Group Presentation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2016 Annual Report PDF 12.3MB

Contents Message from the Chairman 02-03 Identity of MYTILINEOS Group 04-07 Annual Report Financial 2016 01 Message from the Chairman The world, as we knew it until today, has radically changed. Every day, the things we had been taking for granted are being overturned. The challenges we have to cope with keep increasing in complexity, evolving and changing, as the stable frameworks that had been in place for decades no longer apply. This was also evidenced by last year’s major political, social and economic developments, both in Greece and abroad, which changed the global landscape. In this new environment of a globalised economy, with political reversal following upon political reversal, our country is trying to find its balance and face the modern world’s challenges. To resolve pending issues and make changes where these needed to be made for years, so that it can enter a course of growth that will ultimately enable it to put in place the conditions for prosperity in the future. It is in this very same environment that MYTILINEOS Group has to operate. Faithful to the values and to the business strategy it has been following all these years, it continues tirelessly to create the conditions that will not only allow it to survive the economic crisis but will also strengthen its capabilities, establishing it as Greece’s new, major industrial player with international prospects. A model business that is driven by vision and is able to contribute its share (and more) to the effort to support the country's modernisation. A leading company which applies a unique and modern employment model, has an active social profile, adopts innovative investment and business growth mechanisms and enjoys international presence and recognition. -

Greek Energy Directory 2 0 1 6

) ENERGIA•gr Greek Energy Directory 2 0 1 6 t n e m Business The Oil Sector Natural Gas The Electricity SectorRenewable EnergyEnergy Sources Efficiency &The Co Genera2on Legal FrameworkResearch & DevelopDirectory TERNA ENERGY is a major player in the Renewable Energy Market and specifically in the development of Wind Parks, in Hydroelectric Projects, Solar Energy Plants as well as Waste to Energy and Biomass Projects, with presence in Greece, Europe and the USA. The total installed capacity of the Group accounts for 664 MW: 394 MW in Greece, 138 MW in the USA, 102 MW in Poland and 30 MW in Bulgaria, while 274 more MW are currently under development in Greece and abroad. Overall, the company operates, is constructing or has fully licensed 938 MW of RES installations in Europe and the USA. The company is targeting to reach almost 1,000 MW of RES projects in operation in all countries where it is active, over the following years. T A B L E O F C O N T E N T S Publisher’s Foreword 9 Preface by the Minister of Environment and Energy, Mr. PANOS SKOURLETIS M.P. 11 1. An introduction to Greece’s Energy Sector by COSTIS STAMBOLIS, Execu=ve Director, IENE and Managing Editor of Energia.gr 14 2. The Oil Sector Overview of Greece’s Oil Sector by COSTIS STAMBOLIS 40 Hellenic Petroleum, A Market Leader in SE Europe by GRIGORIS STERGIOULIS, CEO, HELPE 49 Hydrocarbon E &P sector: When the Vision Becomes a Reality by Professor SOFIA STAMATAKI, ex - Chairman, Hellenic Hydrocarbons Managements Company (ΕΔΕΥ) 53 A New Era for Greece’s Upstream Sector by MATHIOS RIGAS, CEO, Energean Oil & Gas 61 Greece’s Oil Retail Market by DIMITRIS MEZARTASOGLOU, Research Associate, IENE 67 3. -

Announcement

ANNOUNCEMENT FTSE Russell has conducted a detailed review of the operation of the FTSE-Med Index for the six-month period from November 2016 to April 2017, in accordance with the Ground Rules of Operation of the Index. Following the relevant assessment by FTSE Russell, the new composition of the Index for the next six months is announced here below in order to inform investors and market players. During the current review of the composition of the Index and in accordance with the Ground Rules, it is noted that the Index includes fifty-seven (57) companies from the Tel Aviv Stock Exchange, twenty-eight (28) companies from the Athens Stock Exchange and five (5) companies from the Cyprus Stock Exchange (CSE). During the next six months, the Index will comprise the following companies: Company Country 1 Teva Pharmaceutical ISR 2 Coca -Cola HBC AG GRC 3 Bank Hapoalim ISR 4 Bank Leumi ISR 5 Azrieli Group ISR 6 Israel Chemicals ISR 7 Elbit Systems ISR 8 Hellenic Telecommunications Organization S.A. GRC 9 Bezeq ISR 10 Nice Ltd ISR 11 Mizrahi Tefahot Bank Ltd. ISR 12 Frutarom ISR 13 Alpha Bank S.A. GRC 14 OPAP GRC 15 National Bank of Greece S.A. GRC 16 Israel Discount Bank ISR 17 Delek Group ISR 18 Melisron ISR 19 Jumbo S.A. GRC 20 Tower Semiconductor Ltd ISR 21 Gazit Globe (1982) Ltd ISR Co mpany Country 22 Titan Cement Co. S.A. GRC 23 Strauss Group ISR 24 Motor Oil Hellas Corinth Refineries S.A. GRC 25 Piraeus Bank S.A. -

