State of Georgia

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

James.Qxp March Apri

COBB COUNTY A BUSTLING MARCH/APRIL 2017 PAGE 26 AN INSIDE VIEW INTO GEORGIA’S NEWS, POLITICS & CULTURE THE 2017 MOST INFLUENTIAL GEORGIA LOTTERY CORP. CEO ISSUE DEBBIE ALFORD COLUMNS BY KADE CULLEFER KAREN BREMER MAC McGREW CINDY MORLEY GARY REESE DANA RICKMAN LARRY WALKER The hallmark of the GWCCA Campus is CONNEE CTIVITY DEPARTMENTS Publisher’s Message 4 Floating Boats 6 FEATURES James’ 2017 Most Influential 8 JAMES 18 Saluting the James 2016 “Influentials” P.O. BOX 724787 ATLANTA, GEORGIA 31139 24 678 • 460 • 5410 Georgian of the Year, Debbie Alford Building A Proposed Contiguous Exhibition Facilityc Development on the Rise in Cobb County 26 PUBLISHED BY by Cindy Morley INTERNET NEWS AGENCY LLC 2017 Legislators of the Year 29 Building B CHAIRMAN MATTHEW TOWERY COLUMNS CEO & PUBLISHER PHIL KENT Future Conventtion Hotel [email protected] Language Matters: Building C How We Talk About Georgia Schools 21 CHIEF OPERATING OFFICER LOUIE HUNTER by Dr. Dana Rickman ASSOCIATE EDITOR GARY REESE ADVERTISING OPPORTUNITIES Georgia’s Legal Environment on a PATTI PEACH [email protected] Consistent Downward Trend 23 by Kade Cullefer The connections between Georggia World Congress Center venues, the hotel MARKETING DIRECTOR MELANIE DOBBINS district, and the world’world s busiest aairporirport are key differentiaferentiatorsators in Atlanta’Atlanta’s ability to [email protected] Georgia Restaurants Deliver compete for in-demand conventions and tradeshows. CIRCULATION PATRICK HICKEY [email protected] Significant Economic Impact 31 by Karen Bremer CONTRIBUTING WRITERS A fixed gateway between the exhibit halls in Buildings B & C would solidify KADE CULLEFER 33 Atlanta’s place as the world’s premier convention destination. -

Sterling Church Of

GLYNN COUNTY OFFICIAL ABSENTEE/PROVISIONAL/CHALLENGED BALLOT OFFICIAL GENERAL ELECTION BALLOT OF THE STATE OF GEORGIA NOVEMBER 2, 2010 To vote, blacken the Oval ( ) next to the candidate of your choice. To vote for a person whose name is not on the ballot, manually WRITE his or her name in the write-in section and blacken the Oval ( ) next to the write-in section. If you desire to vote YES or NO for a PROPOSED QUESTION, blacken the corresponding Oval ( ). Use only blue or black pen or pencil. Do not vote for more candidates than the number allowed for each specific office. Do not cross out or erase. If you erase or make other marks on the ballot or tear the ballot, your vote may not count. If you change your mind or make a mistake, you may return the ballot by writing “Spoiled” across the face of the ballot and return envelope. You may then mail the spoiled ballot back to your county board of registrars, and you will be issued another official absentee ballot. Alternatively, you may surrender the ballot to the poll manager of an early voting site within your county or the precinct to which you are assigned. You will then be permitted to vote a regular ballot. "I understand that the offer or acceptance of money or any other object of value to vote for any particular candidate, list of candidates, issue, or list of issues included in this election constitutes an act of voter fraud and is a felony under Georgia law." [OCGA 21-2-285(h) and 21-2-383(a)] For United States Senate For Commissioner of Agriculture For U.S. -

