Citigroup 2002 Proxy Statement

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

China's 2020 Vision for Global Fund Managers

Markets and Securities Services | China’s 2020 vision for global fund managers 1 CHINA’S 2020 VISION FOR GLOBAL FUND MANAGERS Around 25 years ago, the authorities in China began to develop their capital markets ambitions. Stock exchanges were opened in Shanghai and Shenzhen. Members of the general public were allowed to buy stocks and shares on the market, albeit their choices at the time were limited to mainly (former) State-Owned Enterprises (SOEs). Talks also began for allowing the creation of mutual funds and the setting-up of fund management companies. Few would have believed, at the time, that by In July 2019, it was announced that the date for 2019 China’s stock markets in aggregate would 100% foreign ownership of fund management become one of the top-three largest in the companies would be brought forward to world by size and the largest by trading volume. sometime in 2020, and in October 2019 it was The aggregate scale of the assets managed in confirmed this would apply from April 2020. mutual funds, wealth management products and These announcements confirmed that non- other schemes made available to citizens now Chinese firms could own 100% of a Mainland exceeds approximately USD20 trillion. Chinese fund management company, allowing unrestricted access to offer investment services There’s a fantastic success story to be told. Yet and products to the retail market. for the most part, many of the top prizes to date have been reserved for domestic businesses in During the last three years, Chinese regulators China. Foreign firms, i.e. -

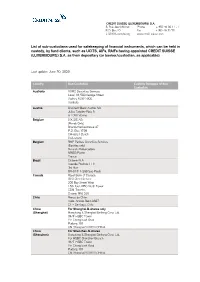

List of Sub-Custodians Used for Safekeeping of Financial Instruments

CREDIT SUISSE (LUXEMBOURG) S.A. 5, Rue Jean Monnet Phone + 352 46 00 11 - 1 P.O. Box 40 Fax + 352 46 32 70 L-2010 Luxembourg www.credit-suisse.com List of sub-custodians used for safekeeping of financial instruments, which can be held in custody, by fund clients, such as UCITS, AIFs, RAIFs having appointed CREDIT SUISSE (LUXEMBOURG) S.A. as their depositary (or banker/custodian, as applicable) Last update: June 30, 2020 Country Sub-Custodian Custody Delegate of Sub- Custodian Australia HSBC Securities Services Level 13, 580 George Street Sydney NSW 2000 Australia Austria UniCredit Bank Austria AG Julius Tandler-Platz 3 A-1090 Vienna Belgium SIX SIS AG (Bonds Only) Brandschenkestrasse 47 P.O. Box 1758 CH-8021 Zurich Switzerland Belgium BNP Paribas Securities Services (Equities only) 9 rue du Débarcadère 93500 Pantin France Brazil Citibank N.A. Avenida Paulista 1111 3rd floor BR-01311-290 Sao Paulo Canada Royal Bank of Canada GSS Client Service 200 Bay Street West 15th floor, RBC North Tower CDN-Toronto, Ontario M5J 2J5 Chile Banco de Chile Avda. Andrés Bello 2687 CL – Santiago, Chile China For Shanghai-B-shares only (Shanghai) Hongkong & Shanghai Banking Corp. Ltd. 34/F HSBC Tower Yin Cheng East Road Pudong 101 CN-Shanghai 200120 CHINA China For Shenzhen-B-shares (Shenzhen) Hongkong & Shanghai Banking Corp. Ltd. For HSBC Shenzhen Branch 34/F HSBC Tower Yin Cheng East Road Pudong 101 CN-Shanghai 200120 CHINA Colombia Cititrust Colombia S.A. Sociedad Fiduciaria Carrera 9A No. 99-02 First Floor Santa Fé de Bogotá D.C. -

