Abbott Laboratories

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Health Advisory

Health Advisory July 2, 2021 • Information for Pierce County Healthcare Providers Communicable Disease Control Communicable Disease Control • (253) 649-1412 3629 S. D St. • Tacoma, WA 98418 (253) 649-1412 • (253) 649-1358 (fax) COVID-19 Updates for Providers Requested actions • Be aware Washington State Department of Health (DOH) issued a behavioral health provider alert about Fourth of July celebrations and other summertime gatherings. The alert asks providers to give patients information about safe social behaviors and the potential negative effects of impulsive behaviors following the state’s full reopening and the misperception that the COVID-19 pandemic has ended. • Be aware the U.S. Food and Drug Administration (FDA) updated the following Emergency Use Authorization (EUA) fact sheets to include the possible risk of pericarditis and myocarditis following vaccination: o Pfizer fact sheet for healthcare providers. o Pfizer fact sheet for patients. o Moderna fact sheet for healthcare providers. o Moderna fact sheet for patients. • Continue to report any case of myocarditis and pericarditis among people who received COVID-19 mRNA vaccine within the last 2 weeks. o Promptly report cases to the U.S. Vaccine Adverse Events Reporting System (VAERS). o Report cases to the Health Department’s 24-hour reporting line at (253) 649-1413. Include vaccine manufacturer, vaccine lot number, vaccination date, dose number, patient gender, age and history of prior SARS-CoV-2 infection. • Be aware the FDA extended the shelf life of Janssen (Johnson & Johnson) COVID-19 vaccine from 3 months to 4½ months. Visit Janssen’s lot expiry checker to determine the updated expiration of your vaccine. -

1 UNITED STATES DISTRICT COURT DISTRICT of MINNESOTA Shirley

CASE 0:10-cv-01821-JNE-JJK Document 65 Filed 04/05/11 Page 1 of 5 UNITED STATES DISTRICT COURT DISTRICT OF MINNESOTA Shirley Venus Shannon, Plaintiff, v. Civil No. 10-1821 (JNE/JJK) ORDER Baxter Healthcare Corporation, Hospira, Inc., and Abbott Laboratories, Inc., Defendants. In April 2010, Shirley Venus Shannon brought this action against Eli Lilly & Company and several unidentified entities. In October 2010, she filed an Amended Complaint against Baxter Healthcare Corporation, Hospira, Inc., and Abbott Laboratories, Inc. Abbott Laboratories and Hospira moved to dismiss the case for improper venue, see Fed. R. Civ. P. 12(b)(3); moved to dismiss the case for failure to state a claim upon which relief can be granted, see Fed. R. Civ. P. 12(b)(6); and moved to transfer the case to the United States District Court for the Northern District of Illinois, Eastern Division, see 28 U.S.C. § 1404(a) (2006). After answering, Baxter Healthcare joined the motions of Abbott Laboratories and Hospira. Baxter Healthcare did not separately submit memoranda of law. Shannon opposed the motions, but she asserted that the case should be transferred to the United States District Court for the Western District of Tennessee, Western Division. For the reasons set forth below, the Court transfers this action to the Western District of Tennessee. The Court first considers whether this case should be dismissed for improper venue. See Fed. R. Civ. P. 12(b)(3). The defendant bears the burden of establishing improper venue. United States v. Orshek, 164 F.2d 741, 742 (8th Cir. -