2015 Georgia Newspaper Directory

2015 Georgia Newspaper Directory An official listing of the members of the Georgia Press Association Published by: Georgia Newspaper Service Inc. January 2015 Affiliate of the Georgia Press Association Table of Contents About Georgia Press Association . 2 GPA Leadership Guide . 3 Newspaper Groups with GPA Members . .4 GPA Member Locator Map . 6 Newspapers by County/Legal Organ . 7 Advertisers: The Brunswick News GPA Daily Newspaper Listings . 9 Cherokee Ledger-News, Woodstock GPA Weekly Newspaper Listings . 22 Georgia EMC GPA Associate Member Listings . .76 Georgia Municipal Association BEHIND EVERY TRAIN ARE GPA Media Associate Member Listings . .78 Georgia Newspaper Service STRONG LOCAL PARTNERSHIPS. Total Market Coverage Publications (TMCs) . 79 Georgia Peanut Commission Georgia College Press Association Member Listings. .80 At Norfolk Southern, we value our community GeorgiaPublicNotice.com connections. Our partnerships are built on a 2014 Statewide Political Officers . 82 Jackson Spalding foundation of safety and service to strengthen 2014 Georgia U.S. Congressmen and General Assembly . 83 MultiAd Georgia’s economy. At Norfolk Southern, we handle everything from combines to cars. But it’s State and Regional Newspaper Associations . 86 Norfolk Southern how we handle them that makes the difference. Smith Communications Inc. * Although every effort is made to ensure the accuracy and thoroughness of Georgia Press Association directory listings, errors and omissions sometimes occur. For corrections or additions, To learn more, contact -

Prayer Calendar (Capcom-GA-Screven)

Georgia – Screven County 2011 Prayer Calendar Pray that our political Gary Black Mark Butler Executive leaders will rely upon (Agriculture Comr.) (Labor Comr.) National Leadership State Leadership prayer and God’s Word Lt. Gov. Casey Cagle Pray for Members Sam Olens Brian Kemp (Attorney General) (Secretary of State) President Barack Obama Governor Nathan Deal as their strength and Dan Ebersole of the Governor’s Ralph T. Hudgens John D. Barge Vice Pres. Joe Biden First Lady Sandra Deal means of success (Senior Advisor) and Lt. Governor’s staff Chris Riley (Insurance Comr.) (Superintendent) (Chief of Staff) Stan Wise Pray that our political Legislative Mayor Justine Brown Chuck Eaton County Leadership leaders will rely upon Congress (Oliver) Tim Echols Mayor Gerry Forehand prayer and God’s Word Sen. Saxby Chambliss Sen. Johnny Isakson Rep. John Barrow Doug Everett as their strength and Mayor James W. Hankinson (District 12) (Hiltonia) (Rocky Ford) Charlie Harman Chris Carr “Bubba” McDonald Mayor J. Donald Scott means of success (Chief of Staff) (Chief of Staff) Ashley Jones (Public Service Mayor Margaret Evans (Chief of Staff) (Newington) (Sylvania - County Seat) Commissioners) Pray that our political Staff: Dianne Hardin Judicial Georgia General Assembly leaders will rely upon Staff: Leishea Johnson County Leadership US Supreme Court Justices Sen. Jesse Stone Speaker David Ralston prayer and God’s Word Staff: Kristy Lindstrom Rep. John Burns Commissioners John G. Roberts (District 23) Spiro Amburn as their strength and Staff: Marshall Guest (District 157) (7 Districts) Antonin Scalia Phyllis Walker (Chief of Staff) means of success Staff: Bill Reilly Pat Harris Anthony Kennedy (Legislative Assistant) Staff: Hayley Yaun (Staff for Rep. -

