Tampines Mall

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Capitaland Corporate Presentation Template 2019 W Dividers

CAPITALAND MALL TRUST Third Quarter 2019 Financial Results 21 October 2019 Disclaimer This presentation may contain forward-looking statements that involve assumptions, risks and uncertainties. Actual future performance, outcomes and results may differ materially from those expressed in forward-looking statements as a result of a number of risks, uncertainties and assumptions. Representative examples of these factors include (without limitation) general industry and economic conditions, interest rate trends, cost of capital and capital availability, competition from other developments or companies, shifts in expected levels of occupancy rate, property rental income, charge out collections, changes in operating expenses (including employee wages, benefits and training costs), governmental and public policy changes and the continued availability of financing in the amounts and the terms necessary to support future business. You are cautioned not to place undue reliance on these forward-looking statements, which are based on the current view of management on future events. The information contained in this presentation has not been independently verified. No representation or warranty expressed or implied is made as to, and no reliance should be placed on, the fairness, accuracy, completeness or correctness of the information or opinions contained in this presentation. Neither CapitaLand Mall Trust Management Limited (the ‘Manager’) or any of its affiliates, advisers or representatives shall have any liability whatsoever (in negligence or otherwise) for any loss howsoever arising, whether directly or indirectly, from any use, reliance or distribution of this presentation or its contents or otherwise arising in connection with this presentation. The past performance of CapitaLand Mall Trust (‘CMT’) is not indicative of the future performance of CMT. -

Acquisition of 100% Stake in Food Junction Group of Companies

Investor Presentation Acquisition of 100% Stake in Food Junction Group of Companies 2 September 2019 Acquisition of 100% Stake in Food Junction (“FJ”) Group . Transaction Summary . Food Junction Business Overview . Appendix – List of Food Republic Food Courts in Singapore and Malaysia 1 Acquisition of 100% Stake in FJ Group TRANSACTION SUMMARY Acquisition BreadTalk Auric Pacific Structure Group Limited (“BTG”) Group Limited Singapore Singapore 100% 98.10% Topwin Investment Food Junction Holding Pte Ltd Holdings Ltd Singapore Singapore 100% Acquisition of 100% Stake Food Junction Management (“FJM”) Pte Ltd Singapore 100% 100% Food Junction T&W Food Singapore (“FJS”) Junction (“T&W”) Pte Ltd Sdn Bhd Singapore Malaysia Acquisition . Enterprise Value S$ 80 million. Terms . Funded by approximately 60% borrowings and 40% cash. 2 Acquisition of 100% Stake in FJ Group FJ BUSINESS OVERVIEW Singapore FJ operates 12 food courts and its direct operated stores across Singapore, including the newly opened Five Spice Food Court at Jewel Changi Airport. Lot One Shoppers’ Mall Junction 8 Nex Serangoon Jewel Changi Airport Food Junction Food Court LocationsList of Food Junction Food Courts 1. Bugis Junction 2. Century Square 3. Great World City 4. Harbourfront Centre 5. Junction 8 6. Lot One Shoppers’ Mall 7. Nex Serangoon 8. One Raffles Place 9. Raffles City 10. Rivervale Mall 11. United Square 12. Jewel Changi Airport Source: Google Maps, Food Junction Website 3 Acquisition of 100% Stake in FJ Group FJ BUSINESS OVERVIEW Malaysia FJ operates a total of 3 food courts and its direct operated stores in Kuala Lumpur, Malaysia. The 4th food court is scheduled to open in 2020 at The Mall, Mid Valley Southkey in Johor Bahru, Malaysia. -

