Study on Identification of Export Oriented Integrated Infrastructure For

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

List of Village Panchayats in Tamil Nadu District Code District Name

List of Village Panchayats in Tamil Nadu District Code District Name Block Code Block Name Village Code Village Panchayat Name 1 Kanchipuram 1 Kanchipuram 1 Angambakkam 2 Ariaperumbakkam 3 Arpakkam 4 Asoor 5 Avalur 6 Ayyengarkulam 7 Damal 8 Elayanarvelur 9 Kalakattoor 10 Kalur 11 Kambarajapuram 12 Karuppadithattadai 13 Kavanthandalam 14 Keelambi 15 Kilar 16 Keelkadirpur 17 Keelperamanallur 18 Kolivakkam 19 Konerikuppam 20 Kuram 21 Magaral 22 Melkadirpur 23 Melottivakkam 24 Musaravakkam 25 Muthavedu 26 Muttavakkam 27 Narapakkam 28 Nathapettai 29 Olakkolapattu 30 Orikkai 31 Perumbakkam 32 Punjarasanthangal 33 Putheri 34 Sirukaveripakkam 35 Sirunaiperugal 36 Thammanur 37 Thenambakkam 38 Thimmasamudram 39 Thilruparuthikundram 40 Thirupukuzhi List of Village Panchayats in Tamil Nadu District Code District Name Block Code Block Name Village Code Village Panchayat Name 41 Valathottam 42 Vippedu 43 Vishar 2 Walajabad 1 Agaram 2 Alapakkam 3 Ariyambakkam 4 Athivakkam 5 Attuputhur 6 Aymicheri 7 Ayyampettai 8 Devariyambakkam 9 Ekanampettai 10 Enadur 11 Govindavadi 12 Illuppapattu 13 Injambakkam 14 Kaliyanoor 15 Karai 16 Karur 17 Kattavakkam 18 Keelottivakkam 19 Kithiripettai 20 Kottavakkam 21 Kunnavakkam 22 Kuthirambakkam 23 Marutham 24 Muthyalpettai 25 Nathanallur 26 Nayakkenpettai 27 Nayakkenkuppam 28 Olaiyur 29 Paduneli 30 Palaiyaseevaram 31 Paranthur 32 Podavur 33 Poosivakkam 34 Pullalur 35 Puliyambakkam 36 Purisai List of Village Panchayats in Tamil Nadu District Code District Name Block Code Block Name Village Code Village Panchayat Name 37 -

Thiruvallur District

DISTRICT DISASTER MANAGEMENT PLAN FOR 2017 TIRUVALLUR DISTRICT tmt.E.sundaravalli, I.A.S., DISTRICT COLLECTOR TIRUVALLUR DISTRICT TAMIL NADU 2 COLLECTORATE, TIRUVALLUR 3 tiruvallur district 4 DISTRICT DISASTER MANAGEMENT PLAN TIRUVALLUR DISTRICT - 2017 INDEX Sl. DETAILS No PAGE NO. 1 List of abbreviations present in the plan 5-6 2 Introduction 7-13 3 District Profile 14-21 4 Disaster Management Goals (2017-2030) 22-28 Hazard, Risk and Vulnerability analysis with sample maps & link to 5 29-68 all vulnerable maps 6 Institutional Machanism 69-74 7 Preparedness 75-78 Prevention & Mitigation Plan (2015-2030) 8 (What Major & Minor Disaster will be addressed through mitigation 79-108 measures) Response Plan - Including Incident Response System (Covering 9 109-112 Rescue, Evacuation and Relief) 10 Recovery and Reconstruction Plan 113-124 11 Mainstreaming of Disaster Management in Developmental Plans 125-147 12 Community & other Stakeholder participation 148-156 Linkages / Co-oridnation with other agencies for Disaster 13 157-165 Management 14 Budget and Other Financial allocation - Outlays of major schemes 166-169 15 Monitoring and Evaluation 170-198 Risk Communications Strategies (Telecommunication /VHF/ Media 16 199 / CDRRP etc.,) Important contact Numbers and provision for link to detailed 17 200-267 information 18 Dos and Don’ts during all possible Hazards including Heat Wave 268-278 19 Important G.Os 279-320 20 Linkages with IDRN 321 21 Specific issues on various Vulnerable Groups have been addressed 322-324 22 Mock Drill Schedules 325-336 -

