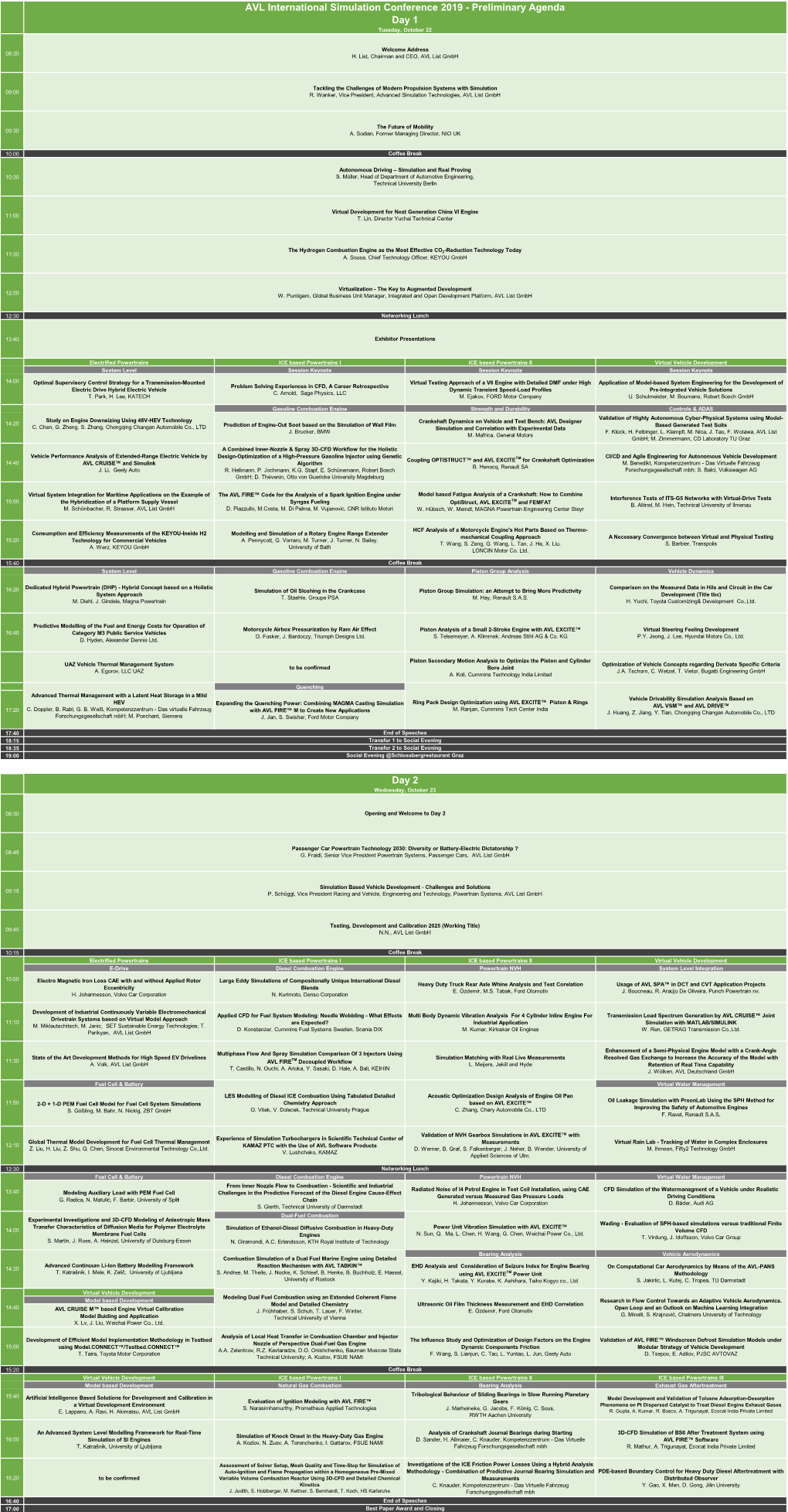

Day 1 AVL International Simulation Conference 2019

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The History of Success of Central Asian Company in Automobile Industry

