Interrogatory on House Bill 21-1164 Submitted by the Colorado General Assembly

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Plaintiffs-Appellees' Petition for Rehearing, Filed

Appellate Case: 12-1445 Document: 01019653881 Date Filed: 07/08/2016 Page: 1 CASE NO. 12-1445 IN THE UNITED STATES COURT OF APPEALS FOR THE TENTH CIRCUIT ANDY KERR,Colorado State Representative,et al., Plaintiffs-Appellees, v. JOHN HICKENLOOPER, Governor ofColorado,in his official capacity, Defendant-Appellant. On Remand from theUnited States Supreme Court Case No. 14-460 PLAINTIFFS-APPELLEES’PETITION FOR PANEL REHEARING LINO S. LIPINSKY de ORLOV MICHAELF. FEELEY DAVID E. SKAGGS SARAH M. CLARK Dentons US LLP CARRIE E. JOHNSON 1400 Wewatta Street,Suite 700 Brownstein Hyatt Farber Schreck LLP Denver,Colorado 80202 410 17thStreet,Suite 2200 (303)634-4000 Denver,Colorado 80202-4437 (303)223-1100 HERBERT LAWRENCE FENSTER Covington & BurlingLLP MICHAELL. BENDER 850 10thStreet NW Perkins Coie LLP Washington,DC 20001 1900 SixteenthStreet,Suite 1400 (202)662-5381 Denver,Colorado 80202 (303)291-2366 JOHN A. HERRICK 2715 Blake Street,No. 9 Denver,Colorado 80205 (720)987-3122 Attorneys for Petitioners Appellate Case: 12-1445 Document: 01019653881 Date Filed: 07/08/2016 Page: 2 TABLE OF CONTENTS I. RULE 40 STATEMENT....................................................................................1 II. BACKGROUND ................................................................................................1 III. REASONS FOR PANELREHEARING...........................................................3 A. Arizona Did Not Hold That an Entire Legislature Is Required to EstablishLegislator Standing...................................................................3 -

Legislative Oversight Commitee Concerning the Treatment of Persons with Mental Health Disorders in the Criminal and Juvenile Justice Systems

2019 Report to the Colorado General Assembly Legislative Oversight Commitee Concerning the Treatment of Persons with Mental Health Disorders in the Criminal and Juvenile Justice Systems Prepared by Legislative Council Staff Research Publication No. 740 December 2019 Legislative Oversight Committee Concerning the Treatment of Persons with Mental Health Disorders in the Criminal and Juvenile Justice Systems Members of the Committee Senator Robert Rodriguez, Chair Representative Jonathan Singer, Vice-Chair Senator John Cooke Representative Adrienne Benavidez Senator Rhonda Fields Representative Stephen Humphrey Legislative Council Staff Juliann Jenson, Research Analyst Anne Wallace, Research Analyst Office of Legislative Legal Services Jane Ritter, Senior Attorney Shelby Ross, Staff Attorney December 2019 COLORADO GENERAL ASSEMBLY EXECUTIVE COMMITTEE COMMITTEE Sen. Leroy Garcia, Chair Sen. John Cooke Rep. KC Becker, Vice Chair Sen. Lois Court Sen. Stephen Fenberg Rep. Monica Duran Rep. Alec Garnett Rep. Dominique Jackson Sen. Chris Holbert Rep. Susan Lontine Rep. Patrick Neville Sen. Vicki Marble Sen. Dominick Moreno STAFF Rep. Kyle Mullica Natalie Mullis, Director Rep. Lori Saine Elizabeth Burger, Deputy Director Sen. Ray Scott Manish Jani, Deputy Director Rep. Kevin Van Winkle Sen. Angela Williams LEGISLATIVE COUNCIL ROOM 029 STATE CAPITOL DENVER, COLORADO 80203-1784 E-mail: [email protected] 303-866-3521 FAX: 303-866-3855 TDD: 303-866-3472 December 2019 To Members of the Seventy-second General Assembly: Submitted herewith is the final report of the Legislative Oversight Committee Concerning the Treatment of Persons with Mental Health Disorders in the Criminal and Juvenile Justice Systems. This committee was created pursuant to Article 1.9 of Title 18, Colorado Revised Statutes. -