Abbott-Abbvie Multiple Employer Pension Plan

Abbott-AbbVie Multiple Employer Pension Plan Summary Plan Description Effective January 1, 2013 This summary plan description (SPD) describes the key features of the Abbott-AbbVie Multiple Employer Pension Plan effective January 1, 2013. This booklet describes only the highlights of the plan and does not attempt to cover all administrative details. Every attempt has been made to communicate this information clearly and in easily understandable terms. Benefits and services described here apply only to those former employees and retirees eligible for benefits under the plan. The boards of directors of the companies, or when applicable, the Abbott-AbbVie Pension Plan Administrative Committee, reserve the right to modify, suspend or terminate these benefits at any time to the extent permitted by law. This SPD does not constitute a contract of employment or guarantee any particular benefit. The terms of the Abbott-AbbVie Multiple Employer Pension Plan are governed by the plan and trust documents. In case of a conflict between this SPD and those documents, the plan and trust documents will control. Table of Contents Introduction................................................................................................................................................. 1 Eligibility ..................................................................................................................................................... 1 Eligible Employees ................................................................................................................................ -

Amgen 2008 Annual Report and Financial Summary Pioneering Science Delivers Vital Medicines

Amgen 2008 Annual Report and Financial Summary Pioneering science delivers vital medicines About Amgen Products Amgen discovers, develops, manufactures Aranesp® (darbepoetin alfa) and delivers innovative human therapeutics. ® A biotechnology pioneer since 1980, Amgen Enbrel (etanercept) was one of the fi rst companies to realize ® the new science’s promise by bringing EPOGEN (Epoetin alfa) safe and effective medicines from the lab Neulasta® (pegfi lgrastim) to the manufacturing plant to patients. NEUPOGEN® (Filgrastim) Amgen therapeutics have changed the practice of medicine, helping millions of Nplate® (romiplostim) people around the world in the fi ght against ® cancer, kidney disease, rheumatoid Sensipar (cinacalcet) arthritis and other serious illnesses, and so Vectibix® (panitumumab) far, more than 15 million patients worldwide have been treated with Amgen products. With a broad and deep pipeline of potential new medicines, Amgen remains committed to advancing science to dramatically improve people’s lives. 0405 06 07 08 0405 06 07 08 0405 06 07 08 0405 06 07 08 Total revenues “Adjusted” earnings Cash fl ow from “Adjusted” research and ($ in millions) per share (EPS)* operations development (R&D) expenses* (Diluted) ($ in millions) ($ in millions) 2008 $15,003 2008 $4.55 2008 $5,988 2008 $2,910 2007 14,771 2007 4.29 2007 5,401 2007 3,064 2006 14,268 2006 3.90 2006 5,389 2006 3,191 2005 12,430 2005 3.20 2005 4,911 2005 2,302 2004 10,550 2004 2.40 2004 3,697 2004 1,996 * “ Adjusted” EPS and “adjusted” R&D expenses are non-GAAP fi nancial measures. See page 8 for reconciliations of these non-GAAP fi nancial measures to U.S. -

Companies in Attendance

COMPANIES IN ATTENDANCE Abbott Diabetes Care Archbow Consulting LLC Business One Technologies Abbott Laboratories ARKRAY USA BusinessOneTech AbbVie Armory Hill Advocates, LLC CastiaRX ACADIA Artia Solutions Catalyst Acaria Health Asembia Celgene Accredo Assertio Therapeutics Celltrion Acer Therapeutics AssistRx Center for Creative Leadership Acorda Therapeutics Astellas Pharma US Inc. Cigna Actelion AstraZeneca Cigna Specialty Pharmacy AdhereTech Athenex Oncology Circassia Advantage Point Solutions Avanir Coeus Consulting Group Aerie Pharmaceuticals Avella Coherus Biosciences AGIOS AveXis Collaborative Associates LLC Aimmune Theraputics Bank of America Collegium Akcea Therapeutics Bausch Health Corsica Life Sciences Akebia Therapeutics Bayer U.S. CoverMyMeds Alder BioPharmaceuticals Becton Dickinson Creehan & Company, Inc., an Inovalon Company Alexion Biofrontera CSL Behring Alkermes Biogen Curant Health Allergan Biohaven CVS Health Almirall BioMarin D2 Consulting Alnylam BioMatrix Specialty Pharmacy Daiichi Sankyo Amarin BioPlus Specialty Pharmacy DBV Technologies Amber Pharmacy Bioventus Deloitte Consulting LLP AmerisourceBergen Blue Cross Blue Shield Association Dendreon Amgen Blue Fin Group Dermira Amicus Therapeutics bluebird bio Dexcom Amneal Boehringer Ingelheim Diplomat Pharmacy Anthem Boston Biomedical Dova Applied Policy Bowler and Company Decision Resources Group Aquestive Therapeutics Braeburn Eisai Arbor Pharmaceuticals Bristol-Myers Squibb 1 electroCore Indivior Merz Pharmaceuticals EMD Serono Inside Rx Milliman Encore Dermatology, -