Review Article, ISSN 2304-2613 (Print); ISSN 2305-8730 (Online) The History of Success of Central Asian Company in Automobile Industry Kanat Zhumanov1, Anel Zhumanova2, Benjamin Chan Yin-Fah3 1,2,3Faculty of Business Management, Asia Pacific University of Technology & Innovation (APU), Kuala Lumpur, MALAYSIA 3Center of Entrepreneurship and Leadership, (APU), Technology Park Malaysia, MALAYSIA *E-mail for correspondence: [email protected] https://doi.org/10.18034/abr.v8i2.155 ABSTRACT The paper analyzes the key success factors of automobile industry in Central Asia, Kazakhstan. In particularly, strategies used, experienced challenges faced by “Bipek Auto – Asia Auto” will be presented in this paper. Key words: Success factors, Kazakhstan, Auto Company INTRODUCTION Kazakhstan in the form of tax and other payments; more than $ 24 million was directed by the company for Today Asia is a platform for a successful business. The charitable and social purposes. The staff of Bipek Auto - rapid development of innovation in Asia is facilitated by Asia Auto has over 4,500 employees in 19 cities of a large number of people, a fast temp of life, and the Kazakhstan and 13 regions of Russia. progress of the economy GDP per capita is higher than in other regions. And one-third of global companies are From 1992 to 2017 (Figure 2), Kazakhstan’s people located in Asia - Taiwan, Japan, China, and Korea. If we purchased more than 475,000 new cars at the company's look are the record provided by Ernst & Young's, Asia branches (Cursive Kazakhstan, 2018). Within 25 years accounted for 14% of world consumer spending in 2011 Bipek Auto - Asia Auto is a leader both in an automobile but been projected to 25% in 2020 and 40% in year 2030. -

Russian Automotive Market 2018 Results and Outlook

Russian automotive market www.pwc.ru/automotive 2018 results and outlook Passenger cars | Light commercial vehicles | Trucks | Buses February 2019 Contents 1 Overview of the Russian passenger car market 3 2 Overview of the Russian commercial vehicle market 11 3 Conclusions 15 4 About PwC 17 PwC 2 1 Overview of the Russian passenger car market PwC 3 Sanctions-related risks materialising in the first half of 2018 triggered year-end declines in several key macroeconomic indicators GDP growth rate and consumer price index (CPI), Average nominal RUB/USD exchange rate, Q1 2016 to Q4 2018 Q1 2016 to Q4 2018 8.4 74.9 7.4 6.8 GDP against similar quarter last year, % 5.8 65.9 CPI against similar quarter last year, % 66.5 4.6 64.6 65.6 4.2 3.9 63.0 3.4 61.9 3.0 57.1 2.5 2.2 2.6 2.2 2.4 2.2 58.6 59.0 58.4 56.8 0.4 0.9 -0.4 -0.2 0.6 1.9 1.5 -0.5 1.3 1Q ’16 2Q ’16 3Q ’16 4Q ’16 1Q ’17 2Q ’17 3Q ’17 4Q ’17 1Q ’18 2Q ’18 3Q ’18 4Q ’18 1Q ’16 2Q ’16 3Q ’16 4Q ’16 1Q ’17 2Q ’17 3Q ’17 4Q ’17 1Q ’18 2Q ’18 3Q ’18 4Q ’18 Sources: Ministry of Economic Development of the Russian Federation, Rosstat. Source: Central Bank of the Russian Federation Consumer confidence index, Q-end Brent oil price behaviour, USD Q1 2016 - Q4 2018 Q1 2016 - Q4 2018 82.7 79.4 70.3 -8.0% -8.0% 66.9 -11.0% -11.0% 56.8 57.5 -15.0% -14.0% -14.0% 52.8 53.8 -18.0% -17.0% -19.0% 49.7 49.1 47.9 39.6 -26.0% -30.0% 1Q ’16 2Q ’16 3Q ’16 4Q ’16 1Q ’17 2Q ’17 3Q ’17 4Q ’17 1Q ’18 2Q ’18 3Q ’18 4Q ’18 1Q ’16 2Q ’16 3Q ’16 4Q ’16 1Q ’17 2Q ’17 3Q ’17 4Q ’17 1Q ’18 2Q ’18 3Q ’18 4Q ’18 Source: Rosstat Source: Bloomberg PwC 4 In 2018, the passenger car market continued to recover, demonstrating 13% growth despite the slowdown in the Russian economy In 2018, sales of new Sales among Russian makers Sales of foreign brands Imports accounted for around passenger cars in Russia increased by 14%, driven by surging assembled in Russia grew by 16% of total sales in 2018. -

