Full Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

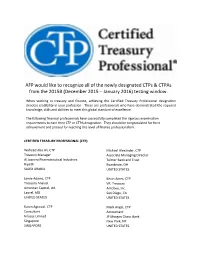

AFP Would Like to Recognize All of the Newly Designated Ctps & Ctpas

AFP would like to recognize all of the newly designated CTPs & CTPAs from the 2015B (December 2015 – January 2016) testing window. When working in treasury and finance, achieving the Certified Treasury Professional designation denotes credibility in your profession. These are professionals who have demonstrated the required knowledge, skills and abilities to meet this global standard of excellence. The following financial professionals have successfully completed the rigorous examination requirements to earn their CTP or CTPA designation. They should be congratulated for their achievement and praised for reaching this level of finance professionalism. CERTIFIED TREASURY PROFESSIONAL (CTP) Waheed Abu Ali, CTP Michael Alexander, CTP Treasury Manager Associate Managing Director Al Jazeera Pharmaceutical Industries Talmer Bank and Trust Riyadh Boardman, OH SAUDI ARABIA UNITED STATES Jamie Adams, CTP Kevin Ames, CTP Treasury Analyst VP, Treasury American Capital, Ltd. Amobee, Inc. Laurel, MD San Diego, CA UNITED STATES UNITED STATES Karan Agrawal, CTP Mark Angel, CTP Consultant Accountant Infosys Limited JP Morgan Chase Bank Singapore New York, NY SINGAPORE UNITED STATES Alexandru Anton, CTP Rishi Bajaj, CTP Treasurer Director Rompetrol Sa Sofina Foods Inc. Navodari Mississauga, ON ROMANIA CANADA Spiridoula Arceo, CTP Lisa Balfe, CTP Vice President Director First American Bank Corporation Commonwealth Bank Of Australia Elk Grove Village, IL New York, NY UNITED STATES UNITED STATES Frank Armocida, CTP Jenny Barahona, CTP Director Securities -

Collections and Crime Ons and Crime: the Case of Citibank in Indonesia

Journal of Business Cases and Applications Collecti ons and crime : the case of Citibank in Indonesia Michael Martin University of Northern Colorado Joseph J. French University of Northern Colorado ABSTRACT The principal subject matter of this study involves the operation of multinational businesses , international law, and business ethics. This case study describes several hypothetical dilemmas, both overt and subtle, our fictitious corporate officer at Citibank International must appropriately address. This case describes several modern s candals faced by Citibank’s operations in Jakarta, Indonesia. These scandals range from the embezzlement of millions of dollars by a Citigold manager to the tragic collections related death of a Citibank credit card holder. This case provides a detailed ba ckground on the Indonesian business climate, discussion of applicable domestic and international laws, as well as analysis of appropriate ethical frameworks and decision making. Key Words : Business Ethics, Banking, International law, Case Study Collections and crime, Page 1 Journal of Business Cases and Applications INTRODUCTION Matt Lelander lets out a big sigh as he approaches the bar in the bu siness lounge of San Francisco International airport. Matt is returning from a banking conference in Vancouver, Canada and was hoping to make it home before a late night FedEx package and e -mail changed his plans. As he pours himself a full g lass of local California wine Matt carefully contemplates recent events. Matt is an operations and ethics officer for Citib ank’s international division and was recently assigned to monitor Citib ank’s operations in Indonesia. Mr. Lelander is considered a rising star in the banking world and many believe he will soon be sitting on Citigroup’s board of directors. -

