Golden Entertainment

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Laughlin Bay Marina

ASF Realty Presents TEAM SORRELLS at ASF LAUGHLIN BAY MARINA 2117 Paradise Road Las Vegas, NV 89104 Lagoon by the Colorado River that leads to Lake Billy Dee Sorrells (English) Havasu Broker Salesperson Cell: 702-234-6123 Office: 702-916-1992 Wechat: BillyDeeRealEstate [email protected] Sarah Sorrells (English & Chinese 中文) Salesperson Cell: 702-576-5951 Office: 702-916-1993 Wechat: sarahvegas2013 [email protected] 29.58 Acres H-1 Zoning PROPERTY FACTS 20.8 undeveloped partially graded land Three Buildings 20,133 sq. ft Air Cooled Dry Boat Storage 7,280 sq. ft. Restaurant/Bar/Offices 5,409 sq. ft. Club House with pool 100’ wide Channels that lead into the Laughlin Lagoon Marina hold up to 110 boats Dry Storage hold up to 160 Watercraft Billy Dee Sorrells (English) Sarah Sorrells (English & Chinese 中文) Broker Salesperson Salesperson Cell: 702-234-6123 Cell: 702-576-5951 Office: 702-916-1992 Office: 702-916-1993 Wechat: BillyDeeRealEstate Wechat: sarahvegas2013 [email protected] [email protected] RIVER RELATED FACTS US Recreational Boat sales exceeds $39 Billion 95% are under 26’ in length and are towable Nevada and Arizona have a combined 188,000 registered boats Active Colorado River lifestyles in the Desert every year; 347,000 Nevada residents engage in Watersport activities 750,000 Arizona residents engage in Watersport Activities 234,000 Nevada residents go fishing 923,000 Arizona residents go fishing Billy Dee Sorrells (English) Sarah Sorrells (English & Chinese 中文) Broker Salesperson -

Station, Caesars, MGM Properties Approved for 100 Percent Casino Capacity

Station, Caesars, MGM properties approved for 100 percent casino capacity By Bailey Schulz Las Vegas Review-Journal May 12, 2021 - 7:23 am Three of the largest casino operators in Las Vegas can now run their casinos at full capacity. MGM Resorts International, Caesars Entertainment Inc. and Station Casinos are the latest companies to have gaming floor capacity and social distancing restrictions waived by the Nevada Gaming Control Board. The Wednesday announcements mean an additional 24 casinos across the valley to can now operate at full capacity, effective immediately. Industry watchers say the shift is a watershed moment in Las Vegas’ road to recovery. “The more properties that come back to full capacity really signal an end to much of the pandemic for us,” Amanda Belarmino, an assistant professor at UNLV’s college of hospitality, said. “First of all, it will allow people to go back to work. Second, it will speed our economic recovery as a city and a state that will help all of the members of our community. … It is heartwarming to see our world come back.” Return to normalcy A Wednesday statement from MGM Resorts said the gaming floors at Bellagio, Aria, MGM Grand, Mandalay Bay, Park MGM, The Mirage, New York-New York, Luxor and Excalibur can operate at 100 percent of fire code capacity. The casinos had been operating under occupancy restrictions since their reopenings last year. Clark County’s 80 percent occupancy restrictions and 3-feet social distancing policies remain in place outside of the casinos, in areas such as the properties’ restaurants, pools and other nongaming venues. -

DEUCE Bus Time Schedule & Line Route

DEUCE bus time schedule & line map DEUCE Deuce on the Strip Northbound View In Website Mode The DEUCE bus line (Deuce on the Strip Northbound) has 2 routes. For regular weekdays, their operation hours are: (1) Deuce on the Strip Northbound: 24 hours (2) Deuce on the Strip Southbound: 24 hours Use the Moovit App to ƒnd the closest DEUCE bus station near you and ƒnd out when is the next DEUCE bus arriving. Direction: Deuce on the Strip Northbound DEUCE bus Time Schedule 22 stops Deuce on the Strip Northbound Route Timetable: VIEW LINE SCHEDULE Sunday 24 hours Monday 24 hours South Strip Transit Terminal Bay 14 Tuesday 24 hours Nb Las Vegas Before Sunset Wednesday 24 hours Nb Las Vegas at Las Vegas Sign Thursday 24 hours 5200 South Las Vegas Boulevard, Paradise Friday 24 hours Nb Las Vegas After Four Seasons South Las Vegas Boulevard, Paradise Saturday 24 hours Nb Las Vegas at Luxor Nb Las Vegas Before Tropicana DEUCE bus Info Nb Las Vegas at Mgm/Showcase Direction: Deuce on the Strip Northbound South Las Vegas Boulevard, Paradise Stops: 22 Trip Duration: 62 min Nb Las Vegas at Polo Towers Line Summary: South Strip Transit Terminal Bay 14, 3755 S Las Vegas Blvd, Paradise Nb Las Vegas Before Sunset, Nb Las Vegas at Las Vegas Sign, Nb Las Vegas After Four Seasons, Nb Nb Las Vegas at Planet Hollywood Las Vegas at Luxor, Nb Las Vegas Before Tropicana, Nb Las Vegas at Mgm/Showcase, Nb Las Vegas at Nb Las Vegas at Paris Las Vegas Polo Towers, Nb Las Vegas at Planet Hollywood, Nb Las Vegas at Paris Las Vegas, Nb Las Vegas at Nb Las Vegas at Harrahs -