Johnson & Johnson / Abbott Medical Optics Regulation

EUROPEAN COMMISSION DG Competition Case M.8237 - JOHNSON & JOHNSON / ABBOTT MEDICAL OPTICS Only the English text is available and authentic. REGULATION (EC) No 139/2004 MERGER PROCEDURE Article 6(1)(b) NON-OPPOSITION Date: 21/02/2017 In electronic form on the EUR-Lex website under document number 32017M8237 EUROPEAN COMMISSION Brussels,21.2.2017 C(2017) 1336 final In the published version of this decision, some PUBLIC VERSION information has been omitted pursuant to Article 17(2) of Council Regulation (EC) No 139/2004 concerning non-disclosure of business secrets and other confidential information. The omissions are shown thus […]. Where possible the information omitted has been replaced by ranges of figures or a general description. To the notyfing party: Subject: Case M.8237 – Johnson & Johnson / Abbott Medical Optics Commission decision pursuant to Article 6(1)(b) of Council Regulation No 139/20041 and Article 57 of the Agreement on the European Economic Area2 Dear Sir or Madam, (1) On 17 January 2017, the European Commission received notification of a proposed concentration pursuant to Article 4 of the Merger Regulation by which Johnson & Johnson ("J&J", US) acquires within the meaning of Article 3(1)(b) of the Merger Regulation sole control of the whole of Abbott Medical Optics Inc. ("AMO", US) by way of purchase of shares3. J&J and AMO are collectively referred to as "the Parties". I. THE PARTIES AND THE OPERATION (2) J&J, headquartered in the US, is the parent company of a global group of companies which are active in the provision of pharmaceutical products, medical devices and consumer healthcare products. -

UNITED STATES SECURITIES and EXCHANGE COMMISSION Form

Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington D.C. 20549 Form 10-K (Mark One) ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF ☒ 1934 For the fiscal year ended December 31, 2008 OR TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT ☐ OF 1934 Commission file number 000-12477 Amgen Inc. (Exact name of registrant as specified in its charter) Delaware 95-3540776 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification No.) One Amgen Center Drive, 91320-1799 Thousand Oaks, California (Zip Code) (Address of principal executive offices) (805) 447-1000 (Registrant’s telephone number, including area code) Securities registered pursuant to Section 12(g) of the Act: Common stock, $0.0001 par value; preferred share purchase rights (Title of class) Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒ Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or Section 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐ Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. -

2019 Annual Report on Form 10-K

2 0 1 9 A n n u a l R e p o r t o n AbbVie F o r m 1 0 - K 2 0 2 0 . N Here Now o t i c e o f A n n u a l M e e t i n g & P r o x y S t a t e m e n t 2019 Annual Report on Form 10-K 2020 Notice of AbbVie 1 North Waukegan Road, North Chicago, IL 60064 U.S.A. Annual Meeting Copyright© 2020 AbbVie. All rights reserved. abbvie.com & Proxy Statement 3033_Cover.indd 1 3/18/20 6:36 PM AbbVie’s Commitment to Corporate Responsibility Stockholder Information We strive to make a remarkable impact on patients and drive sustainable growth by discovering and AbbVie Inc. Corporate Headquarters delivering a consistent stream of innovative medicines that address serious health problems. 1 North Waukegan Road North Chicago, IL 60064 IIn accordance wiitth our Priinciiplles:: 847.932.7900 abbvie.com Transforming lives Embracing diversity and inclusion Acting with integrity Serving the community Investor Relations Driving innovation Dept. ZZ05, AP34 Our Corporate Responsibility priorities are: Corporate Secretary Dept. V364, AP34 Using our expertise to Stewarding our ethical and Supporting long-term Stock Listing improve health sustainable business community strength The ticker for AbbVie’s common stock Creating real health improvement is We recognize that health is of The health of our business is is ABBV. The principal market for our mission and the premise of our fundamental importance to all people. intertwined with that of our communities. -

