Trading Binary Options the Bloomberg Financial Series Provides Both Core Reference Knowledge and Actionable Information for Financial Professionals

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Seeking Income: Cash Flow Distribution Analysis of S&P 500

RESEARCH Income CONTRIBUTORS Berlinda Liu Seeking Income: Cash Flow Director Global Research & Design Distribution Analysis of S&P [email protected] ® Ryan Poirier, FRM 500 Buy-Write Strategies Senior Analyst Global Research & Design EXECUTIVE SUMMARY [email protected] In recent years, income-seeking market participants have shown increased interest in buy-write strategies that exchange upside potential for upfront option premium. Our empirical study investigated popular buy-write benchmarks, as well as other alternative strategies with varied strike selection, option maturity, and underlying equity instruments, and made the following observations in terms of distribution capabilities. Although the CBOE S&P 500 BuyWrite Index (BXM), the leading buy-write benchmark, writes at-the-money (ATM) monthly options, a market participant may be better off selling out-of-the-money (OTM) options and allowing the equity portfolio to grow. Equity growth serves as another source of distribution if the option premium does not meet the distribution target, and it prevents the equity portfolio from being liquidated too quickly due to cash settlement of the expiring options. Given a predetermined distribution goal, a market participant may consider an option based on its premium rather than its moneyness. This alternative approach tends to generate a more steady income stream, thus reducing trading cost. However, just as with the traditional approach that chooses options by moneyness, a high target premium may suffocate equity growth and result in either less income or quick equity depletion. Compared with monthly standard options, selling quarterly options may reduce the loss from the cash settlement of expiring calls, while selling weekly options could incur more loss. -

Implied Volatility Modeling

Implied Volatility Modeling Sarves Verma, Gunhan Mehmet Ertosun, Wei Wang, Benjamin Ambruster, Kay Giesecke I Introduction Although Black-Scholes formula is very popular among market practitioners, when applied to call and put options, it often reduces to a means of quoting options in terms of another parameter, the implied volatility. Further, the function σ BS TK ),(: ⎯⎯→ σ BS TK ),( t t ………………………………(1) is called the implied volatility surface. Two significant features of the surface is worth mentioning”: a) the non-flat profile of the surface which is often called the ‘smile’or the ‘skew’ suggests that the Black-Scholes formula is inefficient to price options b) the level of implied volatilities changes with time thus deforming it continuously. Since, the black- scholes model fails to model volatility, modeling implied volatility has become an active area of research. At present, volatility is modeled in primarily four different ways which are : a) The stochastic volatility model which assumes a stochastic nature of volatility [1]. The problem with this approach often lies in finding the market price of volatility risk which can’t be observed in the market. b) The deterministic volatility function (DVF) which assumes that volatility is a function of time alone and is completely deterministic [2,3]. This fails because as mentioned before the implied volatility surface changes with time continuously and is unpredictable at a given point of time. Ergo, the lattice model [2] & the Dupire approach [3] often fail[4] c) a factor based approach which assumes that implied volatility can be constructed by forming basis vectors. Further, one can use implied volatility as a mean reverting Ornstein-Ulhenbeck process for estimating implied volatility[5]. -

Show Me the Money: Option Moneyness Concentration and Future Stock Returns Kelley Bergsma Assistant Professor of Finance Ohio Un