AVTOVAZ Call with Financial Analysts

AVTOVAZ Call with Financial Analysts Nicolas MAURE / Dr. Stefan MAUERER CEO / CFO 16.01.2017 Disclaimer Information contained within this document may contain forward looking statements. Although the Company considers that such information and statements are based on reasonable assumptions taken on the date of this report, due to their nature, they can be risky and uncertain and can lead to a difference between the exact figures and those given or deduced from said information and statements. PJSC AVTOVAZ does not undertake to provide updates or revisions, should any new statements and information be available, should any new specific events occur or for any other reason. PJSC AVTOVAZ makes no representation, declaration or warranty as regards the accuracy, sufficiency, adequacy, effectiveness and genuineness of any statements and information contained in this report. Further information on PJSC AVTOVAZ can be found on AVTOVAZ’s web sites (www.lada.ru/en and http://info.avtovaz.ru). AVTOVAZ Call with Financial Analysts 16.01.2017 2 AVTOVAZ Overview Moscow International Automobile Salon 2016 AVTOVAZ 50-years History 1966/1970 VAZ 2101 2016 LADA XRAY AVTOVAZ Call with Financial Analysts 16.01.2017 4 AVTOVAZ Group: Key information 408 467 Cars & KDs produced 20.1% MOSCOW AVTOVAZ 331 Representative office sales points 30 IZHEVSK LADA-Izhevsk countries TOGLIATTI plant AVTOVAZ Head-office & 2015: 176.5 B-Rub (2.6 B-Euro) Togliatti plants 2016: estimated T/O > 2015 51 527 p. AVTOVAZ Call with Financial Analysts 16.01.2017 5 LADA product portfolio -

SAIGA NEWS Issue 7 Providing a Six-Language Forum for Exchange of Ideas and Information About Saiga Conservation and Ecology

Published by the Saiga Conservation Alliance summer 2008 SAIGA NEWS issue 7 Providing a six-language forum for exchange of ideas and information about saiga conservation and ecology The Altyn Dala Conservation Initiative: A long term commitment CONTENTS to save the steppe and its saigas, an endangered couple The Altyn Dala Conservation Initiative (ADCI) is a large scale project to Feature article conserve the northern steppe and semi desert ecosystems and their critically Eva Klebelsberg The Altyn Dala Conservation endangered flagship species like the saiga antelope (Saiga tatarica tatarica) and Initiative: A long term commitment to save the the Sociable Lapwing (Vanellus gregarius). ADCI is implemented by the steppe and its saigas, an endangered couple Kazakhstan government, the Association for Conservation of Biodiversity of 1 Kazakhstan (ACBK), the Frankfurt Zoological Society (FZS), the Royal Society for Updates 3 Protection of Birds (RSPB; BirdLife in the Saigas in the News UK) and WWF International. The Alina Bekirova Saiga saga. CentrAsia. 27.06.2008. 6 German Centre for International Migration and Development Articles (CIM) is supporting Duisekeev B.Z., Sklyarenko S.L. Conservation of the project through the saiga antelopes in Kazakhstan 7 long-term integration of two experts who Fedosov V. The Saiga Breeding Centre – a centre have working for the for ecological education 9 Association for Conservation of Kosbergenov M. Conservation of a local saiga Biodiversity in population on the east coast of the Aral Sea in Kazakhstan since the 10 beginning of 2007. Uzbekistan The “Altyn Dala Conservation Mandjiev H.B., Moiseikina L.G. On albinism in Initiative” (“altyn the European saiga population 10 dala” means “golden steppe” in Kazakh), Project round-up started in 2006 and focuses on an area of WWF Mongolian Saiga project. -

Sollers Financial Results 2019

SOLLERS FINANCIAL RESULTS 2019 July 3, 2020 CONTENT Sollers strategic Operating and financial 01 developments 03 performance 2019 Russian automotive Joint venture’s results 02 market overview 04 2 SOLLERS STRATEGIC DEVELOPMENTS (1/3) MARCH 2019 MAY 2019 JUNE 2019 Ford Sollers JV announced Adil Shirinov was appointed Nikolay Sobolev was restructuring. the CEO of Uliyanovsk appointed On Jul 1, 2019 Automotive Plant the CEO of Sollers Sollers acquired the controlling stake in the JV 3 SOLLERS STRATEGIC DEVELOPMENTS (2/3) JULY 2019 OCTOBER 2019 DECEMBER 2019 New Ford Sollers JV started UAZ starts sales of UAZ Sollers establishes operations Patriot ATM Engineering Centre 4 SOLLERS STRATEGIC DEVELOPMENTS (3/3) FEBRUARY 2020 APRIL 2020 APRIL 2020 Elena Frolova appointed Ford Sollers JV supplies UAZ launches the first series CEO of Mazda Sollers JV Ambulances to the Ministry of ambulances based on of Health fighting COVID-19 UAZ Profi platform 5 CONTENT Sollers strategic Operating and financial 01 developments 03 performance 2019 Russian automotive Joint venture’s results 02 market overview 04 6 RUSSIAN AUTOMOTIVE MARKET: LCV Total decline of CV sales – 3% 121 118 The slight decrease of 1,3% in LCV+MPV segment is mostly due to stop of Mercedes Sprinter Classic local assembly The share of Russian branded LCV+MPV went up from 69% to 71% while imported vehicles 104 and foreign assembly amount to 12% and 17% LCV+MPV 103 respectively CDV UAZ sales of commercial vehicles went down by 7%, the brand is #2 player with 19% market share 17 15 The sales -