«Mytilineos Holdings Sa»

Announcement for the availability of the Prospectus of «MYTILINEOS HOLDINGS SA» The company “MYTILINEOS HOLDINGS SA” (the “Company”) announces pursuant to Regulation (EC) 809/2004 of the Commission of the European Communities and law 3401/2005, as in force, that since 15.06.2017 makes available to the investors, the Prospectus, as approved by the meeting of board of directors of the Capital Markets Commission dated 15.06.2017, in relation to the issuance by the Company of a common bond loan (the “CBL”), of a total amount of up to €300,000,000, of a duration of five (5) years, divided into up to 300,000 dematerialized, common, bearer bonds, each of a nominal value of €1,000 (the “Bonds”), in accordance with the resolution of the Company’s board of directors dated 08.06.2017. The Bonds that will be issued, will be offered for subscription by investors by way of a public offer (the “Public Offer”), with use of the electronic book- building service (“E.BB”) of Athens Exchange and will be admitted for trading in the category of Fixed Income Securities of the Organized Market of the Athens Exchange (the “Athens Exchange”). Athens Exchange ascertained on 15.6.2017 the admission for trading in the category of Fixed Income Securities of the Organized Market of the Athens Exchange of up to 300,000 dematerialized, common, bearer bonds, under the condition of Capital Markets Commission’s approval of the Prospectus and the success of the Public Offer. The indicative timetable for completion of the Public Offer is as follows: INDICATIVE DATE EVENT 15.06.2017 Approval of the Prospectus by the Capital Markets Commission. -

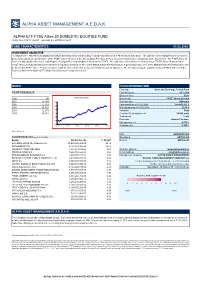

Alpha Asset Management Α.Ε.D.Α.Κ

ALPHA ASSET MANAGEMENT Α.Ε.D.Α.Κ. ALPHA ETF FTSE Athex 20 DOMESTIC EQUITIES FUND HCMC Rule 789/13.12.2007 Gov.Gaz. s.n. 2474/B/31.12.07 FUND CHARACTERISTICS 01.02.2008 INVESTMENT OBJECTIVE The Alpha ETF FTSE Athex 20 DOMESTIC EQUITIES FUND is the first Exchange Traded Fund listed on the Athens Stock Exchange. The objective of the Mutual Fund’s investment policy is to replicate the performance of the FTSE® Athex 20 Index of the Athens Stock Exchange in Euro, by mirror matching the composition of the Benchmark. The FTSE® Athex 20 Index is a big capitalization Index, capturing the 20 largest blue chip companies listed on the ATHEX. The total value of investments in shares of the FTSE® Athex 20 Index and in FTSE® Athex 20 Index derivatives accounts for a regulatory minimum of 95% of the Mutual Fund’s Net Asset Value. A percentage up to 35% of the Mutual Fund’s Net Asset Value may be invested in FTSE® Athex 20 Index derivatives with the aim of achieving the Mutual Fund’s investment objectives. The derivatives may be tradable (such as FTSE® Athex 20 Index futures) and/or non-tradable (OTC Swap Transactions) in a regulated market. INDEX FUND INFORMATION Fund type Domestic Exchange Traded Fund PERFORMANCE First listing date 24.1.2008 Base currency Euro Year (%) FTSE Athex 20 Index Benchmark FTSE® Athex 20 Index 2007 15,79% 3300 Currency risk Minimum 2006 17,73% Fund assets as of 01.02.2008 141.403.221 € 2800 2005 30,47% Net unit price as of 01.02.2008 23,40 € 2004 32,27% 2300 Valuation Daily 2003 35,43% 1800 Creation / Redemption unit 50.000 units 1300 Trading unit 1 unit Dividends Annual - 30 June 800 Management fee 0,275% 300 31/12/02 31/12/03 31/12/04 31/12/05 31/12/06 31/12/07 Custodian fee 0,100% Source: Bloomberg ISIN GRF000013000 COMPOSITION (as of 01.02.2008) Bloomberg AETF20 GA Equity Market Cap (€) % Weight Reuters AETF20.AT NATIONAL BANK OF GREECE S.A. -

