Solarpro 7.3, April & May 2014

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Town of Amherst Request for Proposals

TOWN OF AMHERST REQUEST FOR PROPOSALS FOR OLD LANDFILL REUSE PROPOSAL Presented by: In partnership with: Letter of Transmittal............................................................................................................... 5 Executive Summary ................................................................................................................ 8 1. Evaluation Criteria ............................................................................................................ 10 1.1. Proposal protects the existing landfill caps. ...............................................................................10 1.2. Proposal protects operation of landfill gas systems...................................................................10 1.3. Experience of team proposing project........................................................................................10 1.4. Risk to human, health and the environment..............................................................................11 1.5. Effect on the environment..........................................................................................................11 1.6. Project compatibility with neighboring properties.....................................................................12 1.7. Noise levels from use of site.......................................................................................................12 1.7. Best compensation to Town of Amherst ....................................................................................13 -

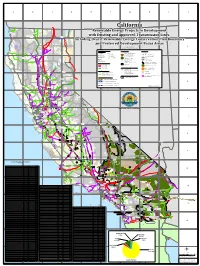

California Renewable Energy Projects in Development with Existing And

A B C D E F G H I J California ¨¦§5 2 ¤£101 !( Crescent Renewable Energy Projects in Development City Yreka D e l N o r t e !( C o u n t y S i s k i y o u M o d o c with Existing and Approved Transmission Lines C o u n t y C o u n t y Alturas !( Including Desert Renewable Energy Conservation Plan Boundary ¤£395 and Preferred Development Focus Areas Updated 12/17/2015 3 Prepared by the California Energy Commission S h a s t a H u m b o l d t C o u n t y Renewable Energy Projects Eureka C o u n t y Land Ownerships Other Features !( L a s s e n In Development C o u n t y Biomass/ Solar PV Bureau of Land Management (! City Weaverville (! !( [[ !( Landfill Gas 1 - 20 MW )" [ [ Existing Substation* [ Department of Defense 5 (! Geothermal (! )" ¨¦§ 21 - 200 MW Bureau of Indian Affairs Approved Substation* 101 Redding !( ¤£ T r i n i t y !( (! Small Hydro C o u n t y (! 201 - 2,400 MW California State Park Road (! Wind State Owned Land County Boundary Susanville !( (! Solar Thermal Williamson Act NOTE: Williamson Act for Alpine, Del Norte, Inyo, Mono, Orange, San Benito, San Francisco and Yuba Counties not available Desert Renewable Energy Existing Transmission Line Conservation Plan Boundary Private Land 4 Red 345 - 500kV Bluff DRECP Conservation Lands !( 200 - 287kV Te h a m a Prohibited, Restricted & Limited Lands C o u n t y 110 - 161kV Mohave Ground Squirrel ¤£395 Category I Lands Key Population Center Energy Development Prohibited or Restricted by Policy Quincy !( Federal Energy Corridors P l u m a s Category II Lands Dry Lake C o u n t -

BNEF Long Form

THE EVOLVING LANDSCAPE FOR EPCS IN US RENEWABLES 14 OCTOBER 2014 SECTION 4. THE PLAYERS This section of the report analyzes players in EPC for solar and wind in the US. About this analysis This section is based mostly on data gathered from companies’ websites. Much of this analysis relies on linking firms to projects in our database, which contains nearly 3,000 wind and solar projects in the US at various stages of development. The information mapping projects to their EPCs is captured in our Industry Intelligence database, available to subscribers of our service. There are a number of assumptions, caveats, and methodological points that are important to note in the context of this analysis; an Appendix at the end of this report identifies these. 4.1. LEAGUE TABLES The charts below show the top EPC firms for solar and wind, ranked strictly in terms of historic activity – ie, this does not reflect any kind of qualitative assessment about firms’ competencies. • Top-ranked solar EPCs includes the three vertically-integrated giants – SunPower, First Solar, and SunEdison – and some EPC specialists, like Bechtel and Fluor, that have performed a small number of very large projects. • The league tables for wind are headlined by Mortenson, IEA, RES Americas, and Blattner (with Blattner under-represented, as explained in the Appendix). Figure 8: Top EPC firms for US utility-scale solar (GW of Figure 9: Top EPC firms for US wind (GW of ‘active’ ‘active’ projects) projects) 0.0 0.5 1.0 1.5 2.0 0 4 8 12 SunPower MA Mortenson Co First Solar Inc IEA / White Construction MA Mortenson Co RES Americas E Light Wind and Solar Michels Corp Abengoa Blattner Energy Inc Bechtel Power Corp Wanzek Construction SunEdison Fluor Rosendin Electric Inc AMEC Tetra Tech Construction Inc Strata Solar LLC Signal Energy LLC Blymyer Engineers Dashiell Swinerton Inc TVIG / American Helios Blattner Energy Inc Reed & Reed Inc Baker Electric S&C Electric Co Blue Oak Energy Inc Barton Malow Co ARB Jay Cashman, Inc. -

