Vod Pricing in Latam: a Business Perspective

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Liberty Latin America Completes Split-Off from Liberty Global

Liberty Latin America Completes Split-Off from Liberty Global Newly listed company well-positioned to leverage world-class technology, innovation and scale Value creation strategy to stem from both organic and inorganic opportunities Denver, Colorado – January 2, 2018 Liberty Latin America Ltd. (NASDAQ: LILA and LILAK, OTC Link: LILAB) (“Liberty Latin America”), a leading telecommunications company with operations in Chile, Puerto Rico, the Caribbean and other parts of Latin America, today announced the completion of its previously announced split-off from Liberty Global plc (“Liberty Global”) and its launch as an independent, publicly-traded company. Following the successful completion of the split-off, Liberty Latin America Class A and Class C common shares are now trading on the NASDAQ Global Select Market under the symbols “LILA” and “LILAK,” respectively, and the Class B common shares are quoted on the OTC Markets under the symbol “LILAB”. Mike Fries, Executive Chairman of Liberty Latin America and CEO of Liberty Global, commented, “The split-off of our Latin American and Caribbean operations from Liberty Global will ensure that this new company will have access to the capital and resources necessary to achieve superior financial and strategic growth. I have tremendous confidence in Balan Nair’s leadership as well as the world-class board of directors and management team we have put in place. As Liberty Latin America charts its own course going forward, it will continue to benefit from its Liberty Global heritage and will have access to key shared services and expertise across products, technology, procurement and more. The launch of Liberty Latin America is an exciting moment for all shareholders and a clear confirmation of the opportunity for value creation in the Latin American and Caribbean region.” Balan Nair, President and Chief Executive Officer of Liberty Latin America, stated, “Today marks an important milestone for Liberty Latin America as we begin the path forward as an independent company focused squarely on the region. -

Vanishing Starlight by David Clarkson

Multicultural characters in tragic conflict during the 1950s. Vanishing Starlight By David Clarkson Order the book from the publisher Booklocker.com https://www.booklocker.com/p/books/2579.html?s=pdf or from your favorite neighborhood or online bookstore. Copyright © 2006-2020 David Clarkson ISBN: 978-1-59113-990-4 All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, recording or otherwise, without the prior written permission of the author. Printed in the United States of America. All characters and events depicted in this novel are fictitious, except: (1) The portrayal of Elvis Presley’s actual appearance in Paris, Texas, is based on documentation provided by The Paris News, to which the author extends heartfelt thanks; and by eye-witness accounts. (2) The depictions of Alexander White Neville are based on archival data and on the author’s recollections. (3) Descriptions of the 1916 fire and of the 1893 lynching, two events that occurred in Paris, Texas, are taken from a cross section of sources; they are historically factual. (4) The football games, including all players named, were both witnessed and researched by the author. (5) The lunch counter scene that took place in Dallas, Texas, April 25, 1960, is derivative of a true incident. Any similarities to other happenings, and to other persons, living or dead, are purely coincidental. Booklocker.com, Inc. 2020 Prologue: Meteors Retrospect. The night of falling stars. At four hours before dawn, the vast arc of heaven burst aflame. -

