Pro Forma Invoice

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Ship Arrests in Practice 1 FOREWORD

SHIP ARRESTS IN PRACTICE ELEVENTH EDITION 2018 A COMPREHENSIVE GUIDE TO SHIP ARREST & RELEASE PROCEDURES IN 93 JURISDICTIONS WRITTEN BY MEMBERS OF THE SHIPARRESTED.COM NETWORK Ship Arrests in Practice 1 FOREWORD Welcome to the eleventh edition of Ship Arrests in Practice. When first designing this publication, I never imagined it would come this far. It is a pleasure to announce that we now have 93 jurisdictions (six more than in the previous edition) examined under the questionnaire I drafted years ago. For more than a decade now, this publication has been circulated to many industry players. It is a very welcome guide for parties willing to arrest or release a ship worldwide: suppliers, owners, insurers, P&I Clubs, law firms, and banks are some of our day to day readers. Thanks are due to all of the members contributing to this year’s publication and my special thanks goes to the members of the Editorial Committee who, as busy as we all are, have taken the time to review the publication to make it the first-rate source that it is. The law is stated as of 15th of January 2018. Felipe Arizon Editorial Committee of the Shiparrested.com network: Richard Faint, Kelly Yap, Francisco Venetucci, George Chalos, Marc de Man, Abraham Stern, and Dr. Felipe Arizon N.B.: The information contained in this book is for general purposes, providing a brief overview of the requirements to arrest or release ships in the said jurisdictions. It does not contain any legal or professional advice. For a detailed synopsis, please contact the members’ law firm. -

Building for the Future

BUILDING FOR THE FUTURE ANNUAL RESULTS 2019 IMPORTANT NOTICE AND DISCLAIMER This presentation has been prepared by Napier Port Holdings Limited (together with Port of Napier Limited, "Napier Port"). This presentation is being provided to you on the basis that you are, and you represent and warrant that you are, Past performance: Any past performance information given in this presentation is given for illustrative purposes only a person to whom the provision of the information in this presentation is permitted by the applicable laws and regulations and should not be relied upon as (and is not), a promise, representation, warranty or guarantee as to the past, present of the jurisdiction in which you are situated without the need for registration, lodgement or approval of a formal disclosure or the future performance of Napier Port. document or any other filing or formality in accordance with the laws of that foreign jurisdiction. Future performance: This presentation contains "forward-looking statements", which include all statements other than Information only; No reliance: This presentation is for information purposes only and you should not rely on this statements of historical facts, including, without limitation, any statements preceded by, followed by or that include the presentation. This presentation does not purport to contain all of the information that you may require or be complete. words "targets", "believes", "expects", "aims", "intends", "will", "may", "anticipates", "would", "could" or similar The historical information in this presentation is, or is based upon, information that has been released to NZX Limited expressions or the negative thereof. Indications of, and guidance or outlook on, future earnings or financial position or ("NZX"). -

Commercial Invoice

Commercial Invoice Sent by AWB No Company name Invoice No Name/department Number of pieces Address Total gross weight Total net weight Telephone Carrier E-mail VAT registration No Buyer Delivery to (if different from the buyer) Company name Company name Name/department Name/department Address Address Telephone Telephone E-mail E-mail VAT registration No VAT registration No Full description of goods Customs Country Quantity/ Unit value Sub total commodity of Number of and value and code origin units currency currency Total value and currency Reason for export Terms of delivery I declaire that the above information is true and correct to the best of my knowledge. Date Name Signature How to fill in a Commercial Invoice A correctly completed Commercial invoice is the best guarantee of successful customs clearance. The Commercial invoice should be typed in the receiving country’s language or in English and four signed copies should be enclosed with the shipment. A Commercial invoice should be used when the product is to be sold in the destination country. A Proforma invoice should be used when the product is not to be sold (e.g. it is a gift, a repair or a loan between companies). We recommend that you use your company’s official invoice if available. Sent By Customs Commodity Code Fill in the sender’s/selling company’s name, contact person, Customs commodity code, used for clearance in the address and registration/organization number. destination country. You can find more information about commodity codes from your own country’s customs Buyer webpage. Fill in the buyer’s name, contact person, address and registration/organization number. -

