Fidelity® International Index Fund

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

DXE Liquidity Provider Registered Firms

DXE Liquidity Provider Program Registered Securities European Equities TheCboe following Europe Limited list of symbols specifies which firms are registered to supply liquidity for each symbol in 2021-09-28: 1COVd - Covestro AG Citadel Securities GCS (Ireland) Limited (Program Three) DRW Europe B.V. (Program Three) HRTEU Limited (Program Two) Jane Street Financial Limited (Program Three) Jump Trading Europe B.V. (Program Three) Qube Master Fund Limited (Program One) Societe Generale SA (Program Three) 1U1d - 1&1 AG Citadel Securities GCS (Ireland) Limited (Program Three) HRTEU Limited (Program Two) Jane Street Financial Limited (Program Three) 2GBd - 2G Energy AG Citadel Securities GCS (Ireland) Limited (Program Three) Jane Street Financial Limited (Program Three) 3BALm - WisdomTree EURO STOXX Banks 3x Daily Leveraged HRTEU Limited (Program One) 3DELm - WisdomTree DAX 30 3x Daily Leveraged HRTEU Limited (Program One) 3ITLm - WisdomTree FTSE MIB 3x Daily Leveraged HRTEU Limited (Program One) 3ITSm - WisdomTree FTSE MIB 3x Daily Short HRTEU Limited (Program One) 8TRAd - Traton SE Jane Street Financial Limited (Program Three) 8TRAs - Traton SE Jane Street Financial Limited (Program Three) Cboe Europe Limited is a Recognised Investment Exchange regulated by the Financial Conduct Authority. Cboe Europe Limited is an indirect wholly-owned subsidiary of Cboe Global Markets, Inc. and is a company registered in England and Wales with Company Number 6547680 and registered office at 11 Monument Street, London EC3R 8AF. This document has been established for information purposes only. The data contained herein is believed to be reliable but is not guaranteed. None of the information concerning the services or products described in this document constitutes advice or a recommendation of any product or service. -

Egistration Document Including the Annual Financial Report 2017 Contents

egistration document including the Annual Financial Report 2017 Contents MESSAGE FROM THE CHAIRMAN AND CEO 3 FINANCIAL AND OPERATIONAL GLOSSARY 4 PRESENTATION OF THE GROUP FINANCIAL STATEMENTS 151 1 AND 2017 INTEGRATED REPORT 5 4 4.1 Statutory Auditors’ report 1.1 Corporate profi le 6 on the consolidated fi nancial statements 152 1.2 Strategic vision, investment strategy and outlook 19 4.2 Consolidated fi nancial statements 156 1.3 Highlights of the year 24 4.3 Statutory Auditors’ report on the fi nancial statements 232 1.4 Selected three-year fi nancial information 25 4.4 Parent company fi nancial statements and notes 236 1.5 Shareholder information 26 1.6 Milestones 27 1.7 The management team 28 ANNUAL SHAREHOLDERS MEETING 269 1.8 Regulatory environment 30 5 5.1 Presentation of proposed resolutions 270 1.9 Contractual relationships 32 5.2 Resolutions of the Annual Shareholders Meeting 279 1.10 Intellectual property 33 5.3 Statutory Auditors’ special reports 297 1.11 Real estate 33 1.12 Specifi c risks and opportunities 33 ADDITIONAL INFORMATION 301 6.1 Investor relations and documents available MANAGEMENT REPORT 35 6 to the public 302 2.1 The Company, ownership structure, dividends 6.2 Persons responsible for the Registration Document 2 and market for Edenred securities 36 and the audit of the accounts 303 2.2 Risk factors and management 48 6.3 Fees paid to the Statutory Auditors 304 2.3 Financial review 65 6.4 Information on holdings 304 2.4 Corporate Social Responsibility 77 6.5 Third-party information 304 6.6 Information incorporated by reference 304 6.7 Regulatory fi lings 305 CORPORATE GOVERNANCE REPORT 111 6.8 Cross-reference tables 306 6.9 Cross-reference table with the Annual 3 3.1 Corporate governance 112 Financial Report 311 3.2 Executive Directors’ compensation 135 6.10 Cross-reference table for social, societal 3.3 Information about the Company’s capital 143 and environmental data 312 6.11 GRI cross-reference table 315 The information required in the Annual Financial Report is identified in the Contents table by the AFR pictogram AFR. -

