Private Markets Trends

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Private Equity & Venture Capital

VOLUME 14, ISSUE 6 ■ AUGUST 2018 PRIVATE EQUITY & VENTURE CAPITAL SPOTLIGHT THE RISE OF VENTURE AND IN THIS ISSUE GROWTH CAPITAL IN EUROPE €11bn in capital has already been secured by venture and growth capital funds focused on Europe that have closed this FEATURE 3 year; this is the highest figure seen at this stage in recent The Rise of Venture years. We put activity in the region under the microscope, examining the economic factors that have contributed to and Growth Capital in this. Europe Find out more on page 3 INDUSTRY NEWS 7 THE FACTS ■ Private Equity in the 9 PRIVATE EQUITY IN THE NORDIC Nordic Region REGION ■ Public Pension Funds 12 Investing in Private With the capital raised by managers based in the Nordic Equity region reaching record highs, we take a look at the growing private equity market in terms of fundraising activity, investor make-up and largest exits in the region. CONFERENCES 14 Find out more on page 9 RECENTLY RELEASED: THE 2018 PREQIN PRIVATE CAPITAL FUND TERMS THE 2018 PRIVATE CAPITAL All data in this newsletter ADVISOR can be downloaded to PREQIN FUND TERMS ADVISOR Excel for free Order Your Copy Download Sample Pages Sign up to Spotlight, our free monthly newsletter, providing insights into performance, investors, deals and fundraising, powered by Preqin data: Alt Credit Intelligence European and US Fund Services Awards: Best Data and Information Provider | Africa Global Funds Awards 2016: Best Research and Data Provider | The Queen’s SIGN UP Award for Enterprise: International Trade | HedgeWeek Global Awards: -

FT PARTNERS RESEARCH 2 Fintech Meets Alternative Investments

FT PARTNERS FINTECH INDUSTRY RESEARCH Alternative Investments FinTech Meets Alternative Investments Innovation in a Burgeoning Asset Class March 2020 DRAFT ©2020 FinTech Meets Alternative Investments Alternative Investments FT Partners | Focused Exclusively on FinTech FT Partners’ Advisory Capabilities FT Partners’ FinTech Industry Research Private Capital Debt & Raising Equity Sell-Side / In-Depth Industry Capital Buy-Side Markets M&A Research Reports Advisory Capital Strategic Structuring / Consortium Efficiency Proprietary FinTech Building Advisory FT Services FINTECH Infographics Partners RESEARCH & Board of INSIGHTS Anti-Raid Advisory Directors / Advisory / Monthly FinTech Special Shareholder Committee Rights Plans Market Analysis Advisory Sell-Side Valuations / LBO Fairness FinTech M&A / Financing Advisory Opinion for M&A Restructuring Transaction Profiles and Divestitures Named Silicon Valley’s #1 FinTech Banker Ranked #1 Most Influential Person in all of Numerous Awards for Transaction (2016) and ranked #2 Overall by The FinTech in Institutional Investors “FinTech Excellence including Information Finance 40” “Deal of the Decade” • Financial Technology Partners ("FT Partners") was founded in 2001 and is the only investment banking firm focused exclusively on FinTech • FT Partners regularly publishes research highlighting the most important transactions, trends and insights impacting the global Financial Technology landscape. Our unique insight into FinTech is a direct result of executing hundreds of transactions in the sector combined with over 18 years of exclusive focus on Financial Technology FT PARTNERS RESEARCH 2 FinTech Meets Alternative Investments I. Executive Summary 5 II. Industry Overview and The Rise of Alternative Investments 8 i. An Introduction to Alternative Investments 9 ii. Trends Within the Alternative Investment Industry 23 III. Executive Interviews 53 IV. -