Adressverzeichnis

ADRESSVERZEICHNIS ANHÄNGER & AUFBAUTEN . .Seite 11–13 BUSSE. .Seite 13–16 LKW und TRANSPORTER . .Seite 16–19 SPEZIALFAHRZEUGE . .Seite 19–22 ANHÄNGER & Aebi Schmidt ALF Fahrzeugbau Andreoli Rimorchi S.r.l. Deutschland GmbH GmbH & Co.KG Via dell‘industria 17 AUFBAUTEN Albtalstraße 36 Gewerbehof 12 37060, Buttapietra (Verona) 79837 St. Blasien 59368 Werne ITALIEN Acerbi Veicoli Industriali S.p.A. Tel. +49.7672-412-0 Tel. +49.2389 98 48-0 Tel. +39 045 666 02 44 Strada per Pontecurone, 7 www.aebi-schmidt.com www.alf-fahrzeugbau.de www.andreoli-ribaltabili.it 15053 Castelnuovo Scrivia (AL) ITALIEN Agados spol. s.r.o. ALHU Fahrzeugtechnik GmbH Andres www.acerbi.it Rumyslová 2081 Borstelweg 22 Hermann Andres AG 59401 Velké Mezirici 25436 Tornesch Industriering 42 Achleitner Fahrzeugbau TSCHECHIEN Tel. +49.4122 - 90 67 00 3250 Lyss Innsbrucker Straße 94 Tel. +420 566 653 311 www.alhu.de SCHWEIZ 6300 Wörgl www.agados.cz Tel. +41 32 387 31 61 Asch- ÖSTERREICH AL-KO www.andres-lyss.ch wege & Tönjes Aucar- Tel. +43 5332-7811-0 Agados Anhänger Handels Alois Kober GmbH Zur Schlagge 17 Trailer SL www.achleitner.com GmbH Ichenhauser Str. 14 Annaburger Nutzfahrzeuge 49681 Garrel Pintor Pau Roig 41 2-3 Schwedter Str. 20a 89359 Kötz GmbH Tel. +49.4474-8900-0 08330 Premià de mar, Barcelona Ackermann Aufbauten & 16287 Schöneberg Tel. +49.8221-97-449 Torgauer Straße 2 www.aschwege-toenjes.de SPANIEN Fahrzeugvertrieb GmbH Tel. +49.33335 42811 www.al-ko.de 06925 Annaburg Tel. +34 93 752 42 82 Am Wallersteig 4 www.agados.de Tel. +49.35385-709-0 ASM – Equipamentos www.aucartrailer.com 87700 Memmingen-Steinheim Altinordu Trailer www.annaburger.de de Transporte, S Tel. -

Uaz Patriot Brochure En

CREATED FOR EMOTIONS. UAZ PATRIOT RESTYLED FOR THE ENTIRE FAMILY. SINCE 1941 UAZ SPIRIT OF AND FREEDOM... ADVENTURES CITY OFF-ROAD Small lanes and broad avenues, traffic jams and The condition of the dirt road greatly affects its inexperienced drivers, complicated parking at passability, and to a great extent the weather shopping malls and unexpected maneuvers on the conditions as well. However, for the UAZ Patriot, road, no matter what tests a city has in store for none of this matters, it will take you to your you, your UAZ Patriot will always be at its best. destination—no matter what. TRACK HEAVY OFF-ROAD When driving your UAZ Patriot, your longest trip Off-road driving is often a memorable adventure, becomes an enchanting comfortable voyage but not every vehicle can handle this. The UAZ through the most picturesque locations of the Patriot is a famous off-road conqueror. With it, you country. can always be confident in your abilities. 2 UAZ UAZ FREEDOM OF CHOICE SPACIOUS LUGGAGE COMPARTMENT The restyled UAZ Patriot is designed for family Genuinely spacious luggage 60:40 split bench seat trips to the most picturesque destinations, trips compartment (volume to roof 1,130 l) to the countryside for picnicking and village cottages for gardening. It goes without saying that for trips of this kind, one needs a lot of space to carry along tools, equipment and appliances. The UAZ Patriot luggage compartment is unbelievably spacious, and its configuration can be changed. Luggage compartment volume matters during city trips as well when driving to a park with a stroller and/or moving your stuff to a new apartment. -