Condominium with the Widest Reservoir Frontage in Sengkang Previews This Friday

PRESS RELEASE For Immediate Release Condominium with the Widest Reservoir Frontage in Sengkang Previews this Friday Offers Eight Exclusive Waterfront Landed Homes Singapore, 12 February 2014 – Joint developers Frasers Centrepoint Limited, Far East Orchard Limited, and Sekisui House, Ltd. will preview their latest private residential project, RiverTrees Residences, located in Sengkang, this Friday, 14 February 2014. Expected to be completed in 20181, RiverTrees Residences sits on a scenic site along the Sungei Punggol Reservoir, and has around 150 metres of reservoir frontage, the widest among all developments in the area. Over 90% of its units will have views of the reservoir. Designed to maximise residents’ views of the reservoir, apartment blocks in RiverTrees Residences are spread out in a crescent shape facing the reservoir, overlooking a cluster of eight strata-titled landed homes within the development, called ‘Cove Houses’. Positioned just 10 metres from the reservoir’s edge, ‘Cove Houses’ are the only waterfront landed houses in Singapore, apart from those at Sentosa Cove. Each of these duplex three-bedroom houses will have a direct view of the reservoir from the living, dining, and bedroom areas, as well as a private carpark lot. Mr Cheang Kok Kheong, Chief Executive Officer, Development and Property, Singapore, Frasers Centrepoint Limited, commented, “The beauty of RiverTrees Residences’ location is compelling. We expect great interest from prospective home buyers as it offers them an opportunity to own a home with an unblocked view of the Sungei Punggol Reservoir. It is located very close to nature yet provides excellent connectivity to the variety of amenities in the vicinity.” Strategic Location with Potential for Value Appreciation Situated at Fernvale Close, the development is within a three-minute walk from the Layar LRT Station, which is linked to the Sengkang MRT Station along the North East MRT Line. -

UC Berkeley Earlier Faculty Research

UC Berkeley Earlier Faculty Research Title The Transit-Oriented Global Centers for Competitiveness and Livability: State Strategies and Market Responses in Asia Permalink https://escholarship.org/uc/item/44g9t8mj Author Murakami, Jin Publication Date 2010 eScholarship.org Powered by the California Digital Library University of California University of California Transportation Center UCTC Dissertation No. UCTC-DISS-2010-02 The Transit-Oriented Global Centers for Competitiveness and Livability: State Strategies and Market Responses in Asia Jin Murakami University of California, Berkeley 2010 The Transit-Oriented Global Centers for Competitiveness and Livability: State Strategies and Market Responses in Asia by Jin Murakami A dissertation submitted in partial satisfaction of the requirements for the degree of Doctor of Philosophy in City and Regional Planning in the Graduate Division of the University of California, Berkeley Committee in charge: Professor Robert B. Cervero, Chair Associate Professor Karen S. Christensen Professor Harrison S. Fraker Spring 2010 The Transit-Oriented Global Centers for Competitiveness and Livability: State Strategies and Market Responses in Asia © 2010 by Jin Murakami Abstract The Transit-Oriented Global Centers for Competitiveness and Livability: State Strategies and Market Responses in Asia by Jin Murakami Doctor of Philosophy in City and Regional Planning University of California, Berkeley Professor Robert B. Cervero, Chair Over the past two decades, the spatial development patterns of city-regions have increasingly been shaped by global-scale centripetal and centrifugal market forces. Complex managerial tasks and specialized producer services agglomerate in the central locations of global city-regions, whereas standardized assemble lines, wholesale inventories, and customer services stretch over the peripheral locations of global production networks. -

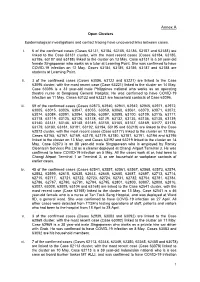

Annex a Open Clusters

Annex A Open Clusters Epidemiological investigations and contact tracing have uncovered links between cases. i. 6 of the confirmed cases (Cases 63131, 63184, 63185, 63186, 63187 and 63188) are linked to the Case 63131 cluster, with the most recent cases (Cases 63184, 63185, 63186, 63187 and 63188) linked to the cluster on 13 May. Case 63131 is a 50 year-old female Singaporean who works as a tutor at Learning Point. She was confirmed to have COVID-19 infection on 12 May. Cases 63184, 63185, 63186, 63187 and 63188 are students at Learning Point. ii. 3 of the confirmed cases (Cases 63096, 63122 and 63221) are linked to the Case 63096 cluster, with the most recent case (Case 63221) linked to the cluster on 14 May. Case 63096 is a 33 year-old male Philippines national who works as an operating theatre nurse at Sengkang General Hospital. He was confirmed to have COVID-19 infection on 11 May. Cases 63122 and 63221 are household contacts of Case 63096. iii. 59 of the confirmed cases (Cases 62873, 62940, 62941, 62942, 62945, 62971, 62972, 63005, 63015, 63026, 63047, 63055, 63059, 63060, 63061, 63070, 63071, 63072, 63074, 63084, 63091, 63094, 63095, 63097, 63098, 63100, 63109, 63115, 63117, 63118, 63119, 63125, 63126, 63128, 63129, 63132, 63135, 63136, 63138, 63139, 63140, 63141, 63146, 63148, 63149, 63150, 63165, 63167, 63169, 63177, 63178, 63179, 63180, 63181, 63191, 63192, 63194, 63195 and 63219) are linked to the Case 62873 cluster, with the most recent cases (Case 63177) linked to the cluster on 12 May, Cases 63165, 63167, 63169, 63178, 63179, 63180, 63181, 63191, 63194 and 63195 linked to the cluster on 13 May, and Cases 63192 and 63219 linked to the cluster on 14 May. -