Banking Type Feature Summary

Banking Type Feature Summary Citi Plus Citibanking Citi Priority Citigold Citigold Private Client Local Clients Relationship Balance No minimum balance No minimum balance To maintain the “Average Daily To maintain the “Average Daily To maintain the “Average Daily Requirement requirements. requirements. Combined Balance”1 of Combined Balance”1 of Combined Balance”1 of HK$500,000 or above. HK$1,500,000 or above. HK$8,000,000 or above. Monthly Service Fee No monthly service fee. No monthly service fee. No monthly service fee. HK$300 applied if the “Average HK$300 applied if the “Average Daily Combined Balance” falls Daily Combined Balance” falls below HK$1,500,000 for 3 below HK$1,500,000 for 3 consecutive months2. consecutive months2. International Personal Banking Clients3 Relationship Balance Not applicable to this banking Not applicable to this banking Not applicable to this banking To maintain the “Average Daily To maintain the “Average Daily Requirement type. type. type. Combined Balance”1 of Combined Balance”1 of HK$1,500,000 or above. HK$8,000,000 or above. Monthly Service Fee Not applicable to this banking HK$400 applied to all clients, HK$400 applied to all clients, HK$500 applied if the “Average HK$500 applied if the “Average type. irrespective of the clients' irrespective of the clients' Daily Combined Balance” falls Daily Combined Balance” falls “Average Daily Combined “Average Daily Combined below HK$1,500,000 for 3 below HK$1,500,000 for 3 Balance”4. Balance”4. consecutive months2. consecutive months2. All Clients Account Features - Enjoy Citi Interest Booster5 - Integrated banking services - Integrated banking services - Integrated banking services - Integrated banking services (an interest-bearing checking include saving and checking include saving and checking include saving and checking include saving and checking account) that you can boost the services. -

Fatca Consent Macau English.Pdf

March 15, 2016 Letter of Citibank N.A. Macau Branch Dear Valued Customer, Re: Acceptance of New Account Terms and Request for IRS Tax Forms for all Existing Citi Accounts and Services in Macau This letter is accompanied by a copy of the Master Account and Service Terms (“MAST”), which includes the Confidentiality and Data Privacy Conditions (“CDPC”) and the Macau Local Conditions. The Customer should read these documents and have an authorized person(s) sign and return 1) the enclosed Acceptance Form and 2) a valid IRS Tax Form (where necessary) to the Account Services Unit at either address below not later than June 30, 2016. Account Services Unit Account Services Unit Unit A, 15th Floor, 13/F, Harbourfront II Macau Square 22 Tak Fung Street 43-53A Avenida do Infante D. Henrique Hunghom, Kowloon Macau or Hong Kong The signed Acceptance Form and your continued use of your Account(s) and Services will be deemed to be your agreement to the new account terms. Application and Acceptance of New Account Terms Effective August 25, 2014, Citibank, N.A. Macau Branch (“Citi”) has applied the MAST, CDPC and the Macau Local Conditions as the new terms and conditions for all new Treasury and Trade Solutions (“TTS”) Accounts and Services in Macau, replacing our previous bank account agreement, the General Account Conditions (“GAC”). The foregoing step was made in light of the changes that have happened over the years to the environment within which Citi operates and our experience with customers using the GAC. The MAST is reworded for greater clarity, and updated to reflect legal, regulatory and technological changes in recent years. -

Citigroup Inc. 399 Park Avenue New York, NY 10043 March 11, 2003

Citigroup Inc. 399 Park Avenue New York, NY 10043 March 11, 2003 Dear Stockholder: We cordially invite you to attend Citigroup’s annual stockholders’ meeting. The meeting will be held on Tuesday, April 15, 2003, at 9AM at Carnegie Hall, 154 West 57th Street in New York City. The entrance to Carnegie Hall is on West 57th Street just east of Seventh Avenue. At the meeting, stockholders will vote on a number of important matters. Please take the time to carefully read each of the proposals described in the attached proxy statement. Thank you for your support of Citigroup. Sincerely, Sanford I. Weill Chairman of the Board and Chief Executive Officer This proxy statement and the accompanying proxy card are being mailed to Citigroup stockholders beginning about March 11, 2003. Citigroup Inc. 399 Park Avenue New York, NY 10043 Notice of Annual Meeting of Stockholders Dear Stockholder: Citigroup’s annual stockholders’ meeting will be held on Tuesday, April 15, 2003, at 9AM at Carnegie Hall, 154 West 57th Street in New York City. The entrance to Carnegie Hall is on West 57th Street just east of Seventh Avenue. You will need an admission ticket or proof of ownership of Citigroup stock to enter the meeting. At the meeting, stockholders will be asked to ᭟ elect directors, ᭟ ratify the selection of Citigroup’s independent auditors for 2003, ᭟ act on certain stockholder proposals, and ᭟ consider any other business properly brought before the meeting. The close of business on February 27, 2003, is the record date for determining stockholders entitled to vote at the annual meeting. -