BGP Interconnection in the Region of Latin America and the Caribbean

BGP Interconnection in the Region of Latin America and the Caribbean Author: Augusto Mathurín Coordination/Revision: Guillermo Cicileo Edition and Design: Maria Gayo, Carolina Badano, Martín Mañana Project: Strengthening Regional Internet Infrastructure Department: Internet Infrastructure R&D Contents Contents 2 Introduction 4 Methodology 4 Stated Objectives 4 Data Sources 4 Data Processing 6 Generated Datasets 8 Data by Country 10 Argentina 10 Aruba 12 Bolivia 13 Brazil 15 Belize 17 Chile 19 Colombia 21 Costa Rica 23 Cuba 25 Dominican Republic 27 Ecuador 29 French Guiana 31 Guatemala 32 Guyana 34 Honduras 36 Haiti 38 Mexico 40 Nicaragua 42 Panama 44 2 Peru 46 Paraguay 48 Suriname 50 El Salvador 52 Trinidad and Tobago 54 Uruguay 56 Venezuela 58 Regional Data Analysis 60 Connection to the Other Regions 62 Conclusions and Future Work 65 3 Introduction Internet development and the quality of user connectivity depend on the existence of good communications infrastructure and proper connectivity between countries. In Latin America, there are still some deficiencies in this regard which result in many people experiencing high latencies in their connections. The main reason for these latencies is the lack of local interconnection between different network operators, which means that traffic between nearby countries must often use distant Internet exchange points, located in the United States or Europe. The deployment of various Internet exchange points (IXPs) has helped improve this situation, although the actual status of connectivity between countries and networks remains a mystery. To find answers to these unknowns, some time ago LACNIC created Simón1, a project that seeks to generate information by measuring latency levels between countries and in this way estimate traffic volumes. -

In the United States District Court for the District of Puerto Rico

IN THE UNITED STATES DISTRICT COURT FOR THE DISTRICT OF PUERTO RICO STEELHEAD LICENSING LLC, Plaintiff, Civil Num.________________ v. TRIAL BY JURY DEMANDED CLARO PUERTO RICO, PUERTO RICO TELEPHONE COMPANY, INC., and TELECOMUNICACIONES DE PUERTO RICO, INC., AMERICA MOVIL S.A.B. de C.V. Defendants. COMPLAINT FOR PATENT INFRINGEMENT Plaintiff Steelhead Licensing LLC (“Steelhead”), by and through its undersigned counsel, for its Complaint against Claro Puerto Rico (“Claro”), Puerto Rico Telephone Company, Inc. (“PRTC”), Telecomunicaciones de Puerto Rico, Inc. (“TELPRI”) and América Móvil S.A.B. d C.V. (“América Móvil”), (collectively, “Defendants”), alleges as follows: NATURE OF THE ACTION 1. This is an action for patent infringement arising under the patent laws of the United States, Title 35 of the United States Code (“U.S.C.”) to prevent and enjoin Defendants from infringing and profiting, in an illegal and unauthorized manner and without authorization and/or consent from Steelhead, from U.S. Patent No. 5,491,834 (the “‘834 Patent”), (attached hereto as Exhibit A) pursuant to 35 U.S.C. §271, and to recover damages, attorneys’ fees, and costs. THE PARTIES 2. Plaintiff Steelhead is a Delaware limited liability with its principal place of business at 222 Delaware Avenue, PO Box 25130, Wilmington, DE 19899. 3. Defendants PRTC and TELPRI are wholly owned by América Móvil and are doing business as Claro, and have offices located in 562 Ponce de León Avenue, San Juan, Puerto Rico 00918. 4. Defendant América Móvil is a company organized in Mexico with its principal place of business at Lago Zurich 245, Colonia Ampliación Granada, México, D.F., C.P. -

Planos Nº 211, 212, 213, 214, 215, 216, 260, 502, 503, 505, 506, 507, 508, 509, 510, 511 E 512)

