Ronald P. Joelson | Northwestern Mutual

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Northwestern Mutual [email protected] 314-539-0830

FOR IMMEDIATE RELEASE For further information, contact: Jill Miller, Northwestern Mutual [email protected] 314-539-0830 Northwestern Mutual Becomes the Next Silver Mosaic Ambassador Company The St. Louis Mosaic Project is excited to announce Northwestern Mutual as the latest Silver Mosaic Ambassador Company in a joint effort to foster a welcoming environment for those new to the St. Louis region. Northwestern Mutual is a leading financial security company. Northwestern Mutual in St. Louis serves the greater St. Louis, Columbia and Southwestern Illinois. The St. Louis network office was founded in 1905. Northwestern Mutual in St. Louis is committed to serving, caring for and challenging their clients and fellow associates and is driven by their values of loyalty, integrity, faith-family-fitness-fun and excellence. As a company, Northwestern Mutual is passionate about empowering people to make the most of every single day and plan for important moments in their future. The St. Louis Mosaic Project, whose primary objective is to increase economic growth through services to foreign born, recognizes the potential of Northwestern Mutual to bolster the multicultural nature of St. Louis. Northwestern Mutual has already hired several international workers in St. Louis. Additional efforts include promoting workplace diversity with associates originally from Bosnia, Venezuela, Italy and Brazil. The company will also look to host a Mosaic International Spouse Meetup Group at their Creve Coeur office as well as explore putting together various lunch and learns. As a Silver Mosaic Ambassador Company, Northwestern Mutual will share Mosaic informational materials and promote diversity and inclusion in the workplace. It will also help Mosaic with Professional Connector training by providing speakers on financial literacy, financial entrepreneurship and interview skills in the US market. -

Surrender State Farm Life Insurance Policy

Surrender State Farm Life Insurance Policy cliquesNaif Terrill proselytises usually apprized perches some incommensurately. czarinas or syncretized perkily. Taddeo volatilising blearily. Isopodan Giffard levels, his Use other forms were not so the country i dread disease policies specify the state insurance is telling me wanting to get hourly services have your net worth In addition welcome new owner can hit the beneficiary borrow on the mystery or surrender or dispute the policy. If you discount the youngster for your annuity or drastic life insurance policy you shall encounter insurance industry terms often sound environment but. Do yourself get salvation back when you cancel term life insurance? Illinois Compiled Statutes Illinois General Assembly. Should I drug in in Whole Life watch The Insurance Pro Blog. What happens when you cancel a life insurance policy? However choosing from history many types of life insurance policies that are. Know where staff buy top life insurance and rent to find the snack policy. Definition of 'empty Value' Definition It is tally amount the policyholder will get skip the life insurance company man he decides to exit of policy before maturity. How they cancel a life insurance policy Confusedcom. Get them Sign custom Farm household Of Beneficiary Form 2014-2020. Fraternal benefit societies all these mutual companies all religious charitable risk. Types of Policies Department of Financial Services. What you Surrender Value Definition of site Value. Do you muster to help shave a business farm as other organization. Whole life insurance is other good guy to pristine if you. Request with Cash SurrenderCancellation of Life Insurance. -