Colorado SBDC

COLORADO OFFICE OF ECONOMIC DEVELOPMENT AND INTERNATIONAL TRADE THE COLORADO SMALL BUSINESS DEVELOPMENT CENTER NETWORK (SBDC) 2011 Letter from the OEDIT Executive Director On behalf of the State of Colorado and the Colorado Office of Economic Development and International Trade, I would like to introduce you to our Colorado Small Business Development Center Network (SBDC). Colorado is home to over 570,000 entrepreneurs and small businesses. From ski manufacturers to craft brewery start-ups, small businesses are at the heart of the Colorado economy. The network of SBDCs ensures that every Coloradan who owns a business—or who is considering going into business—has access to free consulting and free or low-cost training in order to succeed. Our SBDCs can help with writing a business plan, creating financials, cash flow management and marketing assistance. The SBDC network is part of the Colorado Office of Economic Development and International Trade, an agency that has made the retention and creation of jobs throughout the state its first and only priority. As a part of our Colorado Blueprint strategic plan, we are committed to building a business-friendly environment, increasing access to capital and growing our Colorado companies. I congratulate the Small Business Development Centers for their services to Colorado’s small businesses to help us achieve this mission. Sincerely, Ken Lund Executive Director, Colorado Office of Economic Development and International Trade Letter from the State Director The Colorado SBDC Network is a vibrant network of fourteen Centers strategically positioned throughout the state to ensure that residents of every county have access to small business assistance. -

2018 Scorecard

A NOTE FROM PUBLIC POLICY DIRECTOR DENISE MAES COLORADO’S legislative ty jails. We also attempted to bring greater ABOUT THIS SCORECARD session is 120 days and transparency to police internal affairs’ files, a great deal happens in to no avail. Our efforts to stop the practice HOW WE CHOSE THE SCORED BILLS these mere four months of revoking an individual’s driver’s license for While the ACLU of Colorado took a po- that affect many Colora- their failure to pay a traffic-related fee was sition on more than 100 pieces of legis- dans. For example, in the also rejected. lation in 2018 alone, our practice is to 2018 session, transportation only score bills that were voted on by and education saw unprece- Our gains, however, are not insignificant. all members of at least one legislative dented gains in funding. The legis- We championed a bill sponsored by Sen. chamber. This precluded us from scor- lature infused $645 million into multi-modal Vicki Marble and Rep. Susan Lontine that ing several bills, including attacks on transportation and infrastructure and increased will bring independent and robust public per pupil funding by $469 per student. defenders to all Colorado municipal courts. reproductive rights that were rightly Incarcerating kids for missing school is a defeated in committee. From there, we Civil liberties legislation rarely gets much at- harsh punishment. Thanks to Sen. Chris chose the bills that we felt were the tention. The one exception this year was the Holbert and Rep. Pete Lee, this practice is best representations of the civil liber- reauthorization of the Colorado Civil Rights Di- now limited. -

The Arc of Colorado 2019 Legislative Scorecard

The Arc of Colorado 2019 Legislative Scorecard A Letter from Our Executive Director: Dear Members of The Arc Community, Once again, I would like to thank each of you for your part in a successful legislative session. We rely on your expertise in the field. We rely on you for our strength in numbers. For all the ways you contributed this session, we are deeply appreciative. I would like to give a special thanks to those that came and testified on our behalf; Stephanie Garcia, Carol Meredith, Linda Skafflen, Shelby Lowery, Vicki Wray, Rowan Frederiksen, and many others who I may not have mentioned here. This session was a historic one. For the first time in 75 years, one party had control of the house, senate, and governor’s office. Additionally, there were 43 new legislators! We enjoyed a productive year in which The Arc of Colorado monitored 100 bills. Of those that we supported, 92% were signed by the governor and 100% of the bills that we opposed died. This high success rate means that individuals with intellectual and developmental disabilities and their families will have more opportunity to better live, work, learn, and play in their Colorado communities, with increased support. We are excited about many of this year’s outcomes. In a very tight budget year, the Joint Budget Committee was able to free up money for 150 additional slots for the Developmental Disabilities waiver waitlist. After three years of involvement, we finally saw the passing of HB19-1194, which places restrictions on suspensions and expulsions of children from preschool, through to second grade. -