2016 POLITICAL DONATIONS Made by WEYERHAEUSER POLITICAL ACTION COMMITTEE (WPAC)

2016 POLITICAL DONATIONS made by WEYERHAEUSER POLITICAL ACTION COMMITTEE (WPAC) ALABAMA U.S. Senate Sen. Richard Shelby $2,500 U.S. House Rep. Robert Aderholt $5,000 Rep. Bradley Byrne $1,500 Rep. Elect Gary Palmer $1,000 Rep. Martha Roby $2,000 Rep. Terri Sewell $3,500 ARKANSAS U.S. Senate Sen. John Boozman $2,000 Sen. Tom Cotton $2,000 U.S. House Rep. Elect Bruce Westerman $4,500 FLORIDA U.S. House Rep. Vern Buchanan $2,500 Rep. Ted Yoho $1,000 GEORGIA U.S. Senate Sen. Johnny Isakson $3,000 U.S. House Rep. Rick Allen $1,500 Rep. Sanford Bishop $2,500 Rep. Elect Buddy Carter $2,500 Rep. Tom Graves $2,000 Rep. Tom Price $2,500 Rep. Austin Scott $1,500 IDAHO U.S. Senate Sen. Mike Crapo $2,500 LOUISIANA U.S. Senate Sen. Bill Cassidy $1,500 U.S. House Rep. Ralph Abraham $5,000 Rep. Charles Boustany $5,000 Rep. Garret Graves $1,000 Rep. John Kennedy $2,500 Rep. Stephen Scalise $3,000 MAINE U.S. Senate Sen. Susan Collins $1,500 Sen. Angus King $2,500 U.S. House Rep. Bruce Poliquin $2,500 MICHIGAN U.S. Senate Sen. Gary Peters $1,500 Sen. Debbie Stabenow $2,000 MINNESOTA U.S. Senate Sen. Amy Klobuchar $2,000 U.S. House Rep. Rick Nolan $1,000 Rep. Erik Paulsen $1,000 Rep. Collin Peterson $1,500 MISSISSIPPI U.S. Senate Sen. Roger Wicker $4,000 U.S. House Rep. Gregg Harper $4,000 Rep. Trent Kelly $3,000 Rep. -

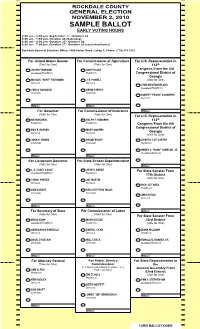

Sample Ballot Early Voting Hours

ROCKDALE COUNTY GENERAL ELECTION NOVEMBER 2, 2010 SAMPLE BALLOT EARLY VOTING HOURS 8:00 am - 4:30 pm, September 17 - October 22 9:00 am - 1:30 pm, October 23 (Saturday) 8:00 am - 4:30 pm, October 25 - October 26 8:00 am - 7:00 pm, October 27 - October 29 (extended hours) Rockdale Board of Elections Office, 1400 Parker Road, Lobby C, Phone: (770) 278-7333 For United States Senate For Commissioner of Agriculture For U.S. Representative in (Vote for One) (Vote for One) 112th JOHNNY ISAKSON GARY BLACK Congress From the 3rd (Incumbent) Republican Republican Congressional District of Georgia MICHAEL "MIKE" THURMOND J. B. POWELL (Vote for One) Democrat Democrat LYNN WESTMORELAND (Incumbent) Republican CHUCK DONOVAN KEVIN CHERRY Libertarian Libertarian ROBERT "FRANK" SAUNDERS Democrat Write-in Write-in For Governor For Commissioner of Insurance Write-in (Vote for One) (Vote for One) For U.S. Representative in NATHAN DEAL RALPH T. HUDGENS 112th Republican Republican Congress From the 4th Congressional District of ROY E. BARNES MARY SQUIRES Democrat Democrat Georgia (Vote for One) JOHN H. MONDS SHANE BRUCE LISBETH "LIZ" CARTER Libertarian Libertarian Republican HENRY C. "HANK" JOHNSON, JR. (Incumbent) Democrat Write-in Write-in For Lieutenant Governor For State School Superintendent (Vote for One) (Vote for One) Write-in L. S. CASEY CAGLE JOHN D. BARGE For State Senator From (Incumbent) Republican Republican 17th District (Vote for One) CAROL PORTER JOE MARTIN Democrat Democrat RICK JEFFARES Republican DAN BARBER KIRA GRIFFITHS WILLIS Libertarian Libertarian JIM NICHOLS Democrat Write-in Write-in For Secretary of State For Commissioner of Labor Write-in (Vote for One) (Vote for One) For State Senator From BRIAN KEMP MARK BUTLER 43rd District (Incumbent) Republican Republican (Vote for One) GEORGANNA SINKFIELD DARRYL HICKS DIANA WILLIAMS Democrat Democrat Republican DAVID CHASTAIN WILL COSTA RONALD B. -