United States Venture Capital Review

United States Venture Capital Review FULL YEAR 2020 United States Venture Capital Full Year 2020 | United States Venture Capital Review United States Venture Capital Deals Intelligence Venture Capital Investment Activity in U.S. Companies $140 6000 UNITED STATES VENTURE CAPITAL INVESTMENTS REACHES $124.8 BILLION United States venture capital investments reached a record high of $124.8 billion from 5,084 transactions during full year 2020, a 16% increase by dollars despite a 4% downtick in numbers of $120 deals compared to a year ago. United States venture-stage investment during the fourth quarter alone 5000 totaled $30.6 billion from 1,208 deals, a 20% decrease compared to the third quarter of 2020 in terms of dollars. $100 4000 FOUR VENTURE INVESTMENTS OVER $1 BILLION COMPLETED Four venture-stage investments over $1 billion, totaling $8.4 billion, were secured in 2020. Rivian $80 Automotive, a manufacturer of electric vehicles, secured a $2.5 billion investment from a consortium 3000 of investors, leading all other venture investments in 2020. Waymo, a company that develops self- $60 driving vehicles, secured the second largest venture investment with $2.3 billion in capital. Also included was the $1.9 billion investment into SpaceX which produces space transport vehicles and 2000 the $1.8 billion investment into video game and software developer, Epic Games. $40 COMPUTER SOFTWARE & SERVICES LEADS ALL SECTOR BY DOLLARS INVESTED 1000 The Computer Software & Services sector led all other sectors by value with $50.3 billion invested in $20 more than 2,000 transactions during full year 2020, an increase of 23% in dollars compared to 2019. -

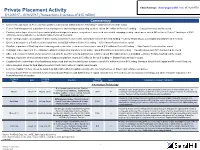

Private Placement Activity Chris Hastings | [email protected] | 917-621-3750 8/7/2017 – 8/11/2017 (Transactions in Excess of $15 Million) Commentary

Private Placement Activity Chris Hastings | [email protected] | 917-621-3750 8/7/2017 – 8/11/2017 (Transactions in excess of $15 million) Commentary . Iconectiv, a developer of telecommunications software and interconnection technology, raised $200 million — Francisco Partners led the deal. Information Resources, a provider of consulting and advisory services, raised $100 million. Investors include New Mountain Capital and Silver Canyon Group. Appboy, a developer of a life-cycle engagement platform, raised $50 million in Series D funding at a $350 million pre-money valuation — ICONIQ Capital led the round. Oryx Vision, a developer of next-generation automotive LiDAR technology, raised $50 million in Series B funding — Third Point Ventures and WRV led the round. Chef’d, a provider of an online food sales and delivery service, raised $35 million in Series B funding. Amplitude, a provider of a mobile and web-based analytics platform, raised $30 million in Series C funding — IVP led the round. Signals Analytics, a developer of an insights as a service augmented intelligence platform, raised $25 million in Series C funding — Pitango Venture Capital led the round. InContext Solutions, a developer of 3D virtual simulation technology, raised $22 million in Series F funding — Beringea and Intel Capital led the round. Stratford School, a provider of academic programs, raised $21 million. Investors include Warburg Pincus. Guideline, a provider of automated investment technology, raised $15 million in Series B funding at a $70 million pre-money valuation — Felicis Ventures led the round. Company Company Amount Date Investors Series Company Description / Comments Name Location Raised ($M) Information Technology Developer of telecommunications software and interconnection technology. -

Boston San Francisco Munich London

Internet & Digital Media Monthly August 2018 BOB LOCKWOOD JERRY DARKO Managing Director Senior Vice President +1.617.624.7010 +1.415.616.8002 [email protected] [email protected] BOSTON SAN FRANCISCO HARALD MAEHRLE LAURA MADDISON Managing Director Senior Vice President +49.892.323.7720 +44.203.798.5600 [email protected] [email protected] MUNICH LONDON INVESTMENT BANKING Raymond James & Associates, Inc. member New York Stock Exchange/SIPC. Internet & Digital Media Monthly TECHNOLOGY & SERVICES INVESTMENT BANKING GROUP OVERVIEW Deep & Experienced Tech Team Business Model Coverage Internet / Digital Media + More Than 75 Investment Banking Professionals Globally Software / SaaS + 11 Senior Equity Research Technology-Enabled Solutions Analysts Transaction Processing + 7 Equity Capital Markets Professionals Data / Information Services Systems | Semiconductors | Hardware + 8 Global Offices BPO / IT Services Extensive Transaction Experience Domain Coverage Vertical Coverage Accounting / Financial B2B + More than 160 M&A and private placement transactions with an Digital Media Communications aggregate deal value of exceeding $25 billion since 2012 E-Commerce Consumer HCM Education / Non-Profit + More than 100 public equities transactions raising more than Marketing Tech / Services Financial $10 billion since 2012 Supply Chain Real Estate . Internet Equity Research: Top-Ranked Research Team Covering 25+ Companies . Software / Other Equity Research: 4 Analysts Covering 40+ Companies RAYMOND JAMES / INVESTMENT BANKING OVERVIEW . Full-service firm with investment banking, equity research, institutional sales & trading and asset management – Founded in 1962; public since 1983 (NYSE: RJF) – $6.4 billion in FY 2017 revenue; equity market capitalization of approximately $14.0 billion – Stable and well-capitalized platform; over 110 consecutive quarters of profitability . -

