Justice Department Requires Divestitures in Unilever's

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Limits of Arbitrage: Evidence from Dual-Listed Companies

The Limits of Arbitrage: Evidence from Dual-Listed Companies Abe de Jong Erasmus University Rotterdam [email protected] Leonard Rosenthal Bentley College [email protected] Mathijs A. van Dijk Erasmus University Rotterdam [email protected] May 2003 Correspondence Mathijs A. van Dijk Department of Financial Management (Room F4-21) Erasmus University Rotterdam PO Box 1738 3000 DR Rotterdam THE NETHERLANDS Phone: +31 10 408 2748 Fax : +31 10 408 9017 The Limits of Arbitrage: Evidence from Dual-Listed Companies Abstract We study the limits of arbitrage in international equity markets by examining a sample of dual-listed companies (DLCs). DLCs are the result of a merger in which both companies remain incorporated independently. DLCs have structured corporate agreements that allocate current and future equity cash flows to the shareholders of the parent companies according to a fixed ratio. This implies that in integrated and efficient financial markets, the stock prices of the parent companies will move together perfectly. Therefore, DLCs offer a unique opportunity to study market efficiency and the roles of noise traders and arbitrageurs in equity markets. We examine all 13 known DLCs that currently exist or have existed. We show that for all DLCs large deviations from the theoretical price ratio occur. The difference between the relative price of a DLC and the theoretical ratio is often larger than 10 percent in absolute value and occasionally reaches levels of 20 to 50 percent. Moreover, deviations from parity vary considerably over time for all DLCs. We find that return differentials between the DLC parent companies can to a large extent be attributed to co-movement with domestic stock market indices, consistent with Froot and Dabora (1999). -

FTSE Factsheet

FTSE COMPANY REPORT Share price analysis relative to sector and index performance Data as at: 27 March 2020 Brand Architekts Group BAR Personal Goods — GBP 1.2 at close 27 March 2020 Absolute Relative to FTSE UK All-Share Sector Relative to FTSE UK All-Share Index PERFORMANCE 21-Apr-2015 1D WTD MTD YTD Absolute - - - - Rel.Sector - - - - Rel.Market - - - - VALUATION Data unavailable Trailing PE 8.1 EV/EBITDA 7.5 PB 1.1 PCF 3.8 Div Yield 3.9 Price/Sales 1.5 Net Debt/Equity 0.1 Div Payout 31.4 ROE 13.5 DESCRIPTION Data unavailable The principal activities of the is a market leader in the development, formulation, and supply of personal care and beauty products. See final page and http://www.londonstockexchange.com/prices-and-markets/stocks/services-stock/ftse-note.htm for further details. Past performance is no guarantee of future results. Please see the final page for important legal disclosures. 1 of 4 FTSE COMPANY REPORT: Brand Architekts Group 27 March 2020 Valuation Metrics Price to Earnings (PE) EV to EBITDA Price to Book (PB) 28-Feb-2020 28-Feb-2020 28-Feb-2020 80 25 6 70 5 20 60 4 50 15 +1SD +1SD +1SD 40 3 10 Avg 30 Avg Avg 2 20 5 -1SD 1 -1SD 10 -1SD 0 0 0 Mar-2015 Mar-2016 Mar-2017 Mar-2018 Mar-2019 Mar-2015 Mar-2016 Mar-2017 Mar-2018 Mar-2019 Mar-2015 Mar-2016 Mar-2017 Mar-2018 Mar-2019 PZ Cussons 29.7 Watches of Switzerland Group 14.6 Watches of Switzerland Group 10.3 Burberry Group 20.0 Unilever 11.2 Unilever 8.7 Personal Goods 19.5 Personal Goods 11.1 Personal Goods 7.9 Unilever 19.1 Burberry Group 10.7 Burberry Group 4.7 Brand -