Lasvegasadvisor December 2020 • Vol

ANTHONY CURTIS’ LasVegasAdvisor December 2020 • Vol. 37 • Issue 12 $5 STRANGE HOLIDAYS Is anyone celebrating? … pgs. 1, 12 ROOM RATES ARE LOW But probably not as low as you thought … pgs. 1, 2, 3 SUPER CIRCA Checking out the cool new downtown joint … pgs. 3, 8, 9, 11, 13, 17 NEW COVID RESTRIC- TIONS Do you have reservations for that bar? … pgs. 7, 12 THE $1 BLACKJACK CHALLENGE Whose is best? … pg. 14 CASINOS Local (702) Toll Free Aliante Casino+Hotel+Spa ...................692-7777 ...... 877-477-7627 Aria .......................................................590-7111 ...... 866-359-7757 Arizona Charlie’s Boulder .....................951-5800 ...... 800-362-4040 Arizona Charlie’s Decatur .....................258-5200 ...... 800-342-2695 Bally’s ...................................................739-4111 ...... 877-603-4390 Bellagio .................................................693-7111 ...... 888-987-7111 Binion’s .................................................382-1600 ...... 800-937-6537 Boulder Station .....................................432-7777 ...... 800-683-7777 Caesars Palace.....................................731-7110 ...... 866-227-5938 California ..............................................385-1222 ...... 800-634-6505 Cannery ................................................507-5700 ...... 866-999-4899 Casino Royale (Best Western Plus) ......737-3500 ...... 800-854-7666 Circa .....................................................247-2258 ...... 833-247-2258 Circus Circus ........................................734-0410 -

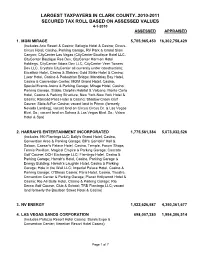

Largest Taxpayer Secured Values 2010-11

LARGEST TAXPAYERS IN CLARK COUNTY..2010-2011 SECURED TAX ROLL BASED ON ASSESSED VALUES 4-1-2010 ASSESSED APPRAISED 1. MGM MIRAGE 5,705,965,450 16,302,758,429 (Includes Aria Resort & Casino; Bellagio Hotel & Casino; Circus- Circus Hotel, Casino, Parking Garage, RV Park & Grand Slam Canyon; CityCenter Las Vegas (CityCenter Boutique Hotel LLC, CityCenter Boutique Res Dev, CityCenter Harmon Hotel Holdings, CityCenter Vdara Dev LLC, CityCenter Veer Towers Dev LLC, Crystals CityCenter all currently under construction); Excalibur Hotel, Casino & Stables; Gold Strike Hotel & Casino; Luxor Hotel, Casino & Pedestrian Bridge; Mandalay Bay Hotel, Casino & Convention Center; MGM Grand Hotel, Casino, Special Events Arena & Parking Garage; Mirage Hotel, Casino, Parking Garage, Stable, Dolphin Habitat & Volcano; Monte Carlo Hotel, Casino & Parking Structure; New York-New York Hotel & Casino; Railroad Pass Hotel & Casino; Shadow Creek Golf Course; Slots-A-Fun Casino; vacant land in Primm (formerly Nevada Landing); vacant land on Circus Circus Dr. & Las Vegas Blvd. So.; vacant land on Sahara & Las Vegas Blvd. So.; Vdara Hotel & Spa) 2. HARRAH'S ENTERTAINMENT INCORPORATED 1,775,561,384 5,073,032,526 (Includes 190 Flamingo LLC; Bally's Grand Hotel, Casino, Convention Area & Parking Garage; Bill's Gamblin' Hall & Saloon; Caesar's Palace Hotel, Casino, Temple, Forum Shops, Tennis Pavillion, Magical Empire & Parking Garage; Cascata Golf Course; DCH Exchange LLC; Flamingo Hotel, Casino & Parking Garage; Harrah's Hotel, Casino, Parking Garage & Energy Building; Harrah's Laughlin Hotel, Casino & Parking Garage; Hole in the Wall LLC; Imperial Palace Hotel, Casino & Parking Garage; O'Sheas Casino; Paris Hotel, Casino, Theatre, Convention Center & Parking Garage; Planet Hollywood Hotel & Casino; Rio All-Suite Hotel, Casino & Parking Garage; Rio Secco Golf Course, Club & School; TRB Flamingo LLC; vacant land formerly the Bourbon Street Hotel & Casino) 3. -