Collections and Crime: the Case of Citibank in Indonesia

Journal of Business Cases and Applications Collections and crime: The case of Citibank in Indonesia Michael Martin University of Northern Colorado Joseph J. French University of Northern Colorado ABSTRACT The principal subject matter of this study involves the operation of multinational businesses, international law, and business ethics. This case study describes several hypothetical dilemmas, both overt and subtle, our fictitious corporate officer at Citibank International must appropriately address. This case describes several modern scandals faced by Citibank’s operations in Jakarta, Indonesia. These scandals range from the embezzlement of millions of dollars by a Citigold manager to the tragic collections related death of a Citibank credit card holder. This case provides a detailed background on the Indonesian business climate, discussion of applicable domestic and international laws, as well as analysis of appropriate ethical frameworks and decision making. Keywords: Business Ethics, Banking, International law, Case Study Copyright statement: Authors retain the copyright to the manuscripts published in AABRI journals. Please see the AABRI Copyright Policy at http://www.aabri.com/copyright.html. Collections and crime, page 1 Journal of Business Cases and Applications INTRODUCTION Matt Lelander lets out a big sigh as he approaches the bar in the business lounge of San Francisco International airport. Matt is returning from a banking conference in Vancouver, Canada and was hoping to make it home before a late night FedEx package and e-mail changed his plans. As he pours himself a full glass of local California wine Matt carefully contemplates recent events. Matt is an operations and ethics officer for Citibank’s international division and was recently assigned to monitor Citibank’s operations in Indonesia. -

Citi Indonesia Named As the Best International Bank in Indonesia

Press Release For Immediate Distribution Citi Indonesia Named as The Best International Bank in Indonesia Jakarta, June 2, 2020 - Citi Indonesia (Citibank, N.A., Indonesia) has been named as Best International Bank in Indonesia from one of the leading financial publication in Asia, Finance Asia, during its annual Country Awards 2020. The awards recognizes the best banks, brokers, law firms across Asia and rating agencies in China. On its official website, Finance Asia emphasizes that not only is this year's competition fierce, but it also took place during an unprecedented global backdrop due to the COVID-19 situation. The award also highlighted banks' resilience and their ability to adapt to fast-changing conditions, which includes enabling most of their employees to successfully work from home. Commenting on this achievement, Citi Indonesia CEO Batara Sianturi said, “Among the increasingly competitive and volatile market situation, we are really grateful to receive this award from Finance Asia magazine. This achievement shows our focus and commitment as a global bank, which offers innovative and integrated financial solutions in our line of businesses, namely Institutional Banking and Consumer Banking. Amid ongoing concerns around COVID-19 situation in Indonesia, we want our customers to know that we remain committed to serve them by prioritizing them, to navigate these challenging times together.” In terms of financial performance, Citibank N.A., Indonesia has announced its first quarter 2020 result, where the bank was able to post a net income of Rp 1 Trillion. The bank also recorded a Return on Equity (ROE) of 22.5% and a Return on Assets (ROA) of 5.6% during the same period. -

Data Perusahaan Laporan Tahunan 2008 • PT Bank Danamon Indonesia Tbk 295 Dewan Komisaris

294 PT Bank Danamon Indonesia Tbk • Laporan Tahunan 2008 Data Perusahaan Laporan Tahunan 2008 • PT Bank Danamon Indonesia Tbk 295 Dewan Komisaris J. B. Kristiadi Ng Kee Choe Wakil Komisaris Utama/ Komisaris Utama Komisaris Independen Ng Kee Choe telah menjabat sebagai Komisaris sejak Maret 2004 dan Dr. Kristiadi menjabat sebagai Komisaris sejak tahun 2005. kemudian diangkat sebagai Komisaris Utama dalam RUPST bulan Mei tahun 2006 dan telah menjabat sebagai Komisaris sejak Maret 2004. Beliau memperoleh gelar PhD dari Sorbonne University, Perancis tahun 1979. Saat ini merupakan Chairman Singapore Power Limited dan NTUC Income Insurance Cooperative. Beliau juga duduk dalam Boards of Singapore Saat ini Beliau menjabat sebagai Staf Ahli Menteri Keuangan Republik Exchange Limited dan Singapore Airport Terminal Services Limited. Indonesia Beliau juga pernah menjabat sebagai Vice Chairman dan Direktur DBS Sebelumnya, menjabat sebagai Direktur Pemeliharaan Aset dan Group Holdings Ltd hingga pensiun pada bulan Juni tahun 2003. Direktur Anggaran Kementrian Keuangan RI dan Ketua Lembaga Administrasi Negara RI dari tahun 1990 hingga tahun 1998. Selanjutnya Mendapat penghargaan Public Service Star Award pada bulan Agustus menjabat sebagai Asisten V Menteri Koordinator Bidang Pengawasan, tahun 2001. Pembangunan, dan Pendayagunaan Aparatur Negara sampai tahun 2001, Deputi Menteri Sekretaris Menteri Negara kabinet reformasi Keahlian: sampai tahun 2004, sekertaris menteri Komunikasi dan Informasi hingga Kredit, Keuangan, Sumberdaya Manusia, Tresuri, Manajemen Risiko tahun 2004. Beliau menjabat sebagai Sekretaris Jenderal Departemen Keuangan Republik Indonesia pada tahun 2005-2006. Penugasan Khusus: Anggota Komite Nominasi dan Remunerasi Keahlian: Keuangan, Manajemen Risiko Penugasan Khusus: Ketua Komite Nominasi dan Remunerasi Milan R. Shuster Gan Chee Yen Komisaris Independen Komisaris Milan Robert Shuster, PhD menjabat sebagai Komisaris sejak tahun Gan Chee Yen menjabat sebagai Komisaris sejak tahun 2003. -