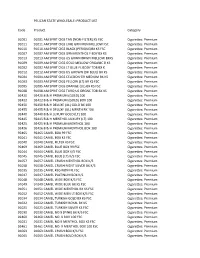

(NON-FILTER) KS FSC Cigarettes: Premiu

PELICAN STATE WHOLESALE: PRODUCT LIST Code Product Category 91001 91001 AM SPRIT CIGS TAN (NON‐FILTER) KS FSC Cigarettes: Premium 91011 91011 AM SPRIT CIGS LIME GRN MEN MELLOW FSC Cigarettes: Premium 91010 91010 AM SPRIT CIGS BLACK (PERIQUE)BX KS FSC Cigarettes: Premium 91007 91007 AM SPRIT CIGS GRN MENTHOL F BDY BX KS Cigarettes: Premium 91013 91013 AM SPRIT CIGS US GRWN BRWN MELLOW BXKS Cigarettes: Premium 91009 91009 AM SPRIT CIGS GOLD MELLOW ORGANIC B KS Cigarettes: Premium 91002 91002 AM SPRIT CIGS LT BLUE FL BODY TOB BX K Cigarettes: Premium 91012 91012 AM SPRIT CIGS US GROWN (DK BLUE) BX KS Cigarettes: Premium 91004 91004 AM SPRIT CIGS CELEDON GR MEDIUM BX KS Cigarettes: Premium 91003 91003 AM SPRIT CIGS YELLOW (LT) BX KS FSC Cigarettes: Premium 91005 91005 AM SPRIT CIGS ORANGE (UL) BX KS FSC Cigarettes: Premium 91008 91008 AM SPRIT CIGS TURQ US ORGNC TOB BX KS Cigarettes: Premium 92420 92420 B & H PREMIUM (GOLD) 100 Cigarettes: Premium 92422 92422 B & H PREMIUM (GOLD) BOX 100 Cigarettes: Premium 92450 92450 B & H DELUXE (UL) GOLD BX 100 Cigarettes: Premium 92455 92455 B & H DELUXE (UL) MENTH BX 100 Cigarettes: Premium 92440 92440 B & H LUXURY GOLD (LT) 100 Cigarettes: Premium 92445 92445 B & H MENTHOL LUXURY (LT) 100 Cigarettes: Premium 92425 92425 B & H PREMIUM MENTHOL 100 Cigarettes: Premium 92426 92426 B & H PREMIUM MENTHOL BOX 100 Cigarettes: Premium 92465 92465 CAMEL BOX 99 FSC Cigarettes: Premium 91041 91041 CAMEL BOX KS FSC Cigarettes: Premium 91040 91040 CAMEL FILTER KS FSC Cigarettes: Premium 92469 92469 CAMEL BLUE BOX -

Q2 2011 Full Announcement

2011 FIRST HALF YEAR RESULTS CONTINUING GOOD PROGRESS DESPITE DIFFICULT MARKETS First Half Highlights • Strong second quarter underlying sales growth 7.1%; first half underlying sales growth 5.7% comprising volume growth 2.2% and price growth 3.5%. • Turnover up 4.1% at €22.8 billion with a negative impact from foreign exchange of 1.6%. • Underlying operating margin down 20bps; impact of high input cost inflation mitigated by pricing and savings. Stepped-up continuous improvement programmes generated efficiencies in advertising and promotions and led to lower indirect costs. • Advertising and promotions expenditure, at around €3 billion, was higher than the second half of 2010 but down 150bps versus the exceptionally high prior year comparator. • Fully diluted earnings per share up 10% at €0.77. • Integration of Sara Lee brands largely complete and Alberto Culver progressing rapidly. The acquisition of the laundry business in Colombia completed. Chief Executive Officer “We are making encouraging progress in the transformation of Unilever to a sustainable growth company. In a tough and volatile environment we have again delivered strong growth. Volumes were robust and in line with the market, despite having taken price increases. This shows the strength of our brands and innovations. Our emerging markets business continues to deliver double digit growth. Performance in Western Europe was also strong in the second quarter so that the half year results reflect the true progress we have been making. Bigger and better innovation rolled out faster and moving our brands into white spaces continue to be the biggest drivers of growth. We are now striving to go further and faster still. -