DOWNTOWN LAS VEGAS Prime Multi-Family Investment Opportunity 505-515 S

DOWNTOWN LAS VEGAS Prime Multi-Family Investment Opportunity 505-515 S. 13th Street, Las Vegas, NV 89101 | Palm Garden Apartments • PRIME MULTI-FAMILY INVESTMENT • BELOW MARKET ASKING PSF OPPORTUNITY • LOCATED IN A QUALIFIED • 52 VERY SPACIOUS APARTMENT UNITS OPPORTUNITY ZONE • BELOW MARKET RENTS CommercialSun Real Estate, Inc. Sun Commercial Real Estate, Inc., 6140 Brent Thurman Way, Suite 140, Las Vegas, Nevada 89148 702 | 968 | 7300 Phone • 702 | 968 | 7301 Fax • www.SunCommercialRE.com CONFIDENTIALITY & DISCLOSURE SUN COMMERCIAL REAL ESTATE, INC. (the “Broker”) has been retained on an exclusive basis to market the property described herein (the “Property”). Broker has been authorized by the Seller of the Property (the “Seller”) to prepare and distribute the enclosed information (the “Material”) for the purpose of soliciting offers to purchase from interested parties. More detailed financial, title and tenant lease information may be made available upon request following the mutual execution of a letter of intent or contract to purchase between the Seller and a prospective purchaser. You are invited to review this opportunity and make an offer to purchase based upon your analysis. If your offer results in the Seller choosing to open negotiations with you, you will be asked to provide financial references. The eventual purchaser will be chosen based upon an assessment of price, terms, ability to close the transaction and such other matters as the Seller deems appropriate. The Material is intended solely for the purpose of soliciting expressions of interest from qualified investors for the acquisition of the Property. The Material is not to be copied and/or used for any other purpose or made available to any other person without the express written consent of Broker or Seller. -

117002 LVCVA Reprint Reque

ATTRACTIONS COLORADO RIVER HOOVER DAM, BYPASS BRIDGE Coursing more than a thousand miles from the Rockies to the Sea AND LAKE MEAD of Cortez, the mighty Colorado River provides irrigation, public Named one of the top 10 construction achievements of the 20th water and hydroelectric power to parts of Nevada, California century, few sights are more breathtaking than massive Hoover and Arizona. In Laughlin, the river also offers a wide spectrum of Dam. A National Historic Landmark that continues to draw crowds recreational activities. Enjoy boating, waterskiing, jet skiing, fishing more than 75 years after its creation, Hoover Dam is the highest or a refreshing dip in the brisk water. Launch ramp facilities are concrete dam in the Western Hemisphere, standing at more than plentiful along the river, as well as a multitude of watercraft rental 725’ above the Colorado River. Opened on October 19, 2010, services. For a more relaxed pace, take a leisurely, scenic ride or a and flanking the Hoover Dam, the Mike O’Callaghan-Pat Tillman dinner cruise aboard paddlewheel steamship replicas and tour boats Memorial Bridge was the first concrete-steel composite arch while listening to a narrated history of Laughlin and the surrounding bridge built in the U.S. and incorporates the longest arch in the area. The river can also be enjoyed by strolling along Laughlin’s River Western Hemisphere, standing at 840’ above the Colorado River. Walk. Extending from the Riverside Resort to the Laughlin River Above Hoover Dam is Lake Mead, the country’s largest manmade Lodge, visitors can take a relaxing walk along the river’s edge and lake, providing 550 miles of shoreline with varied and exceptional see the many fish and waterfowl that flock to its shores. -

Top of the Strat Package Exchange Your Vows in the Bella Vista Chapel Located on Level 103 with This One-Hour Wedding Package

