2000 Consumer Survey: Locally Grown Foods Strategic Positioning

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Federal Communications Commission Before the Federal

Federal Communications Commission Before the Federal Communications Commission Washington, D.C. 20554 In the Matter of ) ) Existing Shareholders of Clear Channel ) BTCCT-20061212AVR Communications, Inc. ) BTCH-20061212CCF, et al. (Transferors) ) BTCH-20061212BYE, et al. and ) BTCH-20061212BZT, et al. Shareholders of Thomas H. Lee ) BTC-20061212BXW, et al. Equity Fund VI, L.P., ) BTCTVL-20061212CDD Bain Capital (CC) IX, L.P., ) BTCH-20061212AET, et al. and BT Triple Crown Capital ) BTC-20061212BNM, et al. Holdings III, Inc. ) BTCH-20061212CDE, et al. (Transferees) ) BTCCT-20061212CEI, et al. ) BTCCT-20061212CEO For Consent to Transfers of Control of ) BTCH-20061212AVS, et al. ) BTCCT-20061212BFW, et al. Ackerley Broadcasting – Fresno, LLC ) BTC-20061212CEP, et al. Ackerley Broadcasting Operations, LLC; ) BTCH-20061212CFF, et al. AMFM Broadcasting Licenses, LLC; ) BTCH-20070619AKF AMFM Radio Licenses, LLC; ) AMFM Texas Licenses Limited Partnership; ) Bel Meade Broadcasting Company, Inc. ) Capstar TX Limited Partnership; ) CC Licenses, LLC; CCB Texas Licenses, L.P.; ) Central NY News, Inc.; Citicasters Co.; ) Citicasters Licenses, L.P.; Clear Channel ) Broadcasting Licenses, Inc.; ) Jacor Broadcasting Corporation; and Jacor ) Broadcasting of Colorado, Inc. ) ) and ) ) Existing Shareholders of Clear Channel ) BAL-20070619ABU, et al. Communications, Inc. (Assignors) ) BALH-20070619AKA, et al. and ) BALH-20070619AEY, et al. Aloha Station Trust, LLC, as Trustee ) BAL-20070619AHH, et al. (Assignee) ) BALH-20070619ACB, et al. ) BALH-20070619AIT, et al. For Consent to Assignment of Licenses of ) BALH-20070627ACN ) BALH-20070627ACO, et al. Jacor Broadcasting Corporation; ) BAL-20070906ADP CC Licenses, LLC; AMFM Radio ) BALH-20070906ADQ Licenses, LLC; Citicasters Licenses, LP; ) Capstar TX Limited Partnership; and ) Clear Channel Broadcasting Licenses, Inc. ) Federal Communications Commission ERRATUM Released: January 30, 2008 By the Media Bureau: On January 24, 2008, the Commission released a Memorandum Opinion and Order(MO&O),FCC 08-3, in the above-captioned proceeding. -

Broadcast Applications 8/2/2011

Federal Communications Commission 445 Twelfth Street SW PUBLIC NOTICE Washington, D.C. 20554 News media information 202 / 418-0500 Recorded listing of releases and texts 202 / 418-2222 REPORT NO. 27541 Broadcast Applications 8/2/2011 STATE FILE NUMBER E/P CALL LETTERS APPLICANT AND LOCATION N A T U R E O F A P P L I C A T I O N DIGITAL TRANSLATOR OR DIGITAL LPTV APPLICATIONS FOR ASSIGNMENT OF LICENSE ACCEPTED FOR FILING VA BAPDTL-20110714AAQ WJDW-LD JOHN C. DASH Voluntary Assignment of License 168776 E VA , TAZEWELL From: JOHN C. DASH CHAN-35 To: JOHN C. DASH INVESTMENT LLC Form 345 DIGITAL TV APPLICATIONS FOR ASSIGNMENT OF LICENSE ACCEPTED FOR FILING CA BALCDT-20110728AIC KFTY 34440 HIGH PLAINS BROADCASTING Voluntary Assignment of License LICENSE COMPANY LLC E CHAN-32 From: HIGH PLAINS BROADCASTING LICENSE COMPANY LLC CA , SANTA ROSA To: UNA VEZ MAS SAN FRANCISCO LICENSE, LLC Form 314 FM STATION APPLICATIONS FOR ASSIGNMENT OF LICENSE ACCEPTED FOR FILING ND BALED-20110728AFF KHRU 166059 HORIZON CHRISTIAN Voluntary Assignment of License FELLOWSHIP E 97.9 MHZ From: HORIZON CHRISTIAN FELLOWSHIP ND , BEULAH To: SYNERGY BROADCAST NORTH DAKOTA, LLC Form 314 ND BALED-20110728AFG KCVD 164305 HORIZON CHRISTIAN Voluntary Assignment of License FELLOWSHIP E 95.7 MHZ From: HORIZON CHRISTIAN FELLOWSHIP ND , NEW ENGLAND To: SYNERGY BROADCAST NORTH DAKOTA, LLC Form 314 Page 1 of 42 Federal Communications Commission 445 Twelfth Street SW PUBLIC NOTICE Washington, D.C. 20554 News media information 202 / 418-0500 Recorded listing of releases and texts 202 / 418-2222 REPORT NO. -