Annex 1: Parker Review Survey Results As at 2 November 2020

Annex 1: Parker Review survey results as at 2 November 2020 The data included in this table is a representation of the survey results as at 2 November 2020, which were self-declared by the FTSE 100 companies. As at March 2021, a further seven FTSE 100 companies have appointed directors from a minority ethnic group, effective in the early months of this year. These companies have been identified through an * in the table below. 3 3 4 4 2 2 Company Company 1 1 (source: BoardEx) Met Not Met Did Not Submit Data Respond Not Did Met Not Met Did Not Submit Data Respond Not Did 1 Admiral Group PLC a 27 Hargreaves Lansdown PLC a 2 Anglo American PLC a 28 Hikma Pharmaceuticals PLC a 3 Antofagasta PLC a 29 HSBC Holdings PLC a InterContinental Hotels 30 a 4 AstraZeneca PLC a Group PLC 5 Avast PLC a 31 Intermediate Capital Group PLC a 6 Aveva PLC a 32 Intertek Group PLC a 7 B&M European Value Retail S.A. a 33 J Sainsbury PLC a 8 Barclays PLC a 34 Johnson Matthey PLC a 9 Barratt Developments PLC a 35 Kingfisher PLC a 10 Berkeley Group Holdings PLC a 36 Legal & General Group PLC a 11 BHP Group PLC a 37 Lloyds Banking Group PLC a 12 BP PLC a 38 Melrose Industries PLC a 13 British American Tobacco PLC a 39 Mondi PLC a 14 British Land Company PLC a 40 National Grid PLC a 15 BT Group PLC a 41 NatWest Group PLC a 16 Bunzl PLC a 42 Ocado Group PLC a 17 Burberry Group PLC a 43 Pearson PLC a 18 Coca-Cola HBC AG a 44 Pennon Group PLC a 19 Compass Group PLC a 45 Phoenix Group Holdings PLC a 20 Diageo PLC a 46 Polymetal International PLC a 21 Experian PLC a 47 -

Iodopropynyl Butylcarbamate

IODOPROPYNYL BUTYLCARBAMATE Your patch test result indicates that you have a contact allergy to iodopropynyl butylcarbamate. This contact allergy may cause your skin to react when it is exposed to this substance although it may take several days for the symptoms to appear. Typical symptoms include redness, swelling, itching, and fluid-filled blisters. Where is iodopropynyl butylcarbamate found? This substance is used in the cosmetic industry as a preservative. Additionally, iodopropynyl butylcarbamate is used as a fungicide and bactericide for wood and paint preservation. How can you avoid contact with iodopropynyl butylcarbamate? Avoid products that list any of the following names in the ingredients: • 3-Iodo-2-propynyl butylcarbamate • Troysan polyphase anti-mildew • CAS RN: 55406-53-6 • Woodlife What are some products that may contain iodopropynyl butylcarbamate? Bar Soaps: Household Products: • Aveeno Acne Treatment Bar • Bug Geta Plus Snail, Slug & Insect Killer • Aveeno Balancing Bar for Combination Skin • Duron Ultra Deluxe Exterior Acrylic Latex Flat, • Aveeno Moisturizing Bar for Dry Skin Accent Base • Duron Ultra Deluxe Exterior Acrylic Latex Flat, Deep Base Body Washes: • Duron Ultra Deluxe Exterior Acrylic Latex Flat, • Dove Sensitive Skin Moisturizing Body Wash, New High Hiding White • Herbal Essence Body Wash (Dry Skin and Normal) • Duron Ultra Deluxe Exterior Acrylic Latex Flat, • Herbal Essence Fruit Fusions Moisturizing Body Wash Intermediate Base • Herbal Essence Ultra Rich Moisturizing Body Wash • Duron Ultra Deluxe -

Sustainability Overview Oddo BHF – Environment Forum Paris June 8, 2017 Step Change in Growth and Long-Term Value Creation

Sustainability overview Oddo BHF – Environment Forum Paris June 8, 2017 Step change in growth and long-term value creation AkzoNobel Bullets Only use the List Level buttons to apply the AkzoNobel Branded Bullets Sustainability overview June 2017 2 Step change in growth Title area max over 2 lines and long-term value creation Accelerating growth momentum and enhanced profitability Creating two focused businesses as a logical next step Clear separation within 12 months Increasing returns to shareholders Committed to investing in sustainability, innovation and society Best placed to unlock value ourselves Insert Topic Icons Click on the picture icon and browse to the location of the Topic Icons Sustainability overview June 2017 3 Accelerating growth momentum Title area max over 2 lines and enhanced profitability Paints and Coatings Specialty Chemicals 2016-2018 2016-2018 guidance* 2020 guidance* guidance* 2020 guidance* ROS 10-12% ROS 15% ROS 11.5-13% ROS 16% ROI >18% ROI >25% ROI >16% ROI >20% Clear aim to grow faster than relevant markets 2020 guidance for AkzoNobel (current portfolio) ROS 14% and ROI >20% Insert Topic Icons Click on the picture icon * Excluding unallocated corporate center costs and invested capital; assumes no significant market disruption and browse to the location of the Topic Icons Sustainability overview June 2017 4 Strong culture to support a step change Title area max over 2 lines in growth and value creation Top quartile safety performance Our Code of Conduct: Engagement increasing for six years running Insert -