Laporan Pelaksanaan Tata Kelola Terintegrasi Integrated Corporate Governance Report Konglomerasi Keuangan Citibank N.A

LAPORAN PELAKSANAAN TATA KELOLA TERINTEGRASI INTEGRATED CORPORATE GOVERNANCE REPORT KONGLOMERASI KEUANGAN CITIBANK N.A. DI INDONESIA FINANCIAL CONGLOMERATION CITIBANK N.A. IN INDONESIA 31 December 2015 INTEGRATED CORPORATE GOVERNANCE TATA KELOLA PERUSAHAAN TERINTEGRASI In the framework to improve the performance Dalam rangka meningkatkan kinerja of Financial Conglomeration and improve the Konglomerasi Keuangan dan meningkatkan compliance towards the laws and regulations kepatuhan terhadap peraturan perundang- as well as the ethical values that are undangan serta nilai-nilai etika yang berlaku applicable in the financial services industry, pada industri jasa keuangan, Konglomerasi Financial Conglomeration shall perform its Keuangan wajib melaksanakan kegiatan business activities based on good Integrated usaha dengan berpedoman pada prinsip Tata Good Corporate Governance principles. Kelola Terintegrasi yang baik. Citibank N.A. Financial Conglomeration in Konglomerasi Keuangan Citibank N.A. di Indonesia consists of Citibank N.A., Indonesia terdiri dari Citibank N.A., Indonesia Indonesia as the Main Entity and PT sebagai Entitas Utama dan PT Citigroup Citigroup Securities Indonesia as the Securities Indonesia sebagi anggota. member. Citibank N.A., Indonesia is established Citibank N.A., Indonesia berdiri berdasarkan pursuant to the Minister of Finance Letter No. Surat Menteri Keuangan No. D.15.6.1.4.23 D.15.6.1.4.23 dated June 14, 1968 to conduct tanggal 14 Juni 1968 untuk commercial bank and foreign exchange menyelenggarakan kegiatan bank umum dan activities. Main activity of Citibank N.A., aktivitas devisa. Aktivitas utama dari Citibank Indonesia is includes Corporate and N.A., Indonesia meliputi aktifitas Corporate Consumer Bank. dan Consumer Bank. PT Citigroup Securities Indonesia has been PT Citigroup Securities Indonesia yang berdiri established since July 3, 1989 owned by sejak 3 Juli 1989 dimiliki oleh Citibank Citibank Overseas Investment Corporation Overseas Investment Corporation (COIC) dan (COIC) and local partner. -

Citi Indonesia Named As “Digital Bank of the Year in Indonesia”

Press Release For Immediate Distribution Citi Indonesia Named as “Digital Bank of the Year in Indonesia” by The Asset Citi also wins Digital Bank of the Year in the Asia Pacific regional level as well as in 6 other countries Jakarta, March 9, 2020 - Citi Indonesia was recently awarded as “Digital Bank of the Year” for the third consecutive year by The Asset Magazine, during its annual Triple A Digital Awards. The event recognizes financial institutions and technology firms that have excelled in innovating and developing a unique digital experience for customers across the Asia-Pacific and Middle East regions. “This award underlines our commitment as a global bank that continues to provide innovative digital banking services and products to facilitate the needs of our customers,” said Head of Consumer Banking Citi Indonesia Cristina Teh Tan. Beside Indonesia, Citi was also named as Digital Bank of The Year in Asia Pacific regional level as well as in 6 other countries, namely Hong Kong, Malaysia, South Korea, Thailand, Bahrain and the UAE (United Arab Emirates). Citi Asia Pacific and EMEA Consumer Banking Head Gonzalo Luchetti said, “We are honored to be named Asia Pacific’s leading digital bank, recognizing that the advancement we are making in digital banking is leading to customer-led growth. Technology is enabling us to design and create superior and best-in-class experiences, an area we continue to be intensely focused on. Beyond introducing innovative products and services, we want to make banking simple, intuitive and increasingly personalized and we remain committed to delivering these experiences through our digital and mobile platforms and through our expanded network of digital partnerships in the region.” In Indonesia, the Consumer Banking business has transformed into a simpler, faster and far more digital model. -