NEW to Acquire First Australian Asset: Manildra Solar Power Plant 25 June 2018

RENEWABLE ENERGY. SUSTAINABLE INVESTING NEW to acquire first Australian asset: Manildra Solar Power Plant 25 June 2018 Questions to the New Energy Solar management team can be addressed to [email protected] 1 Manildra Solar Power Plant – May 2018 Disclaimer This document is prepared by New Energy Solar Manager Pty Limited (ACN 609 166 645) (Investment Manager), a corporate authorised representative (CAR No. 1237667) of Walsh & Company Asset Management Pty Limited (ACN 159 902 708, AFSL 450 257), and investment manager for New Energy Solar Fund (ARSN 609 154 298) (Trust), and New Energy Solar Limited (ACN 609 396 983) (Company). The Trust and the Company (together with their controlled entities) are referred to as the ‘Business’, ‘NEW’ or ‘New Energy Solar’. This document may contain general advice. Any general advice provided has been prepared without taking into account your objectives, financial situation or needs. Before acting on the advice, you should consider the appropriateness of the advice with regard to your objectives, financial situation and needs. This document may contain statements, opinions, projections, forecasts and other material (forward looking statements), based on various assumptions. Those assumptions may or may not prove to be correct. The Investment Manager and its advisers (including all of their respective directors, consultants and/or employees, related bodies corporate and the directors, shareholders, managers, employees or agents of any of them) (Parties) do not make any representation as to the accuracy or likelihood of fulfilment of the forward-looking statements or any of the assumptions upon which they are based. Actual results, performance or achievements may vary materially from any projections and forward looking statements and the assumptions on which those statements are based. -

Celebrating U.S. Solar Contractors

July 2017 www.solarpowerworldonline.com Technology • Development • Installation CELEBRATING U.S. SOLAR CONTRACTORS Cover_July 2017_Vs3.indd 1 6/30/17 8:32 AM HONORING THE BEST OF THE INDUSTRY The 2017 class of Top Solar Contractors is dedicated to bringing solar to the United States. The following pages honor the hard-working efforts of 500 solar companies across the country. The Top 500 List Begins On The Next Page Lists By Market p.52 Lists By Top States p.87 Lists By Service p.68 Contractors Across America p.105 INTRO Top 500_Vs2kp.indd 1 6/30/17 9:16 AM = UTILITY CONTRACTOR = RESIDENTIAL CONTRACTOR = COMMERCIAL/INDUSTRIAL CONTRACTOR = OFF-GRID CONTRACTOR = EPC = INSTALLATION SUBCONTRACTOR = ELECTRICAL SUBCONTRACTOR = DEVELOPER = ROOFTOP CONTRACTOR Pie pieces represent all services and markets in which a company works RANK & STATE/ PRIMARY TOTAL KILOWATTS ALL ALL PRIMARY COMPANY CITY TERRITORY FOUNDED EMPLOYEES MARKET INSTALLED INSTALLED SERVICES MARKETS SERVICE KILOWATTS IN 2016 OFFERED SERVED 21 CSI Electrical Contractors Santa Fe Springs CA 1990 1000 1,231,825 281,805 22 E Light Electric Services Englewood CO 1998 255 1,752,050 276,430 23 Moss Fort Lauderdale FL 2004 600 790,015 244,015 24 Vivint Solar Lehi UT 2011 5000 680,000 221,500 25 DKD Electric Albuquerque NM 1978 129 370,120 220,400 26 Bombard Renewable Energy Las Vegas NV 1982 800 420,033 219,494 27 SunEnergy1 Mooresville NC 2009 211 706,000 214,000 28 DEPCOM Power Scottsdale AZ 2013 84 390,000 205,000 29 Cantsink Lilburn GA 1988 50 416,000 197,387 30 CSW Contractors Scottsdale AZ 1982 350 1,669,000 195,000 31 HCS Renewable Energy Round Rock TX 2014 425 553,000 189,000 32 Primoris Renewable Energy Denver CO 2013 20 479,000 186,000 33 The Ryan Company Greenwood Village CO 1949 100 536,496 182,294 34 juwi Boulder CO 2008 60 420,000 182,089 35 ESA Renewables Sanford FL 2002 25 615,000 165,011 36 Hypower Fort Lauderdale FL 1991 450 425,000 165,000 37 J&B Solar Cocoa FL 2013 85 360,000 160,000 38 J. -