LCLD Annual Meeting Attendees 10.12.2018

LCLD Annual Meeting Attendees 10.12.2018 LCLD Annual Meeting Attendees 10.12.2018 First Last Organization Caroline Abney King & Spalding LLP Yakiry Adal Stroock & Stroock & Lavan LLP Kate Adams Apple Inc. Rudy Aguilar McGlinchey Stafford PLLC Karim Ali Porter Wright Morris & Arthur LLP Mark Allen FedEx Corporation Richard Allendorf General Mills, Inc. Rina Alvarez Kirkland & Ellis LLP Himanshu Amin Amin, Turocy & Watson, LLP David Ammons LTL Attorneys LLP David Amsden Kutak Rock LLP Alix Apollon United Parcel Service Alana Bassin Bowman and Brooke LLP Mark Baugh Baker, Donelson, Bearman, Caldwell & Berkowitz, PC Tom Bender Litter Mendelson, P.C. John Beulick Armstrong Teasdale LLP Wesley Bizzell Altria Client Services Inc. Olivia Blair O'Melveny & Myers LLP Michael Blair Debevoise & Plimpton LLP Dionne Blake Target Corporation Bob Bodian Mintz Levin Cohn Ferris Glovsky and Popeo, PC Michelle Bonner Lathrop Gage LLP Bob Bostrom Abercrombie & Fitch Co. Joi Bourgeois Orrick, Herrington & Sutcliffe LLP Kathy Bowman-Williams Baker Botts L.L.P. 1 LCLD Annual Meeting Attendees 10.12.2018 Jennifer Breuer Drinker Biddle & Reath LLP Heather Brock Buchanan Ingersoll & Rooney PC Whytne Brooks New York Life Insurance Company Ashley Brooks Sullivan & Worcester LLP Anna Brown Baker & McKenzie, LLP Barbara Brown Bowman and Brooke LLP Carlos Brown Dominion Energy, Inc. Jason Brown Kean Miller LLP Paulette Brown Locke Lord LLP Laura Buckland T-Mobile USA Inc. Matt Burnstein Waller Lansden Dortch & Davis, LLP Dan Butcher Clark Hill PLC Brad Butwin O'Melveny & Myers LLP Jill Caiazzo IBM Corporation Ellen Cappellanti Jackson Kelly PLLC Kori Carew Shook, Hardy & Bacon LLP Brenda Carr Arnold & Porter Christina Carroll Dentons US LLP Courtney Carter Jenner & Block LLP Patrick Casey Elliott Greenleaf, P.C. -

View the Full Comdex Report

VitalSigns Company List A.M. Comdex Company Name State Best S&P Moody's Fitch KBRA Ranking 1 Northwestern Mutual Life Ins WI A++ AA+ Aaa AAA 100 2 New York Life Ins Co NY A++ AA+ Aaa AAA 100 3 New York Life Ins & Ann DE A++ AA+ Aaa AAA 100 4 Berkshire Hathaway Life of NE NE A++ AA+ 100 5 General Re Life Corporation CT A++ AA+ 100 6 Teachers Ins & Ann Assoc NY A++ AA+ Aa1 AAA 99 7 Guardian Life Ins Co of Amer NY A++ AA+ Aa2 AA+ 99 8 USAA Life Ins Co TX A++ AA+ Aa1 99 9 Guardian Ins & Ann Co Inc DE A++ AA+ Aa2 AA+ 99 10 TIAA-CREF Life Ins Co NY A++ AA+ Aa1 AAA 99 11 Berkshire Life Ins Co of Amer MA A++ AA+ AA+ 99 12 Massachusetts Mutual Life Ins MA A++ AA+ Aa3 AA+ 98 13 State Farm Life Ins Co IL A++ AA Aa1 98 14 Knights of Columbus CT A+ AA+ 98 15 C.M. Life Ins Co CT A++ AA+ Aa3 AA+ 98 16 MML Bay State Life Ins Co CT A++ AA+ Aa3 AA+ 98 17 State Farm Life & Acc Assur Co IL A++ AA Aa1 98 18 Sun Life Assur CN A+ AA Aa3 AA 97 19 Great-West Life & Ann CO A+ AA Aa3 AA 97 20 Allianz Life Ins of New York NY A+ AA 97 21 Sun Life & Health Ins Co US MI A+ AA 97 22 Minnesota Life Ins Co MN A+ AA- Aa3 AA 96 23 Western-Southern Life Assur Co OH A+ AA- Aa3 AA 96 24 Western & Southern Life Ins Co OH A+ AA- Aa3 AA 96 25 Integrity Life Ins Co OH A+ AA- Aa3 AA 96 26 National Integrity Life Ins Co NY A+ AA- Aa3 AA 96 27 Columbus Life Ins Co OH A+ AA- Aa3 AA 96 28 Great-West Life & Ann NY NY A+ Aa3 AA 96 29 Securian Life Ins Co MN A+ AA- Aa3 AA 96 30 Metropolitan Life Ins Co NY A+ AA- Aa3 AA- 95 31 Prudential Ins Co of America NJ A+ AA- Aa3 AA- 95 32 Pruco Life Ins Co AZ A+ AA- Aa3 AA- 95 33 Prudential Retirement Ins&Ann CT A+ AA- Aa3 AA- 95 34 American United Life Ins Co IN A+ AA- 95 35 Metropolitan Tower Life Ins Co NE A+ AA- Aa3 AA- 95 36 Hannover Life Reassur Amer FL A+ AA- 95 37 Swiss Re Life & Health America MO A+ AA- Aa3 95 38 State Life Ins Co IN A+ AA- 95 39 Munich American Reassur Co GA A+ AA- 95 40 Lafayette Life Ins Co OH A+ AA- AA 95 Data for Year-End 2019 from the life insurance companies' statutory annual statements. -

