Press Release

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

FCT Reports 5.996 Cents DPU for 1H2021, Boosted by Acquisition of ARF Portfolio

PRESS RELEASE FCT reports 5.996 cents DPU for 1H2021, boosted by acquisition of ARF portfolio 1H2021 performance boosted by the enlarged retail portfolio post the ARF Acquisition FCT’s portfolio tenants’ sales recovery outpaced broader retail market Steady roll-out of Singapore’s COVID-19 vaccination programme and continued re-opening of the economy will further support the recovery of shopper traffic and tenants’ sales SINGAPORE, 23 APRIL 2021 Frasers Centrepoint Asset Management Ltd. (“FCAM” or the “Manager”), the manager of Frasers Centrepoint Trust (“FCT” or the “Trust”), is pleased to report distribution per unit (“DPU”) of 5.9961 Singapore cents for the period from 1 October 2020 to 31 March 2021 (“1H2021”) which is 28.4% higher year-on-year (“y-o-y”). The books closure date for the 1H2021 DPU is 5.00 p.m. on 3 May 2021 and the payment date is 28 May 2021. Mr Richard Ng, Chief Executive Officer of FCAM, said, “This is the first set of financial results following the completion of the acquisition (the “ARF Acquisition”) of the remaining 63.11% stake in AsiaRetail Fund Limited (“ARF”) in October last year. Overall performance was boosted by the enlarged retail portfolio and FCT’s financial position remains strong. Our retail portfolio occupancy remained stable at 96.1%, despite the challenging leasing environment, and we have renewed approximately 50% of the expiring leases for the financial year ending 30 September 2021. Our portfolio tenants’ sales registered y- o-y growth of 0.4% in January 2021 and 11.7% in February 2021, ahead of the y-o-y change in the Singapore retail sales value2 of -8.1% and 7.7%, respectively for the same months. -

Kindness Heroes

PRESS RELEASE Under Embargo until 31 March 2021, 3am SGT Frasers Hospitality gives back to over 200 ‘Kindness Heroes’ worldwide Nearly 700 room nights across 16 countries will be granted to inspiring individuals, including Frasers Hospitality’s own employees, who have displayed selfless acts of kindness as part of the global ‘Remembering Kindness’ campaign Singapore, 31 March 2021 – Frasers Hospitality, a member of Frasers Property Group, has concluded its ‘Remembering Kindness’ campaign, announcing today that over 200 individuals or ‘Fraser Kindness Heroes’ – including its own outstanding employees or ‘Everyday Heroes’ – will each be granted with a complimentary stay at one of the global hospitality operator’s award-winning collection of serviced and hotel residences, and boutique hotels across the world. Aberdeen Brisbane Dubai Harrogate Manchester Poole Tianjin Penang (2021) Abuja Bristol Dundee Henley-on-Thames Melbourne Reading Tunbridge Wells Putrajaya (2021) Bahrain Budapest Edinburgh Ho Chi Minh City Muscat Riyadh Wimbledon Bournemouth (2022) The Bangkok Buriram Exeter Istanbul Nanjing Seoul Winchester Barcelona Cambridge Frankfurt Jakarta Newcastle Shanghai Wuhan Fraser Beijing Changsha Geneva Johor New Delhi Shenzhen Wuxi Belfast Cheltenham Glasgow Kuala Lumpur Osaka Singapore York Collection Berlin Chengdu Guangzhou Leeds Oxford St Andrews Leipzig (2020) Birmingham Dalian Hamburg Liverpool Paris Stratford-upon-Avon Tokyo (2020) Brighton Doha Hanoi London Perth Sydney Jeddah (2021) PRESS RELEASE Launched in December 2020 as part of Frasers Hospitality’s #FraserCares initiatives, ‘Remembering Kindness’ is a global campaign that seeks to celebrate kindness by recognising and rewarding those who have gone beyond the call of duty to help others in need. As part of the campaign, members of the public have come forward to share stories of individuals in their communities who have performed acts of kindness for the benefit of others. -