Nr.105 (01.06 – 15.06)

Selected News 0 1 . 0 6 – 1 5 . 0 6 . 2 0 1 7 Russian Government plans to boost car exports to 240,000 vehicles in 2025 15.06.2017 / Kommersant T h e Ministry of Industry and Commerce has announced a development strategy for car exports until 2025. According to the baseline scenario, an annual export growth of $4.9 billion is expected: to 240,000 vehicles per year (10% of the production) and $1.6 b i l l i o n worth of auto components. In an ambitious scenario, the exports will rise to $7.8 billion: 400,000 automobiles and components by 16%, generating $2.5 billion. Government subsidies will amount to 136 billion rubles between 2018 - 2015 under the baseline scenari o and to 215 billion rubles under the ambitious scenario, as written in Kommersant. CIS - c o u n t r i e s , the Middle - East (Iran, Lebanon, Jordan), a number of European countries (Czech Republic, Germany, Austria), Asia (India, China), Africa (Egypt, Algeria, Tunisia, Ethiopia) and several countries from Latin America and Southeast Asia are na m e d a s export markets with priority for Russian car manufacturers. CIS - countries, Iran and Lebanon are considered as priority markets f o r international automakers, alongside Turkey, South Africa, Egypt and Tunisia. In general, there are no fundamentally new export support measures in the project. There are plans to formulate a stable export support system for 8 - 10 years, in order to evaluate business cases for the life cycle of the model. It’s expected to develop the suppliers of subcomponents and second and third level materials to reduce costs and the dependency on the ruble exchange rate . -

Bo Andersson CEO Avtovaz AVTOVAZ

Bo Andersson CEO AvtoVAZ AVTOVAZ The Russian Automotive Industry Today & Tomorrow Bo Inge Andersson President & CEO of AVTOVAZ ТВОЙ ГОД ТВОЕ БУДУЩЕЕ 10 June 2015 Current Macroeconomic Situation •1 Global Oil Prices have fallen by over 50 % • In Q1 2015 Russian Income from oil export reduced by 43.5% •2 Imposed Sanctions on Russia from the West • In 2015 estimated affect can reach 75 B-EURO or 4.8% of GDP •3 RUB Rate has plunged vs. EUR and USD • In Q1 2015 EUR/RUB and USD/RUB grew up to 90-100% •4 Cost of Borrowing has increased substantially • In 2014 key interest rate was increased by Russian central bank from 5.5% to 17.0%. Current rate is 12.5% •5 Increasing Inflation and Russian Recession • Annual Inflation in May was 15.8% • GDP decrease in Q1 2015 is 2.2%, annual forecast is -2.5 to -5.0% 3 Passenger Vehicles Market Outlook • AVTOVAZ forecast the Market to drop by 32-36% in 2015 vs. 2014 M-units 3.10 3.00 3.0 2.90 2.8 2.77 2.7 2.68 2.90 2.6 2.60 2.80 2.55 2.5 2.70 2.5 2.4 2.58 2.4 2.52 2.46 2.20 2.40 2.0 2.10 1.85 1.8 1.8 1.59 1.70 1.5 1.4 1.4 1.3 1.50 1.0 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 4 Actual Optimistic Forecast Pessimistic Forecast Who we are 2015 Leading Manufacturer 585,000 of vehicles in Russia Cars & CKD Own Brand Name LADA Market Share in Russia (4M 2015) 18.7% Market Share in <600 k-RUB segment 51% Dealer Network in 336 Russia dealers Export 29 countries Controlling Alliance Rostec Auto B.V., a part of Shareholder Alliance Renault-Nissan Togliatti, Russia 5 Headquarters The Russian Automotive Industry Majority of Russian plants have problems being cost competitive due to low production capacities k-units / year Production Capacities of Russian Plants 1000 910 900 800 700 600 500 400 300 Typical plant in other Markets 300 200 190 175 200 – 400 k-units / year 200 150 150 120 110 100 100 75 75 75 100 50 0 UAZ Renault GAZ Moscow Ford Izhevsk GM Togliatti Kaluga AVTOVAZ AVTOVAZ Elabuga Ulyanovsk Nissan Toyota Togliatti Kaluga Nizhny Nov. -