Appendix O, Existing Renewable Energy Projects Within DRECP

Appendix O Existing Renewable Energy Projects Within DRECP Plan Area Draft DRECP and EIR/EIS APPENDIX O. EXISTING RENEWABLE ENERGY PROJECTS WITHIN PLAN AREA O EXISTING RENEWABLE ENERGY PROJECTS WITHIN PLAN AREA Background. The list of projects included in this file was developed to help define the number and capacity of existing renewable energy projects in the Plan Area. These projects are considered part of the affected environment in the EIR/EIS Volume III. A map indicating the locations of these projects is presented as Figure III.1-2. Existing projects include those that are either operational or under construction as of October 2013. Two tables are attached: Table O-1: Summary of Existing RE Projects (data summarized from Table O-2) Table O-2: Existing RE Projects (all projects) Table O-1 below presents the acreage of existing renewable energy projects in the DRECP Plan Area. For informational purposes, 57% (50,337 acres) of the land affected by existing renewable energy projects are located in the Preferred Alternative DFAs, as defined in Volume II. This represents less than 2.5% of the DFA acreage for the Preferred Alternative. Table O-1 Summary of Existing Renewable Energy (RE) Projects in the DRECP Plan Area Generation Capacity Acreage Percent of Percent Total Acres Total Total of Percent of RE Projects Acres of RE Project Total Total of Total in the RE Projects Acreage MW MW Acres Plan Area in DFAs* in DFAs* BLM-Administered 1,805 29% 28% 24,593 8,686 35% Public Lands – Total Wind 615 34% 61% 15,028 2,592 11% Solar 1,190 66% 39% 9,565 6,094 25% Private Lands and 4,445 71% 72% 64,463 41,634 65% Other Public Lands – Total Wind 2,015 45% 69% 44,643 23,222 36% Solar 2,330 53% 31% 19,265 18,419 29% Geothermal 100 2% 0.1% 545 545 0.1% Total RE Projects 6,250 100% 100% 89,046 50,337 57% *The DFA locations for the Preferred Alternative are used to define in this exercise. -

BC-TES-TMP-2443.Pdf (5.514Mb)

UNIVERSIDAD NACIONAL “PEDRO RUIZ GALLO” Facultad de Ingeniería Mecánica y Eléctrica TESIS Para Optar el Título Profesional de INGENIERO MECÁNICO ELECTRICISTA “UTILIZACIÓN DE LA ENERGÍA EÓLICA Y SOLAR COMO FUENTE PARA EL SUMINISTRO DE ENERGÍA ELÉCTRICA AL CASERÍO ALTO PONGOYA EN CHIMBAN PROVINCIA DE CHOTA DEPARTAMENTO DE CAJAMARCA” Presentado Por: Bach. KEVIN ARNOLD TARRILLO VÁSQUEZ Asesor: Msc. Ing. JONY VILLALOBOS CABRERA LAMBAYEQUE – PERÚ Enero del 2019 UNIVERSIDAD NACIONAL “PEDRO RUIZ GALLO” Facultad de Ingeniería Mecánica y Eléctrica TESIS Para Optar el Título Profesional de INGENIERO MECÁNICO ELECTRICISTA “UTILIZACIÓN DE LA ENERGÍA EÓLICA Y SOLAR COMO FUENTE PARA EL SUMINISTRO DE ENERGÍA ELÉCTRICA ALELECTRICISTA CASERÍO ALTO PONGOYA EN CHIMBAN PROVINCIA DE CHOTA DEPARTAMENTO DE CAJAMARCA” Presentado Por: Bach. KEVIN ARNOLD TARRILLO VÁSQUEZ Aprobado por el Jurado Examinador PRESIDENTE: Dr. DANIEL CARRANZA MONTENEGRO. SECRETARIO: ING. CARLOS JAVIER COTRINA SAAVEDRA. MIEMBRO: ING. TEOBALDO EDGAR JULCA OROZCO. ASESOR: M.Sc. JONY VILLALOBOS CABRERA. LAMBAYEQUE – PERÚ Enero del 2019 UNIVERSIDAD NACIONAL “PEDRO RUIZ GALLO” Facultad de Ingeniería Mecánica y Eléctrica TESIS TITULO “UTILIZACIÓN DE LA ENERGÍA EÓLICA Y SOLAR COMO FUENTE PARA EL SUMINISTRO DE ENERGÍA ELÉCTRICA AL CASERÍO ALTO PONGOYA EN CHIMBAN PROVINCIA DE CHOTA DEPARTAMENTO DE CAJAMARCA” CONTENIDOS CAPITULO I: PROBLEMA DE LA INVESTIGACIÓN. CAPITULO II: MARCO TEÓRICO. CAPITULO III: MARCO METODOLÓGICO. CAPITULO IV: PROPUESTA DE LA INVESTIGACIÓN. CAPITULO V: ANÁLISIS E INTERPRETACIÓN DE LOS RESULTADOS. CAPITULO VI: CONCLUSIONES Y RECOMENDACIONES. AUTOR: Bach. KEVIN ARNOLD TARRILLO VÁSQUEZ --------------------------------- --------------------------------------- PRESIDENTE SECRETARIO ---------------------------------- ------------------------------------- MIEMBRO ASESOR LAMBAYEQUE – PERÚ Enero del 2019 DEDICATORIA Dedico éste Proyecto de Tesis a: Dios ya que gracias a Él he llegado a concluir una de mis metas la cual es concluir con mi carrera. -