Ishares, Inc. Form NPORT-P Filed 2021-07-28

SECURITIES AND EXCHANGE COMMISSION FORM NPORT-P Filing Date: 2021-07-28 | Period of Report: 2021-05-31 SEC Accession No. 0001752724-21-159023 (HTML Version on secdatabase.com) FILER iShares, Inc. Mailing Address Business Address 400 HOWARD STREET 400 HOWARD STREET CIK:930667| IRS No.: 510396525 | State of Incorp.:MD | Fiscal Year End: 0831 SAN FRANCISCO CA 94105 SAN FRANCISCO CA 94105 Type: NPORT-P | Act: 40 | File No.: 811-09102 | Film No.: 211121066 (415) 670-2000 Copyright © 2021 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document Schedule of Investments (unaudited) iShares® MSCI Eurozone ETF May 31, 2021 (Percentages shown are based on Net Assets) Security Shares Value Common Stocks Austria — 0.6% Erste Group Bank AG 329,035 $ 13,477,023 OMV AG 173,018 9,869,717 Raiffeisen Bank International AG 174,780 4,143,945 Verbund AG 80,105 7,319,840 voestalpine AG 136,442 6,137,868 40,948,393 Belgium — 2.6% Ageas SA/NV 204,774 13,342,470 Anheuser-Busch InBev SA/NV 895,037 66,929,866 Elia Group SA/NV 36,295 3,873,987 Etablissements Franz Colruyt NV 64,934 3,939,867 Groupe Bruxelles Lambert SA 132,846 15,005,785 KBC Group NV 294,112 23,969,586 Proximus SADP 178,918 3,620,324 Sofina SA 18,344 7,588,286 Solvay SA 87,264 11,736,541 UCB SA 148,716 13,850,568 Umicore SA 230,261 13,760,841 177,618,121 Finland — 3.1% Elisa OYJ 167,775 9,872,502 Fortum OYJ 523,048 14,860,326 Kesko OYJ, Class B 322,190 11,103,618 Kone OYJ, Class B 398,352 32,117,085 Neste OYJ 496,242 32,609,530 Nokia OYJ(a) 6,349,095 -

Full Portfolio Holdings

Hartford Multifactor International Fund Full Portfolio Holdings* as of August 31, 2021 % of Security Coupon Maturity Shares/Par Market Value Net Assets Merck KGaA 0.000 152 36,115 0.982 Kuehne + Nagel International AG 0.000 96 35,085 0.954 Novo Nordisk A/S 0.000 333 33,337 0.906 Koninklijke Ahold Delhaize N.V. 0.000 938 31,646 0.860 Investor AB 0.000 1,268 30,329 0.824 Roche Holding AG 0.000 74 29,715 0.808 WM Morrison Supermarkets plc 0.000 6,781 26,972 0.733 Wesfarmers Ltd. 0.000 577 25,201 0.685 Bouygues S.A. 0.000 595 24,915 0.677 Swisscom AG 0.000 42 24,651 0.670 Loblaw Cos., Ltd. 0.000 347 24,448 0.665 Mineral Resources Ltd. 0.000 596 23,709 0.644 Royal Bank of Canada 0.000 228 23,421 0.637 Bridgestone Corp. 0.000 500 23,017 0.626 BlueScope Steel Ltd. 0.000 1,255 22,944 0.624 Yangzijiang Shipbuilding Holdings Ltd. 0.000 18,600 22,650 0.616 BCE, Inc. 0.000 427 22,270 0.605 Fortescue Metals Group Ltd. 0.000 1,440 21,953 0.597 NN Group N.V. 0.000 411 21,320 0.579 Electricite de France S.A. 0.000 1,560 21,157 0.575 Royal Mail plc 0.000 3,051 20,780 0.565 Sonic Healthcare Ltd. 0.000 643 20,357 0.553 Rio Tinto plc 0.000 271 20,050 0.545 Coloplast A/S 0.000 113 19,578 0.532 Admiral Group plc 0.000 394 19,576 0.532 Swiss Life Holding AG 0.000 37 19,285 0.524 Dexus 0.000 2,432 18,926 0.514 Kesko Oyj 0.000 457 18,910 0.514 Woolworths Group Ltd. -