The Chennai Comprehensive Transportation Study (CCTS)

ACKNOWLEDGEMENT The consultants are grateful to Tmt. Susan Mathew, I.A.S., Addl. Chief Secretary to Govt. & Vice-Chairperson, CMDA and Thiru Dayanand Kataria, I.A.S., Member - Secretary, CMDA for the valuable support and encouragement extended to the Study. Our thanks are also due to the former Vice-Chairman, Thiru T.R. Srinivasan, I.A.S., (Retd.) and former Member-Secretary Thiru Md. Nasimuddin, I.A.S. for having given an opportunity to undertake the Chennai Comprehensive Transportation Study. The consultants also thank Thiru.Vikram Kapur, I.A.S. for the guidance and encouragement given in taking the Study forward. We place our record of sincere gratitude to the Project Management Unit of TNUDP-III in CMDA, comprising Thiru K. Kumar, Chief Planner, Thiru M. Sivashanmugam, Senior Planner, & Tmt. R. Meena, Assistant Planner for their unstinted and valuable contribution throughout the assignment. We thank Thiru C. Palanivelu, Member-Chief Planner for the guidance and support extended. The comments and suggestions of the World Bank on the stage reports are duly acknowledged. The consultants are thankful to the Steering Committee comprising the Secretaries to Govt., and Heads of Departments concerned with urban transport, chaired by Vice- Chairperson, CMDA and the Technical Committee chaired by the Chief Planner, CMDA and represented by Department of Highways, Southern Railways, Metropolitan Transport Corporation, Chennai Municipal Corporation, Chennai Port Trust, Chennai Traffic Police, Chennai Sub-urban Police, Commissionerate of Municipal Administration, IIT-Madras and the representatives of NGOs. The consultants place on record the support and cooperation extended by the officers and staff of CMDA and various project implementing organizations and the residents of Chennai, without whom the study would not have been successful. -

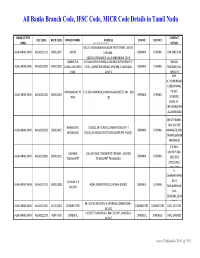

Banks Branch Code, IFSC Code, MICR Code Details in Tamil Nadu

All Banks Branch Code, IFSC Code, MICR Code Details in Tamil Nadu NAME OF THE CONTACT IFSC CODE MICR CODE BRANCH NAME ADDRESS CENTRE DISTRICT BANK www.Padasalai.Net DETAILS NO.19, PADMANABHA NAGAR FIRST STREET, ADYAR, ALLAHABAD BANK ALLA0211103 600010007 ADYAR CHENNAI - CHENNAI CHENNAI 044 24917036 600020,[email protected] AMBATTUR VIJAYALAKSHMIPURAM, 4A MURUGAPPA READY ST. BALRAJ, ALLAHABAD BANK ALLA0211909 600010012 VIJAYALAKSHMIPU EXTN., AMBATTUR VENKATAPURAM, TAMILNADU CHENNAI CHENNAI SHANKAR,044- RAM 600053 28546272 SHRI. N.CHANDRAMO ULEESWARAN, ANNANAGAR,CHE E-4, 3RD MAIN ROAD,ANNANAGAR (WEST),PIN - 600 PH NO : ALLAHABAD BANK ALLA0211042 600010004 CHENNAI CHENNAI NNAI 102 26263882, EMAIL ID : CHEANNA@CHE .ALLAHABADBA NK.CO.IN MR.ATHIRAMIL AKU K (CHIEF BANGALORE 1540/22,39 E-CROSS,22 MAIN ROAD,4TH T ALLAHABAD BANK ALLA0211819 560010005 CHENNAI CHENNAI MANAGER), MR. JAYANAGAR BLOCK,JAYANAGAR DIST-BANGLAORE,PIN- 560041 SWAINE(SENIOR MANAGER) C N RAVI, CHENNAI 144 GA ROAD,TONDIARPET CHENNAI - 600 081 MURTHY,044- ALLAHABAD BANK ALLA0211881 600010011 CHENNAI CHENNAI TONDIARPET TONDIARPET TAMILNADU 28522093 /28513081 / 28411083 S. SWAMINATHAN CHENNAI V P ,DR. K. ALLAHABAD BANK ALLA0211291 600010008 40/41,MOUNT ROAD,CHENNAI-600002 CHENNAI CHENNAI COLONY TAMINARASAN, 044- 28585641,2854 9262 98, MECRICAR ROAD, R.S.PURAM, COIMBATORE - ALLAHABAD BANK ALLA0210384 641010002 COIIMBATORE COIMBATORE COIMBOTORE 0422 2472333 641002 H1/H2 57 MAIN ROAD, RM COLONY , DINDIGUL- ALLAHABAD BANK ALLA0212319 NON MICR DINDIGUL DINDIGUL DINDIGUL -