Solar Power Card U.S

NORTH SCORE AMERICAN SOLAR POWER CARD U.S. SOLAR POWER Canada Solar Power Total grid-connected PV generating capacity for the U.S., as of the Total PV grid-connected capacity, end of 2019: 3,196 MW end of Q1, 2020: 81,400 megawatts (MW) Installed in 2019: 102 MW Growth in PV generated capacity during 2019: 13,300 MW of new solar PV ✷ Solar power accounted for nearly 40 percent of all new electricity generating capacity added in the U.S. in 2019, the largest annual share in the industry’s history. Canadian Solar Power Initiatives ✷ The U.S. solar market installed 3.6 gigawatts (GW) of new solar photovoltaic (PV) capacity in Q1 2020, representing its largest first quarter ever in the U.S. ✷ The Government of Canada launched the long-awaited Greening Government initiative, a power purchase agreement (PPA) program, with a request for information regarding The COVID-19 pandemic is having a significant impact on the U.S. solar industry, but overall, the ✷ the procurement of up to 280,000 MWh per year in newly-built solar PV and wind generation Solar Energy Industries Association (SEIA) and consulting firm Wood Mackenzie forecast 33 percent capacity. It is designed to offset federal government operations within the province of growth in 2020, owing entirely to the strong performance of the utility-scale segment, which is Alberta, as well as an additional 240,000 – 360,000 MWh per year in Renewable Energy expected to account for more than 14 GW of new installations this year. Certificates (REC) to offset Federal electricity emissions in other provinces. -

Audit of Solar Power Purchase Agreements December 22, 2020

Audit of Solar Power Purchase Agreements December 22, 2020 By Onondaga County Comptroller Martin D. Masterpole Report Index Report Section Name Page Section Number I Background and Executive Summary 2 II Scope and Methodology 6 III Findings and Recommendations 7 IV Exhibits 25 V Departmental Responses 30 VI Clarification of Management Response 37 1 SECTION I BACKGROUND AND EXECUTIVE SUMMARY Background In 2013 and again in 2014, Onondaga County (County) began to pursue solar power solutions using a request for proposals (RFP) process. At the conclusion of the RFP process, the County executed Commercial Purchase and Performance Guarantee agreements (Contracts) with SolarCity Corporation (SolarCity), a company which sells large-scale solar power solutions. The County is currently contracted with Solar City and purchasing solar energy at three sites—Oak Orchard Lagoons, Oak Orchard Waste Water Treatment Plant and Jamesville Correctional Facility. The Contracts with SolarCity included the construction of arrays of solar energy collecting panels to be built at the three sites. While the County retains ownership of the land at the sites, Solar City owns and maintains the panels. Each site has a 20-year contract and upon conclusion, the County has the option to purchase the solar panel systems from SolarCity. In addition, the Contracts define the terms for the location of the panels, set-up requirements for the panels (tilt, azimuth, etc.), price per kilowatt hour (kWh) per year, expected first year and every five year production as well as having a SolarGuard readable meter at each site. The County pays SolarCity a set fee per kWh for the use of the panels (with a 2% annual accelerator increase) and the County receives credits per kWh from National Grid for the energy collected by the panels. -