Broadcast Applications 8/3/2011

Federal Communications Commission 445 Twelfth Street SW PUBLIC NOTICE Washington, D.C. 20554 News media information 202 / 418-0500 Recorded listing of releases and texts 202 / 418-2222 REPORT NO. 27542 Broadcast Applications 8/3/2011 STATE FILE NUMBER E/P CALL LETTERS APPLICANT AND LOCATION N A T U R E O F A P P L I C A T I O N AM STATION APPLICATIONS FOR AMENDMENT RECEIVED NC BR-20110727ACL WGOS 56508 IGLESIA NUEVA VIDA OF HIGH Amendment filed 07/29/2011 POINT, INC. E 1070 KHZ NC , HIGH POINT FM STATION APPLICATIONS FOR AMENDMENT RECEIVED MD BRH-20110518AED WXCY 53488 DELMARVA BROADCASTING Amendment filed 07/29/2011 COMPANY E 103.7 MHZ MD , HAVRE DE GRACE FM TRANSLATOR APPLICATIONS FOR AMENDMENT RECEIVED NC BRFT-20110725AEI W249BZ 154301 TRUTH BROADCASTING Amendment filed 07/29/2011 CORPORATION E 97.7 MHZ NC , CLEMMONS FM STATION APPLICATIONS FOR ASSIGNMENT OF LICENSE ACCEPTED FOR FILING AR BALH-20110729AHB KHOM 6619 THREE RIVERS Voluntary Assignment of License COMMUNICATIONS, LLC E 100.9 MHZ From: THREE RIVERS COMMUNICATIONS, LLC AR , SALEM To: DIAMOND MEDIA, LLC Form 314 Page 1 of 44 Federal Communications Commission 445 Twelfth Street SW PUBLIC NOTICE Washington, D.C. 20554 News media information 202 / 418-0500 Recorded listing of releases and texts 202 / 418-2222 REPORT NO. 27542 Broadcast Applications 8/3/2011 STATE FILE NUMBER E/P CALL LETTERS APPLICANT AND LOCATION N A T U R E O F A P P L I C A T I O N FM STATION APPLICATIONS FOR ASSIGNMENT OF LICENSE ACCEPTED FOR FILING MO BALH-20110729AHC KBMV-FM 29623 THREE RIVERS Voluntary Assignment of License COMMUNICATIONS, LLC E 107.1 MHZ From: THREE RIVERS COMMUNICATIONS, LLC MO , BIRCH TREE To: DIAMOND MEDIA, LLC Form 314 FM STATION APPLICATIONS FOR ASSIGNMENT OF PERMIT ACCEPTED FOR FILING MA BAPED-20110729AGI WJCI 177345 MORGAN BROOK CHRISTIAN Voluntary Assignment of Construction Permit RADIO, INC. -