Annual Report 2017

ANNUAL REPORT 2017 VISION SPH REIT aims to be a premier retail real CORPORATE estate investment trust in Singapore and Asia Pacific, with a portfolio of quality PROFILE income-producing retail properties. SPH REIT is a Singapore-based Real Estate Investment Trust (“REIT”) established principally to invest, directly MISSION or indirectly, in a portfolio of income-producing real estate which is used primarily for retail purposes in To be the landlord of choice for our tenants Asia-Pacific, as well as real estate related assets. and shoppers and be committed in our delivery of quality products and services. To SPH REIT was listed on the Singapore Exchange provide Unitholders of SPH REIT with regular Securities Trading Limited (“SGX-ST”) on 24 July and stable distributions, and sustainable 2013 and is sponsored by Singapore Press Holdings long-term growth in distribution per unit and Limited (“SPHL” or the “Sponsor”), Asia’s leading media organisation, with publications across multiple net asset value per unit, while maintaining languages and platforms. an appropriate capital structure. CONTENTS 02 Financial Highlights 07 Statement by Chairman and CEO 10 Year In Review 12 Trust Structure 13 Organisation Structure 14 Board of Directors 19 Management Team 21 Property Management Team 24 Operations Review 32 Financial Review 38 Unit Price Performance 40 Portfolio Overview 48 Market Overview 54 Corporate Social Responsibility 58 Investor Relations 60 Risk Management 63 Corporate Governance 81 Financial Statements 127 Statistics of Unitholdings 129 Interested Person Transactions 130 Notice of Annual General Meeting Proxy Form Corporate Directory INUNISON | INSYNC 1. As at 31 August 2017, SPH REIT comprises with a total 223,097 sq ft of medical suite/ two high quality and well located office NLA (“Paragon Medical”); and commercial properties in Singapore totalling 910,395 sq ft Net Lettable Area (“NLA”) with THE CleMentI Mall, a mid-market an aggregate appraised value of S$3.278 suburban mall located in the centre of billion. -

Financial Review

FINANCIAL REVIEW GROSS REVENUE contributed S$74.9 million and Funan (retail and office Gross revenue for Financial Year (FY) 2019 was S$786.7 components) which opened on 28 June 2019, accounted million, an increase of S$89.2 million or 12.8% from FY for S$28.5 million to the total gross revenue of CMT 2018. The increase was mainly due to the acquisition and its subsidiaries (CMT Group). The increase was of the balance 70.00% of the units in Infinity Mall Trust partially offset by lower gross revenue from Sembawang (IMT) which holds Westgate (Acquisition). Westgate Shopping Centre which was divested on 18 June 2018. Gross Revenue by Property FY 2019 FY 2018 S$ million Tampines Mall 82.9 81.4 Junction 8 61.2 60.8 Funan1 28.5 – IMM Building 86.8 85.8 Plaza Singapura 92.1 91.5 Bugis Junction 84.9 84.9 Bukit Panjang Plaza, JCube and Sembawang Shopping Centre2 50.5 58.5 Lot One Shoppers' Mall 43.2 44.1 The Atrium@Orchard 50.0 50.1 Clarke Quay 40.1 38.6 Bugis+ 33.7 33.6 Bedok Mall 57.9 57.0 Westgate3 74.9 11.2 CMT Group 786.7 697.5 1 Funan was closed for redevelopment from 1 July 2016 and re-opened on 28 June 2019. The retail component of Funan is held through the Trust and the office components are held through Victory Office 1 Trust and Victory Office 2 Trust. 2 The divestment of Sembawang Shopping Centre was completed on 18 June 2018. -