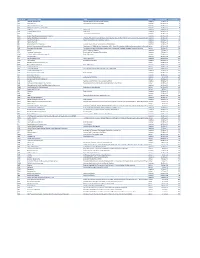

Mvx List.Pdf

MVX_CODE manufacturer_name Notes status last updated date manufacturer_id AB Abbott Laboratories includes Ross Products Division, Solvay Inactive 16-Nov-17 1 ACA Acambis, Inc acquired by sanofi in sept 2008 Inactive 28-May-10 2 AD Adams Laboratories, Inc. Inactive 16-Nov-17 3 ALP Alpha Therapeutic Corporation Inactive 16-Nov-17 4 AR Armour part of CSL Inactive 28-May-10 5 AVB Aventis Behring L.L.C. part of CSL Inactive 28-May-10 6 AVI Aviron acquired by Medimmune Inactive 28-May-10 7 BA Baxter Healthcare Corporation-inactive Inactive 28-May-10 8 BAH Baxter Healthcare Corporation includes Hyland Immuno, Immuno International AG,and North American Vaccine, Inc./acquired somInactive 16-Nov-17 9 BAY Bayer Corporation Bayer Biologicals now owned by Talecris Inactive 28-May-10 10 BP Berna Products Inactive 28-May-10 11 BPC Berna Products Corporation includes Swiss Serum and Vaccine Institute Berne Inactive 16-Nov-17 12 BTP Biotest Pharmaceuticals Corporation New owner of NABI HB as of December 2007, Does NOT replace NABI Biopharmaceuticals in this codActive 28-May-10 13 MIP Emergent BioSolutions Formerly Emergent BioDefense Operations Lansing and Michigan Biologic Products Institute Active 16-Nov-17 14 CSL bioCSL bioCSL a part of Seqirus Inactive 26-Sep-16 15 CNJ Cangene Corporation Purchased by Emergent Biosolutions Inactive 29-Apr-14 16 CMP Celltech Medeva Pharmaceuticals Part of Novartis Inactive 28-May-10 17 CEN Centeon L.L.C. Inactive 28-May-10 18 CHI Chiron Corporation Part of Novartis Inactive 28-May-10 19 CON Connaught acquired by Merieux Inactive 28-May-10 21 DVC DynPort Vaccine Company, LLC Active 28-May-10 22 EVN Evans Medical Limited Part of Novartis Inactive 28-May-10 23 GEO GeoVax Labs, Inc. -

CDP Climate Change Disclosure?

Abbott Laboratories - Climate Change 2020 C0. Introduction C0.1 (C0.1) Give a general description and introduction to your organization. Abbott is a global company with a straightforward purpose: We help people live more fully with life-changing health technologies and products. Since 1888, our business has brought new products to market for 130 years, creating more possibilities for more people at all stages of life. We create breakthrough products – in diagnostics, medical devices, nutrition and branded generic pharmaceuticals – that help you, your family and your community lead healthier lives, full of unlimited possibilities. Today, 107,000 of us are working to make a lasting impact on health in the more than 160 countries we serve. With leadership positions in every market we serve, Abbott is prepared for continued above-market growth and consistently strong shareholder returns. • Our nutrition products build and maintain health at every stage of life. • Our diagnostic solutions provide the information to guide effective treatment decisions. • Our branded generic medicines help people get and stay healthy. • Our medical devices use the most advanced technologies to keep hearts and arteries healthy, to treat chronic pain and movement disorders, and to give people with diabetes more freedom and less pain. In each of these four core businesses, we innovate early, moving quickly to address developing health needs. Our ability to respond in this way ultimately depends upon our sustainability as a business. For Abbott, sustainability includes operating ethically and responsibly, ensuring quality and safety, valuing our people, building a resilient supply chain, and delivering results for our shareholders. -