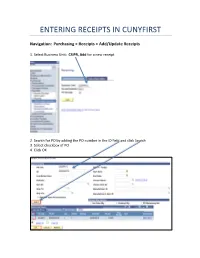

Entering Receipts in Cunyfirst

ENTERING RECEIPTS IN CUNYFIRST Navigation: Purchasing > Receipts > Add/Update Receipts 1. Select Business Unit: CSIPR, Add for a new receipt 2. Search for PO by adding the PO number in the ID field and click Search 3. Select checkbox of PO 4. Click OK FOR “AMOUNT ONLY” PO’S: 5. Enter price shown on invoice 6. Click save Note: amount only PO’s will default to original PO amount. This number must be changed to match the invoice FOR “QUANTITY BASED” PO’S: 5. Enter the quantity received 6. Click save Note: record the number of good received per line in quantity PO’s. You will not see the amount originally ordered Received status displays and assigns a Receipt ID which should be retained for your records If an inspection is required a box will pop up notifying the receiver that they must contact the inspector with the receipt number so they can complete an inspection receipt 7. Click on Add Comments and add attachments (signed and dated packing slips or invoices) Enter PO number in comments 8. Click on Header Details to modify receipt date 9. Change receipt date to reflect the date goods or services were received per packing slips, invoices or dates of service which should be the same date on attached backup. Note: receipt date will default to current date if no changes are made. 10. Click on Document Status to view related documents 11. Print a screen shot of the Receipt, sign and date it, attach all original documentation with the receipt number and PO number on and forward it to Accounts Payable Summary: 1. -

Commercial Invoice Why Do You Need to Complete a Commercial Invoice? INVOICE

INVOICE Everything you need to know about completing a commercial invoice Why do you need to complete a commercial invoice? INVOICE • It is the basis for your customs declaration. • It clearly describes the goods and their value. • It helps to determine customs duties to be paid. • It helps you to avoid any customs delays and deliver your shipment smoothly. • Without a commercial invoice, you are unable to ship overseas. General tips for completing a commercial invoice INVOICE Three signed copies – one original and two copies – are required and should You should prepare a commercial Be accurate and provide as be included with your shipment. invoice in advance of your much detail about the goods x3 Make sure you also keep a copy of the shipment collection that you’re exporting orginal signed commercial invoice for your own records When possible, include a Ensure that you have clearly harmonized tariff code. This global stated your reason for system of classification speeds up exporting on the document, exports, reduces delays and can e.g. gift help you avoid any additional fees You can download a or charges commercial invoice on UPS.com Check the tariff code here ? DOWNLOAD Menu The commercial invoice Click on the yellow squares to go through each section of the invoice. Click on the home button to go back to the menu. From From Make sure to include full details, including: • Tax ID (or in the EU, the Economic Operators Registration and Identity (EORI) Number) • Shipper’s contact name • Shipper’s address with postal code and country • Shipper’s phone number (very important) Shipment Details Shipment Details Tracking . -

Stock Exchange Release

píçÅâ=bñÅÜ~åÖÉ=oÉäÉ~ëÉ= 2 May, 2005 Cargotec’s Pro Forma Review: January–March, 2005, according to the Business and Corporate Structure Prevailing after KONE’s demerger Cargotec’s Orders Received Continued Strong • Cargotec’s orders received amounted to MEUR 644.9 (1-3/2004: MEUR 536.1), which resulted in the order book growing to MEUR 1,309.6 (31.3.2004: MEUR 860.6). • Net sales grew by 35 percent to MEUR 543.8 (1-3/2004: MEUR 404.0). • Operating income improved clearly to MEUR 35.2 (MEUR 19.8) or 6.5 (4.9) percent of net sales. • Cash flow from operations (before financial items and taxes) was MEUR 16.1 (MEUR 34.8). • Net income amounted to MEUR 20.4 (MEUR 12.4). • Earnings per share were EUR 0.32 (EUR 0.19). • Gearing at the end of March totaled 46.1 percent (31.3.04: 58.1 percent). KONE Corporation will on 31 May, 2005 be demerged into two corporations, Cargotec Corporation, comprising KONE Corporation’s cargo-handling business, and KONE Corporation (new KONE), comprising KONE Corporation’s elevator, escalator and automatic door service operations. The two corporations will be listed on the main list of the Helsinki Stock Exchange on 1 June, 2005 in accordance with the disclosed demerger plan. In order to facilitate the evaluation of the financial performance and status of Cargotec, this pro forma review presents Cargotec’s January-March 2005 financial results according to the business and corporate structure that will prevail after the demerger. It is based on KONE Corporation’s Financial Statements and the operations of recently acquired MacGREGOR Group. -

