Joint Press Release

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

W O R K I N G P a P E R Natural Gas Import and Export

W ORKING P APER Working Paper No26 July 2019 NATURAL GAS IMPORT AND EXPORT ROUTES IN SOUTH-EAST EUROPE AND TURKEY Gina Cohen Lecturer & Consultant on Natural Gas ΙΕΝΕ Working Paper No26 NATURAL GAS IMPORT AND EXPORT ROUTES IN SOUTH-EAST EUROPE AND TURKEY Author Gina Cohen, Lecturer & Consultant on Natural Gas Institute of Energy for SE Europe (IENE) 3, Alexandrou Soutsou, 106 71 Athens, Greece tel: 0030 210 3628457, 3640278 fax: 0030 210 3646144 web: www.iene.gr, e-mail: [email protected] Copyright ©2019, Institute of Energy for SE Europe All rights reserved. No part of this study may be reproduced or transmitted in any form or by any means without the prior written permission of the Institute of Energy for South East Europe. Please note that this publication is subject to specific restrictions that limit its use and distribution. [2] ACRONYMS AERS - Energy Agency of the Republic of Serbia AIIB - Asian Infrastructure Investment Bank BCM - Billion cubic meters BOTAS - Boru Hatlari Ile Petroleum Tasima Anonim Sirketi (Petroleum Pipeline Corporation) BRUA - Bulgaria-Romania-Hungary-Austria BRUSKA- Bulgaria-Romania-Hungary-Slovakia-Austria EBRD - European Bank for Reconstruction and Development EITI - Exctractive Industries Transparency Initiative EPDK - Enerji Piyasasi Duzenleme Kurumu (Energy Market Regulatory Authority) EU - European Union FGSZ - Foldgazszallito Zrt. (Hungarian Gas Transmission System Operator) FSRU – Floating Storage and Regasification unit GWh - Gigawatt hour HAG - Hungaria-Austria-Gasleitung (Hungary-Austria Interconnector) -

Delivering the Energy Transition Through a Strategic Focus on Gas in the East Med Mathios Rigas, Energean Group CEO IP Week London, 25Th February 2020

Delivering the Energy Transition Through a Strategic Focus on Gas in the East Med Mathios Rigas, Energean Group CEO IP Week London, 25th February 2020 Το σχέδιο ανάπτυξης του κοιτάσματος υδρογονανθράκων στο Δυτικό Κατάκολο Δρ. Κωνσταντίνος Νικολάου, Τεχνικός Σύμβουλος Energean Δημοτικό Συμβούλιο Πύργου, 14 Νοεμβρίου 2019 1 Key questions 1. Is there a role for independent E&P players in today’s market? 2. What is the role of the East Med in delivering the energy transition? 2 1 Energean at a glance Creating the leading independent, gas-focused, sustainable E&P company in the Eastern Mediterranean 820 MMboe ~130 kboed 80% FTSE 250 2P reserves and Production gas-weighted The Largest 2C resources by 2022* portfolio independent E&P ESG & HSE ESG action Focused 1st E&P to commit A rating MSCI to net zero by 2050 *Edison E&P reserve estimates as of 31.10.2018, excludes UK, Norway and Algeria. 3 *Energean Israel reserve estimates as of 30.06.2019 CPR. Energean reserve estimates are pending finalisation of 2019 CPR. 2 *2022 production excludes UK, Norway and Algeria. Taking Action on Environmental Issues Through Focus on Gas Leaders in ESG Carbon Intensity Reduction Plan 80 80% gas-weighted portfolio Energean today 70 First E&P company to commit 60 to net zero by 2050 50 40 Targeting 70% reduction in carbon Energean intensity 2020-22 + Edison 30 E&P Energean + Edison Executive pay linked to ESG goals 20 E&P + from 2020 Israel 10 Committed to transparency and 0 adherence to the UN SDG’s 2019 2021 2022 Carbon intensity scope 1 & 2 (kgCO2/boe) 4 3 -

A Shaping Factor for Regional Stability in the Eastern Mediterranean?