Participating Merchants

PARTICIPATING MERCHANTS PARTICIPATING POSTAL ADDRESS MERCHANTS CODE 460 ALEXANDRA ROAD, #01-17 AND #01-20 119963 53 ANG MO KIO AVENUE 3, #01-40 AMK HUB 569933 241/243 VICTORIA STREET, BUGIS VILLAGE 188030 BUKIT PANJANG PLAZA, #01-28 1 JELEBU ROAD 677743 175 BENCOOLEN STREET, #01-01 BURLINGTON SQUARE 189649 THE CENTRAL 6 EU TONG SEN STREET, #01-23 TO 26 059817 2 CHANGI BUSINESS PARK AVENUE 1, #01-05 486015 1 SENG KANG SQUARE, #B1-14/14A COMPASS ONE 545078 FAIRPRICE HUB 1 JOO KOON CIRCLE, #01-51 629117 FUCHUN COMMUNITY CLUB, #01-01 NO 1 WOODLANDS STREET 31 738581 11 BEDOK NORTH STREET 1, #01-33 469662 4 HILLVIEW RISE, #01-06 #01-07 HILLV2 667979 INCOME AT RAFFLES 16 COLLYER QUAY, #01-01/02 049318 2 JURONG EAST STREET 21, #01-51 609601 50 JURONG GATEWAY ROAD JEM, #B1-02 608549 78 AIRPORT BOULEVARD, #B2-235-236 JEWEL CHANGI AIRPORT 819666 63 JURONG WEST CENTRAL 3, #B1-54/55 JURONG POINT SHOPPING CENTRE 648331 KALLANG LEISURE PARK 5 STADIUM WALK, #01-43 397693 216 ANG MO KIO AVE 4, #01-01 569897 1 LOWER KENT RIDGE ROAD, #03-11 ONE KENT RIDGE 119082 BLK 809 FRENCH ROAD, #01-31 KITCHENER COMPLEX 200809 Burger King BLK 258 PASIR RIS STREET 21, #01-23 510258 8A MARINA BOULEVARD, #B2-03 MARINA BAY LINK MALL 018984 BLK 4 WOODLANDS STREET 12, #02-01 738623 23 SERANGOON CENTRAL NEX, #B1-30/31 556083 80 MARINE PARADE ROAD, #01-11 PARKWAY PARADE 449269 120 PASIR RIS CENTRAL, #01-11 PASIR RIS SPORTS CENTRE 519640 60 PAYA LEBAR ROAD, #01-40/41/42/43 409051 PLAZA SINGAPURA 68 ORCHARD ROAD, #B1-11 238839 33 SENGKANG WEST AVENUE, #01-09/10/11/12/13/14 THE -

Annual Reports and Related Documents:: Page 1 of 1

Annual Reports and Related Documents:: Page 1 of 1 Annual Reports and Related Documents:: Issuer & Securities Issuer/ Manager SPH REIT MANAGEMENT PTE. LTD. Securities SPH REIT - SG2G02994595 - SK6U Stapled Security No Announcement Details Announcement Title Annual Reports and Related Documents Date & Time of Broadcast 11-Nov-2015 08:30:08 Status New Report Type Annual Report Announcement Reference SG151111OTHRTN3S Submitted By (Co./ Ind. Name) Lim Wai Pun Designation Company Secretary Description (Please provide a detailed description of the event in the box below - The SPH REIT Annual Report 2015 is attached. Refer to the Online help for the format) Additional Details Period Ended 31/08/2015 Attachments SPH REIT- Annual Report 2015.pdf Total size =4235K Like 0 Tweet 0 0 http://infopub.sgx.com/Apps?A=COW_CorpAnnouncement_Content&B=Announce... 11/11/2015 PERFORMING WELL WELL-POSITIONED ANNUAL REPORT 2015 Visit us or download the Annual Report at www.sphreit.com.sg VISION SPH REIT aims to be a premier retail real estate investment trust in Singapore and Asia Pacifi c, with a portfolio of quality income-producing retail properties. MISSION To be the landlord of choice for our tenants and shoppers and be committed in our delivery of quality products and services. To provide Unitholders of SPH REIT with regular and stable distributions, and sustainable long-term growth in distribution per unit and net asset value per unit, while maintaining an appropriate capital structure. CONTENTS 02 Financial Highlights 24 Operations Review 65 Corporate -

![THE HUMBLE BEGINNINGS of the INQUIRER LIFESTYLE SERIES: FITNESS FASHION with SAMSUNG July 9, 2014 FASHION SHOW]](https://docslib.b-cdn.net/cover/7828/the-humble-beginnings-of-the-inquirer-lifestyle-series-fitness-fashion-with-samsung-july-9-2014-fashion-show-667828.webp)