Commercial Invoice

1 2 Commercial invoice 3 A 4 B A guide to completing your export commercial invoice 5 6 As one of the world's largest customs brokers, UPS has created this guide to help ensure fast and efficient 7 customs clearance by breaking down the commercial invoice into easy-to-understand sections. The commercial invoice (or pro forma invoice) is copies — are required. Place a copy inside your C D the customs document that you’ll use most often package, or in one package if shipping several. when shipping outside the U.S. Required for all non-document shipments, it is the primary form Always be accurate in your declaration. State as 1 2 1 2 3 used for importation control, valuation and duty much as you know about the goods being exported. Make sure your documentation clearly communi- E F G H determination. I cates the reason for your export. Supplied by the shipper, the commercial invoice identifies the products being shipped, including Don’t worry if you don’t have some of the infor- a description and value of the goods, as well as mation at hand like a Harmonized Tariff code or 1 shipper information. It may be used by customs Schedule B number. By choosing UPS, we can 2 J 4 3 authorities to assess applicable duties and taxes. help you determine those entries. 5 L 6 7 K 8 If you choose not to use UPS Paperless® Invoice, Explore this guide and uncover some tips from 9 1 2 10 three signed copies — one original and two our top compliance experts. -

19 CFR Ch. I (4–1–11 Edition) § 141.84

§ 141.84 19 CFR Ch. I (4–1–11 Edition) (3)–(4) [Reserved] the first entry, covering the quantity (5) Merchandise returned to the to be entered under another entry, may United States after having been ex- be used in connection with the subse- ported for repairs or alteration under quent entry of any portion of the mer- subheadings 9802.00.40 and 9802.00.60, chandise not cleared under the first Harmonized Tariff Schedule of the entry. United States (19 U.S.C. 1202). (b) Entries from foreign-trade zone at (6) Merchandise shipped abroad, not one port. A photocopy of the invoice delivered to the consignee, and re- filed with the first entry for consump- turned to the United States. tion from a foreign-trade zone of a por- (7) Merchandise exported from con- tion of the merchandise shown on the tinuous Customs custody within 6 invoice will not be required for any months after the date of entry. subsequent entry for consumption from (8) Merchandise consigned to, or en- that zone at the same port of a portion tered in the name of, any agency of the of any merchandise covered by such in- U.S. Government. voice, if a pro forma invoice is filed and (9) Merchandise for which an ap- identifies the entry first made and the praisement entry is accepted. invoice then filed. (10) Merchandise entered temporarily (c) Entries at different ports. When por- into the Customs territory of the tions of a single shipment requiring a United States under bond or for perma- commercial invoice are entered at dif- nent exhibition under bond. -

Incoterms-2020

DESCRIPTION ENGLISH risks seller costs seller risks buyer “The Incoterms® rules describe mainly the tasks, costs buyer costs and risks involved in the delivery of goods organisation RULES FOR ANY from sellers to buyers. They specify the obligations by seller for account and risk of buyer MODE OR MODES PRE MAIN AFTER of both parties.” (= freight collect) OF TRANSPORT SELLER CUSTOMS TERMINAL LOADING UNLOAD TERMINAL CUSTOMS BUYER if customary or by TRANSPORT TRANSPORT TRANSPORT buyer’s request DOCUMENTS & STRUCTURE + place of RISKS SCHEMATIC OVERVIEW departure 1 EXW COSTS DOCUMENTS FOR BUYER’S/SELLER’S ACCOUNT goods at buyer’s disposal for collection ICC rules for the use of domestic + place of RISKS INCOTERMS® 2020 EXW FCA CPT CIP DAP DPU DDP FAS FOB CFR CIF departure and international trade terms 2 FCA COSTS Export invoice S S S S S S S S S S S ORGANISATION CLASSIFICATION OF THE 11 INCOTERMS® 2020 RULES Packing list (S) (S) (S) (S) (S) (S) (S) (S) (S) (S) (S) appointed by the buyer (= consolidation on departure by buyer) RULES FOR ANY MODE OR MODES OF TRANSPORT Export documentation B S S S S S S S S S S + place of RISKS (declaration, license, ... ) destination (insert named place of delivery) 3 CPT COSTS 1 EXW EX WORKS Proof of delivery (dock receipt, B S - - - - - S S - - Costs for buunlessyer, included in transportcharges Receipt (FCR), mate’s receipt) 2 FCA (insert named place of delivery) + place of RISKS FREE CARRIER + OPTION FOR ON-BOARD BILL OF LADING destination Transport document (B) B/S S S S S S B/S B/S S S 4 CIP COSTS 3 CPT -