Enhance Innovation and Agility with Digital Twins Executive Summary

Enhance innovation and agility with Digital Twins Executive Summary There’s no denying we live in uncertain and rapidly changing times and companies are looking for every opportunity to become more agile. Digital twins is a rapidly emerging technology that delivers to this end. Not to be confused as a mere dashboard, a digital twin is a virtual replica of a physical object, machine part, system, process or entire lifecycle. Digital twin technology enables real-time monitoring and control, the ability to learn with AI and ML, to autonomously update, self-heal, and even improve systems and designs over time. This paper seeks to achieve four objectives. First, to help the reader understand Digital twin technology and its potential. Second, to provide a structured way of looking at the various use cases and applications of this technology. Third, to feature Microsoft partners who have differentiated capabilities that bring digital twin visions to life. Fourth, to discuss the Azure Digital Twin platform and other investments from Microsoft in this space. Digital twin technology is commonly applied to manufacturing across key applications that span manufacturing scenarios/use-cases. The priority scenarios, or use cases, as they relate in Manufacturing are 1) Product, 2) Factory, 3) Supply Chain, and 4) Spaces. The top applications include configuration management, asset management, process control, performance management and simulation modeling. Configuration management tracks bills of materials, around assets as designed, manufactured, configured, and maintained. E.g. For complex & expensive assets like aircrafts this information is typically maintained by tail number. Asset management deals with telemetry of an asset itself and gives insight in to how something is working. -

Parker Review

Ethnic Diversity Enriching Business Leadership An update report from The Parker Review Sir John Parker The Parker Review Committee 5 February 2020 Principal Sponsor Members of the Steering Committee Chair: Sir John Parker GBE, FREng Co-Chair: David Tyler Contents Members: Dr Doyin Atewologun Sanjay Bhandari Helen Mahy CBE Foreword by Sir John Parker 2 Sir Kenneth Olisa OBE Foreword by the Secretary of State 6 Trevor Phillips OBE Message from EY 8 Tom Shropshire Vision and Mission Statement 10 Yvonne Thompson CBE Professor Susan Vinnicombe CBE Current Profile of FTSE 350 Boards 14 Matthew Percival FRC/Cranfield Research on Ethnic Diversity Reporting 36 Arun Batra OBE Parker Review Recommendations 58 Bilal Raja Kirstie Wright Company Success Stories 62 Closing Word from Sir Jon Thompson 65 Observers Biographies 66 Sanu de Lima, Itiola Durojaiye, Katie Leinweber Appendix — The Directors’ Resource Toolkit 72 Department for Business, Energy & Industrial Strategy Thanks to our contributors during the year and to this report Oliver Cover Alex Diggins Neil Golborne Orla Pettigrew Sonam Patel Zaheer Ahmad MBE Rachel Sadka Simon Feeke Key advisors and contributors to this report: Simon Manterfield Dr Manjari Prashar Dr Fatima Tresh Latika Shah ® At the heart of our success lies the performance 2. Recognising the changes and growing talent of our many great companies, many of them listed pool of ethnically diverse candidates in our in the FTSE 100 and FTSE 250. There is no doubt home and overseas markets which will influence that one reason we have been able to punch recruitment patterns for years to come above our weight as a medium-sized country is the talent and inventiveness of our business leaders Whilst we have made great strides in bringing and our skilled people. -