Order Adopting Superior Court Weather Policy

STATE OF NORTH CAROLINA IN THE GENERAL COURT OF JUSTICE 29A JUDICIAL DISTRICT SUPERIOR COURT DIVISION RUTHERFORD & MCDOWELL FILE NO.: _________________ =============================================================== ORDER ADOPTING SUPERIOR COURT WEATHER POLICY Superior Court Adverse Weather Policy Adverse weather conditions include any conditions that might lead a significant number of members of the public or of employees to conclude that it would be unsafe to come to court or to work (such as light snow fall; icy roads; flash flooding). The following policy is adopted for Superior Courts in 29A Judicial District in the event of adverse weather conditions: 1. When circumstances allow, the decision to cancel or delay a session of Superior Court shall be made by the Senior Resident Superior Court Judge consulting with the Sheriff, Clerks of Superior Court, the District Attorney and other judicial officials; considering any actions recommended by local emergency management personnel and determinations made by county officials for the operation of county government; and making every effort to make decisions that are consistent and will not result in public confusion and risk to litigants, witnesses, jurors, judges and court employees. The Trial Court Administrator will communicate the decision to the judges scheduled to preside, Clerks of Court, the District Attorney, Sheriffs, the court reporters and probation supervisors in the two counties; and to the Assistant Director of the Administrative Office of the Courts. The Judicial Assistant will communicate the decision to media outlets serving the two counties (including but not limited to radio stations: WCAB AM 59 (Rutherfordton). WAGY (Forest City), WBRM 1250 AM (Marion), WKSF 99.9 FM (Asheville), WWNC 570 AM (Asheville), and WMNC 1430 AM (Morganton); and television stations: WLOS Channel 13, WBTV Channel 3, WSOC Channel 9, WYFF Channel 4 and WSPA Channel 7. -

Listening Patterns – 2 About the Study Creating the Format Groups

SSRRGG PPuubblliicc RRaaddiioo PPrrooffiillee TThhee PPuubblliicc RRaaddiioo FFoorrmmaatt SSttuuddyy LLiisstteenniinngg PPaatttteerrnnss AA SSiixx--YYeeaarr AAnnaallyyssiiss ooff PPeerrffoorrmmaannccee aanndd CChhaannggee BByy SSttaattiioonn FFoorrmmaatt By Thomas J. Thomas and Theresa R. Clifford December 2005 STATION RESOURCE GROUP 6935 Laurel Avenue Takoma Park, MD 20912 301.270.2617 www.srg.org TThhee PPuubblliicc RRaaddiioo FFoorrmmaatt SSttuuddyy:: LLiisstteenniinngg PPaatttteerrnnss Each week the 393 public radio organizations supported by the Corporation for Public Broadcasting reach some 27 million listeners. Most analyses of public radio listening examine the performance of individual stations within this large mix, the contributions of specific national programs, or aggregate numbers for the system as a whole. This report takes a different approach. Through an extensive, multi-year study of 228 stations that generate about 80% of public radio’s audience, we review patterns of listening to groups of stations categorized by the formats that they present. We find that stations that pursue different format strategies – news, classical, jazz, AAA, and the principal combinations of these – have experienced significantly different patterns of audience growth in recent years and important differences in key audience behaviors such as loyalty and time spent listening. This quantitative study complements qualitative research that the Station Resource Group, in partnership with Public Radio Program Directors, and others have pursued on the values and benefits listeners perceive in different formats and format combinations. Key findings of The Public Radio Format Study include: • In a time of relentless news cycles and a near abandonment of news by many commercial stations, public radio’s news and information stations have seen a 55% increase in their average audience from Spring 1999 to Fall 2004. -

MHC Program Review Appendices

MHC Program Review Appendices Appendix A—The Digital Heritage Project Appendix B—The UNC-Tomorrow Report (in italics) and the Mountain Heritage Center Appendix C—The QEP in action: The Mountain Heritage Center’s Digital Heritage Project Appendix D—MHC exhibits 2006 - 2011 Appendix E—MHC positions and Vitae Appendix F—MHC Visitation Appendix G—MHC Budgets Appendix H—MHC Vitae Appendix A, The Digital Heritage Project Originally conceived by the Institute for the Economy of the Future (IEF), the Digital Heritage Project was intended as a vehicle to increase regional awareness and heritage tourism. The Mountain Heritage Center (MHC)—which inherited the idea—supports those aims, but we also realized that the project could encourage student engagement in the region and that it offered a significant opportunity for applied student learning. To that end, we have worked with faculty and students in a variety of departments to generate content for the project, redesign the website, and prepare multi-media materials. The Mountain Heritage Center publically launched the Digital Heritage Project on June 2, 2008. The project now consists of three closely linked products: • a series of over 150 one-minute radio spots on the history, culture, and traditions of Southern Appalachia, • a companion website (digitalheritage.org), • and a print version in The Laurel of Asheville and The Sylva Herald. To date we have produced almost 150 radio moments that are heard daily on radio stations WKSF- FM, WMXF-AM, WPEK-AM, and WWNC-AM (combined market share average of 40%-50% in western North Carolina). The 60-second radio moments run 2-4 times per day depending on the station. -