Factsheetchina EN 01

Fact Sheet Citi China WHO WE ARE Citi Inc. (NYSE: C) Citi is a leading global bank in China. We first opened our doors here in 1902, and became one of the first international banks to establish an incorporated entity in 2007. Citi’s Global Coverage 6 continents Today, we bank close to 1,000 MNCs - including about 70% of Fortune 500 companies - More than 160 countries over 350 local corporates and over 2,300 emerging corporates and middle corporates. By and jurisdictions listed market cap, we bank 85% of the largest 20 companies in China. We also have 128 currencies dedicated China desks across the world supporting Chinese clients across our global 200 million customer accounts network. We raised over US$30 billion for Chinese clients in 2020 from global capital markets, CCCL Credit Rating: including in Hong Kong and New York. We serve our Chinese clients with around 6,000 AAA (S&P colleagues across 16 locations. China, 2020) Citi China remains resilient despite the impact of COVID-19. At the height of the outbreak in Citigroup Tower China, we supported our clients and processed 100% of our transactions on time while No.33 Hua Yuan Shi Qiao Road Lu Jia Zui Finance accelerating digitization. and Trade Zone Shanghai, 200120, QUICK FACTS P.R. China Tel: +86 21 2896 6000 • Citibank (China) Co., Ltd. (“CCCL”) (est. 2007) is 100% www.citi.com.cn owned by parent Citibank N. A. •The bank has a presence across 12 major Chinese cities, Press Contacts including Beijing, Shanghai, Guangzhou and Shenzhen, Marine Mao and lending companies in four other locations serving +86 21 2896 6366 rural counties and towns. -

What? How? Why?

CRE177 IGLB114909 0716 Rev. July 2016 WHAT DOES CITIBANK DO WITH FACTS YOUR PERSONAL INFORMATION? Why? Financial companies choose how they share your personal information. Federal law gives consumers the right to limit some but not all sharing. F:3.5” Federal law also requires us to tell you how we collect, share, and protect your personal information. Please read this notice carefully to understand what we do. What? The types of personal information we collect and share depend on the product or service you have with us. This information can include: n Social Security number and income n account balances and employment information n credit history and transaction history How? All financial companies need to share customers’ personal information to run their everyday business. In the section below, we list the reasons financial companies can share their customers’ personal information; the reasons Citibank chooses to share; and whether you can limit this sharing. Does Citibank Can you limit Reasons we can share your personal information share? this sharing? T:10.375” For our everyday business purposes — S:9.875” such as to process your transactions, maintain Yes No F:3.5” your account(s), respond to court orders and legal investigations, or report to credit bureaus For our marketing purposes — Yes No to offer our products and services to you For joint marketing with other financial companies Yes No For our affiliates’ everyday business purposes — Yes No information about your transactions and experiences For our affiliates’ everyday business purposes — Yes Yes information about your creditworthiness For our affiliates to market to you Yes Yes For our nonaffiliates to market to you Yes Yes To limit n Call 1-877-640-3983 — our menu will prompt you through your choice(s). -

Citigroup Inc. (Exact Name of Registrant As Specified in Its Charter)

UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 FORM 10-K ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2010 Commission file number 1-9924 Citigroup Inc. (Exact name of registrant as specified in its charter) Delaware 52-1568099 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification No.) 399 Park Avenue, New York, NY 10043 (Address of principal executive offices) (Zip code) Registrant’s telephone number, including area code: (212) 559-1000 Securities registered pursuant to Section 12(b) of the Act: See Exhibit 99.01 Securities registered pursuant to Section 12(g) of the Act: none Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes X No Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes X No Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. X Yes No Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files). -

The Weekly Globaliser

Citi Research The Weekly Globaliser US Election Special: Global Economic Implications Economics & Currencies | Strategy | Global Sector Highlights 10 Nov 2016 22:35:19 ET In this week’s special edition, we assess potential implications of the Trump Presidency across the markets in the US and around the world. Citi Global Research +44-20-7500-1400 Trump Wins – The Republican candidate Donald Trump won the 2016 US Presidential Election; Republicans retained their majority in the House of Editors Representatives and the Senate. US presidents have the greatest authority over Tatiana Voytekhovich foreign and security policy and trade. But with a single-political party government and a President-elect that ran his campaign mainly as an ‘outsider’, the scope for +61-2-8225-4118 potential policy changes under the next administration is unusually large. Multi-Asset US Implications – The new administration will likely pursue some fiscal Global loosening, deregulation in certain industries and, at a minimum, reassess the costs and benefits of further liberalization of international trade and investment. But the scale & nature of any fiscal boost or of changes to external trade and investment policy are uncertain at this stage and will depend in part on intra-party agreements about the size of (corporate) tax cuts and infrastructure spending. The combination of fiscal loosening, trade restrictions & anti-immigration policies could raise US inflation, increase the pace of Fed rate hikes and boost the dollar. Global Implications – US growth, US financial conditions and US-related uncertainties matter greatly for global growth: the US economy accounts for 24.7% of global GDP (at market exchange rates) and an eighth of world goods imports. -