Case Study: Unilever1

CASE STUDY: UNILEVER1 1. Introduction Unilever is a British-Dutch company that operates in the market of consumer goods and sells its products in around 190 countries. Another remarkable fact is that they own more than 400 brands, what means an important diversification in both risk and the products they sell, among which there is food, personal care products and cleaning agents. In fact, twelve of these brands have sales of more than a billion euros. The importance of this multinational is reflected too in the fact 2.5 billion people use Unilever products every day, being part of their daily life. They also are responsible for the employment of 161,000 people in the different countries they operate. Finally, they believe in a sustainable business plan in which they reduce the environmental footprint and increase their positive social impact at the time they keep growing. 2. History Unilever was officially formed in 1929 by the merger of a margarine Dutch company and a British soapmaker. The margarine company of Netherlands was also a merger between the first margarine factory called in the world and another factory of the same product and from the same city, Oss, in the Netherlands. The soapmaker company revolutionized the market because it helped to a more hygienic society and the manufacturing of the product was wrapped. The name of the company is a fusion between the Dutch firm called Margarine Unie and the British firm called Lever Brothers. What Unilever did, was to expand its market locations to the American Latin and Africa. Moreover they widened the product areas to new sectors such as particular food and chemical products. -

Chemicals Used in the Household

Supplementary Information An Approach for Prioritizing “Down-the-Drain” Chemicals Used in the Household The questionnaire: Please list up to 10 products you most frequently use in the bathroom and kitchen. These should be: • Cleaning products in the kitchen (such as dishwashing liquid, dishwasher powder, fabric conditioner, disinfectant) • Cleaning products in the bathroom (such as bleach, lime scale remover) • Personal care products (such as shampoo, hair conditioner, toothpaste, deodorant, cream soap, soap and body cream) Please identify the product, along with the brand and the exact name of the product. For each of these, please tick how often (daily, weekly or montly) and how much (0–10, 10–100 or >100 mL (or g)) of the product is used each day/week/month. Two examples are given below. Frequency Quantity Used Each Day/Week/Month Product Brand 0–10 mL 1–100 mL >100 mL Daily Weekly Monthly (or g) (or g) (or g) Dishwashing liquid FAIRY clean and fresh (apple and orchard) Toothpaste SENSODYNE Daily care 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. Int. J. Environ. Res. Public Health 2015, 12 S2 Table S1. The 26 different hand wash gels as reported by the respondents who used these products, in order of decreasing average use. Frequency Estimate of Use (mL) Average Use Brand Full Description Users Daily 0–10 10–100 >100 L·per-1·yr-1 Palmolive Milk and Honey 4 4 4 0.83 Simple Kind to Skin (Antibacterial) 3 3 1 2 0.62 Cien Water Lily and Lotus 2 2 2 0.42 Dove Beauty Cream Wash 2 2 2 0.42 (Cussons) Protect Plus Carex 2 2 1 1 0.23 (Antibacterial) Dettol -