Healthy Living Consumer Products: Industry Update, Deal Review and ‘Hot’ Categories

Healthy Living Consumer Products: Industry Update, Deal Review and ‘Hot’ Categories Natural Products Expo West Michael Burgmaier Nicolas McCoy Managing Director Managing Director March 2017 o. 508-251-5702 o. 508-251-8205 c. 207-232-2480 c. 508-954-4931 [email protected] [email protected] 2 What the Whipstitch Team Has Been Up To 2016 by the Numbers • Three M&A Transactions • Four Private Placements • One Unannounced Deal • Three New Team Members • Eight New Associated Industry Experts (Our “Stitching Crew”) • Ten Speaking Events with Emerging Consumer Companies • One Stitching Crew Lobster Bake 2017 Transactions Bill Moses Joins the Whipstitch Team as • Several transactions expected to close Senior Operating and Strategic Advisor in first half of 2017, for example: • Former Co-Founder, Chairman/ CEO of KeVita Probiotic Drinks o Nutrient-dense Superfood Company • Founder, angel investor and o Sports Nutrition and Supplement strategic advisor to several on- Company trend functional CPG ventures • Owner of Casa Barranca Winery o Better-for-you Snack Company • Charity advocate & non-profit board member 3 Contents . Whipstitch Capital Overview . Healthy Living: Industry Overview and Deal Update / Whipstitch’s Top 11 Healthy Living Consumer Trends . SPINS Market Update: Produced for Whipstitch’s Industry Analysis . Food & Beverage M&A and Private Placement Deal Data 4 Whipstitch – A Bank Solely Focused on the Healthy Living Market Whipstitch [hwip-stitch] Noun. The stitch that passes over an edge, in joining, finishing, or gathering. • Launched October 2015 by Nick McCoy and Michael Burgmaier • Focused exclusively on innovative consumer companies • Financial Advisory on M&A and institutional private placements • Participate in over 15 consumer industry events/year • Lead events such as all-day financing seminars, networking events • The Whipstitch team has completed >50 consumer transactions; select recent deals: 5 Whipstitch Differentiation: This is What We Do Focus You Get the Top Experience . -

AGC-Restaurant-Tech-Nov-2019

Type & Color November, 2019 INSIGHTS The Future of Restaurant Technology How Technology is Transforming the Restaurant Industry Greg Roth, Partner Ben Howe, CEO Jon Guido, Partner & COO Sean Tucker, PartnerAGC Partners ExecutiveType & Color Summary Massive $900B market experiencing rapid digital adoption and software growth . An extended economic recovery, low unemployment rate, and continued rise of millennials as the largest demographic in the workplace are factors driving strong restaurant spending . Third party delivery market is exploding; eating in is the new dining out US Digital Restaurant Sales . Cloud based POS systems are replacing incumbent providers at an accelerating pace and ($ Billions) achieving higher ACV with additional features and functionality $328 . Front of house applications including Online Ordering, CRM and Loyalty programs are other areas of accelerating spend in order to capture more valuable repeat diners 27% CAGR . Razor thin profit margins and unique challenges restaurants face require purpose built solutions to cut costs, gain efficiencies, and increase visibility . Hiring, training and retaining workers in a complex and changing regulatory environment is one $117 of the largest challenges restaurants face $48 . Unlocking of data silos enabling business analytics across the value chain . Automation and AI beginning to impact restaurant operations and economics, freeing up scarce employee resources to focus on customers 2017 2020 2025 . Ghost Kitchens and Online Catering are two emerging growth areas taking advantage of online Note: based on estimated percentage of sales derived from digital channels and total industry sales forecasts delivery trends and attractive unit economics . Restaurant Management Software spend tilted towards front of house (~60%) technologies vs. -

