Texas Register December 25, 2020 Issue

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2022 City Observed Holidays- 2023

City Observed Holidays- 2021 1. New Year’s Day - Friday, January 1, 2021 2. Martin Luther King, Jr. Day - Monday, January 18, 2021 3. Memorial Day – The City will observe Memorial Day on Monday, May 31, 2021 (Memorial Day is on Sunday May 30, 2021) 4. Independence Day – The City will observe Independence Day on Monday, July 5, 2021 (Independence Day is on Sunday, July 4, 2021) 5. Labor Day - Monday, September 6, 2021 6. Veterans Day - Thursday, November 11, 2021 7. Thanksgiving Day - Thursday, November 25, 2021 8. The Day After Thanksgiving - Friday, November 26, 2021 9. Christmas Eve- Friday, December 24, 2021 10. Christmas Day- The City will observe Christmas Day on Monday, December 27, 2021 (Christmas Day is on Saturday, December 25, 2021) City Observed Holidays- 2022 1. New Year’s Day - The City will observe New Year’s Day on Friday, December 31, 2021 (New Year’s Day is on Saturday January 1, 2022) 2. Martin Luther King, Jr. Day - Monday, January 17, 2022 3. Memorial Day - Monday, May 30, 2022 4. Independence Day - Monday, July 4, 2022 5. Labor Day - Monday, September 5, 2022 6. Veterans Day - Friday, November 11, 2022 7. Thanksgiving Day - Thursday, November 24, 2022 8. The Day After Thanksgiving - Friday, November 25, 2022 9. Christmas Eve - The City will observe Christmas Eve on Friday, December 23, 2022 (Christmas Eve is on Saturday, December 24, 2022) 10. Christmas Day – will be observed on Monday, December 26, 2022 (Christmas Day is on Sunday, December 25, 2022) City Observed Holidays- 2023 1. New Year’s Day - Monday, January 2, 2023 (New Year’s Day is on Sunday, January 1, 2023) 2. -

2021 7 Day Working Days Calendar

2021 7 Day Working Days Calendar The Working Day Calendar is used to compute the estimated completion date of a contract. To use the calendar, find the start date of the contract, add the working days to the number of the calendar date (a number from 1 to 1000), and subtract 1, find that calculated number in the calendar and that will be the completion date of the contract Date Number of the Calendar Date Friday, January 1, 2021 133 Saturday, January 2, 2021 134 Sunday, January 3, 2021 135 Monday, January 4, 2021 136 Tuesday, January 5, 2021 137 Wednesday, January 6, 2021 138 Thursday, January 7, 2021 139 Friday, January 8, 2021 140 Saturday, January 9, 2021 141 Sunday, January 10, 2021 142 Monday, January 11, 2021 143 Tuesday, January 12, 2021 144 Wednesday, January 13, 2021 145 Thursday, January 14, 2021 146 Friday, January 15, 2021 147 Saturday, January 16, 2021 148 Sunday, January 17, 2021 149 Monday, January 18, 2021 150 Tuesday, January 19, 2021 151 Wednesday, January 20, 2021 152 Thursday, January 21, 2021 153 Friday, January 22, 2021 154 Saturday, January 23, 2021 155 Sunday, January 24, 2021 156 Monday, January 25, 2021 157 Tuesday, January 26, 2021 158 Wednesday, January 27, 2021 159 Thursday, January 28, 2021 160 Friday, January 29, 2021 161 Saturday, January 30, 2021 162 Sunday, January 31, 2021 163 Monday, February 1, 2021 164 Tuesday, February 2, 2021 165 Wednesday, February 3, 2021 166 Thursday, February 4, 2021 167 Date Number of the Calendar Date Friday, February 5, 2021 168 Saturday, February 6, 2021 169 Sunday, February -

Salary Payroll Schedule - 2021 Fiscal Pay Salary Overtime &Retro Leave Semester Pay Period HR Transaction Deadline Payday Days Year Number Entry (PHAHOUR) Periods