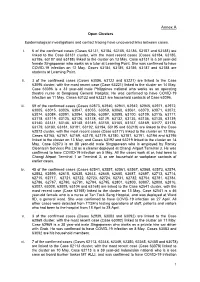

Annex a Open Clusters

Annex A Open Clusters Epidemiological investigations and contact tracing have uncovered links between cases. i. 6 of the confirmed cases (Cases 63131, 63184, 63185, 63186, 63187 and 63188) are linked to the Case 63131 cluster, with the most recent cases (Cases 63184, 63185, 63186, 63187 and 63188) linked to the cluster on 13 May. Case 63131 is a 50 year-old female Singaporean who works as a tutor at Learning Point. She was confirmed to have COVID-19 infection on 12 May. Cases 63184, 63185, 63186, 63187 and 63188 are students at Learning Point. ii. 3 of the confirmed cases (Cases 63096, 63122 and 63221) are linked to the Case 63096 cluster, with the most recent case (Case 63221) linked to the cluster on 14 May. Case 63096 is a 33 year-old male Philippines national who works as an operating theatre nurse at Sengkang General Hospital. He was confirmed to have COVID-19 infection on 11 May. Cases 63122 and 63221 are household contacts of Case 63096. iii. 59 of the confirmed cases (Cases 62873, 62940, 62941, 62942, 62945, 62971, 62972, 63005, 63015, 63026, 63047, 63055, 63059, 63060, 63061, 63070, 63071, 63072, 63074, 63084, 63091, 63094, 63095, 63097, 63098, 63100, 63109, 63115, 63117, 63118, 63119, 63125, 63126, 63128, 63129, 63132, 63135, 63136, 63138, 63139, 63140, 63141, 63146, 63148, 63149, 63150, 63165, 63167, 63169, 63177, 63178, 63179, 63180, 63181, 63191, 63192, 63194, 63195 and 63219) are linked to the Case 62873 cluster, with the most recent cases (Case 63177) linked to the cluster on 12 May, Cases 63165, 63167, 63169, 63178, 63179, 63180, 63181, 63191, 63194 and 63195 linked to the cluster on 13 May, and Cases 63192 and 63219 linked to the cluster on 14 May. -

Office Address 705 Sims Drive #04-16B Shun Li Industrial

MAIN OFFICE ADDRESS 705 SIMS DRIVE #04-16B SHUN LI INDUSTRIAL COMPLEX SINGAPORE 387384 Tel : 6844 2298 Fax : 6513 2843 Stores Day Bus Hrs Ops Hrs 1 Aljunied MRT (AJM) Mon - Fri 0700 - 2030 0630 - 2100 81 Geylang Lorong 25 Sat/Sun/PH 0800 - 2000 0730 - 2030 #01-12 Aljunied MRT Station Singapore 388310 Tel: 6747 1850 2 Ang Mo Kio Hub 2 (AMH 2) Mon - Sun 0700 - 2200 0600 - 2230 53 Ang Mo Kio Avenue 3 #01-19 Ang Mo Kio Hub Singapore 569933 Tel: 6853 1747 3 Bukit Gombak MRT (BGM) Mon - Sun 0630 - 2230 0600 - 2300 802 Bukit Batok West Avenue 5 #01-03 Bukit Gombak MRT Station Singapore 659083 Tel: 6560 1385 4 Buangkok Square (BKS) Wed - Sun 1300 - 2000 1200 - 2030 991 Buangkok Link Mon/Tue Closed Closed #01-04 Singapore 530991 Tel: 6957 0311 5 Boon Lay MRT (BL3) Mon - Sat 0600 - 2100 0500 - 2130 301 Boon Lay Way Sun & PH 0630 - 2100 0530 - 2130 #01-23 Boon Lay MRT Station Singapore 649846 Tel: 6793 1358 6 Bedok Mall (BM) Mon - Sun 0900 - 2100 0830 - 2130 311 New Upper Changi Road #B2-K2 Bedok Mall Singapore 467360 Tel: 6384 4405 7 Bukit Panjang Plaza (BP) Mon - Sun 0830 - 2130 0800 - 2200 1 Jelebu Road #01-19 Bukit Panjang Plaza Singapore 677743 Tel: 6760 4929 8 Choa Chu Kang MRT (CCK) Mon - Fri 0630 - 2200 0530 - 2230 10 Choa Chu Kang Ave 4 Sat / Sun / PH 0630 - 2200 0600 - 2230 #01-03 Choa Chu Kang MRT Station Singapore 689810 Tel: 6767 8343 9 Changi City Point (CCP) Mon - Fri 0730 - 2100 0700-2130 5 Changi Business Park Central 1 Sat 0930-2100 0900-2130 #B1-21 Changi City Point Sun / PH 1030-2100 1000-2130 Singapore 486038 Tel: 6636 1290 -