Preqin and First Republic Us Venture Capital Update: Q3 2018 Preqin and First Republic Us Venture Capital Update: Q3 2018

PREQIN AND FIRST REPUBLIC US VENTURE CAPITAL UPDATE: Q3 2018 PREQIN AND FIRST REPUBLIC US VENTURE CAPITAL UPDATE: Q3 2018 CONTENTS 3 Deals & Exits 12 Performance 6 Fundraising 14 Fund Managers 8 Funds in Market 16 Investors 9 Micro Venture Capital FIRST REPUBLIC BANK First Republic and its subsidiaries offer private banking, private business banking and private wealth management, including investment, trust and brokerage services. First Republic specializes in delivering exceptional, relationship-based service, with a solid commitment to responsiveness and action. Services are offered through preferred banking or wealth management offices primarily in San Francisco, Palo Alto, Los Angeles, Santa Barbara, Newport Beach and San Diego, California; Portland, Oregon; Boston, Massachusetts; Palm Beach, Florida; Greenwich, Connecticut; New York, New York; and later in 2018, Jackson, Wyoming. First Republic offers a complete line of banking products for individuals and businesses, including deposit services, as well as residential, commercial and personal loans. For more information, visit: www.firstrepublic.com Preqin partnered with First Republic Bank to prepare this information regarding US Venture Capital. This report is for information purposes only and is not intended as an offer, solicitation, advice (investment, legal, tax, or otherwise), or as the basis for any contract. First Republic Bank has not independently verified the information contained herein and shall not have liability to any third party in any respect for this report or any actions taken or decisions made based upon anything contained herein. This information is valid only as of October 2018 and neither Preqin nor First Republic Bank will undertake to update this report with regard to changes in market conditions, information, laws, or regulations after the date of this report. -

2013 ACA Summit – Navigating Change for Angel Success Agenda

2013 ACA Summit – Navigating Change for Angel Success Agenda Tuesday, April 16 10:00 – 2:00 pm Bike Tour Frank Peters Our guided route takes us over the Golden Gate Bridge to Sausalito, where we'll have lunch and enjoy the views before hopping on the ferry to return to San Francisco. Wednesday, April 17 7:00 – 9:00 am Registration and Continental Breakfast Seacliff Foyer 8:00 – 4:15 pm Angel Investing Overview Seminar Seacliff C-D Susan Preston, CALCEF Clean Energy Angel Fund Are you new to angel investing or looking to "tune-up" your investment skills? Or are you interested in finding an education program that will help recruit business angels to your angel organization or economic development initiative? This program is for both of you. This full-day seminar provides an overview of the angel investing process, including the details of finding, evaluating, and structuring deals and developing angel-entrepreneur relationships that lead to success. The highly interactive program provides attendees with practical information on best practices in angel investing through a balance of expert presentations, panel discussions, and small group case studies. A faculty of experienced angel investors, serial entrepreneurs, and expert service providers delivers the seminar. 8:00 – 12:00 pm Valuation of Early-Stage Companies Workshop Ballroom C Bill Payne, Frontier Angels Understanding how to properly value an early stage company is one of the most important skills an investor and entrepreneur can possess. The process of determining a value can seem difficult and intimidating. It should not be and with the right knowledge the process can be efficient and ultimately lead to greater returns. -

