Boyd Gaming Corporation Annual Report 2019

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Ace of Adventures Hotel Pick up List

King of Canyons Hotel Pick Up List Hotel Name: Hotel Address: Pickup Location: Pickup Time: Alexis Park All Suites Resort 375 E Harmon Ave Outside - Main Entrance approximately 45 minutes before your selected departure time Aria Resort & Casino 3730 S Las Vegas Blvd Underground Tour Lobby approximately 0 minute before your selected departure time Arizona Charlie's Boulder 4575 Boulder Hwy Golden Nugget Las Vegas Hotel & Casino - approximately 1 hour 20 minutes Outside Tour Lobby on 1st Street before your selected departure time Arizona Charlie's Decatur 740 S Decatur Blvd Palace Station Hotel - Outside West Entrance approximately 1 hour 20 minutes before your selected departure time Artisan Hotel Boutique 1501 W Sahara Ave Outside - Main Entrance approximately 1 hour 5 minutes before your selected departure time Aviation Inn 5330 E Craig Rd Golden Nugget Las Vegas Hotel & Casino - approximately 1 hour 20 minutes Outside Tour Lobby on 1st Street before your selected departure time Bally's Las Vegas Hotel & Casino 3645 S Las Vegas Blvd Outside - North Tour Lobby approximately 1 hour 55 minutes before your selected departure time Four Points by Sheraton Las 4055 Palos Verdes St Silver 7 Hotel & Casino - Outside Main Entrance approximately 1 hour 55 minutes Vegas East Flamingo before your selected departure time Baymont by Wyndham Las Vegas 55 E. Robindale Rd Hilton Garden Inn Las Vegas Strip South - approximately 1 hour 35 minutes South Strip Outside Front Door before your selected departure time Bellagio Hotel and Casino 3600 S Las Vegas -

2021-25 Th Annual Report

Louisiana Gaming Control Board 25th Annual Report to the Louisiana State Legislature 2021 MISSION STATEMENT OF THE LOUISIANA GAMING CONTROL BOARD To regulate all gaming activities under its jurisdiction in a manner which instills public confidence and trust that gaming activities are conducted honestly and free from criminal and corruptive elements; to ensure the integrity of individual gaming activities by the regulation of persons, practices, associations and activities within the gaming industry. i TABLE OF CONTENTS LOUISIANA GAMING CONTROL BOARD MISSION STATEMENT ........................................................... i TABLE OF CONTENTS ........................................................................................................................................ ii CHAIRMAN’S LETTER ........................................................................................................................................ 1 ATTORNEY GENERAL’S GAMING DIVISION AND LOUISIANA STATE POLICE PERSONNEL ...... 4 ACKNOWLEDGMENTS ....................................................................................................................................... 5 RIVERBOAT GAMING ......................................................................................................................................... 6 Riverboat Gaming Activity Summary ................................................................................................................ 7 Riverboat Gaming Licensees ............................................................................................................................. -

Some Nevada Casinos Still Closed, Some May Never Reopen by Dylan Svoboda Las Vegas Review-Journal June 15, 2021 - 7:13 Pm

Some Nevada casinos still closed, some may never reopen By Dylan Svoboda Las Vegas Review-Journal June 15, 2021 - 7:13 pm Despite the state’s full reopening on June 1, several Nevada casinos remain closed. Some won’t reopen for at least another year. Others have closed their doors for good. As of June 1, Gov. Steve Sisolak gave Nevada the green light to remove capacity limits and social distancing requirements. Las Vegas casinos had been operating under capacity restrictions since reopening last summer. But even as masks come off, doctors administer hundreds more vaccines a day and tourists come from across the world, some gaming houses are still getting their bearings. Off the Strip, Boyd Gaming Corp.’s Main Street Station and Eastside Cannery remain shuttered. Both properties have been closed since March 2020. Last year, Boyd Gaming executives said that Main Street Station would open sometime this year. Spokesman David Strow said the company could not comment on recent business trends as it was nearing next month’s quarterly earnings report. In March, Strow told the Review-Journal that the reopenings will depend on business volumes. During an earnings call in April, CEO Keith Smith said that “as COVID vaccinations continue to roll out and restrictions lift, (the company) expect(s) visitation among our rated destination customers to improve.” Others will stay closed for another six months to a year, possibly more. This month, Station Casinos’ Texas Station and Fiesta Rancho casinos placed their “non-restricted gaming, non-restricted gaming liquor and full liquor off- sale business licenses” on hold for the second year in a row — through June 4, 2022 — citing the state’s “uncertain economic conditions.” The licenses can be placed on hold for a maximum of two consecutive years. -