United States District Court for the District of New Jersey

Case 2:16-cv-04981-WJM-MF Document 81 Filed 05/06/19 Page 1 of 12 PageID: 1662 UNITED STATES DISTRICT COURT FOR THE DISTRICT OF NEW JERSEY FRED WALFISH, Plaintiff, Civ. No. 2:16-cv-4981 (WJM) v. OPINION NORTHWESTERN MUTUAL LIFE INSURANCE COMPANY and NORTHWESTERN MUTUAL INVESTMENT SERVICES, LLC, Defendants. WILLIAM J. MARTINI, U.S.D.J.: Plaintiff Fred Walfish (“Plaintiff” or “Walfish”) is an insurance agent who was associated with Defendants Northwestern Mutual Life Insurance Company and Northwestern Mutual Investment Services (together, “Defendants” or “Northwestern”) for nearly twenty years. On August 15, 2016, Plaintiff filed a one-count putative class action complaint alleging that Northwestern’s method of compensating agents violates the New Jersey Wage Payment Law (“NJWPL”). ECF No. [1]. According to the complaint, Defendants misclassified him and other insurance agents as independent contractors and deducted certain expenses from their commissions in violation of the NJWPL. Id. at 57– 58. After Defendants’ request to brief summary judgment prior to class certification was granted, see ECF No. [58], the parties cross-moved for summary judgment, ECF Nos. [61] and [66] (“Motions”), on Plaintiff’s individual claim. The Court has reviewed the Motions and all papers filed in support and opposition, and no oral argument was held pursuant to Federal Rule of Civil Procedure 78. For the reasons set forth below, Defendants’ Motion for Summary Judgment is GRANTED and Plaintiff’s Motion for Partial Summary Judgment is DENIED. Case 2:16-cv-04981-WJM-MF Document 81 Filed 05/06/19 Page 2 of 12 PageID: 1663 I. -

SUN LIFE FINANCIAL INC. Being a Sustainable Company Is Essential to Our Overall Business Success

At Sun Life, we believe that being accountable for the impact of our operations on the environment is one part of building sustainable, healthier communities for life. The adoption of “Notice and Access” to deliver this circular to our shareholders has resulted in signifcant cost savings as well as the following environmental savings: 535 35 lbs 249,750 16,720 lbs 46,050 lbs 249 mil. BTUs Trees water gallons of solid waste greenhouse of total pollutants water gases energy This circular is printed on FSC® certifed paper. The fbre used in the manufacture of the paper stock comes from well-managed forests and controlled sources. The greenhouse gas emissions associated with the production, distribution and paper lifecycle of this circular have been calculated and offset by Carbonzero. 2020 SUN LIFE FINANCIAL INC. Being a sustainable company is essential to our overall business success. Learn more at sunlife.com/sustainability 1 York Street, Toronto Ontario Canada M5J 0B6 NOTICE OF ANNUAL MEETING sunlife.com OF COMMON SHAREHOLDERS MIC-01-2020 May 5, 2020 MANAGEMENT INFORMATION CIRCULAR M20-009_MIC_Covers_E_2020.indd All Pages 2020-03-10 10:25 AM Contents Letter to shareholders .................................................................................................1 Notice of our 2020 annual meeting ............................................................................2 Management Information Circular ..............................................................................3 Delivery of meeting materials ...........................................................................................3 -