R&S®FSV Signal and Spectrum Analyzer

WMIT-FM says goodbye to air-cooled transmitters by switching to a 100 % liquid-cooled system At a glance Executive summary WMIT-FM wanted stellar audio performance, reduced ❙ Customer: WMIT-FM, Black Mountain, NC, USA operating costs, easy installation and long product life ❙ Task: Replace an aging air-cooled, vacuum tube trans- expectancy from a new transmitter. The R&S®THR9 liquid- mitter with the best technology available in the FM cooled FM transmitter met all those goals and, in addition, transmitter market today the station found a technology partner with a long-term ❙ Solution/product: R&S®THR9 liquid-cooled transmitter vision and reputation for world-class customer service in ❙ Key advantages of this solution: Energy costs cut Rohde & Schwarz. by two-thirds, maximum robustness, low service costs, small footprint and excellent audio quality Business Case Broadcast and Media The situation Joshua Pierce has the responsibility for operating two For a station with 36,000 watts of effective radiated power, stations for Blue Ridge Broadcasting. Budget constraints WMIT-FM has a surprisingly large coverage area encom- make him very familiar with the full range of technologies passing a potential market of nearly five million. Broad- and products that broadcasters employ daily. He identified casting high-quality music to more listeners is certainly the important factors for a technology partner as: reliability good from an operational and business perspective. But and responsiveness; expert and timely technical support; for 25 years, the station’s impressive geographic reach parts availability; and product life expectancy of at least 15 also created engineering challenges in terms of providing to 20 years. -

PROOF Aug 2013

Next Issue Available in September My City Magazine . August 2013 . Vol. 1 Issue 1 Cover Art by John Hairston, Jr. “Queen Charlotte” Mena Mae Chan by Ellen Gurley | Page 4 Learnby Bill “The to Thrill” Take Cleveland a Joke | Page America 14 Andrewby Ellen Gurley Taylor | Page 5 Monicaby Shane Elks Jeffries | Page 15 Funkyby Ellen Gurley Geezer | Page 6 Alexanderby Shane Elks | Page “Lexi” 16 Walker LoBiondo EventsPage 8 in Your Area Cheapby Ellen Gurley Momma’s | Page 18 Guide Spinnerby Seth Peagle Rack | Page 11 Truckby Ellen Gurley Stalking | Page 19 Letter From the Editor Hello, Charlotte. This is My City Magazine. We are delighted to be celebrating the first issue of print. Thank you for picking up a copy. We are committed to keeping you abreast of the happenings in your city in an artsy not fartsy fashion via news, reviews, interviews and viewpoints. - We have columnists who act as mouthpieces for every aspect of Charlotte culture; art, food, beer, music, fash ion, comics, neighbourhoods, theatre, alternative lifestyle, raising families and home improvement. We hope you enjoy My City as much as we delight in bringing it to you. Thank you for your warm reception. Sincerely, Ellen Gurley [email protected] | 704.575.6611 | P.O. Box 5606, Charlotte, NC 28299 THE MY CITY MAGAZINE TEAM John Hairston, Jr. Seth Peagler Marc “El Guapo” Jacksina Greggory Bradford Ellen “LNMental” Gurley Ray “About Your House” Terry Alex Barnette Austin Caine Shane “Mr. Red” Elks Jennifer Davis Clairsean “Babe” Alexander-Floyd Liz Eagle Bill “The Thrill” Cleveland and the one and only Erin Tracy-Blackwood My City Staff My City Staff SETH PEAGLER | Columnist - In 2003, Seth Peagler received a B.A. -