SUMÁRIO E TERMOS E CONDIÇÕES DE USO CLARO TV E PROMOÇÕES VIGENTES (PLANOS Nº 211, 212, 213, 214, 215, 216, 260, 502, 503, 505, 506, 507, 508, 509, 510, 511 E 512) O presente documento é parte integrante do Contrato de Prestação de Serviços de TV por Assinatura Via Satélite (DTH) da CLARO TV e tem a finalidade de registrar as características e Promoções vigentes dos “PLANOS CLARO TV” vigentes, em atendimento ao Art. 50 da Resolução nº 632/2014 da Anatel, e regular as relações entre a EMBRATEL TVSAT TELECOMUNICAÇÕES LTDA., inscrita no CNPJ/MF sob o nº. 09.132.659/0001-76, com sede na Rua Presidente Vargas, 1012 - Centro, Rio de Janeiro – RJ, doravante denominada somente CLARO TV e o CLIENTE que adquirir um destes Planos e aderir a uma das Ofertas vigentes, doravante denominado simplesmente USUÁRIO, o qual está ciente e concorda que ao prosseguir com a contratação estará concordando com todas as disposições constantes deste, declarando ter lido e compreendido o mesmo em todos os seus termos e se obrigando a cumprir todas as disposições. 1. OS PLANOS CLARO TV E VALORES APLICÁVEIS SEM PROMOÇÃO 1.1 Os Planos CLARO TV são Planos Pós-Pago Alternativo de Serviço para disponibilização do sinal de TV por Assinatura via Satélite, comercializado pela CLARO TV e devidamente apresentado à ANATEL, de acordo com a cobertura em território nacional nas cidades em que a CLARO TV atua e conforme disponibilidade técnica em cada endereço, que poderão ser verificadas no site https://www.claro.com.br/tv- por-assinatura, com uma quantidade e grade de canais específica e disponível para consulta no site https://www.claro.com.br/tv-por-assinatura. -

Vtr Finance Bv

VTR FINANCE B.V. Annual Report December 31, 2018 VTR FINANCE B.V. Boeing Avenue 53 1119 PE Schiphol-Rijk The Netherlands VTR FINANCE B.V. TABLE OF CONTENTS Page Number Forward-looking Statements 2 Business 4 Management and Governance 13 Independent Auditors’ Report 15 Consolidated Balance Sheets as of December 31, 2018 and 2017 16 Consolidated Statements of Operations for the Years Ended December 31, 2018, 2017 and 2016 18 Consolidated Statements of Comprehensive Earnings (Loss) for the Years Ended December 31, 2018, 2017 and 2016 19 Consolidated Statements of Owner’s Deficit for the Years Ended December 31, 2018, 2017 and 2016 20 Consolidated Statements of Cash Flows for the Years Ended December 31, 2018, 2017 and 2016 21 Notes to Consolidated Financial Statements 23 Management’s Discussion and Analysis of Financial Condition and Results of Operations 46 1 FORWARD-LOOKING STATEMENTS Certain statements in this annual report constitute forward-looking statements. To the extent that statements in this annual report are not recitations of historical fact, such statements constitute forward-looking statements, which, by definition, involve risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements. In particular, statements under Business and Management’s Discussion and Analysis of Financial Condition and Results of Operations may contain forward-looking statements, including our business, product, service offering, foreign currency and finance strategies in 2019; our property -

Comments of the National Association of Broadcasters

Federal Communications Commission Washington, D.C. 20554 In the Matter of ) ) 2018 Quadrennial Regulatory Review -- ) MB Docket No. 18-349 Review of the Commission’s Broadcast ) Ownership Rules and Other Rules Adopted ) Pursuant to Section 202 of the ) Telecommunications Act of 1996 ) COMMENTS OF THE NATIONAL ASSOCIATION OF BROADCASTERS Rick Kaplan Jerianne Timmerman Erin Dozier Patrick McFadden Larry Walke Emily Gomes Daniel McDonald Theresa Ottina Loren White NAB Research September 2, 2021 TABLE OF CONTENTS I. INTRODUCTION AND SUMMARY .................................................................................... 1 II. THE FCC SHOULD FOCUS IN THS PROCEEDING ON ENSURING THE COMPETITIVE VIABLITY OF LOCAL STATIONS ....................................................................................... 6 III. THE FCC’S DECADES-OLD OWNERSHIP RULES HAVE NEVER SUCCESSFULLY PROMOTED DIVERSE OWNERSHIP OF RADIO AND TELEVISION STATIONS .................. 9 The FCC’s Rules Do Not Address The Central Challenge To New Entry And Diverse Ownership In Broadcasting, Which Is Access To Capital .................... 10 The FCC’s Ownership Rules Affirmatively Undermine Investment In Broadcasting And New Entry ............................................................................ 15 IV. REFORM OF THE OWNERSHIP RULES WOULD PROMOTE LOCALISM BY SAFEGUARDING THE VIABILITY OF LOCAL BROADCAST JOURNALISM IN TODAY’S BIG TECH-DOMINATED MARKETPLACE .............................................................................. 19 The FCC Cannot Ignore The -