One Bangkok and SCG Sign MOU for Collaboration On

One Bangkok and SCG sign MOU for collaboration on sustainable construction management towards circular economy to be implemented for the largest Thai real estate project One Bangkok, the THB 120 billion fully-integrated district and the largest private sector property development in Thailand’s history, and SCG, signed a Memorandum of Understanding (MoU) for the implementation of construction waste management practices according to circular economy principles. The partnership aims to set new standards of sustainability in construction at One Bangkok by recycling concrete waste into precast panels and developing of holistic waste and pollution management plan. Mr. Panote Sirivadhanabhakdi, Group Chief Executive Officer of Frasers Property Limited, a joint developer of One Bangkok, said: “As a landmark project slated to set new standards in design, quality, sustainability and smart city living in Thailand, One Bangkok has always looked into strategic partnerships with industry leaders widely recognized for their outstanding capabilities, expertise, quality and reliability. We are delighted to strengthen our relationship with SCG, a long-term partner who shares our vision and ambition to create long- term values through sustainable construction practices.” “Sustainability has been a core development principle for One Bangkok. By collaborating with SCG, we will implement sustainable management of construction wastes throughout the development and operations of the district. This is also in line with Frasers Property’s commitment to be a net-zero carbon corporation by 2050; to incorporate environmentally and socially friendly practices throughout the entire value chain – from investment to design, development and operations – with a focus on carbon reduction, energy efficiency and innovative solutions,” added Panote. -

Participating Merchants

PARTICIPATING MERCHANTS PARTICIPATING POSTAL ADDRESS MERCHANTS CODE 460 ALEXANDRA ROAD, #01-17 AND #01-20 119963 53 ANG MO KIO AVENUE 3, #01-40 AMK HUB 569933 241/243 VICTORIA STREET, BUGIS VILLAGE 188030 BUKIT PANJANG PLAZA, #01-28 1 JELEBU ROAD 677743 175 BENCOOLEN STREET, #01-01 BURLINGTON SQUARE 189649 THE CENTRAL 6 EU TONG SEN STREET, #01-23 TO 26 059817 2 CHANGI BUSINESS PARK AVENUE 1, #01-05 486015 1 SENG KANG SQUARE, #B1-14/14A COMPASS ONE 545078 FAIRPRICE HUB 1 JOO KOON CIRCLE, #01-51 629117 FUCHUN COMMUNITY CLUB, #01-01 NO 1 WOODLANDS STREET 31 738581 11 BEDOK NORTH STREET 1, #01-33 469662 4 HILLVIEW RISE, #01-06 #01-07 HILLV2 667979 INCOME AT RAFFLES 16 COLLYER QUAY, #01-01/02 049318 2 JURONG EAST STREET 21, #01-51 609601 50 JURONG GATEWAY ROAD JEM, #B1-02 608549 78 AIRPORT BOULEVARD, #B2-235-236 JEWEL CHANGI AIRPORT 819666 63 JURONG WEST CENTRAL 3, #B1-54/55 JURONG POINT SHOPPING CENTRE 648331 KALLANG LEISURE PARK 5 STADIUM WALK, #01-43 397693 216 ANG MO KIO AVE 4, #01-01 569897 1 LOWER KENT RIDGE ROAD, #03-11 ONE KENT RIDGE 119082 BLK 809 FRENCH ROAD, #01-31 KITCHENER COMPLEX 200809 Burger King BLK 258 PASIR RIS STREET 21, #01-23 510258 8A MARINA BOULEVARD, #B2-03 MARINA BAY LINK MALL 018984 BLK 4 WOODLANDS STREET 12, #02-01 738623 23 SERANGOON CENTRAL NEX, #B1-30/31 556083 80 MARINE PARADE ROAD, #01-11 PARKWAY PARADE 449269 120 PASIR RIS CENTRAL, #01-11 PASIR RIS SPORTS CENTRE 519640 60 PAYA LEBAR ROAD, #01-40/41/42/43 409051 PLAZA SINGAPURA 68 ORCHARD ROAD, #B1-11 238839 33 SENGKANG WEST AVENUE, #01-09/10/11/12/13/14 THE -