Hindustan Unilever Limited Unilever House, B. D. Sawant Marg Chakala

Hindustan Unilever Limited Unilever House, B. D. Sawant Marg Chakala, Andheri East Mumbai 400 099 CIN : L15140MH1933PLC002030 Tel : +91 (22) 3983 0000 Web : www.hul.co.in [DATE] Name Dear ___, We are pleased to inform you that upon the recommendation of Nomination and Remuneration Committee, approval of the Board of Directors of Hindustan Unilever Limited (hereinafter referred to as HUL or the Company) and approval of Shareholders of the Company at the Annual General Meeting held on ___, you are being appointed as an Independant Director on the Board of the Company. The terms of your appointment shall be as follows: 1. Appointment 1.1 You have been appointed as a Non-Executive Independent Director on the Board of Directors of HUL with effect from ________ for a period of upto five years. The appointment shall be governed by the provisions of the Companies Act, 2013 and the Listing Regulations, 2015. The appointment is also subject to the maximum permissible Directorships that one can hold as per the provisions of the Companies Act, 2013 and the Listing Regulations, 2015. 1.2 The term ‘Independent Director’ should be construed as defined under the Companies Act, 2013 and the Listing Regulations, 2015. 1.3 The Company has adopted the provisions with respect to the appointment and tenure of Independent Directors which is consistent with the Companies Act, 2013 and the Listing Regulations, 2015. Accordingly, the Independent Directors will serve for not more than two terms of five years each on the Board of the Company. The disengagement earlier than five years will be in accordance with the provisions of the Companies Act, 2013 or on mutually agreed terms. -

Hindustan Unilever Limited

Hindustan Unilever Limited Shift to Biomass Fired Burners CASE STUDY Figure 1: Nashik Biomass Boiler Figure 2: Orai Burner for incorporation of Vegetable Oil Residue Summary Hindustan Unilever Limited (HUL) has more than 20 manufacturing sites, where fossil fuel is being used to generate steam and hot air for process heating. To minimize our dependence on conventional fossil fuels and reduce CO2 emissions, the company started focusing on renewable energy opportunities since 2009. Prior to this, only 5 of our sites had biogenic fuel firing. A long-term road map for conversion of major fuel consuming sites was drawn-up. Since then, the company has commissioned 10 biomass fired Boilers and Hot Air Generators in India. Presently, more than 60,000 T of biogenic fuel is utilized annually for our process heating. Objective of Intervention The objective of the case study is to demonstrate the impact of biomass-based fuel usage on CO2 reduction along deliverance of cost savings. Type of Intervention and Location The intervention is to increase the share of renewable energy in HUL’s overall energy consumption portfolio by maximizing utilization of biomass fired fuels and reducing dependence on fossil fuels. The Reinforcing India’s Commitment Page 1 sites of intervention are the following locations where biomass-fired burners have been installed post-2010. These include biomass fuel-based Hot Air Generators (HAG) and Boilers (BMB): Chiplun (HAG), Goa (BMB), Haldia (HAG), Haridwar (BMB), Hosur (BMB), Mysore (BMB), Nashik (BMB), Orai (BMB), and Rajpura (HAG and BMB). Description of Intervention Since 2009, we have invested more than INR 60 crores in installation of Biomass Fired Steam Boilers and Hot Air Generators. -

Product Catalog

2018 OUR PRODUCT LINE INCLUDES: • Automotive Merchandise • Beverages • Candy • Cigarettes • Cigars • Cleaning Supplies • Dry Groceries • General Merchandise • Health & Beauty Care • Hookah • Medicines • Smoking Accessories • Snacks • Store Supplies • Tobacco Since 1941, James J. Duffy Inc. has been servicing retailers in Eastern Massachusetts with quality candy and tobacco products at a first class level of service you will only find in a family business that has been in business for 4 generations. This past year we have been striving to upgrade our technology to better serve you, our business partners. We have upgraded computers, software, and have added online ordering. Our mission is to provide quality service at an affordable price to all of our customers. Our staff will conduct themselves at all times in a professional manner and assist our retailers where needed. We will strive to expand our product lines to make available the latest items. Our passion to succeed and improve can only be achieved by our customer’s success. TO PLACE AN ORDER OR CONTACT A DUFFY SALESPERSON: CALL 617-242-0094 FAX 617-242-0099 EMAIL [email protected] WEB www.jamesjduffy.com Page 2 • James J. Duffy Inc. • 617-242-0094 • 781-219-0000 • www.jamesjduffy.com INDEX 1. Candy .25 30. Deodorants 1. Novelties 30. Shaving 6. Gum 31. Oral Hygiene 7. Mints 31. Personal Care 7. Count Goods 32. Body Lotion 11. Cough Drops 32. Hair Products 11. Antacids 33. Body Care 11. Changemakers 33. Cleaning Supplies 12. Peg Bags 34. Detergents 13. King Size 35. Plastic Bags 14. Sathers 35. Paper Bags 14.