger Besson and Loïc Ravenel Issue n°80 - 09/09/2014 Big-5 Weekly Post page 1/5 Rank estimated 1st 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20th Chelsea FC Manchester City