Comunicado De Prensa 78-2016.Pdf

– – – – Evaluación Calificación Estatus Final De 80% a 100% Calidad Buena De 51% a 79% Calidad Regular Menor o igual a 50% Calidad Deficiente Instrumento No. de emisoras Verde Amarillo Rojo Acciones 137 124 5 8 Deuda a largo plazo 66 66 - - FIBRAs* 11 11 - - CKDs 55 55 - - Total 269 256 5 8 * Incluye un fideicomiso hipotecario. Nota: La calificación que obtuvo cada una de las emisoras evaluadas se detalla en el Anexo 1 de este comunicado. , Clave de Razón Social de la emisora (ACCIONES) Calificación Pizarra Accel, S.A.B. de C.V. ACCELSA 100 Alfa, S.A.B. de C.V. ALFA 100 Alpek, S.A.B. de C.V. ALPEK 100 América Móvil, S.A.B. de C.V. AMX 100 Arca Continental, S.A.B. de C.V. AC 100 Axtel, S.A.B. de C.V. AXTEL 100 Banregio Grupo Financiero, S.A.B. de C.V. GFREGIO 100 Bio Pappel, S.A.B. de CV PAPPEL 100 Bolsa Mexicana de Valores, S.A.B. de C.V. BOLSA 100 Casa de Bolsa Finamex, S.A.B. de C.V. (3) FINAMEX 100 Cemex, S.A.B. de C.V. CEMEX 100 CMR, S.A.B. de C.V. CMR 100 Coca-Cola FEMSA, S.A.B. de C.V. KOF 100 Compañia Minera Autlan, S.A.B. de C.V. AUTLAN 100 Consorcio Ara, S.A.B. de C.V. ARA 100 Consorcio Aristos, S.A.B. de C.V. ARISTOS 100 Controladora Vuela Compañía de Aviación, S.A.B. de C.V. VOLAR 100 Convertidora Industrial, S.A.B. -

Lehman Brothers

Lehman Brothers Lehman Brothers Holdings Inc. (Pink Sheets: LEHMQ, former NYSE ticker symbol LEH) (pronounced / ˈliːm ə n/ ) was a global financial services firm which, until declaring bankruptcy in 2008, participated in business in investment banking, equity and fixed-income sales, research and trading, investment management, private equity, and private banking. It was a primary dealer in the U.S. Treasury securities market. Its primary subsidiaries included Lehman Brothers Inc., Neuberger Berman Inc., Aurora Loan Services, Inc., SIB Mortgage Corporation, Lehman Brothers Bank, FSB, Eagle Energy Partners, and the Crossroads Group. The firm's worldwide headquarters were in New York City, with regional headquarters in London and Tokyo, as well as offices located throughout the world. On September 15, 2008, the firm filed for Chapter 11 bankruptcy protection following the massive exodus of most of its clients, drastic losses in its stock, and devaluation of its assets by credit rating agencies. The filing marked the largest bankruptcy in U.S. history.[2] The following day, the British bank Barclays announced its agreement to purchase, subject to regulatory approval, Lehman's North American investment-banking and trading divisions along with its New York headquarters building.[3][4] On September 20, 2008, a revised version of that agreement was approved by U.S. Bankruptcy Judge James M. Peck.[5] During the week of September 22, 2008, Nomura Holdings announced that it would acquire Lehman Brothers' franchise in the Asia Pacific region, including Japan, Hong Kong and Australia.[6] as well as, Lehman Brothers' investment banking and equities businesses in Europe and the Middle East. -

Blackstone Group L.P

BLACKSTONE GROUP L.P. FORM 10-K (Annual Report) Filed 03/12/08 for the Period Ending 12/31/07 Address 345 PARK AVENUE NEW YORK, NY 10154 Telephone 212 583 5000 CIK 0001393818 Symbol BX SIC Code 6282 - Investment Advice Industry Real Estate Operations Sector Services Fiscal Year 12/31 http://www.edgar-online.com © Copyright 2014, EDGAR Online, Inc. All Rights Reserved. Distribution and use of this document restricted under EDGAR Online, Inc. Terms of Use. Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 FORM 10-K (Mark One) ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED DECEMBER 31, 2007 OR TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM TO Commission File Number: 001-33551 The Blackstone Group L.P. (Exact name of Registrant as specified in its charter) Delaware 20 -8875684 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification No.) 345 Park Avenue New York, New York 10154 (Address of principal executive offices)(Zip Code) (212) 583-5000 (Registrant’s telephone number, including area code) Securities registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered Common units representing limited partner interests New York Stock Exchange Securities registered pursuant to Section 12(b) of the Act: None Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.