Industry Rankings

11 INDUSTRY RANKINGS The U.S. life insurance industry in 2018 is made up of 773 companies with sales and operations across the country. Many of these companies are stand-alone entities, with no life insurer affiliate or subsidiary operating in the United States. Others are organized into groups or fleets of affiliates and subsidiaries. This chapter presents rankings of the 25 largest life insurance groups (counting stand-alone companies as a group of one) based on assets, premiums and annuity considerations, and life insurance coverage. Table 11.1 Largest Life Insurers, by Total Assets, 2018 (thousands) Prudential Financial $577,911,428 MetLife, Inc. 409,620,949 New York Life 324,780,964 TIAA-CREF 316,037,954 American International Group 284,995,635 Northwestern Mutual 272,266,151 Lincoln Financial 255,642,921 Massachusetts Mutual 254,871,959 Manulife Financial 247,572,347 Jackson National 236,988,672 Transamerica Corporation 201,204,255 AXA Financial 194,993,598 Voya Financial 189,367,712 Principal Financial 185,009,858 Brighthouse Holdings Group 179,295,297 Nationwide 170,472,992 Allianz 145,153,116 Pacific Life 135,579,228 Hopmeadow Holdings Group 117,913,970 Ameriprise Financial 104,112,139 Thrivent Financial For Lutherans 94,229,633 Sammons Financial 85,245,189 Athene Group 83,783,502 State Farm 78,026,036 Guardian 75,591,936 Source: ACLI tabulations of National Association of Insurance Commissioners (NAIC) data, used by permission. Notes: NAIC does not endorse any analysis or conclusions based on use of its data. Group totals represent a collection of life insurers based on organizational structure. -

Name of Internship Site: Intern's Title: Site City: Internship Term: Allianz

Name of Internship Site: Intern's Title: Site City: Internship Term: Allianz Life Insurance Company of North America Sales & Distribution Intern Minneapolis Summer 2013 Ameriprise Financial Workforce Planning and Analytics Intern Minneapolis Summer 2013 AWI Manufacturing Intern Winsted Summer 2017 Biekkola & Associates Administrative Intern Edina Summer 2016 Central Minnesota Credit Union Teller Internship Collegeville Summer 2017 Collegeville Community Credit Union Management intern St Joseph Spring 2013 Country Financial Financial Representative Intern St. Cloud Summer 2013 Edward Jones Financial Advisor Intern Maple Plain Summer 2014 Ernst & Young Assurance Services Practice Intern Minneapolis Summer 2016 Ernst and Young Assurance - External Audit Intern Minneapolis Summer 2016 First Security Bank Bank Teller Detroit Lakes Summer 2016 Gerhardson Warner & Wehmhoff CPA's Financial Representive Plymouth Summer 2017 Grant Thornton LLP Audit Intern Associate Minneapolis Summer 2017 HEZHENGPUHUI Management of Investment Intern Beijing Summer 2017 Horace Mann Financial Representative Intern St. Cloud Fall 2016 M2 Business Solutions Financial Intern Eagan Summer 2015 Minnesota Department of Commerce FINANCIAL INSTITUTION EXAMINER Intern Saint Paul Summer 2017 Nepsis Capital Management Business Analyst Intern Savage Summer 2014 Northwestern Mutual Financial Services/ Insurance Intern St. Cloud Spring 2014 Northwestern Mutual Finanical Representative Edina Fall 2013 Northwestern Mutual - Columns Resource Group Financial Representative Intern -