Company Country

Company Country 1 Teva Pharmaceutical ISR 2 Coca-Cola HBC AG GRC 3 Bank Hapoalim ISR 4 Israel Chemicals ISR 5 Bank Leumi ISR 6 Bezeq ISR 7 Azrieli Group ISR 8 Hellenic Telecommunications Organization S.A. GRC 9 Nice Systems ISR 10 Elbit Systems ISR 11 OPAP GRC 12 Mizrahi Tefahot Bank Ltd. ISR 13 Delek Group ISR 14 Frutarom ISR 15 Osem Investments ISR 16 Israel Discount Bank ISR 17 Israel Corporation ISR 18 Hellenic Petroleum S.A. GRC 19 Gazit Globe (1982) Ltd ISR 20 BANK OF CYPRUS PUBLIC COMPANY LTD CYP 21 Titan Cement Co. S.A. GRC 22 Melisron ISR 23 Alpha Bank S.A. GRC 24 National Bank of Greece S.A. GRC 25 Paz Oil ISR 26 Strauss Group ISR 27 Folli Follie GRC 28 Motor Oil Hellas Corinth Refineries S.A. GRC 29 First Intl Bank of Israel (5) ISR 30 Public Power Corp. S.A. GRC 31 Jumbo S.A. GRC 32 Oil Refineries ISR 33 Alony Hetz Properties & Inv ISR 34 Tower Semiconductor Ltd ISR 35 Migdal Insurance & Financial Holdings Ltd. ISR 36 Grivalia Properties R.E.I.C GRC 37 Harel Investments & Finance ISR 38 Delek Automotive Systems ISR 39 Amot Investments Ltd. ISR 40 Clal Insurance ISR 41 Delta Galil Industries ISR 42 Shikun & Binui Ltd ISR 43 Airport City Ltd ISR 44 Kenon Holdings ISR 45 Athens Water Supply & Sewerage GRC 46 Ezchip Semiconductor ISR 47 Jerusalem Oil Exploration ISR 48 Phoenix Holdings ISR Company Country 49 IDI Insurance Company Ltd ISR 50 Cellcom Israel Ltd. ISR 51 Partner Communications ISR 52 VIOHALCO SA/NV (CB) GRC 53 Mytilineos Holdings S.A. -

Sustainability Report Sustainability Report 5-7 Patroklou Str

Sustainability Report Sustainability Report 5-7 Patroklou str. Maroussi, 151 25 Athens Tel.: +30 210 6877300 Fax: +30 210 6877400 www.mytilineos.gr Contents 1. Message from the Chairman 2 2. MYTILINEOS Group 4 3. Sustainability Report Parameters 6 4. Materiality analysis of sustainability issues 7 5. Strategy & Outlook 2016 12 6. Corporate Responsibility Overview 2015 14 7. Stakeholder Engagement 16 7.1 Engagement process 2015 17 Translating 7.2 Response to Stakeholders requests, as these were raised in the 2014 Engagement process 21 8. ENVIRONMENTAL PERFORMANCE 24 challenges into 8.1 Environmental compliance 26 8.2 Raw & Other Materials 26 opportunities, 8.3 Energy 29 8.4 Emissions 30 8.5 Management of solid and liquid waste 32 creating value for 8.6 Water 35 9. SOCIAL PERFORMANCE 36 society 9.1 Bolstering employment 38 9.2 Work Conditions 40 9.3 Management – Employee relations 41 9.4 Occupational Health & Safety 42 9.5 Employee Training & Development 45 9.6 Human Rights 47 9.7 Social Contribution 49 9.8 Strengthen Transparency 52 9.9 Product Quality and Safety 52 9.10 Customer satisfaction 54 9.11 Responsible communication and marketing 55 9.12 Supply Chain 55 10. CORPORATE GOVERNANCE 58 10.1 Statement of Corporate Governance 2015 60 10.2 Governance Structures 60 10.3 CSR Governance 64 10.4 Risk Management & Internal Control 65 11. UN Global Compact Communication on Progress (Advanced Level) 68 12. Compliance Table with GREEK SUSTAINABILITY CODE (Level A) 70 MYTILINEOS HOLDINGS SUSTAINABILITY REPORT 2015 1. Message from the Chairman Firmly focused on its strategic goal of “CONTINUOUS an annual basis, in order to further reduce our environmental RESPONSIBLE DEVELOPMENT”, MYTILINEOS Group has footprint, always in line with the relevant international standards. -