Salary Payroll Schedule - 2021 Fiscal Pay Salary Overtime &Retro Leave Semester Pay Period HR Transaction deadline Payday Days Year Number Entry (PHAHOUR) Periods December 25 – January 9 1 Monday, January 4, 2021 Wednesday, January 6, 2021 Friday, January 15, 2021 11 12 January 10 – January 24 2 Tuesday, January 19, 2021 Thursday, January 21, 2021 Monday, February 1, 2021 10 1 January 25 – February 9 3 Tuesday, February 2, 2021 Thursday, February 4, 2021 Tuesday, February 16, 2021 12 February 10 – February 24 4 Tuesday, February 16, 2021 Thursday, February 18, 2021 Monday, March 1, 2021 11 Spring Semester 2 Classes Begin February 25 – March 9 5 Wednesday, March 3, 2021 Friday, March 5, 2021 Tuesday, March 16, 2021 9 1/19/21 Exams End 5/13/21 21 March 10 – March 24 6 Thursday, March 18, 2021 Monday, March 22, 2021 Wednesday, March 31, 2021 11 3 March 25 – April 9 7 Monday, April 5, 2021 Wednesday, April 7, 2021 Friday, April 16, 2021 12 April 10 – April 24 8 Monday, April 19, 2021 Wednesday, April 21, 2021 Friday, April 30, 2021 10 4 April 25 – May 9 9 Monday, May 3, 2021 Wednesday, May 5, 2021 Friday, May 14, 2021 10 May 10 – May 24 10 Tuesday, May 18, 2021 Thursday, May 20, 2021 Tuesday, June 1, 2021 11 Summer I 5 Classes Begin May 25 – June 9 11 Thursday, June 3, 2021 Monday, June 7, 2021 Wednesday, June 16, 2021 12 5/24/21 (Paid 7/1/21) June 10 – June 24 12 Friday, June 18, 2021 Tuesday, June 22, 2021 Thursday, July 1, 2021 11 6 June 25 – July 9 13 Friday, July 2, 2021 Wednesday, July 7, 2021 Friday, July 16, 2021 11 Summer II Classes -

A Sunday Between March 22Nd and April 25. July 4Th

HOLIDAYS - PAGE 1 Please connect the symbols with the date of the holiday they represent. A Sunday between March 22nd and April 25. December 25 February 14 1st Monday in September Late November - late December July 4th The last Monday in May (or November 11) March 17 HOLIDAYS IN AMERICA HOLIDAYS - PAGE 2 Every month of the year has something special to celebrate in the U.S. Throughout the years, the U.S.Congress has passed laws declaring special days as official observances known as federal holidays. Each federal holiday represents a day when federal employees and many other workers have a paid day off from their jobs. There are some holidays we celebrate that are not federal holidays but are very popular holidays to celebrate. January The first day of January isNew Year’s Day. This federal holiday celebrates the beginning of each New Year. People in the U.S. sometimes spend this day watching college football games and parades. On the third Monday in January, we celebrate Martin Luther King, Jr.’s birthday as a federal holiday. Martin Luther King, Jr. worked to change laws so that all people in the U.S. would be treated fairly. He worked for change in the 1950s and 60s when many states had laws separating black and white people. Martin Luther King taught people to use peaceful demonstrations to change laws, instead of violence. Many laws were changed because of his work. Many people worked with him in the hope that the U.S. could be a fair country for all people. -

Holiday Schedule for January 1, 2020 to December 25, 2021 (Paid Holiday)