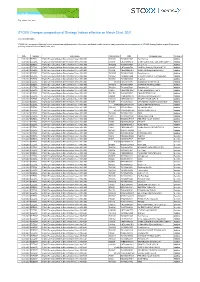

STOXX Changes Composition of Strategy Indices Effective on March 22Nd, 2021

Zug, March 13th, 2021 STOXX Changes composition of Strategy Indices effective on March 22nd, 2021 Dear Sir and Madam, STOXX Ltd., the operator of Qontigo’s index business and a global provider of innovative and tradable index concepts, today announced the new composition of STOXX Strategy Indices as part of the regular quarterly review effective on March 22nd, 2021 Date Symbol Index name Internal Key ISIN Company name Changes 12.03.2021 EDEDSL STOXX Emerging Markets Diversification Select 100 USD TW01UK TW0001722007 Twn Fertilizer Addition 12.03.2021 EDEDSL STOXX Emerging Markets Diversification Select 100 USD CN0010 CNE1000002H1 CHINA CONSTRUCTION BANK CORP H Addition 12.03.2021 EDEDSL STOXX Emerging Markets Diversification Select 100 USD TW02MD TW0002301009 Liteon Tech Addition 12.03.2021 EDEDSL STOXX Emerging Markets Diversification Select 100 USD CN249E CNE000000T59 YANTAI CHANGYU PION.WINE 'B' Addition 12.03.2021 EDEDSL STOXX Emerging Markets Diversification Select 100 USD CN1I6O CNE100000HF9 CHINA MINSHENG BANKING H Addition 12.03.2021 EDEDSL STOXX Emerging Markets Diversification Select 100 USD TW025W TW0002015005 Feng Hsin Iron Addition 12.03.2021 EDEDSL STOXX Emerging Markets Diversification Select 100 USD TW505Z TW0006412000 CHICONY POWER TECHNOLOGY Addition 12.03.2021 EDEDSL STOXX Emerging Markets Diversification Select 100 USD TW0751 TW0004938006 Pegatron Addition 12.03.2021 EDEDSL STOXX Emerging Markets Diversification Select 100 USD 691316 HK0270001396 Guangdong Investment Ltd. Addition 12.03.2021 EDEDSL STOXX Emerging Markets -

Ready Awarded It to Operators by the End of 2016, Whereas Mexico Has Already Allocated 90 Mhz of That Band to Those in Charge of Deploying the Shared Network

TABLE OF CONTENTS TABLE OF CONTENTS ............................................................................................................ 2 EXECUTIVE SUMMARY ........................................................................................................... 3 INTRODUCTION ...................................................................................................................... 6 ITU MOBILE SPECTRUM SUGGESTIONS .............................................................................. 8 ITU RECOMMENDATIONS: SPECTRUM ALLOCATION FOR THE DEVELOPMENT OF IMT AND IMT-ADVANCED TECHNOLOGIES .............................................................................. 9 LATIN AMERICA SPECTRUM OVERVIEW ............................................................................ 10 FUTURE OF THE RADIO SPECTRUM IN LATIN AMERICA ................................................... 12 CHALLENGES TO AWARD THE RADIO SPECTRUM ............................................................ 15 CONCLUSION ........................................................................................................................ 16 APPENDIX A: LATIN AMERICA MARKETS PROFILES ......................................................... 18 ARGENTINA ....................................................................................................................... 18 BOLIVIA ............................................................................................................................. 18 BRAZIL .............................................................................................................................. -