DIRECTORATE-GENERAL FOR EXTERNAL POLICIES POLICY DEPARTMENT STUDY Energy: a shaping factor for regional stability in the Eastern Mediterranean? ABSTRACT Since 2010 the Eastern Mediterranean region has become a hotspot of international energy discussions due to a series of gas discoveries in the offshore of Israel, Cyprus and Egypt. To exploit this gas potential, a number of export options have progressively been discussed, alongside new regional cooperation scenarios. Hopes have also been expressed about the potential role of new gas discoveries in strengthening not only the regional energy cooperation, but also the overall regional economic and political stability. However, initial expectations largely cooled down over time, particularly due to delays in investment decision in Israel and the downward revision of gas resources in Cyprus. These developments even raised scepticism about the idea of the Eastern Mediterranean becoming a sizeable gas- exporting region. But initial expectations were revived in 2015, after the discovery of the large Zohr gas field in offshore Egypt. Considering its large size, this discovery has reshaped the regional gas outlook, and has also raised new regional cooperation prospects. However, multiple lines of conflict in the region continue to make future Eastern Mediterranean gas activities a major geopolitical issue. This study seeks to provide a comprehensive analysis of all these developments, with the ultimate aim of assessing the realistic implications of regional gas discoveries for both Eastern Mediterranean countries and the EU. EP/EXPO/B/AFET/2016/03 EN June 2017 - PE578.044 © European Union, 2017 Policy Department, Directorate-General for External Policies This paper was requested by the European Parliament's Committee on Foreign Affairs. -

Gas Infrastructure Map of the Mediterranean Region

Empowering Mediterranean regulators for a common energy future. Working Group on Gas (GAS WG) GAS INFRASTRUCTURE MAP OF THE MEDITERRANEAN REGION MED17-24GA -5.4.2 FINAL REPORT Luogo, data MEDREG is co-funded by the European Union MEDREG – Association of Mediterranean Energy Regulators Corso di Porta Vittoria 27, 20122 Milan, Italy - Tel + 39 02 655 65 537 - Fax +39 02 655 65 562 [email protected] – www.medreg-regulators.org Ref: MED17-24GA -5.4.2 Gas Infrastructure Map of the Mediterranean region Table of content 1. Introduction ................................................................................................................................... 4 2. Work’s methodology description .................................................................................................. 6 3. Analysis of the Results ................................................................................................................... 8 3.1 TPA regimes in a nutshell ...................................................................................................... 8 3.2 A growing trend: LNG and FSRUs .......................................................................................... 8 3.3 Benefits and impacts of the investments .............................................................................. 9 3.4 Implementation barriers ...................................................................................................... 9 3.5 Key performance indicators ............................................................................................... -

Policy Brief

EUROPEAN COUNCIL ON FOREIGN BRIEF POLICY RELATIONS ecfr.eu PIPELINES AND PIPEDREAMS HOW THE EU CAN SUPPORT A REGIONAL GAS HUB IN THE EASTERN MEDITERRANEAN Tareq Baconi There has been a great deal of excitement over the past few years around newly-discovered gas reserves in the eastern SUMMARY Mediterranean, and rightly so. With confirmed reserves • Large natural gas discoveries in the eastern reaching close to 100 billion cubic metres (bcm) of gas, and the Mediterranean have raised hopes that the region possibility of more discoveries to come, the Levantine Deep could serve EU energy needs, helping it to fulfil its Marine Basin has the potential to offer two things of value to goals of energy diversification, security, and resilience. the European Union: energy security, and an improvement in regional cooperation between Middle Eastern countries. • But there are commercial and political hurdles in the way. Cyprusʼs reserves are too small to be The diversification of Europe’s gas supply has long been a commercially viable and Israel needs a critical mass priority for the European Union. With gas wars taking place of buyers to begin full-scale production. Regional between Russia and EU member states in 2006 and 2009, and cooperation – either bilaterally or with Egypt – is a major escalation of diplomatic tension following Russia’s the only way the two countries will be able to export. annexation of Crimea in 2014, efforts to address this issue have accelerated in recent years.1 The prospect of reducing the EU’s • Egypt is the only country in the region that could dependency on Russian gas by securing supplies from within export gas to Europe independently because Europe’s geographical vicinity could help the EU build energy of the size of its reserves and its existing export resilience – a stated goal of its Energy Union strategy. -

