Press Release Imperial Bank Limited (In Receivership)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

KDIC Annual Report 2012

Annual Report & Accounts th For Annualthe Year Report ended &3 0Accounts June 20 12 th For the Year ended 30 June 2012 Deposit Protection DepositFund Protection Board i Fund Board i Vision To be a best-practice deposit insurance scheme Mission The Year under Review under Year The Corporate Social Responsibility Social Corporate To promote and contribute to public confidence in the stability of the nation’s 23iii 12 12 financial system by providing a sound safety net for depositors of member institutions. Strategic Objectives • Promote an effective and efficient deposit insurance scheme • Enhance operational efficiency • Promote best practice Strategic Pillars • Strong supervision and regulation • Public confidence • Prompt problem resolutions • Public awareness • Effective coordination Corporate Values • Integrity • Professionalism • Team work • Transparency and accountability • Rule of Law Corporate Information The Year under Review under Year The Corporate Social Responsibility Social Corporate 12iv 23 Deposit Protection Fund Board CBK Pension House Harambee Avenue PO Box 45983 - 00100 Nairobi, Kenya Tel: +254 – 20 - 2861000 , 2863841 Fax: +254 – 20 - 2211122 Email : [email protected] Website: www.centralbank.go.ke Bankers Central Bank of Kenya, Nairobi Haile Selassie Avenue PO Box 60000 - 00200 Nairobi Auditors KPMG Kenya 16th Floor, Lonrho House Standard Street PO Box 40612 - 00100 Nairobi Table of Contents Statement from the Chairman of the Board..................................................................................6 -

Bank Code Finder

No Institution City Heading Branch Name Swift Code 1 AFRICAN BANKING CORPORATION LTD NAIROBI ABCLKENAXXX 2 BANK OF AFRICA KENYA LTD MOMBASA (MOMBASA BRANCH) AFRIKENX002 3 BANK OF AFRICA KENYA LTD NAIROBI AFRIKENXXXX 4 BANK OF BARODA (KENYA) LTD NAIROBI BARBKENAXXX 5 BANK OF INDIA NAIROBI BKIDKENAXXX 6 BARCLAYS BANK OF KENYA, LTD. ELDORET (ELDORET BRANCH) BARCKENXELD 7 BARCLAYS BANK OF KENYA, LTD. MOMBASA (DIGO ROAD MOMBASA) BARCKENXMDR 8 BARCLAYS BANK OF KENYA, LTD. MOMBASA (NKRUMAH ROAD BRANCH) BARCKENXMNR 9 BARCLAYS BANK OF KENYA, LTD. NAIROBI (BACK OFFICE PROCESSING CENTRE, BANK HOUSE) BARCKENXOCB 10 BARCLAYS BANK OF KENYA, LTD. NAIROBI (BARCLAYTRUST) BARCKENXBIS 11 BARCLAYS BANK OF KENYA, LTD. NAIROBI (CARD CENTRE NAIROBI) BARCKENXNCC 12 BARCLAYS BANK OF KENYA, LTD. NAIROBI (DEALERS DEPARTMENT H/O) BARCKENXDLR 13 BARCLAYS BANK OF KENYA, LTD. NAIROBI (NAIROBI DISTRIBUTION CENTRE) BARCKENXNDC 14 BARCLAYS BANK OF KENYA, LTD. NAIROBI (PAYMENTS AND INTERNATIONAL SERVICES) BARCKENXPIS 15 BARCLAYS BANK OF KENYA, LTD. NAIROBI (PLAZA BUSINESS CENTRE) BARCKENXNPB 16 BARCLAYS BANK OF KENYA, LTD. NAIROBI (TRADE PROCESSING CENTRE) BARCKENXTPC 17 BARCLAYS BANK OF KENYA, LTD. NAIROBI (VOUCHER PROCESSING CENTRE) BARCKENXVPC 18 BARCLAYS BANK OF KENYA, LTD. NAIROBI BARCKENXXXX 19 CENTRAL BANK OF KENYA NAIROBI (BANKING DIVISION) CBKEKENXBKG 20 CENTRAL BANK OF KENYA NAIROBI (CURRENCY DIVISION) CBKEKENXCNY 21 CENTRAL BANK OF KENYA NAIROBI (NATIONAL DEBT DIVISION) CBKEKENXNDO 22 CENTRAL BANK OF KENYA NAIROBI CBKEKENXXXX 23 CFC STANBIC BANK LIMITED NAIROBI (STRUCTURED PAYMENTS) SBICKENXSSP 24 CFC STANBIC BANK LIMITED NAIROBI SBICKENXXXX 25 CHARTERHOUSE BANK LIMITED NAIROBI CHBLKENXXXX 26 CHASE BANK (KENYA) LIMITED NAIROBI CKENKENAXXX 27 CITIBANK N.A. NAIROBI NAIROBI (TRADE SERVICES DEPARTMENT) CITIKENATRD 28 CITIBANK N.A. -