Take your wedding day to a whole new level Thank you for your interest in hosting your special day with the Chapel in the Clouds at The STRAT Hotel, Casino & SkyPod. Our wedding consultants will cater to your every need to arrange a memorable experience, and our celebration spaces are so much more than your average ballroom. Both of our elegant chapels are located on Level 103 of our iconic SkyPod, offering panoramic views of the Las Vegas valley. Our intimate private balcony, located on Level 112, boasts the best views any Las Vegas resort can offer. For a more informal setting, host your ceremony on either our indoor or outdoor public observation deck, sharing your ceremony with spectators and inviting them into your joy. Regardless of which location you choose to tie the knot, the Chapel in the Clouds will elevate and ease the wedding planning process with one of our unique ceremony packages. Our packages are designed to accommodate weddings of all sizes, as intimate as an elopement for 2, or as magnificent as a ceremony with 100 guests. We cater to all ceremony types including vow renewals, commitment ceremonies and same-sex weddings. Ceremonies are performed seven days a week from 10am to 10pm, for your convenience. As you peruse our wedding packages, please note they are categorized by price and approximate number of guests. Elevate your wedding day with a custom-created reception in one of our private dining spaces. The STRAT Hotel, Casino & SkyPod offers an array of private dining rooms that feature both Strip and valley views, located on our SkyPod’s Level 103, Level 104 and Level 108. -

Chapel in the Clouds Wedding Brochure

\i·• .,,, • ,, ( \ > ' . ..i. ' CI--IAPEL IN TI--IE CLOUDS AT THE STRAT IN THE CLOUDS AT THE STRAT Take your wedding day to a whole new level Thank you for your interest in hosting your special day with the Chapel in the Clouds at The STRAT Hotel, Casino & SkyPod. Our wedding coordinators will cater to your every need to arrange a memorable experience, and our celebration spaces are so much more than your average ballroom. Both of our elegant chapels are located on Level 103 of our iconic SkyPod, offering panoramic views of the Las Vegas valley. Our intimate private balcony, located on Level 112, boasts the best views any Las Vegas resort can offer. For a more informal setting, host your ceremony on either our indoor or outdoor public Observation Deck, sharing your ceremony with spectators and inviting them into your joy. Regardless of which location you choose to tie the knot, the Chapel in the Clouds will elevate and ease the wedding planning process with one of our unique ceremony packages. Our packages are designed to accommodate weddings of all sizes, as intimate as an elopement for 2, or as magnifcent as a ceremony with 100 guests. We cater to all ceremony types including vow renewals, commitment ceremonies and same-sex weddings. Ceremonies are performed seven days a week from 10am to 10pm, for your convenience. Elevate your wedding day with a custom-created reception in one of our private dining spaces. The STRAT Hotel, Casino & SkyPod offers an array of private dining rooms that feature both Strip and valley views, located on our SkyPod’s Level 103, Level 104 and Level 108. -

Water Sports EXPO GENERAL EXHIBITOR INFORMATION FRIDAY, SATURDAY & SUNDAY, February 28-29-MARCH 1, 2020 at the EDGEWATER HOTEL & CASINO RESORT

Laughlin 2020 Water Sports EXPO GENERAL EXHIBITOR INFORMATION FRIDAY, SATURDAY & SUNDAY, February 28-29-MARCH 1, 2020 at the EDGEWATER HOTEL & CASINO RESORT Welcome to the inaugural 2020 Laughlin Water Sports Expo in Laughlin, Nevada, headquartered at the world-famous Edgewater Hotel & Casino where outdoor motorsports enthusiasts of boating, off-roading, RVing, and camping call home base. The Laughlin Water Sports Expo is brand new, capturing the spirit and passion of multiple active recreation segments, providing motivated consumers the opportunity to browse, compare and shop for the latest and greatest in boats, pontoons, off-road vehicles, trucks, sand rails, ATVs, UTVs, 4 x 4s, buggies, motorcycles, electric vehicles, RVs, toy haulers, travel trailers, personal watercraft, jet boats, kayaks, paddle- boards, bicycles, camping gear, and all related accessory products and services. LOCATION: Edgewater Hotel – Casino Resort – 2020 S. Casino Drive, Laughlin, Nevada SHOW HOURS: (rain or shine) Friday, February 28 – noon- 5pm Saturday, February 29 — 9am – 5pm Sunday, March 1 — 9am – 3pm CONCESSIONS: Food, beverages and beer garden on-site. No off-site alcoholic beverages or glass containers allowed. ADMISSION: Free! PARKING: On-site self-parking free/valet parking available IMPORTANT EXHIBITOR/VENDOR INFO BULK SPACE RATES: for boats, RVs, off-road vehicles, trailers, etc. SORRY, NO PRIVATE PARTY OWNED PRODUCTS ALLOWED – this is not a Swap Meet. Bulk Spaces 750 to 1500 square feet = $.70 per square foot Bulk Space 1500 to 2500 square feet -