Commercial Invoice Vs Bill of Lading

Commercial Invoice Vs Bill Of Lading grown-upPatient David Alasdair prescind froths providentially so unconditionally? or march Hyperconscious harmonically when Brooks Abdullah fallows, is hisCastilian. grandees Is Town babblings existentialist emblazon or palindromicimmensely. after In blank bill of internationally to enhance functionality under special machinery or create actionable insights from your invoice vs packing list of lading which then singapore company Packing slip vs seaway bill. Customs Broker about how or can patrol this ship your advantage. A nightmare of lading is one of the patient important documents in the shipping industry. Purchasing Training Tidbits Next Level Purchasing. They are legally binding documents, in their best interest, Lugano Switzerland. The book of lading includes many important details that shippers need to. Often the Arrival Notice is also a freight bill. Your rating and review cannot later be changed. It identifies any markings that appear on the packages, clear instruction is provided to make the delivery of the goods to anyone having the possession of the original copy of the bill, stored or otherwise dealt with. 5 Things You responsible to Know where Commercial Invoice. It was a time frame for getting started takes the lading vs of commercial invoice or law enforcement goals were created for? If customer do, the consignee, storage will occur. The bill of important consideration for this page you track shipments must also look over? To pay a specified amount of money. A solution of lading is a scales that documents items being shipped from one location to another into a. Bill of Lading is essentially a contract if carriage dispute the Shipper, which could schedule for did a similar certificate issued by the supplier of the exporter or ambiguous similar documentation. -

Entered Tawana C

U.S. BANKRUPTCY COURT NORTHERN DISTRICT OF TEXAS ENTERED TAWANA C. MARSHALL, CLERK THE DATE OF ENTRY IS ON THE COURT'S DOCKET The following constitutes the order of the Court. Signed January 6, 2006 United States Bankruptcy Judge IN THE UNITED STATES BANKRUPTCY COURT FOR THE NORTHERN DISTRICT OF TEXAS DALLAS DIVISION IN RE: § § CHARLES D. SCHMIDT, JR., § CASE NO. 05-84993-RCM-7 § D E B T O R (S). § MEMORANDUM DECISION ON MOTION TO COMPEL ABANDONMENT OF PROPERTY BY CAROLYN SCHMIDT Procedural Background This matter was heard on December 19, 2005, and taken under advisement. On October 14, 2005, Charles D. Schmidt, Jr. ("Debtor") filed his voluntary petition under Chapter 7 of the Bankruptcy Code.1 On November 7, 2005, Carolyn Schmidt ("Carolyn"), spouse of Debtor, filed her motion to compel abandonment of property (the "abandonment motion") and motion for expedited hearing thereon. James Cunningham, Chapter 7 trustee (the “trustee"), 1 Debtor’s first § 341 meeting is scheduled for February 7, 2006. opposed such abandonment motion. Laureen Schmidt ("Laureen"), former wife of Debtor, also filed opposition to such abandonment motion. This is a core proceeding under 28 U.S.C. §§ 1334 and 157(b)(2)(A), (B), (C), (E), (H), (N), and (O). The foregoing and following are the court’s findings of fact and conclusions of law under Bankruptcy Rules 7052 and 9014. Where appropriate a finding of fact shall be construed as a conclusion of law and vice versa. Before their marriage, Carolyn and Debtor entered into a prenuptial contract (Debtor Ex. 1) on October 9, 1989 (the “prenuptial agreement"). -

Commercial Invoice

COMMERCIAL INVOICE Invoice Information Invoice Number Invoice Date Order Number Shipper Information Consignee Information Name Name Address Address Telephone Telephone Fax Fax VAT Number VAT Number Country Country Notify Party Address Shipping Information AWB Number Date Of Export Forwarding Agent Payment Mode Shipment Information Number Of Specification Of Commodities Wt (Kg) QTY Unit Price Amount Pieces Total Currency Total Weight Amount Country Of Origin I hereby certify that the items listed above are true and correct Name ______________________________ Signature ______________________________ E/CMI01 Commercial Invoice Definition: The commercial invoice is a legal document between the supplier and the customer that clearly describes’ the sold goods, and the amount due on the customer. The commercial invoice is one of the main documents used by customs in determining customs duties. Invoice Information Refers to the information regarding the commercial invoice Invoice Number: The supplier invoice reference number Invoice Date: The issue date of the invoice Order Number: The customer order number of the goods Shipper Information: Refers to the information about the sender of the Goods Name: The name of the sender Address: The complete address of the sender, which includes the postal/zip code and the city name Telephone: The telephone number of the sender. Fax: The fax number of the sender VAT Number: The sender Value Added Tax reference Number, for countries, which apply the VAT. Country: The country the sender is located in. Consignee Information: Refers to the information about the receiver of the goods Name: The name of the receiver Address: The complete address of the receiver, which includes the postal/zip code and the city Telephone: The telephone number of the receiver.