SNO APP.No Name Contact Address Reason 1 AP-1 K

SNO APP.No Name Contact Address Reason 1 AP-1 K. Pandeeswaran No.2/545, Then Colony, Vilampatti Post, Intercaste Marriage certificate not enclosed Sivakasi, Virudhunagar – 626 124 2 AP-2 P. Karthigai Selvi No.2/545, Then Colony, Vilampatti Post, Only one ID proof attached. Sivakasi, Virudhunagar – 626 124 3 AP-8 N. Esakkiappan No.37/45E, Nandhagopalapuram, Above age Thoothukudi – 628 002. 4 AP-25 M. Dinesh No.4/133, Kothamalai Road,Vadaku Only one ID proof attached. Street,Vadugam Post,Rasipuram Taluk, Namakkal – 637 407. 5 AP-26 K. Venkatesh No.4/47, Kettupatti, Only one ID proof attached. Dokkupodhanahalli, Dharmapuri – 636 807. 6 AP-28 P. Manipandi 1stStreet, 24thWard, Self attestation not found in the enclosures Sivaji Nagar, and photo Theni – 625 531. 7 AP-49 K. Sobanbabu No.10/4, T.K.Garden, 3rdStreet, Korukkupet, Self attestation not found in the enclosures Chennai – 600 021. and photo 8 AP-58 S. Barkavi No.168, Sivaji Nagar, Veerampattinam, Community Certificate Wrongly enclosed Pondicherry – 605 007. 9 AP-60 V.A.Kishor Kumar No.19, Thilagar nagar, Ist st, Kaladipet, Only one ID proof attached. Thiruvottiyur, Chennai -600 019 10 AP-61 D.Anbalagan No.8/171, Church Street, Only one ID proof attached. Komathimuthupuram Post, Panaiyoor(via) Changarankovil Taluk, Tirunelveli, 627 761. 11 AP-64 S. Arun kannan No. 15D, Poonga Nagar, Kaladipet, Only one ID proof attached. Thiruvottiyur, Ch – 600 019 12 AP-69 K. Lavanya Priyadharshini No, 35, A Block, Nochi Nagar, Mylapore, Only one ID proof attached. Chennai – 600 004 13 AP-70 G. -