Robert Lowinger, Et Al. V. MGM Mirage, Et Al. 09-CV-01558-Class Action

Case 2:09-cv-01558-BES-LRL Document 1 Filed 08/19/2009 Page 1 of 25 Ross C. Goodman, Esq., Nevada State Bar No. 7722 GOODMAN LAW GROUP 520 South Fourth Street Las Vegas, Nevada 89101 (702) 383-5088 (702) 385-5088 (Facsimile) Samuel H. Rudman, Esq., New York State Bar No. SR7957 David Rosenfeld, Esq., New York State Bar No. DR7564 Joseph Russello, Esq., New York State Bar No. JR2041 COUGHLIN STOIA GELLER RuDMAN & ROBBINS, LLP 58 South Service Road, Suite 200 Melville, NY 11747 (531) 367-7100 (631) 367-1173 (Facsimile) Jack G. Fruchter, Esq., New York State Bar No. JF8435 ABRAHAM FRUCHTER & TWERSKY, LLP One Penn Plaza, Suite 2805 New York, NY 10119 (212) 279-5050 (212) 279-3655 (Facsimile) ATTORNEYS FOR PLAINTIFF UNITED STATES DISTRICT COURT DISTRICT OF NEVADA ROBERT LOWINGER, Individually and On } Behalf of All Others Similarly Situated, } ) Case No.: Plaintiff, } } CLASS ACTION COMPLAINT FOR vs. } VIOLATIONS OF FEDERAL ^ SECURITIES LAWS MGM MIRAGE, J. TERRENCE LANNI, JAMES J. MURREN, DANIEL J. D'ARRIGO JURY DEMAND and ROBERT H. BALDWIN, } Defendants. } } Case 2:09-cv-01558-BES-LRL Document 1 Filed 08/19/2009 Page 2 of 25 Plaintiff alleges the following based upon the investigation of plaintiff's counsel, which included a review of United States Securities and Exchange Commission ("SEC") filings made by MGM Mirage ("MGM" or the "Company"), as well as regulatory filings and reports, securities analysts' reports and advisories about the Company, press releases and other public statements issued by the Company, and media reports about the Company, and believes that substantial additional evidentiary support will exist for the allegations set forth herein after a reasonable opportunity for discovery. -

Aquarius Resort Casino Bronze Golden Nugget Laughlin

For Immediate Release LAUGHLIN, NV – September 17, 2019 5th Annual Best of Laughlin Award Winners for 2019 Laughlin Buzz is proud to announce the 5th Annual Winners of the 2019 Best of Laughlin Awards. Every year the voting is very close in many categories. To honor more of the wonderful businesses, people and places we have expanded the awards this year to include the top three vote-getters in each Category. Gold is the Overall Winner, Silver is 2nd Place, and Bronze is the 3rd place. Best Casino Resort & Hotel Awards Best Casino Resort Gold Harrah’s Laughlin Silver Aquarius Casino Resort Bronze Riverside Resort Best Hotel Gold Aquarius Casino Resort Silver Harrah’s Laughlin Bronze Golden Nugget Laughlin Best Gaming Gold Harrah’s Laughlin Silver Aquarius Casino Resort Bronze Laughlin River Lodge Best Slot Machines Gold Harrah’s Laughlin Silver Aquarius Casino Resort Bronze Laughlin River Lodge Best Video Poker Gold Harrah’s Laughlin Silver Riverside Resort Bronze Aquarius Casino Resort Best Video Keno Gold Harrah’s Laughlin Silver Riverside Resort Bronze Laughlin River Lodge Best Table Games Gold Harrah’s Laughlin Silver Riverside Resort Bronze Aquarius Casino Resort Best Live Poker Gold Harrah’s Laughlin Silver Riverside Resort Bronze Colorado Belle (now closed) Best Live Keno Gold Harrah’s Laughlin Silver Riverside Resort Bronze Golden Nugget Laughlin Best Players Club Gold Caesar’s Rewards, Harrah’s Laughlin Silver King of Clubs, Riverside Resort Bronze Laughlin River Lodge Best Sports Book Gold Aquarius Casino Resort Silver Harrah’s