Kansas Star.Pdf

Table of Contents Vision …………………………………………………………………………………….. 3 Key Parties & Gaming Management Experience..…………………….………………….. 4 Management Profiles …………………………………………………………………….. 7 Proposed Project ……………………………..………………………………………………….. 9 Infrastructure Improvements …………………………………………………………………… 18 Site Utilities ……………………………………………………………………………… 19 Emergency Services Facility ……………………………………………………………... 20 Project Budget …………………………………………………………..……………………….. 21 Project Financing ………………………………………………………………………… 22 Benefit to Sumner County ……………………………………………..…………….…… 23 Kansas All-Star Scholars Fund “Ad Astra” ………………………………………………….. 24 Summary ...……………………………………………………………………………….. 25 2 Vision Kansas Star Casino, Hotel, and Event Center will be a regional destination attraction, offering first-class gaming and non-gaming amenities, with experiences tailored specifically for the people of Sumner County, South Central Kansas, and the entire state. It has been designed with the customer in mind, to meet and even beat their expectations of Kansas fun, excitement, friendliness and value. The vision for the resort is to offer world-class gaming entertainment, fine dining, and Las Vegas-style entertainment combined with Midwestern friendliness and warmth. Along with gaming amenities that include 1,850 state-of-the-art gaming machines, 42 table games, and a 5 table poker room, our project will include a 115-seat steakhouse and cocktail bar; a 250-seat live action buffet, a 40-seat food court, a sports bar, and a casino bar offering live music and Las Vegas-style entertainment. -

Download Full Book

Vegas at Odds Kraft, James P. Published by Johns Hopkins University Press Kraft, James P. Vegas at Odds: Labor Conflict in a Leisure Economy, 1960–1985. Johns Hopkins University Press, 2010. Project MUSE. doi:10.1353/book.3451. https://muse.jhu.edu/. For additional information about this book https://muse.jhu.edu/book/3451 [ Access provided at 25 Sep 2021 14:41 GMT with no institutional affiliation ] This work is licensed under a Creative Commons Attribution 4.0 International License. Vegas at Odds studies in industry and society Philip B. Scranton, Series Editor Published with the assistance of the Hagley Museum and Library Vegas at Odds Labor Confl ict in a Leisure Economy, 1960– 1985 JAMES P. KRAFT The Johns Hopkins University Press Baltimore © 2010 The Johns Hopkins University Press All rights reserved. Published 2010 Printed in the United States of America on acid- free paper 2 4 6 8 9 7 5 3 1 The Johns Hopkins University Press 2715 North Charles Street Baltimore, Mary land 21218- 4363 www .press .jhu .edu Library of Congress Cataloging- in- Publication Data Kraft, James P. Vegas at odds : labor confl ict in a leisure economy, 1960– 1985 / James P. Kraft. p. cm.—(Studies in industry and society) Includes bibliographical references and index. ISBN- 13: 978- 0- 8018- 9357- 5 (hardcover : alk. paper) ISBN- 10: 0- 8018- 9357- 7 (hardcover : alk. paper) 1. Labor movement— Nevada—Las Vegas— History—20th century. 2. Labor— Nevada—Las Vegas— History—20th century. 3. Las Vegas (Nev.)— Economic conditions— 20th century. I. Title. HD8085.L373K73 2009 331.7'6179509793135—dc22 2009007043 A cata log record for this book is available from the British Library. -