Prospectus Établi a L’Occasion De L’Émission Et De L’Admission Des Actions Gdf Suez Résultant De La Fusion Par Absorption De Suez Par Gaz De France

PROSPECTUS ÉTABLI A L’OCCASION DE L’ÉMISSION ET DE L’ADMISSION DES ACTIONS GDF SUEZ RÉSULTANT DE LA FUSION PAR ABSORPTION DE SUEZ PAR GAZ DE FRANCE A ANNEXER AUX RAPPORTS DES CONSEILS D’ADMINISTRATION DE GAZ DE FRANCE ET SUEZ PRÉSENTÉS A LEURS ASSEMBLÉES GÉNÉRALES DU 16 JUILLET 2008 Visa de l’Autorité des marchés financiers En application des articles L.412-1 et L.621-8 du Code monétaire et financier, ainsi que des articles 211-1 à 216-1 de son règlement général, l’Autorité des marchés financiers a apposé sur le présent prospectus le visa n™08-126, en date du 13 juin 2008. Le présent prospectus a été établi par Suez et Gaz de France et engage la responsabilité de ses signataires. Ce visa a été attribué, conformément aux dispositions de l’article L.621-8-1-I du Code monétaire et financier, après que l’AMF a vérifié si le document est complet et compréhensible et si les informations qu’il contient sont cohérentes. Il n’implique ni approbation de l’opportunité de l’opération, ni authentification des éléments comptables et financiers présentés. Il atteste que l’information contenue dans ce prospectus correspond aux exigences réglementaires en vue de l’admission ultérieure aux négociations sur le marché Euronext Paris des actions nouvelles de Gaz de France qui, sous réserve de l’accord des assemblées générales des actionnaires, seront émises en rémunération de la fusion. L’avis de publicité relatif au traité de fusion entre Suez et Gaz de France, ainsi que les avis de réunion des assemblées générales de Suez et Gaz de France appelées à statuer sur la fusion ont été publiés au Bulletin des annonces légales obligatoires (BALO) le 11 juin 2008 (Bulletin n™0808234). -

Press Release

SUEZ ENVIRONNEMENT TOUR CB21 16, PLACE DE L’IRIS 92040 PARIS LA DÉFENSE CEDEX, FRANCE TEL +33 (0)1 58 81 20 00 WWW.SUEZ-ENVIRONNEMENT.COM PRESS RELEASE Paris, 27 November 2014 SUEZ ENVIRONNEMENT WELCOMES SYCTOM ’S ANNOUNCEMENT OF THE DECISION TO AWARD IT THE DESIGN -BUILD -OPERATE CONTRACT FOR THE ENERGY -FROM -WASTE RECOVERY FACILITY AT IVRY -PARIS XIII SYCTOM, the consortium in charge of treating and recovering the waste of 84 Ile-de-France districts, has announced that the contract to design, build and operate the energy-from-waste recovery facility at IVRY-PARIS XIII has been awarded to the consortium headed by SUEZ Environnement and its subsidiary SITA. 1 This contract is worth a total €1.8 billion over its 23-year lifetime, half of it going to SUEZ ENVIRONNEMENT. 2 A symbol of urban ecology, the future facility will harness the best technologies to turn waste into new resources and will be at the cutting edge of environmental performance. Having managed the facility since 2011, SITA will continue to operate the existing plant before starting work with its partners. SUEZ ENVIRONNEMENT and its subsidiary SITA are delighted with this contract award decision. SUEZ Environnement Press Contact: Isabelle Herrier Naufle Tel: +33 1 58 81 55 62 [email protected] Analysts/Investors Contact: Tel: + 33 1 58 81 24 05 ABOUT SUEZ ENVIRONNEMENT Natural resources are not infinite. SUEZ ENVIRONNEMENT (Paris: SEV, Brussels: SEVB) and its subsidiaries are committed to meeting the challenge of protecting resources by providing innovative solutions to millions of people and to industries on a daily basis. -