Reed May 01 Full

LETTERS Reed welcomes letters from readers found on page 50. The grinding wheel from kindergarten to fifth grade, concerning the contents of the left Reed for parts unknown many and everybody knows exactly where magazine or the college.Letters years ago.] they are and where they’re going. must be signed and may be edited The most enthusiastic prosely- for clarity and space.Our email IS SUCCESS FOR ALL tizers of SFA are invariably teachers address is [email protected]. A SUCCESS ? who didn’t know anything about Reed is now on line.Visit the elec- best practices in the teaching of tronic version of this publication at From Io McNaughton ’90 reading or cooperative learning http://web.reed.edu/ community/ How ironic that the very same pro- before coming across the program. newsandpub/reedmag /index.html. gram that drove me away from the And in my experience, SFA is teaching profession was invented driving the most thoughtful, by two Reedlings. experienced, creative teachers THE DOYLE OWL IN THE FIFTIES Slavin and Madden’s Success For away from the schools that need All has indeed been a lifesaver for them most. Success For All is an From David Lapham ’60 many troubled schools, but not easy way out for districts that In the summer of 1950 I had been because of any particular charac- don’t want to train and pay their a Reed student for two years. I was teristic of the program itself. teachers to use their own smarts living in a two-room apartment Instead, the program’s success has and initiative to develop their with Gary Snyder. -

Oklahoma Property Developer Sent to Prison for Money Laundering - 29 December 2011

Oklahoma property developer sent to prison for money laundering - 29 December 2011 Derek Swann, a property developer in Oklahoma, has been sentenced to 40 months in prison for money laundering. Swann and his business partner Giovanni Stinson used false information to solicit investors for “The Falls”, their proposed commercial and residential development. According to the prosecution: “From 2006 to 2008, individuals invested more than US$5 million [about £3.2 million] into The Falls based on promises made by Swann. Swann then used investors’ monies for reasons different from what he told them: rather than paying for engineering, architectural or infrastructure costs... Swann used the investments for personal expenses and repayment of earlier investors.” Among the personal expenses cited, Swann and Stinson paid for golf and meals at the Oklahoma City Golf Club and leased BMW cars. The Falls was never completed. In February 2011, Swann admitted misusing some of the $255,000 put into the project by a Texan investor, and has been ordered to pay more than $4.3 million in restitution to more than two dozen investors. Stinson is awaiting sentencing after pleading guilty earlier this year to conspiracy to commit securities fraud. Back to top of page Australian executive to be extradited to the UK to face charges of corruption and money laundering - 29 December 2011 Bruce Hall, an Australian former aluminium executive, will be extradited to the UK to face charges of corruption and money laundering charges related to Alcoa’s sale of Australian alumina to Bahrain. Hall was arrested at his home in New South Wales on 20 October 2011 as part of an investigation by the Serious Fraud Office into millions of dollars allegedly paid by Alcoa to gain aluminium contracts. -

Citi Indonesia Named As Best International Bank in Indonesia from Asiamoney Magazine