A Case Study of Commercial Bank of Africa by Paul Mathen

THE EFFECT OF AGILE WORK ON ORGANIZATIONAL PERFORMANCE IN KENYAN BANKS: A CASE STUDY OF COMMERCIAL BANK OF AFRICA BY PAUL MATHENGE UNITED STATES INTERNATIONAL UNIVERSITY- AFRICA SUMMER 2019 THE EFFECT OF AGILE WORK ON ORGANIZATIONAL PERFORMANCE IN KENYAN BANKS: A CASE STUDY OF COMMERCIAL BANK OF AFRICA BY PAUL MATHENGE A Research Project Report Submitted to the Chandaria School of Business in Partial Fulfillment of the Requirements for the Degree of Master of Science in Management and Organizational Development (MOD) UNITED STATES INTERNATIONAL UNIVERSITY- AFRICA SUMMER 2019 STUDENT DECLARATION I, the undersigned declare that this project is my original work and that it has not been submitted to any other college or other institution of higher learning for academic credit other than United States International University-Africa Signed: ___________________________ Date: ____________________ Paul K. Mathenge This project has been presented for examination with my approval as the appointed supervisor Signed: ___________________________ Date: ____________________ Fred Newa Signed: ___________________________ Date: ____________________ Dean, Chandaria School of Business ii COPYRIGHT All rights reserved. No part of this report may be photocopied, recorded or otherwise reproduced, stored in a retrieval system or transmitted in any form or by any electronic or mechanical means without prior permission of the copyright owner. Copyright © PAUL MATHENGE (2019) iii ABSTRACT The general objective of the study was to determine the Effect of the Agile -

Parliament of Kenya the Senate

November 1, 2016 SENATE DEBATES 1 PARLIAMENT OF KENYA THE SENATE THE HANSARD Tuesday, 1st November, 2016 The House met at the Senate Chamber, Parliament Buildings, at 2.30 p.m. [The Speaker (Hon. Ethuro) in the Chair] PRAYER STATEMENTS ALLEGED MISAPPROPRIATION AND LOSS OF PUBLIC FUNDS IN THE MINISTRY OF HEALTH The Senate Minority Leader (Sen. Wetangula): Mr. Speaker, Sir, pursuant to Standing Order No.45(2)(b), I rise to seek a Statement from the Chairperson of the Standing Committee on Health on the alleged misappropriation and loss of public funds at the Ministry of Health. In the Statement, the Chairperson should:- (a) Table the interim internal audit report on procurement and financial operations of the Ministry of Health for the Financial Year 2015/2016. (b) Table a list of all tender advertisements of the Financial Year 2015/2016 in the Ministry of Health under audit, the corresponding firms that bid and those that were finally awarded the tenders. (c) Table a schedule of payments to companies that were awarded the said tenders. (d) Table the particulars of the companies that were awarded the said tenders, including details of directors, financial statements and tax returns and the invoices attached to the payments including ETR receipts, tax compliance and pin numbers. (e) State why the funds which were allocated to be transferred as Government of Kenya (GoK) grants to various institutions and counties for free maternity were diverted in contravention of the law on misapplication of funds. (f) Give the reasons as to why under the directive of the head of the accounting unit, the internal audit department was denied full access to the financial documents. -