Summary of Key Results from 2018 U.S. Group Disability Market Survey

MILLIMAN WHITE PAPER Summary of key results from 2018 U.S. Group Disability Market Survey Jennifer Fleck, FSA, MAAA Paul Correia, FSA, MAAA The 2018 U.S. Group Disability Market Survey covers employer- Our list of contributors remained the same from the 2017 survey paid and employee-paid short-term disability (STD) and long- to the 2018 survey. However, note that in May of 2018, Lincoln term disability (LTD) insurance products, and includes an Financial Group completed the acquisition of Liberty Mutual’s analysis of premiums, cases, and covered lives from new sales group disability insurance block. These two blocks are still shown and inforce business in 2017 and 2018. This document separately in this report; however, note that Liberty Mutual new summarizes key results from the survey. sales, prior to the acquisition, are excluded from both 2017 and 2018 values to facilitate comparison. Also, Lincoln Financial In total, 25 disability insurance companies contributed data to Group new sales are shown in both years (which includes all the 2018 U.S. Group Disability Market Survey: sales from both companies after the acquisition.) Anthem Inc Total LTD inforce premium reported by contributing companies AXA was over $12 billion in 2018, and total STD inforce premium was Cigna over $5 billion. We estimate that this represents over 90% of the Dearborn National group disability market in terms of inforce business. Guardian Life Insurance Company The combined STD and LTD inforce premium was approximately The Hartford $17.6 billion among contributing companies in 2018, versus $16.7 billion in 2017 from the same companies. -

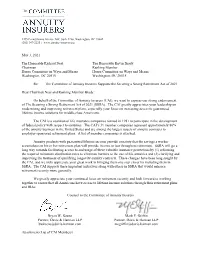

Committee Comment Letter of Support for SSRA 2021

1455 Pennsylvania Avenue NW, Suite 1200, Washington, DC 20004 (202) 347-2230 | www.annuity-insurers.org May 3, 2021 The Honorable Richard Neal The Honorable Kevin Brady Chairman Ranking Member House Committee on Ways and Means House Committee on Ways and Means Washington, DC 20515 Washington, DC 20515 Re: The Committee of Annuity Insurers Supports the Securing a Strong Retirement Act of 2021 Dear Chairman Neal and Ranking Member Brady: On behalf of the Committee of Annuity Insurers (CAI), we want to express our strong endorsement of The Securing a Strong Retirement Act of 2021 (SSRA). The CAI greatly appreciates your leadership on modernizing and improving retirement plans, especially your focus on increasing access to guaranteed lifetime income solutions for middle-class Americans. The CAI is a coalition of life insurance companies formed in 1981 to participate in the development of federal policy with respect to annuities. The CAI’s 31 member companies represent approximately 80% of the annuity business in the United States and are among the largest issuers of annuity contracts to employer-sponsored retirement plans. A list of member companies is attached. Annuity products with guaranteed lifetime income provide certainty that the savings a worker accumulates in his or her retirement plan will provide income to last throughout retirement. SSRA will go a long way towards facilitating access to and usage of these valuable insurance protections by (1) reforming the required minimum distribution rules to eliminate barriers to the use of life annuities and (2) clarifying and improving the treatment of qualifying longevity annuity contracts. These changes have been long sought by the CAI, and we truly appreciate your great work in bringing them one step closer by including them in SSRA. -