Elected Officials Contact Information U.S

ELECTED OFFICIALS CONTACT INFORMATION U.S. Senators Saxby Chambliss: www.chambliss.senate.gov Johnny Isakson: www.isakson.senate.gov GA Congressional Districts 9 Doug Collins Office: 513 Cannon H.O.B, Washington, D.C. 20515 Phone (202)225-9893 State Representatives Alan Powell (District 32): www.alanpowell.net/contact Tom McCall (District 33) Office: 228 State Capitol Atlanta, Ga. 30334; Phone (404)656.5099 State Senator (47) Frank Ginn (Senate District 47) Office: 321-A Coverdell Legislative Office Building Atlanta, Ga. 30374; Phone (404)656-4700 Governor Nathan Deal: www.gov.georgia.gov Lt. Governor: Casey Cagle: www.caseycagel.com Attorney General Sam Olens: www.law.ga.gov Commissioner of Agriculture: Gary Black: www.agr.georgia.gov Commissioner of Labor: Mark Butler: www.dol.state.ga.us Commissioner of Insurance: Ralph Hudgens: www.oci.ga.gov Public Service Commission: www.georgia.gov./agencies/public-service-commission Doug Everett (District 1) Tim Echols (District 2) Chuck Eaton Chair (District 3) Lauren “Bubba” McDonald (District 4) Stan Wise (District 5) Secretary of State: Brian Kemp: www.sos.ga.gov State School Superintendent: John Barge : www.gadoe.org Madison County: www.madisoncountyga.us Magistrate Court of Madison County Chief Magistrate Harry F. Rice P.O. Box 6 Danielsville, GA 30633 Phone: 706 -795- 6375 Fax: 706-795-2222 District Attorney D. Parks White P. O. Box 515 Hartwell Georgia 30643 Phone: 706-376-3128 Fax: 706-376-1620 Probate Judge Judge Cody Cross P.O. Box 207 91 Albany Avenue Danielsville, GA 30633 Phone: 706-795-6365 Fax: 706-795-5933 Sheriff Kip Thomas: www.madisoncountysheriffga.org 1436 Highway 98 West Danielsville, Georgia 30633 Phone: 706 795-6202 Fax: 706 795-2999 Coroner Coach Julie H. -

Fulton County Official Absentee/Provisional/Challenged Ballot

FULTON COUNTY OFFICIAL ABSENTEE/PROVISIONAL/CHALLENGED BALLOT OFFICIAL REPUBLICAN PARTY PRIMARY AND NONPARTISAN GENERAL ELECTION BALLOT OF THE STATE OF GEORGIA MAY 24, 2016 To vote, blacken the Oval ( ) next to the candidate of your choice. To vote for a person whose name is not on the ballot, manually WRITE his or her name in the write-in section and blacken the Oval ( ) next to the write-in section. If you desire to vote YES or NO for a PROPOSED QUESTION, blacken the corresponding Oval ( ). Use only blue or black pen or pencil. Do not vote for more candidates than the number allowed for each specific office. Do not cross out or erase. If you erase or make other marks on the ballot or tear the ballot, your vote may not count. If you change your mind or make a mistake, you may return the ballot by writing “Spoiled” across the face of the ballot and return envelope. You may then mail the spoiled ballot back to your county board of registrars, and you will be issued another official absentee ballot. Alternatively, you may surrender the ballot to the poll manager of an early voting site within your county or the precinct to which you are assigned. You will then be permitted to vote a regular ballot. "I understand that the offer or acceptance of money or any other object of value to vote for any particular candidate, list of candidates, issue, or list of issues included in this election constitutes an act of voter fraud and is a felony under Georgia law." [OCGA 21-2-284(e), 21-2-285(h) and 21-2-383(a)] For United States For State Senator From For State For State Senate 6th District Representative in the Representative in the (Vote for One) (Vote for One) General Assembly General Assembly From From MARY KAY BACALLAO HUNTER HILL nd th (Incumbent) 22 District 49 District (Vote for One) (Vote for One) DERRICK GRAYSON For State Senator From WES CANTRELL CHARLES E. -