707 NE COUCH ST. PORTLAND, OR 97232 HOLIDAY SCHEDULE FOR JANUARY 1, 2020 TO DECEMBER 25, 2021 (PAID HOLIDAY) SCHEDULE A* - RECOGNIZED HOLIDAYS: ADMINISTRATIVE, CLERICAL, SUPERVISORY (EXEMPT) AND SUPPORT STAFF JANUARY 1, 2020 WEDNESDAY NEW YEAR’S DAY JANUARY 20, 2020 MONDAY MARTIN LUTHER KING DAY MAY 25, 2020 MONDAY MEMORIAL DAY JULY 3, 2020 (OBSERVED) FRIDAY INDEPENDENCE DAY SEPTEMBER 7, 2020 MONDAY LABOR DAY NOVEMBER 26, 2020 THURSDAY THANKSGIVING DAY DECEMBER 25, 2020 FRIDAY CHRISTMAS DAY JANUARY 1, 2021 FRIDAY NEW YEAR’S DAY JANUARY 18, 2021 MONDAY MARTIN LUTHER KING DAY MAY 31, 2021 MONDAY MEMORIAL DAY JULY 5, 2021 (OBSERVED) MONDAY INDEPENDENCE DAY SEPTEMBER 6, 2021 MONDAY LABOR DAY NOVEMBER 25, 2021 THURSDAY THANKSGIVING DAY DECEMBER 24, 2021 FRIDAY CHRISTMAS DAY SCHEDULE B** - LEGAL HOLIDAYS: NON-EXEMPT RESIDENTIAL STAFF AND RESIDENTIAL RELIEF WORKERS JANUARY 1, 2020 WEDNESDAY NEW YEAR’S DAY JANUARY 20, 2020 MONDAY MARTIN LUTHER KING DAY MAY 25, 2020 MONDAY MEMORIAL DAY JULY 4, 2020 SATURDAY INDEPENDENCE DAY SEPTEMBER 7, 2020 MONDAY LABOR DAY NOVEMBER 26, 2020 THURSDAY THANKSGIVING DAY DECEMBER 25, 2020 FRIDAY CHRISTMAS DAY JANUARY 1, 2021 FRIDAY NEW YEAR’S DAY JANUARY 18, 2021 MONDAY MARTIN LUTHER KING DAY MAY 31, 2021 MONDAY MEMORIAL DAY JULY 4, 2021 SUNDAY INDEPENDENCE DAY SEPTEMBER 6, 2021 MONDAY LABOR DAY NOVEMBER 25, 2021 THURSDAY THANKSGIVING DAY DECEMBER 25, 2021 SATURDAY CHRISTMAS DAY *Holiday A schedule - program is closed and employees receive 8 hours of pay if 100% FTE or a pro-rated amount for less than 100% FTE. **Holiday B Schedule - program is open and employees are paid time and a half for hours worked on holiday. -

2018 - 2019 Days of Rotation Calendar

2018 - 2019 DAYS OF ROTATION CALENDAR Day # Date Rotation Day Type Notes Day # Date Rotation Day Type Notes Saturday, October 13, 2018 Sunday, October 14, 2018 Monday, September 3, 2018 Holiday/Vaca Labor Day 27 Monday, October 15, 2018 Day 3 In Session 1 Tuesday, September 4, 2018 Day 1 In Session 28 Tuesday, October 16, 2018 Day 4 In Session 2 Wednesday, September 5, 2018 Day 2 In Session 29 Wednesday, October 17, 2018 Day 5 In Session 3 Thursday, September 6, 2018 Day 3 In Session 30 Thursday, October 18, 2018 Day 6 In Session 4 Friday, September 7, 2018 Day 4 In Session 31 Friday, October 19, 2018 Day 1 In Session Saturday, September 8, 2018 Saturday, October 20, 2018 Sunday, September 9, 2018 Sunday, October 21, 2018 Monday, September 10, 2018 Day Holiday/Vaca Rosh Hashanah 32 Monday, October 22, 2018 Day 2 In Session 5 Tuesday, September 11, 2018 Day 5 In Session 33 Tuesday, October 23, 2018 Day 3 In Session 6 Wednesday, September 12, 2018 Day 6 In Session 34 Wednesday, October 24, 2018 Day 4 In Session 7 Thursday, September 13, 2018 Day 1 In Session 35 Thursday, October 25, 2018 Day 5 In Session 8 Friday, September 14, 2018 Day 2 In Session 36 Friday, October 26, 2018 Day 6 In Session Saturday, September 15, 2018 Saturday, October 27, 2018 Sunday, September 16, 2018 Sunday, October 28, 2018 9 Monday, September 17, 2018 Day 3 In Session 37 Monday, October 29, 2018 Day 1 In Session 10 Tuesday, September 18, 2018 Day 4 In Session 38 Tuesday, October 30, 2018 Day 2 In Session Wednesday, September 19, 2018 Day Holiday/Vaca Yom Kippur 39 Wednesday, October 31, 2018 Day 3 In Session 11 Thursday, September 20, 2018 Day 5 In Session 40 Thursday, November 1, 2018 Day 4 In Session 12 Friday, September 21, 2018 Day 6 In Session 41 Friday, November 2, 2018 Day 5 In Session Saturday, September 22, 2018 Saturday, November 3, 2018 Sunday, September 23, 2018 Sunday, November 4, 2018 13 Monday, September 24, 2018 Day 1 In Session 42 Monday, November 5, 2018 Day 6 In Session 14 Tuesday, September 25, 2018 Day 2 In Session Tuesday, November 6, 2018 Prof Dev. -