03/06/18 State of Nevada Gaming Control Board Erfnrp 08:44 Am

03/06/18 STATE OF NEVADA GAMING CONTROL BOARD ERFNRP 08:44 AM 2017 DATA LISTING OF FINANCIAL STATEMENTS SQUARE FOOTAGE Pg 1 Statewide RACE & POKER LOCATION PIT GAMES SLOTS KENO BINGO SPORTS & PAN TOTAL ALAMO CASINO - LAS VEGAS TA 144 2,536 0 0 0 120 2,800 ALAMO CASINO - MILL CITY 0 4,100 0 0 0 0 4,100 ALAMO CASINO AT WELLS PETRO 0 5,000 0 0 0 0 5,000 ALAMO TRAVEL CENTER 1,400 5,550 0 0 0 200 7,150 ALIANTE CASINO + HOTEL 5,060 100,116 0 5,624 14,200 0 125,000 AQUARIUS CASINO RESORT 8,215 42,075 0 0 6,780 0 57,070 ARIA RESORT & CASINO 48,147 86,028 0 0 10,156 5,669 150,000 ARIZONA CHARLIE'S BOULDER 2,125 35,950 0 7,546 1,920 0 47,541 ARIZONA CHARLIE'S DECATUR 1,903 39,092 560 9,196 4,096 380 55,227 ATLANTIS CASINO RESORT 5,500 53,614 800 0 3,000 1,900 64,814 BALDINI'S SPORTS CASINO 0 41,250 300 0 0 0 41,550 BALLY'S LAS VEGAS 10,963 45,435 1,336 0 7,932 2,709 68,375 BARLEY'S CASINO & BREWING COMPANY 0 4,440 0 0 750 0 5,190 BARTON'S CLUB 93 2,500 10,050 0 0 0 0 12,550 BELLAGIO 38,332 103,698 0 0 6,320 7,650 156,000 BIGHORN CASINO 240 3,500 0 0 0 0 3,740 BINION'S GAMBLING HALL & HOTEL 14,400 59,600 0 0 0 3,800 77,800 BODINE'S 0 11,070 0 0 504 0 11,574 BONANZA CASINO 350 12,134 0 0 0 0 12,484 BONANZA INN AND CASINO 0 5,430 400 0 0 0 5,830 BONANZA LOUNGE 0 1,560 0 0 0 0 1,560 BOOMTOWN RENO 1,400 36,150 500 0 0 500 38,550 BORDERTOWN 0 4,600 0 0 0 0 4,600 BOULDER STATION HOTEL & CASINO 8,500 62,985 1,500 9,125 5,500 1,833 89,443 BROADWAY COLT INN CASINO 0 570 0 0 0 0 570 BUFFALO BILL'S RESORT & CASINO 7,442 53,930 0 0 0 0 61,372 CACTUS JACK'S SENATOR CLUB 0 3,600 0 0 0 400 4,000 03/06/18 STATE OF NEVADA GAMING CONTROL BOARD ERFNRP 08:44 AM 2017 DATA LISTING OF FINANCIAL STATEMENTS SQUARE FOOTAGE Pg 2 Statewide RACE & POKER LOCATION PIT GAMES SLOTS KENO BINGO SPORTS & PAN TOTAL CACTUS PETES RESORT CASINO 3,870 19,332 0 0 0 896 24,098 CAESARS PALACE 21,438 90,713 0 0 7,908 4,122 124,181 CALIFORNIA HOTEL AND CASINO 6,334 26,869 2,240 0 1,960 0 37,403 CANNERY HOTEL CASINO, THE 3,500 63,879 0 5,108 5,855 625 78,967 CARSON NUGGET, INC. -