Peoplepeople Onon Thethe Move Move Gilles Fortin Jonathan Lambert Abbott Laboratories Abbott Laboratories PHARMA COMPANIES

PeoplePeople onon thethe Move Move Gilles Fortin Jonathan Lambert Abbott Laboratories Abbott Laboratories PHARMA COMPANIES Abbott Laboratories Gilles Fortin, most recently Director, Ross Products Division, has been appointed Director of Marketing, Primary Care Division, at Abbott Laboratories. Jonathan Lambert has been promoted to Product Manager, Virology/HIV, Specialty Products Division, at Abbott Laboratories. Gary Schmid, formerly Director of Marketing, Primary Gary Schmid Glenn Block Care Division, has been appointed Director, Ross Abbott Laboratories Biogen Idec Products Division, at Abbott Laboratories. Biogen Idec Glenn Block has moved to Director, Neurology Business Unit, at Biogen Idec. John Haslam has recently been promoted to Director, Dermatology Business Unit, at Biogen Idec. Bristol-Myers Squibb Greg Buie, formerly Product Manager Tequin/Cefzil, has been promoted to Senior Product Manager, Avapro/Avalide, at Bristol-Myers Squibb. John Haslam Greg Buie Biogen Idec Bristol-Myers Squibb Fournier Pharma Arturo Leal, formerly Product Manager, Invanz, with Merck, Mexico and, more recently, Promotions Manager, Cardiovasculars, with Merck Frosst, Canada, has been appointed Associate Product Manager, Lipidil Supra, at Fournier Pharma. Shirley Skutnik, formerly Promotions Manager at Merck Frosst, has joined Fournier Pharma as Product Manager of the Lipidil Portfolio. Arturo Leal Shirley Skutnik Fournier Pharma Fournier Pharma Canadian Pharmaceutical Marketing / June 2005 53 People on the Move Novartis Pharmaceuticals Jacques Archambeault, -

Annual Report

ANNUAL REPORT 2019 MARCH 2020 To Our Shareholders Alex Gorsky Chairman and Chief Executive Officer By just about every measure, Johnson & These are some of the many financial and Johnson’s 133rd year was extraordinary. strategic achievements that were made possible by the commitment of our more than • We delivered strong operational revenue and 132,000 Johnson & Johnson colleagues, who adjusted operational earnings growth* that passionately lead the way in improving the health exceeded the financial performance goals we and well-being of people around the world. set for the Company at the start of 2019. • We again made record investments in research and development (R&D)—more than $11 billion across our Pharmaceutical, Medical Devices Propelled by our people, products, and and Consumer businesses—as we maintained a purpose, we look forward to the future relentless pursuit of innovation to develop vital with great confidence and optimism scientific breakthroughs. as we remain committed to leading • We proudly launched new transformational across the spectrum of healthcare. medicines for untreated and treatment-resistant diseases, while gaining approvals for new uses of many of our medicines already in the market. Through proactive leadership across our enterprise, we navigated a constant surge • We deployed approximately $7 billion, of unique and complex challenges, spanning primarily in transactions that fortify our dynamic global issues, shifting political commitment to digital surgery for a more climates, industry and competitive headwinds, personalized and elevated standard of and an ongoing litigious environment. healthcare, and that enhance our position in consumer skin health. As we have experienced for 133 years, we • And our teams around the world continued can be sure that 2020 will present a new set of working to address pressing public health opportunities and challenges.