GAZ Group Annual Report 2008

Annual Report 2008 GAZ Group 1 Contents Statement of the Chairman of the Management Board ........................................................................ 3 GAZ Group general information .......................................................................................................... 5 GAZ Group profile ........................................................................................................................... 5 GAZ Group mission and strategy..................................................................................................... 7 Organizational structure ................................................................................................................... 9 Key events of 2008......................................................................................................................... 10 Key events of the beginning of 2009.............................................................................................. 17 Main lines of business ........................................................................................................................ 19 Light commercial vehicles (LCV) and medium commercial vehicles (MCV) .............................. 19 Buses............................................................................................................................................... 25 Trucks ............................................................................................................................................. 30 Construction -

RUSSIAN 2017 BUS MARKET the Russian Bus Market Is Quite Conservative and the «Rules of the Game» Are Determined by the State

А В Т О б у с ы ANALY TICS RUSSIAN 2017 BUS MARKET The Russian bus market is quite conservative and the «rules of the game» are determined by the state. In this text we will tell about what those rules are and the alignment of forces on the market in 2017 MINIBUSES A significant part of commercial passenger trans minibuses on the basis of vans of European brands and MercedesBenz Sprinter Classic are produced portation in Russian cities is made by route mini (according to the company ASMholding). At the in Russia in full cycle. But the importation from buses – minivans of the M2 category, created on same time, the base vans of the Peugeot Boxer, abroad of new fullblown minibuses for commer the basis of LCV segment vans. From time to time Citroen Jumper, FIAT Ducato, IVECO Daily, Merce cial passenger transport is devoid of any economic regional authorities declare their desire to remove desBenz Sprinter and Renault Master models sense, since such vehicles will be absolutely un minibuses from urban routes and replace them are imported from abroad, while the Ford Transit competitive at a price. It remains to add that the with large buses. But in fact, in the overwhelming majority of regions the picture remains the same, and small private carriers continue to operate main ly minibuses. For this reason, the volume of sales of minibuses is almost three times higher than sales of other «ordinary» buses (small, medium and large capacity): according to our estimates, in 2017 at least 30 thousand minibuses were delivered to the register against 11.5 thousand larger buses . -

Autocomponents from Togliatti Production Company LADAPLAST-T

Autocomponents from Togliatti Production company LADAPLAST-T Togliatti 8th November 2018 Autocomponents from Togliatti 2 General information 2009 378 people Date of official company registration Overall quantity of personell 8935 m2 IATF 16949 total area Sertifyed 5100 м2 — 18 Borkovskaya str. 1700 м2 — 18 Severnaya str. 2135 м2 — 94B Vokzalynaya str. Autocomponents from Togliatti 3 History 2009 2011 2012 2013 Production and supply for AVTOVAZ Modernization of seats supplied for Work under Yo-Mobile project, design Modernization of Priora seats, design, and GM-AVTOVAZ GM-AVTOVAZ with a full validation and development, engineering. engineering, production preparation. cycle. 2014 2015 2016 2017 Design and supply seats for UAZ. Diversification of supplied Design and development seats for Production preparation of a speaker Nomination for seats supply for NGN specification to AVTOVAZ including UAZ for CARGO project– design, grilles for UMP project, design of a project – GM-AVTOVAZ, full cycle of seats for LADA 4х4, KALINA 2, engineering, production preparation. seiling handrail for UMP project, design and development, engineering Datsun. Start of supply for Eberspacher. design and development of seat set for and production preparation. sedan car UMP project. 2018 Start of supply for Faurecia. Autocomponents from Togliatti 4 Financial figures in 2017 2,097 9,84 271 58 Billion rub. Million rub. people people Seat set turnover Other parts turnover Direct and indirect Management staff Since 2010 the growth in Since 2014 гcompany seats realization was starts to diversify business Since 2010 company keeps balance of a labor rate – the 202.66% -more than 2 with new products and same level of management staff while increase in times technologies.