THE KENYA GAZETTE Published by Authority of the Republic of Kenya (Registered As a Newspaper at the G.P .0 .) � Vol

NATIONAL COUNCIL FOR LAW REPORTING LIBRARY THE KENYA GAZETTE Published by Authority of the Republic of Kenya (Registered as a Newspaper at the G.P .0 .) Vol. CXXII —No. 94 NAIROBI, 22nd May, 2020 Price Sh. 60 CONTENTS GAZETTE NOTICES PAGE PAGE The Certified Public Secretaries Act—Appointment 1962 88— The Railway City Development Authority Order, The National Government Constituencies Development 2020 991 Fund Act—Appointment 1962 89— The Public Health (COVID-19 Restriction of County Governments Notices 1962-1963, Movement of Persons and Related Measures) 1969,1970,1987 (Nairobi Metropolitan Area) (Extension) Order, The Land Registration Act—Issue of New Title Deeds, etc .1963-1965,1969 No. 2 of 2020 1003 90— The University of Embu Statutes, 2020 Statement of Actual Revenues and Net Exchequer Issues as 1005 at 30th April, 2020 1966 The Ethics and Anti-Corruption Commission—Fourth Quarterly Report 1970-1978 SUPPLEMENT No. 40 The Companies Act—Intended Dissolution, etc 1978 Senate Bills , 2020 The Kenya Information and Communications Act— PAGE Application for Licences 1979-1980 The Community Health Services Bill, 2020 51 The Insolvency Act—Creditors Voluntary Winding-up, etc 1980-1981 The Environmental Management and Co-ordination Act— Environmental Impact Assessment Study Report 1981-1986 SUPPLEMENT No. 70 Disposal of Uncollected Goods 1986 Acts , 2020 Change of Names 1986-1987 PAGE The Banking Act —Acquistion of Certain Assets 1987 The Supplementary Appropriation Act, 2020 37 The Small Claims Court (Amendment) Act, 2020 65 SUPPLEMENT Nos. 73,74,75,77 and 78 Legislative Supplements, 2020 LEGAL NOTICE NO. PAGE SUPPLEMENT No. 76 86— The Customs and Excise (Railway Development National Assembly Bills , 2020 Levy Fund) (Amendment) Regulations, 2020 987 PAGE 87— The Public Order (State Curfew) (Extension) Order No. -

The Kenyagazette

‘ SPECIALISSUE_ .- THE KENYAGAZETTE Published by Authority of the Republic of Kenya (Registered as a Newspaper at the G.P.O.) Vol. CVIII—No.49 NAIROBI,7th July,2006 | - Price Sh. 50 GAZETTE NOTICE NO.5200 - THE TRANSPORTLICENSING ACT (Cap. 404) APPLICATIONS THE under mentioned applications will be considered by the Transport Licensing Board at St. Mary’s Pastoral Centre Hall, Nakuru on the following days: Monday, 17th July, 2006—NKU /R/06/2/01/to NKU/R/06/2/50. Tuesday, 18th July 2006—NKU/B/06/2/S t/to NKU/B/06/2/100. Wednesday, 19th July, 2006. Thursday, 20th July, 2006 to consider deferred cases and renewals for the year. Friday, Zist July, 2006. Every objection in respect of an application shall be lodged with the Licensing Authority and the DistrictCommissioner of the district in which such an application is. to be heard and a copy therefore shall be sent to the applicant not less than seven (7) days before the date at which such an application is to be heard. Objections received later will not be considered except where otherwisestated that the applications are for one vehicle. Every objector shall include the registration numberofhis/her vehicle (together with the timetables where applicable), operating on the applicants proposed route. ‘Those who submit applications in the namesofpartnership and companies must bring certificates of business registration to the Transport Licensing Board meeting. Applicants who are Kenya, Tanzania or Ugandacitizens oftnon-African origin must prodiice their certificates or any other documentary proof of their citizenship. Applicants who fail to attend the above meeting as required of this notice, without reasonable cause will have their applications refused and should therefore, not expect further communication from the Board. -