THE HUMBLE BEGINNINGS of the INQUIRER LIFESTYLE SERIES: FITNESS FASHION with SAMSUNG July 9, 2014 FASHION SHOW]

1 The Humble Beginnings of “Inquirer Lifestyle Series: Fitness and Fashion with Samsung Show” Contents Presidents of the Republic of the Philippines ................................................................ 8 Vice-Presidents of the Republic of the Philippines ....................................................... 9 Popes .................................................................................................................................. 9 Board Members .............................................................................................................. 15 Inquirer Fitness and Fashion Board ........................................................................... 15 July 1, 2013 - present ............................................................................................... 15 Philippine Daily Inquirer Executives .......................................................................... 16 Fitness.Fashion Show Project Directors ..................................................................... 16 Metro Manila Council................................................................................................. 16 June 30, 2010 to June 30, 2016 .............................................................................. 16 June 30, 2013 to present ........................................................................................ 17 Days to Remember (January 1, AD 1 to June 30, 2013) ........................................... 17 The Philippines under Spain ...................................................................................... -

CELEBRATING 19 YEARS of ENTERTAINMENT in the EAST Golden Village Tampines Reopens After a Swanky Facelift with Unbeatable Promotions and Freebies!

FOR IMMEDIATE RELEASE CELEBRATING 19 YEARS OF ENTERTAINMENT IN THE EAST Golden Village Tampines reopens after a swanky facelift with unbeatable promotions and freebies! Singapore, 24 April 2015 – After 19 years of creating movie magic in the East, Golden Village Tampines reopens following a short hiatus on Monday, 20th April 2015. The revamped cinema now boasts a sleek new interior, an auto-gate system and automated ticketing kiosks, giving patrons a quicker, seamless cinematic experience from the very moment they step into the cinema. All eight halls in Golden Village Tampines now come equipped with the award-winning ProBax® seats. The ProBax® seat is the seat of choice for Golden Village as it ensures patrons enjoy prolonged comfort and improved posture. The patented ProBax® technology reconfigures the foam structure within the seat base to encourage an anatomically correct posture in the seat occupant, removing the slumped posture often created in foam-based seats. This in turn leads to reduced back ache and decreased muscle fatigue which improves concentration levels and minimises fidgeting. “Golden Village strives to continuously upgrade and improve our cinemas and since 2010, we have undertaken various renovations and upgrading of our cinemas. Patrons’ comfort is of utmost importance to us and it is always encouraging to see them enjoy our new space and its improved amenities. Golden Village Tampines has been around for close to two decades and is a heartland gem to many. We hope the new upgrade will offer regular GV Tampines patrons a pleasurable cinema experience,” said Ms. Clara Cheo, Chief Executive Officer, Golden Village Multiplex Pte. -

CAPITALAND MALL TRUST Singapore’S First & Largest Retail REIT

CAPITALAND MALL TRUST Singapore’s First & Largest Retail REIT Nomura Investment Forum Asia 2017 6 June 2017 Disclaimer This presentation may contain forward-looking statements that involve assumptions, risks and uncertainties. Actual future performance, outcomes and results may differ materially from those expressed in forward-looking statements as a result of a number of risks, uncertainties and assumptions. Representative examples of these factors include (without limitation) general industry and economic conditions, interest rate trends, cost of capital and capital availability, competition from other developments or companies, shifts in expected levels of occupancy rate, property rental income, charge out collections, changes in operating expenses (including employee wages, benefits and training costs), governmental and public policy changes and the continued availability of financing in the amounts and the terms necessary to support future business. You are cautioned not to place undue reliance on these forward-looking statements, which are based on the current view of management on future events. The information contained in this presentation has not been independently verified. No representation or warranty expressed or implied is made as to, and no reliance should be placed on, the fairness, accuracy, completeness or correctness of the information or opinions contained in this presentation. Neither CapitaLand Mall Trust Management Limited (the ‘Manager’) or any of its affiliates, advisers or representatives shall have any liability whatsoever (in negligence or otherwise) for any loss howsoever arising, whether directly or indirectly, from any use, reliance or distribution of this presentation or its contents or otherwise arising in connection with this presentation. The past performance of CapitaLand Mall Trust (‘CMT’) is not indicative of the future performance of CMT.