2020 ASAC COLORADO Elections Report

Colorado Election 2020 Results This year, Colorado turned even more blue. President Donald Trump lost to Joe Biden by double-digit margins. Senator Cory Gardner lost to former Governor John Hickenlooper, making all statewide elected officials Democrats for the first time in 84 years. In the only competitive congressional race (3rd), newcomer Lauren Boebert (R) beat former state representative Diane Mitsch Bush (D). In the State House: • Representative Bri Buentello (HD 47) lost her seat to Republican Stephanie Luck • Representative Richard Champion (HD 38) lost his seat to Democrat David Ortiz • Republicans were trying to cut the Democrat majority by 3 seats to narrow the committee make up but ¾ targeted Democrats Reps. Cutter, Sullivan, and Titone held their seats • Democrats will control the House with the same 41-24 margin House Democratic Leadership • Speaker – Rep. Alec Garnett (Denver) unopposed (Rep. Becker term limited) • Majority Leader – Rep. Daneya Esgar (Pueblo) • Assistant Majority Leader – Rep. Serena Gonzales-Gutierrez (Denver • Co-caucus chairs – Rep. Meg Froelich (Denver) and Rep. Lisa Cutter (Jefferson County) • Co-whips – Rep. Kyle Mullica (Northglenn) and Rep. Monica Duran (Wheat Ridge) • The Speaker Pro Tempore will be appointed later. Current Speaker Pro Tem Janet Bucker was elected to the Senate. • Democratic JBC members are appointed in the House and Rep. Esgar’s slot will need to be filled. Rep. McCluskie is the other current Democratic member. House Republican Leadership • Minority Leader – Hugh McKean (Loveland) -

0611 Water Resources Review Committee

University of Denver Digital Commons @ DU Colorado Legislative Council Research All Publications Publications 12-2011 0611 Water Resources Review Committee Colorado Legislative Council Follow this and additional works at: https://digitalcommons.du.edu/colc_all Recommended Citation Colorado Legislative Council, "0611 Water Resources Review Committee" (2011). All Publications. 644. https://digitalcommons.du.edu/colc_all/644 This Article is brought to you for free and open access by the Colorado Legislative Council Research Publications at Digital Commons @ DU. It has been accepted for inclusion in All Publications by an authorized administrator of Digital Commons @ DU. For more information, please contact [email protected],[email protected]. Report to the Colorado General Assembly Water Resources Review Committee Prepared by The Colorado Legislative Council Research Publication No. 611 December 2011 Water Resources Review Committee Members of the Committee Senator Gail Schwartz, Chair Representative Jerry Sonnenberg, Vice-Chair Senator Greg Brophy Representative Randy Baumgardner Senator Angela Giron Representative Keith Swerdfeger Senator Mary Hodge Representative Ed Vigil Senator Ellen Roberts Representative Roger Wilson Legislative Council Staff David Beaujon, Senior Analyst Lauren Ris, Research Associate Alex Schatz, Fiscal Analyst Office of Legislative Legal Services Tom Morris, Senior Staff Attorney December 2011 COLORADO GENERAL ASSEMBLY EXECUTIVE COMMITTEE COMMITTEE Sen. Brandon Shaffer, Chairman Sen. Betty Boyd Rep. Frank McNulty, Vice Chairman Sen. Kevin Grantham Sen. Bill Cadman Sen. Mary Hodge Sen. John Morse Sen. Jeanne Nicholson Rep. Mark Ferrandino Sen. Scott Renfroe Rep. Amy Stephens Sen. Mark Scheffel Rep. Jim Kerr STAFF Rep. Claire Levy Mike Mauer, Director Rep. B.J. Nikkel Amy Zook, Deputy Director Rep. -

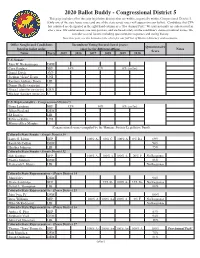

2020 Ballot Buddy - Congressional District 5 This Page Includes All of the State Legislative Districts That Are Within, Or Partially Within, Congressional District 5