Motor Oil and the Mytilineos Group Conclude Major Deal in the Energy Sector

Press Release 3/11/2008 MOTOR OIL AND THE MYTILINEOS GROUP CONCLUDE MAJOR DEAL IN THE ENERGY SECTOR MYTILINEOS Holdings S.A. and ΜOTOR OIL (HELLAS) CORINTH REFINERIES S.A. announce the signature of a Joint Venture Agreement for the joint construction, operation and exploitation of a 395.9MW combined cycle, natural gas driven power station within the MOTOROIL facilities in Ag. Theodori, Corinthia. The agreement provides for the acquisition by MYTILINEOS Holdings S.A. of a 65% stake in KORINTHOS POWER S.A. , which currently holds the licences for the above plant, through a share capital increase, with MOTOR OIL S.A. retaining a 35% stake in the Company. The increase of the Company’s share capital will amount to 59.5 million Euro and will be fully subscribed by MYTILINEOS Holdings S.A. until the procedures for transferring it to Endesa Hellas S.A. are completed. As foreseen in the agreement, construction of the new combined-cycle station is scheduled to begin by January 2009 and will be undertaken by METKA S.A. , a subsidiary of MYTILINEOS Holdings S.A. According to the construction schedule, construction of the station will be finished in 30 months, i.e. by April 2011. The total investment will amount to 285 million Euro . The above participation of MYTILINEOS Holdings S.A. is expected to form part of the overall energy portfolio of Endesa Hellas S.A. , once the procedure for the contribution of the other energy assets from the former to the latter has been completed. The above agreement is subject to the approval of the Regulatory Authority for Energy (RAE) and of the Hellenic Competition Commission. -

Annual Report 2018

ANNUAL REPORT 2018 Message from the Chairman 2018 was another year of changes, domestically and globally. For the Greek Economy, the completion of the Third Economic Adjustment Program was a milestone, creating new opportunities and prospects for positive developments in the country. Despite the favorable forecasts, however, challenges remain for the next day to come, as 2019 is an election year. Internationally, major political events have led to the destabilization of several regions globally, which, together with the trade tensions between major economies, have strengthened the feeling of uncertainty. However, in this context, MYTILINEOS has managed, for yet another year, to cope with the challenges and achieve a positive economic performance. In the Metallurgy Business Unit, and in a year of unpredictable turns, the company successfully took advantage of the opportunities that rose from the imposition of US tariffs on the Russian industry. The rapid rise in the price of alumina, which negatively affected almost all aluminium producers, did not affect our company, demonstrating once again the advantage of the fully vertically integrated producer. Part of enhancing the metallurgical sector was the acquisition of 97.87% of EP.AL.ME. SA, a company that operates in the production, processing and trading of metals and especially aluminium alloys and derivative products. The particular investment increases the company’s presence in Greek and international markets, directly boosts its production and extends its activity by recycling aluminium scrap. At the same time, the basic engineering study for a new -game changer - Alumina production plant is rapidly proceeding at our Aghios Nikolaos premises. In the EPC Business Unit, the company continued its successful course undertaking a series of international energy construction projects, while METKA EGN announced some new investment partnerships expanding its activities both in existing and emerging markets. -