VTR Finance 2020 Annual Bank Report

VTR FINANCE N.V. Annual Report December 31, 2020 VTR FINANCE N.V. Boeing Avenue 53 1119 PE Schiphol-Rijk The Netherlands VTR FINANCE N.V. TABLE OF CONTENTS Page Number Forward-looking Statements....................................................................................................................................... 2 Business...................................................................................................................................................................... 4 Management and Governance..................................................................................................................................... 16 Management’s Discussion and Analysis of Financial Condition and Results of Operations..................................... 18 Consolidated Financial Statements Independent Auditors’ Report............................................................................................................................... 33 Consolidated Balance Sheets as of December 31, 2020 and 2019......................................................................... 34 Consolidated Statements of Operations for the Years Ended December 31, 2020, 2019 and 2018...................... 36 Consolidated Statements of Comprehensive Earnings (Loss) for the Years Ended December 31, 2020, 2019 and 2018.............................................................................................................................................................. 37 Consolidated Statements of Owner’s Equity (Deficit) -

VTR Finance Q4 2017 Bank Report

VTR FINANCE B.V. Annual Report December 31, 2017 VTR FINANCE B.V. Boeing Avenue 53 1119 PE Schiphol-Rijk The Netherlands VTR FINANCE B.V. TABLE OF CONTENTS Page Number Forward-looking Statements....................................................................................................................................... 2 Business ...................................................................................................................................................................... 4 Management and Governance .................................................................................................................................... 13 Independent Auditors’ Report..................................................................................................................................... 15 Consolidated Balance Sheets as of December 31, 2017 and 2016............................................................................. 16 Consolidated Statements of Operations for the Years Ended December 31, 2017, 2016 and 2015........................... 18 Consolidated Statements of Comprehensive Earnings (Loss) for the Years Ended December 31, 2017, 2016 and 2015......................................................................................................................................................................... 19 Consolidated Statements of Owner’s Deficit for the Years Ended December 31, 2017, 2016 and 2015................... 20 Consolidated Statements of Cash Flows for the Years Ended December -

Dominican Republic

THIS REPORT CONTAINS ASSESSMENTS OF COMMODITY AND TRADE ISSUES MADE BY USDA STAFF AND NOT NECESSARILY STATEMENTS OF OFFICIAL U.S. GOVERNMENT POLICY Required Report - public distribution Date: 12/26/2017 GAIN Report Number: DR1717 Dominican Republic Exporter Guide Opportunities Abound for U.S. Consumer-Oriented Products Approved By: Lisa Ahramjian, Agricultural Attaché Prepared By: Mayra Carvajal, Agricultural Marketing Specialist Report Highlights: In 2016, the Dominican Republic was the fifth-largest market, valued at almost $484 million, for U.S. consumer-oriented products in the Western Hemisphere after Canada, Mexico, Colombia, and Chile. The U.S.-Dominican Republic-Central America Free Trade Agreement (CAFTA-DR) has improved the competitiveness of U.S. products; consumer-oriented product sales have increased by 200 percent since the implementation of the agreement in 2007. The United States is the largest consumer food exporter to the Dominican Republic, with a market share of approximately 50 percent. With a very active tourism sector valued at approximately $5.3 billion in 2016 (representing 7.8 percent of the GDP), there are opportunities for increased U.S. exports to the Dominican market. Products with the highest potential include snack foods, powdered milk, wine, craft beer, and cheddar cheese. Post: Santo Domingo Page 1 of 24 SECTION I. MARKET OVERVIEW 1.1. Economic situation According to the Dominican Republic Central Bank, the Dominican Republic (DR)’s gross domestic product (GDP) grew by 6.6 percent in 2016. This growth has positioned the DR as a leader in Latin America for the third consecutive year, exceeding the expectations of the government and other international institutions.