Stations Monitored

Stations Monitored 10/01/2019 Format Call Letters Market Station Name Adult Contemporary WHBC-FM AKRON, OH MIX 94.1 Adult Contemporary WKDD-FM AKRON, OH 98.1 WKDD Adult Contemporary WRVE-FM ALBANY-SCHENECTADY-TROY, NY 99.5 THE RIVER Adult Contemporary WYJB-FM ALBANY-SCHENECTADY-TROY, NY B95.5 Adult Contemporary KDRF-FM ALBUQUERQUE, NM 103.3 eD FM Adult Contemporary KMGA-FM ALBUQUERQUE, NM 99.5 MAGIC FM Adult Contemporary KPEK-FM ALBUQUERQUE, NM 100.3 THE PEAK Adult Contemporary WLEV-FM ALLENTOWN-BETHLEHEM, PA 100.7 WLEV Adult Contemporary KMVN-FM ANCHORAGE, AK MOViN 105.7 Adult Contemporary KMXS-FM ANCHORAGE, AK MIX 103.1 Adult Contemporary WOXL-FS ASHEVILLE, NC MIX 96.5 Adult Contemporary WSB-FM ATLANTA, GA B98.5 Adult Contemporary WSTR-FM ATLANTA, GA STAR 94.1 Adult Contemporary WFPG-FM ATLANTIC CITY-CAPE MAY, NJ LITE ROCK 96.9 Adult Contemporary WSJO-FM ATLANTIC CITY-CAPE MAY, NJ SOJO 104.9 Adult Contemporary KAMX-FM AUSTIN, TX MIX 94.7 Adult Contemporary KBPA-FM AUSTIN, TX 103.5 BOB FM Adult Contemporary KKMJ-FM AUSTIN, TX MAJIC 95.5 Adult Contemporary WLIF-FM BALTIMORE, MD TODAY'S 101.9 Adult Contemporary WQSR-FM BALTIMORE, MD 102.7 JACK FM Adult Contemporary WWMX-FM BALTIMORE, MD MIX 106.5 Adult Contemporary KRVE-FM BATON ROUGE, LA 96.1 THE RIVER Adult Contemporary WMJY-FS BILOXI-GULFPORT-PASCAGOULA, MS MAGIC 93.7 Adult Contemporary WMJJ-FM BIRMINGHAM, AL MAGIC 96 Adult Contemporary KCIX-FM BOISE, ID MIX 106 Adult Contemporary KXLT-FM BOISE, ID LITE 107.9 Adult Contemporary WMJX-FM BOSTON, MA MAGIC 106.7 Adult Contemporary WWBX-FM -

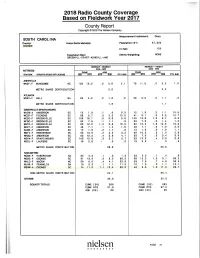

WSNW Nielsen Rating

2018 Radio Cove ,r 7 County Report Copyright @ 2018 The Nielsen Company Measurement I nstrumont: Dlary SOUTH CAROLINA County: Home Radlo Motro(s): Populatlon l2+: 67, 300 O@NEE ln-Tah 120 Televlslon DMA: Ethnlc Wolghtlng: NONE GREENVLL - SPART. ASHEVLL. AND MONDAY - SUNDAY MONDAY - FRIDAY BAM. MID 6AM.7PM METRO(S) AOH OF LICENSE RTG SHR CTY SHR RTG SHR CTY SHR STATION -ASH- ASHEVILLE WKSF. F BUNCOIvIBE NC 128 1 9.0 .3 2.6 2.1 78 11.5 3 2.2 1.9 METRO SHARE CONTRIBUTION 2.6 2.2 AILANTA WSRV.F HALL GA 28 1.2 2 1.8 26 3.8 2 1.1 3 METRO SHARE CONTRIBUTION 1.8 1.1 G REENV ILLE-SPARTANBURG WAIM.A ANDERSON SC 12 I 9 .1 .8 9.3 12 1.9 21 .l 0.5 WCCP.F PICKENS SC 588 7 .3 3.2 1 0.5 41 6.1 53 .5 0.7 WESC.F GREENVILLE SC 109 16 1 .9 8.6 5.6 106 5;8 38 .7 6.5 WFBC.F GREENVILLE sc 537 8 .t 1.1 .9 53 7.8 21 ,4 1.2 WGTK.F GREENVILLE SC 82 12 2 1.0 9.6 6.9 82 2.2 1 8 12 .6 9.8 o WHZT.F ANDERSON SC 487 1 .,1 1.1 1.6 48 7.1 31 2.5 o WJMZ.F ANDERSON sc 13 1 I .2 1.7 .8 l3 1.9 31 1.1 WMYI.F HENDERSON NC 93 13 I .2 2.2 3.2 68 0.2 3'l o 2.8 WROO.F ANDERSON SC 82 12 2 .4 3.8 4.1 53 7.9 53 .1 3.9 WSPA.F SPARTANBURG sc 106 15 I .3 3.1 2.7 83 2.3 42 o 2.6 WSSL.F LAURENS SC 18 2 6 .3 .2 15 2.2 .3 .2 METRO SHARE C1CNTRIBUTION 35.8 39 .6 NON.METRC' W@N. -