Agility & Tenacity

AGILITY & TENACITY ANNUAL REPORT 2020 Chinese sculptor Zheng Lu’s “Moving Water – Marvellous” sculpture at Frasers Tower – reminiscent of a water wave – reflects the dynamism of Frasers Property in its ability to adapt to fast-changing times. In this particular work deeply influenced by Chinese calligraphy, the characters – Collaborative, Respectful, Progressive and Real – reflect our core values that guide how we think, how we act and what we value. GLOSSARY For ease of reading, this glossary provides definitions of abbreviations that are frequently used throughout this report Frasers Property entities Other Abbreviations FCT : Frasers Centrepoint Trust APBFE : Attributable profit before fair value FHT : Frasers Hospitality Trust change and exceptional items FLCT : Frasers Logistics & Commercial Trust AsiaRetail FPA : Frasers Property Australia Fund : AsiaRetail Fund Limited FPC : Frasers Property China AUM : Assets under management FPHT : Frasers Property Holdings Thailand BCA : Building and Construction Authority, Singapore FPI : Frasers Property Industrial CBD : Central business district FPL : Frasers Property Limited DPU : Distribution per unit FPS : Frasers Property Singapore EMTN : Euro medium-term notes FPT : Frasers Property Thailand ERM : Enterprise-wide risk management FPUK : Frasers Property United Kingdom FY : Financial year FPV : Frasers Property Vietnam GDP : Gross domestic product FTREIT : Frasers Property Thailand Industrial Freehold & GDV : Gross development value Leasehold REIT GFA : Gross floor area GOLD : Golden Land -

List-Of-Bin-Locations-1-1.Pdf

List of publicly accessible locations where E-Bins are deployed* *This is a working list, more locations will be added every week* Name Location Type of Bin Placed Ace The Place CC • 120 Woodlands Ave 1 3-in-1 Bin (ICT, Bulb, Battery) Apple • 2 Bayfront Avenue, B2-06, MBS • 270 Orchard Rd Battery and Bulb Bin • 78 Airport Blvd, Jewel Airport Ang Mo Kio CC • Ang Mo Kio Avenue 1 3-in-1 Bin (ICT, Bulb, Battery) Best Denki • 1 Harbourfront Walk, Vivocity, #2-07 • 3155 Commonwealth Avenue West, The Clementi Mall, #04- 46/47/48/49 • 68 Orchard Road, Plaza Singapura, #3-39 • 2 Jurong East Street 21, IMM, #3-33 • 63 Jurong West Central 3, Jurong Point, #B1-92 • 109 North Bridge Road, Funan, #3-16 3-in-1 Bin • 1 Kim Seng Promenade, Great World City, #07-01 (ICT, Bulb, Battery) • 391A Orchard Road, Ngee Ann City Tower A • 9 Bishan Place, Junction 8 Shopping Centre, #03-02 • 17 Petir Road, Hillion Mall, #B1-65 • 83 Punggol Central, Waterway Point • 311 New Upper Changi Road, Bedok Mall • 80 Marine Parade Road #03 - 29 / 30 Parkway Parade Complex Bugis Junction • 230 Victoria Street 3-in-1 Bin Towers (ICT, Bulb, Battery) Bukit Merah CC • 4000 Jalan Bukit Merah 3-in-1 Bin (ICT, Bulb, Battery) Bukit Panjang CC • 8 Pending Rd 3-in-1 Bin (ICT, Bulb, Battery) Bukit Timah Plaza • 1 Jalan Anak Bukit 3-in-1 Bin (ICT, Bulb, Battery) Cash Converters • 135 Jurong Gateway Road • 510 Tampines Central 1 3-in-1 Bin • Lor 4 Toa Payoh, Blk 192, #01-674 (ICT, Bulb, Battery) • Ang Mo Kio Ave 8, Blk 710A, #01-2625 Causeway Point • 1 Woodlands Square 3-in-1 Bin (ICT, -