TYNDP 2017 FID Status (Final Investment Decision) White Sea PCI Status (Project of Common Interest) Submission

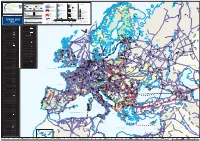

SHTOKMAN SNØHVIT Pechora Sea ASKELADD MELKØYA KEYS ALBATROSS Hammerfest Salekhard Cross-border points / intra-country or intra balancing zone points Transport by pipeline LNG Import Terminals Storage facilities Compressor stations Barents KILDIN N Acquifer Sea 1ACross-border interconnection point Cross-border interconnection point Pipeline diameters : LNG Terminals’ entry point within Europe within Europe Diameter < 600 mm intro transmission system Salt cavity - cavern or export point to non-EU country or export point to non-EU country Operational Under construction or Planned Diameter 600 - 900 mm Depleted (Gas) eld on shore / oshore MURMAN Diameter > 900mm Other type Unknown Cross-border interconnection point Cross-border third country (import) with third country (import) Under construction or Planned Pomorskiy Project categories : Project categories : Project categories : Project categories : Strait Intra-country or Murmansk Third country cross-border FID projects FID projects FID projects intra balancing zone points interconnection point FID projects Non-FID, advanced projects Non-FID, advanced projects Non-FID, advanced projects REYKJAVIK Non-FID, advanced projects Non-FID, non-advanced projects Non-FID, non-advanced projects Non-FID, non-advanced projects Gas Reserve areas Countries Non-FID, non-advanced projects ENTSOG Member Countries ICELAND Project is part of 2nd PCI list : Project is part of 2nd PCI list : Project is part of 2nd PCI list : Project is part of 2nd PCI list : Drilling platform ENTSOG Associated Partner P ENTSOG -

Energy Discoveries in the Eastern Mediterranean: Impact of the Cyprus Issue and Relevance for the Eu Energy Security

CENTRE INTERNATIONAL DE FORMATION EUROPEENNE SCHOOL OF GOVERNMENT INSTITUT EUROPEEN · EUROPEAN INSTITUTE ENERGY DISCOVERIES IN THE EASTERN MEDITERRANEAN: IMPACT OF THE CYPRUS ISSUE AND RELEVANCE FOR THE EU ENERGY SECURITY BY Beliz Küçükosman A thesis submitted for the Joint Master degree in Global Economic Governance & Public Affairs (GEGPA) Academic year 2019 – 2020 July 2020 Supervisor: Giulio Venneri Reviewer: Lorenzo Liso PLAGIARISM STATEMENT I certify that this thesis is my own work, based on my personal study and/or research and that I have acknowledged all material and sources used in its preparation. I further certify that I have not copied or used any ideas or formulations from any book, article or thesis, in printed or electronic form, without specifically mentioning their origin, and that the complete citations are indicated in quotation marks. I also certify that this assignment/report has not previously been submitted for assessment in any other unit, except where specific permission has been granted from all unit coordinators involved, and that I have not copied in part or whole or otherwise plagiarized the work of other students and/or persons. In accordance with the law, failure to comply with these regulations makes me liable to prosecution by the disciplinary commission and the courts of the French Republic for university plagiarism. 1 Table of Contents Glossary of Acronyms .................................................................................................................. 3 Introduction ................................................................................................................................ -