Guide to the John Hamilton Collection of Keno Pay Charts

Guide to the John Hamilton Collection of Keno Pay Charts This finding aid was created by Joyce Moore on September 25, 2017. Persistent URL for this finding aid: http://n2t.net/ark:/62930/f11w24 © 2017 The Regents of the University of Nevada. All rights reserved. University of Nevada, Las Vegas. University Libraries. Special Collections and Archives. Box 457010 4505 S. Maryland Parkway Las Vegas, Nevada 89154-7010 [email protected] Guide to the John Hamilton Collection of Keno Pay Charts Table of Contents Summary Information ..................................................................................................................................... 3 Biographical Note ............................................................................................................................................ 3 Scope and Contents Note ................................................................................................................................ 3 Arrangement .................................................................................................................................................... 4 Administrative Information ............................................................................................................................. 4 Names and Subjects ........................................................................................................................................ 4 Collection Inventory ....................................................................................................................................... -

The Future Boyd Gaming

1 Keith Smith President and Chief Executive Officer 2 Stronger Together • Your future family: • 30 properties in 11 states • 27,000+ team members • Par-A-Dice Hotel & Casino, East Peoria • Greater resources and support • Career advancement opportunities nationwide 3 Why Lattner Entertainment? 4 A Track Record of Excellence • A top performer in Illinois • Market-leading win per unit • A strong reputation for customer service & integrity 5 Expanding Our Business • Gives us an entry point into distributed gaming • Diversifies our entertainment product • Provides us a chance to engage new customers • Future growth opportunities in IL, elsewhere in U.S. 6 A Great Cultural Fit • Shared culture of a family-owned business • Committed to integrity in everything we do • Well-known for great customer service 7 The Future Boyd Gaming Blue Chip Casino Hotel Spa Lattner Wilton Rancheria Diamond Jo Dubuque Las Vegas Locals Belterra Park Diamond Jo Worth • Aliante Hotel Casino Spa Valley Forge Casino Resort Par-A-Dice Hotel Casino • Cannery Casino Hotel • Eastside Cannery Casino Hotel Kansas Star • Eldorado Casino Belterra Casino Resort • Gold Coast Hotel and Casino Sam’s Town Hotel and Gambling Hall Tunica • Jokers Wild Casino Evangeline Downs Sam’s Town Hotel and Casino Shreveport • The Orleans Hotel and Casino • Sam's Town Hotel and Downtown Amelia Belle IP Casino Resort Spa Gambling Hall Las Vegas • Suncoast Hotel and Delta Downs Racetrack Casino • California Hotel and Casino Casino Hotel Treasure Chest Casino • Fremont Hotel and Casino • Main Street Station Casino Brewery Hotel Ameristar Kansas City Ameristar St. Charles 8 Our Future Size and Scale 30 properties in 11 states 1.8 Million square feet of casino space 41,000 slot machines 1,000 table games 11,300 hotel rooms 300+ restaurants and bars 27,000+ team members 9 Founded by Family – Sam and Bill Boyd • 1941: Sam Boyd moves to Las Vegas • 1952: Sam Boyd invests in Sahara 10 Founded by Family – Sam and Bill Boyd • 1957: Sam Boyd named GM of The Mint • 1962: Sam and Bill Boyd acquire Eldorado Casino in Henderson, Nev. -

ANNUAL REPORT 2013 Boyd Gaming Corporation Made Great Strides As a Company in 2013

ANNUAL REPORT 2013 Boyd Gaming Corporation made great strides as a Company in 2013. Throughout the year, we successfully executed on a thoughtful, multifaceted strategic plan aimed at enhancing long-term shareholder value. As a result, we significantly strengthened our financial position while continuing to build a business capable of generating sustainable growth. We refined our core business. Our success depends on providing a market- Boyd Gaming leading experience to our customers, and that begins with continually refining our product, our marketing and amenities. Penny Lane is a highly successful is taking the example — an attractive new gaming destination that drove meaningful increases in play at Boyd Gaming properties across the country. Those efforts will continue in 2014, with a particular focus on refreshing our non-gaming amenities right steps to in a cost-effective way. We strengthened our balance sheet. We paid down more than half a billion dollars in debt, eliminating more than $60 million a year in interest expense alone. maximize long-term And we are generating nearly $100 million a year in free cash flow from Peninsula in our first full year of ownership. We are a stronger and more flexible company, able to pursue a wider range of growth opportunities. shareholder value. We are expanding our business. We successfully integrated the five Peninsula properties into our Company, on the heels of our successful acquisition of the IP. We continued to make progress on our new development opportunities in northern California and south Florida. And we are actively exploring other growth opportunities as well, both across the United States and throughout the world. -