Frasers Property Announces Leadership Changes for Australia

PRESS RELEASE Frasers Property announces leadership changes for Australia effective 1 October 2020 Anthony Boyd will succeed Rod Fehring as Chief Executive Officer of Frasers Property Australia Rod Fehring will be appointed as Executive Chairman of Frasers Property Australia and will continue to chair Frasers Property Industrial and Frasers Property UK Olivier Lim will step down as non-executive Chairman of Frasers Property Australia and remain as Advisor to the Group AUSTRALIA / SINGAPORE, 6 MAY 2020 Frasers Property Limited (“Frasers Property” and together with its subsidiaries, the “Group”), today announced leadership changes for Australia effective 1 October 2020. Anthony Boyd will be appointed as Chief Executive Officer (CEO) of Frasers Property Australia. Mr Boyd currently serves as Chief Financial Officer at Frasers Property Australia. As CEO, Mr Boyd will succeed Rod Fehring, who will remain on the board of directors of Frasers Property Australia Pty Limited as the newly appointed Executive Chairman and will continue to serve as Chairman of the management boards of Frasers Property Industrial and Frasers Property UK. Mr Fehring will succeed Olivier Lim who will step down as non-executive Chairman of Frasers Property Australia Pty Limited and remain as Advisor to the Group. “Today’s announcement is a further evolution of Frasers Property that highlights our bench strength. Rod has very ably led our Australian business over the last five years. He has played a critical part in the formation of our integrated industrial & logistics platform, which includes asset portfolios in Australia and Europe and provides the asset management services to the newly merged Frasers Logistics & Commercial Trust (“FLCT”). -

FCT Presentation

Frasers Centrepoint Trust Investor Presentation Frasers Day Bangkok 12 November 2020 WATERWAY POINT • Certain statements in this Presentation constitute “forward-looking statements”, including forward-looking financial information. Such forward-looking statement and financial information involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of FCT or the Manager, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements and financial information. Such forward-looking statements and financial information are based on numerous assumptions regarding the Manager’s present and future business strategies and the environment in which FCT or the Manager will operate in the future. Because these statements and financial information reflect the Manager’s current views concerning future events, these statements and financial information necessarily involve risks, uncertainties and assumptions. Actual future performance could differ materially from these forward-looking statements and financial information. • The Manager expressly disclaims any obligation or undertaking to release publicly any updates or revisions to any forward-looking statement or financial information contained in this Presentation to reflect any change in the Manager’s expectations with regard thereto or any change in events, conditions or circumstances on which any such statement or information is based, subject to compliance with all applicable laws and regulations and/or the rules of the SGX-ST and/or any other regulatory or supervisory body or agency. The value of Units in FCT and the income derived from them may fall as well as rise. The Units in FCT are not obligations of, deposits in, or guaranteed by, the Manager or any of their affiliates. -