Private Equity Analyst

PRIVATE EQUITY ANALYST NOVEMBER 2020 Women to Private Equity’s Top Female Talent of Today and Tomorrow p. 7 10 VCs Grooming Game-Changing Startups p. 13 Watch LP Cycles Ad HFA+PEA-Ltr DR080420.pdf 1 8/4/20 5:43 PM Private equity investing has its cycles. Work with a secondary manager who’s C experienced them all. M Y CM MY As leaders of the secondary market, the Lexington Partners team CY draws on more than 400 years of private equity experience. CMY Through all types of business cycles, we have completed over K 500 secondary transactions, acquiring more than 3,000 interests managed by over 750 sponsors with a total value in excess of $53 billion. Our team has excelled at providing customized alternative investment solutions to banks, financial institutions, pension funds, sovereign wealth funds, endowments, family offices, and other fiduciaries seeking to reposition their private investment portfolios. If you have an interest in the secondary market, our experience is second to none. To make an inquiry, please send an email to [email protected] or call us at one of our offices. Innovative Directions in Alternative Investing New York • Boston • Menlo Park • London • Hong Kong • Santiago • Luxembourg www.lexingtonpartners.com Includes information regarding six funds managed by Lexington’s predecessor formed during the period 1990 to 1995. This information is provided for informational purposes only and is not an offer to sell or solicitation of offers to purchase any security. Private Equity Analyst November 2020 contents Volume XXX, Issue 11 Fund News u The Roundup Comment Clayton Dubilier Collects About $14B for Latest Buyout Fund 26 H.I.G. -

US Venture Capital First Quarter 2021

United States Venture Capital Review FIRST QUARTER 2021 An LSEG Company United States Venture Capital First Quarter 2021 | United States Venture Capital Review United States Venture Capital Deals Intelligence Venture Capital Investment Activity in U.S. Companies $140 1800 UNITED STATES VC INVESTMENT REACHES $62.0 BILLION 1600 United States venture capital investments reached a record high of $62.0 billion from 1,543 deals in the $120 first quarter, an explosive rate of growth. This not only set an all-time high in terms of disbursements in 1400 any quarter in United States history, but exceeded the second-best quarter by 57%. Indeed, of the top $100 five quarters ever recorded in terms of dollars invested, four have occurred since Q1 2020, while of the 1200 top 25 states, 24 of them received more capital invested in Q1 2021 than in the same period last year. The average venture capital round size in the quarter also exceeded $40 million for the first time in $80 1000 history. 800 While the 1,543 venture capital deals recorded in the first quarter was not itself an all-time high, it did $60 represent the most deals completed in twenty years, when 1,845 deals were completed in Q4 2000, and round sizes were only $12.3 million on average. 600 $40 400 FIVE VENTURE INVESTMENTS OVER $1 BILLION COMPLETED $20 200 While four venture-stage investments $1 billion or greater, totaling $8.4 billion, were completed in all of 2020, in the first quarter of 2021 alone there were five such investments recorded totaling $10.2 billion. -

Private Placement Activity Chris Hastings | [email protected] | 917-621-3750 6/12/2017 – 6/16/2017 (Transactions in Excess of $15 Million) Commentary

Private Placement Activity Chris Hastings | [email protected] | 917-621-3750 6/12/2017 – 6/16/2017 (Transactions in excess of $15 million) Commentary . Element AI, a provider of AI as a Service platform, raised $102 million in Series A funding — Data Collective led the round. Fusion Risk Management, a provider of risk management and contingency planning services, raised $41 million in Series C funding — Catalyst Investors led the round. Conviva, a developer of an intelligent control platform designed to power every internet-connected screen with engaging viewing experiences, raised $40 million in Series F funding at a $260 million pre-money valuation — Australia Future Fund led the round. Drone Racing League, an organizer of drone racing competitions and events, raised $25 million in Series B funding — Liberty Media Group, Lux Capital and Sky UK led the round. Entelo, a developer of a SaaS recruitment platform, raised $20 million in Series C1 funding — US Venture Partners led the round. ShipBob, a provider of SaaS logistics technology and services for e-commerce businesses, raised $18 million in Series B funding — Bain Capital Ventures led the round. HelloSign, a developer of a free eSignature platform designed to sign documents online, raised $16 million in Series E funding — Foundry Group and Zach Coelius led the round. AEye, a developer of robotic vision systems created to be used for sensing autonomous vehicles, raised $16 million in Series A funding — Kleiner Perkins Caufield led the round. Highspot, a provider of a cloud-based sales engagement platform, raised $15 million in Series B funding — Shasta Ventures led the round.