Relationship Between Cost Efficiency and Non-Performing Loans of Commercial Banks in Kenya

RELATIONSHIP BETWEEN COST EFFICIENCY AND NON- PERFORMING LOANS OF COMMERCIAL BANKS IN KENYA BY WAINAINA ESTHER NYAMATU A RESEARCH PROJECT SUBMITTED FOR PARTIAL FULFILLMENT OF THE REQUIREMENTS FOR THE AWARD OF A MASTER OF BUSINESS ADMINISTRATION DEGREE, UNIVERSITY OF NAIROBI NOVEMBER 2016 DECLARATION I declare that this project is my original work and has never been submitted for a degree in any other university or college for examination/academic purposes. Signature: …………………………………….. Date:………………………………… WAINAINA ESTHER NYAMATU D61/76925/2014 This research project has been submitted for examination with my approval as the University Supervisor. Signature…………………………………….…. Date………………………………….. Dr. Duncan Elly Ochieng’, PhD, CIFA Lecturer, Department of Finance and Accounting University of Nairobi ii ACKNOWLEDGEMENTS I would like to acknowledge and extend by heartfelt gratitude to the following persons who have made the completion of this project possible; my supervisor Dr. Duncan Elly Ochieng’ for his vital encouragement and support, all faculty staff and most especially to my family, friends and to God who made all things possible. iii DEDICATION To my family for standing beside me during this entire study period; Further to my friends who continuously supported me and lastly to my Employee and colleagues at work for encouragement toward successful completion of this course. iv ABSTRACT In third world countries, efficiency of the banking system is particularly vital because the banking organization serves as the central nerve for the total financial development in terms of economic growth. A large bulk of non-performing loans in failing institutions has been named as the source of bank and thrift decline and that a significant predictor of insolvency is statistically asset quality. -

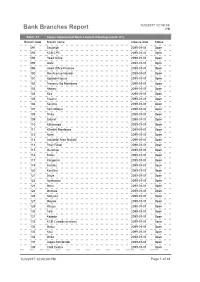

Bank Branches Report PM

1/23/2017 12:40:40 Bank Branches Report PM Bank: 01 Kenya Commercial Bank Limited (Clearing centre: 01) Branch code Branch name Closure date Status 091 Eastleigh 2099-01-01 Open 092 KCB CPC 2099-01-01 Open 094 Head Office 2099-01-01 Open 095 Wote 2099-01-01 Open 096 Head Office Finance 2099-01-01 Open 100 Moi Avenue Nairobi 2099-01-01 Open 101 Kipande House 2099-01-01 Open 102 Treasury Sq Mombasa 2099-01-01 Open 103 Nakuru 2099-01-01 Open 104 Kicc 2099-01-01 Open 105 Kisumu 2099-01-01 Open 106 Kericho 2099-01-01 Open 107 Tom Mboya 2099-01-01 Open 108 Thika 2099-01-01 Open 109 Eldoret 2099-01-01 Open 110 Kakamega 2099-01-01 Open 111 Kilindini Mombasa 2099-01-01 Open 112 Nyeri 2099-01-01 Open 113 Industrial Area Nairobi 2099-01-01 Open 114 River Road 2099-01-01 Open 115 Muranga 2099-01-01 Open 116 Embu 2099-01-01 Open 117 Kangema 2099-01-01 Open 119 Kiambu 2099-01-01 Open 120 Karatina 2099-01-01 Open 121 Siaya 2099-01-01 Open 122 Nyahururu 2099-01-01 Open 123 Meru 2099-01-01 Open 124 Mumias 2099-01-01 Open 125 Nanyuki 2099-01-01 Open 127 Moyale 2099-01-01 Open 129 Kikuyu 2099-01-01 Open 130 Tala 2099-01-01 Open 131 Kajiado 2099-01-01 Open 133 KCB Custody services 2099-01-01 Open 134 Matuu 2099-01-01 Open 135 Kitui 2099-01-01 Open 136 Mvita 2099-01-01 Open 137 Jogoo Rd Nairobi 2099-01-01 Open 139 Card Centre 2099-01-01 Open 1/23/2017 12:40:40 PM Page 1 of 44 1/23/2017 12:40:40 Bank Branches Report PM 140 Marsabit 2099-01-01 Open 141 Sarit Centre 2099-01-01 Open 142 Loitokitok 2099-01-01 Open 143 Nandi Hills 2099-01-01 Open 144 Lodwar 2099-01-01 -