Show Me the Money: Option Moneyness Concentration and Future Stock Returns Kelley Bergsma Assistant Professor of Finance Ohio University Vivien Csapi Assistant Professor of Finance University of Pecs Dean Diavatopoulos* Assistant Professor of Finance Seattle University Andy Fodor Professor of Finance Ohio University Keywords: option moneyness, implied volatility, open interest, stock returns JEL Classifications: G11, G12, G13 *Communications Author Address: Albers School of Business and Economics Department of Finance 901 12th Avenue Seattle, WA 98122 Phone: 206-265-1929 Email: [email protected] Show Me the Money: Option Moneyness Concentration and Future Stock Returns Abstract Informed traders often use options that are not in-the-money because these options offer higher potential gains for a smaller upfront cost. Since leverage is monotonically related to option moneyness (K/S), it follows that a higher concentration of trading in options of certain moneyness levels indicates more informed trading. Using a measure of stock-level dollar volume weighted average moneyness (AveMoney), we find that stock returns increase with AveMoney, suggesting more trading activity in options with higher leverage is a signal for future stock returns. The economic impact of AveMoney is strongest among stocks with high implied volatility, which reflects greater investor uncertainty and thus higher potential rewards for informed option traders. AveMoney also has greater predictive power as open interest increases. Our results hold at the portfolio level as well as cross-sectionally after controlling for liquidity and risk. When AveMoney is calculated with calls, a portfolio long high AveMoney stocks and short low AveMoney stocks yields a Fama-French five-factor alpha of 12% per year for all stocks and 33% per year using stocks with high implied volatility. -

OPTION-BASED EQUITY STRATEGIES Roberto Obregon

MEKETA INVESTMENT GROUP BOSTON MA CHICAGO IL MIAMI FL PORTLAND OR SAN DIEGO CA LONDON UK OPTION-BASED EQUITY STRATEGIES Roberto Obregon MEKETA INVESTMENT GROUP 100 Lowder Brook Drive, Suite 1100 Westwood, MA 02090 meketagroup.com February 2018 MEKETA INVESTMENT GROUP 100 LOWDER BROOK DRIVE SUITE 1100 WESTWOOD MA 02090 781 471 3500 fax 781 471 3411 www.meketagroup.com MEKETA INVESTMENT GROUP OPTION-BASED EQUITY STRATEGIES ABSTRACT Options are derivatives contracts that provide investors the flexibility of constructing expected payoffs for their investment strategies. Option-based equity strategies incorporate the use of options with long positions in equities to achieve objectives such as drawdown protection and higher income. While the range of strategies available is wide, most strategies can be classified as insurance buying (net long options/volatility) or insurance selling (net short options/volatility). The existence of the Volatility Risk Premium, a market anomaly that causes put options to be overpriced relative to what an efficient pricing model expects, has led to an empirical outperformance of insurance selling strategies relative to insurance buying strategies. This paper explores whether, and to what extent, option-based equity strategies should be considered within the long-only equity investing toolkit, given that equity risk is still the main driver of returns for most of these strategies. It is important to note that while option-based strategies seek to design favorable payoffs, all such strategies involve trade-offs between expected payoffs and cost. BACKGROUND Options are derivatives1 contracts that give the holder the right, but not the obligation, to buy or sell an asset at a given point in time and at a pre-determined price. -

Option Prices Under Bayesian Learning: Implied Volatility Dynamics and Predictive Densities∗

Option Prices under Bayesian Learning: Implied Volatility Dynamics and Predictive Densities∗ Massimo Guidolin† Allan Timmermann University of Virginia University of California, San Diego JEL codes: G12, D83. Abstract This paper shows that many of the empirical biases of the Black and Scholes option pricing model can be explained by Bayesian learning effects. In the context of an equilibrium model where dividend news evolve on a binomial lattice with unknown but recursively updated probabilities we derive closed-form pricing formulas for European options. Learning is found to generate asymmetric skews in the implied volatility surface and systematic patterns in the term structure of option prices. Data on S&P 500 index option prices is used to back out the parameters of the underlying learning process and to predict the evolution in the cross-section of option prices. The proposed model leads to lower out-of- sample forecast errors and smaller hedging errors than a variety of alternative option pricing models, including Black-Scholes and a GARCH model. ∗We wish to thank four anonymous referees for their extensive and thoughtful comments that greatly improved the paper. We also thank Alexander David, Jos´e Campa, Bernard Dumas, Wake Epps, Stewart Hodges, Claudio Michelacci, Enrique Sentana and seminar participants at Bocconi University, CEMFI, University of Copenhagen, Econometric Society World Congress in Seattle, August 2000, the North American Summer meetings of the Econometric Society in College Park, June 2001, the European Finance Association meetings in Barcelona, August 2001, Federal Reserve Bank of St. Louis, INSEAD, McGill, UCSD, Universit´edeMontreal,andUniversity of Virginia for discussions and helpful comments. -