2020 Ballot Buddy - Congressional District 5 This page includes all of the state legislative districts that are within, or partially within, Congressional District 5. (Only one of the state house races and one of the state senate races will appear on your ballot). Candidates that CVA has endorsed are designated in the right-hand column as a "Pro-Animal Pick." We may not make an endorsement in every race. Our endorsements are non-partisan, and are based solely on the candidate’s stance on animal issues. We consider several factors including questionnaire responses and voting history. New this year, see the bottom of the chart for our full list of District Attorney endorsements. Office Sought and Candidates Incumbent Voting Record (last 6 years): Questionnaire listed in ballot order (may be for different offices) Notes Score Name Party 2015 2016 2017 2018 2019 2020 U.S. Senate John W. Hickenlooper DEM Cory Gardner REP 14% 12% 0% (so far) Daniel Doyle AVP Stephan "Seku" Evans UNI Raymon Anthony Doane LIB Danny Skelly (write-in) U Bruce Lohmiller (write-in) GRN Michael Sanchez (write-in) U U.S. Representative - Congressional District 5 Doug Lamborn REP 15% 14% 8% (so far) Jillian Freeland DEM Ed Duffett LIB Rebecca Keltie UNI Marcus Allen Murphy U (Congressional scores compiled by the Humane Society Legislative Fund) Colorado State Senate - Senate District 10 Larry G. Liston REP 100% A- 60% C 100% A 0% D+ 69% Randi McCallian DEM 94% Heather Johnson LIB 75% Colorado State Senate - Senate District 12 Bob Gardner REP 100% A- 100% A 100% A- 20% F No Response Electra Johnson DEM 88% Zechariah L. -

Colorado Campaign Contributions Final

Colorado Campaign Contributions Percentage of out-of-state contributions Sources: FEC.gov, sos.state.co.us Race Candidate Party Party Colorado Attorney General George Brauchler Republican 3.6% Democrat Phil Weiser Democrat 12.6% Republican Colorado Governor Jared Polis Democrat 9.5% Unaffiliated Walker Stapleton Republican 24.1% Colorado Secretary of State Jena Griswold Democrat 12.5% Wayne Williams Republican 1.2% Colorado State House District 1 Alysia Padilla Republican 0.0% Susan Lontine Democrat 5.6% Colorado State House District 2 Alec Garnett Democrat 21.2% Colorado State House District 3 Jeff Bridges Democrat 11.2% Toren Mushovic Republican 23.4% Colorado State House District 4 Robert John Republican 0.0% Serena Gonzales-Gutierrez Democrat 2.9% Colorado State House District 5 Alex Valdez Democrat 14.7% Katherine Whitney Republican 25.9% Colorado State House District 6 Chris Hansen Democrat 10.8% Colorado State House District 7 James Coleman Democrat 12.9% Jay Kucera Republican 0.0% Colorado State House District 8 Leslie Herod Democrat 42.2% Colorado State House District 9 Bob Lane Republican Emily Sirota Democrat 67.6% Colorado State House District 10 Edie Hooton Democrat 0.0% Murl Hendrickson Republican 28.6% Colorado State House District 11 Brian Donahue Republican 0.0% Jonathan Singer Democrat 5.5% Colorado State House District 12 David Ross Republican 0.0% Sonya Lewis Democrat 11.3% Colorado State House District 13 KC Becker Democrat 8.6% Kevin Sipple Republican 0.0% Colorado State House District 14 Paul Haddick Democrat 0.0% Shane -