Bank Supervision Annual Report 2016

BANK SUPERVISION ANNUAL REPORT 2016 MACROECONOMIC CONDITIONS DEVELOPMENTS BANKING SECTOR PERFORMANCE Market Share Asset Quality Risks Loans and Advances Liquidity Bureaus REGIONAL AND INTERNATIONAL DEVELOPMENTS AND INITIATIVES Performance Rating COMESA SUPERVISORY FRAMEWORK MACROECONOMIC CONDITIONS AND BANKING SECTOR PERFORMANCE Profit and Loss Interest Rates Regional Economy Liquidity Domestic Economy Credit Report Distribution of Foreign ExchangeCENTRAL BANK Bureaus OF KENYA BANK SUPERVISION ANNUAL REPORT 2016 1 CENTRAL BANK OF KENYA II BANK SUPERVISION ANNUAL REPORT 2016 TABLE OF CONTENTS VISION STATEMENT VII THE BANK’S MISSION VII MISSION OF BANK SUPERVISION DEPARTMENT VII THE BANK’S CORE VALUES VII GOVERNOR’S MESSAGE VIII FOREWORD BY DIRECTOR, BANK SUPERVISION IX CHAPTER ONE STRUCTURE OF THE BANKING SECTOR 1.1 The Banking Sector 2 1.2 Ownership and Asset Base of Commercial Banks 4 1.3 Distribution of Commercial Banks Branches 5 1.4 Commercial Banks Market Share Analysis 5 1.5 Automated Teller Machines (ATMs) 7 1.6 Asset Base of Microfinance Banks 8 1.7 Microfinance Banks Market Share Analysis 8 1.8 Distribution of Foreign Exchange Bureaus 9 CHAPTER TWO DEVELOPMENTS IN THE BANKING SECTOR 2.1 Introduction 12 2.2 Developments in Information and Communication Technology 12 2.3 Financial Inclusion and Policy Development Initiatives 13 2.4 Money Remittance Providers 14 2.5 Agency Banking 15 2.6 New Products 17 2.7 Operations of Representative Offices of Authorized Foreign Financial Institutions 17 2.8 Residential Mortgages Market Survey -

DAVID NTONGAI.Pdf

ORGANIZATION CULTURE, STRATEGY OPERATIONALISATION AND PERFORMANCE OF COMMERCIAL BANKS IN KENYA DAVID NTONGAI A THESIS SUBMITTED IN PARTIAL FULFILLMENT OF THE REQUIREMENT FOR THE CONFERMENT OF THE DOCTOR OF PHILOSOPHY DEGREE IN BUSINESS ADMINISTRATION AND MANAGEMENT (STRATEGIC MANAGEMENT) OF KENYA METHODIST UNIVERSITY OCTOBER 2020 I DECLARATION This Thesis is my original work and has not been presented for a degree in any other university. Signature………………………… Date …………………………… David Ntongai BUS-4-0188-1-2015 This Thesis has been submitted for examination with our approval as University Supervisors: Signature……………………….… Date……………………… Prof. (Eng.) Thomas A. Senaji (PhD) School of Business and Economics Kenya Methodist University Signature……………………….… Date……………………… Prof. George K. King’oriah, PhD., MBS University of Nairobi ii DEDICATION To my mother for instilling in me virtues of hard work, responsibility, discipline, passion and aspirations for greater things in life and for making me who I am, your prayers and wise counsel will forever be treasured. To my wife, your encouragement and patience during the long and many hours of absence cannot be taken for granted. iii ACKNOWLEDGEMENTS I sincerely salute my University supervisors Prof. (Eng.) Thomas A. Senaji and Prof. George K. King’oriah for their effective guidance and continuous availability for consultation. To all other lecturers in KEMU who guided me throughout my course work, I thank you. Special thanks to all members of my family, whose financial support and moral encouragement made this study possible; thank you for being there for me. All my friends and colleagues I acknowledge you, for the encouragement. I sincerely appreciate and acknowledge all my respondents in this research who took their valuable time to respond. -