20131120 - Nxt - Vigeo - Semi-Annual Review Enb

Semi-annual review Euronext-Vigeo indices Paris, November 20th 2013 Vigeo and Euronext, a wholly owned subsidiary of IntercontinentalExchange Group, Inc. (NYSE: ICE), have completed the semi-annual revision of their indices. The new composition will become effective from Monday 2nd of December 2013. The range of Euronext-Vigeo indices is composed of the following seven indices: -Euronext-Vigeo France 20, -Euronext-Vigeo UK 20, -Euronext-Vigeo Benelux 20, -Euronext-Vigeo US 50, -Euronext-Vigeo Eurozone 120, -Euronext-Vigeo Europe 120, -Euronext-Vigeo World 120. The index constituents reflect company performance with regards to the set of risks Vigeo defines and evaluates to assess and measure corporate responsibility. Index composition is updated twice a year, in June and December. Their composition is detailed in tables in the appendix hereunder. Methodology and highlights The added constituents are companies rated highest for control of corporate responsibility risk and contribution to sustainable development. Performance is measured by the Equitics method pioneered by Vigeo. Ratings are based on 38 criteria including respect of environment policy, human rights and recognition of companies’ human capital, corporate governance and business ethics; including integrity in influencing policy and effort to fight corruption; and the prevention of negative impacts on the social and environmental supply and subcontracting chain. Vigeo draws on its existing database to analyse nearly 330 indicators for each company. The update of the Euronext-Vigeo indices in December 2013 features the addition of a number of companies belonging to the real estate sector. These companies have significantly improved their commitments to integrate ESG objectives and principles into their strategies, operations and reporting practices. -

Large Cap International Portfolio- Institutional Class As of July 31, 2021 (Updated Monthly) Source: State Street Holdings Are Subject to Change

Large Cap International Portfolio- Institutional Class As of July 31, 2021 (Updated Monthly) Source: State Street Holdings are subject to change. The information below represents the portfolio's holdings (excluding cash and cash equivalents) as of the date indicated, and may not be representative of the current or future investments of the portfolio. The information below should not be relied upon by the reader as research or investment advice regarding any security. This listing of portfolio holdings is for informational purposes only and should not be deemed a recommendation to buy the securities. The holdings information below does not constitute an offer to sell or a solicitation of an offer to buy any security. The holdings information has not been audited. By viewing this listing of portfolio holdings, you are agreeing to not redistribute the information and to not misuse this information to the detriment of portfolio shareholders. Misuse of this information includes, but is not limited to, (i) purchasing or selling any securities listed in the portfolio holdings solely in reliance upon this information; (ii) trading against any of the portfolios or (iii) knowingly engaging in any trading practices that are damaging to Dimensional or one of the portfolios. Investors should consider the portfolio's investment objectives, risks, and charges and expenses, which are contained in the Prospectus. Investors should read it carefully before investing. Your use of this website signifies that you agree to follow and be bound by the terms and -