Monte Carlo Strategies in Option Pricing for Sabr Model

MONTE CARLO STRATEGIES IN OPTION PRICING FOR SABR MODEL Leicheng Yin A dissertation submitted to the faculty of the University of North Carolina at Chapel Hill in partial fulfillment of the requirements for the degree of Doctor of Philosophy in the Department of Statistics and Operations Research. Chapel Hill 2015 Approved by: Chuanshu Ji Vidyadhar Kulkarni Nilay Argon Kai Zhang Serhan Ziya c 2015 Leicheng Yin ALL RIGHTS RESERVED ii ABSTRACT LEICHENG YIN: MONTE CARLO STRATEGIES IN OPTION PRICING FOR SABR MODEL (Under the direction of Chuanshu Ji) Option pricing problems have always been a hot topic in mathematical finance. The SABR model is a stochastic volatility model, which attempts to capture the volatility smile in derivatives markets. To price options under SABR model, there are analytical and probability approaches. The probability approach i.e. the Monte Carlo method suffers from computation inefficiency due to high dimensional state spaces. In this work, we adopt the probability approach for pricing options under the SABR model. The novelty of our contribution lies in reducing the dimensionality of Monte Carlo simulation from the high dimensional state space (time series of the underlying asset) to the 2-D or 3-D random vectors (certain summary statistics of the volatility path). iii To Mom and Dad iv ACKNOWLEDGEMENTS First, I would like to thank my advisor, Professor Chuanshu Ji, who gave me great instruction and advice on my research. As my mentor and friend, Chuanshu also offered me generous help to my career and provided me with great advice about life. Studying from and working with him was a precious experience to me. -

Empirical Properties of Straddle Returns

EDHEC RISK AND ASSET MANAGEMENT RESEARCH CENTRE 393-400 promenade des Anglais 06202 Nice Cedex 3 Tel.: +33 (0)4 93 18 32 53 E-mail: [email protected] Web: www.edhec-risk.com Empirical Properties of Straddle Returns December 2008 Felix Goltz Head of applied research, EDHEC Risk and Asset Management Research Centre Wan Ni Lai IAE, University of Aix Marseille III Abstract Recent studies find that a position in at-the-money (ATM) straddles consistently yields losses. This is interpreted as evidence for the non-redundancy of options and as a risk premium for volatility risk. This paper analyses this risk premium in more detail by i) assessing the statistical properties of ATM straddle returns, ii) linking these returns to exogenous factors and iii) analysing the role of straddles in a portfolio context. Our findings show that ATM straddle returns seem to follow a random walk and only a small percentage of their variation can be explained by exogenous factors. In addition, when we include the straddle in a portfolio of the underlying asset and a risk-free asset, the resulting optimal portfolio attributes substantial weight to the straddle position. However, the certainty equivalent gains with respect to the presence of a straddle in a portfolio are small and probably do not compensate for transaction costs. We also find that a high rebalancing frequency is crucial for generating significant negative returns and portfolio benefits. Therefore, from an investor's perspective, straddle trading does not seem to be an attractive way to capture the volatility risk premium. JEL Classification: G11 - Portfolio Choice; Investment Decisions, G12 - Asset Pricing, G13 - Contingent Pricing EDHEC is one of the top five business schools in France. -