Benchmarking the Performance of Solar Installers and Rooftop Photovoltaic Installations in California

sustainability Article Benchmarking the Performance of Solar Installers and Rooftop Photovoltaic Installations in California Dadi Wang 1,2 1 Business School, China University of Political Science and Law, Beijing 100088, China; [email protected]; Tel.: +86-10-5890-9402 2 Desautels Faculty of Management, McGill University, Montreal, QC H3A 1G5, Canada Received: 20 June 2017; Accepted: 5 August 2017; Published: 9 August 2017 Abstract: Rooftop photovoltaic (PV) systems are rapidly proliferating around the world. Whether the PV systems have been efficiently installed is an issue of utmost importance for both solar installers and policymakers. However, the impact of solar installers on PV performance is not well understood. In this paper, we investigate the performance of rooftop PV installations and the solar installers using a dataset of 1035 projects developed by 213 installers in California. Based on data envelopment analysis (DEA), our study takes the PV system capacity, electricity generation, cost, modules, solar irradiance, and ambient temperature into account simultaneously to construct a unified measure for the efficiency of PV installations. We analyze the relationship between installer characteristics and PV system performance. We find PV installations with the installer also being the module manufacturer, exhibit significantly better performance than other installations. PV installations by subsidiaries of oil firms have inferior performance. PV installations by large installers on average do not perform better than the installations by small installers. Geographic diversification of an installer’s operations is significantly and inversely related to the performance of installations. We demonstrate the aforementioned findings have significant implications for policymakers and the solar installation industry. -

RE-Powering America's Land Initiative: Project Tracking Matrix April 2016

RE-Powering America’s Land Initiative: April 2016 Project Tracking Matrix The U.S. Environmental Protection Agency (EPA) recognizes the overall environmental RE-Powering America’s benefit of siting renewable energy projects on contaminated properties. Through Land Initiative the RE-Powering America’s Land Initiative, EPA is encouraging renewable energy development on current and formerly contaminated lands, landfills, and mine sites To provide information on renewable energy on when such development is aligned with the community’s vision for the site. contaminated land projects not currently appearing Using publically available information, RE-Powering maintains a list of completed in this document, email [email protected]. renewable energy installations on contaminated sites and landfills. To date, the To receive updates, newsletters, and other RE-Powering Initiative has identified 179 renewable energy installations on 171 information about the RE-Powering program, contaminated lands, landfills, and mine sites1, with a cumulative installed capacity of click the banner below. just over 1,124 megawatts (MW) and consistent growth in total installations since the inception of the RE-Powering Initiative. Approximately 60% of these installations are Subscribe large-scale systems with a project capacity of 1 MW or more, either exporting energy EPA’s RE-Powering Listserv onto the utility grid or offsetting onsite energy demands. This document provides summary statistics of known installations and discusses emerging trends. In addition to the completed sites listed here, EPA is tracking more than 50 renewable energy projects on contaminated or disturbed properties in various stages of planning, approval, or construction. These include a 1.1-MW solar project under construction on a Meriden, CT landfill; a 2.25-MW solar project under construction on a coal ash landfill in Beloit, WI; and an 18.6-MW solar installation underway at the U.S. -

CLIMATE CHANGE BUSINESS JOURNAL® Volume V, No

on for the Clim mati ate C for han In g ic e I g nd te u a s r t t r S y CLIMATE CHANGE BUSINESS JOURNAL® Volume V, No. 11/12 November/December 2012 Climate Change Business Journal 2012 Business 2012 Executive Review & CCBJ Awards Achievement Awards CCBJ’s 2012 Business Achievement Awards recognize more than 30 high achievers in the climate change industry. Senior executives and top experts in the Business Achievement: Growth industry share their perspectives in Q&A sessions and bylined guest articles. Gold Q&As & Articles Inside this Issue: rightSource Energy (Oakland, 11: Top 12 CCBJ quotes from 2012 30: Greenhouse Gas Management Institute focuses on professional development and Calif.) for becoming the clear 12: Then & Now: Skeptics who changed education. leader in the U.S. concentrat- their minds about climate change ing solar power (CSP) segment. At a 34: Powerit offers automated solutions to B 18: AECOM on risk management and time when most CSP projects proposed industrial demand response market. over the last four years in the United climate change adaptation. 37: WSP finds mitigation and adaptation States have been delayed, canceled or 21: Jane Capital offers perspective on smart figuring large in the in supply chain. reconfigured as solar PV projects, Bright- grid investments. Source has pushed ahead with its 377 40: WESTON describes how sustainability 24: Pike Research addresses distributed MW Ivanpah Solar Energy Generating unites a diverse practice. generation and microgrids. System (86% owned by NRG Energy 43: CH2M HILL engages with climate risk and Google) in the southwest California 26: Real estate services firm CBRE looks at worldwide.