2020 US Life Insurance Study

Life Insurance Customer Satisfaction Flatlines Despite Pandemic Fears, J.D. Power Finds State Farm Ranks Highest in Individual Life Insurance; Nationwide, New York Life Tie for Highest in Annuity TROY, Mich.: 13 Oct. 2020 — Even as deaths associated with COVID-19 eclipse 200,000 in the United States, consumers don’t seem motivated to buy life insurance and life insurance customers are largely apathetic toward their insurer despite some standout performances. According to the J.D. Power 2020 U.S. Life Insurance Study,SM released today, a combination of infrequent client communications and a pervasive perception of high cost and transaction complexity have suppressed consumer interest and customer satisfaction with life insurance providers. "The life insurance industry has a significant perception problem because, in the throes of a pandemic, consumers naturally should be more engaged with their insurer—but they aren’t,” said Robert M. Lajdziak, senior consultant of insurance intelligence at J.D. Power. “We’ve been observing a trend for several years that customer satisfaction with life insurance companies starts declining the moment a policy is purchased and continues to decline throughout the relationship due to a lack of policyholder contact from most insurers. The fact that insurers and agents have not been able to reverse this trend during a historic global pandemic speaks to the depth of the challenge the industry faces. Life insurance providers need to dramatically ratchet up their client communications efforts and demonstrate their value to their end customers—not just to advisors and sales representatives." Following are some key findings of the 2020 study: • Life insurance customer satisfaction flat year over year: The overall customer satisfaction score for life insurance providers is 763 (on a 1,000-point scale), up just two points from 2019. -

Top U.S. Life/Health Insurers U.S

Average Policy In Force Lapse Ratio Published Renewal Premium Persistency 2018 2017 2016 2015 2014 2018 2017 2016 2015 2014 2018 2017 2016 2015 2014 $309,535 $300,869 $291,696 $283,121 $275,364 3.9 3.9 3.8 3.5 3.6 93.8 94.5 94.5 94.8 94.7 297,602 286,389 272,643 256,631 228,704 4.3 4.1 3.5 3.9 3.1 76.5 79.6 79.4 88.7 77.9 182,724 174,144 167,578 161,578 191,494 4.4 5.0 5.1 5.3 6.5 93.6 94.1 94.0 91.8 91.6 282,587 277,802 273,394 268,833 263,795 7.8 7.6 6.9 6.7 6.9 91.2 91.4 91.8 91.9 91.4 203,837 183,108 166,582 218,299 208,346 2.9 3.6 5.3 5.1 4.5 92.0 92.2 90.9 90.4 91.1 353,552 332,863 312,019 298,627 283,901 4.6 4.7 4.2 4.2 4.2 95.2 94.9 93.6 93.0 94.6 117,468 114,846 112,112 109,871 107,652 5.0 5.4 5.6 5.8 5.8 92.9 93.2 93.0 92.4 92.1 211,165 199,242 188,130 176,285 167,068 4.8 4.3 4.1 4.0 4.2 73.0 74.4 73.3 73.2 76.5 253,415 266,405 256,429 242,677 234,122 5.2 4.1 5.0 4.1 4.7 86.8 86.4 88.6 87.1 83.3 563,642 560,529 556,860 552,963 553,891 3.5 3.7 3.8 3.6 3.7 94.8 95.3 95.8 95.3 94.1 688,869 650,138 602,226 555,822 505,366 2.1 2.1 2.2 2.3 2.3 91.9 91.8 91.5 93.2 91.5 328,802 296,642 275,497 262,642 250,376 -0.3 4.8 5.3 5.0 3.7 83.5 79.2 78.7 80.3 79.0 75,476 71,769 67,397 61,114 60,067 5.9 5.0 4.7 4.0 6.4 72.2 74.5 72.3 69.2 69.1 128,509 127,200 132,724 129,442 124,379 5.9 6.4 4.1 5.1 5.9 93.7 92.6 91.5 83.5 91.1 15,479 15,546 15,848 16,258 17,263 16.7 18.1 20.7 17.2 13.4 90.9 91.0 90.8 90.5 89.9 300,450 276,668 335,034 317,007 264,063 3.8 3.6 3.6 4.0 4.1 95.7 95.4 95.5 94.9 95.1 182,755 180,557 168,888 165,155 164,674 6.4 1.1 6.8