Press Release For Immediate Distribution Citi Indonesia Named as Best International Bank in Indonesia from Asiamoney Magazine Citi also named as Best Bank overall for Advising Chinese Institutions on the Belt and Road Initiative (BRI) from Asiamoney Jakarta, 30 October 2019 - Citi Indonesia (Citibank) has been named as “Best International Bank in Indonesia” from prestigious publication, Asiamoney, during its Best Bank Awards 2019. Held annually, the award aims to identify banks in six markets in Asia-Pacific, which have excelled across a range of core banking activities over the past 12 months. Award decisions were made by a team of senior journalists, chaired by Euromoney’s editor, in conjunction with research into the banking and capital markets by the magazine’s editorial committee. Judging criterias were based on several factors, namely: the bank’s retail and credit card banking operations; services such as cash management, trade finance and foreign exchange; and capital market businesses and M&A/advisory mandates. Commenting on the award, Citi Indonesia’s Chief Executive Officer Batara Sianturi said, “We are honored to be acknowledged by Asiamoney as the Best International Bank in Indonesia. This award encapsulates our strong commitment to deliver innovative products and solutions to our customers for both Corporate and Consumer Banking businesses. The awards also reflects our passion to be the best for our clients in Indonesia.” With its mission of enabling growth and economic progress, Citi Indonesia offers integrated technology, products and customized solutions in financial services for clients and customers in Indonesia. On its official website, Asiamoney stated that Citi is one of the few international banks in the Southeast Asian country to cover corporate and investment, commercial and consumer banking. -

Citi Named Asia's Best Bank for Transaction Services by Euromoney

Press Release For Immediate Distribution Citi Named Asia’s Best Bank for Transaction Services by Euromoney Hong Kong, July 23, 2019 - Citi’s Asia franchise was recently recognized as the region’s Best Bank for Transaction Services by Euromoney in its 2019 Awards for Excellence program. Held annually, Euromoney’s Awards for Excellence program is regarded as one of the most prestigious award programs in the financial services industry. As Asia’s Best Bank for Transaction Services. “Citi continues to grow from an already high base, achieving a 10% jump in year-on-year Asia Pacific TTS revenues to US$2.17 billion in 2018, and a 15% climb in income,” Euromoney said. The publication noted the business’ digital shift, citing growth in TTS’ digital client segment, focus on innovation internally as well as through client co-creation and fintech partnerships, and the launch of new digital and leading capabilities. “Citi has always been among the leading contenders, but it impressed in our review period for a willingness to disrupt. It launched a new ecosystem origination strategy, allowing it to connect the dots between its customers and their broader commercial periphery and to position itself accordingly,” the publication added. In addition to Best Bank for Transaction Services, Citi’s franchise in the region was also named Asia’s Best Digital Bank. The award recognized the digital progress the bank has made across the Global Consumer Banking business and Institutional Clients Group, including Treasury and Trade Solutions. Commenting on the wins, Asia Pacific Head of Treasury and Trade Solutions, Rajesh Mehta, said, “We aspire to be the financial ecosystem for the digital economy and digitization is key to making this possible. -

Citi Announces New Five-Year Support for Various Climate Solutions

PRESS RELEASE FOR IMMEDIATE DISTRIBUTION Citi Announces New Five-Year Support for Various Climate Solutions US$250 Billion Environmental Finance Goal greatly exceeds previous goal in amount and time Climate risk analysis expected to deepen alongside client engagement Citi to be 100 percent powered by renewable electricity by the end of 2020 Citi to further support clients on their Asia Pacific sustainable financing needs Hong Kong / Singapore - Citi has announced its new five-year 2025 Sustainable Progress Strategy to help accelerate the transition to a low-carbon economy. This new strategy includes a US$250 Billion Environmental Finance Goal to finance and facilitate climate solutions globally. This builds on Citi’s previous US$100 billion goal announced in 2015 and completed last year, more than four years ahead of schedule. “If there’s one lesson to be learned from the COVID-19 pandemic it is that our economic and physical health and resilience, our environment and our social stability are inextricably linked,” said Peter Babej, Asia Pacific CEO. “ESG has been front and center in Citi’s response to the health crisis, and evermore present in conversations with clients and communities across Asia Pacific. With the $250 billion global goal, we want to be a leading bank in driving the transition to a low-carbon economy. Asia Pacific has a key role to play and we anticipate further acceleration in the region as businesses of all kinds shift to a more sustainable future,” said Babej. This new strategy, integrated into Citi’s Environmental and Social Policy Framework, will focus on three key areas over the next five years: • Low-Carbon Transition: Citi aims to finance and facilitate an additional US$250 billion in low- carbon solutions, in addition to the US$164 billion the bank counted toward its US$100 Billion Environmental Finance Goal (2014-2019).