Delos Pet Ote Balanced Fund H.C.M.C

DELOS PET OTE BALANCED FUND H.C.M.C. Rule 3/261/26-7-2001 NBG Asset Management MFMC 103-105 Syngrou Avenue 117 45, Athens Greece Risk Profile Tel. +30 210 900 7400 Fax.+30 210 900 7499 www.nbgam.gr The investment objective of the Mutual Fund is the highest possible return, through income and the capital appreciation of its investments. The Mutual Fund invests mainly in a combination of equities, sovereign and corporate fixed income securities, money-market instruments, and derivative instruments. Report Date 31/03/2017 FUND INFORMATION PERFORMANCE MUTUAL FUND Currency EUR 3 Years Cumulative Return (31/03/2014- Fund Size (mm) 8,55 31/03/2017) Launch Date 7/11/2001 0% ISIN GRF000011004 -5% Bloomberg Code DELPOIB GA EQUITY -10% RETURNS -15% Ytd 1year 3year -20% (01/01/2017- (31/03/2016- (31/03/2014- -25% 31/03/2017) 31/03/2017) 31/03/2017) Mutual Fund 2,11% 9,68% -16,09% -30% Until 15/02/2017 the Mutual Fund used the following benchmark: 25% ATHEX Composite Share Price Index, 20% Dj Eurostoxx 50, 20% ΙΒΟΧΧ € CRP TR 1-3 15% Bloomberg/EFFAS Bond Indices Greece Govt All > 1 Yr TR, 20% EONIA Total Return Since 16/02/2017 the Mutual Fund does not use Benchmark. STATISTICAL DATA (3 years rolling) (31/03/2014-31/03/2017) ASSET ALLOCATION Fund Equity Sharpe Ratio -0,61 45,8% Annualised Standard Deviation 13,23% Equity Funds Maximum Monthly Return 6,73% 5,0% Minimum Monthly Return -7,41% Cash / Months with Positive Return 20 Equivalents Months with Negative Return 16 2,6% Top 10 Holdings Gov't Bonds Corporate 23,2% Bonds HELLENIC REPUBLIC 4 3/4 04/17/19 3,3% 23,4% NBGAM ETF ATHEX GEN DOM EQTY 3,1% GE CAPITAL EURO FUNDING 5 3/8 01/16/18 2,4% Bond Portfolio Characteristics TITAN GLOBAL FINANCE PLC 3 1/2 06/17/21 2,4% MOTOR OIL FINANCE PLC 5 1/8 05/15/19 2,4% Duration 4,89 MOTOR OIL FINANCE PLC 3 1/4 04/01/22 2,3% Yield to Maturity 4,50% ALPHA BANK AE 2,3% Years to Maturity 7,14 OPAP SA 2,0% Coupon 3,63% MOTOR OIL (HELLAS) SA 1,9% MYTILINEOS HOLDINGS S.A. -

Sustainability Report Continuous Effort Contents 1

Sustainability Report Continuous effort Contents 1. Message from the Chairman .............................................................................................. 4 for business progress, 2. MYTILINEOS Group ............................................................................................................... 6 3. Materiality analysis of sustainability issues ...................................................................... 8 evolution and 4. Strategy & Outlook 2017 ....................................................................................................... 10 5. Corporate Responsibility Overview 2016 .......................................................................... 12 responsible growth. 6. Stakeholder Engagement .................................................................................................... 14 6.1 Engagement process 2016 ......................................................................................... 16 6.2 Response to Stakeholders requests ......................................................................... 19 7. ENVIRONMENTAL PERFORMANCE ................................................................................... 22 7.1 Climate Change ............................................................................................................ 24 7.1.1 Emissions ......................................................................................................... 24 7.1.2 Energy ............................................................................................................... -

Mytilineos Holdings SA

Company Report N . C H R Y S S O CMytilineosHOIDIS HoldingsSTOCK SA B ROKERAGE Energy / Industrials Sector Greek Equity Research I N V E S T M E N T 11/4 SE/2019RVIC ES S.A. (Energy / Industrials Sector) Equity Research Department Mytilineos Holdings SA We reiterate Mytilineos Holdings SA fair estimated price to Date 11/4/2018 €14,00 per share, on the back of satisfactory FY2018a results, FAIR ESTIMATED PRICE: €14,00 / Share the confirmation by the management that 2019 will be a record year in terms of revenues and profitability, as well as Investment Thesis : UV the group’s growth prospects for the next 3 years. Stock Data Bloomberg Ticker MYTIL: GA Reuters Ticker MYTr.AT FY18a Performance at a Glance: Price 9,62 Low / High price 52w 7,53 / 10,03 Total Group revenues stood at €1,526mn, unchanged Market Cap (€mn) 1.375 compared to 2017. Enterprise Value (€mn) 1.938 Adjusted EBITDA of €290mn, against €298,9mn in 2017. Trailing P/E (x) 9,6 Net Income of €144,2mn from €145,8mn a year ago. Trailing EPS 1,01 Net Debt dropped significantly by €177,7mn, to DPS (Proposed) 0,36 €390,4mn from €568,1mn at year end 2017. Dividend Yield % 3,7% The management declares a dividend of €0,36 per share. Investment Thesis Mytilineos is expected to deliver strong growth in the coming years driven by the high selling prices of Aluminum/Alumina products, the efficient and low cost operation of its aluminum industrial complex, the execution of its international EPC backlog and the commercial launch of the new electricity power plant.