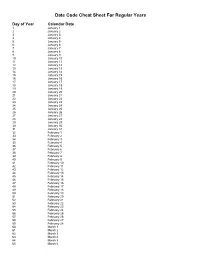

Julian Date Cheat Sheet for Regular Years

Date Code Cheat Sheet For Regular Years Day of Year Calendar Date 1 January 1 2 January 2 3 January 3 4 January 4 5 January 5 6 January 6 7 January 7 8 January 8 9 January 9 10 January 10 11 January 11 12 January 12 13 January 13 14 January 14 15 January 15 16 January 16 17 January 17 18 January 18 19 January 19 20 January 20 21 January 21 22 January 22 23 January 23 24 January 24 25 January 25 26 January 26 27 January 27 28 January 28 29 January 29 30 January 30 31 January 31 32 February 1 33 February 2 34 February 3 35 February 4 36 February 5 37 February 6 38 February 7 39 February 8 40 February 9 41 February 10 42 February 11 43 February 12 44 February 13 45 February 14 46 February 15 47 February 16 48 February 17 49 February 18 50 February 19 51 February 20 52 February 21 53 February 22 54 February 23 55 February 24 56 February 25 57 February 26 58 February 27 59 February 28 60 March 1 61 March 2 62 March 3 63 March 4 64 March 5 65 March 6 66 March 7 67 March 8 68 March 9 69 March 10 70 March 11 71 March 12 72 March 13 73 March 14 74 March 15 75 March 16 76 March 17 77 March 18 78 March 19 79 March 20 80 March 21 81 March 22 82 March 23 83 March 24 84 March 25 85 March 26 86 March 27 87 March 28 88 March 29 89 March 30 90 March 31 91 April 1 92 April 2 93 April 3 94 April 4 95 April 5 96 April 6 97 April 7 98 April 8 99 April 9 100 April 10 101 April 11 102 April 12 103 April 13 104 April 14 105 April 15 106 April 16 107 April 17 108 April 18 109 April 19 110 April 20 111 April 21 112 April 22 113 April 23 114 April 24 115 April -

Pay Date Calendar

Pay Date Information Select the pay period start date that coincides with your first day of employment. Pay Period Pay Period Begins (Sunday) Pay Period Ends (Saturday) Official Pay Date (Thursday)* 1 January 10, 2016 January 23, 2016 February 4, 2016 2 January 24, 2016 February 6, 2016 February 18, 2016 3 February 7, 2016 February 20, 2016 March 3, 2016 4 February 21, 2016 March 5, 2016 March 17, 2016 5 March 6, 2016 March 19, 2016 March 31, 2016 6 March 20, 2016 April 2, 2016 April 14, 2016 7 April 3, 2016 April 16, 2016 April 28, 2016 8 April 17, 2016 April 30, 2016 May 12, 2016 9 May 1, 2016 May 14, 2016 May 26, 2016 10 May 15, 2016 May 28, 2016 June 9, 2016 11 May 29, 2016 June 11, 2016 June 23, 2016 12 June 12, 2016 June 25, 2016 July 7, 2016 13 June 26, 2016 July 9, 2016 July 21, 2016 14 July 10, 2016 July 23, 2016 August 4, 2016 15 July 24, 2016 August 6, 2016 August 18, 2016 16 August 7, 2016 August 20, 2016 September 1, 2016 17 August 21, 2016 September 3, 2016 September 15, 2016 18 September 4, 2016 September 17, 2016 September 29, 2016 19 September 18, 2016 October 1, 2016 October 13, 2016 20 October 2, 2016 October 15, 2016 October 27, 2016 21 October 16, 2016 October 29, 2016 November 10, 2016 22 October 30, 2016 November 12, 2016 November 24, 2016 23 November 13, 2016 November 26, 2016 December 8, 2016 24 November 27, 2016 December 10, 2016 December 22, 2016 25 December 11, 2016 December 24, 2016 January 5, 2017 26 December 25, 2016 January 7, 2017 January 19, 2017 1 January 8, 2017 January 21, 2017 February 2, 2017 2 January -