PERSPECTIVES Annual Youth Legislative Conference

PERSPECTIVES Annual Youth Legislative Conference HOT TOPICS: Gun rights Religious freedom Raising the teen driving age fb.com/GaCloseUp instagram.com/georgia_closeup © Georgia Close Up Foundation 2016 www.georgiacloseup.org Getting to know us: about Georgia Close Up Volunteer community leaders dedicated to the promotion of civic education for American Citizens. a non-profit, non-partisan organization associated with the Close Up Foundation. Mission Statement Georgia Close Up’s mission is to encourage informed active citizen participation in the democratic process and for young people, teachers, and citizens of all ages to gain a practical understanding of how public policy affects their lives and how they can affect public policy. Georgia Close Up is committed to developing new and better ways for young people to become effective participants by providing a balanced perspective on issues. History For the last 30 years, Georgia Close Up has conducted over 75 local programs on topics ranging from state legislation to public health or the environment. More than 5,600 students, teachers, parents and senior citizens have participated in our local education programs. With a small grant from the Close Up Foundation, community support, and a host of volunteers, Close Up has been able to bring speakers such as Former President and Governor Jimmy Carter to our conferences. Other guest speakers who have participated in Georgia Close Up programs include Former Ambassador and Mayor Andrew Young, Former Governors Zell Miller and Roy Barnes, Secretary of State Cathy Cox, Lieutenant Governor Mark Taylor, Former Congressman Ben Jones, Former Texas Governor Ann Richards, civil rights leaders Julian Bond and Vernon Jordan, as well as countless state representatives, dignitaries, officials, experts and specialists who have addressed participants on different issues throughout the years. -

2020AB Official Statement

NEW ISSUE RATINGS: (BOOK-ENTRY ONLY) Moody’s: Aaa S&P: AAA Fitch: AAA See “RATINGS” herein. In the opinion of Bond Counsel, based upon an analysis of existing laws, regulations, rulings and judicial decisions, and assuming, among other matters, the accuracy of certain representations and the continued compliance with certain covenants and tax law requirements, interest on the 2020A Bonds (the “Tax-Exempt Bonds”) is excludable from gross income for federal income tax purposes under Section 103 of the Internal Revenue Code of 1986, as amended, and is not a specific preference item for purposes of the federal alternative minimum tax. INTEREST EARNED ON THE 2020B BONDS (THE “TAXABLE BONDS”) IS NOT EXCLUDABLE FROM GROSS INCOME OF THE HOLDERS OF THE TAXABLE BONDS FOR FEDERAL INCOME TAX PURPOSES. In the opinion of Bond Counsel, interest on the Tax-Exempt Bonds and the Taxable Bonds (collectively, the “Bonds”) is exempt from present State of Georgia income taxation. See APPENDIX E and APPENDIX F herein for the forms of the opinions Bond Counsel proposes to deliver in connection with the issuance of the Bonds. For a more complete discussion of the tax status of the Bonds and certain other tax consequences relating to the Bonds, see “LEGAL AND TAX STATUS” herein. $1,132,515,000 STATE OF GEORGIA $802,570,000 General Obligation Bonds 2020A $329,945,000 General Obligation Bonds 2020B (Federally Taxable) Dated: Date of Delivery Due: As shown on inside cover This Official Statement has been prepared by the Georgia State Financing and Investment Commission (the “Commission”) for and on behalf of the State of Georgia (the “State”) to provide information on the above- captioned bonds (respectively, the “2020A Bonds,” the “2020B Bonds,” and collectively, the “Bonds”). -