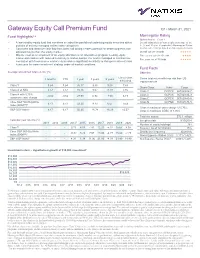

Gateway Equity Call Premium Fund

Gateway Equity Call Premium Fund Q1 • March 31, 2021 Fund Highlights1,2 Morningstar Rating Options-based – Class Y • A low-volatility equity fund that combines an index-like portfolio of underlying equity securities with a Overall rating derived from weighted average of the portfolio of actively managed written index call options 3-, 5- and 10-year (if applicable) Morningstar Rating • Consistent and attractive cash flow from index call writing creates potential for better long-term risk- metrics; other ratings based on risk-adjusted returns adjusted returns than the equity market Overall out of 113 funds ★★★★★ • May be used as a component of an equity allocation or an alternatives program seeking equity Three years out of 113 funds ★★★★ market participation with reduced sensitivity to market swings; the fund is managed to maintain low Five years out of 70 funds correlation with fixed-income market returns and no significant sensitivity to changes in interest rates ★★★★★ • Fund uses the same investment strategy under all market conditions Fund Facts Average annualized total returns† (%) Objective Life of class 3 months YTD 1 year 3 years 5 years Seeks total return with less risk than US 9/30/2014 equity markets Class Y 5.64 5.64 36.17 9.35 9.08 7.43 Share Class Ticker Cusip Class A at NAV 5.57 5.57 35.76 9.07 8.79 7.16 Class Y GCPYX 367829-82-7 Class A with 5.75% -0.52 -0.52 27.93 6.94 7.50 6.19 Class A GCPAX 367829-84-3 maximum sales charge Class C GCPCX 367829-83-5 Cboe S&P 500 BuyWrite Class N GCPNX 367829-78-5 5.73 5.73 32.20 4.79 6.67 -

An Option Greeks Primer – Building Intuition with Delta Hedging and Monte Carlo Simulation Using Excel

Global Financial Markets series Global Financial Markets is a series of practical guides to the latest financial market tools, techniques and strategies. Written for practitioners across a range of disciplines it provides comprehensive but practical coverage of key topics in finance covering strategy, markets, financial products, tools and techniques and their implementation. This series will appeal to a broad readership, from new entrants to experienced prac- titioners across the financial services industry, including areas such as institutional investment; financial derivatives; investment strategy; private banking; risk manage- ment; corporate finance and M&A, financial accounting and governance, and many more. Titles include: Cyril Demaria PRIVATE EQUITY FUND INVESTMENTS New Insights on Alignment of Interests, Governance, Returns and Forecasting Erik Banks DARK POOLS, 2nd Edition Off-Exchange Liquidity in an Era of High Frequency, Program, and Algorithmic Trading Erik Banks LIQUIDITY RISK, 2nd Edition Managing Funding and Asset Risk Felix Lessambo THE INTERNATIONAL CORPORATE GOVERNANCE SYSTEM Audit Roles and Board Oversight Sandy Chen INTEGRATED BANK ANALYSIS AND VALUATION A Practical Guide to the ROIC Methodology Jawwad Farid MODELS AT WORK A Practitioner’s Guide to Risk Management Frances Cowell RISK-BASED INVESTMENT MANAGEMENT IN PRACTICE, 2nd Edition Daniel Capocci THE COMPLETE GUIDE TO HEDGE FUNDS AND HEDGE FUND STRATEGIES Guy Fraser-Sampson INTELLIGENT INVESTING A Guide to the Practical and Behavioural Aspects of Investment Strategy -

Liquidity Effects in Options Markets: Premium Or Discount?

Liquidity Effects in Options Markets: Premium or Discount? PRACHI DEUSKAR1 2 ANURAG GUPTA MARTI G. SUBRAHMANYAM3 March 2007 ABSTRACT This paper examines the effects of liquidity on interest rate option prices. Using daily bid and ask prices of euro (€) interest rate caps and floors, we find that illiquid options trade at higher prices relative to liquid options, controlling for other effects, implying a liquidity discount. This effect is opposite to that found in all studies on other assets such as equities and bonds, but is consistent with the structure of this over-the-counter market and the nature of the demand and supply forces. We also identify a systematic factor that drives changes in the liquidity across option maturities and strike rates. This common liquidity factor is associated with lagged changes in investor perceptions of uncertainty in the equity and fixed income markets. JEL Classification: G10, G12, G13, G15 Keywords: Liquidity, interest rate options, euro interest rate markets, Euribor market, volatility smiles. 1 Department of Finance, College of Business, University of Illinois at Urbana-Champaign, 304C David Kinley Hall, 1407 West Gregory Drive, Urbana, IL 61801. Ph: (217) 244-0604, Fax: (217) 244-9867, E-mail: [email protected]. 2 Department of Banking and Finance, Weatherhead School of Management, Case Western Reserve University, 10900 Euclid Avenue, Cleveland, Ohio 44106-7235. Ph: (216) 368-2938, Fax: (216) 368-6249, E-mail: [email protected]. 3 Department of Finance, Leonard N. Stern School of Business, New York University, 44 West Fourth Street #9-15, New York, NY 10012-1126. Ph: (212) 998-0348, Fax: (212) 995-4233, E- mail: [email protected]. -