Israel's Contradictory Gas Export Policy. the Promotion of A

NO. 43 NOVEMBER 2019 Introduction Israel’s Contradictory Gas Export Policy The Promotion of a Transcontinental Pipeline Contradicts the Declared Goal of Regional Cooperation Stefan Wolfrum In order to market its gas reserves, Israel has until now relied on exports to Egypt and Jordan. Through regional networking in the energy sector – for example, within the framework of the Eastern Mediterranean Gas Forum (EMGF), which was founded at the beginning of 2019 – the Israeli government hopes to improve its political relations in the region. At the same time, Israel is investing hope in the building of the EastMed gas pipeline. Its construction would create a direct export link to Europe, but it would thereby also undermine energy cooperation with its Arab neighbours. The European Union (EU) should promote regional energy cooperation, as this could promote part- nerships in other areas. Accordingly, the EU should not support the construction of the EastMed pipeline. Israel is estimated to have between 800 bil- awarded all exploitation rights for the lion to 1 trillion cubic metres (m³) of natu- Tamar, Leviathan, Karish, and Tanin gas ral gas. Its own consumption amounts to fields to the American-Israeli consortium around 10 billion m³ per year; in 2017 this Noble Energy/Delek Drilling without a call corresponded to around 35 per cent of total for tenders, since they had discovered the energy consumption. However, the exploi- gas deposits. This was supposed to acceler- tation of the gas fields for the export of ate the development of the gas fields. In this gas surplus has not progressed far. -

Igi Poseidon S.A. »

“NATURAL GAS SUBMARINE INTERCONNECTOR GREECE-ITALY-IGI POSEIDON S.A” Annual Financial Statements for the year ended 31st December 2016 (1/1/2016-31/12/2016) (All amounts are expressed in Euro unless differently mentioned) ANNUAL FINANCIAL STATEMENTS for the year ended 31st December 2016 (1/1/2016-31/12/2016) in accordance with the International Financial Reporting Standards (I.F.R.S.) It is certified that the attached Annual Financial Statements are those approved by the Management Board of “IGI-Poseidon S.A.” on the February 7th, 2017. Chairman of the Board of Directors Chief Executive Officer The Accounting Advisor IGI-Poseidon S.A. IGI-Poseidon S.A. ERGO Accounting SA Kitsakos Theodoros Elio Ruggeri Agis Panagakos - 1 – “NATURAL GAS SUBMARINE INTERCONNECTOR GREECE-ITALY-IGI POSEIDON S.A” Annual Financial Statements for the year ended 31st December 2016 (1/1/2016-31/12/2016) (All amounts are expressed in Euro unless differently mentioned) I N D E X Page Auditor’s Report 3 Board of Directors’ Report 5 Statement of comprehensive income 9 Statement of financial position 10 Statement of Changes in Equity 11 Cash Flow Statement 12 Notes to the Financial Statements 13 Notes to the Income Statement 25 Notes to the Balance Sheet 26 Related party transactions and balances 30 Commitments and contingent liabilities 31 After balance sheet events 31 - 2 – “NATURAL GAS SUBMARINE INTERCONNECTOR GREECE-ITALY-IGI POSEIDON S.A” Annual Financial Statements for the year ended 31st December 2016 (1/1/2016-31/12/2016) (All amounts are expressed in Euro unless differently mentioned) ΙNDEPENDENT AUDITOR’S REPORT To the shareholders of the « Natural Gas Submarine Interconnector Greece-Italy IGI POSEIDON S.A. -

The Euroasia Interconnector and Israel's Pursuit of Energy

Supercharged: The EuroAsia Interconnector and Israel’s Pursuit of Energy Interdependence Gabriel Mitchell February 2021 A. Introduction Contemporary analysis of Eastern Mediterranean geopolitics tends to focus on the discovery of offshore hydrocarbons, and how a desire to maximize commercial profits has spurred a realignment of regional interests. There is similar emphasis on how this realignment pushed some Eastern Mediterranean states into conflict with one another over maritime boundaries and drilling rights. But while natural gas pipelines may dominate political and analytical discourse, there are other infrastructure projects that deserve attention and shed further light on the region’s evolution and Israel’s role in this transitionary period. One example to support this claim is the EuroAsia Interconnector, an ambitious infrastructure project that intends to connect the European electrical grid via undersea cable from Greece to Cyprus, and Israel. Few in Israel are familiar with the interconnector. Unlike the much-publicized EastMed pipeline, the interconnector garners little attention. Ironically, there is a greater chance that the interconnector – whose cable would run along a similar route as the EastMed pipeline – will successfully link Israel and Europe in the Eastern Mediterranean, and not the more recognizable natural gas project. This paper attempts to outline the principal reasons why Israel is interested in the EuroAsia Interconnector (EAI) and why an undersea electricity cable may be a more feasible project than the EastMed pipeline (EMP). In the process, it hopes to contribute to current research on Israel’s engagement in the Eastern Mediterranean, as well as its transition from energy dependency to a new era of energy independence and interdependence. -