Participating Merchants Address Postal Code Club21 3.1 Phillip Lim 581 Orchard Road, Hilton Hotel 238883 A|X Armani Exchange

Participating Merchants Address Postal Code Club21 3.1 Phillip Lim 581 Orchard Road, Hilton Hotel 238883 A|X Armani Exchange 2 Orchard Turn, B1-03 ION Orchard 238801 391 Orchard Road, #B1-03/04 Ngee Ann City 238872 290 Orchard Rd, 02-13/14-16 Paragon #02-17/19 238859 2 Bayfront Avenue, B2-15/16/16A The Shoppes at Marina Bay Sands 018972 Armani Junior 2 Bayfront Avenue, B1-62 018972 Bao Bao Issey Miyake 2 Orchard Turn, ION Orchard #03-24 238801 Bonpoint 583 Orchard Road, #02-11/12/13 Forum The Shopping Mall 238884 2 Bayfront Avenue, B1-61 018972 CK Calvin Klein 2 Orchard Turn, 03-09 ION Orchard 238801 290 Orchard Road, 02-33/34 Paragon 238859 2 Bayfront Avenue, 01-17A 018972 Club21 581 Orchard Road, Hilton Hotel 238883 Club21 Men 581 Orchard Road, Hilton Hotel 238883 Club21 X Play Comme 2 Bayfront Avenue, #B1-68 The Shoppes At Marina Bay Sands 018972 Des Garscons 2 Orchard Turn, #03-10 ION Orchard 238801 Comme Des Garcons 6B Orange Grove Road, Level 1 Como House 258332 Pocket Commes des Garcons 581 Orchard Road, Hilton Hotel 238883 DKNY 290 Orchard Rd, 02-43 Paragon 238859 2 Orchard Turn, B1-03 ION Orchard 238801 Dries Van Noten 581 Orchard Road, Hilton Hotel 238883 Emporio Armani 290 Orchard Road, 01-23/24 Paragon 238859 2 Bayfront Avenue, 01-16 The Shoppes at Marina Bay Sands 018972 Giorgio Armani 2 Bayfront Avenue, B1-76/77 The Shoppes at Marina Bay Sands 018972 581 Orchard Road, Hilton Hotel 238883 Issey Miyake 581 Orchard Road, Hilton Hotel 238883 Marni 581 Orchard Road, Hilton Hotel 238883 Mulberry 2 Bayfront Avenue, 01-41/42 018972 -

Contractor Appointed for First Building at Midtown Macpark Parkview Constructions Wins Tender to Build MAC Residences

PRESS RELEASE Contractor appointed for first building at Midtown MacPark Parkview Constructions wins tender to build MAC Residences Construction set to begin in September 2021 Over 200 local jobs to be created SYDNEY, 14 APRIL 2021 Parkview Constructions has been appointed to deliver the first apartment building at Midtown MacPark, Sydney’s next great urban neighbourhood by Frasers Property Australia. Excavation work has already commenced on site and construction of the first building, MAC Residences, is set to begin in September with completion expected in the second half of 2023. Parkview Constructions has a proven track record of delivering high quality projects and is the builder behind some of Sydney’s most iconic residential buildings, including Sanctuary at Wentworth Point and West Village in Parramatta. MAC Residences is proving popular with buyers of all demographics with over 170 out of 269 apartments already sold. “The appointment of Parkview Constructions follows an extensive tender process, and we are looking forward to our vision for MAC Residences, the first building in the large-scale masterplanned community, becoming a reality,” says Nigel Edgar, General Manager Development NSW, Frasers Property Australia. “The start of construction of the first homes is a major milestone for Midtown MacPark and we’re pleased to have a company with the local expertise and proven track record of Parkview on board to bring these new homes to life. “This is an exciting time for the people who have already purchased at MAC Residences as well as members of the local community who are eagerly awaiting the new homes, amenities and parks coming soon to the new heart of Macquarie Park.” Parkview Constructions Operations Manager, Glenn Moran says the company is excited to partner with Frasers Property in the creation of MAC Residences.