Due Date Chart 201803281304173331.Xlsx

Special Event Permit Application Due Date Chart for Events from January 1, 2019 - June 30, 2020 If due date lands on a Saturday or Sunday, the due date is moved to the next business day Event Date 30 Calendar days 90 Calendar Days Tuesday, January 01, 2019 Sunday, December 02, 2018 Wednesday, October 03, 2018 Wednesday, January 02, 2019 Monday, December 03, 2018 Thursday, October 04, 2018 Thursday, January 03, 2019 Tuesday, December 04, 2018 Friday, October 05, 2018 Friday, January 04, 2019 Wednesday, December 05, 2018 Saturday, October 06, 2018 Saturday, January 05, 2019 Thursday, December 06, 2018 Sunday, October 07, 2018 Sunday, January 06, 2019 Friday, December 07, 2018 Monday, October 08, 2018 Monday, January 07, 2019 Saturday, December 08, 2018 Tuesday, October 09, 2018 Tuesday, January 08, 2019 Sunday, December 09, 2018 Wednesday, October 10, 2018 Wednesday, January 09, 2019 Monday, December 10, 2018 Thursday, October 11, 2018 Thursday, January 10, 2019 Tuesday, December 11, 2018 Friday, October 12, 2018 Friday, January 11, 2019 Wednesday, December 12, 2018 Saturday, October 13, 2018 Saturday, January 12, 2019 Thursday, December 13, 2018 Sunday, October 14, 2018 Sunday, January 13, 2019 Friday, December 14, 2018 Monday, October 15, 2018 Monday, January 14, 2019 Saturday, December 15, 2018 Tuesday, October 16, 2018 2019 Tuesday, January 15, 2019 Sunday, December 16, 2018 Wednesday, October 17, 2018 Wednesday, January 16, 2019 Monday, December 17, 2018 Thursday, October 18, 2018 Thursday, January 17, 2019 Tuesday, December 18, 2018 -

EASTMINSTER PRESBYTERIAN CHURCH Christmas Day, December 25, 2020

EASTMINSTER PRESBYTERIAN CHURCH Christmas Day, December 25, 2020 PRELUDE WORDS OF WELCOME & ANNOUNCEMENTS Rev. Nicholas P. Demuynck LIGHTING OF THE ADVENT CANDLE Gracen Cabiness, Hannah Lea, Teresa Shelton RESPONSIVE CALL TO WORSHIP Leader: I am bringing you good news of great joy for all the people. All: To you is born this day in the city of David a Savior, who is the Messiah, the Lord. Leader: This will be a sign for you; you will find a child wrapped in bands of cloth and lying in a manger. All: With the angels we say: “Glory to God in the highest heaven, and on earth peace, among those whom he favors.” SONG OF ADORATION #132 Good Christian Friends Rejoice IN DULCI JUBILO CHRISTMAS PRAYER OF ADORATION Rev. Brian J. Marsh PASSING OF THE PEACE AND TIME OF OFFERING During this time you are encouraged to extend the hand of Christ by texting “The peace of Christ be with you,” “The Lord be with you,” or another brief greeting to 3-4 people, Eastminster members or beyond. To respond to God’s grace by participating in God’s work through Eastminster, use one of the following options: 1. Mail contributions to: EPC, 3200 Trenholm Road, Columbia, SC 29204. 2. To set up recurring gifts, register on the members’ portal at https://members.eastminsterpres.org then follow prompts for giving. 3. One time gifts: Go to our webpage at https://eastminsterpres.org/contribute and select “2020 General Fund” and follow prompts. 4. Give by texting 18035909901, type “give” and hit send. You will be sent a link to give. -