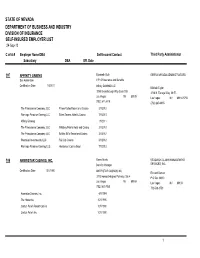

SELF-INSURED EMPLOYER LIST 24-Sep-13

STATE OF NEVADA DEPARTMENT OF BUSINESS AND INDUSTRY DIVISION OF INSURANCE SELF-INSURED EMPLOYER LIST 24-Sep-13 C of A # Employer Name/DBA Self-Insured Contact Third Party Administrator Subsidiary DBA Eff. Date 397 AFFINITY GAMING Elizabeth Guth SIERRA NEVADA ADMINISTRATORS See Addendum V.P. Of Insurance and Benefits Certification Date: 1/1/2011 Affinity GAMING LLC Michele Taylor 3755 Breakthrough Way Suite 300 2716 N. Tenaya Way, 5th FL Las Vegas NV 89135 Las Vegas NV 89114-5750 (702) 341-2419 (702) 240-8935 The Primadonna Company, LLCPrimm Valley Resort and Casino 3/1/2012 Flamingo Paradise Gaming LLCSilver Sevens Hotel & Casino 7/1/2013 Affinity Gaming 1/1/2011 The Primadonna Company, LLCWhiskey Pete's Hotel and Casino 3/1/2012 The Primadonna Company, LLCBuffalo Bill's Resort and Casino 3/1/2012 Plantation Investments, LLCRail City Casino 3/1/2012 Flamingo Paradise Gaming, LLCHenderson Casino Bowl 7/1/2013 106 AMERISTAR CASINOS, INC. Karen Burris SEDGWICK CLAIMS MANAGEMENT Benefits Manager SERVICES, INC. Certification Date: 10/1/1990 AMERISTAR CASINOS INC Richard Gomez 3773 Howard Hughes Parkway, Ste 4 P O Box 34660 90 South Las Vegas NV 89169 Las Vegas NV 89133 (702) 567-7060 702-568-3750 Ameristar Casinos, Inc. 4/1/1994 The Horseshu 10/1/1990 Cactus Pete's Resort Casino 10/1/1990 Cactus Pete's Inc. 10/1/1990 1 C of A # Employer Name/DBA Self-Insured Contact Third Party Administrator Subsidiary DBA Eff. Date 55 ARCHON CORPORATION David Lowden SIERRA NEVADA ADMINISTRATORS Executive Office Administrator Certification Date: 8/15/1982 ARCHON CORPORATION Michele Taylor 3221 S Torrey Pines 2716 N. -

Committee Meeting Expanded Agenda

2014 Regular Session The Florida Senate COMMITTEE MEETING EXPANDED AGENDA GAMING Senator Richter, Chair Senator Sachs, Vice Chair MEETING DATE: Monday, December 9, 2013 TIME: 1:00 —3:00 p.m. PLACE: Toni Jennings Committee Room, 110 Senate Office Building MEMBERS: Senator Richter, Chair; Senator Sachs, Vice Chair; Senators Benacquisto, Braynon, Clemens, Dean, Galvano, Gardiner, Latvala, Lee, Margolis, Montford, and Thrasher BILL DESCRIPTION and TAB BILL NO. and INTRODUCER SENATE COMMITTEE ACTIONS COMMITTEE ACTION Review of workshop records and public comments submitted to the Committee on Gaming Public testimony and industry perspectives regarding two-part "Florida Gambling Impact Study" To be listed on the agenda, make request to speak at http://www.flsenate.gov/topics/gaming on or before Friday, December 6, 2013 Other related meeting documents S-036 (10/2008) 12022013.0956 Page 1 of 1 The Florida Senate Committee on Gaming Senator Richter, Chair Senator Sachs, Vice Chair MEETING DATE: Monday, December 9, 2013 TIME: 1:00 — 3:00 p.m. PLACE: Toni Jennings Committee Room, 110 Senate Office Building MEMBERS: Senator Richter, Chair; Senator Sachs, Vice Chair; Senators Benacquisto, Braynon, Clemens, Dean, Galvano, Gardiner, Latvala, Lee, Margolis, Montford, and Thrasher Remarks by Professional Committee Staff: Review of workshop records and public comments accessible from the Gaming Committee webpage (http://www.flsenate.gov/Committees/Show/GM). Date Workshop/Meeting Duration Speakers Handouts Comments 7-Oct-13 Spectrum Gaming Group Testimony 2:56 6 0 0 23-Oct-13 Coconut Creek workshop 3:10 77 6 17 30-Oct-13 Lakeland workshop 2:43 59 4 7 4-Nov-13 Tallahassee committee meeting 1:59 13 1 0 14-Nov-13 Pensacola workshop 2:12 36 4 10 15-Nov-13 Jacksonville workshop 2:18 49 4 6 Handouts and comments submitted at workshops are included in respective meeting packets. -