Jamesan Inside View Into Georgia’S News, Politics & Culture

MARCH/APRIL2015 JAMESAN INSIDE VIEW INTO GEORGIA’S NEWS, POLITICS & CULTURE 2015 JAMES’ MOST INFLUENTIAL COLUMNS BY JOSH BELINFANTE // RANDY EVANS // MAC McGREW // WAYNE OLIVER // DR. DANA RICKMAN JAVIER RODRIGUEZ // MATT TOWERY // LARRY WALKER Y E A R S OF 100championing & job ECONOMIC GROWTH creation, increasing the quality of life for all Georgians, supporting tax, regulatory and legal policies to help your business grow, RAISING EDUCATION STANDARDS because those kids are going to be running our companies, promoting a career-ready, GLOBALLY COMPETITIVE WORKFORCE, advocating for policies that enhance our BUSINESS CLIMATE from the mountains to the coast, building the ENSURING INFRASTRUCTURE, to health care, and transportation system we need, ACCESS partnering with ELECTED OFFICIALS, local and regional chambers and business leaders and WORKING TOGETHER. CELEBRATING A CENTURY OF LEADERSHIP With the support of thousands of members and investors statewide, the Georgia Chamber is proud of what we’ve accomplished over the past 100 years to create a better state of business. Join and lead today at gachamber.com. DEPARTMENTS ON THE COVER 4 James’ 2015 “Georgians of the Year” PUBLISHER’S MESSAGE Jeffrey Sprecher and Kelly Loeffler FLOATING BOATS of Intercontinental Exchange. 6 FEATURES JAMES 2015JAMES’ MOST INFLUENTIAL 18 P.O. BOX 724787 ATLANTA, GEORGIA 31139 404 • 233 • 3710 33 PUBLISHED BY INTERNET NEWS AGENCY LLC 35 CHAIRMAN MATTHEW TOWERY COLUMNS CEO & PUBLISHER PHIL KENT [email protected] WHEN LOYALTY WINS OUT CHIEF OPERATING OFFICER LOUIE HUNTER by Matt Towery ASSOCIATE EDITOR GARY REESE 8 ADVERTISING OPPORTUNITIES SCOTT BARD A Good Political Name is Rather to be Had [email protected] by Larry Walker CIRCULATION PATRICK HICKEY 11 [email protected] INTERN WILLIAM STOWERS Transportation Legislation: Fix it Plus by Randy Evans 12 CONTRIBUTING WRITERS JOSH BELINFANTE RANDY EVANS On the midnight train to Sine Die MAC McGREW by Josh Belinfante WAYNE OLIVER 15 DR. -

Newsletter OICES

Vol. 2 Issue 2 June 2016 1 OICES FEDERATION Newsletter GE0RGIA FEDERATION OF REPUBLICAN WOMEN GFRW 2016 Spring By Cindy Theiler Board Meeting allaway Gardens was the place to be May 12-14 pg. 1, 3-5 C for Georgia Federation of Republican Women’s Spring Board Meeting. In addition to the board meeting, other President’s Message activities included: educational workshops, a cookout pg. 2 and dancing by the pool, as well as meetings with district directors and club presidents. More than 50 Caring & Sharing members and other guests attended this fun-filled and pg. 6-8 educational weekend event. GFRW President Barbara Hickey kicked the weekend Spotlight: GFRW 9th off May 12 with a welcome reception for members on District Workshop the inn’s patio. pg. 9-11 Keynote speaker Attorney General Sam Olens Three educational workshops and meetings with district Photo by Judy True. directors and presidents followed on May 13. Committee Reports Workshop facilitators for this board meeting were: and challenges. Theiler also shared survey results with pg. 12-13 this group. Linda Beggs (Linda Beggs & Associates), who spoke about emotional intelligence Membership Tips Following a full day of informative sessions, the Chip Lake (principal in the consulting firms, pg. 13 organization’s Reagan Club members were treated to a Glendale Strategies, Inc. and Twin Oaks Connect, special wine and cheese reception in one of the inn’s Inc.), who spoke about running a successful rooftop rooms with a scenic view of Callaway Gardens’ Reagan Club grassroots campaign Robin Lake. pg. 14 Prisca Villa (Georgia Young Republicans), who spoke about social media.