Religious Holy Days and Days of Significance Calendar

RELIGIOUS OR CREED-BASED HOLY DAYS AND DAYS OF SIGNIFICANCE CALENDAR 2021–2022 The dates listed below are the faith days of particular significance for students and employees who are members of the major faith communities in our District as identified through consultation with local community organizations. Where possible, the District will consider Religious Holy Days and Days of Significance when scheduling programs and events. The District will refrain from holding events involving parents/guardians on religious holy days. Student absences on days of religious observance will be marked as “G” (grant) days, regardless of whether or not the day(s) of observance is noted in the procedure. Note: * Tentative dates subject to the sighting of the moon each month ** Local or regional customs may use a variation of this date. Faith Holy Day(s) or Days of Significance Date Indigenous National Day for Truth and Reconciliation September 30, 2021 (Orange Shirt Day) Nunatsiavut Day December 1, 2021 Louis Riel Day February 21, 2022 National Indigenous Peoples Day June 21, 2022 Bahá’i Birth of Baha’u’llah November 7, 2021 All Bahá’i holy days Naw Ruz March 20, 2022 commence on the preceding Ridvan (12-day Festival) April 20 - May 1, 2022 evening at sunset. Buddhist Chinese, Vietnamese, Korean New Year February 1, 2022 Magha Puja Day ** February 16, 2022 Wesak/Vesak** May 6, 2022 Christian (Orthodox) Christmas – Feast of the Nativity January 7, 2022 Holy Friday April 22, 2022 Orthodox Easter April 24, 2022 Christian Christmas December 25, 2021 Ash Wednesday March 2, 2022 Good Friday April 15, 2022 Easter April 17, 2022 Hindu Dussehra (Vijayadashmi) October 11–15, 2021 Diwali Festival ** November 4, 2021 Makar Sankranti January 14, 2022 Islam Eid-al-Fitr* **(3 days Holy Day) May 3–5, 2022 All Islamic holy days Eid-al-Adha* ** (4 days Holy Day) July 10–12, 2022 commence on the preceding Ashura * ** August 8, 2022 evening at sunset. -

Date of Close Contact Exposure

Date of Close Contact Exposure 7 days 10 days 14 days Monday, November 16, 2020 Tuesday, November 24, 2020 Friday, November 27, 2020 Tuesday, December 1, 2020 Tuesday, November 17, 2020 Wednesday, November 25, 2020 Saturday, November 28, 2020 Wednesday, December 2, 2020 Wednesday, November 18, 2020 Thursday, November 26, 2020 Sunday, November 29, 2020 Thursday, December 3, 2020 Thursday, November 19, 2020 Friday, November 27, 2020 Monday, November 30, 2020 Friday, December 4, 2020 Friday, November 20, 2020 Saturday, November 28, 2020 Tuesday, December 1, 2020 Saturday, December 5, 2020 Saturday, November 21, 2020 Sunday, November 29, 2020 Wednesday, December 2, 2020 Sunday, December 6, 2020 Sunday, November 22, 2020 Monday, November 30, 2020 Thursday, December 3, 2020 Monday, December 7, 2020 Monday, November 23, 2020 Tuesday, December 1, 2020 Friday, December 4, 2020 Tuesday, December 8, 2020 Tuesday, November 24, 2020 Wednesday, December 2, 2020 Saturday, December 5, 2020 Wednesday, December 9, 2020 Wednesday, November 25, 2020 Thursday, December 3, 2020 Sunday, December 6, 2020 Thursday, December 10, 2020 Thursday, November 26, 2020 Friday, December 4, 2020 Monday, December 7, 2020 Friday, December 11, 2020 Friday, November 27, 2020 Saturday, December 5, 2020 Tuesday, December 8, 2020 Saturday, December 12, 2020 Saturday, November 28, 2020 Sunday, December 6, 2020 Wednesday, December 9, 2020 Sunday, December 13, 2020 Sunday, November 29, 2020 Monday, December 7, 2020 Thursday, December 10, 2020 Monday, December 14, 2020 Monday, November