Eastmed Pipeline’ – Hard Reality Or a Pipedream?

THE ‘EASTMED PIPELINE’ – HARD REALITY OR A PIPEDREAM? 2020 commenced with a milestone which could, it has been said, be of great geo-political significance. On 2nd January 2020, after many years of discussion and evaluation, the energy ministers of Greece, Cyprus and Israel, in the presence of their President and Prime-Ministers, signed in Athens an Agreement for the Construction of the Offshore/Onshore Natural Gas Pipeline connecting the East Mediterranean gas reserves to the South European mainland: the ‘EastMed Pipeline’. The Background to the Pipeline At the time of writing, the Agreement itself had not yet been released into the public domain. This makes it currently impossible to place a legal interpretation on the intentions of the Parties. However, in anticipation of its publication, below follow some background facts: By 2025, the EastMed Pipeline should facilitate the exploitation and transportation of some 553 milliard cubic metres of natural gas estimated to be present in the exploration fields ‘Leviathan’ and 238 milliard cubic metres in ‘Tamar’, both located in the Israeli exclusive economic zone in the Levantine Basin. Originating in the Levantine Gasfield, at some 130 kilometers distance west of Haifa, the pipeline’s exit points are to be located in Cyprus, Crete and on Mainland Greece. From there the gas will be routed under the Mediterranean Sea to depths of almost 3000 metres. The pipeline’s ultimate landfall will be in Italy after travelling a distance of some 1900 kilometers. From Italy, the gas can be further transported to Northern Europe. Since Cyprus and Greece are exploring substantial reserves of natural gas in their own territorial waters, they will, it has been said, shortly be able to exploit these using the EastMed Pipeline. -

Natural Gas Prospects in Egypt, the East Mediterranean and North Africa* IGU Executive Committee Workshop Cairo, 19 April 2018

Natural Gas Prospects in Egypt, the East Mediterranean and North Africa* IGU Executive Committee Workshop Cairo, 19 April 2018 1. The evolving nature of natural gas in Euro-Mediterranean relations 1.1 Features and prospects of the energy landscape in the Mediterranean - Mediterranean countries account for 7% of the world’s primary energy demand. The latter is expected to grow substantially over the next 25 years spurred by sustained population (+105 million compared to 2013) and economic growth (+2.3% per year on average) in the region1. - According to OME, final energy consumption would double by 2040 in the South Mediterranean countries and electricity consumption would triple, notably on account of the increase of air conditioning and new electrical appliances. Carbon dioxide emissions would increase by 45% for the whole region and more than double in the South Mediterranean. - The Energy transition Scenario, developed by MEDENER and OME, assumes the implementation of those measures that are currently the most technically, economically, and politically mature for large- scale rollout of the energy efficiency and renewable energies. Compared to the business-as-usual scenario, the transition scenario would lead to a sizeable reduction in primary energy demand (-30%) and final energy consumption (-23%), a substantial increase of the share of renewables in the energy mix, mainly solar and wind (27% in 2040), and a decrease in CHG emissions of 38%. - Expected trajectories for energy demand are very contrasted in the Mediterranean: o Northern Mediterranean countries have embarked upon a transition path with substantial levels of renewables and effective demand-side management. The energy demand has indeed decreased by 4% since 2010, to be put in relation with low population growth (+0.5) and decreasing GDP (-2%).