Date: 10/05/10 Chip / Token Tracking Time: 11:22 AM Sorted by City - Approved Chips

Date: 10/05/10 Chip / Token Tracking Time: 11:22 AM Sorted by City - Approved Chips Licensee ----- Sample ----- Chip/ City Approved Disapv'd Token Denom. Description ARIA RESORT & CASINO 09/07/10 00/00/00 CHIP ROULETTE N 400 OF EACH COLOR (BABY BLUE,MINT,BRGHT LAS VEGAS ORANGE,TAN,RUST,DARK GRAY) FOUR QUEENS HOTEL & CASINO 09/20/10 00/00/00 CHIP 5.00 HALLOWEEN OCTOBER 31, 2010 WITH A PUMPKIN & CANDY LAS VEGAS CORN REVERSE LAS VEGAS, NV W/WOLF AND MOON FOUR QUEENS HOTEL & CASINO 09/23/10 00/00/00 CHIP 5.00 VETERANS DAY NOVEMBER 11, 2010 STARS AND IWA JIMA LAS VEGAS MEMORIAL BOTH SIDES FREMONT HOTEL AND CASINO 09/01/10 00/00/00 CHIP 0.25 LOGO PRIMARY RACK HOT PINK BOTH SIDES LAS VEGAS GOLDEN NUGGET 09/07/10 00/00/00 CHIP NO CASH CALUE NUMERAL 25000 THE GRAND POKER SERIES LAS VEGAS SHOWBOAT GRAY HARD ROCK HOTEL & CASINO 09/13/10 00/00/00 CHIP 5.00 HAPPY HALLOWEEN 2010 W/ BATS AND LIGHTENING LAS VEGAS HOOTERS CASINO HOTEL 09/07/10 00/00/00 CHIP ROULETTE A 400 OF EACH COLOR (LEMON GREEN,BAHAMA LAS VEGAS BLUE,SEA GREEN,ORCHID,PLUM,YELLOW,GOLD) HOOTERS CASINO HOTEL 09/07/10 00/00/00 CHIP ROULETTE B 400 OF EACH COLOR (MOSS GREEN,PURPLE, LAS VEGAS AQUA,COLON ORANGE,CANARY YELLOW,RADIANT RED,FUSCHI LUXOR HOTEL AND CASINO 09/29/10 00/00/00 CHIP ROULETTE A LEAF GREEN BOTH SIDES LAS VEGAS LUXOR HOTEL AND CASINO 09/29/10 00/00/00 CHIP ROULETTE B LEAF GREEN BOTH SIDES LAS VEGAS LUXOR HOTEL AND CASINO 09/29/10 00/00/00 CHIP ROULETTE C LEAF GREEN BOTH SIDES LAS VEGAS LUXOR HOTEL AND CASINO 09/29/10 00/00/00 CHIP ROULETTE D LEAF GREEN BOTH SIDES LAS VEGAS