Jim Shumate and the Development of Bluegrass Fiddling

JIM SHUMATE AND THE DEVELOPMENT OF BLUEGRASS FIDDLING A Thesis by NATALYA WEINSTEIN MILLER Submitted to the Graduate School Appalachian State University in partial fulfillment of the requirements for the degree of MASTER OF ARTS May 2018 Center for Appalachian Studies JIM SHUMATE AND THE DEVELOPMENT OF BLUEGRASS FIDDLING A Thesis by NATALYA WEINSTEIN MILLER May 2018 APPROVED BY: Sandra L. Ballard Chairperson, Thesis Committee Gary R. Boye Member, Thesis Committee David H. Wood Member, Thesis Committee William R. Schumann Director, Center for Appalachian Studies Max C. Poole, Ph.D. Dean, Cratis D. Williams School of Graduate Studies Copyright by Natalya Weinstein Miller 2018 All Rights Reserved Abstract JIM SHUMATE AND THE DEVELOPMENT OF BLUEGRASS FIDDLING Natalya Weinstein Miller, B.A., University of Massachusetts M.A., Appalachian State University Chairperson: Sandra L. Ballard Born and raised on Chestnut Mountain in Wilkes County, North Carolina, James “Jim” Shumate (1921-2013) was a pioneering bluegrass fiddler. His position at the inception of bluegrass places him as a significant yet understudied musician. Shumate was a stylistic co-creator of bluegrass fiddling, synthesizing a variety of existing styles into the developing genre during his time performing with some of the top names in bluegrass in the 1940s, including Bill Monroe in 1945 and Lester Flatt & Earl Scruggs in 1948. While the "big bang" of bluegrass is considered to be in 1946, many elements of the bluegrass fiddle style were present in Bill Monroe's Blue Grass Boys prior to 1945. Jim Shumate’s innovative playing demonstrated characteristics of this emerging style, such as sliding double-stops (fingering notes on two strings at once) and syncopated, bluesy runs. -

Media List for More Information: Contact Jill Hendrix at Phone (864) 675-0540 Or Email [email protected]

Fiction Addiction Media List For more information: Contact Jill Hendrix at Phone (864) 675-0540 or Email [email protected] Media List has been confirmed as of 1/9/20. Local Dailies: The Greenville News P.O. Box 1688 Greenville, SC 29602 (864) 298-4100 https://www.greenvilleonline.com/contact/staff/ Lillia Callum-Penso Food Writer (interested in food-related book events) 864-298-3768 [email protected] Haley Waters Breaking News Reporter [email protected] Angelia Davis Social Issues Reporter [email protected] Donna Walker Arts and Entertainment Writer 864-298-4004 [email protected] Paul Hyde (would like to be kept in the loop re: upcoming book-signings, etc..) Education [email protected] Spartanburg Herald Journal (next city over) P. O. Drawer 1657 Spartanburg, SC 29304 (864) 582-4511 Jose Franco Editor [email protected] (864)582-4511 ext7229 Local Weeklies: Greenville Journal 148 River Street Suite 120 Greenville, SC 29601 FAX 467-9808 Meredith Rice, Operations Manager [email protected] Calendars: [email protected] The Greer Citizen Billy Cannada– Editor (interested in Greer-based authors/books/events) [email protected] P.O. Box 70 Greer, SC 29652 (864) 877-2076 or Fax: (864) 877-3563 Local Magazines: Upstate Parent Magazine P. O. Box 1179 Simpsonville, SC 29681 Kim Hassold, Editor 864-298-4726 [email protected] Chris Worthy, Calendar and Press Releases [email protected] Food-Related Edible Upcountry 209 N. Main Street, #397 Greenville, SC 29601 [email protected] Country-Related The Country Register of North and South Carolina 888-942-8950 [email protected] Area Publications Spartanburg Herald - Journal Jose Franco – Entertainment Editor [email protected] Entertainment Editor P.O.