Euro Stoxx® Multi Premia Index

EURO STOXX® MULTI PREMIA INDEX Components1 Company Supersector Country Weight (%) SARTORIUS STEDIM BIOTECH Health Care France 1.59 IMCD Chemicals Netherlands 1.25 VOPAK Industrial Goods & Services Netherlands 1.15 BIOMERIEUX Health Care France 1.04 REMY COINTREAU Food, Beverage & Tobacco France 1.03 EURONEXT Financial Services France 1.00 HERMES INTERNATIONAL Consumer Products & Services France 0.94 SUEZ ENVIRONNEMENT Utilities France 0.94 BRENNTAG Chemicals Germany 0.93 ENAGAS Energy Spain 0.90 ILIAD Telecommunications France 0.89 DEUTSCHE POST Industrial Goods & Services Germany 0.88 FUCHS PETROLUB PREF Chemicals Germany 0.88 SEB Consumer Products & Services France 0.87 SIGNIFY Construction & Materials Netherlands 0.86 CARL ZEISS MEDITEC Health Care Germany 0.80 SOFINA Financial Services Belgium 0.80 EUROFINS SCIENTIFIC Health Care France 0.80 RATIONAL Industrial Goods & Services Germany 0.80 AALBERTS Industrial Goods & Services Netherlands 0.74 KINGSPAN GRP Construction & Materials Ireland 0.73 GERRESHEIMER Health Care Germany 0.72 GLANBIA Food, Beverage & Tobacco Ireland 0.71 PUBLICIS GRP Media France 0.70 UNITED INTERNET Technology Germany 0.70 L'OREAL Consumer Products & Services France 0.70 KPN Telecommunications Netherlands 0.68 SARTORIUS PREF. Health Care Germany 0.68 BMW Automobiles & Parts Germany 0.68 VISCOFAN Food, Beverage & Tobacco Spain 0.67 SAINT GOBAIN Construction & Materials France 0.67 CORBION Food, Beverage & Tobacco Netherlands 0.66 DAIMLER Automobiles & Parts Germany 0.66 PROSIEBENSAT.1 MEDIA Media Germany 0.65 -

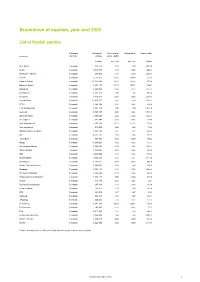

Breakdown of Equities, Year-End 2020

Breakdown of equities, year-end 2020 Listed Danish equities Company Number of Ownership of Voting rights Market value Company domicile equities share capital number per cent per cent DKKm ALK-Abello Denmark 830,794 7.46 4.10 2,077.0 Ambu Denmark 4,818,951 1.91 0.86 1,268.3 AP Moller - Maersk Denmark 253,690 1.27 0.90 3,358.9 Asetek Denmark 2,722,415 10.30 10.30 210.3 Bang & Olufsen Denmark 17,092,036 13.92 13.92 573.6 Bavarian Nordic Denmark 5,904,171 10.11 10.11 1,104.1 Carlsberg Denmark 1,227,664 0.84 0.27 1,197.2 Chr Hansen Denmark 1,381,570 1.06 1.06 865.4 Coloplast Denmark 1,310,347 0.61 0.35 1,218.1 Danske Bank Denmark 13,693,257 1.60 1.60 1,378.2 DFDS Denmark 1,949,162 3.32 3.32 536.4 DSV PANALPINA Denmark 2,281,956 1.00 1.00 2,327.6 Genmab Denmark 1,166,965 0.09 0.09 1,544.8 GN Store Nord Denmark 3,166,046 2.24 2.24 1,542.5 H Lundbeck Denmark 931,964 0.47 0.47 194.6 H+H International Denmark 2,107,893 11.72 11.72 278.2 Huscompagniet Denmark 615,000 3.08 3.08 76.9 INVISIO Communications Denmark 3,183,701 7.22 7.22 589.2 ISS Denmark 4,551,135 2.46 2.46 479.7 Jyske Bank 1 Denmark 455,709 0.63 0.00 106.2 Matas Denmark 1,846,027 4.82 4.82 159.5 Netcompany Group Denmark 1,660,500 3.33 3.33 1,033.7 Nilfisk Holding Denmark 1,436,062 5.29 5.29 189.0 NKT Denmark 2,637,690 6.14 6.14 715.3 Novo Nordisk Denmark 7,546,288 0.32 0.11 3,219.6 Novozymes Denmark 1,724,215 0.61 0.23 602.6 Nordic Transport Group Denmark 1,086,064 4.80 4.80 278.0 Pandora Denmark 2,153,187 2.16 2.16 1,466.3 Per Aarsleff Holding Denmark 2,064,304 10.13 6.34 636.8 Ringkjoebing