14December 2020 India Daily

INDIA DAILY December 14, 2020 India 11-Dec 1-day 1-mo 3-mo Sensex 46,099 0.3 5.6 18.9 Nifty 13,514 0.3 5.7 18.1 Contents Global/Regional indices Dow Jones 30,046 0.2 1.9 7.3 Special Reports Nasdaq Composite 12,378 (0.2) 4.6 11.9 Economy FTSE 6,547 (0.8) 3.6 8.6 Economy: CY2021 outlook: turning the corner Nikkei 26,653 (0.4) 5.0 13.1 Hang Seng 26,506 0.4 1.3 7.6 Theme Report KOSPI 2,766 (0.1) 10.9 13.8 Internet Software & Services: India e-commerce: the race for leadership Value traded – India Daily Alerts Cash (NSE+BSE) 686 756 334 11,32 Derivatives (NSE) 18,034 36,464 Company alerts 2 Deri. open interest 4,767 4,891 3,849 TCS: Industry view from TCS' lens Cipla: Revlimid litigation settled ABB: Prospects of right-sizing costs to parent beyond royalty Forex/money market Change, basis points Economy alerts 11-Dec 1-day 1-mo 3-mo Economy: Positive surprise from IIP Rs/US$ 73.7 (1) (63) 31 10yr govt bond, % 6.1 - (7) (23) Net investment (US$ mn) 10-Dec MTD CYTD FIIs 477 3,290 19,396 (1,506 MFs (95) (4,929) ) Top movers Change, % Best performers 11-Dec 1-day 1-mo 3-mo SHTF in Equity 1,043 (0.6) 19.6 63.9 TATA in Equity 622 1.9 26.3 53.6 IIB in Equity 924 0.9 19.9 51.6 KMB in Equity 1,920 0.9 8.5 47.2 BJFIN in Equity 8,995 (0.4) 22.6 47.2 Worst performers UPLL in Equity 435 (0.8) 1.3 (15.7) RIL in Equity 2,006 (0.1) 0.2 (12.9) BPCL in Equity 397 (0.5) (3.7) (4.7) LPC in Equity 939 (0.4) 3.7 (3.0) BRIT in Equity 3,733 (0.2) 5.8 0.4 [email protected] Contact: +91 22 6218 6427 For Private Circulation Only. -

Gateway Distriparks

Result Update February 2, 2015 Rating matrix Rating : Buy Gateway Distriparks (GATDIS) | 383 Target : | 485 Target Period 12 months Potential Upside : 26% Strong volumes continue to drive growth… What’s changed? • Gateway Distriparks reported spirited Q3FY15 revenue growth of Target Changed from |330 to |485 10% YoY to | 273.7 crore vs. | 248.2 crore in Q3FY14. Rail segment EPS FY16E Changed from |19.9 to |20.7 revenues recorded healthy growth of 19.5% YoY to | 163 crore while EPS FY17E Changed from |24.3 to |24.6 Rating Unchanged CFS posted strong growth ~26% YoY to | 88.6 crore • EBITDA in the quarter was at | 86.4 crore growing strongly by 35% YoY whereas QoQ it remained mostly flattish. On the margin front, Quarterly performance EBITDA margin expanded ~582 bps YoY, 227 bps QoQ to 31.6% Q3FY15 Q3FY14 YoY (%) Q2FY15 QoQ (%) • PAT for the quarter stood at | 54.3 crore posting growth of ~61% Revenue 273.7 248.2 10.3 292.7 -6.5 YoY. On the volume front, CFS throughput for Q3FY15 stood at EBITDA 86.4 63.9 35.2 85.7 0.7 96,612 TEUs with rail/ICD at 63,952 TEUs, posting growth of 16% and EBITDA (%) 31.6 25.7 495 bps 29.3 581 bps 24%, respectively, YoY PAT 54.3 31.9 70.4 47.7 13.8 CFS volume grows strong at Vizag, Kochi; Mumbai volumes return Key financials GDL with ~5,50,000 TEUs annual capacity is one of the largest container | Crore FY14 FY15E FY16E FY17E freight station (CFS) operators in India. -

Automated Brochure

Premier KVT Township By Premier Housing and Properties Madhavaram Chennai Near Panchayat union primary school Plots from 31 Lakhs Launch Date Not Available Expected Possession 01 Sep 2019 Floor Plans Not Available Overview of Premier KVT Township Township is a premium residential project developed by Premier Housing and Properties, Chennai. The project is spread on a total area of 28 acres and is offering plots of varying sizes. Township was launched in October 2015 and was ready for possession in July 2019. A total number of 335 plots were launched, developer KVT Homes and Estates or owners of the plots put up for sale can be contacted by interested buyers. About the Project KVT Township in Madhavaram, Chennai North by KVT Homes is a residential project. The project offers Land with perfect combination of contemporary architecture and features to provide comfortable living. Highlights CMDA Approved (1/2016) On Vadaperumbakkam Highway Within the Greater Chennai Corporation Adjacent residents & Commercials Entire site filled with soil 4 feet from the ground level 28 acres, 344 plots with Tar Roads, Fully Compound wall 2.29 acres Park & Children play area Broad roads, Avenue trees 24/7 Security, Electricity & water facility 80% Loans approved by Major Banks Location Advantages: On Vadaperumbakkam State Highway Close Proximity to Madhavaram Red Hills road 3 km from Madhavaram Round Tana 3 km from new Andhra Bus Stand 2 km from Madhavaram Bus Stand 3 km from Chennai Metro Within Chennai city corporation limits Phase 1 Approval number-1/2016 -