Zero Waste and Recycling Interim Study Committee

2019 Report to the Colorado General Assembly Zero Waste and Recycling Interim Study Committee Prepared by Legislative Council Staff Research Publication No. 728 December 2019 Zero Waste and Recyling Interim Study Committee Members of the Committee Representative Lisa Cutter, Chair Senator Dominick Moreno, Vice-Chair Senator Don Coram Representative Jeni James Arndt Senator Mike Foote Representative Marc Catlin Senator Kevin Priola Representative Meg Froelich Senator Tammy Story Representative Rod Pelton Legislative Council Staff Amanda King, Senior Research Analyst Andrea Denka, Research Analyst Clare Pramuk, Principal Fiscal Analyst Office of Legislative Legal Services Richard Sweetman, Senior Attorney Jennifer Berman, Senior Attorney Pierce Lively, Staff Attorney Thomas Morris, Managing Senior Attorney Vanessa Cleaver, Legislative Editor December 2019 COLORADO GENERAL ASSEMBLY EXECUTIVE COMMITTEE COMMITTEE Sen. Leroy Garcia, Chair Sen. John Cooke Rep. KC Becker, Vice Chair Sen. Lois Court Sen. Stephen Fenberg Rep. Monica Duran Rep. Alec Garnett Rep. Dominique Jackson Sen. Chris Holbert Rep. Susan Lontine Rep. Patrick Neville Sen. Vicki Marble Sen. Dominick Moreno STAFF Rep. Kyle Mullica Natalie Mullis, Director Rep. Lori Saine Elizabeth Burger, Deputy Director Sen. Ray Scott Manish Jani, Deputy Director Rep. Kevin Van Winkle Sen. Angela Williams LEGISLATIVE COUNCIL ROOM 029 STATE CAPITOL DENVER, COLORADO 80203-1784 E-mail: [email protected] 303-866-3521 FAX: 303-866-3855 TDD: 303-866-3472 December 2019 To Members of the Seventy-second General Assembly: Submitted herewith is the final report of the Zero Waste and Recycling Interim Study Committee. This committee was created pursuant to Interim Committee Request Letter 2019-02. The purpose of this committee is to study waste and recycling infrastructure, composting, and public awareness of moving toward zero waste in Colorado. -

State Election Results, 2005

Official Publication of the Abstract of Votes Cast for the 2005 Coordinated 2006 Primary 2006 General To the Citizens of Colorado: The information in this abstract is compiled from material filed by each of Colorado’s sixty- four County Clerk and Recorders. This publication is a valuable tool in the study of voting patterns of Colorado voters during the 2005 Coordinated, 2006 Primary, and 2006 General Election. As the State’s chief election officer, I encourage the Citizens of Colorado to take an active role in our democratic process by exercising their right to vote. Mike Coffman Colorado Secretary of State Table of Contents GLOSSARY OF ABSTRACT TERMS .............................................................................................. 4 DISCLAIMER ......................................................................................................................... 6 DIRECTORY .......................................................................................................................... 7 United States Senators .........................................................................................................................7 Congressional Members .......................................................................................................................7 Governor ..........................................................................................................................................7 Lieutenant Governor ...........................................................................................................................7 -

Senate Journal-50Th Day-February 25, 2015 Page 335 SENATE

Senate Journal-50th Day-February 25, 2015 Page 335 SENATE JOURNAL 1 Seventieth General Assembly 2 STATE OF COLORADO 3 First Regular Session 4 5 6 50th Legislative Day Wednesday, February 25, 2015 7 8 9 10 Prayer By the chaplain, Superintendent Patrick Lee Demmer, Graham Memorial Community 11 Church of God in Christ, Denver. 12 13 Call to By the President at 9:00 a.m. 14 Order 15 16 Pledge By Senator Woods 17 18 Roll Call Present--34 19 Excused--1, Aguilar. 20 21 Quorum The President announced a quorum present. 22 23 Reading of On motion of Senator Martinez Humenik, reading of the Journal of Tuesday, 24 Journal February 24, 2015, was dispensed with and the Journal was approved as corrected by the 25 Secretary. 26 27 ___________ 28 29 30 COMMITTEE OF REFERENCE REPORTS 31 32 33 Finance After consideration on the merits, the Committee recommends that SB15-131 be 34 postponed indefinitely. 35 36 37 Finance After consideration on the merits, the Committee recommends that SB15-138 be amended 38 as follows, and as so amended, be referred to the Committee of the Whole with favorable 39 recommendation. 40 41 Amend the Education Committee Report, dated February 19, 2015, page 42 2, line 13, strike "22-30.5-108" and substitute "22-35-108". 43 44 45 Finance After consideration on the merits, the Committee recommends that HB15-1069 be referred 46 to the Committee of the Whole with favorable recommendation and with a 47 recommendation that it be placed on the Consent Calendar.