FX Volatility Smile Construction

A Service of Leibniz-Informationszentrum econstor Wirtschaft Leibniz Information Centre Make Your Publications Visible. zbw for Economics Reiswich, Dimitri; Wystup, Uwe Working Paper FX volatility smile construction CPQF Working Paper Series, No. 20 Provided in Cooperation with: Frankfurt School of Finance and Management Suggested Citation: Reiswich, Dimitri; Wystup, Uwe (2009) : FX volatility smile construction, CPQF Working Paper Series, No. 20, Frankfurt School of Finance & Management, Centre for Practical Quantitative Finance (CPQF), Frankfurt a. M. This Version is available at: http://hdl.handle.net/10419/40186 Standard-Nutzungsbedingungen: Terms of use: Die Dokumente auf EconStor dürfen zu eigenen wissenschaftlichen Documents in EconStor may be saved and copied for your Zwecken und zum Privatgebrauch gespeichert und kopiert werden. personal and scholarly purposes. Sie dürfen die Dokumente nicht für öffentliche oder kommerzielle You are not to copy documents for public or commercial Zwecke vervielfältigen, öffentlich ausstellen, öffentlich zugänglich purposes, to exhibit the documents publicly, to make them machen, vertreiben oder anderweitig nutzen. publicly available on the internet, or to distribute or otherwise use the documents in public. Sofern die Verfasser die Dokumente unter Open-Content-Lizenzen (insbesondere CC-Lizenzen) zur Verfügung gestellt haben sollten, If the documents have been made available under an Open gelten abweichend von diesen Nutzungsbedingungen die in der dort Content Licence (especially Creative Commons -

Annual Accounts and Report Draft

Draft Annual Accounts and Report as at 30 June 2017 Annual General Meeting, 28 October 2017 LIMITED COMPANY SHARE CAPITAL € 440,617,579.00 HEAD OFFICE: PIAZZETTA ENRICO CUCCIA 1, MILAN, ITALY REGISTERED AS A BANK. PARENT COMPANY OF THE MEDIOBANCA BANKING GROUP. REGISTERED AS A BANKING GROUP Annual General Meeting 28 October 2017 www.mediobanca.com translation from the Italian original which remains the definitive version BOARD OF DIRECTORS Term expires Renato Pagliaro Chairman 2017 * Maurizia Angelo Comneno Deputy Chairman 2017 Marco Tronchetti Provera Deputy Chairman 2017 * Alberto Nagel Chief Executive Officer 2017 * Francesco Saverio Vinci General Manager 2017 Tarak Ben Ammar Director 2017 Gilberto Benetton Director 2017 Mauro Bini Director 2017 Marie Bolloré Director 2017 Maurizio Carfagna Director 2017 * Angelo Caso’ Director 2017 Maurizio Costa Director 2017 Vanessa Labérenne Director 2017 Elisabetta Magistretti Director 2017 Alberto Pecci Director 2017 * Gian Luca Sichel Director 2017 * Alexandra Young Director 2017 * Member of Executive Committee STATUTORY AUDIT COMMITTEE Natale Freddi Chairman 2017 Laura Gualtieri Standing Auditor 2017 Gabriele Villa Standing Auditor 2017 Alessandro Trotter Alternate Auditor 2017 Barbara Negri Alternate Auditor 2017 Silvia Olivotto Alternate Auditor 2017 *** Massimo Bertolini Head of Company Financial Reporting and Secretary to the Board of Directors www.mediobanca.com translation from the Italian original which remains the definitive version CONTENTS Consolidated Accounts Review of operations