Marine Infrastructure Developer Private Limited (MIDPL)

Marine Infrastructure Developer Private Limited (MIDPL) Executive Summary PROPOSED REVISED MASTER PLAN DEVELOPMENT OF KATTUPALLI PORT December 2020 PREPARED BY C1161303 NABET ACCREDITED Certificate No: NABET/EIA/2023/RA 0175 RP003, Rev. A L&T Infrastructure Engineering Ltd. Client: Marine Infrastructure Developer Private Limited (MIDPL) Project: Proposed Revised Master Plan Project No.: Development of Kattupalli Port C1161303 Title: Document No.: Rev.: Executive Summary RP003 A This document is the property of L&T Infrastructure Engineering Ltd. and File path: must not be passed on to any person or body not authorised by us to receive it l:\ports\2016\c1161303 - ceia kattupalli port nor be copied or otherwise made use of either in full or in part by such person or expansion\outputs\reports\rp003-executive summary\13.12.2020\executive body without our prior permission in writing. summary-14.12.2020.docx Notes: 1. Revision Details: SAP TKS A 13.12.2020 Second Submission SNV BRT S SNV SAP TKS 0 26.10.2020 First Submission Sd/- Sd/- Sd/- IRR BRT S Init. Sign. Init. Sign. Init. Sign. Rev. Date Details Prepared Checked Approved Table of Contents Proposed Revised Master Plan Development of Kattupalli Port C1161303 Executive Summary RP003 rev. A TABLE OF CONTENTS 1 Introduction .....................................................................................................................................1 2 Project Site ......................................................................................................................................1 -

Parent Company (If Applicable) Factory Name Address Country No. of Workers Type of Product __ Ambathur Clothing Private Limted No

Parent company (if applicable) Factory name Address Country No. of workers Type of product __ Ambathur Clothing Private Limted No. D16, Industrial Estate, Ambathur, Chennai - 600 058 India < 1000 Apparel __ Anhui Beiyade Garment Co. Ltd. (YinShanHong) Industrial Concentration District Zhenbei District, Shiqiao Dangtu, China < 1000 Apparel Maanshan City, Anhui Province __ Bhartiya International Ltd. Apiic Industrial Park, Kondur Village, Tada Mandal, Spsr Nellore India < 1000 Apparel Dist, 524401 Shanghai Yuren International Trading Changshu Kailan Knitting Co. Ltd. No. 8, Penghu Road, New & Hi-tech Industrial Development Zone China < 1000 Apparel __ Changzhou Ability Garments Co. Ltd. No. 69 Qing Yang North Road, Changzhou, 213021 China < 1000 Apparel __ Changzhou Xuenaili Garment Co. Ltd. West Street, Daibu Town,Liyang City, Changzhou, Jiangsu Province China < 1000 Apparel DBL Group DB-Tex Ltd. Nayapara, Kashimpur, Gazipur Bangladesh < 1000 Apparel Dekko Group Dekko Design Noroshinghapur, Ashulia, Dhaka Bangladesh 5,001 - 10,000 Apparel __ Donglong (Tancheng) Garments Co. Ltd. Yanghong Road Yangji Town, Tancheng City, Shandong Province China < 1000 Apparel AUHC: Denim Clothing Ltd. Dor Sun Garment Factory Lang Pei Industrial Area, Chang Ping Town, Dongguan City China < 1000 Apparel __ Duocai Fabric Print Factory Baoshan village, Ganpu town, Hanyan count, Jiaxing, Zhejiang China < 1000 Apparel Province __ Echotex Limited Chandra, Pollibidyut, Kaliakior, Gazipur Bangladesh < 1000 Apparel __ Epyllion Style Limited Nayapara, Vhawal Mirzapur, Gazipur Sadar, Gazipur Bangladesh < 1000 Apparel __ Epyllion Washing Limted Jangaliapara (Bangla Bazar), Bhawal Mirzapur, Gazipur, 1703 Bangladesh < 1000 Apparel __ Eureka Leather Garments SF. No. 195/1, 196/1 M.C. Road, Pachakuppam- Village, India < 1000 Apparel Vadaputhupattu- Post, Ambur-Taluka, 635812 __ Evolv Clothing Company Pvt. -