Effect of Corporate Governance on Board of Directors Disclosure in Commercial Banking Sector in Kenya

EFFECT OF CORPORATE GOVERNANCE ON BOARD OF DIRECTORS DISCLOSURE IN COMMERCIAL BANKING SECTOR IN KENYA BY CATHERINE WANJUGU KABUGU D61/74708/2014 A RESEARCH PROJECT SUBMITED IN PARTIAL FULFILLMENT OF THE REQUIREMENTS FOR THE AWARD OF THE DEGREE OF MASTER OF BUSINESS ADMINISTRATION IN FINANCE, SCHOOL OF BUSINESS, UNIVERSITY OF NAIROBI SEPTEMBER, 2016 DECLARATION This Research Project is my own original work and has not been presented for a Degree qualification in any other University or Institution of learning. SIGNED………………………………… DATE ……………………………………………. CATHERINE WANJUGU KABUGU D61/74708/2014 This Research Project has been submitted for Examination with my approval as the: University Supervisor SIGNED…………………………………… DATE: ………………………………………….... MR. NICHOLAS T.T. SIMIYU School of Business The University of Nairobi ii ACKNOWLEDGEMENTS I wish to thank the Almighty God for taking me through my academic years in the University and the completion of my study. A special thanks to my supervisor Mr Nicholas T.T. Simiyu for his countless hours of reading, reflecting, and most of all his patience throughout the entire process, Peter Muruthi who was very helpful with his expertise and gave me valuable guidance. Finally, I thank each and everyone who helped in any way in my journey through this project. iii DEDICATION I dedicate this project to the Kabugu senior family, my dear parents for their love, my sister Sylviah and brother Jonam for their encouragement. I also dedicate this project to all who supported me throughout the entire process, especially Eliud who helped me kick start the proposal. Finally a special thanks to Martha and Denis for encouraging me to forge forward when it was tough, the two of you have been my best cheer leaders. -

The Relationship Between Bank Corporate Governance and Performance of Kenyan Banks

THE RELATIONSHIP BETWEEN BANK CORPORATE GOVERNANCE AND PERFORMANCE OF KENYAN BANKS. JEREMY MUTWIRI KIRIMI REG NO: X50/79133/2015 SUPERVISOR: MS. SUSAN AYAKO Research project submitted to the School of Economics, University of Nairobi, in Partial Fulfilment of the Requirement for the Degree of Master of Arts in Economics DECLARATION This research project paper is my original work and has not been presented for any partial fulfillment of award of degree in any other institution. Signature: ……………………. Date:……………………………………. Jeremy Mutwiri Kirimi Reg. No X50/79133/2015 This research project has been submitted to the School of Economics, The University of Nairobi, with approval from the University supervisor. Signature: …………………………….. Date: ………………………… Ms. Susan A. Ayako:…………………………………… (University Supervisor) School of Economics The University of Nairobi ii ACKNOWLEDGMENT I wish to acknowledge the contributions of my supervisor, Ms. Susan A Ayako, for her continuous guidance and teachings. The success of this research project would not have been possible without her dedicated support in equipping me with the skills of research writing. I also acknowledge the selfless guidance of Dr. Peter Muriu on the project. I also acknowledge the contribution by relatives and friends. I also extend my regard to my classmates, Elizabeth, Onesmus, Lenah and Bernard for their constant encouragement and support during the class work and project stages. I appreciate the input of Bernard and Kagecha on this project. iii DEDICATION I humbly dedicate this project to my late Grandfather and Grandmother who planted a seed of chasing dreams in me. I further dedicate it to my niece Joy Kathomi, my mentor Wallace and relatives and Man Enough members.