INDIAN DREDGING Troubled Sector Gets a Lifeline Indian Dredging Companies That Have Been Facing Multiple Challenges Are Likely to Breathe Easy with New Guidelines

India’s premier maritime business magazine `100 MARCH 2016 WWW.MARITIMEGATEWAY.COM RNI NO: TELENG/2009/30633 POSTAL REGISTRATION NO: LII/RNP/HD/1137/2016-18 ECMBS 2016: SUMMIT MARKED DATE OF PUBLICATION: 26/02/2016 DATE OF POSTING: 28/02/2016 BY DELIBERATIONS AND BONHOMIE INDIAN DREDGING troubled sector gets a lifeline Indian dredging companies that have been facing multiple challenges are likely to breathe easy with new guidelines. 02 MARITIME GATEWAY / MARCH 2016 Maritime Gateway- 20.5x27.5 CM www.elektrans.net What others see is a consignment. What we see are the dreams of a young India. Elektrans Global: Welcome to a whole new perspective. At Elektrans, we put people before our business. Whether it is our customers or our employees, we strongly believe in our ability to turn their dreams into reality. Our integrated services cover the entire shipping value chain. Come, partner with us, and see the world in a new light. Elektrans is more than just cargo. It is a complete cradle to grave solution: Crew Management Technical Management Commercial Management Training Consolidation Ship Owning Ship Recycling FROM THE EDITOR Boost trade, strengthen relations. If India’s relations with Bangladesh government of India has expressed have notably improved, it is largely its interest in developing a new deep because of Prime Minister Narendra sea, all-weather port at Payra close to Modi’s visits both by the Minister of Chittagong. This too we believe, is after For India to enjoy External Affairs and senior government Dhaka snubbed a few Chinese proposals officials to iron out pending issues and to build a port at Sonadia, closer to continued success improve bilateral trade and cooperation. -

Morning Insight

Morning Insight AUGUST 1, 2018 % Chg News Highlights 31-Jul 1 Day 1 Mth 3 Mths Indian Indices Core sector growth rose to a seven-month high of 6.7 per cent in SENSEX Index 37,607 0.3 6.2 7.0 June due to double-digit expansion in coal, cement and refinery NIFTY Index 11,357 0.3 6.0 5.7 products. On the other hand, crude oil and natural gas continued NSEBANK Index 27,764 (0.3) 5.3 8.7 to contract. (BS) NIFTY 500 Index 9,651 0.3 5.3 1.6 CNXMcap Index 18,877 0.4 3.8 (7.0) In a major blow to the government in the gas migration dispute BSESMCAP Index 16,584 0.3 3.4 (9.9) between Reliance Industries (RIL) and state-owned ONGC, an World Indices international arbitration tribunal ruled in favour of RIL led Dow Jones 25,415 0.4 4.7 5.5 consortium. The tribunal rejected the government’s claim of illegal Nasdaq 7,672 0.5 2.2 7.6 gas production by the consortium from the neighbouring block of FTSE 7,749 0.6 1.5 3.0 NIKKEI 22,554 0.0 1.6 0.7 ONGC in the Krishna-Godavari (KG) basin. (BS) Hangseng 22,554 0.0 1.6 0.7 Biocon is aiming to register a 66 per cent growth in its biologics Shanghai 28,583 (0.5) (0.7) (6.7) business this fiscal, which the company hopes will help it clock a Value traded (Rs cr) 31-Jul % Chg Day revenue of $200 mn on the back of emerging markets growth.